Abstract

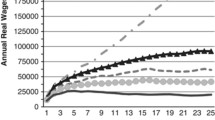

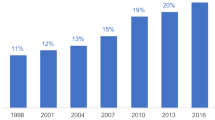

The study of student loan debt remains a timely and relevant higher education finance research and policy-oriented topic, especially when considering the alarming growth rates of student loan debt balances. The Quarterly Report on Household Debt and Credit released in May of 2018 shows that among all debt balances, student loans remain the only form of debt that virtually sextupled over the last 15-years, and this trend is not slowing down. Although aggregated trends are important, by definition they are limited in their capabilities to providing researchers, policy- and decision-makers with insights related to individual debt accumulation and, perhaps more importantly, with knowledge about the factors associated with variation of individual debt burden. Accordingly, the overarching goal of this study is to ameliorate this limitation in three meaningful ways. First, this is the first study that offers inferential estimates of the magnitude of student debt accumulation increase across two different decades (1991–2013) and institutional sectors (public 2- and 4-year colleges). Second, these estimates are based on student level undergraduate non-self-reported longitudinal loan debt disbursements. Third, the estimates not only account for individuals’ baseline differences at the moment of college entry, but also account for institution- and state-level indicators that took place during college enrollment and that may be related to the variation of student loan debt reliance. Two nationally representative samples (NELS and ELS) complemented with other institution- and state-level data were analyzed using doubly robust estimators build from propensity score weights and entropy balancing approaches that were robust to unobservable selection issues using Oster’s approach (J Bus Econ Stat 37(2):1–18, 2017). The results consistently indicated that, among all participants, student borrowing participation increased by 15 percentage points in the 2000s, compared to the 1990s, and individual debt accumulation at least doubled across decades. Notably, among 4-year degree holders, the 2-year path toward a 4-year degree consistently resulted in about 10% lower debt accumulation compared to the 4-year path toward a 4-year degree. Students who did not attain a 4-year degree were better served by having started college in the 2-year sector. In terms of overall debt increase, 4-year degree holders accrued about $8000 more on average than their counterparts did during the 1990s, however, the recent cohort also repaid about $11,000 more, on average (or three times as much), than participants did in the 1990s. These higher repayment behaviors observed among 4-year degree holders, resulted in similar amounts of their respective debt balances across decades. The implications are clear: students with higher propensities toward a 4-year degree attainment are likely to incur lower debt if they start college in the community college sector. However, before fully recommending this pathway, 2- and 4-year colleges’ articulation agreements should be strengthened to ease transfer and eventual degree completion. Without recommending consolidation or merger between 2- and 4-year institutions, researchers and policy makers can learn from the strategies implemented by successful cases such as Perimeter College and Georgia State. Finally, 4-year entrants with lower likelihood to attain a 4-year degree may be better served by beginning college in the 2-year sector instead. Predictive analytics and machine learning techniques can be used to identify these cases, as depicted in the discussion section of the study.

Similar content being viewed by others

Notes

These categories include mortgage debt, student loans, auto loans, credit cards, home equity revolving debt, and other debt.

Estimates obtained, within each of the six loan categories, as the ratio of each quarterly amount reported by the FRBNY (2018), to its corresponding baseline amounts reported in January of 2003.

The data contained in this report were obtained from the Center for Microeconomic Data based on credit records from Equifax and cover 15 years of quarterly data beginning in the first quarter of 2003 and ending in the first quarter of 2018. The descriptive analysis of the data contained in Fig. 3 in Appendix, follows the rationale presented by Kiefer (2016).

Conversely others have claimed that low-income students may be averse to student loans due to fear of not being able to repay such debt, which would also impact their reliance on student loans.

Beginning Postsecondary Students is limited in its availability of pre-college indicators.

See Ridgeway (2007, p. 5, Eq. (12)) for details on the relative influence index.

