Abstract

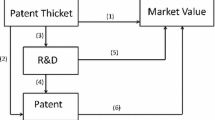

Firms use patents for blocking competitors’ innovation activities. Offensive blocking is a practice whereby firms patent alternatives of a focal invention preempting technological substitutes produced by competitors. Defensive blocking entails the creation of patent portfolios that block technologies in order to increase competitors’ willingness to trade patents. This paper examines the private value of both patent blocking strategies with the use of a novel measure of the offensive and defensive “blocking power” of patent portfolios. We show that both strategies increase firms’ market value. In discrete (complex) product industries, however, only offensive (defensive) patent blocking is associated with higher value.

Similar content being viewed by others

Notes

The prior art consists of all information (including patents) that is publicly available prior to the date that a patent is filed and that is relevant for a patent examiner to assess the novelty and inventiveness (and hence the patentability) of the patent filing. Infringing prior art documents contain claims that prejudice the novelty or inventiveness of claims of the patent filing.

Note that the blocking power of patents is never perfect in the sense that no patent on related technologies (and hence no one that cites the earlier patent) is granted in the near future. This is because patent applications change during the application process, so that applicants can narrow the scope of the invention for which they seek protection in case blocking prior art is found. This explains why patent applications that infringe on prior patents can still be granted, but in a modified version.

Claims are the building blocks of inventions that seek patent protection. Covering individual parts of the invention they define the scope and the boundaries of the patent.

Ceccagnoli (2009) relies on data from the Carnegie Mellon survey—which was also used by Cohen et al. (2000)—to construct an indicator of offensive patent blocking. The offensive patent blocking variable takes a value of one if a firm indicated in the survey that the blocking of rivals and not licensing nor cross-licensing were reasons to file for their most recent product or process patent. .

In constructing the citation-weighted patent stock, we used an ‘additive’ or ‘linear’ approach whereby each citation is considered to be worth as much as each patent. This choice is based on the work of Trajtenberg (1990), who found that a linear weighting of patents by the number of forward patent citations provides a good approximation of the underlying economic value of patents.

These documents may have been suggested by the applicant at the time of the patent filing, or the examiner might have found additional pieces of prior art and added these to the patent dossier under scrutiny. Other than at the USPTO the applicant of a patent at EPO does not have to report relevant prior art in the patent filing. In consequence, about 90 percent of all patent citations in EPO patents are added by the patent examiner (Criscuolo and Verspagen 2008).

Note that a patent can still be granted if it receives blocking citations to prior art, although this is less likely. This can, for instance, be the case for patent filings with many claims. Blocking citations pertain to individual claims, and the remaining claims can be strong enough to support the granting of a modified (although reduced in scope) patent. In our data, we see blocking references to prior art in the initial patent filing.

Blocking citations include the citation categories “X” and “Y” of the European search reports.

The European firms are located in Belgium, Switzerland, Denmark, Finland, France, Germany, the Netherlands, Sweden, and the United Kingdom.

An invention can be applied for at multiple national patent offices, in which case each patent office assigns a different patent number to the same invention.

Since we have complete annual listings of patent filings of the sample firms since 1978 (the foundation year of EPO), the initial value for PAT is set to zero.

We use only patent applications that have been granted at the EPO while using their application date as the relevant date for the match. Although patent applications enter the pool of prior art and may hence constitute conflicting prior art for future patent applications, they do not grant the right to exclude third parties from using the invention—which is the intention of blocking patent strategies. We rely on the EPO grant decision because: (1) the grant rate at the USPTO is relatively high, which leads to a large number of low-quality granted patents (Carley et al. 2013); and (2) patent applications at the JPO cover fewer claims than do patents at the EPO and at the USPTO (Van Pottelsberghe de la Potterie 2011).

Forward citations (blocking and non-blocking) are derived from the OECD/EPO Patent Citation Database and include citations to patent applications at the EPO and the WIPO. By constructing citation counts on patent applications, we get a more complete picture of the blocking potential of patents. Patent equivalents at national patent offices are taken into account in the calculation of citations in order not to underestimate the number of forward patent citations (see Harhoff et al. 2005; Webb et al. 2005).

