Abstract

Supplier market power—such as the ability of branded goods suppliers to dictate terms to retailers—is an important feature of many markets. We show that supplier power can counteract the effects of downstream mergers on consumer prices where there are two-part contracts. This is because greater market power allows suppliers to set contracts that internalise partially the impact of the merger on downstream prices. Post-merger, the supplier reduces the per-unit price at which it supplies the merged downstream firms, with the aim of maintaining total industry profitability—and then recoups the profits via a larger fixed fee. We modify the standard upward pricing pressure (UPP) formula to account for the supplier’s response to a horizontal merger in the downstream market, while preserving much of the simplicity of the standard approach.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Mergers between competing firms are often analysed on the basis of how the merger would affect the incentives of the merging firms to raise prices. This analysis is based on pre-merger profit margins and diversion ratios: the proportion of a company’s sales that would be diverted to its merged affiliate in the event of a price increase. This is particularly common as an initial screen to understand whether a merger is likely to be anti-competitive.

However, this approach overlooks how vertical relationships affect market outcomes—which is often important in practice. For instance, the effect of a merger between two retailers might depend on whether their suppliers would change their own (upstream) pricing strategies in response. Or the bargaining power of a monopsonistic purchaser might reduce any price rise that could result from an upstream merger.

Such issues are frequently considered in the context of mergers between suppliers to supermarkets: Major cases include Diageo’s 2013 purchases of a shareholding in United Spirits and the 2018 merger between Total Produce and Dole Food Company. But these issues can also arise in many other mergers that involve vertical relationships—including in markets as diverse as networking products, engineering consulting and satellite launches.Footnote 1

To date, such vertical interactions have typically been studied in the context of buyer market power: the ability of the downstream consumers of the merging firms to constrain price increases through bargaining. Authorities have tended to assume that, while buyer power might mitigate the impacts of a merger, it is unlikely to eliminate them entirely. For instance, the US Horizontal Merger Guidelines state that “the Agencies do not presume that the presence of powerful buyers alone forestalls adverse competitive effects flowing from the merger. Even buyers that can negotiate favorable terms may be harmed by an increase in market power.”Footnote 2

In this paper, we examine the specific issues that arise in the context of supplier market power: the internalisation effects that result from the supplier’s ability to set contracts and thereby influence market prices. In practice, suppliers can have much more brand recognition than the firms to which they supply, and might therefore be expected to have substantial influence on final market outcomes; for example, a supermarket chain that doesn’t have Coca-Cola available for purchase could soon lose customers.

We demonstrate that, when the supplier has monopoly power (unconstrained), a downstream merger may have little or no effect on consumer prices—even in the absence of efficiencies. We further show how this effect varies with supplier market power, and we adapt the standard formula for upward pricing pressure (UPP) to take account of supplier power. Because this effect arises from the supplier’s accounting for changes in downstream firms’ pricing decisions in the event of a merger, it is different from a standard buyer power argument. Indeed, we demonstrate in a simple example (in the Appendix) that linear wholesale prices may fall after a merger. But, unlike in typical models of buyer power, this emerges from the supplier’s attempts to maintain final (retail) prices at their pre-merger industry profit-maximizing levels (and then recoup the profits via a larger fixed fee), rather than because of increased downstream negotiating power.

2 Relevant Literature

The upward pricing pressure approach to merger analysis originated in the work of Shapiro (1995), who identified the role of margins and diversion ratios as key drivers of post-merger pricing incentives. This approach was later developed, notably by Farrell and Shapiro (2010). The simplicity of the UPP formula was appreciated by both researchers and competition authorities, and was adopted for use in merger control by authorities on both side of the Atlantic (see Oldale and Padilla, 2013 and Valletti and Zenger, 2021). However, it has also come under criticism as being too simplistic to account fully for real-world competition dynamics. For instance, Mathiesen et al. (2012) show that it can lead to false positive results when firms are asymmetric. In their assessment of the 2010 US Horizontal Merger Guidelines, Carlton and Israel (2020) argue that the UPP approach has been overused due to its simplicity, despite being inferior to merger simulation in understanding when to challenge a merger.

