Abstract

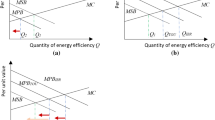

This article empirically compares four electricity-pricing programs—increasing-block pricing (IBP); floating increasing-block pricing (FIBP); free market pricing (FMP); and a price-cum-trade incentive system (PTS)—in terms of efficiency, cost recovery, and income distribution by using the residential electricity data of Taiwan. The research results show that IBP and FIBP suffer from the same problem: It is hard to be cost-neutral. Further, FMP is economically efficient while favoring the electric utility over the households. PTS—which is a pricing program that satisfies the second fundamental theorem of welfare economics—shows a better ability to consider economic efficiency and equity simultaneously.

Similar content being viewed by others

Notes

In Taiwan, the relative shares of electricity consumption for the residential, commercial, industrial, and other sectors (including the energy sector own use, transportation, and the agricultural sector) are around 18%, 19%, 53%, and 10%, respectively. For the reader’s reference, the figures for the average residential electricity price in U.S. cents per kWh and electricity consumption in terms of kWh per capita in 2014 for Taiwan and some selected jurisdictions are respectively displayed as follows: Taiwan (9.38, 10,791), Mexico (9.01, 2090), South Korea (13.51, 10,497), the U.S. (12.52, 12,984), the U.K. (25.34, 5130), Japan (25.33, 7820), and Germany (39.51, 7035). It can be seen that the residential electricity price in Taiwan is relatively low and the electricity consumption per capita is relatively high in comparison with these selected countries. Except for Taiwan, all data on the average residential electricity price are retrieved from IEA (2018Q1) Energy Prices and Taxes. The average residential electricity prices for Taiwan are collected from the Energy Statistics Handbook (Taiwan), 2016 (p. 148) and are converted from NTD to U.S. cents at the exchange rate of 30.37 NTD: 1USD. The data on electricity consumption were retrieved on July 10, 2018, from the website of World Bank: https://data.worldbank.org/indicator/EG.USE.ELEC.KH.PC and of Taiwan’s Bureau of Energy: https://www.moeaboe.gov.tw/wesnq/Views/D01/wFrmD0101.aspx.

The hourly electricity prices are based on the Residual ComEd Zone PJM wholesale market prices. For the details of this hourly pricing program, please see https://hourlypricing.comed.com/. Note that these real-time pricing programs are opt-in style programs at present.

A minimum quantity of electricity per capita for basic life support, \( \underline{q} \) (specified by the government), cannot be traded.

When the electricity demand is low (e.g., on holidays), while the electricity generation is high and inflexible (e.g., lots of wind and solar give rise to a high renewable electricity supply and conventional power plants are not sufficiently flexible to change output), the wholesale electricity price might be low or even negative. In the case where \( P^{*} < P_{AC} \), a user just needs to pay the utility for his actual electricity consumption at the price \( P_{AC} \) under PTS.

IBP sets a lower price for the first block of electricity consumption to take care of the poor. This benefit however leaks to rich households because they can enjoy this low-price electricity quantity as well. Conversely, a poor household with a large family size may face a higher electricity price because more family members use more electricity.

We would like to thank a referee who reminded us that the identification of family size is an important practical issue. If it is defined by the resident population, it means that the electricity utility needs regularly to conduct a census to confirm the family size. This will result in substantial transaction costs. If it is defined by the registered population, but some family members have been away for a long time, then the family will obtain more rights than the actual rights that they are supposed to have. A weighted consideration of both registered population and the actual historical electricity consumption of a household might be an enforceable and lower-cost way that could be used to decide the allocation.

The marginal cost of electricity generation varies substantially over time. In order to meet peak loads—which usually account for only a few hundred hours a year—expensive generating plants have to be installed. Thus, a pricing program that allows the electricity price to vary with cost over time can shift and reduce loads, eliminate cross subsidies, and increase economic efficiency. Time-of-use (TOU) pricing and real-time pricing (RTP) programs are both designed to vary price with cost over time. TOU pricing is static, which fixes the price and time periods in advance, while RTP is dynamic. The simplest TOU pricing involves just two seasons, such as the above-mentioned summer and non-summer periods. With the popularity of smart meters, TOU pricing can be more complex to involve peak and off-peak periods within a day: time-of-day pricing. Among the four pricing programs that are compared in this article, IBP and FIBP can be employed for a time-of-day pricing program, while FMP and PTS can be real-time. In terms of reflecting variations in costs over time, FMP and PTS function better than IBP and FIBP.

