Abstract

This paper analyzes the determinants of health insurance enrollment and health expenditure in Ghana using micro data from wave 7 of the Ghana Living Standards Survey (GLSS 7) with emphasis on the role of risk preferences and the availability of health facilities in one’s own community. It is possible to analyze the determinants of health insurance enrollment in Ghana because its public health insurance system (the National Health Insurance Scheme or NHIS) is, in theory, mandatory, but is, in actual practice, voluntary, with only about 40% of the population enrolled in the scheme. Our empirical findings show that risk preferences have a significant impact on health insurance enrollment, with risk averse individuals being significantly more likely than other households to enroll in health insurance. Moreover, our findings also show that very poor households are significantly more likely to enroll in health insurance than other households, perhaps because they are exempt from paying premiums for health insurance. Finally, our findings also show that the availability of health facilities in one’s own community significantly decreases expenditures on health care.

Highlights

-

Ghana’s National Health Insurance Scheme is, in principle, mandatory but only 40% of households are enrolled.

-

Ghana’s National Health Insurance Scheme is pro-poor, with higher enrollment rates for the very poor.

-

Risk-averse households are more likely to enroll in Ghana’s National Health Insurance Scheme than other households, as expected.

-

Enrollees in Ghana’s National Health Insurance Scheme do not have lower out-of-pocket health expenditures than other households.

-

Proximity to health facilities enables households in Ghana to reduce health expenditures.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Health and wellbeing are crucial global indicators of human development. Good health of a population implies better human capital, which is crucial for implementing the development agenda of any country. All else equal, healthy people are more productive as they do not have to stay away from work due to sickness and are less likely to underperform at work compared to sick individuals. To maintain good health, the population needs access to good health care services, which requires all countries, especially developing ones, to overcome several challenges from both demand and supply side perspectives. One of the crucial challenges related to improved health care services is health care financing. Like most normal goods, people demand more and better health care if they have the ability to pay for it. By implication, persons without adequate means would have difficulty accessing health care, leading to a proportion of the population without access to health care. To this end, household health expenditure is an important part of household expenditures as the level and quality of health care households can receive is intimately linked to how much they are willing and able to spend to access health care. Health insurance has emerged as a key method for relaxing health care financing constraints and for accelerating the attainment of universal health coverage (Duku 2018).

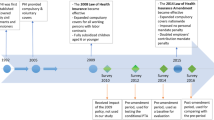

While some developed countries including Japan, Ireland, and Australia operate public, compulsory health insurance systems, other countries only have private health insurance providers while others run a voluntary public health insurance program. In the case of a voluntary public health insurance system, households decide whether or not to join the health insurance program. As explained in detail in the next section, private health insurance is almost non-existent in Ghana, and there was no public health insurance program in Ghana until 2004. The National Health Insurance Scheme (hereafter NHIS) was introduced in 2004, and in principle, it is mandatory, but it is, in actual practice, voluntary. According to wave 7 of the Ghana Living Standards Survey (GLSS 7), only 0.36% of respondents had ever been enrolled in a private health insurance program while 20% had never enrolled in any health insurance program (N = 58,563). The active enrollment rate of the NHIS stood at only 34% in 2010, 38% in 2013, and 41% in 2015 and dropped further to 35% in 2017.Footnote 1 These rates represent active enrollment rates rather than rates based on cumulative membership and therefore exclude persons who have dropped out of the scheme by failing to renew their membership. Nonetheless, these enrollment rates are extremely low for a scheme designed to facilitate universal health coverage and reduce health care inequalities. Furthermore, Kwarteng et al. (2020) noted that disparities exist in health insurance coverage with significantly lower proportions of poor and vulnerable groups enrolling in the scheme, a view supported by Dake (2018).

The low enrollment rates of Ghana’s public health insurance program and the disparity in enrollment rates by income class suggest that a comprehensive examination of the determinants of health insurance enrollment is needed in order to inform policymakers of the appropriate policy response to the low enrollment rates. In line with this, our first objective is to examine the determinants of health insurance enrollment with special focus on the role of behavioral factors in the case of a voluntary-type scheme such as Ghana’s NHIS. In this study, we focus in particular on the role of risk aversion in health insurance enrollment. Condliffe and Fiorentino (2014) affirm that risk preferences are an important behavioral factor in households’ health care choices. Despite this, risk preferences have been largely unaccounted for in studies on health insurance decision making in Ghana and in other countries. Since risk averse individuals do not like to take risks, we hypothesize that they should be more eager than non-risk averse individuals to enroll in health insurance to insure against the risk of falling ill and being denied health care due to not having the means to make out-of-pocket payments. Examining this issue is useful to the extent that many studies on the determinants of health insurance enrollment in Ghana have failed to consider the effect of risk preferences on households’ decision to enroll in the NHIS. There have been a number of studies that have sought to investigate the determinants of health insurance enrollment in Ghana, but none of these studies considered the effect of risk preferences on health insurance, focusing mainly on other socioeconomic variables, mostly income and education. In addition, most of these studies restricted their samples to specific sub-groups or sub-administrative levels, thus limiting the generalizability of their findings (see Nsiah-Boateng et al. 2019; Duku 2018; Agyepong et al. 2016, Amu and Dickson 2016; Fenny et al. 2016; Owusu-Sekyere and Chiraah 2014, among others) although a few studies such as Salari et al. (2019) and Amu et al. (2018) used nationwide data. Hence, our study makes an important contribution to the health insurance enrollment literature by investigating the role of risk preferences using nationwide data.

