Abstract

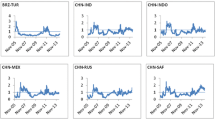

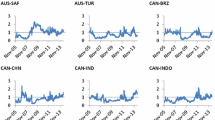

We investigate the means and volatility feedback loop hypotheses in terms of the informational flow among credit distress conditions, equity market expectations and investor sentiment to identify the transmission channels among sovereign CDS, equity and volatility markets. We examine core (Germany, France) and periphery (Portugal, Italy, Ireland, Spain, Greece) EMU countries for the 2009–2014 period. Our findings support the volatility feedback loop hypothesis among markets. Specifically, the major transmitters of shocks (volatility) were both the core and periphery sovereigns, while investor sentiment was the main receiver of volatility. Further, we found that, before the EMU debt crisis (2008–2009), the information flow started from the equity towards the CDS market but turned bidirectionally, post-debt crisis (2010–2014). Finally, geopolitics as a measure of macroeconomic risk, was found to respond more to sovereign risk than to bank risk in the EMU, and to the core sovereign/bank risk than to the periphery.

Similar content being viewed by others

Notes

Since we use geopolitics as a macroeconomic uncertainty index we also built on to the limited literature strand on the channel of (policy or macroeconomic) uncertainty and CDS: eg. Wisniewski and Lambe (2015) argue that CDS spreads react to shocks in policy risk; Wang et al. (2019) associate positively the Economic Policy Uncertainty index to CDS.

The EUROSTOXX50 Index is constructed from blue chip companies of sector leaders in the Eurozone: Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain. The EUROSTOXX 50 Volatility Index (VSTOXX) index exhibits the implied volatility given by the prices of the options with corresponding maturity, on the EUROSTOXX 50 Index.

Since we use this framework as an additional measure of the cross-propagation mechanism we include the time-varying aspect, i.e., dynamic variance decompositions coming from VARs with rolling windows (250 days) and generalized variance decompositions as in Diebold and Yilmaz (2012). Since we utilize the factorization based on the ordering of variables: sovereign, equity, volatility markets we do need to apply the Diebold and Yilmaz (2012) generalized variance decomposition scheme based on Cholesky.

Selection bias is expected given data availability for bank institutions and thus we use a representative sample of 3 per country.

We employ two versions for periphery CDS portfolios for both sovereign and bank risk level; one involving Greek CDS series and the second one excludes them, given that Greece is considered the ground zero country for the Eurozone’s debt crisis. Essentially, we allow for a sensitivity analysis for the pool of periphery CDS portfolios. In the analysis we implemented the second case. All CDS data are scaled /100.

The results are available upon request.

We have also performed additional tests such as autoregressions and cross-correlations to validate the lead-lag relationships. In all cases, a 2- to 3-month lead was detected for the sentiment and GPR indicators followed by index changes. We found similar relationships for the cycle components. Hence, we can state that these indicators move in cycles and precede movements in equity indices (such as the RSTOCK).

References

Acharya V, Drechsler I, Schnabl P (2014) A Pyrrhic victory? Bank bailouts and sovereign credit risk. J Financ 69:2689–2739

Acharya V, Johnson TC (2007) Insider trading in credit derivatives. J Financ Econ 84(1):110–141

Anelli M, Patanè M (2022) The role of CDS market in the price discovery process of the “PIIGS” countries sovereign credit risk during the recent decade of monetary easing. J Financ Invest Anal 11:1–29

Anton M, Mayordomo S, Rodriguez-Moreno M (2018) Dealing with dealers: Sovereign CDS comovements in Europe. J Bank Finance 90:96–112

Ballester L, González-Urteaga A (2020) Is there a connection between sovereign CDS spreads and the stock market? Evidence for European and US returns and volatilities. Mathematics 8:1667

Bampinas G, Panagiotidis T, and Politsidis P (2020) Sovereign bond and CDS market contagion: a story from the Eurozone crisis. MPRA working paper, https://mpra.ub.uni-muenchen.de/102846/

Boussada H, Prigent JL, Soumare I (2023) On the sovereign debt crisis: sovereign credit default swaps and their interaction with stock market indices. Appl Econ 1:55

Bratis T, Nikiforos L, George K (2018) Contagion and interdependence in Eurozone bank and sovereign credit markets. Int J Finance Econ 23(4):655–674

Caldara D, Iacoviello M (2022) Measuring Geopolitical Risk. Am Econ Rev 112(4):1194–1225