The fence consists of five patent families that are listed in the U.S. Food and Drug Administration (FDA) “Orange Book”. The FDA Orange Book identifies drug products, and their patents, that are approved with regards to the safety and effectiveness standards of the FDA.

We thank Franz Schwiebacher for providing this measure.

E.g. if a firm patented only in technology class 1 in the past, the weights are (1, 0, 0, 0, …, 0). If a firm patented equally much in technology classes 1 and 2, the weights are (0.5, 0.5, 0, 0, …, 0).

The reader might wonder whether the coefficients for the control variables differ as well for complex and discrete product industries. We ran a regression that estimates different coefficients for firms in discrete and complex industries. A test on the null hypothesis of jointly equal coefficients for product and complex product industries is not rejected at the 5% level.

Intel has the highest numbers of deals (193 times), followed by Motorola (114), Hewlett Packard (94), Alcatel (78), Texas Instruments (63), Fuji Electric (38), Toshiba (33) and National Semiconductor (31). All these firms operate in complex product industries, where cross-licensing is a frequent strategy. A significant number of firms (87 of 151 firms), which are active in both discrete and complex product industries, have no cross-licensing agreements in the sample period 1995–2000.

References

Alcacer, J., & Gittelman, M. (2006). Patent citations as a measure of knowledge flows: The influence of examiner citations. Review of Economics and Statistics,88(4), 774–779.

Arora, A. (1997). Patents licensing and market structure in the chemical industry. Research Policy,26, 391–403.

Arundel, A., & Kabla, I. (1998). What percentage of innovations are patented? Empirical estimates from European firms. Research Policy,27, 127–141.

Arundel, A., van de Paal, G., & Soete, L. (1995). Innovation strategies of Europe’s largest industrial firms. Maastricht: MERIT.

Belderbos, R., Cassiman, B., Faems, D., Leten, B., & Van Looy, B. (2014). Co-ownership of intellectual property: Exploring the value-appropriation and value-creation implications of co-patenting with different partners. Research Policy,43, 841–852.

Blind, K., Edler, J., Frietsch, R., & Schmoch, U. (2006). Motives to patent: Empirical evidence from Germany. Research Policy,35, 655–672.

Bloom, N., & Van Reenen, J. (2002). Patents, real options and firm performance. Economic Journal,112(3), 97–116.

Blundell, R., Griffith, R., & van Reenen, J. (1995). Dynamic count data models of technological innovation. Economic Journal,105, 333–345.

Blundell, R., Griffith, R., & Van Reenen, J. (1999). Market share, market value and innovation in a panel of British manufacturing firms. Review of Economic Studies,66, 529–554.

Carley, M., Hegde, D. & Marco, A. (2013). What is the probability of receiving a US patent? USPTO economic working paper No. 2013-2.

Ceccagnoli, M. (2009). Appropriability, preemption and firm performance. Strategic Management Journal,30(1), 81–98.

Cohen, W., Goto, A., Nagata, N., Nelson, R., & Walsh, J. (2002). R&D spillovers, patents and the incentives to innovate in Japan and the United States. Research Policy,31, 1349–1367.

Cohen, W., Nelson, R. & Walsh, J. (2000). Protecting their intellectual assets: Appropriability conditions and why U.S manufacturing firms patent (or not). NBER working paper 7552.

Criscuolo, P., & Verspagen, B. (2008). Does it matter where patent citations come from? Inventor vs. examiner citations in European patents. Research Policy,37, 1892–1908.

Czarnitzki, D., Hall, B. H., & Oriani, R. (2006). The market valuation of knowledge assets in US and European firms. In D. Bosworth & E. Webster (Eds.), The management of intellectual property (pp. 111–131). Cheltenham: Cheltenham Glos.

Czarnitzki, D., Hussinger, K., & Schneider, C. (2009). Why challenge the ivory tower? New evidence on the basicness of academic patents. Kyklos,62, 488–499.

Della Malva, A., & Hussinger, K. (2012). Corporate science in the patent system: An analysis of the semiconductor technology. Journal of Economic Behavior & Organization,84, 118–135.

