Abstract

This paper empirically analyzes how individual characteristics are associated with risk aversion, loss aversion, time discounting, and present bias. To this end, we conduct a large-scale demographically representative survey across eight European countries. We elicit preferences using incentivized multiple price lists and jointly estimate preference parameters to account for their structural dependencies. Our findings suggest that preferences are linked to a variety of individual characteristics such as age, gender, and income as well as some personal values. We also report evidence on the relationship between cognitive ability and preferences. Incentivization, stake size, and the order of presentation of binary choices matter, underlining the importance of controlling for these factors when eliciting economic preferences.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Economic preferences, such as risk aversion and time preferences, have been found to predict a wide range of individual decisions, such as savings (e.g. Bradford et al., 2017), environmental choices (e.g. Bartczak et al., 2015), and investments in health (e.g. Galizzi et al., 2018) or in retirement funds (e.g. Goda et al., 2019). For policymakers, it is particularly important to identify individual characteristics associated with such preferences, so that policies can be designed for the appropriate target groups (for instance, offering upfront subsidies to socio-demographic groups known to discount the future highly or warranties to socio-demographic groups known to be particularly risk averse).

Relationships between individual characteristics and economic preferences have been studied extensively in empirical research. The results reported in these studies are often inconsistent, however, making it difficult to derive clear insights and policies. The inconsistencies may stem from a variety of factors. First, studies make use of vastly different methods to elicit and estimate preferences; some studies use incentivized experimental methods (e.g. Boschini et al., 2019; l’Haridon & Vieider, 2019), while others rely on self-reported measures (e.g. Falk et al., 2018; Görlitz & Tamm, 2020). Second, studies make use of different samples: while some studies utilize large scale, demographically representative samples, many rely on small samples consisting predominantly of students.Footnote 1 Finally, studies differ in how they account for structural dependencies between different domains of preferences. Andersen et al. (2008), for instance, argue that the curvature of utility should be taken into account when estimating discount rates. Abdellaoui et al. (2007) show that failing to account for loss aversion can introduce bias in the estimated parameter of risk aversion.

In this paper, we start with a broad review of the empirical literature on the relationships between the most studied individual characteristics with risk aversion, loss aversion, time discounting and present bias.Footnote 2 This literature review enables us to identify relationships for which patterns of findings are clear, ambiguous, inconsistent, or missing. As our main contribution, we then present results from a large-scale multi-country study (with over 12,000 respondents) covering demographically representative samples in eight European countries, eliciting risk aversion, loss aversion, time discounting, and present bias, using state-of-the-art methods for elicitation and estimation as well as a wide range of robustness checks. Preferences are elicited using Multiple Price List (MPL) designs, as introduced by Holt and Laury (2002) for risk preferences, and by Coller and Williams (1999) for time preferences. Multiple price lists are incentive-compatible and easy to explain and understand; they also make it possible to elicit risk aversion, loss aversion, time discounting, and present bias using the same design. We use real monetary incentives and account for stake and order effects.Footnote 3 In our preferred specification, we jointly estimate preference parameters to account for their structural dependencies; we also conduct a variety of alternative estimations to examine the robustness of the findings to different specifications, including different ways of modeling the structural dependencies between risk and time preferences. This study employs a rich set of individual characteristics with a wide range of socio-demographic characteristics as well as psychological characteristics such as cognitive reflection (Frederick, 2005) and cultural values (Schwartz, 2012), allowing us to analyze how these characteristics are related to risk and time preferences.

Overall, this paper aims at obtaining a better understanding of relationships between individual characteristics and risk and time preferences. To our knowledge, this is the first effort to elicit risk aversion, loss aversion, time discounting, and present bias jointly using multi-country representative samples. The findings contribute to the lively discussion on how risk and time preferences are associated with individual characteristics. Our literature review contributes to the literature through the identification of relationships for which more knowledge is needed (either because previous results are ambiguous or inconsistent or because these relationships have rarely or never been studied previously). The findings from our large-sample multi-country survey then provide valuable orientation for these relationships. Table 1 summarizes our main findings. To highlight some of the results, we find that age and gender correlate with all considered preferences. Income appears to be negatively correlated with risk and loss aversion. We also find robust negative correlations between cognitive ability and risk aversion and time discounting. Interestingly, loss aversion appears to be positively correlated with cognitive ability.

Additional findings suggest that design features appear to have significant effects on the estimated parameters: incentivized respondents appear to be less risk averse, present biased, and loss averse, but they tend to discount the future to a greater extent. Stake size as well as order of presentation are also significantly related to elicited preference parameters. In line with mounting evidence on this topic, we find that controlling for decision noise is important:Footnote 4 Failing to do so may lead to spurious correlations between preference parameters and individual characteristics that are correlated with decision noise.

In the following, in Sect. 2 we first systematically review the empirical literature on the relation between individual characteristics and risk and time preferences. We present the theoretical framework used in Sect. 3 and the survey design in Sect. 4. In Sect. 5 we report the findings from the joint estimation of the preference parameters as well as results obtained from a series of robustness checks. We discuss the implications of our findings in Sect. 6.

2 Individual characteristics and preferences: A literature overview

In this section, we first present a systematic overview of empirical studies focusing on the relation between risk and time preferences and the following individual characteristics: age, gender, income (or wealth), education, having children (or household size), living as a couple (or being married), and cognitive ability.

Given the vast number of empirical studies reporting the correlation of individual characteristics with risk and time preferences, a systematic search was necessary. We conducted this search in two separate steps.Footnote 5 In a first step, to ensure that the studies that are most comparable to ours were included, we conducted a focused search for studies using demographically representative samples and relying on experimental methods to elicit preferences.Footnote 6 This initial focused search yielded 437 results on the Google Scholar library database. In a second step, we more broadly searched the literature for studies on risk and time preferences without restrictions on the elicitation methods used (therefore also including stated preferences) nor on the sampling (therefore also including non-demographically representative samples). This search yielded 16,800 results on the Google Scholar library database. For feasibility reasons, we decided to retain the first 1,000 results only (ordered by relevance).Footnote 7

After removing 283 duplicates, this two-step procedure left us with 1,154 studies to be manually screened. At that stage, we eliminated 1,018 studies that did not present empirical results (for instance review papers), and studies that did not include associations of risk and time preferences with individual characteristics. We also added eight relevant studies that had not been found through the search processes. Ultimately, we retained 144 studies in this review (listed in Online Appendix Table A.1).

For each study, we specify the sample size, whether the sample was demographically representative, and whether preference elicitation was incentivized. Finally, we indicate which preferences were considered in the study. For practical reasons we used p-values (here with a 10% threshold) to assess the findings in the literature on the correlation between preferences and covariates. While incentives have been an important concern in the literature over the past two decades (e.g. Camerer & Hogarth, 1999; Brañas-Garza et al., 2020), we observe that large-sample surveys typically do not use incentivization for preference elicitation; we also observe that large-scale studies such as Dohmen et al. (2010) tend to rely on scales rather than experimental elicitation methods. Among the studies retained, about 40% rely on representative samples, the remaining studies often use student samples or special population samples (e.g. homeowners, farmers). The majority of studies focus on risk aversion and to a lesser extent on time discounting; only a few studies have considered present bias and loss aversion. Further, most studies consider one preference domain only. Finally, we note that none of the studies considering several preference domains estimate risk and time preferences parameters jointly.Footnote 8 We summarize the findings of this literature review in Table A.1 in the Online Appendix without any judgment. For example, we do not distinguish between findings according to the methods used to elicit and estimate economic preferences.Footnote 9 Similarly, even though omitted variable bias may explain differences across studies because some of the selected individual characteristics may be correlated but not included as covariates in some of the studies, we do not account for these differences and report the results as they appear in the published articles.

Overall, Table A.1 in the Online Appendix makes clear that there are no previous demographically representative studies incorporating risk aversion, loss aversion, time discounting and present bias.Footnote 10 Our study fills this gap. Specifically, because we use state-of-the-art preference elicitation methods with demographically representative samples of the population in multiple countries, and because we include (and jointly estimate) time and risk preferences, loss aversion, and present bias, and include a wide range of individual characteristics, our study should yield valuable results regarding the individual characteristics associated with these preferences.