Calice G, Ioannidis C (2012) An empirical analysis of the impact of the credit default swap index market on large complex financial institutions. Int Rev Financ Anal 25:117–130

Chau F, Han C, Shi S (2018) Dynamics and determinants of credit risk discovery: Evidence from CDS and stock markets. Int Rev Financ Anal 55(C):156–169

Coronado M, Corzo MT, Lazcano L (2012) A case for Europe: the relationship between Sovereign CDS and stock indexes. Front Financ Econ 9:32–63

Corzo Santamaría MT, Gómez Biscarri J, Lazcano Benito L (2014) Financial crises and the transfer of risks between the private and public sectors: evidence from European financial markets. Span Rev Financ Econ 12:1–14

Diebold FX, Yilmaz K (2012) Better to give than to receive: Predictive directional measurement of volatility spillovers. Int J Forecast 28(1):57–66

Erce A (2015) Bank and sovereign risk feedback loops. European Stability Mechanism, Working Paper Series, 1/2015

Fonseca J, Gottschalk K (2018) The co-movement of credit default swap spreads, equity returns and volatility: evidence from Asia-Pacific markets. Int Rev Financ 20:551–579

Forte S, Lovreta L (2019) Volatility discovery: Can the CDS market beat the equity options market? Finance Res Lett 28(C):107–111.

Fung HG, Sierra GE, Yau J, Zhang G (2008) Are the US stock market and credit default swap market related? Evidence from the CDX indices. J Altern Invest 1:43–61

Gunduz Y, Kaya O (2014) Impacts of the financial crisis on eurozone sovereign CDS spreads. J Int Money Financ 49:425–442

Longstaff PF, Mithal S, Neis E (2005) Corporate yield spreads: default risk or liquidity? New evidence from the credit default swap market. J Financ 60:2213–2253

Marsh IW, Wagner W (2016) News-specific price discovery in credit default swap markets. Financ Manag 45:315–340

Mateev M (2019) Volatility relation between credit default swap and stock market: New empirical tests. J Econ Financ 43:681–712

Narayan PK (2015) An analysis on sectoral equity and CDS spreads. J Int Finan Markets Inst Money 34:80–93

Narayan PK, Sharma SS, Thuraisamy KS (2014) An analysis of price discovery from panel data models of CDS and equity returns. J Bank Financ 41:167–177

Ngene GM, Hassan MK, Alam N (2014) Price discovery process in the emerging sovereign CDS and equity markets. Emerg Market Rev 21:117–132

Norden L, Weber M (2009) The comovement of credit default swap, bond and stock markets: an empirical analysis. Eur Financ Manag 15:529–562

Procasky WJ (2020) Price discovery in CDS and equity markets: Default risk-based heterogeneity in the systematic investment grade and high yield sectors. J Financ Markets 2020:100581

Shahzad SJH, Aloui C, Jammazi R (2020) On the interplay between US sectoral CDS, stock and VIX indices: Fresh insights from wavelet approaches. Financ Res Lett 33:101208

Wang X, Xu W, Zhong Z (2019) Economic policy uncertainty, CDS spreads, and CDS liquidity provision. J Futur Mark 39:461–480

Wisniewski TP, Lambe BJ (2015) Does economic policy uncertainty drive CDS spreads? Int Rev Financ Anal 42:447–458

Xiang V, Chng MT, Fang V (2015) The economic significance of CDS price discovery. Rev Quant Financ Acc 2015:1–30

Zhu H (2006) An empirical comparison of credit spreads between the bond market and the credit default swap market. J Financ Serv Res 29:211–235

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

The paper has benefited from helpful comments and discussions by seminar participants at Athens University of Economics and Business, Audencia Nantes School of Management, IPAG Business School, Imperial University London. We thank Angelos Antzoulatos, Manthos Delis, Dimitris Georgoutsos, Iftekhar Hasan, Alexandros Kontonikas and George Tavlas for many helpful comments and discussions. All remaining errors are our own.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Bratis, T., Laopodis, N.T. & Kouretas, G.P. CDS and equity markets’ volatility linkages: lessons from the EMU crisis. Rev Quant Finan Acc 60, 1259–1281 (2023). https://doi.org/10.1007/s11156-023-01126-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-023-01126-7

Keywords

- Credit default swap spreads

- Financial crises

- Systemic risk

- Spillover effects

- Volatility

- Interconnectedness

- Geopolitical risk