Abstract

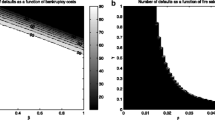

In a banking network model, I analyse the ranking consistency of common systemic risk measures (SRMs). In contrast to previous studies, this model-based analysis offers the advantage that the sensitivity of the ranking consistency with respect to bank and network characteristics can easily be checked. The employed network model accounts, among others, for bank insolvencies as well as illiquidities, stochastic dependencies of non-bank loans as well as of liquidity buffer assets across various banks, bank rating-dependent volumes of deposits and interbank liabilities, and the funding liquidity reducing effect of fire sales of other banks. Within the assumed banking network model, I find that, in general, the ranking consistency (measured by the rank correlation) of various SRMs is rather low. A further finding is that the ranking consistency can significantly vary in statistical terms, for example for an increasing correlation between the returns of the liquidity buffer assets across banks, an increasing volatility of these assets or an increasing default rate in the non-bank loan portfolios. However, forecasting which effect a specific change in parameters, bank behavior or network characteristics has on the ranking consistency of SRMs seems to be difficult because the sign of the effect can be different for different pairs of SRMs. Furthermore, the economic significance of these changes on the overall ranking consistency as measured by Kendall’s coefficient of concordance in general is rather low.

Similar content being viewed by others

Notes

For an extensive, early survey of SRMs, see Bisias et al. (2012), and for a more recent survey Benoit et al. (2017), who differ between global measures of systemic risk (such as MES, SRISK or ΔCoVaR) and those SRMs that are designed to measure specific sources of systemic risk (systemic risk-taking, contagion and amplification).

The idea to compute SRMs in a network model has already been expressed by Tom Hurd in a presentation at the C.R.E.D.I.T. 2013 conference in Venice.

Doing these extensions, network models in the spirit of Gai and Kapadia (2010), Gai et al. (2011) or Hurd et al. (2014) get closer to complex (partly macroeconomic) integrated risk management approaches, such as Aikman et al. (2011), Barnhill and Schumacher (2014) or Wong and Hui (2011), which are used for example for macro stress testing purposes.

Results on robustness checks are summarized in the Online Resource.

See, for example, Craig and von Peter (2014) for the German unsecured interbank market or in’t Veld and van Lelyveld (2014) and Blasques et al. (2015) for the corresponding Dutch market. For an application of a network analysis in a non-bank context (e.g., profitability of firm acquisitions or stock market return predictability), see, for example, Baxamusa et al. (2015) or Eng-Uthaiwat (2017).

Instead, it could be assumed that a bank defaults when its equity value is smaller than some positive constant. This would mimic the threat that regulatory authorities close a bank when minimum capital requirements or—in the future—bounds for the leverage ratio are not fulfilled. Later in this section, however, a bank behavioral rule is introduced that ensures that, as long as this is possible, the equity-to-assets ratio of a bank stays above some lower bound \( \eta_{\hbox{min} } \).

More precisely, in the numerical implementation, the second condition is \( A_{i,t}^{IB} \le 0.001 \cdot A_{i,1}^{IB} \) because due to the reduction of the granted interbank loans by a factor λ in case of funding liquidity problems of bank i (see the following), \( A_{i,t}^{IB} \) cannot reach zero in finite time.

Vasicek-distributed default rates are also associated with the risk weight formula of the internal ratings based approach (IRBA) in the Basel II regulation. Obviously, the appearance of normally distributed random variables in the representation (8) for the default rates does not imply the normality of the default rates.

Of course, the assumption of copulas with non-zero and asymmetric tail dependencies would also be possible (for the assumption of a t-copula, see Section A.2 in the Online Resource).

Contrary to the approach in this paper, Gai and Kapadia (2010) assume that the mark-to-market value of illiquid assets depends on the system-wide fraction of illiquid assets that have been sold in the market. They assume that only if a bank defaults, its illiquid assets are sold in the market. This can reduce the mark-to-market value of the illiquid assets of all surviving banks and, hence, their equity value. In their model, price variations of the illiquid assets cannot happen without any bank defaults. This is somehow problematic because, for example, this neglects the effect of fire sales that banks carry out before a default takes place to deleverage (to comply with minimum capital requirements) or to get funding liquidity. Furthermore, it is not quite clear why assets that are illiquid by definition should be marked-to-market in the balance sheets of the surviving banks.

