Abstract

Using a testable Slutsky equation derived from a formal utility maximization model of portfolio choice under uncertainty, we examine whether the momentum component in daily returns is induced by the interaction of the intertemporal risk-return tradeoff and investor tendency to correct prior mispricing. We find that a substantial portion of short-horizon momentum is generated by the asymmetric intertemporal risk-return tradeoff that the positive risk-return relation is strengthened conditional on a prior negative market return but is attenuated conditional on a prior positive market return. With the observation of a highly positive correlation between the trading signals and price change dummies, we further explore the link between technical trading profits and the two pricing factors. Our empirical results provide strong evidence that the profits associated with technical strategies come from exploiting the same momentum component induced by the interaction of the risk-return relation and investor adjustment behavior. We conclude that technical trading profits are the result of rational pricing factors and therefore not evidence of market inefficiency.

Similar content being viewed by others

Notes

See Fama (1991).

For instance, Lo and MacKinlay (1990) study the cross-autocorrelations of stocks and argue that the lead-lag structure of stock returns can result in contrarian profits. However, Boudoukh et al. (1994) and Jegadeesh and Titman (1995a) argue that the lead-lag effect arises from investors’ delayed reaction to common factors so that the contrarian profit is mainly attributed to the overreaction to firm specific information. Among the alternative explanations are the presence of the bid-ask spread in Jegadeesh and Titman (1995b), microstructure biases for low priced-stocks by Conrad and Kaul (1993), time-variation in expected returns by Ball and Kothari (1989), Chopra, Lakonishok and Ritter (1992), and the book-to-market effect by Chan, Hamao and Lakonishok (1991), Fama and French (1992), and Lakonishok, Shleifer and Vishny (1994). On the other hand, Fama and French (1996) document that, while long-term mean reversion is consistent with a multifactor model of returns, their model fails to account for momentum profits. Chan et al. (1996) show that underreaction to earnings information can partly account for medium-term momentum profits, but price momentum is not explained by earning momentum.

Studies that support a positive intertemporal risk return relation include French et al. (1987), Fama and French (1988), Ball and Kothari (1989), Cecchehtti et al. (1990), Haugen et al. (1991), Campbell and Hentschel (1992), Scruggs (1998), Kim et al. (2001), Ghysel et al. (2005), Ludvigson and Ng (2007), Bali (2008), Nam et al. (2015), Frazier et al. (2016), Chen et al. (2017), and Cederburg (2019). Studies that support a negative intertemporal risk return relation include Campbell (1987), Breen et al. (1989), Nelson (1991), Glosten, et al. (1993), Backus and Gregory (1993), Whitelaw (1994), Harvey (2001), Brandt and Kang (2004), Ang et al. (2006), and Atilgan et al. (2015). On the contrary, Poterba and Summers (1986), Baillie and DeGennaro (1990), Boudoukh et al. (1997), Whitelaw (2000), and Müller et al. (2011) document that the effect of the relation is either negligible or unstable.

Yu and Yuan (2011) argue that sentiment-driven traders have a greater effect on prices in periods of high sentiment by taking short positions, and that sentiment-driven traders are also more likely to be naïve and mis-forecast the conditional volatility of market returns. The consequence is that sentiment-driven traders undermine what would otherwise be a positive risk-return relation when sentiment is high.

Stambaugh, Yu, and Yuan (2015) show that the combined effects of arbitrage risk and arbitrage asymmetry (i.e., relatively less arbitrage activity directed towards overpriced relative to underpriced stocks) can result in a negative relationship between aggregate idiosyncratic volatility and expected market return.

While Fama and Blume (1966) and Jensen and Benington (1970) concluded that technical analysis is not useful in generating profits, Brock, et al. (1992), Lo, et al. (2000), Shynkevich (2012), Smith et al. (2016), Marshall et al. (2017), Nazário et al. (2017), Kang, et al. (2019), Gerritsen, et al. (2020), and many other studies have documented strong evidence of technical trading profits in the equity markets. Bessembinder and Chan (1995), Ito (1999), and Ratner and Leal (1999) show the profitability of trading rules in emerging equity markets. Olson (2004), Neely and Weller (2003, 2001), Neely, et al. (1997), LeBaron (1999), Gençay (1999), Kho (1996), Charles et al. (2012), Levich and Potì (2015), Gradojevic and Lento (2015), and Hsu et al. (2016) document the profitability of technical analysis for currency markets.