Deng, Y. (2007). Private value of European patents. European Economic Review,51, 1785–1812.

Dernis, H. & Khan, M. (2004). Triadic patent families methodology. OECD Science, Technology and Industry working papers 2004/2, OECD Publishing.

Duguet, E., & Kabla, I. (1998). Appropriation strategy and the motivations to use the patent system: An Eeconometric analysis at the firm level in French manufacturing. Annals of Economics and Statistics,49(50), 289–327.

Gambardella, A., Harhoff, D., & Verspagen, B. (2008). The value of European patents. European Management Review,5, 69–84.

Gilbert, R., & Newberry, D. (1982). Preemptive patenting and the persistency of monopoly. American Economic Review,72(3), 514–526.

Giuri, P., Mariani, M., Brusoni, S., Crespi, G., Francoz, G., Gambardella, A., et al. (2007). Inventors and invention processes in Europe: Results from the PatVal-EU survey. Research Policy,36, 107–1127.

Graham, S. J. H., Merges, R. P., Samuelson, P., & Sichelman, T. (2009). High technology entrepreneurs and the patent system: Results of the 2008 Berkeley patent survey. Berkeley Technology Law Journal,24(4), 1255–1328.

Granstrand, O. (1999). The economics and management of intellectual property. Cheltemham UK: Edward Elgar.

Griliches, Z. (1981). Market value, R&D and patents. Economics Letters,7, 183–187.

Griliches, Z., & Mairesse, J. (1984). Productivity and R&D at the firm level. In Z. Griliches (Ed.), R&D, Patents and Productivity: 339–74. Chicago: University of Chicago Press.

Grimpe, C., & Hussinger, K. (2008). Pre-empting technology competition through firm acquisitions. Economics Letters,100, 189–191.

Grimpe, C., & Hussinger, K. (2014a). Resource complementarity and value capture in firm acquisitions: The role of intellectual property rights. Strategic Management Journal,35(12), 1762–1780.

Grimpe, C., & Hussinger, K. (2014b). Pre-empted patents, infringed patents, and firms’ participation in markets for technology. Research Policy,43, 543–554.

Grindley, P., & Teece, D. (1997). Managing intellectual capital: Licensing and cross-licensing in semiconductors and electronics. California Management Review,39(2), 8–41.

Guellec, D., Martinez, C., & Zuniga, M. P. (2012). Pre-emptive patenting: Securing market exclusion and freedom to operate. Economics of Innovation and New Technology,21(1), 1–29.

Guellec, D., & van Pottelsberghe de la Potterie, B. (2008). The economics of the European patent system. Oxford: Oxford University Press.

Hall, B. H. (2000). Innovation and market value. In R. Barrell, G. Mason, & M. O’Mahoney (Eds.), Productivity, innovation and economic performance. Cambridge: Cambridge University Press.

Hall, B. H., Jaffe, A. B., & Trajtenberg, M. (2005). Market value and patent citations. Rand Journal of Economics,36, 16–38.

Hall, B. H., & Oriani, R. (2006). Does the market value R&D investment by European firms? Evidence from a panel of manufacturing firms in France, Germany, and Italy. International Journal of Industrial Organization,5, 971–993.

Hall, B.H., Thoma, G. & Torrisi, S. (2007). The market value of patents and R&D: Evidence from European firms. NBER working paper 13426, Cambridge, MA.

Hall, B. H., & Ziedonis, R. H. (2001). The determinants of patenting in the U.S. semiconductor industry, 1980–1994. RAND Journal of Economics,32, 101–128.

Harhoff, D., Hoisl, K. & Webb, C. (2005). European patent citations: How to count and how to interpret them. Mimeo, Munich.

Harhoff, D., Narin, F., Scherer, F. M., & Vopel, K. (1999). Citation frequency and the value of patented innovation. Review of Economics and Statistics,81(3), 511–515.

Harhoff, D., & Reitzig, M. (2004). Determinants of opposition against EPO patent grants—The case of biotechnology and pharmaceuticals. International Journal of Industrial Organization,22, 443–480.