Researchers have endeavoured to extend the basic UPP formula in several directions, typically at the cost of greater complexityFootnote 3: For instance, Hausman et al. (2011) extend the UPP formula to a two-product case with linear demand. Jaffe and Weyl (2013) generalize the UPP formula further to incorporate multi-product firms. We extend the basic UPP formula to account for supplier response to a horizontal merger, while trying to preserve much of the simplicity of the original formula.

Our paper also contributes to the discussion of how cost pass-through rates affect consumer prices. Jaffe and Weyl (2013) discuss the role of cost-pass through rates in determining changes in prices after a merger; they focus on the cost synergies that arise from the merger. In our setting, we also point out the importance of pass-through rates, but the cost changes in our model emerge from suppliers’ responses to changes in competitive conditions downstream. The model of Lommerud et al. (2005) is closer in spirit to ours, as the authors examine how input prices change in response to a merger. But they focus on linear input prices rather than on two-part tariffs, and they do not consider the effects on final consumer prices in detail. Similarly, Gaudin (2018) discusses how cost pass-through rates affect suppliers’ responses to a change in retail market competition, in a setting with linear input prices. In this case, he shows that consumers will benefit from a downstream merger only if market demand is highly convex; increased retailer bargaining power can then lead to increased production in response to lower input prices.

Several papers consider upstream market responses in mergers that include vertically-integrated firms. Bergh et al. (2020) consider a setting where some non-merging firms are vertically integrated, and calculate how the incorporation of vertical relationships affects UPP calculations. In a similar spirit, Asphjell et al. (2017) consider the upstream market response to a change in competitive conditions in the retail market. As in our work, they find that UPP calculations may overstate the price rise (and hence the ensuing harm) when supplier response is not considered. In contrast to these contributions, our approach focuses purely on how suppliers react to a horizontal merger. There is no price-reducing effect that arises from vertical integration, which allows us to isolate the effect of supplier market power on price changes post-merger. Moreover, we obtain an augmented UPP formula that includes supplier responses.

There is an extensive literature on the effect of buyer power, which ultimately dates back to Galbraith (1952). Von Ungern-Sternberg (1996) and Dobson and Waterson (1997) discuss when buyer power among retailers can mean that a retail merger leads to a reduction in final prices. Carlton (2010) suggests that, under non-linear contracts, unless a merger leads to a decrease in costs, the increased surplus that is accrued by the buyer post-merger cannot be considered an efficiency. We show that, under non-linear contracts, increased downstream market power without any reduction in costs may result in an increase in prices.Footnote 4 However, the supplier is incentivised to change its prices so as to mitigate the price-increasing effects associated with a downstream merger: Supplier power may counteract the price increases that stem from the reduced downstream competitive intensity in this context.

The paper is organized as follows. In Sect. 3, we describe the benchmark model. In Sect. 4, we analyse the effects of supplier power. In Sect. 5, we discuss the possible application of the revised UPP formula, before concluding in Sect. 6.

3 Model

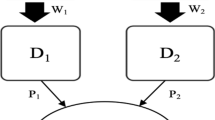

There are \(N>2\) symmetrically differentiated firms in the retail (downstream) market that compete in prices. The consumer price of each firm \(i\in 1, \cdots ,N\) is given as \(p_i\) and the associated demand is \(D_i(p_i,\mathbf {p_{j}})\), where \(\mathbf {p_{j}}\) (with \(j\ne i\in \{1, \cdots ,N\}\)) is the vector of rival retailers’ prices. These retail firms need access to an input from the input supply market to sell in the retail market.

In the input supply (upstream) market, following the approach of Inderst and Shaffer (2019), we assume that there is an efficient supplier U with marginal cost normalized to 0 and a fringe of less efficient suppliers with a marginal cost \(s>0\). This asymmetric marginal cost approach allows us to capture the effect of changes in supplier market power on a supplier’s response to a change in retail market structure in a tractable manner.Footnote 5 Additionally, we generally assume that the production cost of the competitive supply fringe is sufficiently low— \(s<{\tilde{s}}\)—so that it presents a competitive constraint on the supplier U. This threshold is defined by linear wholesale fee set by the efficient supplier absent competition in the supply market. For any \(s\ge {\tilde{s}}\), we are in the case where the supplier U is not competitively constrained and can fully exert its market power behaving like a monopolist.