Sullivan, Timmermann, and White (1999) and Ready (2002) examined the possibility that data mining biases affect the results of Brock et al. (1992). Bessembinder and Chan (1998) indicated that technical trading rules had been able to yield economic profits in US stock markets until the late 1980s, but not thereafter. Olson (2004) show that risk-adjusted trading rule profits in currency markets have declined over time from the 1970s to the 1990s.

Our conjecture that the profits associated technical analysis can be linked to the two pricing factors is motivated by Marks and Nam (2018). While the focus in Marks and Nam (2018) is limited to the time variation in the intertemporal risk-return relation after controlling for investor adjustment behavior, in this work we study the link between momentum and these two pricing factors.

An anonymous referee has suggested that we test whether the return series of a momentum portfolio exhibits the momentum component induced by the intertemporal risk-return relation and investor behavior, as we have documented for the market portfolio. We conduct this analysis in Appendix A. The referee has also suggested that we examine the possibility that our model of the asymmetric risk-return relation combined with investor adjustment behavior could provide a partial explanation of the phenomenon of momentum crashes. We address this question and present related analysis in Appendix B.

A value of \({x}_{i}>0\) indicates a long position and \({x}_{i}<0\) indicates a short position.

Note that the substitution term in asset demand is not necessarily restricted in sign, while the pure substitution term is negative in the traditional demand theory.

The negative effect of an increase to the risk premium on the current price of an asset is also caused by this negative effect of the risk premium on the expected price of the asset.

We define momentum as the time-series property of \(E\left({r}_{t+1}|{r}_{t}>0\right)>0\) and \(E\left({r}_{t+1}|{r}_{t}<0\right)<0\) and mean reversion as \(E\left({r}_{t+1}|{r}_{t}>0\right)<0\) and \(E\left({r}_{t+1}|{r}_{t}<0\right)>0\). Note that this definition of momentum and mean reversion is different from that of underreaction and overreaction. Underreaction is defined as \(E\left({r}_{t+1}|{r}_{t}>0\right)>E\left({r}_{t+1}|{r}_{t}<0\right)\) and overreaction as \(E\left({r}_{t+1}|{r}_{t}>0\right)<E\left({r}_{t+1}|{r}_{t}<0\right)\) for \(j\ge 0\).

To select an asymmetric GARCH model, we compare the EGARCH and the GARCH-GJR in terms of statistical information criterion, including the Akaike information criterion (AIC), Schwarz information criterion (SIC), and Hannan-Quinn information criterion (HQIC), along with the log-likelihood value. As shown in the following table, the EGARCH (1, 1) outperforms the GARCH-GJR (1, 1) in all criterion.

We examine the effect of including the adjustment term on the estimation of the intertemporal risk-return relation by comparing the estimated values of the RRA coefficients from Model 1B with those of Model 1A.

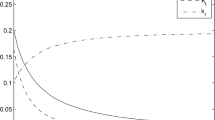

We first run the regression of \({r}_{m,t+1}=c+\delta {\widehat{\sigma }}_{m,t+1}^{2}+{\sum }_{j=1}^{5}{\phi }_{j}{r}_{m,t+1-j}+{\varepsilon }_{m,t+1}\) to measure the constant RRA parameter. For the value-weighted index, the estimated value of \(\delta \) (robust t-value) is 0.811 (1.10) and \(\phi \left(1\right)\) is 0.059 (2.51) for \({\xi }_{m,t}^{2}\) while \(\delta =1.417 \left(1.99\right)\) and \(\phi \left(1\right)=0.068 (2.83)\) for \({h}_{m,t}^{2}\). For the equal-weighted index, the estimated value of \(\delta \) (robust t-value) is 2.685 (2.79) and \(\phi \left(1\right)\) is 0.281 (10.43) for \({\xi }_{m,t}^{2}\) while \(\delta =3.899 (5.93)\) and \(\phi \left(1\right)=0.306 (10.87)\) for \({h}_{m,t}^{2}\). The results confirm that the intertemporal risk-return relation in the constant RRA parameter is positive.

We also estimated Model 1A allowing for the same asymmetry in the AR(5) term. The estimation results showed that there is no economically or statistically significant asymmetry in the autoregressive process between the positive and negative price dummies, i.e., \({\phi }_{P}(1)\approx {\phi }_{N}(1)\). For space reasons, the estimation results are not included in this paper, but are available upon request.

