Abstract

In this paper, we investigate the child penalty in Russia using data from the Russian Longitudinal Monitoring Survey (RLMS) and the methodological framework of event studies. We find that five years after childbirth, women suffer an earnings penalty, while no effect is observed for men. The mothers’ penalty stems exclusively from lower employment after childbirth. Contrary to similar studies on Western Europe and the US, we do not find penalties in terms of working hours or hourly wage rates for women who remain in the labour force. We further find that mothers’ employment penalty is strongly driven by household characteristics and by their spouses’ beliefs. Finally, we find that parenthood decreases the probability of working in supervisory positions for mothers and in the public sector for fathers.

Similar content being viewed by others

Explore related subjects

Find the latest articles, discoveries, and news in related topics.Avoid common mistakes on your manuscript.

1 Introduction

Parenthood has heterogeneous effects on labour market behaviours and outcomes, depending on various individual and institutional factors. A common finding in the existing literature is that such effects are asymmetric across genders, with women suffering a considerably larger child penalty than men in terms of employment, hours worked, wages and career opportunities. In fact, some authors have suggested that the majority of gender inequality observed in labour market outcomes in recent years is related to the presence of children (e.g. Cortés & Pan, 2020).

In this paper, we investigate the existence and extent of the child penaltyFootnote 1 in Russia by using longitudinal data from the Russian Longitudinal Monitoring Survey (RLMS) for the period 1994–2018. Russia is an interesting case study for various reasons. The Russian labour market lacks part-time jobs, and the capacity of kindergartens is insufficient; as a result, employment rates for mothers with young children tend to be low (Kazakova, 2019). In addition, in the period considered, Russia experienced extensive reforms, including the introduction of new family policies, which significantly impacted the situation of mothers in the labour market. Last, Russia is regarded as a conservative environment in terms of gender equality, gender roles and family models (Pew Research Center, 2019), which sheds light on aspects beyond the mere economic sphere.

Methodologically, we use an event-study framework, a quasi-experimental approach monitoring parents’ labour market outcomes in the years around the birth of the child. The implementation of this approach for the analysis of the child penalty is not new; however, due to limited appropriate (longitudinal) datasets, it is relatively rare. Specifically, event studies on the child penalty have been carried out on the US (Bertrand et al., 2010; Cortés & Pan, 2020), on Sweden (Angelov et al., 2016), on Denmark (Kleven et al., 2019a), and on a set of six developed economies (five European countries plus the US) (Kleven et al., 2019b). As in Kleven et al. (2019a; 2019b), we decompose the penalty in total earnings into three components: employment, hours worked and hourly wage penalty.

The contribution of our study to the existing literature is twofold. First, we add Russia, with its institutional and social particularities, to the list of countries for which event studies on the child penalty are available. At the same time, we provide evidence for a country where the empirical literature is scant and limited to cross-sectional studies (Nivorozhkina & Nivorozhkin, 2008; Biryukova & Makarentseva, 2017; Kingsbury, 2019). Second, we shed light on the factors able to mitigate or exacerbate the child penalty, particularly focusing on the role of household characteristics and on the social and cultural background of the parents.

Our findings can be summarized as follows: (i) starting from the year before the child’s birth and over the following five years, women suffer an earnings penalty, while a similar effect is not observed for menFootnote 2; (ii) the penalty for women stems from a decline in labour supply at the extensive margin, whereas contrary to Western Europe and the US, no detrimental effects emerge on hourly wage rates or hours worked; (iii) the penalty is stronger and lasts longer for first-child births than for higher-order births; (iv) after the birth of a child, women are less likely to work in supervisory positions, while men are more likely to work in the private sector; and (v) mothers’ employment penalty is strongly driven by household characteristics and by their spouses’ beliefs, while their own beliefs and background play no role.

The rest of the paper is organized as follows. In the next section, we detail our reference literature. Section 3 provides background information on Russia related to gender inequality, child policies and previous studies on the child penalty. In Section 4, we describe the dataset and the samples used. Section 5 illustrates the econometric model and empirical strategy for the estimation (Section 5.1), the baseline results (Section 5.2), and the differences in penalties imposed by first-order and higher-order births (Section 5.3). In Section 6, we extend our empirical model to identify which factors are able to affect the magnitude of the penalty. In Section 7, we investigate the changes in job characteristics associated with parenthood. Section 8 concludes.

2 Literature review

The impact of parenthood on labour market outcomes has been the focus of extensive literature (see Grimshaw & Rubery, 2015; or Fernández-Kranz et al., 2013). A review of how the child penalty shapes gender inequality is available in Cortés and Pan (2020). Here, we provide a bird’s eye view of the factors shaping the child penalty and an account of the studies more closely related to our empirical approach.

2.1 Microeconomic and sociocultural factors

Parenting can impact on labour earnings by shaping labour supply and wage rates. Regarding the former, extensive evidence exists that childbirth decreases participation rates and hours worked only for mothers (OECD, 2007; Schönberg & Ludsteck, 2014; Brewer & Paull, 2006). This effect is observed even after accounting for the possible endogeneity of fertility and adverse selection (e.g. Angrist & Evans, 1998; Jacobsen et al., 1999; Cruces & Galiani, 2007). This loss is often paralleled by a penalty in the wage rate (e.g. Lundborg et al., 2017; Adda et al., 2017), especially when mothers experience substantial interruptions in employment (Lundberg & Rose, 2000). Mothers accumulate less job experience and, due to continuing responsibilities in child rearing, face more challenging career/family conflicts in coping with long hours, heavy travel commitments and inflexible work schedules. As a result, they tend, more often than men, to choose family-friendly jobs and to be less competitive for higher paid jobs (Bertrand et al., 2010; Kleven et al., 2019a).

An interesting branch of the literature has identified a number of individual and household attributes that can mitigate or exacerbate the negative effects of childbirth. Among the individual attributes, age, education and the type of occupation prebirth emerge as relevant (see Sigle-Rushton & Waldfogel, 2007; Davies et al., 2000). Household characteristics (income, age/employment composition) have been less explored, despite their ability to shed light on aspects related to gender role beliefs and stereotypes. Interestingly, a few contributions focus on the role of spouses’ attributes. Bertrand et al. (2010) show that US graduate mothers with lower-earning spouses suffer only a modest and temporary penalty compared to those with higher-earning spouses, who tend to reduce their labour supply considerably more. Fernàndez et al. (2004) focus on the role of the family model in which the man grew up and find that the spouses of men whose mothers worked are themselves significantly more likely to work. Kleven et al. (2019a) find that the motherhood penalty in Denmark is strongly related to the labour supply history of maternal grandparents: women whose mother worked very little compared to the father suffer a larger child penalty when they become mothers.

2.2 Policy and labour market environment

The empirical literature has also shown that the size of the penalty depends on the architecture of parental leave and childcare systems and on the model to which the division of labour within the family is inspired (see Waldfogel, 1998a; 1998b; 2001; Haan & Wrohlich, 2009). Parental leave policies positively impact women’s employment continuity and careers only when they guarantee job security (Hegewisch & Gornick, 2011) and when the leave is paid (De Henau et al., 2007). The length of parental leave should also be appropriate: an excessive duration keeps mothers out of employment for too long (Pettit & Hook, 2009; Jaumotte, 2003); in contrast, if it is too short, leave increases the risk of women dropping out of the labour market altogether (Keck & Saraceno, 2013). Cross-country comparisons show that paid maternity and family leave provisions of up to one year increase the likelihood of employment shortly after childbirth and have either positive or zero impacts on women’s medium- and long-run employment and earnings (Rossin-Slater, 2018). Longer paid leave entitlements can negatively affect women’s wages in the long term (Blau & Kahn, 2013) and for all skill levels (Olivetti & Petrongolo, 2017).

