Abstract

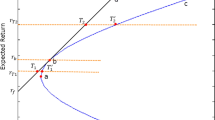

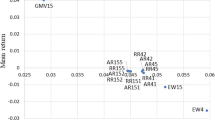

Despite its theoretical appeal, Markowitz mean-variance portfolio optimization is plagued by practical issues. It is especially difficult to obtain reliable estimates of a stock’s expected return. Recent research has therefore focused on minimum volatility portfolio optimization, which implicitly assumes that expected returns for all assets are equal. We argue that investors are better off using the implied cost of capital based on analysts’ earnings forecasts as a forward-looking return estimate. Correcting for predictable analyst forecast errors, we demonstrate that mean-variance optimized portfolios based on these estimates outperform on both an absolute and a risk-adjusted basis the minimum volatility portfolio as well as naive benchmarks, such as the value-weighted and equally-weighted market portfolio. The results continue to hold when extending the sample to international markets, using different methods for estimating the forward-looking return, including transaction costs, and using different optimization constraints.

Similar content being viewed by others

Notes

We use minimum variance portfolio and minimum volatility portfolio interchangeably throughout this study.

Optimization is only one approach to construct a low-volatility portfolio. The alternative of ranking stocks by their beta or volatility and then forming decile portfolios, as in Blitz and van Vliet (2007), results in similar risk-return profiles.

We re-run the main analyses using an investment universe that is not constrained by the availability of ICC estimates for methods not based on the ICC. The findings are similar and available upon request.

Section A.2 in the Appendix provides details on the data requirements and methodology of the ICC computation.

Stock return of the past 12 months lagged by 1 month, see Carhart (1997).

For companies with other financial year-ends, we compute synthetic book values using the latest available book value, earnings forecasts, and clean-surplus accounting, as in Gebhardt et al. (2001).

To illustrate this point, consider the following example: positive cash flow news for a company leads to an increase in its share price. Assume that analysts are slow to incorporate this positive news into their earnings forecasts. Then the ICC would decline in order to equate the (now higher) share price with the (unchanged) earnings forecasts. The result would be a negative correlation between the momentum variable and the ICC.

We download all factor returns from Kenneth French’s website: http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html.

We download the BAB factor returns from https://www.aqr.com/library/data-sets/betting-against-beta-equity-factors-monthly.

We download these factor returns from Kenneth French’s website: http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html.

If the return (r) in t or \(t-1\) is larger than 300% and \((1 + r_t) (1 + r_{t-1}) - 1\) is less than 50% then \(r_t\) and \(r_{t-1}\) are set to NA.

We use German government bonds as the risk-free instrument for the European Monetary Union.

We only include firms for which ICC estimates for all methods are available.

References

Alam P, Liu M, Peng X (2014) R&D expenditures and implied equity risk premiums. Rev Quant Finance Account 43(3):441–462

Amenc N, Goltz F, Lodh A (2012) Choose your betas: benchmarking alternative equity index strategies. J Portf Manag 39(1):88–111

Barry CB (1974) Portfolio analysis under uncertain means, variances, and covariances. J Finance 29(2):515–522

Behr P, Guettler A, Miebs F (2013) On portfolio optimization: imposing the right constraints. J Bank Finance 37(4):1232–1242. https://doi.org/10.1016/j.jbankfin.2012.11.020

Best MJ, Grauer RR (1991) On the sensitivity of mean-variance efficient portfolios to changes in asset means: some analytical and computational results. Rev Financ Stud 4(2):315–342

Blitz D, van Vliet P (2007) The volatility effect: lower risk without lower return. J Portf Manag 34(1):102–113

Campbell CJ, Cowan AR, Salotti V (2010) Multi-country event-study methods. J Bank Finance 34(12):3078–3090. https://doi.org/10.1016/j.jbankfin.2010.07.016

Carhart MM (1997) On persistence of mutual fund performance. J Finance 52(1):57–82