Trading strategies motivated by technical analysis have not received the same level of academic acceptance as have trading strategies based on fundamental analysis. Rather, the notion that technical trading strategies contradict the Efficient Market Hypothesis and offer positive abnormal returns is controversial and not widely accepted among academics. On the other hand, many prominent, sophisticated investment managers do regularly employ technical strategies. Our results offer important implications for the validity of technical analysis strategies. First, we demonstrate that technical trading rules exploit predictable patterns in return variation induced by the two rational pricing factors on which we focus, and thus do not appear to contradict market efficiency. Second, our results justify the profitability of common technical rules that can detect the short-term momentum component in return dynamics, and hence support the usefulness of these technical strategies.

References

Ang A, Hodrick R, Xing Y, Zhang X (2006) The cross-section of volatility and expected returns. J Finance 61:259–299

Atilgan Y, Bali TG, Demirtas KO (2015) Implied volatility spreads and expected market returns. J Bus Econ Statist 33:87–101

Backus D, Gregory AW (1993) Theoretical relations between risk premiums and conditional variances. J Bus Econ Statist 11:177–185

Baillie R, DeGennaro RP (1990) Stock returns and volatility. J Financ Quantit Anal 25:203–214

Bali TG (2008) The intertemporal relation between expected returns and risk. J Financ Econ 87:101–131

Ball R, Kothari S (1989) Nonstationary expected returns: Implications for tests of market efficiency and serial correlation in returns. J Financ Econ 25:51–74

Bessembinder H, Chan K (1998) Market efficiency and the returns to technical analysis. Financ Manage 27:5–17

Bessembinder H, Chan K (1995) The profitability of technical trading rules in the Asian stock markets. Pac Basin Financ J 3:257–284

Bierwag GO, Grove MA (1966) Indifference curves in asset analysis. Economic Journal 76:337–343

Bierwag GO, Grove MA (1968) Slutsky equations for assets. J Polit Econ 76:14–27

Boudoukh J, Richardson MP, Whitelaw RF (1997) Nonlinearities in the relation between the equity risk premium and the term structure. Manage Sci 43:371–385

Boudoukh J, Richardson MP, Whitelaw RF (1994) A tale of three schools: Insights on autocorrelations of short-horizon stock returns. Review of Financial Studies 7:539–573

Brandt MW, Kang Q (2004) On the relationship between the conditional mean and volatility of stock returns: A latent VAR approach. J Financ Econ 72:217–257

Breen W, Glosten L, Jagannathan R (1989) Economic significance of predictable variations in stock index returns. Journal of Finance 44:1177–1189

Brock W, Lakonishok J, LeBaron B (1992) Simple technical trading rules and the stochastic properties of stock returns. Journal of Finance 47:1731–1764

Campbell JY (1987) Stock returns and the term structure. Journal Financial Economics 18:373–399

Campbell JY, Hentschel L (1992) No news is good news: An asymmetric model of changing volatility in stock returns. Journal Financial Economics 31:281–318

Campbell JY, Grossman SJ, Wang J (1993) Trading volume and serial correlation in stock returns. Quart J Econ 108:905–939

Cecchetti SG, Lam P, Mark NC (1990) Mean reversion in equilibrium asset prices. American Economic Review 80:398–418

Cederburg S (2019) Pricing intertemporal risk when investment opportunities are unobservable. Journal of Financial and Quantitative Analysis 54:1759–1789

Chan LK, Jegadeesh N, Lakonishok J (1996) Momentum strategies. Journal of Finance 51:1681–1713

Chan LK, Hamao Y, Lakonishok J (1991) Fundamentals and stock returns in Japan. Journal of Finance 46:1739–1764

Charles A, Darné O, Kim JH (2012) Exchange-rate return predictability and the adaptive markets hypothesis: Evidence from major foreign exchange rates. J Int Money Financ 31:1607–1626

Chen J, Jiang F, Liu Y, Tu J (2017) International volatility risk and Chinese stock return predictability. J Int Money Financ 70:183–203

Chopra N, Lakonishok J, Ritter JR (1992) Measuring abnormal performance: do stocks overreact? J Financ Econ 31:235–268

Conrad J, Kaul G (1993) Long-term market overreaction or biases in computed returns? Journal of Finance 48:39–63