The impact of parental leave provisions is also found to depend crucially on the availability of complementary measures, particularly formal childcare availability and tax/benefit systems (OECD, 2007), especially for full-time employment (Pettit & Hook, 2009). Its importance is lower where part-time jobs are more widely available (Steiber & Haas, 2012; Havnes & Mogstad, 2009). The availability of places and opening hours of kindergartens (see Jaumotte, 2003), as well as positive attitudes towards formal childcare (Hegewisch & Gornick, 2011), also play a crucial role.

Asymmetries in parental leave and childcare provisions across genders still permeate virtually all societies. Even when fathers have leave opportunities similar to those of mothers, as in northern Europe, the gender gap in the take-up rate remains remarkable (see Thorsdottir, 2013, and Hegewisch & Gornick, 2011). Mandatory paternal leave is instead found to reduce gender imbalances in household tasks, with persistent effects after the leave period (Patnaik, 2019). Better availability of childcare facilities is only partially able to reduce the asymmetry; this translates into higher difficulties for mothers to re-enter employment and into higher part-time rates (Paull, 2008), when this is an option. Availability and fiscal incentives for part-time work may indeed represent better chances to return to employment (see Jaumotte, 2003) and the main channel through which the child penalty for mothers materializes (see Budig & England, 2001; Gangl & Ziefle, 2009; Davies & Pierre, 2005).

2.3 Prior event studies on the child penalty

The event study approach that we adopt in our analysis was first employed for similar purposes by Bertrand et al. (2010) on gender differences in career developments of MBAs who graduated between 1990 and 2006 from the Chicago Business School. Soon after graduation, incomes and employment rates start diverging in favour of men because women experience more career interruptions, work shorter hours and more as part-timers and are more often self-employed. All such developments are closely connected to the birth of children and unfold in the subsequent five years. Conversely, men who have children see their earnings increase, and their labour supply is largely unaffected by fatherhood.

More recently, Angelov et al. (2016) employed a similar approach to estimate the impact of childbirth on gender gaps in Sweden using administrative data from a few years before to approximately 15 years after the birth of the first child. The results indicate that parenthood enhances long-run gender pay inequality, especially for women with education lower than their spouse. This effect is explained by the asymmetric burden placed on women for child rearing, indicated by the decline in their hours worked and by the increase in part-time employment after the birth event.

Kleven et al. (2019a) use administrative data for Denmark over the period 1980–2013 and show that, due to the birth of a child, women suffer in the long run a 20% earnings penalty compared to men. The gap is due in equal proportions to differences in participation, hours worked and wage rates. The main channel through which the penalty materializes for women is a slowdown of career progression compared to men and a shift towards more family-friendly jobs.

Kleven et al. (2019b) compare the child penalty for two Scandinavian (Denmark and Sweden), two German-speaking (Germany and Austria), and two English-speaking (United Kingdom and United States) countries. Their results show that a child penalty is observed in all countries, but its magnitude is smaller for the Scandinavian economies and larger for the two German-speaking countries. The components of the child penalty are also heterogeneous: in the Scandinavian and Germanic countries, the earnings penalty is mainly driven by changes in labour supply at the intensive margin and by wage rate effects; conversely, in the US and in the UK, the extensive margin is the key driver of the penalty. Descriptive evidence suggests that more conservative gender norms and views might be good candidates to explain the variability of the child penalty across countries.

In a study on the period 1967–2017, consistent with previous works, Cortés and Pan (2020) find that in the US, women experience a large drop in earnings with the birth of their first child, whereas men’s earnings remain virtually unchanged. The earnings penalty for women relative to men is found to persist at approximately 40% five to ten years after the birth event. When the analysis is replicated for subgroups of couples with different levels of education, the child penalty is slightly smaller (in the short and medium term) for women who are more educated than their spouses.

3 Institutional setting, social norms and previous research on Russia

One of the legacies of the Soviet era in post-communist countries is the high level of female labour market participation, as equality of men and women was one of the key ideological tenets of socialism. Compared to the average in OECD countries, Russia has a higher female participation rate, which stood at 63.1% in 2018 (with only six OECD countries reaching higher levels); the gender gap in participation is also well below the OECD average (Source: Labor Force Participation indicators, OECD, 2018). However, at more than 30 percent, the unadjusted gender pay gap in Russia is among the highest in the group of high-income countries. Despite having slightly declined since the onset of transition, the adjusted pay gap also remains high, approximately 25% (Atencio & Posadas, 2015). The extent to which this disadvantage is related to parenthood in Russia has been left almost completely unexplored.

The availability of childcare services, the opportunity for part-time jobs and the characteristics of maternal leave policies have been identified as the main institutional factors determining the labour supply of mothers. When compared to OECD countries, Russia has a very low employment rate of mothers with children aged 0–2 (25.7 percent in 2019) and a relatively high employment rate of mothers whose youngest child is from 3–6 years old (78.4 percent in the same year); corresponding figures for the average of OECD countries are 58.8 and 73.3 percent, respectively (OECD, 2019a). This gap can be explained by two important institutional factors: the low presence of part-time jobs and the scarcity of available childcare facilities (Kazakova, 2019). In 2019, part-time employment in Russia stood at 4% of total employment, compared to 16.7% in OECD countries (OECD, 2020). Enrolment in childcare services is also relatively low in Russia, especially in nursery schools. In 2017, only 19.0% of children aged 0–2 attended childcare facilities, compared to 35% in OECD countries; the attendance rate of children aged 3–5 in preschools is also below the OECD average (82.8% and 87.2, respectively) (see OECD, 2019b). The particularly low enrolment rate of the younger cohorts can be explained by the long waiting lists for public care facilities and the low attendance rate of private institutions (only 1.4% of children) (Kazakova, 2019). Due to the combinations of such factors, informal childcare plays a prominent role (Pelikh & Tyndik, 2014).

The current framework of family policies in Russia was established in 2007, when a package of measures was designed with the goal of raising the fertility rate. The package included an increase in pregnancy, birth and child benefits; second- and higher-order births were also more incentivised with the introduction of the so-called “maternity capital” (or “baby bonus”). Previous research shows that maternity capital achieved its aim of increasing fertility both in the short and long run (Slonimczyk & Yurko, 2014; Sorvachev & Yakovlev, 2020)Footnote 3. At present, total paid leave for mothers in Russia amounts to 20 months; the first 140 days are remunerated at 100% of the salary, while the remaining period is remunerated at 40%. At the end of the paid leave period, mothers can take an unpaid leave up to 36 months after the child’s birth. While the leave in Russia is longer than the average of OECD and EU countries (53.9 and 65.8 weeks, respectively) (OECD, 2018), the remuneration is relatively low and constitutes a disincentive for women to make use of the whole leave period. Prolonged parental leave duration and low remuneration with job protection are typical of German-speaking countries (Austria and Germany). On the other hand, Scandinavian countries (Denmark and Sweden) offer parental leaves of roughly one year with higher compensations, while English-speaking countries (the UK and the US) have no or very low compensations (one year leave in the UK and 12 weeks leave in the US with job protection).