In Table 2 we summarize the correlations found between individual characteristics and the preference parameters in the 144 papers retained in this overview. In particular, we summarize correlations between risk aversion, loss aversion, time discounting, and the main individual characteristics included in our study. We report in this table the number of studies that investigated this relationship and document a statistically significant (positive or negative) correlation at the 10% level or a non-significant correlation. We separately identify the number of studies for each category that used a demographically representative sample, because most non-representative studies have been conducted with student samples which typically exhibit little variation for many socio-demographic variables. In addition, to ensure that small or under-powered studies are not driving the conclusions, Online Appendix Table A.2 reports the number of observations finding specific relations. Together, these tables can be used to identify, for each relationship between individual characteristics and preferences, the extent to which the literature has found consistent, conflicting, or ambiguous (i.e. non-significant) results.

For age, statistically significant findings for number of studies and number of observations mostly suggest a positive correlation with risk aversion and a negative correlation with time discounting and present bias; still, a substantial share of studies find opposite or ambiguous results, making the association between age and economic preferences somewhat contested. Previous literature provides inconclusive evidence for the relation between age and loss aversion.Footnote 11

For gender, a majority of studies find men to be less risk averse than women, but a substantial number of studies report a non-significant correlation. In comparison, most demographically representative studies find men to be less loss averse than women, while analyses relying on non-representative samples typically fail to find a statistically significant relation between gender and loss aversion.Footnote 12 The patterns of results for the relationship between gender and time preferences appear ambiguous, with the majority of studies reporting non-significant results. However, men are clearly found to be more patient than women when the number of observations is considered instead of the number of studies. Notably, no study so far finds a significant correlation between present bias and gender.

For income, statistically significant results in the literature typically suggest a negative relation with risk aversion, but the majority of findings are ambiguous, especially when accounting for sample size. In comparison, the majority of the few studies on loss aversion find richer households to be less loss averse. For time discounting and present bias, about equal shares of studies (and observations) find either a negative relation with income or a no result; for both time preferences, none of the studies included in our review finds a positive correlation with income.

Next, a majority of studies find ambiguous results for the relation between education and risk aversion, loss aversion and present bias. Focusing on the number of studies, most statistically significant results suggest a negative relation between education and risk aversion; there are numerous studies, however, finding this relation to be positive. When taking into account the number of observations, the relationship between education and risk aversion appears to be ambiguous. For time discounting, most studies suggest a positive association with education; the share of non-significant results is also quite high.

In the majority of studies, having children or living as a couple/being married are not correlated with risk aversion, loss aversion, and time discounting. Statistically significant results mostly suggest a positive relation of risk aversion and having children or being married, especially when taking into account the number of observations and not only the number of studies.

Finally, most previous studies (also when accounting for sample sizes) find participants with higher cognitive ability to be less risk averse and more patient, whereas the associations of cognitive ability with loss aversion and present bias have not yet received much attention and results are mixed. We also note that a high share of studies find an ambiguous association between cognitive ability and risk aversion. Relatedly, Andersson et al. (2016, 2020) suggest that the negative correlation between cognitive ability and risk aversion found in many studies may be spurious; we focus on this issue in Sect. 5.2. In general, the pattern of results in Table 2 appears to be similar for studies that employ demographically representative samples and studies that do not employ such samples. It is worth noting that some relations have been little studied (especially relations with loss aversion and present bias) and that some conclusions are based on less than ten studies and less than 10,000 observations in total.

Overall, this literature review highlights the need for a study that includes the four preference domains and a broad set of individual characteristics. We find that many of the results are either conflicting or ambiguous (non-significant). Further, some relationships have rarely been studied so that empirical evidence on these relationships is scarce or missing. We believe that using a joint estimation of four preferences parameters on large, incentivized, and representative multi-country samples provides valuable insights on the relations between individual characteristics and risk and time preferences.

3 Theoretical framework: Preferences over risk and time

In this section we present the theoretical framework used to model and estimate preferences over risk and time. The framework is based on the commonly used Prospect Theory framework developed by Kahneman and Tversky (1979).Footnote 13 Utility over gains and losses of wealth x, relative to the reference point \((x=0)\), is modelled as:

where \(\alpha\) is the parameter indicating relative risk aversion and \(\lambda\) is the parameter determining loss aversion. Levels of \(\alpha >0\) imply risk aversion, \(\alpha =0\) implies risk neutrality, and \(\alpha <0\) implies risk-seeking behavior. Levels of \(\lambda >1\) imply loss aversion, \(\lambda =1\) implies loss neutrality, and \(\lambda <1\) implies loss-seeking behavior.

Preferences over choices that involve separate points in time were modelled using quasi-hyperbolic discounting, as proposed by Laibson (1997):

where \(U_t(x_t,...,x_T)\) is the expected utility of a stream of wealth gains or losses \(x_0,...,x_T\), \(u(x_t )\) in gain/loss utility at time t as described in Eq. (1), \(\delta\) is the discount rate and \(\gamma\) is the present bias parameter. Here \(\delta >0\) implies impatience, \(\delta =0\) implies time neutrality, and \(\delta <0\) implies patience, while \(\gamma >0\) implies present bias, \(\gamma =0\) implies no bias, and \(\gamma <0\) implies future bias.Footnote 14 In our model, t is expressed in years. Therefore, \(\delta\) is the yearly discount rate.

4 Survey design

Data was collected in July and August 2016 through computer-assisted web interviews (CAWI) conducted by IPSOS GmbH in eight European countries (France, Germany, Italy, Poland, Romania, Spain, Sweden, and the United Kingdom). Respondents were members of IPSOS household panels; quota sampling was used to ensure that for each country, the sample was representative of the population for gender, age (between 18 and 65 years), and region of origin. The sample consisted of 15,055 respondents with the following distribution: 2,000 respondents each from France, Italy, and the United Kingdom; 2,002 from Germany; 2,008 from Poland; 1,529 from Romania; 2,001 from Spain; and 1,515 from Sweden. We dropped 2,330 (113) observations for respondents who answered “do not know” to the income (education level) question. All following analyses are reported based on the remaining 12,612 respondents. The surveys were carefully translated from the original English version into each of the target languages; back translation was used to check the quality of each translation; after discussion with the translators, discrepancies were adjusted for to ensure consistency in understanding across countries. Further, because not all countries in the survey use the same currency, the monetary amounts displayed to respondents throughout the survey were adjusted to keep similar purchasing power values across countries while also showing rounded numbers to ensure equivalent computing difficulty. In all Eurozone countries, the monetary amounts shown to respondents were identical; for Poland, Romania, Sweden and the UK, monetary amounts were multiplied by the following factors: Poland: 1\(\text{\EUR}\) = 3 PLN; Romania: 1\(\text{\EUR}\) = 3 RON; Sweden: 1\(\text{\EUR}\) = 10 SEK; UK: 1\(\text{\EUR}\) = 1\(\pounds\).Footnote 15

4.1 Preference elicitation

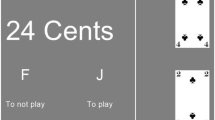

Tables 3, 4 and 5 contain the Multiple Price Lists (MPLs) used to elicit preferences. MPL1.1 and MPL1.2 involve secure gains at varying time frames: one at an earlier date and one at a later date. MPL2 contains 14 choices between two lotteries (one less risky lottery and one riskier lottery, whose expected value increases from upper to lower rows). Finally, MPL3 involves seven choices between two lotteries, including gains as well as losses as outcomes. Together, these price lists jointly identify risk aversion, loss aversion, time discounting, and present bias.

It should be noted that the earliest date at which respondents could receive money was one week into the future. This could be a concern, as one week could be too far in the future to be considered “present” for eliciting present bias. As explained in greater detail in the next subsection, this was because processing and shipping of payments took one week’s time. In Sect. 5.1 we discuss the implications of this procedure for our parameter estimates.

No unique switch point was enforced in our multiple price lists; i.e. respondents were free to switch back and forth between Option A and B. In our sample, 16.48% of respondents have multiple switch points; this share is similar to previous studies (see e.g. Harrison et al., 2005).

4.2 Stakes, incentives, and order effects

Most respondents faced the MPLs with the monetary amounts shown in the previous subsection. In the remainder of this paper, we refer to these amounts as the baseline monetary amounts. In addition, we varied stake size: in the high-stake scenario (ca. 10% of the total sample), the amounts shown were multiplied by 10 compared with amounts in the baseline treatment; in the low-stake scenario (ca. 7% of the total sample), the amounts shown were divided by 10 compared with amounts in the baseline treatment.