The second objective of this study is to investigate the factors that influence household health expenditure with particular focus on health insurance enrollment and the presence of health facilities in one’s community. Previous studies have looked at the association between health insurance enrollment and health care utilization in Ghana, but Blanchet et al. (2012) restrict their analysis to women in Accra, Ghana’s capital city, while Rajkotia and Frick (2011) restrict their analysis to the Nkoranza district, a sub-administrative jurisdiction in the Bono East Region of Ghana. Moreover, both studies examine the impact of health insurance on hospital visits and health care utilization. Our study differs from these studies by employing a nationally representative sample and attempting to shed light on the causal impact of health insurance and the presence of health facilities in one’s community on household health expenditure. We are not aware of any studies that measure the effect of the presence of health facilities on household health expenditure. By accounting for it, our study fills a serious gap in the literature and provides implications for policy regarding the spatial distribution of health infrastructure.

Thus, this paper makes significant original contributions to the literature on health insurance enrollment and the related literature on health care expenditures in at least the following ways. First, it is one of the first studies (other than Nghiem and Graves 2019) to take account of the simultaneity of the decision of whether or not to enroll in health insurance and the decision of how much health care services to consume, which it does by using risk preferences as an instrument for health insurance enrollment. Second, it is one of the first studies to analyze the impact of risk preferences on the demand for health insurance using direct information on risk preferences. Information on risk preferences is rarely available in household datasets from developing countries, thus making this contribution a bit more pronounced. There are already some studies such as Buchmueller et al. (2013) that have examined the impact of risk preferences on the demand for health insurance but they do not use direct information on risk preferences. Third, it is one of the first studies to analyze the impact of the availability of health facilities in one’s own community on the demand for health care services. Fourth, it is somewhat unusual in that it analyzes the determinants of the demand for public health insurance. This is not possible in most countries because public health insurance programs are usually mandatory, but it is possible in the case of Ghana because Ghana’s national health insurance program is, in principle, mandatory, but is, in actual practice, voluntary (previous studies for Ghana include Owusu-Sekyere and Chiraah 2014; Duku 2018; and Salari et al. 2019). Finally, together with Salari et al. (2019), it is one of the few studies that use a nationally representative dataset.

The remainder of this paper is structured as follows: Ghana’s public health insurance program provides a brief description of Ghana’s public health insurance program, Literature review surveys the relevant literature, Data and methodology explains the data and the methodologies adopted to analyze the data, Estimation results and discussion presents and discusses the findings of our empirical analysis, and Conclusions and policy implications concludes the study and provides policy implications for Ghana and other developing countries.

2 Ghana’s public health insurance program

In this section, we briefly describe the history of Ghana’s public health insurance system. Prior to the introduction of this public health insurance program, households in Ghana financed their health care mostly through user fees or out-of-pocket payments, and this system is popularly referred to locally as the “cash and carry” system. Under this health care financing approach, only relatively affluent households had access to health care, and poor households could not meet some or all of their health care needs even in times of serious illness.

In 2004, a public health insurance system called the National Health Insurance Scheme (NHIS) was rolled out in Ghana to phase out the “cash and carry” system and to provide a sustainable and inclusive means of financing health care in Ghana.Footnote 2 While the intention of the revised parliamentary act of the NHIS (Act 852, 2012) was to make enrollment in the scheme mandatory, in actual practice, the NHIS operates as a voluntary public health insurance system.

Those who enroll in the NHIS are required to pay a one-time registration fee of 20 Ghana cedis (about 3 US dollars at the current exchange rate) at the time of first enrollment as well as an annual premium of 30 Ghana cedis (about 5 US dollars). However, workers who are enrolled in the public pension fund (this comprises all formal sector workers and a very limited number of informal sector workers) do not have to pay the full premium or may not have to pay any premium at all because the health insurance program is funded partly by 2.5% of pension contributions.Footnote 3

Hence, only enrollees who are not enrolled in the public pension fund are required to pay the standard annual premium. Moreover, there are exemptions for households who are considered poor and vulnerable as well as for children under the age of 5 and the elderly over the age of 60. They pay either lower premiums or no premiums at all, depending on their circumstances.

The health insurance authority states that the NHIS covers 95% of common disease conditions. Expensive procedures such as cancer treatment or dialysis and the like are not covered. However, some people choose to make out-of-pocket payments even though they are enrolled in NHIS and even though their treatment is, in theory, covered under the scheme because they want to procure better and/or faster treatment or because they are required to pay for drugs that should, in theory, be covered by the scheme because they are told that “insurance drugs” are not available. Thus, in actual practice, NHIS enrollees often pay even for health services and drugs that are, in theory, covered by the scheme.

Moreover, unlike in advanced countries such as the United States, private health insurance provision is very limited in Ghana, as discussed in Introduction.

3 Literature review

3.1 Studies of the determinants of health insurance enrollment

Literature on the determinants of health insurance enrollment abounds. In Ghana, Salari et al. (2019) investigated the socio-economic determinants of health insurance enrollment and found that education, marital status, wealth, and to a limited extent, age had positive correlations with enrollment in Ghana’s National Health Insurance Scheme (NHIS). They also found that the type of employment had equally important associations with the probability of enrollment, with agricultural workers and unemployed persons being less likely to enroll compared with workers in other sectors. Some of the factors identified in this study confirmed earlier findings by Duku (2018), who investigated the determinants of health insurance enrollment in the Greater Accra and Western regions of Ghana. In addition to educational level, wealth, and marital status, Duku (2018) found that travel time to the health facility, age, and sex significantly influenced health insurance enrollment. Owusu-Sekyere and Chiaraah (2014) conducted a study in the Kumasi metropolis of Ghana on the factors influencing health insurance enrollment. Contrary to the earlier studies discussed, this study did not find age, sex, and marital status to be important determinants of enrollment. However, it found that years of schooling, income, employment status, and the cost of curative care were important predictors of enrollment.

