Abstract

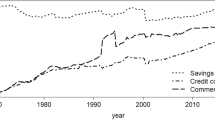

How should we discount cash flows generated by real estate projects up to 30 years in the future? In this paper, we develop a methodology to estimate the term structure of discount rates. We provide empirical estimates of the yield curve for the REIT market, and three subsectors: Equity, Mortgage, and Hybrids. We explore three empirical hypotheses related to the behavior of the yield curve: First, we examine whether the term structure for REITs should be upward or downward sloping. Second, because REIT betas tend to be counter-cyclical, we examine the hypothesis that discount rates implied by our term structure model should be higher than those implied by the traditional CAPM. Third, in the spirit of Campbell 1991, we decompose the variance of REIT prices into variation due to the cost of capital and variation due to expected cash flows and find some unexpected results.

Similar content being viewed by others

Notes

Financial managers realize the importance of getting the right estimate for the cost of capital. Downward biased estimates lead managers to overestimate the market value of a project; in turn, if such investments have a negative net present value, then firm value may be destroyed in the capital budgeting process. Alternatively, biased-up cost of capital estimates may lead firms to reject some positive net present value projects, and potentially lose market shares to competitors.

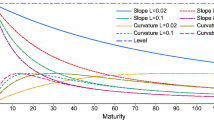

In Section 2.C, we present a numerical example to illustrate how time-varying betas and market risk premium lead to a term structure of discount rates.

Government regulation is another unique feature: REITs are required to pay out at least 90% of their taxable income as dividends; they are also required to generate at least 75% of their gross income from rents (e.g., Steiner and Riddiough 2018; Ott et al. 2005). Our analysis is performed within the REIT industry or across-REIT property segments that are similarly affected by regulation. Therefore, regulation is unlikely to bias our results.

This claim holds to the extent that such entities possess some of the characterizing features of REITs (e.g., firms that buy and hold commercial real estate assets for the purpose of generating rental income, maintain traditionally high-dividend payout and leverage ratios, are characterized by a disperse ownership base, etc.).

This model is very popular in the literature going back to the seminal work in continuous time by Vasicek (1977).

If we set the expected cash flow at $1 for certain, then this valuation model is a discrete time analog of the zero coupon bond pricing formula in Vasicek (1977).

It is well known that the empirical distribution of realized returns has thick tails, thus a better approximation may be Student-t or Stable Paretian. Nevertheless, to obtain closed form solutions for asset pricing models, researchers have adopted the assumption of normality. To be consistent with theory, empirical studies adopt this convention.

According to the National Bureau of Economic Resarch (NBER) the great depression lasted from September 1929 thru March 1933, while the Great Recession was from December 2007 thru June 2009.

We consider also the hypotheses \( {H}_0:\overline{\rho \left(\tau \right)}=0 \) for τ = 1, 5, 10, 15, 20, 25, and 30, and H0: \( \overline{\mu}=0 \). As expected, the evidence against all of the nulls is overwhelming.

Cotter and Stevenson (2006) provide some empirical evidence that REIT return variance is time-varying and may be best described by a GARCH process. However, the constant variance assumption is necessary to make our theoretical term structure model tractable, and on the applications side this assumption is quite common in the literature (e.g. Cosemans et al. 2016).

References

Ali, M. (1977). Analysis of autoregressive-moving average models: Estimation and prediction. Biometrika, 64, 535–545.

Ambrose, B., Lee, D., & Peak, J. (2007). Comovement after joining an index: Spillovers of non fundamental effects. Real Estate Economics, 35, 57–90.

Ang, A., & Liu, J. (2004). How to discount cash flows with time-varying expected returns. Journal of Finance, 59, 2745–2783.

Backus, D., Foresi, S., Mozumdar, A., & Wu, L. (2001). Predictable changes in yields and forward rates. Journal of Financial Economics, 59, 281–311.

Bekaert, G., Engstrom, E., & Grenadier, S. (2010). Stock and bond returns with moody investors. Journal of Empirical Finance, 17, 867–894.

Bollerslev, T., Engle, R., & Wooldridge, J. (1988). A capital asset pricing model with time-varying covariance. Journal of Political Economy, 96, 116–131.

Bracke, P., Pinchbeck, E., & Wyatt, J. (2018). The time value of housing: Historical evidence on discount rates. The Economic Journal, 128, 1820–1843.

Breeden, D. (1979). An Intertemporal asset pricing model with stochastic consumption and investment opportunities. Journal of Financial Economics, 7, 265–296.