Estimates that controlled for unobservables using the Heckman control function rendered similar results. Due to space limitations, these models are omitted from this study, but are available upon request.

Treatment and outcome variables were not imputed. Data points were assumed to be missing at random. Multiple imputations were based on a chained equations approach (van Buuren and Groothuis-Oudshoorn 2011). The conditional distribution of each variable was assigned depending on whether the variable was binary, ordered categorical, or continuous. The number of imputed datasets was 10 and all imputations are completely replicable.

This index was standardized by the NCES to range from − 2 to 2 across samples, with negative signs indicating socioeconomic hardship.

This is not conceptualized as tracking or cooling out, but as a strategy to ameliorate potential debt burden resulting from misalignment between participants’ propensities to 4-year degree attainment and college choice.

An extra set of analyses were restricted to participants who expected to attain at least a 4-year degree and their resulting estimates presented no important variations. These analyses are available upon request.

References

AACC. (2018). 2015 fact sheet. American Association of Community Colleges, Washington, DC. Retrieved Aug 1, 2018, from https://www.aacc.nche.edu/wp-content/uploads/2018/04/2018FastFacts_web.jpg

Abadie, A., Diamond, A., & Hainmueller, J. (2010). Synthetic control methods for comparative case studies: Estimating the effect of California’s tobacco control program. Journal of the American statistical Association, 105(490), 493–505.

Akers, B. (2014). How much is too much? Evidence on financial well-being and student loan debt. Washington, DC: The American Enterprise Institute (AEI). Retrieved Aug, 12, 2014.

Altonji, J. G., Elder, T. E., & Taber, C. R. (2005). Selection on observed and unobserved variables: Assessing the effectiveness of Catholic schools. Journal of political economy, 113(1), 151–184.

Bailey, T. R., Jaggars, S., & Jenkins, P. D. (2015). What we know about guided pathways? Retrieved from https://ccrc.tc.columbia.edu/publications/what-we-know-about-guided-pathways-packet.html

Baum, S. (2015). The evolution of student debt in the united states. Student Loans and the Dynamics of Debt (pp. 11–35). Kalamazoo, MI: W.E. Upjohn Institute for Employment Research.

Baum, S., & O’Malley, M. (2003). College on credit: How borrowers perceive their education debt. Journal of Student Financial Aid, 33(3), 7–19.

Baum, S., & Saunders, D. (1998). Life after debt: Summary results of the national student loan survey. Student Loan Debt, 28(3), 1.

Becker, S., & Ichino, A. (2002). Estimation of average treatment effects based on propensity scores. The Stata Journal, 2(4), 358–377.

Belfield, C. (2013). Student loans and repayment rates: the role of for-profit colleges. Research in Higher Education, 54, 1–29.

Belfield, C., & Bailey, T. (2011). The benefits of attending community college: A review of the evidence. Community College Review, 39(1), 46–68.

Belfield, C., Fink, J., & Jenkins, D. (2017). Is it really cheaper to start at a community college? The costs of inefficient transfer for community college students seeking bachelor’s degrees. In The role of research in making government more effective. New York: Columbia University

Bourdieu, P. (1986). The forms of capital. Handbook of Theory and Research for the Sociology of Education, 241, 258.

Brand, J. E., Pfeffer, F. T., & Goldrick-Rab, S. (2014). The community college effect revisited: The importance of attending to heterogeneity and complex counterfactuals. Sociological Science, 1, 448–465.

Caliendo, M., & Kopeinig, S. (2008). Some practical guidance for the implementation of propensity score matching. Journal of economic surveys, 22(1), 31–72.

Cho, S. H., Xu, Y., & Kiss, D. E. (2015). Understanding student loan decisions: A literature review. Family and Consumer Sciences Research Journal, 43(3), 229–243.

Clark, B. R. (1960a). The “cooling-out” function in higher education. American Journal of Sociology, 65(6), 569–576.

Clark, B. R. (1960b). The open door college: A case study. New York: McGraw-Hill.