In a further study on the NHIS in Ghana, Nsiah-Boateng et al. (2019) investigated the determinants of enrollment in, and dropout from, the health insurance scheme in the Ashiedu Keteke sub-metropolis of Ghana. The study found that indigents are more likely to enroll but also more likely to drop out of the scheme. On the contrary, the study found that informal sector workers as well as formal sector workers who are contributors to the national pension scheme are less likely to enroll but more likely to retain their membership in the health insurance scheme once enrolled. Fenny et al. (2016) conducted a study that examined the factors responsible for the low enrollment and low retention of status in Ghana’s NHIS. The study found that vulnerability as measured by being the poor, aged, disabled, mentally challenged, or migrant served as a social barrier to enrollment and that the absence of family support and social support, cultural and religious norms, poor infrastructure, especially in rural communities, and the NHIS’s own weak internal administrative systems were also partly responsible for hindering health insurance enrollment.

Other studies on the determinants of health insurance enrollment in Ghana confirm the factors identified in the review above as having correlations with health insurance (Amu et al. 2018; Amu and Dickson 2016; Agyepong et al. 2016). However, no study has yet been found that investigated the impact of household risk preferences on enrollment in health insurance. Given the voluntary nature of Ghana’s national health insurance program, an examination of this behavioral factor is crucial to understanding enrollment behavior and enhancing policy planning.

We now turn to a review of studies in jurisdictions other than Ghana where public health insurance might be compulsory, non-existent, or voluntary. Many of these studies explored the determinants of private health insurance purchase. Buchmueller et al. (2013) examined preference heterogeneity in private health insurance enrollment in Australia, a country in which there is a comprehensive universal public health insurance system. Among other things, the study found that those who have purchased other insurance products, i.e., risk averse people, are more likely to purchase private health insurance, and conversely, that those who smoke, i.e., less risk averse people, are less likely to purchase private health insurance. Thus, this study underscores the relevance of risk preferences in determining health insurance enrollment, especially in a voluntary health insurance program. These findings confirm those from an earlier study by Liu et al. (2011) on the impact of expanding public health insurance on private health insurance demand in rural China. This study found that risk averse households were more likely to purchase private health insurance for both adults and children. This was in addition to the main finding of the study—namely, that there were large positive effects of public health insurance expansion on private health insurance demand among higher income groups and communities with a history of health care financing. Similarly, Hopkins and Kidd (1996) found that less risk averse people were less likely to purchase private health insurance in Australia. Another study by Condliffe and Fiorentino (2014) confirms the findings from the above studies. They examined the impact of risk preferences, measured by engagement in risky behavior, on health insurance and health expenditures in the United States. They found that, relative to low risk preference individuals, high risk preference and moderate risk preference individuals were more likely to be uninsured. The study also found gender and educational levels to be significant predictors of health insurance enrollment.

However, the findings of these studies on the role of risk preferences contrast with the findings of Costa and Garcia (2003), who found no significant effects of attitudes toward risk on the demand for private health insurance in Catalonia, Spain. Their study found the demand for private health insurance to be driven mainly by the gaps in quality between public and private health care in addition to other socio-economic factors. This finding corroborates that of Jofre-Bonet (2000), also for Spain, who found that the quality of health care, proxied by waiting times, in the Spanish public health system, reduced the demand for private health insurance. On the contrary, Propper et al. (2001) found a negative effect of waiting lists on private health insurance purchase in the UK. Finn and Harmon (2006) examined the determinants of private health insurance enrollment in Ireland where, similar to the Australian case, there is a near robust public healthcare financing system in place, but the study did not examine the effect of risk preferences. Factors including income, education, and health status were found be significant determinants of whether or not to purchase private health insurance in Ireland.

3.2 Studies of the determinants of health expenditure and health care utilization

Our study also relates to the strand of literature that has examined the determinants of health expenditure and health care utilization. Jeon and Kwon (2013) examined the effect of private insurance on health care utilization and health expenditure in Korea, which has a universal public insurance system, and found that people with private health insurance have a higher probability of seeking outpatient care but not inpatient care. Liu and Zhao (2014) examined the impact of a voluntary health insurance program on health care utilization in urban China. Employing an instrumental variable approach, the study found that enrollment in the health insurance program significantly increased formal health care utilization for both inpatient and outpatient care in the case of children, low-income families, and residents in the poorer western region of China. However, no evidence was found that the program had reduced out-of-pocket health expenditure. Condliffe and Fiorentino (2014) found risk preferences to have a negative relationship with health expenditure in the United States—i.e., that high and moderate risk preference individuals spent significantly less on health care than low risk preference individuals—and that insured persons actually spend more on health care than uninsured individuals, contrary to expectation.

In Ghana, only a few studies exist, especially at the micro level, on the determinants of health expenditure or health care utilization. Blanchet et al. (2012) investigated the effect of Ghana’s NHIS on health care utilization using data on a sample of women in Accra. Using matching techniques, the study found that individuals who are enrolled in the NHIS were more likely to visit clinics, to seek formal health care, and to obtain prescriptions, indicating an increase in health care utilization. The results may not be easily generalizable due to the limited study area (Accra), which is more economically advantaged and better off in terms of health infrastructure and personnel. That notwithstanding, the findings confirm those of Rajkotia and Frick (2011) in the Nkoranza district of Ghana. This study attempted to test for the existence of adverse selection into the NHIS by examining how the observed payoffs to enrollment relate to household enrollment costs (where enrollment costs for a household were measured as the sum of premium payments by non-exempt members). They found that household enrollment costs are positively correlated with the odds and intensity of outpatient health care use by children. Owoo and Lambon-Quayefio (2013) found that women with NHIS use more prenatal services. Finally, Abrokwah et al. (2014) analyzed the impact of NHIS on fertility decisions while Abrokwah et al. (2016) analyzed the impact of NHIS on prenatal care use and both found significant effects.

At the macro level, Angko (2013) examined the determinants of public healthcare expenditure in Ghana using annual time series data. Per capita Gross Domestic Product (GDP), health status of the population, and the age structure of the population were found to be the major determinants of health expenditure in Ghana. A similar macro level study in 26 African countries by Okunade (2005) shows that, in addition to per capita GDP and the dependency ratio, overseas development assistance, the level of income inequality, internal conflicts, and the percentage of births attended by trained personnel were identified as determinants of public health expenditure in the countries included in their sample.