Chen AH, Fabozzi FJ, Huang D (2012) Portfolio revision under mean-variance and mean-CVaR with transaction costs. Rev Quantit Finance Account 39(4):509–526. https://doi.org/10.1007/s11156-012-0292-1

Chen CW, Huang CS, Lai HW (2011) Data snooping on technical analysis: evidence from the taiwan stock market. Rev Pac Basin Financ Markets Policies 14(2):195–212

Chen HH (2008) Value-at-risk efficient portfolio selection using goal programming. Rev Pac Basin Financ Markets Policies 11(2):187–200

Cheng CSA, Collins D, Huang HH (2006) Shareholder rights, financial disclosure and the cost of equity capital. Rev Quant Finance Account 27(2):175–204. https://doi.org/10.1007/s11156-006-8795-2

Chiou P, Lee CF (2013) Do investors still benefit from culturally home-biased diversification? An empirical study of China, Hong Kong, and Taiwan. Rev Quant Finance Account 40(2):341–381

Chiou WJP, Boasson VW (2015) International variations in the benefits of feasible diversification strategies. Rev Pac Basin Financial Markets Policies 18(4):1550022. https://doi.org/10.1142/S0219091515500228

Chopra VK, Ziemba WT (1993) The effect of errors in means, variances, and covariances on optimal portfolio choice. J Portf Manag 19(2):6–12

Chow TM, Hsu J, Kalesnik V, Little B (2011) A survey of alternative equity index strategies. Financ Anal J 67(5):37–57

Chow TM, Hsu JC, Kuo LL, Li F (2014) A study of low-volatility portfolio construction methods. J Portf Manag 40(4):89–105

Chow TM, Kose E, Li F (2016) The impact of constraints on minimum-variance portfolios. Financ Anal J 72(2):52–70

Clarke R, H de Silva, Thorley S (2006) Minimum-variance portfolios in the U.S. equity market. J Portf Manag 33(1):10–24

Clarke R, de Silva H, Thorley S (2011) Minimum-variance portfolio composition. J Portf Manag 37(2):31–45

Claus J, Thomas J (2001) Equity premia as low as three percent? Empirical evidence from analysts earnings forecasts for domestic and international stock markets. J Finance 56(5):1629–1666

DeMiguel V, Garlappi L, Nogales FJ, Uppal R (2009a) A generalized approach to portfolio optimization: improving performance by constraining portfolio norms. Manag Sci 55(5):798–812. https://doi.org/10.1287/mnsc.1080.0986

DeMiguel V, Garlappi L, Uppal R (2009b) Optimal versus naive diversification: how inefficient is the 1/N portfolio strategy? Rev Financ Stud 22(5):1915–1953. https://doi.org/10.1093/rfs/hhm075

Easton PD (2004) PE ratios, PEG ratios, and estimating the implied expected rate of return on equity capital. Acc Rev 79(1):73–95

Elton EJ (1999) Expected return, realized return, and asset pricing tests. J Finance 54(4):1199–1220

Fama E, MacBeth J (1973) Risk, return, and equilibrium: empirical tests. J Polit Econ 81(3):607–630

Fama EF, French KR (1993) Common risk factors in the returns on stocks and bonds. J Financ Econ 33:3–56

Fama EF, French KR (1997) Industry costs of equity. J Financ Econ 43(2):153–193

Fama EF, French KR (2015) A five-factor asset pricing model. J Financ Econ 116(1):1–22

Frankfurter GM, Phillips HE, Seagle JP (1971) Portfolio selection: the effects of uncertain means, variances, and covariances. J Finan Quant Anal 6(05):1251–1262

Frazzini A, Pedersen LH (2014) Betting against beta. J Financ Econ 111(1):1–25

Frost PA, Savarino JE (1986) An empirical Bayes approach to efficient portfolio selection. J Financ Quant Anal 21(03):293–305

Frost PA, Savarino JE (1988) For better performance: constrain portfolio weights. J Portf Manag 15(1):29–34