Breidenbach, M., Mueller, G., & Schulte, K. (2006). Determining real estate betas for markets and property types to set better investment hurdle rates. Journal of Real Estate Portfolio Management, 12, 73–80.

Brennan, M. (1997). The term structure of discount rates. Financial Management, 26, 81–90.

Campbell, J. (1987). Stock returns and the term structure. Journal of Financial Economics, 18, 373–399.

Campbell, J. (1991). A variance decomposition of stock returns. Economic Journal, 101, 157–179.

Campbell, J. & Cochrane, J. (1999). By force of habit: a consumption‐based explanation of aggregate stock market behavior. Journal of Political Economy, 107(2), 205–251.

Carlson, M., Fisher, A., & Giammarino, R. (2004). Corporate investment and asset price dynamics: implications for the cross-section of returns. The Journal of Finance, 59(6), 2577–2603.

Case, B., Guidolin, M., & Yildirim, Y. (2013). Markov switching dynamics in REIT returns: Univariate and multivariate evidence on forecasting performance. Real Estate Economics, 42, 279–342.

Case, B., Yang, Y., & Yildirim, Y. (2012). Dynamic correlations among asset classes: REIT and stock returns. Journal of Real Estate Finance and Economics, 44, 298–318.

Chen, L. And X. Zhao, 2009, “Return decomposition,” Review of Financial Studies, 22: 5213–5249.

Chiang, K., Lee, M., & Wisen, C. (2005). On the time-series properties of real estate investment trust betas. Real Estate Economics, 33, 381–396.

Clayton, J., & Mackinnon, G. (2001). The time-varying nature of the link between REIT, real estate and financial asset returns. Journal of Real Estate Portfolio Management, 7, 43–54.

Clayton, J., & Mackinnon, G. (2003). The relative importance of stock, bond and real estate factors in explaining REIT returns. Journal of Real Estate Finance and Economics, 27, 39–60.

Cochrane, J., & Piazzesi, M. (2005). Bond Risk Premia. American Economic Review, 95, 138–160.

Corgel, J., & Djoganopoulos, C. (2000). Equity REIT Beta estimation. Financial Analysts Journal, 56, 70–79.

Cosemans, M., Frehen, R., Schotman, P., & Bauer, R. (2016). Estimating security betas using prior information based on firm fundamentals. Review of Financial Studies, 29, 1072–1112.

Cotter, J., & Stevenson, S. (2006). Multivariate modeling of daily REIT volatility. Journal of Real Estate Finance and Economics, 32, 305–325.

Dai, Q., & Singleton, K. (2003). Term structure dynamics in theory and reality. Review of Financial Studies, 16, 631–678.

Decain, P. (1994). Determining the discount rate from a CAPM equation. Real Estate Review, 24, 33–35.

Draper, D., & Findlay, M. (1982). Capital asset pricing and real estate valuation. Journal of the American Real Estate and Urban Economics Association, 10, 152–183.

Engle, R. F. (2016). Dynamic conditional Beta. Journal of Financial Econometrics, 14(4), 643–667.

Fama, E., & French, K. (1989). Business conditions and expected returns on stocks and bonds. Journal of Financial Economics, 25, 23–49.

Fama, E., & French, K. (1992). The cross-section of expected returns. Journal of Finance, 47, 427–465.

Fama, E., & French, K. (1997). Industry costs of equity. Journal of Financial Economics, 43(2), 153–193.

Fama, E., & French, K. (2002). The equity premium. Journal of Finance, 57, 637–659.

Fama, E., & French, K. (2015). A five-factor asset pricing model. Journal of Financial Economics, 116, 1–22.

Fama, E., & MacBeth, J. (1973). Risk, return and equilibrium: Empirical tests. Journal of Political Economy, 71, 607–636.

Feltham, G., & Ohlson, J. (1995). Valuation and clean surplus accounting for operating and financial activities. Contemporary Accounting Research, 11, 689–731.

Feng, Z., Ghosh, C., & Sirmans, C. F. (2006). Changes in REIT stock prices, trading volume and institutional ownership Resulting from S&P REIT index changes. Journal of Real Estate Portfolio Management, 12, 59–71.

Ferson, W., & Harvey, C. (1999). Conditioning variables and the cross section of stock returns. Journal of Finance, 54, 1325–1360.

Galai, D., & Masulis, R. (1976). The option pricing model and the risk factor of stock. Journal of Financial Economics, 3, 53–81.