This review of the literature shows that, in the case of determinants of public health insurance enrollment, the role of risk aversion has been left largely unexamined, especially in Ghana where the public health insurance system is a voluntary one. Furthermore, studies on the effect of public health insurance enrollment on health expenditure are limited in Ghana and other countries that are unique in operating voluntary public insurance programs. Our study fills these gaps in the literature and provides the basis for further research in other jurisdictions as well as a basis for effective health policy planning.

4 Data and methodology

4.1 Data

The data for this study were taken from wave 7 of the Ghana Living Standards Survey (GLSS 7). The GLSS is a nationwide household survey conducted by the Ghana Statistical Service (GSS), the official statistics bureau of Ghana. This survey collects economic, social, and demographic data from a large sample of households nationwide, and it is the most comprehensive source of data at the household level in Ghana due to its scope and coverage. Households were selected from enumeration areas so that, when properly weighted, the sample would be representative of the total population of the country. Data collection for GLSS 7 was completed in October 2017 and it is the most recent round of the GLSS survey. It has data on more than 14,000 households and 55,000 individuals. This study uses information from this survey on risk preferences and health insurance enrollment of household heads and their spouses and on household health expenditure. Thus, respondents are household heads and spouses of household heads. The data on household health expenditure includes all out-of-pocket expenditures on health care but does not include the portion of health expenditures covered by health insurance or expenditures on preventive health care, for which data are not available.

The GLSS also collects community-level data from a subsample of communities that are selected to take part in the community survey. Community leaders serve as respondents for the community survey and are asked to respond to questions about the features of the infrastructure that is available in their communities. This study makes use of data from this survey on whether there are any health facilities (hospitals, clinics, pharmacies, maternity homes, traditional herbal clinics, etc.) in the community in which the respondent lives.

Table 1 shows the summary statistics for the variables used in this study. Looking first at the dependent variables used in our analysis, 63.5% of respondents were actively enrolled in health insurance, and household health expenditure averaged 96.7 cedis (about 15–16 US dollars at the current exchange rate) during the 2 weeks preceding the survey.Footnote 4 The maximum value for household health expenditure was 10,307 Ghana cedis. Health insurance enrollment is measured by whether the respondent was actually covered under a health insurance program in the year of the survey. In this study, an affirmative response classifies the respondent as being enrolled in health insurance.

Turning to the explanatory variables of most interest, Table 1 shows that 81.9% of respondents are risk averse, where risk aversion is measured as a dichotomous variable wherein individuals are considered to be risk averse if they choose (1) over (2) where (1) is to invest in a business in which there is no chance of losing any money but would make low profits and (2) is to invest in a business that has a small chance of losing money but potentially makes high profits.Footnote 5 Of respondents whose communities participated in the community survey, only 50.5% of them had a health facility in their communities. This implies that about half of them necessarily have to go outside their communities in order to access health care. With an average household size of nearly 5 in our sample, this could prove crucial in its effect on household health expenditure.

Turning to the other explanatory variables we used, health status is proxied by reporting illness or injury during the 2 weeks preceding the survey. About a sixth of respondents (16.5%) reported an illness/injury during the preceding 2 weeks and can therefore be regarded as being in poor health.

Educational attainment is relatively low, with 62.7% of respondents having only basic school education and only 18.0, 4.7, and 5.2% of respondents having a senior high school, post-secondary, or university education, respectively. More than one in eight respondents are living in poverty, with 9.4% of respondents being “poor” and 3.9% being “very poor.” “Poor” is defined as living below the upper poverty line and “very poor” is defined as living below the lower poverty line, where the upper and lower poverty lines are 1760 and 982.2 Ghana cedis (about 157 and 110 US dollars) per adult equivalent per year, respectively (see Ghana Statistical Service, 2018). 83% of respondents were found to have access to information, which is proxied by ownership of a functioning television set or radio. The average age of respondents is 42.9; the minimum and maximum ages being 15 and 99 respectively, average household size is 4.4 with a minimum of 1 and a maximum of 28, and 74.5% of respondents are male.Footnote 6

We calculated a correlation matrix of all of the explanatory variables used in our analysis, and although it is not shown due to space limitations, we found that multicollinearity was not a problem, with pairwise correlation coefficients being 0.42 or less in all cases.

4.2 Theoretical framework and empirical methodology

This study employs random utility theory and expected utility theory for insurance under uncertainty and risk (von Neumann and Morgenstein 1994) to model health insurance demand. Random utility theory assumes that the utility obtained from consuming a commodity, in this case health insurance (HI), depends on the observable and unobservable factors of the household and of the commodity itself. Thus, an individual i will decide to enroll in a health insurance scheme if the utility derived from being enrolled exceeds the utility to be derived from non-enrollment. Mathematically stated,

Adapting expected utility theory under uncertainty to this study, this framework assumes that individuals are risk averse and make decisions based on the implications of their decisions for their health (original theory: wealth).

Based on the foregoing theories, a model for estimating the probability of enrolling in health insurance is specified as follows:

where R denotes risk aversion and X is a vector of relevant control variables that might affect the decision to enroll in a health insurance scheme. Household risk preferences are a behavioral trait that is considered to a large extent to be exogenous. Thus, we employ a logit model to estimate Eq. (2) to ascertain the effect of risk aversion on health insurance enrollment.

The theory of the demand for health is used to explain household health expenditure. According to Grossman (1972), health capital serves both as a consumption good and an investment good, and individuals can increase their stock of health capital by the amount they invest in their health. This implies that health expenditure can be viewed as an investment in one’s health capital with the amount invested being dependent on the characteristics of the commodity and of the individual as well as unobserved components. Based on this, we model the amount of household health expenditure as follows:

where HI denotes enrollment in a health insurance scheme, HF denotes the presence of a health facility in the respondent’s community, and X is a vector of other control variables.