Gebhardt WR, Lee CMC, Swaminathan B (2001) Toward an implied cost of capital. J Account Res 39(1):135–176

Ghalanos A, Theussl S (2015) Rsolnp: general non-linear optimization using augmented Lagrange multiplier method. R package version 1:16

Gode D, Mohanram P (2003) Inferring the cost of capital using the Ohlson–Juettner model. Rev Account Stud 8(4):399–431

Grossman SJ, Zhou Z (1993) Optimal investment strategies for controlling drawdowns. Math Finance 3(3):241–276

Guay W, Kothari SP, Shu S (2011) Properties of implied cost of capital using analysts forecasts. Aust J Manag 36(2):125–149. https://doi.org/10.1177/0312896211408624

Harvey CR, Liu Y, Zhu H (2016) ... and the cross-section of expected returns. Rev Financ Stud 29(1):5–68

Haugen RA (1997) Modern investment theory. Prentice Hall, Upper Saddle River

Haugen RA, Baker NL (1996) Commonality in the determinants of expected stock returns. J Financ Econ 41(3):401–439

Herfindahl OC (1950) Concentration in the steel industry. Doctoral dissertation, Columbia University

Hilliard JE, Hilliard J (2015) A comparison of rebalanced and buy and hold portfolios: does monetary policy matter? Rev Pac Basin Financ Markets Policies 18(1):1550,006

Hirschman AO (1945) National power and the structure of foreign trade. University of California Press, Berkeley

Hou K, van Dijk MA, Zhang Y (2012) The implied cost of capital: a new approach. J Account Econ 53:504–526

Ince OS, Porter RB (2006) Individual equity return data from Thomson Datastream: handle with care! J Financ Res 29(4):463–479

Jagannathan R, Ma T (2003) Risk reduction in large portfolios: why imposing the wrong constraints helps. J Finance 58(4):1651–1684

Jobson JD, Korkie BM (1981) Putting Markowitz theory to work. J Portf Manag 7(4):70–74

Jorion P (1986) Bayes–Stein estimation for portfolio analysis. J Financ Quant Anal 21(03):279–292

Jorion P (1991) Bayesian and CAPM estimators of the means: implications for portfolio selection. J Bank Finance 15:717–727

Karolyi AG (2016) Home bias, an academic puzzle. Rev Finance 20(6):2049–2078

Kim JB, Shi H, Zhou J (2014) International financial reporting standards, institutional infrastructures, and implied cost of equity capital around the world. Rev Quant Finance Account 42(3):469–507. https://doi.org/10.1007/s11156-013-0350-3

Kritzman M, Page S, Turkington D (2010) In defense of optimization: the fallacy of 1/N. Financ Anal J 66(2):31–39

Ledoit O, Wolf M (2004) Honey, I shrunk the sample covariance matrix. J Portf Manag 30(4):110–119

Lee C, Ng D, Swaminathan B (2009) Testing international asset pricing models using implied cost of capital. J Financ Quant Anal 44(2):307–335

Li KK, Mohanram P (2014) Evaluating cross-sectional forecasting models for implied cost of capital. Rev Account Stud 19(3):1152–1185. https://doi.org/10.1007/s11142-014-9282-y

Li Y, Ng DT, Swaminathan B (2013) Predicting market returns using aggregate implied cost of capital. J Financ Econ 110:419–439

Li Y, Ng DT, Swaminathan B (2014) Predicting time-varying value premium using the implied cost of capital. Working paper

Markowitz H (1952) Portfolio selection. J Finance 7(1):77–91

Michaud RO (1989) The Markowitz optimization enigma: is ’Optimized’ optimal? Financ Anal J 45(1):31–42

Mohanram P, Gode D (2013) Removing predictable analyst forecast errors to improve implied cost of equity estimates. Rev Account Stud 18(2):443–478

Nekrasov A, Ogneva M (2011) Using earnings forecasts to simultaneously estimate firm-specific cost of equity and long-term growth. Rev Account Stud 16(3):414–457. https://doi.org/10.1007/s11142-011-9159-2