For exposition, we first discuss the case where the supplier is a monopolist: where \(s\ge {\tilde{s}}\). Then, we focus on the case when \(s<{\tilde{s}}\). Under this parameter constellation, a decrease in s implies that the competitive fringe supply is more efficient. This restricts the profitable strategy space of the supplier U and is analogous to increased competition in the supply market and a decrease in supplier power. On the contrary when s increases, the opposite occurs.

Retail profits. The efficient input supplier U offers two-part tariff contracts to downstream retailers, \((w_i, F_i)\), where \(w_i\) is the linear wholesale price and \(F_i\) is the fixed fee that is charged to each retailer \(i\in \ 1, \cdots ,N\). Without substantively affecting our results, we assume that retailers have zero marginal costs apart from the contract that is offered by the suppliers. Thus, the profit of each downstream retailer in the event that it accepts the contract that is offered by U is given by:

Here, \(p_i\) is the price that is offered by the retailer i and \(\mathbf {p_{j}}\) is the price that is offered by the other competing retailers.

Retail outside option profits. The presence of the competitive supply fringe presents a competitive constraint on the supplier for \(s<\tilde{s}\), which makes the outside option of each downstream firm endogenous: The outside option of a retailer i is given as retailer i’s profits when retailer i rejects the contract that is offered by U while the retailer’s rivals have accepted the contract. Thus, the contracts that are offered to its downstream rivals affect the outside option profit of each retailer i which is given as

Note that now the marginal cost of firm i per unit sold is s instead of \(w_i\) as it sources its input from the competitive supply fringe that sells at cost. As s increases, the outside option profit of the downstream firm i falls (and supplier U’s market power rises) and vice versa: \(\frac{\partial (p_i-s)D_i(p_i,\mathbf {p_{j}})}{\partial s}<0\).

Supplier profits. The efficient supplier U sets contracts to maximize its profits given as

We assume that the fixed fee \(F_i\) is always positive: \(F_i>0\). This avoids the use of slotting fees that lead to an increase in per-unit fees when \(s\approx 0\).

The timing of the game in the pre-merger and post-merger case is as follows:

-

1.

The suppliers make contractual offers and downstream firms accept or reject the offers.

-

2.

After observing acceptance or rejection decisions, the retailers set final prices.

We solve the game by backward induction. In the analysis section, we first describe the case where the efficient supplier is a monopolist and then discuss the case where the efficient supplier faces a competitive constraint.

4 Analysis

4.1 Supplier U is a Monopolist

In the following, we first consider the pre-merger regime and then analyze the post-merger regime and its effect on prices and the supplier U’s response when the supplier is a monopolist: \(s\ge {\tilde{s}}\).

Pre-merger. Given the contracts, each downstream firm sets its price to maximize its profits. Differentiating the profit of each firm i, as presented in Eq. (1) with respect to price \(p_i\) yields the following system of first order conditions.

The above system of first order conditions determines the prices set in the market denoted by \(p_i^{\star }(\cdot )\). The supplier chooses \(F_i\) to extract all surplus apart from the outside option (which in this case is zero), which is given as \(F_i^{\star }\triangleq (p_i^{\star }(\cdot )-w_i)D_i^{\star }(\cdot ).\) Substituting \(F_i^{\star }\) into the profits as presented in Eq. (2a), we can rewrite the optimization problem of U (profit expression) as a function of linear wholesale fees which is given as:

The supplier sets linear wholesale fees so as to maximize industry profit (which the supplier captures through its fixed fees). For any \(N>2\), the linear fees will be above marginal costs such that the competing retailers set prices at the monopoly levels.Footnote 6

Post-merger. Suppose that retailers 1 and 2 merge; we denote this entity by M. Further, we assume that the merged entity is able jointly to accept or reject a contract offer from the supplier U. Profit of the merged entity when it accepts the contract that is offered by supplier U is given as