The lag of one period in the definition of \( x_{t - 1} \) is necessary to avoid circularity problems.

For an alternative copula choice, see Sect. A.2 of the Online Resource. Furthermore, dependencies between the returns \( r_{1,t} , \ldots ,r_{N,t} \) and the random variables \( Z_{1,t} , \ldots ,Z_{N,t} \) that drive the losses in the banks’ non-bank loan portfolios could be modeled. However, in the following, I assume independence (for an extension with dependence, see also Sect. A.2 of the Online Resource).

This second channel is also one reason why financial distress of banks in the system is not only spread to direct neighbours in the network defined by connections through interbank loans and liabilities, but has a broader impact.

One reason for a market discipline effect by non-bank depositors (despite a potential full deposit insurance) might be their distrust into the ability of the deposit insurance to cover all claims. Therefore, an extension of the above representation for \( L_{i,t}^{D} \) could be to introduce a system-wide bank default indicator. The higher the total number of defaults in the banking system, the larger the distrust into the ability of the deposit insurance to pay and, hence, the larger the market discipline effect should be. Further refinements could consist in introducing an interest rate dependency for the volume of non-bank deposits or an independent additive stochastic component \( \varepsilon_{i,t}^{D} \) that models funding liquidity effects for bank i due to random fluctuations of the volume of non-bank deposits (for such an extension, see Sect. A.3 of the Online Resource).

See, for example, Dias and Ramos (2014) for an analysis of international contagion in the banking sector in 40 countries during the financial crisis 2007–2010.

I assume that a bank is not able to raise new external equity.

For example, in case of insolvency as default reason, it could be assumed that a defaulted bank i calls in all its interbank loans \( A_{ij,t + 1}^{IB} \) and sells all its liquidity buffer assets \( A_{i,t + 1}^{L} \) (without liquidation costs) and its non-bank loans \( A_{i,t + 1}^{NB} \) (with liquidation costs \( \omega \)). This money is used to pay back at first the loans \( L_{i,t + 1}^{D} \) granted by non-bank depositors and then the remaining money is evenly distributed among bank i’s financial creditors \( j \ne i \) to partly satisfy their claims \( A_{ji,t + 1}^{IB} \). Of course, for this kind of endogenous recovery rate of interbank loans, sequential defaults of banks have to be assumed. When banks can simultaneously default, a circularity problem would arise because the amount of money that the defaulted bank would get from its called interbank loans (and, hence, the recovery rate) would depend on whether some of the other banks default (what in turn would depend on the recovery rate). To solve this kind of problem, a settlement mechanism as described by Eisenberg and Noe (2001) would be necessary (see Frey and Hledik 2014, p. 8).

As a further degree of sophistication, a mark-to-market valuation of interbank loans \( A_{ji,t}^{IB} \) at time t (e.g., depending on the equity-to-assets ratio \( etar_{i,t - 1} \) of bank i in the previous period) could be assumed. Doing this, solvency deteriorations of a single bank i would lead via the interbank market to solvency deteriorations of its creditor banks \( j \ne i \) even before bank i defaults (see, e.g., Fink et al. 2014 or Glasserman and Young 2015).

Obviously, this implies that \( A_{i,t}^{L} \) can remain negative for some time.

This is another reason why financial distress of a bank is not only spread to direct neighbours in the network defined by connections through interbank loans and liabilities, but also has an indirect impact.

Other indicators that might trigger an interbank credit rationing could be an inadequate level of liquidity buffer assets or huge losses for non-bank loans (see Domikowsky et al. 2015).

For similar rules ensuring a fixed Tier 1 capital ratio, see Aikman et al. (2011).

Of course, an increase in the volume of the interbank loans of a single bank corresponds to an increase of the volume of the interbank liabilities and of the liquidity buffer assets of some other banks.

If no bank \( j \ne i \) with which bank i is connected via its asset side has survived until time \( t - 1 \), the whole amount \( \Delta_{1} \) is invested in non-bank loans.