Dalal AJ (1983) Comparative statics and asset substitutability/complementarity in a portfolio model: A dual approach. Rev Econ Stud 50:355–367

Daniel K, Moskowitz TJ (2016) Momentum Crashes. J Financ Econo 122:221–247

Daniel K, Hirshleifer D, Subrahmanyam A (1998) A theory of overconfidence, self-attribution, and security market under- and over-reactions. J Financ 53:1839–1885

DeBondt WFM, Thaler RH (1985) Does the stock market overreact? J Financ 40:793–805

De Long JB, Shleifer A, Summers LH, Waldmann RJ (1990) Positive feedback investment strategies and destabilizing rational speculation. J Financ 45:379–395

Epps TW (1975) Wealth effects and Slutsky equations for assets. Econometrica 43:301–303

Fama E (1991) Efficient capital markets: II. J Financ 46:1575–1617

Fama E, Blume M (1966) Filter rules and stock market trading profits. J Bus 39:226–241

Fama EF, French KR (1996) Multifactor explanations of asset pricing anomalies. J Finance 51:55–84

Fama EF, French KR (1992) The cross-section of expected stock returns. J Finance 47:427–465

Fama E, French K (1988) Permanent and temporary components of stock prices. J Polit Econ 96:246–273

Fischer S (1972) Assets, contingent commodities, and the Slutsky equations. Econometrica 40:371–385

Frazier DT, Liu X (2016) A new approach to risk-return trade-off dynamics via decomposition. J Econ Dyn Control 62:43–55

French KR, Schwert GW, Stambaugh RF (1987) Expected stock returns and volatility. J Financ Econ 19:13–29

Gençay R (1999) Linear, non-linear and essential foreign exchange rate prediction with simple technical trading rules. J Int Econ 47:91–107

Gerritsen DF, Bouri E, Ramezanifar E, Roubaud D (2020) The profitability of technical trading rules in the Bitcoin market. Financ Res Lett 34:101263

Ghysel E, Santa-Clara P, Valkanov R (2005) There is a risk return trade-off after all. J Financ Econ 76:509–548

Glosten L, Jagannathan R, Runkle D (1993) On the relation between the expected value and the volatility of the nominal excess return on stocks. J Finance 48:1779–1801

Gradojevic N, Lento C (2015) Multiscale analysis of foreign exchange order flows and technical trading profitability. Econ Model 47:156–165

Grundy BD, Martin JSM (2001) Understanding the nature of the risks and the source of the rewards to momentum investing. The Review of Financial Studies 14:29–78

Harvey C (2001) The specification of conditional expectations. J Empir Financ 8:573–638

Haugen RA, Talmor E, Torous WN (1991) The effect of volatility changes on the level of stock prices and subsequent expected returns. J Finance 46:985–1007

Hong H, Stein JC (1999) A unified theory of underreaction, momentum trading, and overreaction in asset markets. J Finance 54:2143–2184

Hsu PH, Taylor MP, Wang Z (2016) Technical trading: Is it still beating the foreign exchange market? J Int Econ 102:188–208

Ito A (1999) Profits on technical trading rules and time-varying expected returns: Evidence from Pacific-Basin equity markets. Pac Basin Financ J 7:283–330

Jegadeesh N, Titman S (1995a) Short-horizon return reversals and the bid-ask spread. J Finance Intermed 4:116–132

Jegadeesh N, Titman S (1995b) Overreaction, delayed reaction, and contrarian profits. Review of Financial Studies 8:973–993

Jegadeesh N, Titman S (1993) Returns to buying winners and selling losers: Implications for stock market efficiency. J Finance 48:65–91

Jensen M, Benington G (1970) Random walks and technical theories: Some additional evidence. J Finance 25:469–482

Kang M, Krausz J, Nam K (2019) The intertemporal risk-Return relation, investor behavior, and technical trading profits: evidence from the G-7 countries. Eur J Financ 25:780–798

Kho B (1996) Time-varying risk premia, volatility, and technical trading rule profits: Evidence from foreign currency futures markets. J Financ Econ 41:249–290

Kim C, Morley JC, Nelson CR (2001) Does an intertemporal tradeoff between risk and return explain mean reversion in stock price? J Empir Financ 8:403–426

Kothari SP, Shanken J (1992) Stock return variation and expected dividends: A time-series and cross-sectional analysis. J Financ Econ 31:177–210