Differentiating the profit of the merged entity with respect to \(p_1\) yields

Comparing the first-order conditions as presented in Eqs. (6 and 3), we derive the classical upward pricing pressure as

The upward pricing pressure (UPP) is a proxy for the incentive of the merged firm to increase prices post-merger. It is a composite of two terms: the margin of the merged affiliate firm and the diversion ratio. As the margin of the merged affiliate increases, UPP increases: The merged firm finds it profitable to increase the post-merger price that is charged by firm 1. This is because some of the demand will divert to the profitable merged affiliate firm 2. The second term—the diversion ratio—is a measure of the amount of demand that is diverted to firm 2 as a proportion of the sales that are lost by the firm 1 when its price increases by a unit. (A comparable measure applies to the UPP with respect to firm 2’s price.)

In stage 1, the supplier offers take-it-or-leave-it (TIOLI) two-part tariffs to the downstream firms that take into account the post-merger market structure. Linear wholesale prices are again set to maximize the industry profit, with the fixed element set such that the retailers’ participation constraints are just satisfied. The optimization problem of U (profit expression) as a function of linear wholesale fees is given as:

In both the pre-merger and the post-merger cases, the supplier sets wholesale prices so as to maximize industry profit.

A short discussion. The classical UPP assumes that the marginal cost of the retailer remains unchanged pre- and post-merger. In our case, this would mean that the wholesale fees that are charged by the supplier remains unchanged. This is an unrealistic assumption which skews the UPP upwards. Post-merger — after observing changes in the downstream competitive landscape — the monopolist supplier sets contracts so as to ensure that industry surplus is maximized. Observing that the competition between firm 1 and firm 2 has been eliminated after the merger, the monopolist will set lower linear wholesale fees to the merged entity so as to maintain the market price at the industry profit-maximizing levels (and will recover the profit through a higher fixed fee). In Appendix A, we numerically solve this case and show that final consumer prices remain unchanged post-merger when the supplier is a monopolist.

4.2 Supplier Faces a Competitive Constraint

In the following, we first consider the pre-merger regime and then analyze the post-merger regime and its effect on prices and the supplier U’s response when the supplier is constrained: \(s<{\tilde{s}}\).

Pre-merger. Given contracts, the retail pricing strategy is characterized by the first-order condition that was presented in Eq. (3). Solving the system of first-order conditions simultaneously, we obtain the set of equilibrium prices that are denoted by \(p_i^{\star }(w_i,\mathbf {w_{j}})\) for \(j\ne i\in \{1,\ldots ,N\}\).

Substituting these prices into the demand and profit expression of each retailer i yields demands and the associated acceptance profits as a function of linear wholesale fees respectively as \(D_i^{\star }(w_i,\mathbf {w_{-i}})\triangleq D_i(p_i^{\star }(\cdot ),\mathbf {p_{-i}^{\star }}(\cdot ))\) and \(\pi _i(w_i,\mathbf {w_{-i}})-F_i=(p_i^{\star }(\cdot )-w_i)D_i^{\star }(\cdot )-F_i.\)

In the first stage, the supplier U sets contracts so as to maximize

The supplier chooses \(F_i\) to extract all of the surplus apart from the outside option; \(F_i\) is given as:

Substituting \(F_i^{\star }\) into the profits as presented in Eq. (9), we can rewrite the optimization problem of U (profit expression) as a function of the linear wholesale fees is given as

Notice that the supplier sets the linear wholesale fees so as to maximize industry profit apart from the outside option of each firm. Differentiating the above expression with respect to \(w_i\) and employing the envelope theorem yields

The above first-order condition presents forces that determine the equilibrium wholesale fees. As the outside option is affected by the equilibrium fees, the supplier takes this into account.

Post-merger. Given contracts, the retail pricing strategy of the merged entity is characterized by the first-order condition that was presented in Eq. (6), while the pricing strategy of other non-merged firms remains unchanged as in Eq. (3).