4.3 Endogeneity issue and the instrumental variable

Enrollment in health insurance is potentially endogenous. It is possible that persons with poor health will realize their need for frequent health care services and hence be more likely to enroll in health insurance, and since they are likely to access health care more often than others, they may have a higher health expenditure as well. If this is the case, it will hide the true impact of health insurance enrollment on health expenditure. There is also the possibility that other unobserved factors influence households’ decision to enroll in health insurance, thus confounding the effect of health insurance enrollment on health expenditure. To address this problem, we employ an instrumental variables approach. We use risk aversion as our instrument for health insurance enrollment. Given that risk aversion has no direct relationship with health expenditure but has a direct relationship with the endogenous variable—health insurance enrollment (see Data and methodology), it presumably satisfies the exclusion restriction criteria for a good instrument. The presence of a health facility, on the other hand, is a community-level variable and can be considered to be exogenous to the household. Thus, the coefficient of this variable obtained from estimating Eq. (3) is sufficient to indicate its effect on health expenditure.

Due to the presence of an instrument to estimate the effect of health insurance on health expenditure, we estimate (3) using the approach proposed by Lewbel (2012) that identifies structural parameters in models with endogenous regressors. According to Baum et al. (2013), the approach is useful both in the absence of external instruments and in the presence of external instruments. In the case of the latter, the approach is useful as a way of supplementing external instruments to improve the efficiency of the IV estimator. Using Lewbel’s (2012) method, we are able to compare standard two-stage least squares (2SLS) results with results from generated instruments only as well as results from both generated and external instruments. Equations (4) and (5) show the two models fitted for a 2SLS approach where R, HF and X are as previously explained. \(\widehat{{\mathrm{H}} {\mathrm{I}}}\) in (5) is the fitted value of health insurance from (4).

5 Estimation results and discussion

This section presents the results from estimations of the models introduced in the previous section and discusses the findings.

5.1 Determinants of health insurance enrollment

Table 2 shows the marginal effects from a logit estimation of the effect of risk aversion and other variables on health insurance enrollment in Ghana.

From Table 2, it can be seen that the probability of enrolling in health insurance is 3.1–3.3 percentage points higher for those who are risk averse compared to those who are not risk averse and that the difference is statistically significant. This finding is consistent with theoretical expectation as well as with the findings of Hopkins and Kidd (1996) and Buchmueller et al. (2013) for Australia, those of Liu et al. (2011) for rural China, and those of Condliffe and Fiorentino (2014) for the United States (discussed in Studies of the determinants of health insurance enrollment) that persons with low risk tolerance are more likely to enroll in voluntary health insurance programs because they are more eager to insure against the risk of falling ill and being denied health care due to not having the means to make out-of-pocket payments.

We further found that persons who reported an illness/injury 2 weeks prior to their interview were 2.2 percentage points more likely to enroll in a health insurance scheme, and the difference was found to be statistically significant. Since this category of persons is likely to be in poorer health, this variable can be regarded as a proxy for health status, and our result suggests that those in poorer health are more likely to enroll in health insurance because they require more health care services. This finding is consistent with the findings of Duku (2018) and Buchmueller et al. (2013).

Turning next to the impact of access to information, we found that those with access to information are, as one might expect, more likely to enroll in health insurance.

Turning next to the impact of age, we found a non-linear relationship between age and health insurance enrollment, with both younger people and older people being more likely to enroll, with the enrollment rate bottoming out around age 40. The latter result could be due to the fact that one’s health capital depreciates with age and hence that older people have a greater need for health care services compared to younger people, making them more likely to enroll in health insurance. The finding is largely consistent with the previous literature (see, for example, Amu et al. 2018; Dake 2018).

Turning to the impact of poverty, very poor households were found to be 4.5–5.2 percentage points more likely to enroll in health insurance compared to non-poor people, and the differences were found to be statistically significant. To the extent that this finding is attributable to exempting poor and vulnerable households from paying premiums, it suggests that the NHIS in Ghana is achieving its objective of being pro-poor (Amu et al. 2018).

Turning next to the impact of educational attainment, persons with higher levels of education were found to be more likely to enroll in the health insurance program compared with persons with no formal education, and the differences were found to be statistically significant. Furthermore, it is observed that the magnitudes of the coefficients for secondary, post-secondary and university increase with the level of education, thus confirming that the propensity for an individual to enroll in health insurance is higher, the higher is his/her educational attainment. The opportunity cost of time and good health is presumably higher for more highly educated people, and thus they would be expected to take every possible measure to enhance their health and wellbeing, and enrolling in health insurance is one such measure.

Furthermore, we found that urban households are more likely to enroll in health insurance and that males are less likely to enroll in health insurance (but the coefficient of the latter is statistically significant only if variables relating to marital status are included).

Finally, household attributes such as household size and marital status had significant impacts on the likelihood of enrolling in health insurance. Larger households were less likely to enroll in health insurance, with an additional household member reducing the likelihood of health insurance enrollment by 0.5 percentage points. This could be due to the financial burden of larger households reducing the amount of fiscal space the household has to spend on health insurance. With respect to marital status, it was found that, relative to the never married, the married, those in consensual unions, the separated, and the widowed had a significantly higher likelihood of enrolling in health insurance, with the married having the highest likelihood. This could be due to the fact that married couples are better able to afford such things as health insurance because they are able to reap economies of scale in consumption.

5.2 Determinants of health expenditure

Table 3 shows the estimation results from a tobit regression of the effect of risk aversion on health expenditure. It shows a statistically insignificant effect of risk aversion on health expenditure, confirming that risk preferences do not directly impact health expenditure.Footnote 7Risk aversion is therefore used as an instrument for the determinants of health expenditure in the main analysis, and the results are shown in Table 4.