In addition to stake levels, we also manipulated incentivization. The majority of the respondents (55.5%) were incentivized, to mitigate and test for hypothetical bias, as highlighted by Charness et al. (2016). Incentivized respondents were informed that they would have a 1% chance of being picked and paid based on one of their actual choices in the MPLs. This type of incentive scheme is increasingly utilized in experimental economics and is also known as Between-subjects Random Incentivized System (BRIS).Footnote 16 Because of budget constraints, incentivization was implemented only for the baseline and low-stake scenarios. For each selected respondent, one choice was randomly designated as the pay-out-relevant choice. Respondents were informed that if a question from Table 5 (including monetary losses) was chosen as the pay-out-relevant choice, they would receive an additional 100 Euros (or an equivalent sum in Polish, Romanian, or Swedish currencies), regardless of the choice; losses would then be subtracted from these 100 Euros, and gains would be added.Footnote 17

Overall, all respondents selected as winners were immediately informed and paid with a prepaid credit card (a MasterCard) sent to them by postal mail. Because it took one week to process and ship these cards, the earliest payment date was one week after survey completion.Footnote 18 This was reflected in the time frame used in the time preference MPLs. To ensure comparability between the incentivized and non-incentivized conditions, non-incentivized respondents were also shown MPLs with an “in one week” formulation.

In total, 75 respondents among the roughly 7500 incentivized respondents were randomly selected to be paid, with an average pay-off of 54.34 Euros; in total, about 4,000 Euros were paid out in incentives to respondents in addition to the regular study participation fee.

Finally, we randomized the order of presentation: about half of the respondents saw the MPLs as presented above; for the other half, Options A and B were reversed, such that Option B was presented in the left column of the table with Option A in the right column.

Overall, respondents were randomly assigned to one of the experimental conditions (unique combinations of stake level, incentivization or not, and AB or BA presentation order); to avoid confusion or experimenter demand effects, each respondent was assigned to the same combination across all four MPLs.

4.3 Individual characteristics

Our set of covariates included socio-demographic variables employed in previous studies, that is, age, gender, education level, income, and whether respondents had children, lived as a couple; in addition, we also asked whether participants lived in an urban area. To capture cultural differences, we included a ten-item subscale of the personal value questionnaire (Knoppen & Saris, 2009) measuring the following individual values: self-direction, stimulation, hedonism, achievement, power, security, conformity, tradition, benevolence, and universalism (Schwartz, 2012). Finally, the score obtained on the standard cognitive reflection test (CRT, (Frederick, 2005)) was included to reflect cognitive ability. Table 6 provides a description of the variables used in our estimations.

The multivariate estimations also included country-specific dummies, with each country dummy equal to 1 if the respondent was from the specified country and 0 otherwise. Online Appendix Table B.1 reports the summary statistics for each variable in the sample across the eight countries.

5 Results

5.1 Aggregate maximum-likelihood estimation

We estimate all preference parameters jointly, broadly following the maximum likelihood specification in Andersen et al. (2008) and Harrison et al. (2008). Respondents repeatedly choose between two options, A and B. We denote expected utility as specified in Eq. (2) as \(U^A\) and \(U^B\) for Options A and B, respectively.Footnote 19

We consider a random utility model in which individuals may make two types of errors in the decision-making process. First, they may make tremble errors, i.e. with some probability \(\kappa\) they may randomize between both options. Second, they may make errors in evaluating the expected utility of lotteries.Footnote 20 In particular, Options A and B are evaluated by their expected utility plus a stochastic component \(\epsilon\), such that an individual (provided they did not randomize as a result of the tremble error), chooses Option B if \(U^B+\epsilon ^B \ge U^A+\epsilon ^A\). Overall, the probability of choosing Option B therefore writes as follows:

where F is the cumulative distribution function of \((\epsilon ^A-\epsilon ^B)\). In our main specification, we assume that F follows a standard logistic distribution function with \({F(\xi )=(1+e^{-\xi })^{-1}}\). This specification is also commonly referred to as the Luce model (Luce, 1960; Holt & Laury, 2002) or a Fechner error with logit link (Drichoutis & Lusk, 2014).Footnote 21

We estimate six parameters: risk aversion \(\alpha\), loss aversion \(\lambda\), time discounting \(\delta\), present bias \(\gamma\), the tremble error term \(\kappa\), and the Fechner error term \(\mu\). The latter two parameters can be interpreted as follows: for \(\kappa \rightarrow 0\), the tremble error has no effect on choice and for \(\kappa \rightarrow 1\), choice approaches uniform randomization. Analogously, for \(\mu \rightarrow 0\), the decision becomes deterministic (conditional on not choosing at random owing to the tremble error), and for \(\mu \rightarrow \infty\), choice approaches uniform randomization.

The log-likelihood function aggregates over all choices and all respondents and writes as follows:

where \(d_{ji}=1\) when Option B is chosen by individual j in lottery choice i and \(d_{ji}=0\) when Option A is chosen. The log-likelihood function is maximized numerically using Stata’s modified Newton-Raphson (NR) algorithm.Footnote 22 Standard errors are clustered at the individual level.

Table 7 summarizes the resulting preference parameters estimated for the full sample. On average, respondents in our sample are risk averse, with a parameter of relative risk aversion \(\alpha = 0.46\). To put this into perspective, the risk premium associated with a benchmark lottery that pays 0 or 100 Euro with equal probability \(L=(0,0.5;100,0.5)\) would be 22.3 Euro. Respondents are on average loss averse, with parameter \(\lambda = 1.93\), implying that losses are weighted roughly twice as much as equal-sized gains. They are impatient, with a yearly discount factor of \(\delta = 0.28\), and slightly present-biased, with \(\gamma = 0.01\). Both structural error parameters are significantly positive, indicating that choices are influenced by both Fechner and tremble errors.Footnote 23

Note that the point estimate of \(\gamma\) should be interpreted with caution. In essence, \(\gamma\) measures the difference in the discount rates elicited in MPL1.1 and MPL1.2. Because the temporal distance and the magnitude of the payments in both lists are kept constant, a positive \(\gamma\) would indicate that respondents discount the future more in MPL1.2, where choices are closer to the present. This is how present bias is typically defined. However, as the earliest possible payment was one week into the future, our estimate of \(\gamma\) is likely biased downwards compared to studies that have a smaller front-end delay.Footnote 24

In the following, we allow preference and error parameters to vary with individual characteristics as we test how preference parameters are related to these characteristics. To this end, we employ logistic models, where the six preference and error parameters are estimated jointly as linear functions of the individual characteristics outlined in Sect. 4.3. The estimation combines data from all countries (totaling 441,420 choices made by 12,612 respondents). We include country dummies to capture country-specific effects, using the largest country, Germany, as the baseline. The results are presented in Table 8. In the following subsections, we present the findings about the covariates associated with each preference parameter.Footnote 25 Note that when comparing our findings to the literature, we will not relate our findings to all studies reviewed in Sect. 2; instead we will focus on a few exemplary studies, mainly those relying on demographically representative samples.

5.2 Individual characteristics associated with risk aversion

Our results suggest that risk aversion is statistically significantly related with the socio-demographic variables Age, Male, and Income. More specifically, we find a positive correlation between Age and risk aversion. Thus, in our sample, older respondents are, on average, more risk averse than younger respondents, ceteris paribus. While this finding is in line with the majority of previous studies (e.g. Schurer, 2015; Mata et al., 2016; Bouchouicha & Vieider, 2019), a substantial number of studies find a negative relation of age and risk aversion (e.g. Cardenas & Carpenter, 2013; Noussair et al., 2014; Andersson et al., 2016). Consistent with the thrust of the literature (e.g. Hansen et al., 2016; Lee & Kang, 2016; Falk et al., 2018), men appear to be less risk averse than women.

In line with the relative majority of the studies surveyed in our literature review (see Table 2) we fail to find a statistically significant relation between Education and risk aversion. Yet, previous studies also report negative associations (e.g. Mata et al., 2016; Bouchouicha & Vieider, 2019; Browne et al., 2020) or positive associations (e.g. Lee & Kang, 2016; Sepahvand & Shahbazian, 2017; Chapman et al., 2018a) between education and risk aversion. Similar to Castillo et al. (2018), Blake and Cannon (2019) and Bouchouicha and Vieider (2019) for example, we find that respondents with higher Income are less risk averse. The relative majority of previous studies failed to find a statistically significant relation between income and risk aversion. Whether participants have children, are married, or live in an urban environment, does not appear to be associated with risk aversion. These findings are in line with the thrust of the literature.