Newey WK, West KD (1987) A simple, positive semi-definite, heteroskedasticity and autocorrelationconsistent covariance matrix. Econometrica 55(3):703–708

Novy-Marx R, Velikov M (2016) A taxonomy of anomalies and their trading costs. Rev Financ Stud 29(1):104–147. https://doi.org/10.1093/rfs/hhv063

Ohlson JA, Juettner-Nauroth BE (2005) Expected EPS and EPS growth as determinants of value. Rev Account Stud 10(2–3):349–365

Phengpis C, Swanson PE (2011) Optimization, cointegration and diversification gains from international portfolios: an out-of-sample analysis. Rev Quant Finance Account 36(2):269–286

Pástor Ľ, Sinha M, Swaminathan B (2008) Estimating the intertemporal risk return tradeoff using the implied cost of capital. J Finance 63(6):2859–2897

Schmidt PS, Von Arx U, Schrimpf A, Wagner AF, Ziegler A (2014) On the construction of common size, value and momentum factors in international stock markets: a guide with applications. Working Paper, Swiss Finance Institute

Sharpe WF (1966) Mutual fund performance. J Bus 39(1):119–138

Sharpe WF (1994) The Sharpe ratio. J Portf Manag 21(1):49–58

Soe AM (2012) Low-volatility portfolio construction: ranking versus optimization. J Index Invest 3(2):63–73

Statman M (1987) How many stocks make a diversified portfolio? J Financ Quant Anal 22(3):353–363. https://doi.org/10.2307/2330969

Stock JH, Watson MW (2004) Combination forecasts of output growth in a seven-country data set. J Forecast 23(6):405–430. https://doi.org/10.1002/for.928

Tang Y, Wu J, Zhang L (2014) Do anomalies exist ex ante? Rev Finance 18(3):843–875. https://doi.org/10.1093/rof/rft026

Wang CCY (2015) Measurement errors of expected-return proxies and the implied cost of capital. Working paper

Ye Y (1987) Interior algorithms for linear, quadratic, and linearly constrained non linear programming. Ph.D. thesis, Department of ESS, Stanford University

Author information

Authors and Affiliations

Corresponding authors

Additional information

Many thanks to Gonçalo de Almeida Terca, David Blitz, Winfried Hallerbach, Christoph Kaserer, and Milan Vidojevic for the stimulating discussions and helpful comments. We also thank seminar participants at the TUM School of Management brown bag seminar for their input. Part of this research was conducted while Patrick was visiting INSEAD. Disclosures: Patrick works for ERI Scientific Beta, a smart beta index provider. Matthias is employed by Robeco, an asset management firm, which, among other strategies, also offers active low-volatility strategies. All errors are our own.

Appendix

Appendix

1.1 Universe screens and description of portfolio strategies

1.2 Implied cost of capital

We compute the implied cost of capital (\({ ICC}_{n,\tau }\)) for each company at each rebalancing date. The subscript n denotes the respective stock and the subscript \(\tau\) denotes the date. For the sake of clarity, we omit these two subscripts in all subsequent formulas.

1.2.1 GLS method

The implied cost of capital (\({ ICC}_{{ GLS}}\)) according to Gebhardt et al. (2001) is based on a residual income model. Gebhardt et al. (2001) solve the following equation for \({ ICC}_{{ GLS}}\):

where \({ ICC}_{{ GLS}}\) is the ICC estimate according to Gebhardt et al. (2001), \(P_0\) is the respective stock price at \(t=0\) (from IBES), \({ BPS}_0\) is the company’s book value at \(t=0\) (from Compustat and Worldscope for the U.S. and international markets, respectively), \({ ROE}_t = { EPS}_{t}/{ BPS}_{t-1}\), and \({ EPS}_{t}\) is forecasted earnings per share for year t. For the first three periods, \({ ROE}\) is calculated using \({ EPS}\) from analysts’ forecasts (from IBES). After period three, \({ ROE}\) is linearly interpolated to the industry median \({ ROE}\) (computed using earnings and book values from Compustat and Worldscope for the U.S. and international markets, respectively). The industry \({ ROE}\) is a moving median of all profitable companies in the respective industry over at least the previous 5 years (and up to the previous 10 years). Industries are classified according to Fama and French (1997). We calculate book values for future periods using clean-surplus accounting. The growth rate beyond period 12 is set to zero.