Lakonishok J, Shleifer A, Vishny RW (1994) Contrarian investment, extrapolation, and risk. Journal of Finance 49:1541–1578

LeBaron B (1999) Technical trading rule profitability and foreign exchange intervention. J Int Econ 49:125–143

Levich RM, Potì V (2015) Predictability and ‘good deals’ in currency markets. Int J Forecast 31:454–472

Lo AW, Mamaysky H, Wang J (2000) Foundations of technical analysis: Computational algorithms, statistical inference, and empirical implementation. J Finance 55:1705–1765

Lo AW, MacKinlay AC (1990) When are contrarian profits due to stock market overreaction? Review of Financial Studies 3:175–205

Ludvigson SC, Ng S (2007) The empirical risk return relation: A factor analysis approach. J Financ Econ 83:171–222

Marshall BR, Nguyen NH, Visaltanachoti N (2017) Time series momentum and moving average trading rules. Quantitative Finance 17:405–421

Merton RC (1973) An intertemporal asset pricing model. Econometrica 41:867–888

Merton RC (1980) On estimating the expected return on the market: An exploratory investigation. J Financ Econ 8:323–361

Müller G, Durand RB, Maller RA (2011) The risk–return tradeoff: A COGARCH analysis of Merton’s hypothesis. J Empir Financ 18:306–320

Marks JM, Nam K (2018) Intertemporal risk-return tradeoff in the short-run. Econ Lett 172:81–84

Nam, K., Krausz, J., & Arize, A. C. (2015). The Effect of Unexpected Volatility Shocks on Intertemporal Risk-Return Relation. Handbook of Financial Econometrics and Statistics, 413–437.

Nazário RTF, e Silva, J. L., Sobreiro, V. A., & Kimura, H. (2017) A literature review of technical analysis on stock markets. Quarterly Review of Economics and Finance 66:115–126

Neely CJ, Weller PA (2003) Intraday technical trading in foreign exchange market. J Int Money Financ 22:223–237

Neely CJ, Weller PA (2001) Technical analysis and central bank. J Int Money Financ 20:949–970

Neely CJ, Weller PA, Dittmar R (1997) Is technical analysis in the foreign exchange market profitable? A genetic programming approach. J Financial and Quantitative Analysis 32:405–426

Nelson DB (1991) Conditional heteroskedasticity in asset returns: A new approach. Econometrica 59:347–370

Newey W, West K (1987) Hypothesis testing with efficient method of moments estimation. Int Econ Rev 28:777–787

Nofsinger JR, Sias RW (1999) Herding and feedback trading by institutional and individual investors. J Finance 54:2263–2295

Olson D (2004) Have trading rule profits in the currency markets declined over time? J Bank Finance 28:85–105

Poterba JM, Summers LH (1986) The persistence of volatility and stock market fluctuations. American Economic Review 76:1142–1151

Ratner M, Leal RP (1999) Tests of technical trading strategies in the emerging equity markets of Latin America and Asia. J Bank Finance 23:1887–1905

Ready MJ (2002) Profits from technical trading rules. Financ Manage 31:43–61

Roley VV (1983) Symmetry restrictions in a system of financial asset demands: Theoretical and empirical results. Rev Econ Stat 65:124–130

Scruggs JT (1998) Resolving the puzzling intertemporal relation between the market risk premium and conditional market variance: A two-factor approach. J Finance 52:575–603

Sentana E, Wadhwani S (1992) Feedback traders and stock return autocorrelations: evidence from a century of daily data. Economic Journal 102:415–425

Shynkevich A (2012) Performance of technical analysis in growth and small cap segments of the US equity market. J Bank Finance 36:193–208

Smith DM, Wang N, Wang Y, Zychowicz EJ (2016) Sentiment and the effectiveness of technical analysis: Evidence from the hedge fund industry. J Finance and Quantitative Analysis 51:1991–2013

Stambaugh RF, Yu J, Yuan Y (2015) Arbitrage asymmetry and the idiosyncratic volatility puzzle. J Finance 70:1903–1948

Sullivan R, Timmermann A, White H (1999) Data-snooping, technical trading rule performance, and the bootstrap. J Finance 54:1647–1691

Whitelaw RF (1994) Time variations and covariations in the expectation and volatility of stock market returns. J Finan 49:515–541