In addition to institutional and policy factors, social norms can also constrain mothers’ labour supply. The prevailing conservative attitude in Russia places the burden of child rearing and household chores disproportionately on women (Giannelli et al., 2013). Despite communism’s efforts to equalize the roles of men and women in society, the persistence and stability of traditional gender norms in Russia have been confirmed by a number of studies (White, 2005; Kalugina et al., 2009; Lacroix & Radtchenko, 2011; Giannelli et al., 2013; Gimenez-Nadal et al., 2019). ISSP (2016; 2013) offers an extensive comparative overview of gender role beliefs based on the International Social Survey Programme, and Russia stands out as a highly conservative countryFootnote 4. This is not exceptional among post-communist countries, as for the majority of these countries, the transition towards a market economy has been paralleled by a reversal of the gender equality trends observed in the previous decades (see Vecernik, 2003; Perugini & Vladisavljevic, 2019; Pascall & Manning, 2000)Footnote 5.

Past studies on Russia compare the wages of women with and without children and find evidence of no motherhood penalty (Nivorozhkina & Nivorozhkin, 2008) or of a small penalty (Pritchett, 2015, on hourly wages; Biryukova & Makarentseva, 2017, on monthly earnings). Interestingly, Biryukova and Makarentseva (2017) find that more educated mothers suffer a higher penalty. A comparative study on the link between motherhood and monthly wages finds a raw motherhood penalty of 22.3% in Russia. However, once selection into motherhood and individual characteristics are controlled for, the effect disappears completely, as also occurs in Australia, Belgium, East Germany, Finland, Hungary, Italy, Israel and Sweden (Budig et al., 2012). Another comparative study finds that the number of children does not impact women’s earnings in Russia, contrary to most of the other countries considered (Budig et al., 2016).

Compared to these previous studies, which all use cross-sectional data, our research applies a more rigorous methodology based on panel data econometrics. Additionally, our study advances the literature by looking at two outcomes that have not been examined thus far for Russia in relation to the motherhood penalty: participation rate and hours worked.

4 Data, variables and sample

We estimate the child penalty using the Russian Longitudinal Monitoring Survey (RLMS) with reference years between 1994 and 2018. RLMS is a unique, nationally representative panel survey of Russian households coordinated by the Higher School of Economics from Moscow (HSE), which provides detailed information on the health and economic status in the Russian Federation at both the household and individual levels. RLMS data have been used extensively to analyse income and wages in Russia (see, among others, Bogomolova & Tapilina, 1999; Jovanovic, 2001; Nissanov, 2017; Borisov & Pissarides, 2020; Perugini, 2020; Aristei & Perugini, 2022) as well as gender inequalities (see, e.g. Giménez-Nadal et al., 2019).

RLMS shares with other longitudinal datasets issues of nonrandom attrition due to natural causes, refusal to continue participation and moving to another area, as no effort is made to trace respondents who have left their original residence (see Kozyreva et al., 2016). Previous research has indicated that in RLMS data, these aspects do not pose issues significantly different from other data sources (Lukiyanova & Oshchepkov, 2012; Aristei & Perugini, 2022; Borisov & Pissarides, 2020).

We study the penalties on overall monthly earnings and then distinguish its three components: employment, hours worked and hourly wage penalty. Overall earnings are based on the sum of net money received in the last 30 days from primary (question J10 in RLMS) and secondary jobs (question J40 in RLMS)Footnote 6 and include zero wages for men and women who are not currently employed or are on paid (including maternity) leave or unpaid leaveFootnote 7. Nonzero earnings are adjusted for inflation (2015 = 100) and the 1998 devaluation (1000 RBL was converted to 1 RBL in 1998). Employment is a dummy variable based on the present working status variable (question J1) and takes the value 1 if the person is currently working and 0 otherwise (not working, paid (including maternity) or unpaid leave). The working hours variable is based on the sum of hours worked in the last 30 days at the first (question J8) and second job (J38)Footnote 8. Hourly wages are calculated by dividing monthly earnings by working hours in the last 30 days and transformed into a log form.

We analyse labour market outcomes over a period of nine years, starting from three years before to five years after birth. The nine-year period provides the best compromise between a sufficiently long period (similar to Bertrand et al., 2010) and a sufficiently high number of individuals who we are able to follow. For the year of birth, the time variable is set at t = 0, and we index all other years accordingly (t = [−3; 5]). We define mothers and fathers based on the family relationship identifiers (variable B9) for a child aged zero years (based on the year of birth – B5). The identification as a mother is validated using the direct question of whether the women gave birth in that year. The two variables are consistent in 97% of cases. The direct question is not used as a main definition for mothers, as it was not part of the survey in some years (2000, 2004, 2005, 2008, 2010, 2012) and since there is no similar question for fathers. In total, we observe labour market outcomes for 620 mothers and 442 fathers; the total number of observations in the estimation amounts to 5289 and 3704, respectively. The estimation of hours and hourly wage equations has a lower number of observations because they are conditional on being employed.

Although some of the reference papers focus on first-order births only, in this paper, we also include higher-order births for two main reasons. First, given the constraints we impose, our sample size is limited, and including higher-order births allows us to increase the sample size. Second, analysing and comparing the size and drivers of the child penalty for first- and higher-order births has not been done in the literature, and we intend to offer this contribution here (see Section 5.3). The distinction between first- and higher-order births is based on household structure information. Namely, higher-order births are identified when households have one or more children older than the child we can use as the “event-birth” (i.e. to which we can associate a whole period t = [−3, 5]). Unfortunately, due to data limitations, in these cases, for lower-order births (older children), we are unable to monitor parents’ labour market outcomes in the years around their birth.

Figure 1 illustrates the dynamics of unadjusted gender gaps in employment, hours worked and hourly wages associated with the birth of a child. The left panel indicates that the male/female employment gap before the child’s birth (years −3 and −2) is approximately 15 percentage points (on average, the employment rate is 77.5% for men and 62.5% for women). Interestingly, and different from what has been observed in other countries, the gap begins to widen in Russia in year −1. This widened gap is probably due to high rates of sick leave during pregnancy, which is estimated for Russia at approximately 50% in recent years (Truong et al., 2017). This rate is significantly higher than that observed in the countries covered by the reference studies described in Section 2.3. The employment gap, as expected, reaches its maximum in year 0 (with an employment rate of 85% for men and 5% for women). Subsequently, the gap slowly diminishes and returns to the prebirth level. Similarly, the gap in working hours is approximately 17 percent in the years preceding the birth (years −3 and −2) and reaches its peak in year 1, indicating that once women return to work, the gender gap in hours worked does not change compared to prebirth levels.

Gender gaps in employment, hours worked (left panel) and hourly wages (right panel). Notes: The employment gap is calculated as the difference between the average male and female employment rates for each t; the gaps in wages and hours worked are calculated as ratio of the average difference between male and female wages (hours) and average male wage (hours). Source: own elaborations on the RLMS data

The right panel of Fig. 1 indicates that the gender pay gap in the years before the birth (years −3 to −1) is approximately 30 percent, in line with the figures observed in the literature (see, e.g. Atencio & Posadas, 2015). The gap is slightly higher one, two and three years after the birth (peaking to over 40 percent), but in years four and five, it returns to before-birth levels. Due to the small number of observations, the remarkable drop in the gap in year 0 cannot be regarded as statistically significant.

5 The extent and facets of the child penalty in Russia

5.1 Baseline econometric model and estimation strategy

We estimate the child penalty for overall earnings, employment, hours and hourly wages. The existence and magnitude of the penalty related to the birth of the child for each parent and for each of the labour outcomes Yit is estimated with the following model:

where the first expression on the right-hand side is a set of event-time dummy variables. As we omit the one for j = −2, the coefficients of the remaining dummy variables describe changes in outcomes with respect to two years before the birth. This year is chosen as the year of a ‘stable’ period before the birth, as the labour market outcomes in the year before birth might be affected for women, as already shown, by the pregnancy leave. Coefficients αj represent the penalties in relation to birth of the child for mothers and fathers, i.e. the motherhood and fatherhood penalties. The child penalty, in accordance with the definition frequently used in the literature and in line with our research framework, is defined as the difference between penalties of the two parents. Following Bertrand et al. (2010) (Table 8, p. 248), to present the results more clearly and to decrease the number of parameters estimated, we merge the outcomes for years two and three as well as the outcomes for years four and five. As a consequence, we end up with seven event-time dummy variables (t = [−3, −2, −1, 0, 1, 2/3, 4/5]). This is done bearing in mind the investigations of the drivers of the penalty in the next step of the analysis (Section 6), with the introduction of interaction terms and the consequent estimation of a higher number of parameters.