If \( w_{2,1} \cdot \Delta_{2} \) is larger than the whole amount of liquidity buffer assets within the group of banks \( j \ne i \) that are connected with bank i via its liability side and have survived until time \( t - 1 \), the maximum possible amount of money is borrowed from the interbank market and the remaining amount (to reach in total a new additional amount of debt \( \Delta_{2} \)) is borrowed from depositors.

If no bank \( j \ne i \) with which bank i is connected via its asset side has survived until time \( t - 1 \), the whole amount of new debt \( \Delta_{2} \) is invested in non-bank loans.

As the assets are not risk-weighted, this resembles more the fulfillment of a leverage ratio rule. In contrast to reality, it is not assumed that a bank is closed by the regulatory authorities when \( etar_{i,t} < \eta_{\hbox{min} } \) holds, but only the default criteria (5) and (6) are applied.

If the sum of the interbank and non-bank loans of bank i is smaller than \( \Delta_{3} \), then, additionally, liquidity buffer assets are sold to entities outside the banking system. If the volume of non-bank loans of bank i is smaller than \( w_{3,1} \cdot \Delta_{3} \), the volume of interbank loans is more strongly reduced. Analogously, if the volume of interbank loans of bank i is smaller than \( (1 - w_{3,1} ) \cdot \Delta_{3} \), the volume of non-bank loans is more strongly reduced.

If the volume of non-bank deposits of bank i is smaller than \( (1 - w_{3,2} ) \cdot \Delta_{3} \), the volume of interbank liabilities is more strongly reduced. Analogously, if the volume of interbank liabilities of bank i is smaller than \( w_{3,2} \cdot \Delta_{3} \), the volume of non-bank deposits is more strongly reduced.

The MES (as other SRMs) can also be estimated in a more sophisticated way by a dynamic multivariate time series approach that accounts for time-varying return volatilities and correlations (see, for example, Brownlees and Engle 2017). For an analysis of model risk when computing SRMs, see Danielsson et al. (2016a, b).

See Proposition 2 in Acharya et al. (2017, p. 14).

Lower equity returns correspond to lower ranks (rank 1: lowest equity return, rank 250: highest equity return).

An alternative to the usage of historical asset return volatilities would be to compute implied asset return volatilities, based on the well-known fact that in the Merton-model, the equity value equals the value of a European call option with the bank assets as underlying and the nominal value of debt as exercise price.

To account for a potential autocorrelation of the asset returns when computing the asset return volatilities, I also tested the following AR(1) scale factor \( ( {250 + {{2 \cdot\rho \cdot [ {249 \cdot ( {1 - \rho ) - \rho \cdot ( {1 - \rho^{249} } )} )} ]} / {( {1 - \rho } )}}^{2} } )^{0.5} \) with ρ being the correlation between two adjacent asset returns (see Alexander 2008, p. 93). However, the conclusions with respect to the ranking consistency of the SRMs (see Sect. 5) do not change.

Lower PD-log returns correspond to lower ranks (rank 1: lowest PD-log return, rank 250: highest PD-log return).

The bank at the beginning of an arrow is a creditor of the bank at the end of an arrow. The size of the circles indicates the volume of total assets of a bank.

In the following, I assume that all interbank loans (and, hence, interbank liabilities) have a normalized size of one.

For the two considered alternatives, I follow Frey and Hledik (2014).

The core periphery network model is competing with scale-free models with power law distributed degrees. In practice, it seems to be difficult to decide which kind of model fits better for a specific interbank market. On one hand, estimating power law distributions for the degrees suffers from limited financial network sizes. On the other hand, real interbank markets hardly seem to fulfil all three conditions that theoretically characterise a core-periphery model (see the discussion in Craig and von Peter 2014 and in’t Veld and van Lelyveld 2014).

For an alternative construction method, see Sect. A.4 of the Online Resource.

For model 1, these values are fixed over all banks (see Table 1).

This should be the exception because on average for the employed parameters, \( {1 \mathord{\left/ {\vphantom {1 {\kappa_{i} }}} \right. \kern-0pt} {\kappa_{i} }} \) is by factor 3 larger than \( {1 \mathord{\left/ {\vphantom {1 {\left( {1 - etar_{i,1} } \right)}}} \right. \kern-0pt} {\left( {1 - etar_{i,1} } \right)}} \).