Table 4 presents the results from the IV estimation of the determinants of household health expenditure. Column (1) show the results from a standard 2SLS IV estimation, column (2) shows the results from Lewbel’s (2012) method with generated instruments only, and column (3) shows the results with generated and external instruments. As can be seen from the table, the F-statistics are greater than the Stock-Yogo critical values in all models. Therefore, the weak instrument identification test hypothesis is rejected in favor of a strong one. In other words, risk preference is valid as an instrument for identifying the effect of health insurance on health expenditure. The results in columns (2) and (3) are similar and are preferred to those in column (1) since they improve the efficiency of the results relative to the standard 2SLS regression. The results in Table 4 show that health status, the presence of a health facility in one’s own community, poverty status, education, household size, age, and marital status are significant predictors of household health expenditure. Persons in poor health were found to spend about 89% more on health compared to persons in good health status, and the difference was found to be statistically significant. Persons in poorer health require more frequent visits to the hospital and thus may end up spending more on health care. This finding is consistent with those of Azzani et al. (2019) and Su et al. (2006).

Households living in communities that have a health facility were found to have lower health expenditure, and the difference was found to be statistically significant. They spend about 13.7% less on health compared to households without health facilities in their communities. This corroborates the finding of Lambon-Quayefio and Owoo (2017) that shorter distances to health facilities have the potential to improve health outcomes. Health facilities often provide public health education to their host communities which may in turn help community members protect themselves from common disease causes, thus contributing to lower health expenditure. Our finding that the presence of health facilities is helpful in reducing households’ health expenditure is a novel contribution to the literature and policy making as it underscores the importance of the equitable spatial distribution of health infrastructure throughout the country.

As households’ poverty status deteriorates, they spend an average of about 38% less on health expenditure. Given that health is a normal good, persons with higher incomes will demand more of such goods compared to lower income households, and thus this finding is as expected. Household size was found to increase health expenditure, as expected, and the difference was found to be statistically significant. An additional household member increases the health spending of the household by 13% while an additional year of education reduces health spending by about 2%. Persons with higher education may spend less on health because they have a higher opportunity cost of time and hence are more likely to focus more on preventive health practices that might reduce their likelihood of falling sick. As expected, older persons spend more on health expenditure than younger persons due to the fact that one’s stock of health deteriorates as one grows older. Finally, marital status has a weakly significant impact on health expenditure. Those living with a partner spend 16% more on health than those currently without a partner. Couples are more likely to have children and hence, a higher health bill than persons without partners. Similar results on the effect of these socioeconomic factors on health expenditure are found by Olasehinde and Olaniyan (2017) in Nigeria, Mehrabi et al. (2018) in Iran, and Tur-Sinai et al. (2018) in Israel.

An important finding from our study is that health insurance was found not to have a statistically significant effect on households’ out-of-pocket health expenditure. In other words, enrolling in health insurance does not reduce one’s out-of-pocket health expenditure relative to those not enrolled. This finding is contrary to expectation because the out-of-pocket health expenditure of those enrolled in health insurance should, in theory, be close to zero, but there are at least two possible explanations for our finding. One possibility is that there is adverse selection, with those who are in relatively poor health being more likely to enroll in health insurance, and that this can explain why the health expenditure of those enrolled in health insurance is not any lower than those not enrolled in health insurance, but this possibility has been eliminated by including health status as a control variable. Another possible explanation is that enrolling in health insurance leads to moral hazard, with enrollees seeking more health care than is absolutely necessary, but this cannot be the full explanation because out-of-pocket health expenditure of enrollees should be close to zero regardless of how much health care they receive. However, our finding is not entirely unexpected within the Ghanian context. The NHIS in Ghana has been bedeviled with several challenges in its implementation. Agyepong et al. (2016) reported, among other things, that it was not an uncommon practice for provider facilities to charge both formal payments and informal (covert) charges even to insured patients. Since health facilities strongly prefer patients who pay in cash rather than patients who seek treatment pursuant to their health insurance policies because they must complete tedious paper work and wait for a long time before they are reimbursed by the NHIS, patients desiring more timely and higher quality health care choose to make formal or informal (covert) out-of-pocket payments and sometimes even forego using their insurance policies altogether. These considerations partly explain why enrollment in health insurance does not lead to significant reductions in health expenditure. This finding is relevant to how the government ought to re-package the implementation of the NHIS to the benefit of subscribers and to motivate enrollment among non-subscribers.Footnote 8

6 Conclusions and policy implications

This study examined the determinants of health insurance enrollment and health expenditure in Ghana using micro data from wave 7 of the Ghana Living Standards Survey (GLSS 7) with emphasis on the role of risk preferences and the availability of health facilities in one’s own community, neither of which has been emphasized in the previous literature on this topic. It is possible to analyze the determinants of health insurance enrollment in Ghana because its public health insurance system (the National Health Insurance Scheme or NHIS) is, in theory, mandatory, but is, in actual practice, voluntary, with only about 40% of the population enrolled in the scheme. Our empirical results show that risk preferences have a significant impact on health insurance enrollment, with risk averse individuals being significantly more likely than other households to enroll in health insurance, as one would expect. Moreover, our findings also show that very poor households are significantly more likely to enroll in health insurance than other households, perhaps because they are exempt from paying premiums for health insurance. This finding suggests that NHIS is achieving its intended objective of increasing the poor’s access to health care. Somewhat surprisingly, our results show that those who are enrolled in health insurance do not show significantly lower health expenditures than other households even though enrolling in health insurance should greatly reduce out-of-pocket health expenditure. This finding may be due to the fact that even enrollees need to pay substantial out-of-pocket health expenditures in Ghana due to various defects in its health care and health insurance system. Finally, our results also show that the availability of health facilities in one’s own community significantly decreases expenditures on health care, which underscores the importance of ensuring an equitable spatial distribution of health facilities throughout the country.