Substituting these prices into the demand and profit expression of the merged firm yields demands and the associated contract acceptance profits as functions of linear wholesale fees respectively as \(D_i^{\star }(w_i,\mathbf {w_{-i}})\) and \(\pi ^M(w_i,w_{-i})-F=(p_1(\cdot )-w_1)D_1^{\star }(\cdot )+(p_2^{\star }(\cdot )-w_2)D_2^{\star }(\cdot )-F.\)

In the first stage, the supplier offers TIOLI two-part tariffs to the downstream firms that take into account the post-merger market structure. Wholesale prices are again set to maximize the industry profit, with the fixed fee set such that the retailers’ participation constraints are just satisfied:

Notice that, as in the pre-merger case, the supplier U again sets linear wholesale fees so as to maximize industry profit net of the outside option. Differentiating its profit with respect to \(w_1\) and simplifying using the envelope theorem yields the following first-order condition:

Assuming that the retail pass-through rates remain unchanged in the two cases and comparing the supplier’s linear wholesale fee setting strategy in Eq. (10) with (11) yields:

The first expression above is the classic pass-through effect of an increase in \(w_1\) on the profitability of the merged affiliate (firm 2). The second expression is more nuanced and describes the competition-reducing effect of increased linear wholesale fees: A unit increase in \(w_1\) increases the price of firm 2, which indirectly and positively enhances profitability of firm 1. These two expressions negatively affect the incentive to increase wholesale fees. The last term is the effect of a unit increase in \(w_1\) on the outside option of firm 2 which is absent post-merger. This term is a manifestation of the change in market structure (post-merger) in the retail market and the joint bargaining by the merged entity.

The total sign of the above expression determines whether supplier U has incentive to increase or decrease its price. It is straightforward that the sign of the above expression is negative and arises directly from the fact that the outside option retail margin is smaller than the inside option retail margin: \(p_2^{\star }-w_2^{\star }>p_2^{\star }(s,\cdot )-s>0\).

UPP and SDPP. The expression in Eq. (12) can be easily modified by employing the UPP definition in Eq. (7) so as to obtain a measure for the response of a supplier to a merger, which we term "supplier downward pricing pressure" (SDPP). We can rewrite the above to get

To understand further how this \(SDPP_i\) changes with supplier market power, we consider the direct first-order effect of a change in s. This is because UPP is a partial equilibrium concept and considers only the first-order effect:

Proposition 1

When demands are linear and symmetric, a supplier adjusts wholesale prices less in response to a merger as the competitive fringe becomes more efficient (s falls), \(\frac{\partial SDPP_i(\cdot )}{\partial s}=\frac{\partial ^2 \pi _2^O(s,\mathbf {w_{-i}})}{\partial w_i\partial s}<0\).

The results above are intuitive. As the supplier’s market power decreases (as s decreases), the supplier responds by decreasing its linear wholesale fees so as to respond to the improved outside option of the downstream firms. As a consequence, its ability to manipulate downstream prices through its wholesale contracts is reduced as the supplier has less room to manoeuvre.

Employing the \(SDPP_i\), we derive the revised upward pricing pressure formula as

The above expression accounts for the supplier’s response and sums the supplier’s linear wholesale price reduction multiplied by the pass-through rate with the classical upward pricing pressure expression. Note that retail pass-through rates play a significant role in determining the effect of a change in the supplier’s linear pricing levels.Footnote 7 In addition, it is well known that pass-through rates are determined by the market characteristics at the retail level. For instance, if the retail market is fiercely competitive, the pass-through rates will be high and thus also will be the effect of the supplier’s market power.Footnote 8

The effect of supplier market power. We proxy supplier market power as the inefficiency of the outside option: As s decreases—as the outside option becomes more efficient—the supplier’s market power also decreases. Falling supplier market power reduces the supplier’s ability to respond appropriately to a reduction in competition in the downstream market. This can be easily observed in the expression for \(SDPP_i(s)\), which is also the response of a supplier to a merger: As s decreases, the expression for \(SDPP_i\) also decreases: The response of a supplier to a merger is dampened as the supplier’s market power falls. Differentiating \(UPP_i^{Total}\) with respect to s yields the main result in our paper as is presented in the following proposition:

Proposition 2

As the supplier power increases (as s increases), the total UPP decreases.