For cognitive ability, we find that respondents with higher CRT scores are less risk averse. There is some debate in the literature regarding the effects of cognitive ability on risk aversion. In line with our results, Chapman et al. (2018b), Dohmen et al. (2010), and Goda et al. (2019) find cognitive ability to be negatively correlated with risk aversion.Footnote 26 Andersson et al. (2016) argue however that such results may be spurious, an artifact caused by the method used to elicit risk aversion. Dohmen et al. (2010) use an MPL design in which the risk-neutral switch point is located in the upper half of the MPL. Andersson et al. (2016) show that this may lead to a spurious (negative) correlation between cognitive ability and risk aversion.Footnote 27 Andersson et al. (2020) further argue that, after carefully controlling for decision errors in estimating preference parameters, the effects of cognitive ability on risk aversion disappear. To mitigate the effect of risk-neutral switch-point location in the MPL on the relationship between CRT and risk preferences, we designed our MPL in a symmetric way: the risk-neutral switch point falls in the middle of the MPL.Footnote 28 Thus, given that respondents are on average risk averse, our design is biased in the opposite direction of our finding, such that increased randomness (correlated with cognitive ability) should lead to lower observed risk aversion.Footnote 29 In contrast to Andersson et al. (2016, 2020), in our study the effects of cognitive ability on risk aversion remain significant, even after controlling for the effects of cognitive ability on the decision error.Footnote 30 This may be because our analysis benefits from a substantially larger sample (\(N=12,615\) vs. \(N= 1,396\) in Andersson et al. (2020) and our study, respectively), which could lead to an increased chance to detect small effects. It should be noted, however, that our study is not directly comparable with Andersson et al. (2020), owing to differences in the MPL design and measurement of cognitive ability. Also, while we believe that the relation between cognitive ability and risk aversion is robust (see also the simulation exercise in Online Appendix D.5), we can, of course, not exclude the existence of other spurious effects.

Regarding the cultural values, we find that Stimulation is negatively related to risk aversion which implies that individuals who like adventures are less risk averse.

Concerning country effects, risk aversion appears to be higher in Poland and Romania and lower in Italy and Sweden relative to the baseline country, Germany.

We also find order effects: respondents facing the riskier outcomes on the left side of the screen exhibit greater risk aversion. To our knowledge, these effects are rarely considered in the literature (Andersen et al., 2006) and may suggest that randomization of order is important when eliciting preferences using multiple price lists.

Our results further suggest that incentivized participants are less risk averse than non-incentivized participants. While there is no consensus in the literature regarding the effects of incentivization on risk behavior in experiments, most existing studies have found that incentivization has either no effects (Camerer & Hogarth, 1999; Rieger et al., 2015) or that it increases risk aversion (Holt & Laury, 2002). Recent evidence, however, suggests that the effect of incentivization on risk behavior may depend on whether all or only some (randomly selected) participants are paid. In line with our finding, Brañas-Garza et al. (2020) observe that a between-subject random incentive scheme (BRIS) leads to less risk aversion, compared to hypothetical incentives. Finally, in line with Holt and Laury (2002) and Harrison et al. (2005) we find that when stakes are low (compared to the baseline) risk aversion decreases.

5.3 Individual characteristics associated with loss aversion

Overall, we find that age, being male and income are negatively related with loss aversion. While for these characteristics, the scant literature on loss aversion mostly found a non-significant relation, our findings are consistent with Cardenas and Carpenter (2013), Chapman et al. (2018b) and Blake and Cannon (2019) for age, with Booij and van Praag (2009) and Cardenas and Carpenter (2013) for gender, and with Von Gaudecker et al. (2011), Stephens and Tyran (2012) and Blake and Cannon (2019) for income. For CRT, we find a positive relation with loss aversion, which is consistent with Chapman et al. (2018b). For Education, Children, Couple, and Urban, we find no statistically significant relation with loss aversion. Previous literature has rarely considered these characteristics, with the exception of education, for which the majority of studies also find a null result.

Loss aversion is also related with Stimulation: respondents who like adventure and taking risks are less loss averse.

Relating to country effects, we find higher loss aversion in the samples from France, Italy, Sweden and the UK compared to the sample from Germany.

Unlike for the other preference parameters, we find no order effects for loss aversion. Finally, we find that loss aversion is lower for incentivized respondents, and that loss aversion increases with stake size. The latter result is consistent with Vieider (2012).

5.4 Individual characteristics associated with time discounting

The demographic variables Age, Male, Education, and Children are statistically significantly related to time discounting. We find older respondents to be more patient. The relative majority of studies in our literature review (see Table 2) did not find a statistically significant relation between Age and time discounting. Our result is, however, consistent with numerous studies including Andersen et al. (2018), Chapman et al. (2018b) and Falk et al. (2018). While most studies fail to find gender to be statistically significantly related with time discounting, for our sample, male respondents are more impatient. Further, more highly educated respondents appear to be more patient, which is in line with the thrust of findings reported in the literature (e.g. Bruderer Enzler et al., 2014; Chapman et al., 2018b; Goda et al., 2019). Next, respondents with children are more impatient, consistent with what Bruderer Enzler et al. (2014) document. The coefficients associated with Couple and Urban are not statistically significant.

In line with the literature (e.g. Chapman et al., 2018b; Falk et al., 2018; Goda et al., 2019), respondents from our sample with high CRT scores are more patient.

Among the cultural values, only Hedonism and Stimulation are significantly correlated with time discounting. Respondents who like to have a good time, to spoil themselves, and those who like adventures and taking risks appear to be more impatient. These results make intuitive sense, because these two cultural values strongly emphasize immediate rewards, which is consistent with impatience.

Pertaining to country effects, discounting appears to be higher in Italy, Poland, Romania, Spain and the UK compared to Germany.

Further, we find significant relations between time discounting and the order in which the lotteries were shown, as well as with incentivization and stake levels. Specifically, respondents who faced lotteries’ options in reverse order appear more patient than those who faced the lotteries as displayed in Tables 3 through 5. This result highlights the importance of controlling for order effects when eliciting preferences using multiple price lists. Our findings further imply that incentivized respondents discount the future more than non-incentivized respondents. Finally, respondents who faced high stakes discount the future less than respondents who faced the amounts in the baseline treatment.

5.5 Individual characteristics associated with present bias

Only few representative studies have investigated the relationship between individual characteristics and present bias (e.g. Pinger, 2017; Goda et al., 2019). Our results suggest that older respondents are less present biased, which is consistent with what Wang et al. (2016), Hunter et al. (2018) and Breuer et al. (2020) report. In contrast to the scant existing literature, we find a statistically significant relation between gender and present bias: men are more present biased than women. Further, respondents living in an urban environment appear to be more present biased. We find no evidence for present bias to be related to education, income, having children, living as a couple, cognitive ability, and most cultural values. Yet the finding for Conformity suggests that respondents stating that it is important to them to always behave properly and to avoid doing anything people would say is wrong are less likely to be present biased.

Respondents in France and Italy are more present biased and respondents in Romania are less present biased than those in the baseline country (Germany).

Respondents who faced binary choices in reverse order (more delayed outcomes on the left side of the screen) appear to be less present biased. Finally, respondents who were incentivized or faced higher stakes are less present biased whereas those facing lower stakes (compared with the moderate stakes baseline) are more present biased. These results are rather intuitive as they suggest that higher or more perceptible payments (for delayed outcomes) may contribute to reducing respondents’ bias toward present payments.Footnote 31

5.6 Country-level estimates

Our data allows us to compare preferences and their relations with individual characteristics between countries. To this end, we first estimate preference parameters separately for each country. Table 9 illustrates the resulting point estimates and standard errors of the six preference and error parameters.