Hounshell, D. A., & Smith, J. K. (1988). Science and corporate strategy. Cambridge: Cambridge University Press.

Leten, B., Belderbos, R., & Van Looy, B. (2007). Technological diversification, coherence and performance of firms. Journal of Product Innovation Management,24, 567–579.

Levin, R., Klevorick, A., Nelson, R., & Winter, S. (1987). Appropriating the returns from industrial research and development. Brookings Papers on Economic Activity,3, 783–831.

Martin, J. D., & Sayrak, A. (2003). Corporate diversification and shareholder value: A survey of recent literature. Journal of Corporate Finance,9, 37–57.

Motohashi, K. (2008). Licensing or not licensing? An empirical analysis of the strategic use of patents by Japanese firms. Research Policy, 37(9), 1548–1555.

Paik, Y. & Zhu, F. (2013). The impact of patent wars on firm strategy: Evidence from the global smartphone market. HBS working paper 14-015. Harvard Business School.

Pakes, A. (1985). On patents, R&D, and the stock market rate of return. Journal of Political Economy,93(21), 390–408.

Reitzig, M. (2003). What determines patent value? Insights from the semiconductor industry. Research Policy,32, 13–26.

Reitzig, M. (2004). The private values of ‘thickets’ and ‘fences’: Towards an updated picture of the use of patents across industries. Economics of Innovation and New Technology,13(5), 457–476.

Schmoch, U. (2008). Concept of a technology classification for country comparison. Final Report to the World Intellectual Property Rights Orgainzation (WIPO), Fraunhofer Institute for Systems and Innovation Research, Karlsruhe, Germany.

Schneider, C. (2008). Fences and competition in patent races. International Journal of Industrial Organization,26, 1348–1364.

Scotchmer, S. (1991). Standing of the shoulders of giants: Cumulative research and the patent law. The Journal of Economic Perspectives,5(1), 29–42.

Shapiro, C. (2001). Navigating the patent thicket: Cross licenses, patent pools, and standard-setting. Innovation Policy and the Economy,1, 1–31.

Sternitzke, C. (2013). An exploratory analysis of patent fencing in pharmaceuticals: The case of PDE5 inhibitors. Research Policy,42, 542–551.

Teece, D. (1986). Profiting from technological innovation: Implications for integration, collaboration, licensing and public policy. Research Policy,15, 285–305.

Toivanen, O., Stoneman, P., & Bosworth, D. (2002). Innovation and market value of UK firms, 1989–1995. Oxford Bulletin of Economics and Statistics,64, 39–61.

Trajtenberg, M. (1990). A penny for your quotes: Patent citations and the value of innovations. RAND Journal of Economics,21(1), 172–187.

Van Pottelsberghe de la Potterie, B. (2011). The quality factor in patent systems. Industrial and Corporate Change,20(6), 1755–1793.

Van Pottelsberghe de la Potterie, B. & Francois, D. (2006). The cost factor in the patent systems. CEB working paper No. 06/002, Solvay Business School, Brussels.

Von Graevenitz, G., Wagner, S., & Harhoff, D. (2011). How to measure patent thickets—A novel approach. Economics Letters,111, 6–9.

Webb C., Dernis, H., Harhoff, D. & Hoisl, K. (2005). Analyzing European and international patent citations: A set of EPO database building blocks. STI working paper 2005/9, OECD.

Ziedonis, R. H. (2004). Don’t fence me in: Fragmented markets for technology and the patent acquisition strategies of firms. Management Science,50(6), 804–820.

Acknowledgements

We thank Rene Belderbos, Paul Jensen, Leo Sleuwaegen, and Lawrence White, as well as two anonymous reviewers for helpful comments. This paper was presented at the Pacific RIM Conference in Melbourne, the EARIE Conference in Istanbul, and the Patent Statistics Conferences in Vienna and Leuven. We thank the participants for helpful comments and discussions.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Czarnitzki, D., Hussinger, K. & Leten, B. How Valuable are Patent Blocking Strategies?. Rev Ind Organ 56, 409–434 (2020). https://doi.org/10.1007/s11151-019-09710-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-019-09710-9