The upper tail dependence \( UTD_{t}^{i,m} \) between \( r_{i,t}^{PD} \) and \( r_{m,t}^{PD} \) [see (25)] can only be computed for \( t \ge 502 \) because for calculating \( PD_{t}^{i} \), the volatility \( \sigma_{{t - 1,AR_{i} }}^{{}} \) of the daily asset returns is needed which is based on the last observed 250 asset returns. Hence, the first risk-neutral default probability \( PD_{t}^{i} \) can only be computed for \( t = 252 \). All other SRMs can be calculated for \( t \ge 252 \).

Instead of computing the rank \( Rank_{d,i}^{t} \in \left\{ {1, \ldots ,N_{t} } \right\} \) of bank i at time t based on its SRM \( d \in \left\{ {1, \ldots ,5} \right\} \) at time t, alternatively, moving averages (over time) of the respective SRMs could be calculated and employed for determining \( Rank_{d,i}^{t} \) (for this, see Section A.1 of the Online Resource).

When a bank defaults, the rank correlations are only computed until the default time. In case that \( UTD_{t}^{i,m} \) is involved, the time index t starts in 502.

As the daily SRMs are computed based on rolling 250 days time windows, the bank-individual SRMs and, hence, the ranks are highly autocorrelated. To reduce this effect, I repeat the computation of \( Corr\left( {Rank_{{d_{1} ,i}}^{{}} ,Rank_{{d_{2} ,i}}^{{}} } \right) \) in (35) based on SRMs and ranks that are calculated every 250 days and, hence, from data out of non-overlapping time windows. However, the corresponding results are comparable with those for overlapping time windows and, hence, are not displayed in Table 4.

These correlation coefficients are essentially Spearman’s rho values.

Analogously to above, these figures are additionally computed based on the sample of every 250th correlation coefficient \( Corr\left( {Rank_{{d_{1} }}^{t} ,Rank_{{d_{2} }}^{t} } \right) \). Again, the results are comparable.

Jiang (2012, p. 31, second and third panel of the first row of Fig. 12) finds that in the cross-section, there is a positive correlation between MES and LTDE. However, in contrast to the results implied by the banking network, Jiang (2012) also finds this positive correlation between SRISK and LTDE.

For example, Benoit et al. (2013, p. 19) state “that systemic risk rankings of financial institutions based on their MES tend to mirror rankings obtained by sorting firms on beta.” Indeed, they show that under specific distributional assumptions, the cross-sectional rank correlation between MES and Beta must be one. The fact that this cannot be observed in the employed model might be due to estimation error (see Danielsson et al. 2016b) or due to the implied endogeneous equity return distributions that deviate from the bivariate GARCH process assumed in the theoretical part of Benoit et al. (2013).

Benoit et al. (2013) compare MES, SRISK and ΔCoVaR. In the empirical part of their paper, Benoit et al. (2013) find, for example, that on almost half of the days not even a single of the 94 considered financial institutions is simultaneously identified as a TOP 10 systemically important financial institution by all three SRMs.

As non-risk-weighted assets are used in (21), the default setting is \( k = 0.03 \) for the simulations, whereas in many other studies \( k = 0.08 \) is employed.

When using 100 simulation runs, the results are qualitatively similar.

However, it has to be taken into account that Nucera et al. (2016) scale down the bank-individual ranks to numbers between 0 and 1 (by dividing through the number of considered banks), compute the time series standard deviations of these numbers, average these standard deviations over all banks and multiply the result with 100. If the simulation-based results with respect to the cross-sectional averages of the time series standard deviations of the banks’ ranks (taking values between 1 and 50) shown in Table 6 are divided by the number of considered banks and multiplied with 100, the simulation-based results would be larger than the empirical results of Nucera et al. (2016) by a factor of 1.5–2. One reason for larger rank volatilities might be that in the model, instantaneous actions are carried out when some indicators at some date meet a specific condition. In reality, a bank’s reaction might be not so prompt.

In contrast to this paper, Jiang (2012) computes the similarity ratio for a specific pair of SRMs by relating the number of banks that simultaneously belong to the TOP 10 category based on both SRMs to the number of elements in the considered TOP category (i.e., 10). Thus, a similarity ratio of 1 in Jiang (2012) would be identical to a similarity ratio of 10 and 20%, respectively, in Table 6 of this paper.