Most variance across countries can be found in time discounting \(\delta\) and risk aversion \(\alpha\). Estimates for the parameter of relative risk aversion vary between \(\alpha = 0.34\) (Sweden) and \(\alpha =0.68\) (Poland). Using our benchmark lottery \(L=(0,0.5;100,0.5)\), these parameters would generate risk premiums of 15.07 and 38.77 Euro in Sweden and Poland respectively. This implies that differences in risk-taking behavior could be quite large. Romanians have by far the highest discount rate \(\delta =0.51\), and the French appear to discount the future least \(\delta =0.22\). Loss aversion and present bias exhibit lower overall normalized variances between countries, although respondents from Spain and Romania appear to be markedly less loss averse. Romania is the only country where respondents appear to be future biased on average.Footnote 32

To investigate the associations between individual characteristics and preference parameters across countries, we estimate country-level models with a reduced set of covariates. Ideally we would use the same set of covariates as in our main specification; however with the drastically reduced sample sizes, the models fail to converge reliably in the different countries when using the full set of covariates. Estimation results can be found in Online Appendix Tables C.1–C.9. Although a country-by-country comparison of the relations between all individual characteristics and the four preference parameters is beyond the scope of this paper, we observe that due to decreased power, many correlations between preferences and individual characteristics become insignificant at the country level. Nevertheless, the estimates appear consistent across countries: none of the individual country models exhibits a significant effect that is opposite in sign to a significant effect in the model that includes all countries.

5.7 Robustness checks

Our findings on preferences and their correlation with covariates may be sensitive to the specification of intertemporal utility, the selected error process, and the measurement of preferences. Yet, there appears to be no consensus in the literature regarding these assumptions. We therefore analyze the robustness of our results pertaining to i) exclusion of multiple switchers, ii) alternative utility specifications, iii) alternative error-process specifications, and iv) alternative measures of preferences, such as the number of times a specific option was chosen, or switch points. For brevity, we relegate details to Online Appendix D. Summing up, our main findings are largely robust. Among other findings, we document that controlling for noise in the decision making process is important. Simulation exercises confirm that using measures of preference and estimation methods that fail to account for decision noise may lead to spurious correlations between preferences and individual characteristics that are correlated with decision noise. This result is in line with recent findings (Andersson et al., 2016, 2020).

6 Discussion and conclusion

In this paper, we empirically analyze the relationships between individual characteristics and risk aversion, loss aversion, time discounting, and present bias in a large-scale demographically representative sample in eight EU countries. We cautiously control for decision errors in estimating preference parameters to avoid spurious results in cases where individual characteristics may be correlated with decision errors. Our findings provide in particular guidance on relationships that previous literature has never or only rarely analysed such as the relation between individual characteristics and loss aversion or present bias. Regarding present bias and loss aversion, this study uses the largest sample to date to analyze relations between individual characteristics and these preferences. Likewise, most likely because of the large sample size, our study finds statistically significant associations for several relations where a majority or relative majority of the studies included in our systematic literature review find a no result such as the relation of income with risk aversion, of gender with loss aversion, of age and having children with time discounting, and of age and gender with present bias. More specifically, our findings suggest that risk aversion is negatively correlated with income. We also find evidence suggesting the existence of a negative relationship between risk aversion and cognitive ability (as measured by CRT), a relationship that has been subject to debate in the literature. We further find that time discounting is negatively associated with age. In addition, our results suggest that men discount the future to a greater extent and are also more present biased than women. The latter finding is not yet established in the literature. Finally, we find that older respondents and males are less loss averse.

Few studies have tested whether cultural values are related to economic preferences. In our study, Stimulation appears to consistently correlate with risk and time preferences. Respondents who identify to a greater extent with the statement “Adventure and taking risks are important to him/her; to have an exciting life” are less risk averse and loss averse, and also discount the future to a greater extent. These links have remained largely unstudied in the literature, and may be a fruitful area for future research.

Our study also makes methodological contributions that may prove useful for researchers interested in using MPLs to elicit economic preferences: we find that the order of presentation of the two options as well as stake size have statistically significant effects on elicited preference parameters. While it may be difficult to control for stake size in some settings, order of presentation can easily be randomized. Incentivization appears to be important, as it is significantly associated with all elicited preference parameters. Finally, our study highlights the importance of controlling for the effects of observable heterogeneity on decision noise.

Notes

To simplify the exposition, in the remainder of this paper we will categorize risk aversion and loss aversion as risk preferences, and time discounting and present bias as time preferences.

Specifically, we use a between-subjects random incentivized system (BRIS). See Sect. 4.2 for more details.

More details on the search criteria can be found in Online Appendix A.1.

According to the Google Scholar website: “Google Scholar aims to rank documents the way researchers do, weighing the full text of each document, where it was published, who it was written by, as well as how often and how recently it has been cited in other scholarly literature.” We acknowledge that this classification may vary over time and may not reflect the relevance of a particular study in a field.

Studies that elicit risk aversion and loss aversion often estimate these two preferences jointly.

This choice allowed us to present a comprehensive overview of the existing literature on preferences and their covariates. This would not have been possible had we excluded or focused on specific elicitation methods. Including different elicitation methods implies however that studies retained in the overview may not be directly comparable.

Note that many studies have considered non-linear relationships for age; however, this has not lead to consistent findings.

Note that Bouchouicha et al. (2019) suggest that the relationships between gender and loss aversion might depend on the specification used for loss aversion.

Note that for practical reasons, we decided to not elicit probability weighting. All lottery choices were 50/50 gambles, conveyed in everyday language as coin flips. See Section D.2 for a discussion.

Our notation differs somewhat from the usual one, where the present bias parameter is typically written as \(\beta =1/(1+\gamma )\). We have chosen this notation to achieve a uniform interpretation of coefficient estimates across preferences in Table 8: larger coefficients can always be interpreted to indicate increased risk aversion, loss aversion, time discounting and present bias.

The data used in this paper was collected as part of the Horizon 2020 BRISKEE project (https://www.briskee-cheetah.eu). The data is publicly available and several other publications have made use of it, mostly to investigate household adoption of energy efficient technologies (see e.g. Schleich et al., 2019).

See e.g. Abdellaoui et al. (2008) for an early example of BRIS incentivization. Clot et al. (2018) compare the impact of different incentive schemes on behavior in dictator games, and find no difference between BRIS and full incentivization, whereas no incentivization leads to less selfish play. Relevant for our study, Brañas-Garza et al. (2020) find that using BRIS leads to decreased levels of risk aversion compared to hypothetical or full incentives. So while an incentivization of the full sample is likely superior, we would argue that for large scale studies in which a full incentivization is infeasible (such as ours), BRIS appears to be better than no incentives at all.

This procedure differs somewhat from the main approaches in the literature, where often either no incentives are used, or losses are subtracted from a show-up fee that every participant receives. Due to budgetary constraints, offering every participant 100 Euros as a show-up fee was infeasible. Our approach retains incentive compatibility and is viable for large-scale surveys.

Perceived payment reliability is an issue that may confound the elicitation of preferences, especially when an earlier payment may be deemed more reliable or may involve lower transaction costs. In our survey, the payment procedure was kept constant across all time horizons. Additionally, respondents were informed that the market research company would guarantee all payments as specified, and were provided with an email address that they could contact in case they had questions regarding the payment procedure. The survey drew from existing panels, consisting mostly of respondents who had previous experience with the market research company and their payment procedure, which should further alleviate issues of perceived payment reliability.

For notational convenience, we drop the indices for time.

Equation (3) is algebraically identical to \(\text{ Prob }(B)=(1-\kappa )\frac{\exp (U^B/\mu )}{\exp (U^A/\mu )+exp(U^B/\mu )}+\frac{\kappa }{2}\).

The results are robust to the utilization of different algorithms, such as Davidon-Fletcher-Powell (DFP) or Broyden-Fletcher-Goldfarb-Shanno (BFGS).

Note that our estimate of the tremble error is relatively large. Andersson et al. (2020) find tremble errors as high as 0.304, though the magnitude does seem to depend on the specific MPL design. For our estimation, allowing the Fechner error to vary between MPLs appears to reduce the tremble error somewhat. As discussed in Sect. D.3, this only has a negligible effect on the remaining estimates, so we decided to keep the simpler model as our main specification.

See also Meier and Sprenger (2015), who faced a similar issue. They sent out checks as incentives, and acknowledge that the front-end delay may impact their estimates of present bias.

While interesting in its own right, a discussion of how individual characteristics are related to decision-making errors is beyond the scope of this paper.

See also Lilleholt (2019) for a meta-study that also finds small but significantly negative effects.

Respondents with lower cognitive ability may make more mistakes, and since the risk-neutral switch point falls in the upper half of the MPL, there are more opportunities to err towards the safe than to the risky option. A risk-neutral respondent who chooses completely at random will thus appear risk averse.