The second term on the right side of the equation indicates the interaction of age with the event dummy variables. The variable age is centred at the mean for each t and gender to preserve the interpretation of the event dummy variables as the penalty effect at the average sample age (by gender) in year t. The interaction term is aimed at accounting for the effect of having a child in different stages of the parents’ life and career. Xit is a set of time-varying individual (age squaredFootnote 9, education, marital status) and household variables (income of other household members, additional child being born after the first child, and number of elderly (75+) in the household). We also include a lagged average two-year GDP growth rate to account for the effects of the economic cycle and a dummy variable that accounts for the major changes in family policy introduced in 2007 (2007–2018 = 1, 0 otherwise)Footnote 10. The full list of variables included in the analysis and the relevant descriptive statistics are presented in Tables A1, A2 in the Appendix.

The two final components of the model are person-fixed effects, which control for all observable and unobservable time-invariant variables, and the error term. Inclusion of the person-fixed effects, enabled by the existence of the longitudinal dataset, effectively neutralizes all observable and unobservable individual differences. Therefore, the event-time coefficients αj essentially estimate average personal outcome trajectories over the years after controlling for the changes in covariates Xit.

Our specification differs from the one presented in Kleven et al. (2019a, p.187 Eq. 1), as they account for potential covariates by including a full set of age and time dummy variables. In this way, the authors control “non-parametrically for underlying life-cycle … and time trends…” (p. 188). We opt for the specification presented in Eq. 1 in this section for two main reasons. First, our sample size is significantly smaller than the one used by Kleven et al. (2019a); as a consequence, their specification would reduce the degrees of freedom and reliability of our results, especially when the sample is split to analyse the effects of the first- and higher-order births (Section 5.3). Second, Kleven et al. (2019a) control for life-cycle and time trends by using age and time dummies, which prevents the inclusion and analysis of the variables in the vector Xit that are correlated to life and time changes (e.g. changes in marital status, household income, changes in GDP growth, etc.). The inclusion of both age and time dummies and Xit variables would cause multicollinearity and endogeneityFootnote 11. As a consequence, and even more importantly, with Kleven et al.’s (2019a) specification, we could not interact life-cycle and time-variant variables with event-time dummies in order to analyse their impact as drivers of the penalty, which represents a key part of our work (see Section 6). Despite opting for an alternative approach, wherever possible, we replicate our analysis using the Kleven et al. (2019a) specification. This allows us to compare our results to the main reference empirical analysis and to provide a robustness check for our results. It should be noted that the comparability between the two analyses is, in any case, not complete, as they are based on different types of data (in our case: survey, based on a sample; in the case of Kleven et al., 2019a: population census data), which crucially affects the size of the datasets. The comparison of the results from the robustness check is therefore regarded as a descriptive exercise.

The use of sample data instead of census data suggests that controlling for selection into employment would be appropriate as a conservative choice in terms of identification since, as discussed in the literature review, selection can have a relevant impact on the estimation of the child penalty. Hence, in the estimations for hours worked and wage rates, we implement a Heckman-type correction for each event year j = (−3; 5) and gender (m, f). To this end, we first split the sample into subsamples for each event time period and gender (total of 18 subsamples); for each subsample, we then estimate selection into employment (1 employed, 0 otherwise), conditional on a set of personal and household characteristics (age, age squared, education, marital status, income of other household members, additional child being born after the first child, number of people with disabilities, household size and lagged average two-year GDP growth rate). Based on the estimated probability of employment, we compute inverse Mills ratios (IMRs) as the ratios of the probability density function to the cumulative distribution function (Wooldridge, 2002) and include them as additional regressors. With the inclusion of our lagged GDP variable, we control for the potential heterogeneity in selection due to the economic cycleFootnote 12. The logic behind the event-time sample split, rather than a year-by-year split, is that the mechanisms of participation are different in the years before, during, and after the birth, and in this way, the selection term accounts for the changes in the unobservable determinants of hours worked and wage rates in these periods.

The results of the participation equations (not reported here and available upon request) show that for women, in the years before giving birth, age is the dominant driver of participation. Conversely, shortly after birth, being married has a negative effect, whereas in the whole period after birth, higher household income reduces participation. Higher education increases participation in all years. Additional births also obviously decrease participation. Distinctive features of the drivers of participation for men are the positive effect of being married, the role of education being limited to after-birth years and the irrelevant role of additional births.

5.2 Baseline results

Complete results of the estimates on the full sample of our baseline model are reported in Table A3 in the appendix. Earnings and employment equations are estimated via fixed-effect tobit (Honore et al., 2000) and random-effects logit, respectively. Hours worked and hourly wages are estimated via random-effect and fixed-effect OLS, respectivelyFootnote 13. The results indicate that the effects of the control variables are largely in line with ex ante expectations. The birth of an additional child has a significant negative impact on mothers’ earnings only via lower employment probability, whereas being married has a negative effect for mothers and a positive effect for fathers, and the effect is signficant again only in employment equation. For both parents, having higher household income (other than their own) lowers the employment probability and wages, whereas a positive economic cycle, 2007 benefits reform, and higher levels of education increase the likelihood of employment and of higher wages.

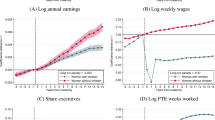

Regarding the focus of the paper, as in previous studies (e.g. Kleven et al., 2019a; 2019b), we summarize our core results on the motherhood and fatherhood penalty graphically by plotting the marginal effects derived from the coefficients in Table A3 (see Fig. 2). The results indicate that five years after the birth of the child, women still suffer an earnings penalty, while the same effect is not observed for men. The penalty is the strongest for the year of the birth (Year = 0) and decreases in the following years. The penalty already appears in the year before birth (Year = −1), likely due to sick leave during pregnancy and maternity leave. In contrast, we do not find any substantial evidence of either penalties or premiums for men. Given that we observe no effect (positive or negative) for fathers, the child penalty, defined as a difference between motherhood and fatherhood penalties, is equal to the motherhood penalty. For this reason, we focus on the interpretation of the results for mothers only.

Changes in labour market outcomes of women and men with respect to the year of the birth of the child. Notes: The panels present marginal effects (in percentages, compared to the stable period of two before birth of the child, t = −2) of event-time variables, based on the αj coefficients from Eq. 1. Coefficient estimates and additional notes on the estimations are presented in Table A3 in the Appendix. Each panel represents one of the four outcomes: Total monthly earnings, Employment, Hours worked and Hourly wages, separately for women and men. Hours worked and Hourly wage are estimated conditional on employment. The lines below and above the dots represent 95 confidence intervals based on robust standard errors (Tables with marginal effects and their standard errors are available upon request)

The earnings penalty for women stems exclusively from the employment penalty, which is significant throughout the whole period monitored (see column ‘Empl’ in Table A3 for the logit coefficients and the top-right panel in Fig. 2 for a plot of the marginal effects). Compared to two years before birth, women’s employment probability decreases by 65 percentage points in the birth year and by 40 percentage points in the year after birth. Employment four/five years after birth remains approximately 6 percentage points lower than in the baseline year, albeit this effect is significant only at the 0.1 level. Furthermore, in the year before birth, women’s employment is lower by 9 percentage points due to pregnancy leave. On the other hand, we find no evidence of penalties in terms of working hours or hourly wagesFootnote 14. As a robustness check, Table A4 in the appendix presents the results of the estimation of the motherhood and fatherhood penalties obtained using the Kleven et al. (2019a p.187) specification. To facilitate the comparison with the reference literature, the table reports marginal effects (estimation coefficients available upon request). The results suggest that the estimated effects do not differ significantly from those obtained using the specification in Eq. 1.