Geltner, D. (1989). Estimating real Estate's systematic risk from aggregate level appraisal based returns. AREUEA Journal, 17, 463–481.

Giglio, S., M. Maggiori, K. Rao, J. Stroebel, & A. Weber. (2018). “Climate change and long-run discount rates: evidence from real estate”. Chicago Booth Research Paper No. 17–22, and National Bureau of Economic Research. https://doi.org/10.2139/ssrn.2639748.

Glascock, J. L. (1991). Market conditions, risk, and real estate portfolio returns: some empirical evidence. The Journal of Real Estate Finance and Economics, 4(4), 367–373.

Goldstein, A., & Nelling, E. (1999). REIT return behavior in advancing and declining stock markets. Real Estate Finance, 15, 68–77.

Gomes, J., Kogan, L., & Zhang, L. (2003). Equilibrium cross-section of returns. Journal of Political Economy, 111, 693–732.

Graham, J., & Harvey, C. (2001). The theory and practice of corporate finance: Evidence from the field. Journal of Financial Economics, 60, 187–244.

Harvey, C. (1989). Time-varying conditional Covariances in tests of asset pricing models. Journal of Financial Economics, 24, 289–317.

Hoesli, M., & Serrano, C. (2007). Securitized real estate and its link with financial assets and real estate: An international analysis. Journal of Real Estate Literature, 15, 59–84.

Keim, D., & Stambaugh, R. F. (1986). Predicting returns in the stock and bond markets. Journal of Financial Economics, 17(2), 357–390.

Khoo, T., Hartzell, D., & Hoesli, M. (1993). An investigation of the change in real estate investment trust betas. Journal of the American Real Estate and Urban Economics Association, 21, 107–130.

Lettau, M., Ludvigson, S. (2001). Consumption, aggregate wealth, and expected stock returns. The Journal of Finance, 56(3), 815–849.

Lettau, M., & Wachter, J. (2007). Why is long-horizon equity less risky? A duration-based explanation of the value premium. Journal of Finance, 62, 55–92.

Ling, D., & Naranjo, A. (2003). The dynamics of REIT capital flows and returns. Real Estate Economics, 31, 405–434.

Liu, C., & Mei, J. (1994). An analysis of real-estate risk using the present value model. Journal of Real Estate Finance and Economics, 8, 5–20.

Livdan, D., Sapriza, H., & Zhang, L. (2009). Financially constrained stock returns. Journal of Finance, 64, 1827–1862.

McIntosh, W., Liang, Y., & Tompkin, D. (1991). An examination of the small-firm effect within the REIT industry. Journal of Real Estate Research, 6, 9–17.

Merton, R. (1973). An Intertemporal capital asset pricing model. Econometrica, 41, 867–887.

Ott, S., Riddiough, T., & Yi, H. (2005). Finance, investment, and investment performance: Evidence from the REIT sector. Real Estate Economics, 33, 203–235.

Pai, A., & Geltner, D. (2007). Stocks are from Mars, real estate is from Venus. Journal of Portfolio Management, 33, 134–144.

Pastor, L., & Veronesi, P. (2003). Stock valuation and learning about profitability. Journal of Finance, 58, 1749–1789.

Petkova, R., & Zhang, L. (2005). Is value riskier than growth? Journal of Financial Economics, 78, 187–202.

Ross, S. (1976). The arbitrage theory of capital asset pricing. Journal of Economic Theory, 13, 341–360.

Sharpe, W. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. Journal of Finance, 19, 425–442.

Sing, T., Tsai, I., & Chen, M. (2016). Time-varying Beta of US REITs from 1972 to 2013. The Journal of Real Estate Finance and Economics, 52, 50–72.

Steiner, E., and T. Riddiough, 2018. “Financial flexibility and manager-shareholder conflict: Evidence from REITs.” Real Estate Economics. Forthcoming.

Vasicek, O. (1977). An equilibrium characterization of the term structure. Journal of Financial Economics, 5, 177–188.

Yang, J., Zhou, Y., & Wai, L. (2012). Asymmetric correlation and volatility dynamics among stock, bond, and securitized real estate markets. Journal of Real Estate Finance and Economics, 45, 491–521.

Zhang, L. (2005). The value premium. The Journal of Finance, 60(1), 67–103.

Zhou, J. (2013). Conditional market beta for REITs: A comparison of modeling techniques. Economic Modelling, 30, 196–204.