A risk-neutral respondent who chooses completely at random will thus appear risk neutral on average. Note that this also implies that respondents who are risk averse should now switch from the safe to the risky option somewhere in the lower half of our MPL. This implies that they have more room to err towards the risky option: a risk-averse respondent who chooses randomly will appear risk neutral.

This intuition is confirmed in Online Appendix D.5, where we simulate choice data and test this explicitly. The findings of these simulations underline the robustness of our finding that risk aversion is negatively associated with cognitive ability and suggest that the effect is likely even larger than documented in Table 8.

Andersson et al. (2020) use a random parameter model based on Apesteguia and Ballester (2018). To our knowledge, this kind of random parameter model has not yet been extended to multi-parameter utility models. In their online Appendix, however, they use a random utility model with tremble error and (logit-link) Fechner error, and show that this is sufficient to control for spurious effects. Our maximum likelihood estimation is based on that model.

Note that the effects of individual characteristics on present bias presented here are rather small. This may (at least in part) be explained by the fact that our estimate of present bias is likely biased downward, as discussed in Sect. 5.1.

References

Abdellaoui, M., Bleichrodt, H., & l’Haridon, O. (2008). A tractable method to measure utility and loss aversion under prospect theory. Journal of Risk and Uncertainty, 36, 245–266.

Abdellaoui, M., Bleichrodt, H., l’Haridon, O., & Paraschiv, C. (2013). Is there one unifying concept of utility? an experimental comparison of utility under risk and utility over time. Management Science, 59, 2153–2169.

Abdellaoui, M., Bleichrodt, H., & Paraschiv, C. (2007). Loss aversion under prospect theory: A parameter-free measurement. Management Science, 53, 1659–1674.

Abdellaoui, M., Kemel, E., Panin, A., & Vieider, F. M. (2019). Measuring time and risk preferences in an integrated framework. Games and Economic Behavior, 115, 459–469.

Albert, S. M., & Duffy, J. (2012). Differences in risk aversion between young and older adults. Neuroscience and Neuroeconomics, 1, 3–9.

Almenberg, J., & Dreber, A. (2015). Gender, stock market participation and financial literacy. Economics Letters, 137, 140–142.

Andersen, S., Harrison, G. W., Lau, M. I., & Rutström, E. E. (2006). Elicitation using multiple price list formats. Experimental Economics, 9, 383–405.

Andersen, S., Harrison, G. W., Lau, M. I., & Rutström, E. E. (2008). Eliciting risk and time preferences. Econometrica, 76, 583–618.

Andersen, S., Harrison, G. W., Lau, M. I., & Rutström, E. E. (2010). Preference heterogeneity in experiments: Comparing the field and laboratory. Journal of Economic Behavior & Organization, 73, 209–224.

Andersen, S., Harrison, G. W., Lau, M. I., & Rutström, E. E. (2018). Multiattribute utility theory, intertemporal utility, and correlation aversion. International Economic Review, 59, 537–555.

Anderson, J. T., Gibson, S., Luchtenberg, K. F., & Seiler, M. J. (2021). How Much Are Borrowers Willing to Pay to Remove Uncertainty Surrounding Mortgage Defaults? The Journal of Real Estate Finance and Economics, (pp. 1–23).

Andersson, O., Holm, H. J., Tyran, J.-R., & Wengström, E. (2016). Risk aversion relates to cognitive ability: Preferences or noise? Journal of the European Economic Association, 14, 1129–1154.

Andersson, O., Holm, H. J., Tyran, J.-R., & Wengström, E. (2020). Robust inference in risk elicitation tasks. Journal of Risk and Uncertainty, (pp. 1–15).

Andreoni, J., & Sprenger, C. (2012). Estimating time preferences from convex budgets. American Economic Review, 102, 3333–56.

Apesteguia, J., & Ballester, M. A. (2018). Monotone stochastic choice models: The case of risk and time preferences. Journal of Political Economy, 126, 74–106.

Aycinena, D., Baltaduonis, R., & Rentschler, L. (2014). Risk preferences and prenatal exposure to sex hormones for ladinos. PloS one, 9, 1–10.

Bacon, P. M., Conte, A., & Moffatt, P. G. (2014). Assortative mating on risk attitude. Theory and Decision, 77, 389–401.

Bajtelsmit, V. L., & Bernasek, A. (2001). Risk preferences and the investment decisions of older Americans. AARP: Public Policy Institute.

Bansback, N., Harrison, M., Sadatsfavi, M., Stiggelbout, A., & Whitehurst, D. G. T. (2016). Attitude to health risk in the canadian population: a cross-sectional survey. CMAJ Open, 4, E284–E291.

Bartczak, A., Chilton, S., & Meyerhoff, J. (2015). Wildfires in poland: The impact of risk preferences and loss aversion on environmental choices. Ecological Economics, 116, 300–309.

Bartke, S., & Schwarze, R. (2008). Risk-Averse by Nation or by Religion? Some Insights on the Determinants of Individual Risk Attitudes. Available at SSRN 1285520.

Bateman, H., Stevens, R., & Lai, A. (2015). Risk information and retirement investment choice mistakes under prospect theory. Journal of Behavioral Finance, 16, 279–296.

Beauchaine, T. P., Ben-David, I., & Sela, A. (2017). Attention-deficit/hyperactivity disorder, delay discounting, and risky financial behaviors: A preliminary analysis of self-report data. PloS one, 12, e0176933.

Benjamin, D. J., Brown, S. A., & Shapiro, J. M. (2013). Who is “behavioral’’? cognitive ability and anomalous preferences. Journal of the European Economic Association, 11, 1231–1255.

Blake, D. P., Cannon, E., & Wright, D. (2019). Quantifying loss aversion: Evidence from a uk population survey. Working Paper.

Bonsang, E., & Dohmen, T. (2015). Risk attitude and cognitive aging. Journal of Economic Behavior & Organization, 112, 112–126.

Booij, A. S., & van de Kuilen, G. (2009). A parameter-free analysis of the utility of money for the general population under prospect theory. Journal of Economic Psychology, 30, 651–666.

Booij, A. S., & van Praag, B. M. (2009). A simultaneous approach to the estimation of risk aversion and the subjective time discount rate. Journal of Economic Behavior & Organization, 70, 374–388.

Booij, A. S., van Praag, B. M. S., & van de Kuilen, G. (2010). A parametric analysis of prospect theory’s functionals for the general population. Theory and Decision, 68, 115–148.

Boschini, A., Dreber, A., von Essen, E., Muren, A., & Ranehill, E. (2019). Gender, risk preferences and willingness to compete in a random sample of the swedish population. Journal of Behavioral and Experimental Economics, 83, 101467.

Bouchouicha, R., Deer, L., Eid, A. G., McGee, P., Schoch, D., Stojic, H., et al. (2019). Gender effects for loss aversion: Yes, no, maybe? Journal of Risk and Uncertainty, 59, 171–184.

Bouchouicha, R., & Vieider, F. M. (2019). Growth, entrepreneurship, and risk-tolerance: a risk-income paradox. Journal of Economic Growth, 24, 257–282.

Boyle, P. A., Yu, L., Buchman, A. S., Laibson, D. I., & Bennett, D. A. (2011). Cognitive function is associated with risk aversion in community-based older persons. BMC geriatrics, 11, 1–8.

Bradford, D., Courtemanche, C., Heutel, G., McAlvanah, P., & Ruhm, C. (2017). Time preferences and consumer behavior. Journal of Risk and Uncertainty, 55, 119–145.

Brañas-Garza, P., Estepa Mohedano, L., Jorrat, D., Orozco, V., & Rascon-Ramirez, E. (2020). To pay or not to pay: Measuring risk preferences in lab and field. Available at SSRN 3687825.

Brañas-Garza, P., Galizzi, M. M., & Nieboer, J. (2018). Experimental and self-reported measures of risk taking and digit ratio (2d: 4d): evidence from a large, systematic study. International Economic Review, 59, 1131–1157.

Breuer, W., Renerken, T., & Salzmann, A. J. (2020). On the measurement of risk-taking and patience in financial decision-making. Available at SSRN 2538482.

Brick, K., Visser, M., & Burns, J. (2012). Risk aversion: Experimental evidence from south african fishing communities. American Journal of Agricultural Economics, 94, 133–152.

Browne, M. J., Hofmann, A., Richter, A., Roth, S.-M., & Steinorth, P. (2020). Peer effects in risk preferences: Evidence from germany. Annals of Operations Research.