The above result is intuitive and confirms our hypothesis. Specifically as s increases, the supplier is better able to respond to changes in market structure post-merger in the retail market. This directly translates into lower UPP. We illustrate this insight technically by differentiating \(UPP_i^{Total}\) with respect to s:

An increase in supplier power (as s increases) decreases the incentive to increase downstream prices post-merger. This effect arises directly through the supplier’s (post-merger) response which reduces wholesale prices.

5 Discussion

We have shown how supplier market power can counteract the upward pricing pressure that might usually be expected to result from a downstream merger. In some circumstances, when a supplier can typically make TIOLI offers and pass-through rates are high, this can even result in unchanged prices after the merger.

This result is potentially important in merger analysis in several contexts: For instance, supplier market power is likely to be relevant where retailers sell branded goods that are produced by well-known suppliers, which may have significant ability to mitigate any effects of a retail merger on final prices. Similarly, mergers in industries such as airlines that are based on inputs that are supplied by oligopolistic markets (such as airframe manufacturers) may also be affected by the extent of supplier power. In such cases, our work suggests that analysis based on the standard UPP formula should be tempered by consideration of the dynamics of relationships with powerful suppliers. Of course, this is not to claim that the consideration of supplier market power in itself would necessarily lead to different decisions; instead, taking supplier market power into account may be important for a full analysis of a merger’s effect.

The information requirements of applying our revised formula for upward pricing pressure are clearly greater than those for the standard UPP calculation. In particular, they require evidence on pass-through rates of wholesale prices to the retail market. However, importantly, pass-through rates can be calculated based on evidence only from the retail market, without requiring full simulation of upstream competition. This is particularly relevant in the context of antitrust investigations, where evidence from the merging parties may be more readily available than that from third-party firms. In some industries, there may also be pre-existing estimates of pass-through rates that could be drawn upon.Footnote 9

Our analysis is based on two-part tariffs, and does not extend to linear contracts. With linear contracts, the analysis for the UPP remain unchanged. This is because—in the presence of a credible outside option, the efficient supplier is always constrained in setting its linear fee and always sets the fee marginally below the cost of the competitive outside option. Thus, the wholesale prices are unchanged pre-merger and post-merger. Therefore, the original UPP analysis remains appropriate.

Despite this limitation, two-part tariffs are common in several industries—such as royalty fees in franchising and standing charges in commodities markets. They will typically be more efficient than linear pricing where there are double marginalization problems. Some retail industries feature non-linear contracts across different dimensions: for instance covering price, quality, range, and service (PQRS). Our results should apply to such contractual structures—provided that the supplier can alter some elements of the contract without affecting the retailer’s decision-making at the margin.

6 Conclusion

In this paper, we discuss how supplier power can affect price setting in downstream markets in the context of a merger between downstream firms. We find that when supplier power is absent, the standard upward pricing pressure (UPP) approach to considering a merger’s effects remains appropriate. However, as suppliers become more powerful, the UPP formula is likely to overestimate the consumer harm that results from the merger—provided that the contracts between the supplier(s) and the downstream firms are non-linear. This can be intuitively described for the case when the supplier has all of the market power. In this case, pre-merger, the supplier sets its non-linear contracts so as to maximize the industry profit (which the supplier captures through its fixed fees) in consideration of the competitive intensity in the downstream market. Post-merger, the competitive intensity in the downstream market changes and the supplier responds accordingly so as to ensure that the industry profit-maximizing surplus is achieved post-merger as well. As a result, when the supplier takes into account the merging retailers’ incentive to increase consumer prices, it reduces the linear wholesale price so as to minimize the deviation away from industry profit-maximizing price levels—and adjusts its fixed fees accordingly. This supplier response dampens the downstream (retail) price increase that arises from a merger. When the pass-through of wholesale prices is high, the effect of supplier power on final prices is likely to be particularly marked.