Acknowledgments

We have received many helpful comments and suggestions from two anonymous referees. We thank also Paul Borochin, Joe Golec, Chinmoy Ghosh, Tom O’Brien, Robert Kurtzman (Discussant) and seminar participants at the 2019 AREUEA National Conference in Washington (DC), the University of Connecticut, and the University of Wisconsin – Whitewater.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

APPENDIX A A Simple Multiperiod Discount Rate Model

Suppose the sequence of discount rates implied by the CAPM may be modeled by a first-order autoregressive process: \( {\mu}_{t+1}=\left(1-\varphi \right)\bar{\mu}+\varphi {\mu}_t+{\epsilon}_{t+1} \) . Then, the future sequence (μt + 1, μt + 2, … , μt + τ ) may be represented in matrix form as

Alternatively, in compact form, this system of equations is: \( \Phi\ \mu =\left(1-\varphi \right)\bar{\mu}\upharpoonleft +\varphi {\mu}_te1+\epsilon \), where ↿ is a column vector of 1 s, and e1 is a column vector with 1 in the first row and 0 in the remaining rows. This specification implies closed form solutions for the moments of the cumulative discount rate \( {\sum}_{j=1}^{\tau }{\mu}_j \) . Specifically, the conditional mean is \( \left(1-\varphi \right)\bar{\mu}{\upharpoonleft}^{\prime }{\varPhi}^{-1}\upharpoonleft +\varphi {\mu}_t{\upharpoonleft}^{\prime }{\varPhi}^{-1}e1 \) and conditional variance σ2↿′Φ−1(Φ−1)′↿. Using a result from time series analysis (Ali 1977), we show next that these moments may be computed without inverting the Φ matrix. Define the vector Z′ ≡ (z(τ), z(τ − 1), …, z(1) ) = ↿′Φ−1 and note that each element may be computed recursively from the previous one: z(j) = φz(j − 1) + 1 for j = 2, 3, …, τ, and starting value z(1)=1 . Hence, the conditional mean is \( {E}_t\ \left[\kern0.5em {\sum}_{j=1}^{\tau }{\mu}_j\right]=\kern0.5em \left[\ \left(1-\varphi \right)\bar{\mu}{\sum}_{j=1}^{\tau }z(j)\right]+\varphi {\mu}_tz\left(\tau \right), \) and for the conditional variance we have \( {Var}_t\ \left[\kern0.5em {\sum}_{j=1}^{\tau }{\mu}_j\right]={\sigma}^2\ \left[\ \left(1-\varphi \right)\bar{\mu}{\sum}_{j=1}^{\tau }z{(j)}^2\ \right]. \)

By definition, the discounted value of a single cash flow Ct + τ expected τ periods from the current period t is: \( V{\left(\tau \right)}_t={E}_t\left[\ {e}^{-{\sum}_{j=1}^{\tau }{\mu}_{t+j}}\ {C}_{t+\tau}\right] \). For simplicity, in this example we assume the expected cash flow is independent of the discount rate. Then, by the properties of log-Normal random variables, the conditional expected value is \( V{\left(\tau \right)}_t={e}^{-\tau\ \pi {\left(\tau \right)}_t}\ {E}_t\left[{C}_{t+\tau}\right] \) where π(τ)t is the geometric average: \( {\left(\tau \right)}_t=\frac{1}{\tau}\left\{\ {E}_t\ \left[{\sum}_{j=1}^{\tau }{\mu}_{t+j}\right]-\frac{1}{2}{Var}_t\ \left[\ {\sum}_{j=1}^{\tau }{\mu}_{t+j}\right]\kern0.5em \right\} \) . Using the closed form solutions developed above, we obtain a model for the term structure of discount rates for each maturity τ:

Estimation of Market Beta

B.1 Prior Distribution Model for Market Beta

We follow the empirical literature (e.g., Petkova and Zhang 2005, and Cosemans et al. 2016) and model time-varying beta as a linear function of firm size (SIZE), book-to-market (BM), Operating leverage (OP_LEV), and Financial leverage (FIN_LEV). The literature also indicates that the relationship between beta and firm characteristics changes with the economic environments. We use the default spread (DEF) to measure general business conditions. The default spread, measured as the difference in yield to maturity between Baa rated corporate bonds and Aaa rated bonds, is lower during economic expansions and higher in recessions. Thus, our prior information for beta is a conditional model specified as follows:

We assume that the intercept term δ0, iand slope coefficient on the business cycle variable DEF, δ1, i, vary across our sample of REITs to capture unobserved variation across firms. The slope coefficient vector γ ' = (γ1, γ2, γ3, γ4, γ5, γ6) does not carry the i subscript as we assume that the relationship between beta and firm characteristics is constant across firms. This specification should yield more efficient parameter estimates.