Browne, M. J., Jaeger, V., Richter, A., & Steinorth, P. (2016). Family Transitions and Risk Attitude. Available at SSRN 2710688.

Bruderer Enzler, H., Diekmann, A., & Meyer, R. (2014). Subjective discount rates in the general population and their predictive power for energy saving behavior. Energy Policy, 65, 524–540.

Bucciol, A., & Miniaci, R. (2011). Household portfolios and implicit risk preference. Review of Economics and Statistics, 93, 1235–1250.

Burks, S. V., Carpenter, J. P., Götte, L., & Rustichini, A. (2009). Cognitive skills affect economic preferences, strategic behavior, and job attachment. Proceedings of the National Academy of Sciences, 106, 7745–7750.

Burks, S. V., Carpenter, J. P., Götte, L., & Rustichini, A. (2012). Which measures of time preference best predict outcomes: Evidence from a large-scale field experiment. Journal of Economic Behavior & Organization, 84, 308–320.

Burks, S. V., Lewis, C., Kivi, P. A., Wiener, A., Anderson, J. E., Götte, L., et al. (2015). Cognitive skills, personality, and economic preferences in collegiate success. Journal of Economic Behavior & Organization, 115, 30–44.

Buser, T., Grimalda, G., Putterman, L., & van der Weele, J. (2020). Overconfidence and gender gaps in redistributive preferences: Cross-country experimental evidence. Journal of Economic Behavior & Organization, 178, 267–286.

Busic-Sontic, A., & Brick, C. (2018). Personality trait effects on green household installations (p. 4). Collabra: Psychology.

Butler, J. V., Guiso, L., & Jappelli, T. (2013). The role of intuition and reasoning in driving aversion to risk and ambiguity. Theory and Decision, 77, 455–484.

Camerer, C. F., & Hogarth, R. M. (1999). The effects of financial incentives in experiments: A review and capital-labor-production framework. Journal of risk and uncertainty, 19, 7–42.

Cardenas, J. C., & Carpenter, J. (2013). Risk attitudes and economic well-being in latin america. Journal of Development Economics, 103, 52–61.

Castillo, M., Petrie, R., Cotla, C. R., & Torero, M. (2018). Risk preferences and decision quality of the poor. Working Paper.

Chapman, J., Dean, M., Ortoleva, P., Snowberg, E., & Camerer, C. (2018a). Econographics. Working Paper.

Chapman, J., Snowberg, E., Wang, S., & Camerer, C. (2018b). Loss attitudes in the us population: Evidence from dynamically optimized sequential experimentation (dose). Working Paper.

Charness, G., Gneezy, U., & Halladay, B. (2016). Experimental methods: Pay one or pay all. Journal of Economic Behavior & Organization, 131, 141–150.

Clot, S., Grolleau, G., & Ibanez, L. (2018). Shall we pay all? an experimental test of random incentivized systems. Journal of Behavioral and Experimental Economics, 73, 93–98.

Clot, S., Stanton, C. Y., & Willinger, M. (2017). Are impatient farmers more risk-averse? evidence from a lab-in-the-field experiment in rural uganda. Applied Economics, 49, 156–169.

Coller, M., & Williams, M. B. (1999). Eliciting individual discount rates. Experimental Economics, 2, 107–127.

Dasgupta, U., Mani, S., Sharma, S., & Singhal, S. (2016). Caste differences in behaviour and personality: Evidence from india. WIDER Working Paper.

Dave, C., Eckel, C. C., Johnson, C. A., & Rojas, C. (2010). Eliciting risk preferences: When is simple better? Journal of Risk and Uncertainty, 41, 219–243.

Delavande, A., Ganguli, J., & Mengel, F. (2018). Attitudes to uncertainty and household decisions. Working Paper.

Di Falco, S., & Vieider, F. M. (2018). Assimilation in the risk preferences of spouses. Economic Inquiry, 56, 1809–1816.

Dittrich, M., & Leipold, K. (2014). Gender differences in time preferences. Economics Letters, 122, 413–415.

Dohmen, T., Falk, A., Huffman, D., & Sunde, U. (2010). Are risk aversion and impatience related to cognitive ability? American Economic Review, 100, 1238–1260.

Dohmen, T., Falk, A., Huffman, D., Sunde, U., Schupp, J., & Wagner, G. G. (2011). Individual risk attitudes: Measurement, determinants, and behavioral consequences. Journal of the European Economic Association, 9, 522–550.

Donkers, B., Melenberg, B., & Van Soest, A. (2001). Estimating risk attitudes using lotteries: A large sample approach. Journal of Risk and Uncertainty, 22, 165–195.

Drichoutis, A. C., & Lusk, J. L. (2014). Judging statistical models of individual decision making under risk using in-and out-of-sample criteria. PloS one, 9, e102269.

Drichoutis, A. C., & Nayga, R. M. (2021). On the stability of risk and time preferences amid the covid-19 pandemic. Experimental Economics, (pp. 1–36).

Eckel, C., Johnson, C., & Montmarquette, C. (2005). Saving decisions of the working poor: Short-and long-term horizons. Research in experimental economics, 10, 219–260.

Faff, R., Hallahan, T., & McKenzie, M. (2011). Women and risk tolerance in an aging world. International Journal of Accounting & Information Management, 19, 100–117.

Falk, A., Becker, A., Dohmen, T., Enke, B., Huffman, D., & Sunde, U. (2018). Global evidence on economic preferences. The Quarterly Journal of Economics, 133, 1645–1692.

Fan, Y., Orhun, A. Y., & Turjeman, D. (2020). Heterogeneous actions, beliefs, constraints and risk tolerance during the covid-19 pandemic. NBER Working Papers 27211.

Fang, M.-C., Hanna, S., & Chatterjee, S. (2013). The impact of immigrant status and racial/ethnic group on differences in responses to a risk aversion measure. Journal of Financial Counseling and Planning, 24, 76–89.

Fehr, D., & Reichlin, Y. (2021). Perceived relative wealth and risk taking. Available at SSRN 3907737.

Frederick, S. (2005). Cognitive reflection and decision making. Journal of Economic perspectives, 19, 25–42.

Fredslund, E. K., Mørkbak, M. R., & Gyrd-Hansen, D. (2018). Different domains - different time preferences? Social Science & Medicine, 207, 97–105.

Freeney, Y., & O’Connell, M. (2010). Wait for it: Delay-discounting and academic performance among an irish adolescent sample. Learning and individual differences, 20, 231–236.

Frey, R., Richter, D., Schupp, J., Hertwig, R., & Mata, R. (2021). Identifying robust correlates of risk preference: A systematic approach using specification curve analysis. Journal of Personality and Social Psychology, 120, 538.

Gächter, S., Johnson, E. J., & Herrmann, A. (2021). Individual-level loss aversion in riskless and risky choices. Theory and Decision, (pp. 1–26).

Galizzi, M. M., Harrison, G. W., & Miraldo, M. (2018). Experimental methods and behavioral insights in health economics: Estimating risk and time preferences in health. Emerald Publishing Limited.

Galizzi, M. M., Machado, S. R., & Miniaci, R. (2016). Temporal stability, cross-validity, and external validity of risk preferences measures: Experimental evidence from a uk representative sample. Working Paper.

Gärtner, M., Mollerstrom, J., & Seim, D. (2017). Individual risk preferences and the demand for redistribution. Journal of Public Economics, 153, 49–55.

Giampietri, E., Bugin, G., & Trestini, S. (2021). On the association between risk attitude and fruit and vegetable consumption: insights from university students in italy. Agricultural and Food Economics, 9, 1–16.

Gillen, B., Snowberg, E., & Yariv, L. (2019). Experimenting with measurement error: Techniques with applications to the caltech cohort study. Journal of Political Economy, 127, 1826–1863.

Gloede, O., Menkhoff, L., & Waibel, H. (2015). Shocks, individual risk attitude, and vulnerability to poverty among rural households in thailand and vietnam. World Development, 71, 54–78.

Goda, G. S., Levy, M., Manchester, C. F., Sojourner, A., & Tasoff, J. (2019). Predicting retirement savings using survey measures of exponential - growth bias and present bias. Economic Inquiry, 57, 1636–1658.

Golsteyn, B. H., Grönqvist, H., & Lindahl, L. (2014). Adolescent time preferences predict lifetime outcomes. The Economic Journal, 124, F739–F761.