The interactions of event-time dummy variables with age (see Table A3) indicate higher earnings penalties for older mothers, again mainly stemming from employment. This means that older mothers have more difficulties re-entering employment after they have given birth than younger mothers. The existing empirical evidence on this specific point is mixed (see Rønsen & Sundström, 2002; Ondrich et al., 1996). Our results are consistent with the idea that older mothers may suffer a growing disadvantage when re-entering employment due to a faster rate of deterioration of their human capital/skills, a limited length of their expected working life (which weakens the incentives to invest in training), and an older age profile of the household. The latter means lower support for child-rearing and heavier caretaking duties for old family members. In this case, one might expect a widening of the motherhood penalty as women age into midlife (Blackburn et al., 1993; Loughran & Zissimopoulos, 2008), especially in contexts such as Russia, in which part-time employment options that would facilitate better work-life reconciliation are limited. Gustafsson et al. (1996) suggest that older mothers might have had enough market work and decide to stay at home longer or not to re-enter employment. Our result is not new in the empirical literature. Wetzels and Tijdens (2002), for example, found that Dutch mothers younger than 45 years are five times more likely to re-enter employment than women over 45 years.

The absence of motherhood penalties in wage rates and hours worked in Russia stands in contrast to the evidence provided by studies with a similar approach for other countries (Bertrand et al., 2010; Angelov et al., 2016; and Kleven et al., 2019a; 2019b). Our results can be viewed in the context of the specific Russian cultural environment and institutional labour market features described in Section 3. The pervasiveness of traditional gender role models entails that mothers strongly prioritize (or have to prioritize) childcare duties over labour market participation, particularly due to childrearing duties in the early stage of the children’s life. Re-entry into employment therefore seems a feasible option only once children enter their school ageFootnote 15. At the same time, limited nonstandard employment options available in the Russian institutional settings make labour market marginal adjustments less likely. We refer in particular to part-time job contractual options, which normally enable better chances to reconcile family and work duties.

Our results can also be viewed in light of other features of the Russian labour market that in the past decades have shaped a peculiar model characterised by an overall stability of employment despite wide output fluctuations. This model is based on a combination of two main features: (i) downward flexibility in wages and working hours, allowing individuals to remain in employment in times of a steep decline in output, and (ii) high labour market mobility, enabling individuals to more easily and quickly move between various states in the labour market (see Gimpelson & Kapeliushnikov, 2013; Gurvich & Vakulenko, 2017; Gimpelson, 2019). Our evidence suggests that the first feature is not serving the needs of mothers, probably due to the gender role factors just discussed. Those women who re-enter employment immediately after having given birth manage to keep the same prebirth employment conditions and wages. However, in other cases, working or earning less after having given birth is simply not an option, as carrying out parental tasks in the first years of life of the child is perceived as incompatible with any other activity. For these women, however, the high intensity of turnover of the Russian labour market facilitates re-entering the labour market once the child-rearing duties are less pressing and the combination of parenthood and work becomes socially acceptable.

5.3 Penalty for the first child and additional children

Thus far, we have provided evidence on the size of the penalties in the overall sample of mothers and fathers. In this part of the analysis, we replicate the analysis on two separate samples related to (i) first-order births and (ii) higher-order births. The second group includes as units of observation women and men who had their previous child prior to the year of birth of the child we use for the definition of the event-time variables. We do not use the birth of these older children as a critical event, as we are not able to observe their parents’ labour market outcomes in the years around their birth. This split is important as, in the first place, it enables us to compare our results more directly to previous event studies on child penalty, all exclusively focused on the first child (Bertrand et al., 2010; Angelov et al., 2016; Kleven et al., 2019a; 2019b). Second, there is evidence that parental labour market adjustments may differ between the birth of the first and additional children (see, for example, Hynes & Clarkberg, 2005; Doren, 2018), and we want to explore these differences using the methodology of event studies.

The outcomes presented in Table A5 (first-order birth parents) and Table A6 (higher-order birth parents) in the appendix confirm the results from the overall sample of women and men. In both subsamples, women suffer earnings penalties, stemming uniquely from participation penalties; effects on hours worked and hourly wages are instead not significant. On the other hand, men do not suffer any kind of penalty associated with either first- or higher-order births. Therefore, as we again observe no effect (positive or negative) for fathers, the child penalty is equal to the motherhood penalty, and we focus on the results for mothers only. Again, as a robustness check, Table A7 in the appendix presents the results of the analysis on the same subsamples (first-/higher-order births; mothers/fathers) using the Kleven et al. (2019a, p.187) specification. Outcomes completely overlap with those from our empirical approach.

Figure 3 graphically summarizes the marginal effects associated with the coefficients in women’s employment equations in two subsamples (Tables A5, A6, column ‘Empl’ for women). First-time mothers suffer an employment penalty of 65 percentage points in the birth year and 44 percentage points in the year after the birth. With reference to the comparable evidence available for other countries (Kleven et al., 2019b), the size of the employment penalty in Russia in the first years around the birth is aligned to those of the German- and English-speaking countries but higher than in Scandinavian ones. The size of the penalty 4/5 years after the birth of the child for first-time Russian mothers declines to approximately 17 percentage points, which is lower than in German- and English-speaking countries but similar to Scandinavian contexts. Hence, considering the overall pattern of the employment penalty over time, Russia performs similarly to Austria and Germany; however, in Russia, the employment penalty seems to plateau earlier and at lower long-term levels. This is mirrored by a similarity in the length (relatively long) and design of parental leave systems. As in Russia, Austria and Germany offer a relatively long parental leave (up to three years, two of which include job protection in Austria; and three years in Germany for both parents until the child is 8 years old). However, the maternity leave allowance is more generous in the two countries than in Russia, being income based for approximately one year and guaranteeing a lower flat rate for the rest of the period.

Women’s employment penalty for first- and higher-order births. Notes: The panels present marginal effects (in percentage points, compared to the stable period of two before birth of the child) of event-time variables, based on the αj coefficients from Eq. 1. Estimated coefficients and additional notes on the estimations are presented in Tables A5, A6 in the Appendix (columns “employment” for women). The lines below and above the dots represent 95 confidence intervals based on the robust standard errors (Tables with marginal effects and their standard errors available upon request)

Our outcomes highlight an interesting asymmetry in the length of the employment penalty between the two groups of women. While first-time mothers still suffer employment penalties up to five years after birth (and possibly beyond), employment penalties for higher-order births are significant up to 2 to 3 years after birth. Our results are in line with the finding that not returning to employment is slightly more common for first‐time mothers than for mothers experiencing additional births (Hynes & Clarkberg, 2002; 2005; Klerman & Leibowitz, 1999). A possible interpretation is that second-time mothers, if they have managed to participate in employment after the birth of the first child, already have set up a sustainable work-family reconciliation model. After the birth of an additional child, they can more easily and quickly implement or adjust this organization and return to work earlier. Another explanation, not an alternative to the previous one, is that first-time and second-time mothers might have different preferences regarding the alternative between childcare and paid work (see Barnes, 2013; Rose, 2021). In particular, first-time mothers might be relatively less inclined to delegate child rearing to other people at home (relatives, babysitters) or to childcare facilities (kindergarten), thereby prolonging their time out of the labour force.