Measured by the number of pairs of SRMs for which the respective parameter has a significant (up to a significance level of 5%) impact on the mean rank correlation.

These ambiguous results for different pairs of SRMs are in line with first empirical results on this topic found by Abendschein and Grundke (2017).

This might also explain why strikingly many negative mean rank correlations can be observed in the various models when the SRM SRISK is involved (see Table 5). Compared to many empirical studies, where usually \( k = 0.08 \) is employed, I have chosen \( k = 0.03 \) which economically seems to be more plausible as the assets are not risk-weighted.

Based on the DebtRank methodology of Battiston et al. (2012c), Roukny et al. (2013) argue that an interplay exists between the relevance of the structure of the financial network for the stability of the system and the degree of market illiquidity. They report that only when the market is illiquid, the network structure does matter for the stability of the system. Thus, liquidity issues might also influence the ranking consistency of SRMs. However, in the model employed in this paper, a variation of the liquidity related parameters \( \tau \) and lr hardly shows any significant impact on the ranking consistency of the SRMs (see Table 7). Repeating the computations of Table 5 for models 4a, 5a and 5b (implying different network connectivities) and with reduced boundaries \( [0.05;0.1] \) for the initial ratio lr of liquidity buffer assets to total assets (instead of \( [0.15;0.25] \) as before; see Table 2) also has hardly any impact on the rank correlations of the SRMs.

First results for such a model-based analysis can be found in Grundke and Tuchscherer (2017).

For example, Döring et al. (2016) find that, beside the loan-to-deposit ratio, the book-to-market ratio of bank equity is a fundamental driver of systemic risk. Thus, it is imaginable that the book-to-market ratio could also have a significant influence on the ranking consisteny of SRMs.

References

Abendschein M, Grundke P (2017) On the ranking consistency of global systemic risk measures: empirical evidence. Working paper, Osnabrück University

Acemoglu D, Ozdaglar A, Tahbaz-Salehi A (2015) Systemic risk and stability in financial networks. Am Econ Rev 105(2):564–608

Acharya VV, Engle R, Richardson M (2012) Capital shortfall: a new approach to ranking and regulation systemic risk. Am Econ Rev 102(3):59–64

Acharya VV, Engle R, Pierret D (2014) Testing macroprudential stress tests: the risk of regulatory risk weights. J Monet Econ 65:36–53

Acharya VV, Pedersen LH, Philippon T, Richardson M (2017) Measuring systemic risk. Rev Financ Stud 30(1):2–47

Adrian T, Brunnermeier MK (2016) CoVaR. Am Econ Rev 106(7):1705–1741

Aikman D, Alessandri P, Eklund B, Gai P, Kapadia S, Martin E, Mora N, Sterne G, Willison M (2011) Funding liquidity risk in a quantitative model of systemic stability. In: Alfaro R (ed) Financial stability, monetary policy, and central banking, Santiago, Chile: Central Bank of Chile (Series on central banking, analysis, and economic policies, 15), pp 371–410

Alexander C (2008) Market risk analysis, volume II, practical financial econometrics. Wiley, Chichester

Allen F, Gale D (2000) Financial contagion. J Polit Econ 108(1):1–33

Barnhill T, Schumacher L (2014) Modeling correlated systemic bank liquidity risks. In: Ong LL (ed) A guide to IMF stress testing. Methods and models, IMF, Washington DC, pp 123–133

Basel Committee on Banking Supervision (BCBS) (2013) Global systemically important banks: updated assessment methodology and the higher loss absorbency requirement. July, Bank for International Settlements

Battiston S, Gatti DD, Gallegati M, Greenwald B, Stiglitz JE (2012a) Default cascades: When does risk diversification increase stability? J Financ Stab 8(3):138–149

Battiston S, Gatti DD, Gallegati M, Greenwald B, Stiglitz JE (2012b) Liaisons dangereuses: increasing connectivity, risk sharing, and systemic risk. J Econ Dyn Control 36(8):1121–1141

Battiston S, Puliga M, Kaushik R, Tasca P, Caldarelli G (2012c) DebtRank: too central to fail? Financial networks, the FED and systemic risk. Sci Rep. https://doi.org/10.1038/srep00541