Whitelaw RF (2000) Stock market risk and return: an equilibrium approach. Rev Finan Studies 13:521–547

Yu J, Yuan Y (2011) Investor sentiment and the mean-variance relation. J Finan Econ 100:367–381

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Momentum portfolio

The capital market equilibrium condition with the law of one price of risk implies that the intertemporal risk-return relation applies not only to the market portfolio but also to other portfolios. In particular, the Intertemporal Capital Asset Pricing Model (ICAPM) implies that the predicted slope from regressing a portfolio’s expected returns on the conditional covariance with the market portfolio measures the representative investor’s relative risk aversion, and hence a portfolio’s expected return can be predicted as a linear function of its conditional covariance with the market portfolio return. We examine whether the significant asymmetric intertemporal risk-return relation observed for the equal- and value-weighted market portfolios is also present for the distinctive returns on a momentum portfolio. In particular, we examine whether the momentum components embedded in the return on a momentum portfolio are explained by the asymmetric ICAPM along with the price adjustment process.

We employ daily return data on the momentum factor from the Fama–French-Carhart four-factor model over the period from November 1926 to December 2017. The momentum factor is constructed as the average return on the two high past return portfolios (large and small stocks) minus the average return on the two low past return portfolios. Thus, the momentum factor represents a zero-net investment strategy that holds long high past return portfolios and shorts low past return portfolios while maintaining approximate neutrality to market risk and the size effect. To examine our conjecture, we estimate the following asymmetric ICAPM specifications.

where \({r}_{i,t+1}\) is daily realized return of the momentum factor. \({\widehat{\sigma }}_{im,t+1}\) is the conditional covariance of the momentum factor return with the market return and is estimated from the bivariate diagonal vech GARCH (1,1) model with the maximum likelihood method under the multivariate student’s t-distribution assumption. \({\phi }_{j}\) is the jth order return autocorrelation coefficient to capture the price adjustment process resulting from investor behavior to correct the prior mispricing. \({Pd}_{t+1}\) (\({Nd}_{t+1}\)) is the dummy variable to represent good (bad) market news and capture prior d-day consecutive positive (negative) price changes in the market portfolio, where d = 1, 2, and 3. The RRA parameter of the momentum portfolio is measured by \({\delta }_{P}\) (\({\delta }_{N}\)) under prior d-day consecutive positive (negative) price changes in the market portfolio. If our conjecture is correct, the RRA parameter under prior positive returns should be non-positive while the RRA parameter under prior negative returns should be strongly positive, i.e., \({\delta }_{P}\le 0\) and \({\delta }_{N}>0\).

The estimation results are presented in Appendix Table A1 with the Newey-West (1987) adjusted t-statistics reported in parentheses. Column (1) of the table shows \({\mu }_{P}>0\) and \({\mu }_{N}<0\), indicating that the average daily realized return is significantly positive after a positive return but is significantly negative after a negative return. This positive (negative) average realized return following a positive (negative) return is associated with the often-documented component in the return on the momentum strategy. Columns (2) and (3) of the table show the estimation result of the simple ICAPM with and without the AR(5) process, \({r}_{i,t+1}=\mu +\delta {\widehat{\sigma }}_{im,t+1}+{\varepsilon }_{i,t+1}\) and \({r}_{i,t+1}=\mu +\delta {\widehat{\sigma }}_{im,t+1}+{\sum }_{j=1}^{5}{\phi }_{j}{r}_{i,t-j}+{\varepsilon }_{i,t+1}\), respectively, where δ measures the constant RRA parameter in the simple ICAPM. The estimated values of δ are all positive and are statistically significant at the 1% level for all three sample periods. The results indicate that the intertemporal risk-return relation estimated by the constant RRA parameter of the ICAPM is economically and statistically positive for the momentum portfolio. This significant positive ICAPM parameter is consistent with the estimates of Bali (2008), who finds a strong positive ICAPM parameter for the various portfolios. In the other columns in the table, we examine whether the positive ICAPM parameter associated with the momentum portfolio is also distorted conditional on good and bad market news.