1.2.2 MPEG method

The modified price-earnings growth (MPEG) method uses the following abnormal earnings growth model (Easton 2004):

where \({ ICC}_{{ MPEG}}\) is the \({ ICC}\) according to the MPEG method, \({ EPS}_t\) is forecasted earnings per share for year t (from IBES), and \({ DPS}_t\) is forecasted dividends per share computed as \({ EPS}_t \times { pr}\) with \({ pr}\) standing for the last available payout ratio (from Compustat and Worldscope for the U.S. and international markets, respectively).

1.2.3 OJ method

The method by Ohlson and Juettner-Nauroth (2005) is also based on an abnormal earnings growth model. We follow the implementation of Gode and Mohanram (2003). The equation is:

where \({ ICC}_{{ OJ}}\) is the ICC following Ohlson and Juettner-Nauroth (2005), \({ EPS}_t\) is forecasted earnings per share for year t (from IBES), \({ DPS}_t\) is forecasted dividends per share computed as \({ EPS}_t \times { pr}\) with \({ pr}\) standing for the last available payout ratio (from Compustat and Worldscope for the U.S. and international markets, respectively), and \(g_s\) and \(g_l\) are the short-term and long-term growth rates, respectively. \(g_s\) is set to the average of the growth rate between \({ EPS}_1\) and \({ EPS}_2\) and the long-term earnings growth rate (\({ EPS}_{{ LTG}}\), from IBES), i.e. \(g_s = \big (\frac{{ EPS}_2 - { EPS}_1}{{ EPS}_1} + { EPS}_{{ LTG}} \big ) \frac{1}{2}\). \(g_l\) is equal to the risk-free rate minus three percent with a lower bound of zero to avoid economically-questionable negative long-term growth rates.

1.2.4 PSS method

The method by Pástor et al. (2008) uses the following dividend discount model:

where \({ ICC}_{{ PSS}}\) is the ICC according to Pástor et al. (2008), \({ EPS}_t\) is forecasted earnings per share for year t (from IBES), and \({ pr}_{{ PSS},t}\) is the payout ratio according to the PSS methodology for year t. This payout ratio is computed as dividends plus stock repurchases minus new stock issues over net income. If net income is missing, the earnings forecast as of December of year \(t-1\) for financial year-end t from IBES is used. For the remaining missing payout ratios, the median \({ pr}_{{ PSS},t}\) of all firms in the respective industry-size portfolio is used. To form the industry-size portfolio in each year, the firms are first sorted into 48 industries based on Fama and French (1997). Then they are assigned to three size groups based on their market value. The size groups each contain an equal amount of firms within each industry. If the median payout ratio of the industry-size portfolio is below \(-\,0.5\) then it is set to \(-\,0.5\). Payout ratios on the firm-level below \(-\,0.5\) and above 1 are set to the median payout ratio of the industry-size portfolio.

We obtain the payout ratio for future periods in the following way. For the first 3 years, we use the value according to the procedure above. After year three, we revert the payout ratio linearly to a steady-state value, which is reached in year 15. We compute the steady-state payout ratio as \(1 - g/ICC_{PSS}\), with g being the long-run nominal GDP growth rate. This assumes that in the steady-state, the return on investment equals the cost of equity.

Rights and permissions

About this article

Cite this article

Bielstein, P., Hanauer, M.X. Mean-variance optimization using forward-looking return estimates. Rev Quant Finan Acc 52, 815–840 (2019). https://doi.org/10.1007/s11156-018-0727-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11156-018-0727-4