Battiston S, Caldarelli G, D’Errico M, Gurciullo S (2016) Leveraging the network: a stress-test framework based on DebtRank. Working paper

Baxamusa M, Javaid S, Harery K (2015) Network centrality and mergers. Rev Quant Financ Acc 44:393–423

Benoit S, Colletaz G, Hurlin C, Pérignon C (2013) A theoretical and empirical comparison of systemic risk measures. Working paper

Benoit S, Colliard J-E, Hurlin C, Pérignon C (2017) Where the risks lie: a survey on systemic risk. Rev Financ 21(1):109–152

Bisias D, Flood M, Lo AW, Valavanis S (2012) A survey of systemic risk analytics. Ann Rev Financ Econ 4(1):255–296

Blasques F, Bräuning F, van Lelyveld I (2015) A dynamic network model of the unsecured interbank lending market. Bank for International Settlements, BIS Working papers No. 491

Brownlees C, Engle R (2017) SRISK: a conditional capital shortfall index for systemic risk measurement. Rev Financ Stud 30(1):48–79

Brownlees C, Chabot B, Ghysels E, Kurz C (2015) Backtesting systemic risk measures during historical bank runs. Federal Reserve Bank of Chicago WP 2015-09

Chinazzi M, Fagiolo G (2015) Systemic risk, contagion, and financial networks: a survey. Working paper

Cifuentes R, Ferrucci G, Shin HS (2005) Liquidity risk and contagion. J Eur Econ Assoc 3(2–3):556–566

Craig B, von Peter G (2014) Interbank tiering and money center banks. J Financ Intermed 23(3):322–347

Danielsson J, James K, Valenzuela M, Zer I (2016a) Model risk of risk models. J Financ Stab 23:79–91

Danielsson J, James K, Valenzuela M, Zer I (2016b) Can we prove a bank guilty of creating systemic risk? A minority report. J Money Credit Bank 48(4):795–812

Dias JG, Ramos SB (2014) The aftermath of the subprime crisis: a clustering analysis of world banking sector. Rev Quant Financ Acc 42:293–308

Dobrić J, Schmid F (2005) Nonparametric estimation of the lower tail dependence λL in bivariate copulas. J Appl Stat 32(4):387–407

Domikowsky C, Kaposty F, Pfingsten A (2015) Market discipline, deposit insurance, and competetive advantages: evidence from the financial crisis. Working paper

Döring B, Wewel C, Hartmann-Wendels T (2016) Systemic risk measures and their viability for banking supervision. Working paper

Eisenberg L, Noe TH (2001) Systemic risk in financial systems. Manag Sci 47(2):236–249

Elliott M, Golub B, Jackson MO (2014) Financial networks and contagion. Am Econ Rev 104(10):3115–3153

Engle R, Jondeau E, Rockinger M (2015) Systemic risk in Europe. Rev Financ 19(1):145–190

Eng-Uthaiwat H (2017) Stock market return predictability: does network topology matter? Rev Quant Financ Acc. https://doi.org/10.1007/s11156-017-0676-3

Fink K, Krüger U, Meller B, Wong LH (2014) BSLoss—a comprehensive measure for interconnectedness. Working paper

Freixas X, Parigi B, Rochet JC (2000) Systemic risk, interbank relations and liquidity provision by the central bank. J Money Credit Bank 32:611–638

Frey R, Hledik J (2014) Correlation and contagion as sources of systemic risk. Working paper

Gai P, Kapadia S (2010) Contagion in financial networks. Proc Royal Soc 466:2401–2423

Gai P, Haldane A, Kapadia S (2011) Complexity, concentration and contagion. J Monet Econ 58(5):453–470

Georg C-P (2013) The effect of the interbank network structure on contagion and common shocks. J Bank Financ 37(7):2216–2228

Giglio S, Kelly BT, Pruitt S (2016) Systemic risk and the macroeconomy: an empirical evaluation. J Financ Econ 119(3):457–471

Girardi G, Ergün AT (2013) Systemic risk measurement: multivariate GARCH estimation of CoVaR. J Bank Financ 37(8):3169–3180

Glasserman P, Young HP (2015) How likely is contagion in financial networks? J Bank Financ 50:383–399