Turning finally to policy implications, our findings suggest that (assuming that the populace is relatively risk averse, as they apparently are in Ghana), educating the populace about the importance of insuring against health risks would be an effective way of increasing health insurance enrollment rates from their current low levels. Second, our results suggest that exempting poor households from paying premiums for health insurance or reducing their premiums has been an effective way of increasing the insurance enrollment rates of the poor. Third, our results underscore the importance of reforming Ghana’s health insurance system so that those enrolled in this system are not required or feel the need to pay various formal and informal (covert) payments when receiving care, which defeat the purpose of enrolling in health insurance. Fourth and finally, ensuring an equitable spatial distribution of health infrastructure throughout the country would be an effective way of reducing household health expenditures and ultimately increasing household welfare. Implementing these recommendations would be an effective way of increasing the quality, affordability, and equity of health care delivery not only in Ghana but also in other developing countries.

Notes

Coverage rates were taken from the 2010 and 2013 annual reports of the NHIS and Nsiah-Boateng and Aikins (2018).

Note, however, that the informal sector employs a far greater proportion of workers than the formal sector in Ghana.

Since the natural logarithm of zero is not defined, 1 cedi (about 0.14 U.S. dollars) was added to the health expenditure of all households to eliminate zero values in the main estimation.

This study is constrained to measure risk aversion as a binary variable as opposed to an ordinal measure with different levels of risk aversion due to the nature of the question asked in the survey. Studies such as Adjei-Mantey and Adusah-Poku (2021) used a similar measure of risk preference.

Note, however, that because the Lewbel method that we used to estimate the health expenditure equation could not accommodate categorical variables, we had to re-define the variables relating to poverty status, education, and marital status when estimating this equation. The poverty status variable equals 0 for the non-poor, 1 for the poor, and 2 for the very poor, the education variable measures years of education, and the marital status variable equals 0 for the never married, separated, divorced, and widowed and 1 for the married and consensual union. When calculating years of education, “none” was assigned a value of 0 years, “basic” a value of 9 years, “secondary” a value of 12 years, “post-secondary” a value of 15 years, and “university” a value of 16 years.

The lack of statistical significance here could be partly attributable to the fact that the measurement of risk aversion in this study is not directly related to investment in one’s own health and its potential returns.

Note, however, that the fact that the health expenditure of those enrolled in the national health insurance scheme and those not enrolled are not significantly different from one another implies that enrollees receive more health care than non-enrollees since at least some of their health expenses are presumably covered by health insurance. Thus, although NHIS does not necessarily lower the health expenses of insurees, it enables them to receive a greater quantity of health care.

References

Abrokwah, S. O., Moser, C. M., & Norton, E. (2014). The effect of social health insurance on prenatal care: the case of Ghana. International Journal of Health Care Finance and Economics, 14(4), 385–406.

Abrokwah, S. O., Moser, C. M., & Norton, E. (2016). The impact of social health insurance on household fertility decisions. Journal of African Economies, 25(5), 699–717.

Adjei-Mantey, K., & Adusah-Poku, F. (2021). Energy efficiency and electricity expenditure: an analysis of risk and time preferences on light bulb use in Ghana. Resources, Conservation & Recycling Advances, 12, 200061.

Agyepong, I. A., Abankwah, D. N. Y., Abroso, A., Chun, C., Dodoo, J. N. O., & Lee, S., et al. (2016). The “Universal” in UHC and Ghana’s National Health Insurance Scheme: policy and implementation challenges an dilemmas of a lower middle income country. BMC Health Services Research, 16, 504.

Alhassan, R. K., Nketiah-Amponsah, E., & Arhinful, D. K. (2016). A review of the National Health Insurance Scheme in Ghana: what are the sustainability threats and prospects? PLoS ONE, 11(11), e0165151.

Amu, H., & Dickson, K. S. (2016). Health insurance subscription among women in reproductive age in Ghana: do socio-demographics matter? Health Economics Review, 6, 24.

Amu, H., Dickson, K. S., Kumi-Kyereme, A., & Darteh, E. K. M. (2018). Understanding variations in health insurance coverage in Ghana, Kenya, Nigeria, an Tanzania: evidence from demographic and health surveys. PLoS ONE, 13(8), e0201833.

Angko, W. (2013). The determinants of healthcare expenditure in Ghana. Journal of Economics and Sustainable Development, 4(15), 102–124.

Azzani, M., Roslani, A. C., & Su, T. T. (2019). Determinants of household catastrophic health expenditure: a systematic review. Malays J Med Sci, 26(1), 15–43.

Baum, C. F., Lewbel, A., Schaffer, M. E., & Talavera, O. (2013). Instrumental variables estimation using heteroskedasticity-based instruments. Potsdam: German Stata Users Group Meeting. June.

Blanchet, N. J., Fink, G., & Osei-Akoto, I. (2012). The effect of Ghana’s National Health Insurance Scheme on health care utilization. Ghana Medical Journal, 46(2), 76–84.

Buchmueller, T. C., Fiebig, D. G., Jones, G., & Savage, E. (2013). Preference heterogeneity and selection in private health insurance: the case of Australia. Journal of Health Economics, 32, 757–767.

Condliffe, S., & Fiorentino, G. T. (2014). The impact of risk preference on health insurance and health expenditures in the United States. Applied Economic Letters, 21(9), 613–616.

Costa, J., & Garcia, J. (2003). Demand for private health insurance: how important is the quality gap? Health Economics, 12, 587–599.

Dake, F. A. A. (2018). Examining equity in health insurance coverage: an analysis of Ghana’s National Health Insurance Scheme. International Journal for Equity in Health, 17, 85.

Duku, S. K. O. (2018). Differences in the determinants of health insurance enrolment among working-age adults in two regions in Ghana. BMC Health Services Research, 18, 384.