Notes

The European Commission considered the possible existence of countervailing buyer power in recent mergers between NVIDIA and Mellanox, Capgemini and Altran, Airbus and Arianespace.

US Department of Justice & the Federal Trade Commission (2010), Sect. 8.

For a detailed survey of the literature on UPP, see Shinkoda et al. (2020).

A similar discussion can be found in Carlton and Israel (2011).

This cost asymmetry results in the competitive fringe suppliers’ supplying by setting price at their market cost s.

See Motta (2004) for a detailed analysis.

In addition, pass-through rates can also be high when the demand is non-elastic and linear (such as Hotelling). In this case, pass-through rates are equal to 1. Instead, if the demand is elastic and linear, pass-through varies from 1/2 (monopoly on retail level) to 1 (under perfect competition).

See, for instance, Fabra and Reguant (2014).

Deviating from the benchmark setting and in favor of brevity, we normalize the marginal cost of input production such that \(c=0\).

The fixed fee is set to just satisfy the participation constraint of each downstream firm.

This is reminiscent of the result in Gaudin (2018), where he shows that pass-through rates are critical in determining a change in retail prices when the number of competing retailers changes.

References

Asphjell, M. K., Bergh, H. N., Merker, T., & Skaar, J. (2017). Unilateral effects of horizontal mergers with vertical relations between firms and other structural market changes. Review of Industrial Organization, 51(3), 381–394.

Bergh, H. N., Gramstad, A. R., & Skaar, J. (2020). Unilateral price effects and vertical relations between merging and non-merging firms. Review of Industrial Organization, 57(1), 131–143.

Carlton, D. W. (2010). Revising the horizontal merger guidelines. Journal of Competition Law and Economics, 6(3), 619–652.

Carlton, D. W., & Israel, M. (2011). Proper treatment of buyer power in merger review. Review of Industrial Organization, 39(1–2), 127.

Carlton, D. W. & Israel, M. A. (2020). An evaluation of the impact of the 2010 horizontal merger guidelines. Corporate Governance Practice Series eJournal.

Dobson, P. W., & Waterson, M. (1997). Countervailing power and consumer prices. The Economic Journal, 107(441), 418–430.

Duso, T., & Szücs, F. (2017). Market power and peterogeneous pass-through in German electricity retail. European Economic Review, 98, 354–372.

Fabra, N., & Reguant, M. (2014). Pass-through of emissions costs in electricity markets. The American Economic Review, 104(9), 2872–2899.

Farrell, J., & Shapiro, C. (2010). Antitrust evaluation of horizontal mergers: An economic alternative to market definition. The BE Journal of Theoretical Economics, 10(1), 0000102202193517041563.

Galbraith, J. K. (1952). American Capitalism: The Concept of Countervailing Power. Boston, MA: Houghton Mifflin.

Gaudin, G. (2018). Vertical bargaining and retail competition: What drives countervailing power? The Economic Journal, 128(614), 2380–2413.

Genakos, C., & Pagliero, M. (2022). Competition and pass-through: Evidence from isolated markets. American Economic Journal: Applied Economics, 14(4), 35–57.

Hausman, J., Moresi, S., & Rainey, M. (2011). Unilateral effects of mergers with general linear demand. Economics Letters, 111(2), 119–121.

Hong, G. H., & Li, N. (2017). Market structure and cost pass-through in retail. Review of Economics and Statistics, 99(1), 151–166.

Inderst, R., & Shaffer, G. (2019). Managing channel profits when retailers have profitable outside options. Management Science, 65(2), 642–659.

Jaffe, S., & Weyl, E. G. (2013). The first-order approach to merger analysis. American Economic Journal: Microeconomics, 5(4), 188–218.

Lommerud, K. E., Straume, O. R., & Sørgard, L. (2005). Downstream merger with upstream market power. European Economic Review, 49(3), 717–743.

Mathiesen, L., Nilsen, Ø. A., & Sørgard, L. (2012). A note on upward pricing pressure: The possibility of false positives. Journal of Competition Law and Economics, 8(4), 881–887.

Motta, M. (2004). Competition policy: theory and practice. Cambridge: Cambridge University Press.