In Taiwan, a formula for calculating the average electricity price—which divides the sum of the costs of electricity and a reasonable profit for the public utility by the quantity of electricity sold—is promulgated and regularly reviewed by the government. The costs of electricity include: the costs of power generation; the costs of ancillary service, transmission, and distribution; as well as the costs of miscellaneous fees. This average price is then adjusted to serve as an IBP rate structure that tries to take care of the multiple purposes of electricity management.

Most developed country markets have fuel adjustment clauses as part of their retail rates.

The 2013 results can be obtained from the authors upon request.

The period of summer months—which includes June, July, August, and September—is the peak period for electricity consumption because the temperature in these months is generally higher. The other months are categorized as non-summer months. In 2007, the rate structures for the residential sector were as follows: (1) the summer rates (NT$/kWh, monthly) were 2.1, 2.73, 3.64, and 3.74 for electricity consumption blocks of 1–110, 111–330, 331–500, and 501+ kWhs, respectively; (2) the non-summer rates were 2.1, 2.415, and 2.9 for electricity consumption blocks of 1–110, 111–330, and 331+ kWh, respectively.

Because the derivations of the demand function [Eq. (1)] and its corresponding parameters (such as the subsistence consumption level as well as the price and income elasticities) have been shown in detail in the literature (see e.g., Gaudin et al. 2001; Martínez-Espiñeira and Nauges 2004; Dharmaratna and Harris 2012; and Hung and Chie 2013), we do not give derivation details to simplify the presentation and avoid duplication. In addition, we use the household average price to represent p. The reason we do not consider marginal price is that the rate structure applied in Taiwan is very complicated and it is too expensive for households to monitor the real-time marginal price in reality (Ito 2014).

It should be noted that because the household average price is endogenous under IBP, the estimate of elasticities might be biased. In this article, we directly take the estimation bias into consideration by varying the estimates of price elasticity to examine the robustness of our comparison results. There are other studies that have estimated Taiwan’s residential electricity demand function. For example, Holtedahl and Joutz (2004) used national, annual time-series data for the period 1955–1995 and a Vector Autoregressive Regression (VAR) system in their estimation. The estimated short-run and long-run price elasticities were − 0.15 and − 0.16, respectively. Hung and Huang (2015) employed a monthly, county-level panel data set during the period 2007–2013 and a pooled mean group (PMG) estimator for their estimates. The estimated short-run and long-run price elasticities for the summer (non-summer) period were − 0.451 and − 1.13 (− 0.819 and − 1.27), respectively. The reasons for the different magnitudes of estimated price elasticities are mainly due to the different degree of variation in electricity prices for different data sets, different weather conditions in different periods, model specifications, and/or estimation methods among articles. Since the estimated price elasticities in this article are very small, we have also used the two largest above-mentioned estimates (− 1.13 and − 1.27 for summer and non-summer periods, respectively) to examine the robustness. We find that the results are consistent in spite of the different price elasticities.

These figures are obtained by the calculation: \( ({\text{TQ}} - Q^{*} ) \)/total household number. In the summer period, it is (7,180,539 − 7,040,911)/13,741; non-summer period (5,372,284 − 5,291,083)/13,741.

The difference in SW between FMP and IBP is approximately 5 (= (114,516,456 − 114,452,247)/13,741) NT$/month per household in the summer period and 2 (= (87,762,355 − 87,741,427)/13,741) NT$/month per household in the non-summer period. In addition, it should be noted that the higher SW is attained by a smaller amount of total electricity consumption (\( Q^{*} < {\text{TQ}} \)).

Increasing the cap of the first low-price block from 110 to 120 kWh and the cross-subsidy measure discussed later are policy measures that have been applied in Taiwan.

We do not mention the results for FMP and PTS because the results for them are similar to those in the previous scenarios.

It should be mentioned that, in the simulation, we assume that the highest marginal cost is equal to the highest-tier price under IBP. It could be inferred that the loss will be bigger if the marginal cost further increases as the quantity increases.

References

Alexander, B. R. (2013). An analysis of retail electric and natural gas competition: Recent developments and policy implications for low income customers. Retrieved February 12, 2019, from http://azpowerconsumers.com/uploads/sites/63/An_Analysis_of_Retail_Electric_and_Natural_Gas_Competition.pdf.

Barde, J. A., & Lehmann, P. (2014). Distributional effects of water tariff reforms: An empirical study for Lima, Peru. Water Resources and Economics,6, 30–57.

Boland, J. J., & Whittington, D. (2000). The political economy of water tariff design in developing countries: Increasing block tariffs versus uniform price with rebate. In A. Dinar (Ed.), The political economy of water pricing reform (pp. 215–235). New York: Oxford University Press.