College Board. (2014). Student Aid and Nonfederal Loans in 2013 Dollars (in Millions), 1970-71 to 2013-14. College Board. Retrieved from https://trends.collegeboard.org/student-aid/figures-tables/total-student-aid-and-nonfederal-loans-2017-dollars-over-time

Delisle, J. (2012). Federal student loan interest rates: History, subsidies, and cost issue brief. Washington, DC: New America Foundation.

Deming, D. J., Goldin, C., & Katz, L. F. (2011). The for-profit postsecondary school sector: Nimble critters or agile predators? Journal of Economic Perspectives, 26(1), 139–164.

DesJardins, S., Ahlburg, D., & McCall, B. (2002). A temporal investigation of factors related to timely degree completion. Journal of Higher Education, 73(5), 555–581.

Dougherty, K. J. (1994). The contradictory college: The conflicting origins, impacts, and futures of the community college. New York: State Univ of New York Pr.

Dowd, A., & Coury, T. (2006). The effect of loans on the persistence and attainment of community college students. Research in Higher Education, 47(1), 33–62.

Doyle, W. (2009). The effect of community college enrollment on bachelor’s degree completion. Economics of Education Review, 28(2), 199–206.

Dynarski, S. (2016). The trouble with student loans? Low earnings, not high debt.

Elith, J., Leathwick, J. R., & Hastie, T. (2008). A working guide to boosted regression trees. Journal of Animal Ecology, 77(4), 802–813.

Elliott, W., Grinstein-Weiss, M., & Nam, I. (2013). Does outstanding student debt reduce asset accumulation (Tech. Rep.). CSD Working Paper 13–32. St. Louis, MO: Washington University, Center for Social Development.

Federal Reserve Bank of New York. (2018). Quarterly report on household debt and credit. Retrieved from https://www.newyorkfed.org/medialibrary/interactives/householdcredit/data/xls/HHD_C_Report_2016Q2.xlsx

Field, E. (2006). Educational debt burden and career choice: Evidence from a financial aid experiment at NYU law school (Tech. Rep.). National Bureau of Economic Research. American Economic Journal: Applied Economics, 1, 1–21.

Friedman, J. H. (2001). Greedy function approximation: A gradient boosting machine. Annals of Statistics, 29, 1189–1232.

Fry, R. (2014). Young adults, student debt and economic well-being. Pew research social and demographic trends. Washington, DC: Pew Charitable Trusts.

Gladieux, L., & Perna, L. (2005). Borrowers who drop out: A neglected aspect of the college student loan trend. national center report# 05-2. National Center for Public Policy and Higher Education, San Jose, p. 64

González Canché, M. S. (2014a). Localized competition in the non-resident student market. Economics of Education Review, 43, 21–35.

González Canché, M. S. (2014b). Is the community college a less expensive path toward a Bachelor’s degree? Public 2-and 4-year colleges’ impact on loan debt. The Journal of Higher Education, 85(5), 723–759.

González Canché, M. S. (2017a). Financial benefits of rapid student loan repayment: An analytic framework employing two decades of data. The Annals of the American Academy of Political and Social Sciences, 671(1), 154–182.

González Canché, M. S. (2017b). The heterogeneous non-resident student body: Measuring the effect of out-of-state students’ home-state wealth on tuition and fee price variations. Research in Higher Education, 58(2), 141–183.

González Canché, M. S. (2018). Reassessing the 2-year sector’s role in the amelioration of a persistent socioeconomic gap: A proposed analytical framework for the study of community college effects in the big and geocoded data and quasi-experimental era. In M. B. Paulsen (Ed.), Higher education: Handbook of Theory and Research. (pp. 175–238). Cham: Springer. Retrieved from https://doi.org/10.1007/978-3-319-72490-4_5

González Canché, M. S. (2019). Re(de)fining college access and its association with divergent forms of financial aid: A proposed conceptual and analytic framework. Journal of Hispanic Higher Education, 18(2), 113–140. https://doi.org/10.1177/1538192719832252.