Oldale, A., & Padilla, J. (2013). EU merger assessment of upward pricing pressure: Making sense of UPP, GUPPI, and the like. Journal of European Competition Law & Practice, 4(4), 375–381.

RBB Economics. (2014). Cost pass-through: theory, measurement, and potential policy implications, Technical report, A Report prepared for the Office of Fair Trading.

Shapiro, C. (1995). Mergers with differentiated products. Antitrust, 10, 23.

Shinkoda, M., Braga, M. & Fully, V. (2020). Upward pricing pressure in oligopoly with competitive fringe. SSRN Electronic Journal.

Shubik, M., & Levitan, R. (2013). Market structure and behavior. Cambridge: Harvard University Press.

US Department of Justice & the Federal Trade Commission (2010), Horizontal merger guidelines, Technical report, US Department of Justice and the Federal Trade Commission.

Valletti, T., & Zenger, H. (2021). Mergers with differentiated products: Where do we stand? Review of Industrial Organization, 58(1), 179–212.

Von Ungern-Sternberg, T. (1996). Countervailing power revisited. International Journal of Industrial Organization, 14(4), 507–519.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

S. Shekhar: This work was supported by Compass Lexecon’s research funding. The views expressed here are the sole responsibility of the authors and cannot be attributed to Compass Lexecon or any other parties. Thanks to Neil Dryden, Mark Israel, Jorge Padilla and Segye Shin for helpful comments. We also thank the editor for giving very detailed and valuable comments.

Appendix: Linear Demand Specification with Two-part Tariffs

Appendix: Linear Demand Specification with Two-part Tariffs

We employ the Shubik and Levitan (2013) demand specification to show our results. We focus on a simple setting with three downstream firms—that are denoted by 1, 2, and 3—that are supplied by an upstream firm that is denoted as U.

The associated direct demand functions are given as follows:

The downstream firms set prices to maximize their profits which are given as

There is a supplier, with zero marginal costs,Footnote 10 that sets contracts so as to maximize its profits given as

Following the discussion in the main text, we consider the pre-merger and then the post-merger regime when the retailers set contracts.

1.1 Monopolist Supplier

1.1.1 Pre-merger

Taking first order conditions and solving simultaneously, we find that pre-merger prices as a function of linear wholesale contracts are

The monopolist supplier sets two-part tariffs to maximize profits. The fixed fee is set so as to just satisfy the participation constraint of each downstream firm. Linear wholesale prices are given by

Denote the vector of equilibrium linear wholesale prices by \(\mathbf {w^{*}}\). The pre-merger consumer prices are then

This is also the price that maximizes industry profits.

1.1.2 Post-merger

Suppose firms 1 and 2 merge. They set prices so as to maximize their joint profit given as

Taking first order conditions with respect to prices and solving simultaneously, we get the post-merger prices as a function of linear wholesale contracts:

The supplier sets two-part tariffs so as to maximize profits.Footnote 11 Linear wholesale prices are given by

Denote the vector of equilibrium linear wholesale prices by \(\mathbf {w^{M*}}\). Observe that the prices that are set to the affiliates of the merged entity decrease post-merger, while the linear wholesale price charged to the outside firm is the same as before. At first glance, it might seem that increased monopsony power by the merging firms, post-merger, has decreased the linear wholesale price that is offered to the downstream merged firm. But the model assumes that the downstream firms are price-takers with respect to their inputs. In the following, we show that the decrease in wholesale prices arises from a more nuanced rationale.

Substituting these wholesale prices into the formula for retail prices, the post-merger consumer prices are

Pre-merger and post-merger prices are therefore identical. The monopoly supplier, with market power, is able to set linear wholesale prices to downstream firms so as to ensure that the industry profit-maximizing prices are set by the retailers.Footnote 12 Because the fixed fee is set to extract all of the industry rents, the merger does not affect either retailer profits or consumer surplus.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Perkins, J., Shekhar, S. Horizontal Mergers and Supplier Power. Rev Ind Organ 64, 533–548 (2024). https://doi.org/10.1007/s11151-024-09947-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-024-09947-z