Borenstein, S. (2005). Time-varying retail electricity prices: Theory and practice. In J. M. Griffin & S. L. Puller (Eds.), Electricity deregulation: Choices and challenges (pp. 317–357). Chicago: University of Chicago Press.

Borenstein, S. (2011). Regional and income distribution effects of alternative retail electricity tariffs. Retrieved February 11, 2019, from Energy Institute at Haas WP225. https://ei.haas.berkeley.edu/research/papers/WP225.pdf.

Borenstein, S. (2012). The redistributional impact of nonlinear electricity pricing. American Economic Journal: Economic Policy,4(3), 56–90.

Castro-Rodríguez, F., Da-Rocha, J. M., & Delicado, P. (2002). Desperately seeking θ’s: Estimating the distribution of consumers under increasing block rates. Journal of Regulatory Economics,22(1), 29–58.

Dharmaratna, D., & Harris, E. (2012). Estimating residential water demand using the Stone-Geary functional form: The case of Sri Lanka. Water Resources Management,26(8), 2283–2299.

Dixon, R. K., McGowan, E., Onysko, G., & Scheer, R. M. (2010). US energy conservation and efficiency policies: Challenges and opportunities. Energy Policy,38(11), 6398–6408.

García-Valiñas, M. A. (2005). Efficiency and equity in natural resources pricing: A proposal for urban water distribution service. Environmental and Resource Economics,32(2), 183–204.

Gaudin, S. G., Griffin, R. C., & Sickles, R. C. (2001). Demand specification for municipal water management: Evaluation of the Stone–Geary form. Land Economics,77(3), 399–422.

Hanemann, W. M. (1998). Price and rate structures. In D. D. Baumann, J. J. Boland, & W. M. Hanemann (Eds.), Urban water demand management and planning (pp. 137–179). New York: McGraw-Hill.

Holtedahl, P., & Joutz, F. L. (2004). Residential electricity demand in Taiwan. Energy Economics,26(2), 201–224.

Hung, M. F., & Chie, B. T. (2013). Residential water use: Efficiency, affordability and price elasticity. Water Resources Management,27(1), 275–291.

Hung, M. F., & Huang, T. H. (2015). Dynamic demand for residential electricity in Taiwan under seasonality and increasing-block pricing. Energy Economics,48, 168–177.

Ito, K. (2014). Do consumers respond to marginal or average price? Evidence from nonlinear electricity pricing. American Economic Review,104(2), 537–563.

Khanna, N. Z., Guo, J., & Zheng, X. (2016). Effects of demand side management on Chinese household electricity consumption: Empirical findings from Chinese household survey. Energy Policy,95, 113–125.

Lin, B., & Jiang, Z. (2012). Designation and influence of household increasing block electricity tariffs in China. Energy Policy,42, 164–173.

Martínez-Espiñeira, R., & Nauges, C. (2004). Is all domestic water consumption sensitive to price control? Applied Economics,36(15), 1697–1703.

Morey, M. J., & Kirsch, L. D. (2016). Retail choice in electricity: What have we learned in 20 years. Retrieved February 11, 2019, from Washington, DC: Christensen Associates Energy Consulting LLC for Electric Markets Research Foundation. http://www.emrf.net/index.html.

Schoengold, K., & Zilberman, D. (2014). The economics of tiered pricing and cost functions: Are equity, cost recovery, and economic efficiency compatible goals? Water Resources and Economics,7, 1–18.

Sun, C., & Lin, B. (2013). Reforming residential electricity tariff in China: Block tariffs pricing approach. Energy Policy,60, 741–752.

Wodon, Q., Ajwad, M. I., & Siaens, C. (2003). Lifeline or means-testing? Electric utility subsidies in Honduras. In P. J. Brook & T. C. Irwin (Eds.), Infrastructure for poor people: Public policy for private provision (pp. 277–296). Washington, DC: World Bank Institute.

Zivin, J. G., & Novan, K. (2016). Upgrading efficiency and behavior: Electricity savings from residential weatherization programs. The Energy Journal,37(4), 1–23. https://doi.org/10.5547/01956574.37.4.jziv.

Acknowledgements

The authors are grateful to Editor Lawrence White and two anonymous referees for their constructive comments, which have significantly improved this article. We also thank Professor H. C. Huang for his helpful suggestions.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Hung, MF., Chie, BT. & Liao, HC. A Comparison of Electricity-Pricing Programs: Economic Efficiency, Cost Recovery, and Income Distribution. Rev Ind Organ 56, 143–163 (2020). https://doi.org/10.1007/s11151-019-09696-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11151-019-09696-4