Time Series Specification for Time-Varying Beta

We define ri t, s as the daily return for portfolio i for day s, in excess of the riskless rate, and rm t, s as the corresponding excess market portfolio return. The time index s covers a six months period ending on the last trading day of month t and beginning 125 trading days earlier. Consider the rolling window regression of portfolio return i on a constant and the market return:

The intercept αi is the risk-adjusted return, and the slope βi measures systematic, or market, risk. The idiosyncratic return ςi t, s is modeled as a sequence of identically, independently distributed random variables with zero mean and variance V[ςi].Footnote 11

Assuming actual and idiosyncratic returns are normally distributed, the estimated rolling window (RW) betas \( {\hat{\beta}}_{i,t}^{RW} \) are also normal with mean βi, t and variance \( V\left[{\hat{\beta}}_{i,t}^{RW}\right]={\hat{\sigma}}_{\varsigma}^2{\left(\;\sum \limits_s{r}_{m,s}^2\right)}^{-1} \), where \( {\hat{\sigma}}_{\varsigma}^2 \) is the residual error variance estimate for the month t regression.

Bayes Conditional Beta Model

The Bayesian beta model proposed by Cosemans et al. (2016) is based on the combination of two estimates: rolling window, and market beta based on fundamental firm characteristics (FC). In the spirit of Bayesian analysis we take the prior distribution to be normal with mean \( {\beta}_{i\;t\mid t-1}^{\ast} \)(Equation B1) and variance \( V\left[{\hat{\beta}}_{i,t-1}^{FC}\right] \), where \( {\hat{\beta}}_{i,t-1}^{FC} \) is the fundamentals beta estimator. Then, the posterior beta for portfolio i at the end of month t is

where the corresponding shrinkage weight wi, t is based on the variance ratio

We discuss the methodology to obtain \( {\hat{\beta}}_{i,t-1}^{FC} \) and its variance below; but first we note that Equation (B3) is standard Bayesian econometrics. The posterior mean \( {\hat{\beta}}_{i\;t\mid t}^{\ast } \) is a weighted average of the prior beta, conditional on firm characteristics, and the rolling window beta. Equation (B4) shows that if the variance \( V\left[{\hat{\beta}}_{i,t-1}^{FC}\right] \) is relatively small, then firm characteristics play a dominant role in determining the posterior beta. Conversely, precise estimates from the rolling window beta, low variance \( V\left[{\hat{\beta}}_{i,t}^{RW}\right] \), lead to a larger role for time series information.

To obtain \( {\hat{\beta}}_{i,t-1}^{FC} \) and its variance, we use a panel time-series regression for each period ending in month t. We define the excess returns column vector ℜiwith sth element Ri, s − Rf, s, (s = t, t-1, t-2, . . ., t–T + 1). Define Π 1 as a matrix with sth row given by (1, DEFs − 1)[Rm, s − Rf, s], and let Π 2i be a matrix of macro and firm specific characteristics for portfolio i with sth row given by\( \left( SIZ{E}_{i,s-1},B{M}_{i,s-1},O{P}_{LE{V}_{i,s-1}}, FI{N}_{LE{V}_{i,s-1}}, SIZ{E}_{i,s-1}\ast DE{F}_{s-1},B{M}_{i,s-1}\ast DE{F}_{s-1}\right)\left[{R}_{m,s}-{R}_{f,s}\right] \) . Then the panel regression model to estimate prior distribution parameters is

where \( {\alpha}_i^{\ast } \) is a column vector of constants. The idiosyncratic returns ζi t are identically and independently distributed with zero mean and variance \( {\sigma}_{\zeta}^2 \); we assume also that these error terms are independent across firms. However, we note that by construction (see equation B5) actual REIT returns are correlated across firms.