Görlitz, K., & Tamm, M. (2020). Parenthood, risk attitudes and risky behavior. Journal of Economic Psychology, 79, 102189.

Guenther, B., Galizzi, M. M., & Sanders, J. G. (2021). Heterogeneity in risk-taking during the covid-19 pandemic: Evidence from the uk lockdown. Frontiers in Psychology, 12, 852.

Halko, M.-L., Kaustia, M., & Alanko, E. (2012). The gender effect in risky asset holdings. Journal of Economic Behavior & Organization, 83, 66–81.

Hansen, J. V., Jacobsen, R. H., & Lau, M. I. (2016). Willingness to pay for insurance in denmark. Journal of Risk and Insurance, 83, 49–76.

Hardeweg, B., Menkhoff, L., & Waibel, H. (2013). Experimentally validated survey evidence on individual risk attitudes in rural thailand. Economic Development and Cultural Change, 61, 859–888.

Harrati, A. (2014). Characterizing the genetic influences on risk aversion. Biodemography and Social Biology, 60, 185–198.

Harrison, G. W., Johnson, E., McInnes, M. M., & Rutström, E. E. (2005). Risk aversion and incentive effects: Comment. American Economic Review, 95, 897–901.

Harrison, G. W., Lau, M. I., & Rutström, E. E. (2007). Estimating risk attitudes in denmark: A field experiment. Scandinavian Journal of Economics, 109, 341–368.

Harrison, G. W., Lau, M. I., & Williams, M. B. (2002). Estimating individual discount rates in denmark: A field experiment. American economic review, 92, 1606–1617.

Harrison, G. W. et al. (2008). Risk aversion in experiments. Emerald Group Publishing.

van der Heijden, E., Klein, T. J., Müller, W., & Potters, J. J. J. (2011). Nudges and impatience: Evidence from a large scale experiment. Netspar Discussion Paper.

Hofmeyr, A., Monterosso, J., Dean, A. C., Morales, A. M., Bilder, R. M., Sabb, F. W., & London, E. D. (2016). Mixture models of delay discounting and smoking behavior. The American Journal of Drug and Alcohol Abuse, 43, 271–280.

Holden, S., & Tilahun, M. (2019). Gender differences in risk tolerance, trust and trustworthiness: Are they related? CLTS Working Papers.

Holm, H. J., Opper, S., & Nee, V. (2013). Entrepreneurs under uncertainty: An economic experiment in china. Management Science, 59, 1671–1687.

Holt, C. A., & Laury, S. K. (2002). Risk aversion and incentive effects. American economic review, 92, 1644–1655.

Hopland, A. O., Matsen, E., & Strøm, B. (2016). Income and choice under risk. Journal of Behavioral and Experimental Finance, 12, 55–64.

Horn, D., & Kiss, H. J. (2019). Gender differences in risk aversion and patience: evidence from a representative survey. Available at SSRN 3313749.

Horn, D., & Kiss, H. J. (2020a). Do individuals with children value the future more? Available at SSRN 3540540.

Horn, D., & Kiss, H. J. (2020b). Time preferences and their life outcome correlates: Evidence from a representative survey. PloS one, 15, e0236486.

Howard, G., & Roe, B. (2011). Comparing the Risk Attitudes of U.S. and German Farmers. 2011 International Congress, August 30-September 2, 2011, Zurich, Switzerland 114528 European Association of Agricultural Economists.

Huffman, D., Maurer, R., & Mitchell, O. S. (2019). Time discounting and economic decision-making in the older population. The Journal of the Economics of Ageing, 14, 100121.

Hunter, R. F., Tang, J., Hutchinson, G., Chilton, S., Holmes, D., & Kee, F. (2018). Association between time preference, present-bias and physical activity: implications for designing behavior change interventions. BMC Public Health, 18.

Hvide, H. K., & Lee, J. H. (2015). Does source of income affect risk and intertemporal choices? Working Paper.

Hwang, I. D. (2017). Behavioral aspects of household portfolio choice: Effects of loss aversion on life insurance uptake and savings. Bank of Korea WP, 8.

Ioannou, C. A., & Sadeh, J. (2016). Time preferences and risk aversion: Tests on domain differences. Journal of Risk and Uncertainty, 53, 29–54.

Ionescu, I. O., & Turlea, E. (2011). The financial auditor’s risk behaviour-the influence of age on risk behaviour in a financial audit context. Accounting and Management Information Systems, 10, 444.

Jarmolowicz, D. P., Bickel, W. K., Carter, A. E., Franck, C. T., & Mueller, E. T. (2012). Using crowdsourcing to examine relations between delay and probability discounting. Behavioural Processes, 91, 308–312.

Jin, J., He, R., Gong, H., Xu, X., & He, C. (2017). Farmers’ risk preferences in rural china: Measurements and determinants. International Journal of Environmental Research and Public Health, 14, 713.

Johnson, E. J., Gächter, S., & Herrmann, A. (2006). Exploring the Nature of Loss Aversion. Available at SSRN 892336.

Jung, S. (2017). The gender wage gap and sample selection via risk attitudes. International Journal of Manpower, 38, 318–335.

Jung, S., & Treibich, C. (2015). Is self-reported risk aversion time variant? Revue d’économie politique, 125, 547–570.

Kahneman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47, 263–292.

Kam, C. D. (2012). Risk attitudes and political participation. American Journal of Political Science, 56, 817–836.

Kettlewell, N. (2019). Risk preference dynamics around life events. Journal of Economic Behavior & Organization, 162, 66–84.

Khachatryan, K., Dreber, A., von Essen, E., & Ranehill, E. (2015). Gender and preferences at a young age: Evidence from armenia. Journal of Economic Behavior & Organization, 118, 318–332.

Kim, Y.-I., & Lee, J. (2012). Estimating risk aversion using individual-level survey data. The Korean Economic Review, 28, 221–239.

Knoppen, D., & Saris, W. (2009). Do we have to combine values in the schwartz’ human values scale? a comment on the davidov studies. In Survey Research Methods (pp. 91–103). volume 3.

Kristjanpoller, W. D., & Olson, J. E. (2015). Choice of retirement funds in chile: Are chilean women more risk averse than men? Sex Roles, 72, 50–67.

Laban Peryman, J. (2015). Culture and risk-sharing networks. Available at SSRN 2912006.

Laibson, D. (1997). Golden eggs and hyperbolic discounting. The Quarterly Journal of Economics, 112, 443–478.

Lampi, E., & Nordblom, K. (2013). Risk-taking middle-borns: A study on birth-order and risk preferences. Journal of Communications Research, 5.

Le, A. T., Miller, P. W., Slutske, W. S., & Martin, N. G. (2010). Are attitudes towards economic risk heritable? analyses using the australian twin study of gambling. Twin Research and Human Genetics, 13, 330–339.

Lee, S. H., & Kang, H. G. (2016). Integrated framework for the external cost assessment of nuclear power plant accident considering risk aversion: The korean case. Energy Policy, 92, 111–123.

l’Haridon, O., & Vieider, F. M. (2019). All over the map: A worldwide comparison of risk preferences. Quantitative Economics, 10, 185–215.

Lilleholt, L. (2019). Cognitive ability and risk aversion: A systematic review and meta analysis. Judgment & Decision Making, 14.

Luce, R. D. (1960). Individual choice behavior, a theoretical analysis. Bulletin of the American Mathematical Society, 66, 259–260.

Martín-Fernández, J., Medina-Palomino, H. J., Ariza-Cardiel, G., Polentinos-Castro, E., & Rutkowski, A. (2018). Health condition and risk attitude in the dutch population: an exploratory approach. Health, Risk & Society, 20, 126–146.

Mata, R., Josef, A. K., & Hertwig, R. (2016). Propensity for risk taking across the life span and around the globe. Psychological science, 27, 231–243.

Meier, S., & Sprenger, C. D. (2015). Temporal stability of time preferences. Review of Economics and Statistics, 97, 273–286.

Meissner, T., & Pfeiffer, P. (2022). Measuring preferences over the temporal resolution of consumption uncertainty. Journal of Economic Theory, 200, 105379.

Melesse, M. B., & Cecchi, F. (2017). Does market experience attenuate risk aversion? evidence from landed farm households in ethiopia. World Development, 98, 447–466.

Menkhoff, L., & Sakha, S. (2017). Estimating risky behavior with multiple-item risk measures. Journal of Economic Psychology, 59, 59–86.