Fenny, A. P., Kusi, A., Arhinful, D. K., & Asante, F. A. (2016). Factors contributing to low uptake and renewal of health insurance: a qualitative study in Ghana. Global Health Research and Policy, 1, 18.

Finn, C., & Harmon, C. (2006). A dynamic model of demand for private health insurance in Ireland. IZA Discussion Paper No. 2472, available at https://doi.org/10.2139/ssrn.950918.

Ghana Statistical Service (2018). Ghana Living Standards Survey Round 7 (GLSS 7) Poverty Trends in Ghana 2005–2007, Poverty Profile Report_2005 - 2017.pdf (statsghana.gov.gh).

Grossman, M. (1972). The demand for health: A theoretical and empirical investigation. New York, NY: Columbia University Press.

Hopkins, S., & Kidd, M. P. (1996). The determinants of the demand for private health insurance under Medicare. Applied Economics, 28(12), 1623–1632.

Jeon, B., & Kwon, S. (2013). Effect of private health insurance on health care utilization in a universal public insurance system: a case of South Korea. Health Policy, 113, 69–76.

Jofre-Bonet, M. (2000). Public health care and private insurance demand: the waiting time as a link. Health Care Management Science, 3, 51–71.

Kwarteng, A., Akazili, J., Welaga, P., Dalinjong, P. A., Asante, K. P., & Sarpong, D., et al. (2020). The state of enrollment on the National Health Insurance Scheme in rural Ghana after eight years of implementation. International Journal for Equity in Health, 19, 4.

Lambon-Quayefio, M., & Owoo, N. S. (2017). Determinants and the impact of the National Health Insurance on neonatal mortality in Ghana. Health Economics Review 7,34.

Lewbel, A. (2012). Using heteroscedasticity to identify and estimate mismeasured and endogenous regressor models. Journal of Business & Economic Statistics, 30(1), 67–80.

Liu, H., & Zhao, Z. (2014). Does health insurance matter? Evidence from China’s urban resident basic medical insurance. Journal of Comparative Economics, 42, 1007–1020.

Liu, H., Gao, S., & Rizzo, J. A. (2011). The expansion of public health insurance and the demand for private health insurance in rural China. China Economic Review, 22, 28–41.

Mehrabi, Y., Payandeh, A., Ghahroodi, Z. R., & Zayeri, F. (2018). Determinants of household’s health expenditures: a population-based study. Journal of Paramedical Sciences, 9(2), 27–32.

Von Neumann, J., & Morgenstern, O. (1994). Theory of games and economic behaviour. Princeton, New Jersey, USA: Princeton University Press.

Nghiem, S., & Graves, N. (2019). Selection bias and moral hazard in the Australian private health insurance market: Evidence from the Queensland skin cancer database. Economic Analysis and Policy, 64, 259–265.

Nsiah-Boateng, E., & Aikins, M. (2018). Trends and characteristics of enrolment in the National Health Insurance Scheme in Ghana: a quantitative analysis of longitudinal data. Global Health Research and Policy, 3, 32.

Nsiah-Boateng, E., Nonvignon, J., Aryeetey, G. C., Salari, P., Tediosi, F., & Akweongo, P., et al. (2019). Sociodemographic determinants of health insurance enrolment and dropout in urban district of Ghana: a cross-sectional study. Health Economics Review, 9, 23.

Okunade, A. A. (2005). Analysis and implications of the determinats of healthcare expenditure in African countries. Health Care Management Science, 8, 267–276.

Olasehinde, N., & Olaniyan, O. (2017). Determinants of household health expenditure in Nigeria. International Journal of Social Economics, 44(12), 1694–1709.

Owoo, N. S., & Lambon-Quayefio, M. P. (2013). National health insurance, social influence and antenatal care use in Ghana. Health Economics Review 3, 19.

Owusu-Sekyere, & Chiraah (2014). Demand for health insurance in Ghana: what factors influence enrollment? American Journal of Public Health Research, 2(1), 27–35.

Propper, C., Rees, H., & Green, K. (2001). The demand for private medical insurance in the UK: a cohort analysis. The Economic Journal, 111(471), C180–C200. Conference papers (May).

Rajkotia, Y., & Frick, K. (2011). Does household enrolment reduce adverse selection in a voluntary health insurance system? Evidence from the Ghanaian National Health Insurance System. Health Policy and Planning, 27(5), 429–37.

Salari, P., Akweongo, P., Aikins, M., & Tediosi, F. (2019). Determinants of health insurance enrolment in Ghana: evidence from three national household surveys. Health Policy and Planning, 34, 582–594.

Su, T. T., Pokhrel, S., Gbangou, A., & Flessa, S. (2006). Determinants of household health expenditure on western institutional health care. European Journal of Health Economics, 7(3), 195–203.

Tur-Sinai, A., Magnezi, R., & Grinvald-Fogel, H. (2018). Assessing the determinants of healthcare expenditures in single-person households. Israel Journal of Health Policy Research, 7(1), 48.

Wang, H., Otoo, N., & Dsane-Selby, L. (2017). Ghana National Health Insurance Scheme. Improving financial sustainability based on expenditure review. World Bank Studies. Washington DC: World Bank. 10.1596/978-1-4648-1117-3.

Acknowledgements

We are grateful to Enrica Croda, Luigi Ventura, participants of the 2022 annual meeting of the Society of Economics of the Household, and two anonymous reviewers for their invaluable comments and suggestions.

Funding

This work was supported by JSPS (Japan Society for the Promotion of Science) KAKENHI Grant Numbers 18H00870, 20H01513, and 20H05633 to Horioka. We are very grateful for this support.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Adjei-Mantey, K., Horioka, C.Y. Determinants of health insurance enrollment and health expenditure in Ghana: an empirical analysis. Rev Econ Household 21, 1269–1288 (2023). https://doi.org/10.1007/s11150-022-09621-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11150-022-09621-x