The results in Appendix Table A1 indicate that our main results concerning the asymmetric ICAPM parameter obtained from the equal- and value-weighted market portfolios are also present for the momentum portfolio. First, the estimation results of A-M2 and A-M3 show that the asymmetry in the intertemporal risk-return relation documented in the two market portfolios is still significant in the momentum portfolio for all three values of d. Within all three sample periods, the estimated RRA parameter of the ICAPM is significantly positive at the 5% level under a prior negative market return but insignificant under a prior positive market return, implying that good (bad) market news weakens (strengthens) the positive risk-return relation. Second, compared to the results of A-M1, the results of A-M2 and A-M3 indicate that the inclusion of the price adjustment terms significantly decreases (increases) the magnitude of \({\delta }_{P}\) (\({\delta }_{N}\)) for all three sample periods. The result verifies that ignoring the price adjustment process in the estimation of the ICAPM leads to model misspecification and induces an upward (downward) bias in estimates of the RRA parameter conditional on good (bad) market news. Third, the magnitude of the asymmetric ICAPM parameter estimates is greater using the dummies that indicate prior 2- and 3-day consecutive price changes, again verifying that the distortion of the positive ICAPM parameter is greater when conditioning on 2- and 3-day consecutive price changes. Fourth, the values of \(\phi (1)\) are all positive and statistically significant at the 1% level for all three sample periods, indicating that the price adjustment process resulting from investor behavior to correct prior mispricing leads to return persistence.

Appendix B Momentum Crash

In this section, we explore the possibility that our main results documenting an asymmetric intertemporal risk-return relation along with the importance of investor adjustment behavior might also partly explain momentum crashes. Despite the significant profitability associated with a high mean return and high Sharpe ratio, the momentum strategy is known to display large negative skewness and excess kurtosis caused by large, but infrequent negative returns. These so-called momentum crashes tend to occur after down markets are followed by a rebound and a high level of ex-ante market volatility, coupled with an abrupt rise in contemporaneous market returns. Several studies attribute momentum crashes to the time-varying beta of a momentum strategy. Kothari and Shanken (1992) were the first to document the time variation in betas of the returns on sorted portfolios. Grundy and Martin (2001) also show that momentum portfolios have time-varying exposure to the market factor by construction. Using these features of momentum crashes, Daniel and Moskowitz (2016) develop an optimal dynamic momentum strategy, which significantly outperforms the standard static momentum strategy.

Our empirical results for the full period reported in Table 3 show that the estimated values of the RRA parameter conditional on severely bad market news (i.e., d = 3) are much greater than that of the RRA parameter conditional on a typical bad market news (d = 1), indicating that such severe bad market news causes a considerable increase in the market risk premium, inducing a high level of market volatility. We extend the estimation to the case with even more extreme consecutive bad market news, i.e., d = 4, 5, 6 to test whether extreme consecutive bad market news continues to cause a dramatic increase in the market risk premium. We estimate the original Model 1B (M1B) for the two market portfolios with \({h}_{m,t}^{2}\) as the conditional market volatility and the asymmetric ICAPM (A-M3) for the momentum portfolio. The estimation results are reported in Appendix Table B1, which shows that the estimated values of \({\delta }_{N}\) are much greater than estimates of the same parameter reported in Table 3. The average estimated values of \({\delta }_{N}\) for d = 4, 5, 6 are 24.222 and 14.017 for the equal- and value-weighted market portfolio, respectively, while the estimates of \({\delta }_{N}\) for d = 2 in Table 3 are only 12.607 and 8.853 for the equal- and value-weighted portfolios. The estimation results of A-M3 for the momentum portfolio show the same result; the average estimated value of \({\delta }_{N}\) for d = 4, 5, 6 is 20.860 while the estimated value of \({\delta }_{N}\) for d = 2 in Appendix Table B1 is 9.741. The estimation results imply the extreme market environments with consecutive market losses cause a dramatic increase in both the market and the individual risk premiums, which in turn reduces the market price of portfolios considerably. The results suggest that momentum crashes can be attributed not only to the negative net beta of the strategy when markets rise, but also to a severe drop in stock prices resulting from a dramatic increase in risk premiums during the period of high market stress.

Rights and permissions

About this article

Cite this article

Kilic, O., Marks, J.M. & Nam, K. Predictable asset price dynamics, risk-return tradeoff, and investor behavior. Rev Quant Finan Acc 59, 749–791 (2022). https://doi.org/10.1007/s11156-022-01057-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-022-01057-9

Keywords

- Intertemporal risk-return relation

- Investor behavior

- Technical trading profits

- Short-term momentum

- Asymmetric return dynamics