Gross, J., Cekic, O., Hossler, D., & Hillman, N. (2009). What matters in student loan default: A review of the research literature. Journal of Student Financial Aid, 39(1), 19–29.

Hainmueller, J., & Xu, Y. (2013). Ebalance: A stata package for entropy balancing. Journal of Statistical, 54(7), 18.

Hauser, R. M. (1970). Educational stratification in the united states. Sociological Inquiry, 40(2), 102–129.

Hearn, J. (1998). The growing loan orientation in federal financial aid policy: A historical perspective (pp. 47–75). Condemning students to debt: College loans and public policy.

Heller, D. (2008). The impact of student loans on college access. The effectiveness of student aid policies: What the research tells us (pp. 39–68). New York: College Board.

Hillman, N. W. (2014). College on credit: A multilevel analysis of student loan default. The Review of Higher Education, 37(2), 169–195.

Holland, P. W. (1986). Statistics and causal inference. Journal of the American statistical Association, 81(396), 945–960.

Houle, J., & Berger, L. (2014). Is student loan debt discouraging home buying among young adults?. Hanover, NH: Association for Public Policy and Management.

Hu, X., Ortagus, J. C., & Kramer, D. A. (2017). The community college pathway: An analysis of the costs associated with enrolling initially at a community college before transferring to a 4-year institution. Higher Education Policy, 31(3), 1–22.

Integrated Postsecondary Education Data System. (2016). Integrated Postsecondary Education Data System (IPEDS) Survey Data files: EF2013D, HD2013, IC2013. National Center for Education Statistics. Retrieved from http://nces.ed.gov/ipeds/datacenter/DataFiles.aspx

Jacobson, L., & Mokher, C. (2009). Pathways to boosting the earnings of low-income students by increasing their educational attainment. Washington, DC: Hudson Institute.

Kesterman, F. (2005). Student loan borrowing in america| metrics, demographics, and loan default aversion strategies. The George Washington University.

Kiefer, L. (2016). Consumer credit trends. Retrieved from http://lenkiefer.com/2016/08/09/trends-in-credit

Lewis, D. (1973). Causation. The Journal of Philosophy, 70(17), 556–567.

Looney, A., & Yannelis, C. (2015). A crisis in student loans? How changes in the characteristics of borrowers and in the institutions they attended contributed to rising loan defaults. Brookings Papers on Economic Activity, 2015(2), 1–89.

Marcotte, D. (2010). The earnings effect of education at community colleges. Contemporary Economic Policy, 28(1), 36–51.

Monaghan, D. B., & Attewell, P. (2014). The community college route to the bachelor’s degree. Educational Evaluation and Policy Analysis, 37(1), 70–91.

MSEP. (2014). The Midwest Student Exchange Program. Midwestern Higher Education Compact. Retrieved from http://msep.mhec.org/

National Association of State Student Grant & Aid Programs. (2004-05). 42nd Annual Survey Report on State-Sponsored Student Financial Aid, 2010-11 Academic Year. Springfield: Illinois Student Assistance Commission. Retrieved from http://www.nassgap.org/viewrepository.aspx?categoryID=3#

NEBHED. (2014). New England Board of Higher Education. New England Board of Higher Education. Retrieved from http://www.nebhe.org/

Oster, E. (2017). Unobservable selection and coefficient stability: Theory and evidence. Journal of Business & Economic Statistics, 37(2), 1–18.

Palardy, G. J. (2008). Differential school effects among low, middle, and high social class composition schools: A multiple group, multilevel latent growth curve analysis. School Effectiveness and School Improvement, 19(1), 21–49.

Pinto, M., & Mansfield, P. (2006). Financially at-risk college students: An exploratory investigation of student loan debt and prioritization of debt repayment. Journal of Student Financial Aid, 36(2), 22–32.