Gravelle T, Li F (2013) Measuring systemic importance of financial institutions: an extreme value theory approach. J Bank Financ 37(7):2196–2209

Grundke P, Tuchscherer M (2017) Global systemic risk measures and their forecasting power for systemic events. Working paper, Osnabrück University

Huang X, Zhou H, Haibin Z (2012) Systemic risk contributions. J Financ Serv Res 42:55–83

Hurd TR, Cellai D, Cheng H, Melnik S, Shao Q (2014) Illiquidity and insolvency: a double cascade model of financial crisis. Working paper

In’t Veld D, van Lelyveld I (2014) Finding the core: network structure in interbank markets. J Bank Financ 49(1):27–40

Iori G, Jafarey S, Padilla FG (2006) Systemic risk on the interbank market. J Econ Behav Organ 61(4):525–542

Jiang C (2012) Does tail dependence make a difference in the estimation of systemic risk? ΔCoVaR and MES. Working paper

Kendall M, Gibbons JD (1990) Rank correlation methods, 5th edn. Oxford University Press, New York

Krause A, Giansante S (2012) Interbank lending and the spread of bank failures: a network model of systemic risk. J Econ Behav Organ 83(3):583–608

Lin EMH, Sun EW, Yu M-T (2018) Systemic risk, financial markets, and performance of financial institutions. Ann Oper Res 262:579–603

Löffler G, Raupach P (2018) Pitfalls in the use of systemic risk measures. J Financ Quant Anal 53(7):269–298

López-Espinosa G, Moreno A, Rubia A, Valderrama L (2012) Short-term wholesale funding and systemic risk: a global CoVaR approach. J Bank Financ 36(12):3150–3162

López-Espinosa G, Moreno A, Rubia A, Valderrama L (2015) Systemic risk and asymmetric responses in the financial industry. J Bank Financ 58:471–485

Merton RC (1974) On the pricing of corporate debt: the risk structure of interest rates. J Financ 29(2):449–470

Nucera F, Schwaab B, Koopmann SJ, Lucas A (2016) The information in systemic risk rankings. J Empir Financ 38:461–475

Roukny T, Bersini H, Pirotte H, Caldarelli G, Battiston S (2013) Default cascades in complex networks: topology and systemic risk. Sci Rep. https://doi.org/10.1038/srep02759

Schmidt R, Stadtmüller U (2006) Nonparametric estimation of tail dependence. Scand J Stat 33(2):307–335

Trapp M, Wewel C (2013) Transatlantic systemic risk. J Bank Financ 37(11):4241–4255

Vasicek OA (1987) Probability of loss on loan portfolio. KMV, San Francisco

Vasicek OA (2002) Loan portfolio value. Risk 15(12):160–162

Weiß GNF, Bostandzic D, Neumann S (2014a) What factors drive systemic risk during international financial crisis? J Bank Financ 41(4):78–96

Weiß GNF, Neumann S, Bostandzic D (2014b) Systemic risk and bank consolidation: international evidence. J Bank Financ 40(3):165–181

Wong E, Hui C-H (2011) A liquidity risk stress-testing framework with interaction between market and credit risks. Working paper, Hong Kong Monetary Authority

Zhang Q, Vallascas F, Keasey K, Cai CX (2015) Are market-based measures of global systemic importance of financial institutions useful to regulators and supervisors? J Money Credit Bank 47(7):1403–1442

Acknowledgements

I thank Michael Abendschein for excellent research assistance. For helpful comments, I thank an anonymous reviewer, Matthias Bank, Jens Dick-Nielsen, Thomas Gehrig, Maria-Chiara Iannino, Alois Knobloch, Jochen Lawrenz, Andreas Pfingsten and Bernhard Schwetzler as well as participants of the annual meeting of the German Academic Association for Business Research in Munich 2016, the EUROFIDAI-AFFI Paris December Finance Meeting in 2016 and the workshop “Regulation as a factor of systemic risk” organized by the research group on ‘Financial Crisis’ of the Österreichische Forschungsgemeinschaft in Innsbruck 2016.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Grundke, P. Ranking consistency of systemic risk measures: a simulation-based analysis in a banking network model. Rev Quant Finan Acc 52, 953–990 (2019). https://doi.org/10.1007/s11156-018-0732-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-018-0732-7