6 Individual and household heterogeneity and the magnitude of the penalty

The outcomes presented thus far indicate that the employment penalty virtually drives the whole earnings penalty suffered by mothers. However, this is an average effect that might hide some heterogeneity related to personal characteristics and household circumstances, as some literature reviewed in Section 2 suggests. A further step of investigation is therefore needed to identify which factors, if any, are able to affect the magnitude of the penalty. Furthermore, although we have not identified strong (mean) effects in terms of hours and hourly wage penalties, there could be factors that enable effects on these variables to emerge as well. Following the early work of Jacobson et al. (1993), we interact the event dummy variables with a number of covariates to uncover which factors moderate or magnify the detrimental effect of the birth of a child on labour market outcomes:

where Zit is a set of variables that we interact with event-time dummies. The Zit consists of time-varying variables that are already in Eq. 1 as additional covariates, such as incomeFootnote 16 or marital status, and time-invariant variables such as own and partner’s religious beliefs (proxy for conservative attitudes), own and partner’s parents’ education levels and own and partner’s mother’s status in the labour market. We investigate the effect of each of these factors separately (rather than simultaneously) to avoid multicollinearity issues and the estimation of a large number of parameters. We investigate the potential drivers of employment, hours worked and hourly wage penalties and present only the results of the relevant variables of interest (i.e. those that are statistically significant).

A first important piece of information emerging from our estimates is that basically none of the interactions in the models of the drivers of hours worked and hourly wages are signficant (results not presented here but available upon request)Footnote 17. This confirms the evidence from the baseline estimation and rules out the possibility that this outcome could hide some kind of heterogeneity.

In contrast, interesting results emerge on the side of employment penalty. Table 1 reports a summary of results (marginal effects) of the drivers of female employment penalty that are significant in our estimates: marital status, household income and strength of mother’s and her partner’s religious beliefs (see Table A8 for the complete results of the logit estimates). In the first column of Table 1, we report, for comparative purposes, the baseline results in terms of marginal effects presented in Fig. 1 (panel ‘Employment’) and based on the estimation coefficients presented in Table A3 (column ‘Empl’ for women). In the following columns, we show the results of augmented specifications (Eq. 2), in which we subsequently add the interaction of event dummies with factors affecting employmentFootnote 18.

The lower panel (‘Interaction terms’) of Column 2 suggests that married women are less likely to return to work after having given birth than single women. Namely, in the years of birth and after birth, married women are approximately 15 percentage points less likely to return to work than single women. Differences in the likelihood of participation between married and single women decrease over time but remain significant; after 4 to 5 years after birth, married women are approximately 10 percentage points less likely to return to work than single women. In fact, for single women, the penalty at 2 to 3 and 4 to 5 years after birth is not significant (upper panel in Table 1)Footnote 19. Additionally, the likelihood of participation for married women in the year before birth is approximately 13 percentage points lower than for single women, for whom the coefficient is not statistically significant. In line with our previous interpretations, this result indicates that married women are more likely to take pregnancy leave, whereas single women rarely use this opportunity.

On the other hand, the results in Column 3 (panel ‘Interaction terms’) suggest that higher household income decreases the likelihood of returning to work after having given birth. The interaction is significant up to 3 years after birth. The magnitude of the effect is not negligible as in all years, and even 2 to 3 years after the birth, a 10 percent higher income is associated with an approximately 0.4 percentage point lower likelihood of returning to work. The results from Columns 2 and 3 are in line with the explanations given within the household production theories. If a woman can economically rely on her partner’s earnings to meet her and the child’s needs, she is more likely to completely devote herself to raising the child. The extent to which this is a deliberate choice, rather than the result of conditioning social or cultural factors, remains an open question. Conversely, single women or those with a lower income are forced to return to work as early as possible to provide resources for raising children.

Columns 4 and 5 illustrate the effects of religious beliefs on women’s employment penalty. The variable is based on question J72.18 of the RLMS individual questionnaire, related to the respondent’s position towards religion and ranging from 1 (highly religious) to 5 (atheist)Footnote 20. The variable we use in the analysis has been coded as a dummy variable equal to 1 for those reporting high attachment to religion and 0 for those with low attachment (see Table A1 in the appendix for details) to make interpretation of the results more intuitive. Higher attachment to religion is widely documented to be closely associated with more traditional/conservative gender role beliefsFootnote 21.

In our sample, the majority of individuals defining themselves as believers belong to the orthodox religion (91.5%), which does not represent an exception in terms of gender patriarchal attitudesFootnote 22. As a matter of fact, Seguino (2011), comparing patriarchal attitudes across ten religious affiliations, finds that no single religion stands out as more gender equitable than others. Our results suggest that a higher attachment to religion by the child’s father is associated with a lower probability for mothers to return into employment (Column 5, Panel ‘Interaction terms’). Interestingly, no similar effects emerge for mothers’ own religious beliefs on their employment probability (Column 4). The interaction with fathers’ religiousness is significant in all years after birth. Women who have strongly religious husbands have an approximately 10 percentage point lower likelihood of returning to work even after 4 to 5 years. The results also suggest that for the latter group, employment penalties are not significant four or five years after birthFootnote 23

The results in Columns 4 and 5 tell an interesting story about how fathers’ conservative beliefs reverberate into mothers’ decision to return to work. Conversely, mothers’ own beliefs show no impact. This suggests that a strong asymmetry might exist in decision-making and in the distribution of power within the household in favour of the father, as his beliefs are the ones impacting the household model, particularly when and how the female spouse will return to work after having given birth. Therefore, patriarchal values that affect women’s employment are transmitted through the woman’s husband rather than her own values. This effect is independent of the effects of the household family variables, as when all the interaction variables are introduced in the model, the size and the significance of the coefficients for all interaction variables remain unchanged.

Table A9 in the appendix reveals that the employment drivers differ between first-child and higher-order births. The penalty-augmenting effect of marital status and household income on employment is observed for first-time mothers only (Columns 2 and 3, panel ‘Interaction terms’). After the birth of the first child, married mothers have between 15 and 20 percentage points higher probability of staying out of employment than single mothers in the year before and in all the years after the birth. Unlike married women, single mothers do not have a significant penalty in the year before or 4 to 5 years after birth. First-time mothers with higher income have a lower likelihood of returning to employment for the whole period observed after birth. No similar effects emerge after the birth of additional children (Columns 7 and 8, panel ‘Interaction terms’)Footnote 24.

In contrast, the impact of fathers’ religious beliefs observed in the total sample seems driven by (and confined to) the birth of children after to the first child (Column 10, panel ‘Interaction terms’). For these mothers, high levels of religious beliefs of the father are associated with between 11 and 16 percentage points lower likelihood of returning to employment. In contrast, mothers who have less religious partners suffer penalties only in the first year after birth. Similar outcomes (not reported here but available upon request) can be observed for fathers’ involvement in preparing meals: higher involvement has a positive effect on female employment prospects after birth, but only for additional children. This evidence seems to indicate that gender roles and beliefs affect mothers’ employment prospects only when the number of children increases.