The firm characteristic beta may be easily obtained as a linear combination of the least squares estimators of the slope coefficients in the panel regression, (\( \hat{\gamma} \), \( {\hat{\delta}}_i \)) and two data (row) vectors for the month prior to the current month t (\( \pi {1}_{t-1}^{\hbox{'}} \), \( \pi {2}_{i,t-1}^{\hbox{'}} \)):

where

\( \pi {1}_{t-1}^{\hbox{'}}=\left(1, DE{F}_{t-1}\right) \), and \( \pi {2}_{i,t-1}^{\hbox{'}}=\Big( SIZ{E}_{i,t-1},B{M}_{i,t-1}, OP\_ LE{V}_{i,s-1}, FIN\_ LE{V}_{i,s-1}, \)

SIZEi, t − 1 ∗ DEFt − 1, BMi, t − 1 ∗ DEFt − 1). Using standard arguments as in Fama and French (1997), this beta estimator has mean \( {\beta}_{it\mid t-1}^{\ast } \). For the variance, we know from Equation (B6) that \( \pi\;{2}_{i,t-1}^{\hbox{'}}V\left[\hat{\gamma}\right]\;\pi\;{2}_{i,t-1}+2\;\pi\;{1}_{t-1}^{\hbox{'}} Cov\left[{\hat{\delta}}_i,{\hat{\gamma}}^{\hbox{'}}\right]\;\pi\;{2}_{i,t-1} \). The individual components \( V\left[{\hat{\delta}}_i\right],\kern0.36em V\left[\hat{\gamma}\right] \) and \( Cov\left[{\hat{\delta}}_i,{\hat{\gamma}}^{\hbox{'}}\right] \) may be obtained from the panel regression error variance \( {\hat{\sigma}}_{\zeta}^2{\left[{\varPi}^{\hbox{'}}\;\varPi \right]}^{-1} \), where Π is the data matrix on the right hand side of equation (B5), and \( {\hat{\sigma}}_{\zeta}^2 \) is the sample variance of the error terms.

The assumption that the error terms in Equation (B5) are independent across firms may seem a bit restrictive. But without this assumption the algebra becomes intractable. We show next that it causes little harm. Consider the panel regression in (B5), written in more compact form as \( \mathfrak{R}=\varPi \Delta +\zeta \) . To allow for cross-sectional correlation between firms one may assume that the variance-covariance matrix of the error terms ζ is \( {\sigma}_{\zeta}^2\Omega \), where the off-diagonal elements in Ω are non-zero.

Let \( \hat{\Delta}={\left[{\varPi}^{\prime}\varPi \right]}^{-1}{\varPi}^{\prime }\ \mathfrak{R} \) be the OLS estimator. Then, \( E\left(\ \hat{\Delta}\right)=\Delta +{\left[{\varPi}^{\prime}\varPi \right]}^{-1}{\varPi}^{\prime }\ E\left(\zeta\ \right) \) . This estimator is unbiased because the expected error term has zero mean. The firm characteristic beta, \( {\hat{\beta}}_{i,t-1}^{FC}=\pi {1}_{t-1}^{\prime }{\hat{\delta}}_i+\pi {2}_{i,t-1}^{\prime}\hat{\gamma} \), is a linear combination of \( \hat{\Delta} \), therefore it is also unbiased.

For the variance of \( {\hat{\beta}}_{i,t-1}^{FC} \) we have \( V\left(\ \hat{\Delta}\ |\ \Omega\ \right)=\kern0.5em {\left[{\varPi}^{\prime}\varPi \right]}^{-1}{\varPi}^{\prime }\ \left(\ {\sigma}_{\zeta}^2\Omega\ \right)\varPi\ {\left[{\varPi}^{\prime}\varPi \right]}^{-1} \). But to compute the weights in (B3) we use instead the OLS variance \( V\left(\ \hat{\Delta}\right)={\sigma}_{\zeta}^2\ {\left[{\varPi}^{\prime}\varPi \right]}^{-1}\kern0.5em \) . The Gauss-Markov theorem suggests that the difference in variances is positive definite:

In turn, this inequality implies a bigger value for the variance \( V\left(\ {\hat{\beta}}_{i,t-1}^{FC}|\ \Omega \right) \) in Equation (B3) – relative to the OLS variance:

This result shows that our estimates, based on OLS, place more weight on the firm characteristic beta rather than the running regression beta. But this is likely to be a second order effect. Both betas in equation (B3) are unbiased and a weighted average should also share that property.

Rights and permissions

About this article

Cite this article

Giaccotto, C., Giambona, E. & Zhao, Y. Short-Term and Long-Term Discount Rates For Real Estate Investment Trusts. J Real Estate Finan Econ 63, 493–524 (2021). https://doi.org/10.1007/s11146-020-09750-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-020-09750-z