Podgursky, M., Ehlert, M., Monroe, R., Watson, D., & Wittstruck, J. (2002). Student loan defaults and enrollment persistence. Journal of Student Financial Aid, 32(3), 27–42.

Ridgeway, G. (2007). Generalized boosted models: A guide to the gbm package. Update, 1, 1.

Ridgeway, G., McCaffrey, D. F., Morral, A. R., Burgette, L. F., & Griffin, B. A. (2014). Toolkit for weighting and analysis of nonequivalent groups.

Rosenbaum, P., & Rubin, D. (1983). The central role of the propensity score in observational studies for causal effects. Biometrika, 70(1), 41.

Rothstein, J., & Rouse, C. E. (2007, May). Constrained after college: Student loans and early career occupational choices (Working Paper No. 13117). National Bureau of Economic Research. Retrieved from http://www.nber.org/papers/w13117

Rubin, D. B. (2005). Causal inference using potential outcomes. Journal of the American Statistical Association, 100(469), 322–331.

SREB. (2014). Southern Regional Education Board. Southern Regional Education Board. Retrieved from http://www.sreb.org/

Steele, P., & Baum, S. (2009). How much are college students borrowing?. New York: The College Board.

Stephan, J. L., Rosenbaum, J. E., & Person, A. E. (2009). Stratification in college entry and completion. Social Science Research, 38(3), 572–593.

The Bureau of Economic Analysis. (2004–2005). The Bureau of Economic Analysis [Data file]. The Bureau of Economic Analysis. Retrieved from http://www.bea.gov/iTable/iTable.cfm?ReqID=70&step=1&isuri=1&acrdn=4

United States Census Bureau Population Estimates. (2014). State-to-state migration flows 2004-05. The United States Census Bureau. Retrieved from https://www.census.gov/popest/data/historical/2000s/

United States Department of Labor. (2018). Consumer Price Index Inflation Calculator, Bureau of Labor Statistics. United States Department of Labor. Retrieved from http://www.bls.gov/data/inflation_calculator.htm

United States Department of Labor: Bureau of Labor Statistics. (2014). Labor Force Statistics from the Current Population Survey [Unemployment Rates 1948-2014]. United States Department of Labor: Bureau of Labor Statistics. Retrieved from http://data.bls.gov/timeseries/LNS14000000

van Buuren, S., & Groothuis-Oudshoorn, K. (2011). mice: Multivariate imputation by chained equations in R. Journal of Statistical Software, 45(3), 1–67.

Volkwein, J., Szelest, B., Cabrera, A., & Napierski-Prancl, M. (1998). Factors associated with student loan default among different racial and ethnic groups. Journal of Higher Education, 69, 206–237.

WICHE. (2014). Western Interstate Commission for Higher Education. Western Interstate Commission for Higher Education. Retrieved from http://www.wiche.edu/

Wyatt, J. N., Wiley, A., Proestler, N., & Camara, W. J. (2012). The development of an index of academic rigor for college readiness. New York: College Board. Retrieved from https://files.eric.ed.gov/fulltext/ED561023.pdf

Funding

This research was supported by a grant from The Spencer Foundation (Grant #201500116).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

González Canché, M.S. Community College Students Who Attained a 4-Year Degree Accrued Lower Student Loan Debt than 4-Year Entrants Over 2 Decades: Is a 10 Percent Debt Accumulation Reduction Worth the Added “Risk”? If So, for Whom?. Res High Educ 61, 871–915 (2020). https://doi.org/10.1007/s11162-019-09565-9

Received:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11162-019-09565-9

Keywords

- Community college effects on student loan debt

- Philosophy of Causation in the social sciences

- Quasi-causal estimates

- Higher education finance and college choice

- Propensity score weighting

- Entropy balancing

- Doubly-robust modeling

- Unobservable selection and Coefficient stability

- Machine learning

- Predictive analytics

- Data science