One possible explanation is that while in the eyes of a conservative father, raising one child is still compatible with labour market participation by the mother, this is not the case when the size of family increases, and the role of the woman is expected to become exclusively centred on child-rearing and housework. This is consistent with the literature emphasizing how gender beliefs correlate to family size and the unbalanced division of labour within the household (see Kaufman, 2002; Schober, 2013; Baxter et al., 2008). A second possible explanation, however, is related to the literature on the relationship between gender role division and the transition to second births, which emphasizes how more gender egalitarian attitudes and behaviours of fathers increase the probability of higher fertility rates (see Torr & Short, 2004; Oláh, 2003; Miettinen et al., 2011). Compared to the decision to become a mother for the first time, in which intrinsic needs and preferences probably play a dominant role, the choice of having additional children might be significantly more conditioned by women with a higher commitment by fathers to the child-rearing effort. This is due to women’s awareness, also underpinned by the experience with the first child, that raising two or more children is only compatible with labour market participation if housework and child-rearing duties are adequately shared with the partner. Should this be the case, this mechanism could indeed shape the evidence, emerging from our analysis, of a relationship between less conservative behaviours of fathers (and thus, a higher willingness to share the family workload) and a higher probability of mothers re-entering employment after the second (or more) birth(s). In contrast, when the father has more conservative attitudes and biased gender beliefs and probably more power within the family, the employment/career preferences of mothers are weak and have no or little relevance in the decision to have additional children. This materializes into housework- and child-rearing-heavy burdens that prevent or, in the best case, delay mothers’ re-entry into employment.

7 Impact of children on jobs and occupations

The results presented in Section 5 clearly indicate that motherhood (not fatherhood) is associated with large and persistent negative effects on earnings essentially driven by a decline in employment participation. The complementary evidence of Section 6 suggests that the drivers of the motherhood penalty are related to household characteristics and behaviours that, according to our interpretation, shape a gender asymmetry in family workload and responsibilities for child rearing. Should this explanation hold true, we should also observe a shift towards more family-friendly jobs for mothers after the birth of a child. We investigate this possbility in this section, following Kleven et al. (2019a). They find that in Denmark, women are less likely to work in higher occupations, particularly in managerial positions, after giving birth. At the same time, after the birth of the child, women are more likely to work in the public sector and men in the private sector.

We analyse the changes in job characteristics that occurred in the period around the birth of the child by using the specification described in Eq. 1. Statistically significant effects are presented in Table A10 in the appendix, and the marginal effects calculated based on their coefficients are plotted in Fig. 4.

Changes in type of occupation for women and men with respect to year of the birth of the child. Notes: The panels present marginal effects (in percentage points, compared to the stable period of two before birth of the child) of event-time variables, based on the αj coefficients from Eq. 1. Complete results and additional notes on the estimations are presented in Table A10 in the Appendix. The lines below and above the dots represent 95 confidence intervals based the robust standard errors (Tables with marginal effects and their standard errors available upon request)

The results indicate that women are less likely (by approximately 5 percentage points on average) to be employed in occupations entailing supervision of other workers (variable J6 in the RLMS questionnaire) in all the years after birth, while this effect for men is nonsignificant (Fig. 4, left panel). On the other hand, we find that starting from the year of the birth of their child, men are less likely to work in the public sector, i.e. they are more likely to work in the private sector by approximately 10 percentage points (Fig. 4, right panel). In contrast, no similar significant effects emerge for mothers. We find no effects of childbirth on the probability of being employed in high/low rank occupationsFootnote 25 or as self-employed for both genders (results available upon request).

These findings are consistent with the evidence that emerged in Section 6, where we found that the drivers of women’s employment penalties (marital status and household income) can be interpreted in light of household production theories. With increasing responsibilities at home, women are less likely to work in jobs that require more responsibilities, higher commitment and flexibility (such as those entailing supervision of other workers). On the other hand, a higher likelihood of working in the private sector for men can be explained by the need for a higher income if the mother decides (or needs) to leave the labour force, as the private sector pays higher wages (e.g. Gimpelson et al., 2019). However, as revealed by our results in Section 5, this higher likelihood of working in the private sector does not materialize in an increase in male wages, at least not a statistically significant increase. This evidence can have two interpretations. First, increases in wages that arise from transitions to the private sector of a relatively small share of fathers could be diluted by changes (or rather stagnation) in the wages of the remaining fathers. Second, the decision to enter the private sector might be driven by expectations of wage growth materializing only in the medium or long run, as the private sector provides better opportunities for promotion than the public sector, where the wage curve (to seniority) tends to be flatter. Coincidentally, Kleven et al. (2019a) also find for Denmark that a higher likelihood of working in the private sector for men is not followed by a wage increase (even in the long term), despite wages being higher in the private sector (see, e.g. Campos et al., 2017).

8 Conclusions

In this paper, we estimated the child penalty in Russia using unique RLMS data and the event-study approach. Unlike previous studies on Russia, which typically employed cross-section data, the use of the person-fixed effects and the event study framework place the claims of existence (or nonexistence) of the penalty on a higher degree of reliability. We analyse the penalty in overall monthly earnings and then decompose the analysis into three components: employment, working hours and hourly wage penalties. We additionally investigate how the birth of children shapes changes in parents’ job characteristics.

Our results suggest that women in Russia suffer an earnings penalty throughout the whole period we monitor, i.e. up to 5 years after the birth of a child. No similar effects are found on fathers; thus, we have focused on the interpretation of the motherhood penalty only. The motherhood penalty materializes in terms of lower employment, whereas we find no evidence of a penalty in hourly wage rates or at the intensive margin (fewer hours worked). Our results are in contrast to previous studies that employ a similar approach for the US (Bertrand et al., 2010), Denmark (Kleven et al., 2019a), Sweden (Angelov et al., 2016) and a set of five European countries plus the US (Kleven et al., 2019b), which found that parenthood for mothers also means a long-term decline in hours worked and wage rates. We explain this distinctive result for Russia in view of the specific institutional labour market features of the country. The limited availability of nonstandard employment options poses significant constraints on the possibility of resorting to part-time jobs, frequently incentivized in the US and Europe as a way to cope with family responsibilities. Clearly, the labour market institutional architecture in Russia is not conducive to such marginal adjustment mechanisms. Mothers either manage (or decide) to return to the jobs they had before having given birth and with unchanged hours and remunerations (also as an effect of maternity leave provisions) or they do not re-enter, at least shortly after the birth of the child, the labour market. Our results suggest that 4 to 5 years after the birth, the employment rates of mothers remain lower than the prebirth levels. This result is mainly driven by first-time mothers, whose employment rates remain approximately 17 percentage points lower 4 to 5 years after birth. Higher-order birth mothers have a higher probability of returning to work earlier, and the employment penalty disappears after 3 years.

In terms of the apparent trade-off between facilitating a return to employment but in weaker positions (part-time or low-pay jobs) and guaranteeing the quality of jobs at the cost of lower employment, Russia seems to place itself towards the second extreme. Alternatively, given the pronounced gender pay gap between men and women, it could also be argued that what we observe is a sort of floor effect. If women are not reaching a high earnings position, giving birth will not have a significant impact on their career, and they will return to the low-paying jobs they had before the birth.

Employment penalty is therefore the only, and quite powerful, channel through which parenthood negatively affects women’s position in the Russian labour market. A more detailed analysis of the factors affecting the magnitude of the employment penalty suggests that it might significantly depend on the division of work within the household. When mothers need to provide a crucial contribution as income earners, i.e. if they are single and/or their family has lower levels of income, they go back to work more often and earlier. On the other hand, if they can economically rely on their partners or on other family income sources, the traditional division of work kicks in: men go to work to earn income for household, while women stay at home to perform domestic work. This division is further perpetuated if partners’ beliefs are more conservative. These interpretations are consistent with the evidence on changes in parents’ job characteristics following the birth of a child. Even when choosing to return to employment, women tend to seek less demanding jobs by working less frequently in supervisory positions, while men tend to switch to the private sector in search of higher future wages. This finding supports the existing evidence of a strongly unbalanced distribution of power within the family in favour of men, a persistent feature of Russian society.

Data availability

The database used for the empirical analysis (Russia Russian Longitudinal Monitoring Survey) is publicly available.

The dataset assembled for the analysis and all materials are rendered available upon request.

Code availability

Codes are rendered available upon request.

Change history

18 July 2022

Missing Open Access funding information has been added in the Funding Note.

Notes

The expression child penalty is interchangeably used in the literature to identify both the labour market loss of (i) mothers compared to nonmothers, and (ii) mothers compared to fathers. The second definition is consistent with our purposes and motivations, as it allows light to be shed more directly on gender asymmetries and their social, economic and institutional drivers.

Given that we observe no effect (positive or negative) for fathers, the child penalty, defined as the difference between motherhood and fatherhood penalty, is essentially equal to the motherhood penalty, and throughout the paper, we focus on the interpretation of the results for mothers.

The success of financial incentives to increase fertility in Russia has been documented for previous reforms as well. In 1981, Russia extended maternity benefits in terms of parental leave and cash transfers upon a child’s birth. The reform is reported to have increased fertility for the whole duration of the program (ten years) and to have triggered higher-order births for women who already had children before the program started (see Malkova, 2018).

In the latest year available (2012), the percentage of Russian respondents strongly agreeing or agreeing with the statement “Family suffers when the woman works” amounted to 37%. The corresponding figure was 12% for the US, 24% for the UK, 20% for Germany and 13% for Sweden. Similarly, 30% of Russians agree or strongly agree that “what women really want is home and kids” (27% in the US, 23% in the UK, 15% in Germany and 14% in Sweden). Last, 31% of Russian respondents agree or strongly agree that “men’s job is to earn money, and women’s job is to look after the home” (17% in the US, 11% in the UK, 9% in Germany and 4% in Sweden) (Source: own elaborations on data files available at GESIS Data Archive, Cologne. ZA5900 Data file Version 4.0.0, https://doi.org/10.4232/1.12661).

When comparing preferences for traditional roles in marriages across age groups, Russia is the only country where young and middle-age generations have a stronger preference for traditional roles than older generations. Roughly a third of young adults state that they prefer a marriage where the husband provides for the family and the wife takes care of the house and the children, compared to only 19% of older adults. In all remaining countries covered by the analysis, the old–young generation gap in preferences is reversed, ranging from 9% to 24% (see Pew Research Center 2019).

For those who are currently working (question J1), if missing values for variables J10 and J40 are observed, we use average monthly wage in the last twelve months (J13.2) and the total amount of money personally received in the last 30 days (J60) as proxies for their current wages.

Where we observe earnings variables for women on maternity leave, we replace these values with zero values to preserve the consistency with the employment variable. We assume that they refer to their pregnancy/maternity benefits, which are not the main focus of our research but are included as control variables for total household income (without wages).

For those who are currently working (based on question J1), if missing values for variables J8 and J38 are observed, we use hours in a usual work week on the primary (j6_2) and secondary job (j36_2) as a proxy for current working hours.

Nonlinear age trends could appear in the interactions with the event-time variables as well; however, when included, these trends are generally not significant and originate multicollinearity issues (results available upon request). In any case, the nonlinearity of age seems not to be an issue for the interpretation of the event-time coefficients, as robustness checks carried out using the same estimation strategy as used by Kleven et al. (2019a; 2019b) (i.e. controlling nonparametrically for underlying life-cycle trends by including a full set of age dummy variables) yield similar results and lead to the same conclusions (see Sections 5.2 and 5.3).

Unfortunately, the structure and size of our sample do not allow an effective analysis of the impact of family policy reforms introduced in 2007 on the event-time dummies. For this purpose, we would need individuals entirely observed (t = [−3; 5]) either before or after 2007. Restricting the sample to these observations would approximately halve our sample size, crucially affecting the quality and significance of our analysis.

Given the inclusion of the person-fixed effects, the impact of covariates Xit (marital status, household income, etc.) is essentially reduced to the effect of (annual) changes in these variables on the changes in the outcome variables. Given this research design, age- and time-fixed effects (set of dummy variables for each of age and year in the sample – in total, 52 dummy variables in our sample), if included together with covariates, causes multicollinearity, as both sets of variables essentially account for (annual) changes in life-cycle and time trends during the period (results available upon request). Additionally, the inclusion of the age- and time-fixed effects could lead to endogeneity issues, i.e. correlation of the error term with the covariates Xit, as two sets of variables are correlated.

The exclusion restriction (or rather the exogeneity) of IMRs to the main estimates is drawn from the fact that the two steps in the estimation take advantage of different sources of variation and samples. The main estimates control for individual fixed effects and essentially analyse the (within-person) dynamics of the outcome variables over time (i.e. how the changes in the independent variables affect changes in outcomes). On the other hand, the estimation of the IMRs is based on separate probit regressions for each of the fixed event-time periods (three years before the birth, two years before the birth, etc.); hence, person-fixed effects are not included, and we take advantage of the between-person heterogeneity in the determinants of participation. As a consequence, although we use in the two steps a similar set of explanatory variables, the exclusion restriction is drawn from the fact that our main estimates takes advantage of within-person heterogeneity, whereas IMR estimations take advantage of between-person heterogeneity explored in seven separate event-time subsamples. The results obtained, not including the correction for selection, are available upon request and do not differ substantially from the ones presented in the following sections.

The choice of random/fixed effect is based on the usual Hausman specification test (results available upon request). The choice of the tobit estimator for the earnings equation (rather than OLS) is motivated by the presence of many zeroes in our sample, which increase the likelihood of the OLS model being strongly biased.

Given that our empirical model includes person-fixed effects, the event-time coefficients essentially estimate average personal wage trajectories over time (compared to the baseline period, t = −2) after controlling for the changes in covariates Xit. However, it is interesting to note that women from all levels of the prebirth wage distribution are equally likely to remain inactive. There are indeed no statistically significant differences in average wages in the baseline period (t = −2) between those women who return to work and those who remain inactive (t = 0.424; p = 0.672; and t = −1.072; p = 0.284, respectively, for t = 1 and t = 2/3). Similarly, the results of the Kolmogorov–Smirnov test for equality of distribution functions confirm that there are no differences in the wage distributions in the baseline period (t = -2) between women who return to work and those who remain inactive in t = 1 and t = 2/3 (D = 0.105; p = 0.408; and D = 0.091; p = 0.620, respectively).

This is consistent with our evidence that mothers’ employment rates converge towards prebirth levels in t = 4/5, as the enrolment of children into primary schools is approaching. The evidence from the International Social Survey Programme (again referred to the latest year available, 2012) corroborates this interpretation. The percentage of Russian respondents stating that women should “stay at home until the youngest kid is at school” amounts to 8%. The corresponding figure for the benchmark countries studied in our reference papers are 3.5% in the US, 2% in the UK, 4.5% in Germany, 0.9% in Sweden and 0.4% in Denmark. Similarly, Russian respondents who think that mothers can work full time while the youngest child is at school amount to 33% (the corresponding percentages are 44% in the US, 27% in the UK and in Germany, 46% in Sweden and 64% in Denmark) (Source: own elaborations on data files available at: GESIS Data Archive, Cologne. ZA5900 Data file Version 4.0.0, https://doi.org/10.4232/1.12661).

The income variable is centered at the mean for each t and gender in order to preserve the interpretation of the event dummy variables as the effect at the average income for each gender in year t.