Abstract

Despite heady growth in cross-border investment into commercial real estate over recent decades, there are few studies that examine differences in investment preferences between domestic and cross-border investors at a micro level. We address the gap by examining the characteristics of assets acquired by cross border investors in six major US metro areas, comparing them with the purchases made by US investors in those same areas. Our study uses data on more than 67,500 transactions recorded by Real Capital Analytics (RCA) over the period from Q1 2003 to Q3 2016. As well as examining cross-border investors in aggregate, we isolate and examine purchases by investors from each of the four principal source nations for cross-border real estate investment in these cities. This is important since treating cross-border investors as a single group may obscure important differences between them. We employ multilevel logit techniques and we find across a number of specifications that cross-border investors prefer larger assets, newer assets and CBD locations regardless of nationality. However, temporal and sectoral patterns of investment, as well as evidence for return chasing behavior, vary with the nationality of investor being studied.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Financial reforms across many developed economies in the 1970s and 1980s ushered in an era of liberalized capital markets that facilitated large scale cross-border investment in both financial and real assets. This presaged tremendous growth in global real estate investment in the decades that followed. Cross border investment in real estate may be motivated by push factors such as economic policies in the home nation and comparatively fewer opportunities for investment in the home market, and pull factors such as expectations of returns from the host market and potential diversification benefits. However, such activity is typically selective when it comes to the countries, cities and assets that are chosen for investment. Geurts and Jaffe (1996) and Holsapple et al. (2006) draw attention to institutional factors, risks and costs that influence the destination of cross-border real estate investment, something that has been studied empirically at a country level, but which also applies to choices of locations and assets within target countries. It is the latter aspect that this paper seeks to explore further.

McAllister and Nanda (2015) suggest that certain cities act as gateway markets for foreign real estate investment in their countries. These are often the largest cities in which a critical mass of investors, advisors and information exists that serves to enhance liquidity and reduce information, search and transaction costs for cross-border investors. Moreover, in such cities, the distribution of foreign investor activity is unlikely to be uniform across areas or types of assets. We anticipate that the properties targeted by cross-border investors will be larger, newer and located in the best researched (CBD) submarkets where the perceived advantages of quality, transparency and the ability to deploy significant capital are likely to be greatest.Footnote 1 Yet there are very few studies to date that examine the revealed preferences of cross-border investors at a micro-level.

Hence, this study examines six important gateway cities for cross-border real estate investment in the United States to determine the asset and submarket preferences of non-domestic investors in such cities. We analyze real estate acquisitions in New York, Los Angeles, Chicago, Boston, San Francisco and Washington DC over 2003–2016. These were the largest cities for domestic institutional investment in our study period and were among the top destinations for cross-border investment in commercial real estate. We use multilevel logit techniques which reflect that the probability of choosing particular types of assets might be conditional on selection of a particular metro at an earlier stage of investment decision making. The modelling uses an array of property characteristics, control variables and lagged total return rates for different property types in each area to understand the factors that might be driving investment choices.

We find that cross-border investors prefer larger properties, newer properties and CBD locations regardless of nationality. This is consistent with our expectations. However, we find that German and Chinese investors exhibit distinct preferences for specific property types, while there are also differences in trend chasing behavior among cross-border investors, this being particularly evident for the Canadian investors in our sample. The study of individual national groups is an important innovation in this study, as prior research typically treats foreign/cross-border investors as a single entity. This is problematic if preferences for certain attributes vary between investors from different nations. Cultural and institutional factors may influence the risk and return preferences of different investor groups, and hence the preferences for those attributes that influence asset performance, leading to different outcomes regarding asset acquisition.

Literature Review

Initial research into international real estate investment focused on issues such as diversification benefits, investment barriers and exchange rate issues. This work is summarized well by Sirmans and Worzala (2003). More recent research that has sought to explain motivations for and patterns in cross-border investments has typically incorporated perspectives from institutional economics. This includes the ways in which formal and informal structures that comprise a market work to enhance or obstruct cross-border real estate acquisitions. Holsapple et al. (2006) propose a modified version of the Dunning Eclectic Paradigm to examine how institutional factors impact the volume and destination of cross border real estate investment, noting the connections with both foreign direct (FDI) and foreign portfolio (FPI) investment activity. McAllister and Nanda (2016a) also discuss how foreign investment in commercial real estate has attributes of both FDI and FPI.

In terms of empirical work, Lieser and Groh (2014) explored a wide range of economic, socio-demographic and institutional variables for 47 national real estate markets in order to determine the factors most important for international investment. This included indicators such as real GDP growth, population growth and tax rates, and composite indexes from their own earlier work on real estate market attractiveness (see Lieser and Groh 2011). They found that positive economic and demographic features encouraged real estate investment, along with deep, sophisticated capital markets. Meanwhile, investment was deterred by legal, regulatory and political risks and barriers. Lieser and Groh concluded that investment patterns reflect economic and institutional characteristics of nations. Yet, while their conceptual framework focused on international real estate investment, Mauck and Price (2017) note that their data comprised total transaction activity (domestic and foreign) in each nation, so further work on cross-border investment flows has been necessary.

Fuerst et al. (2015) built on the research of Lieser and Groh (2014) by distinguishing foreign from domestic real estate investment and by adding variables on real estate liquidity, transparency and performance for their sample of 24 countries. They noted that deviations existed from a natural or naive pattern where global commercial real estate investment is proportional to the size of each nation’s investable stock. The authors then examined a range of variables representing different institutional and macroeconomic features of each country, but found no role for institutional and legal barriers in explaining inflows of cross-border capital. This might reflect the short period and subset of countries studied. However, they did find that liquidity, defined as the ease with which investors could enter/exit a market, was a key variable in predicting cross-border investment into commercial real estate.

McAllister and Nanda (2016a) considered a different array of national variables capturing scale, wealth, distance and cultural factors for over 100 countries in order to unpack the factors most affecting cross border real estate investment. Using a gravity modelling framework, they found that geographic distance between markets (a proxy that captures cultural affinities and information issues) had an expected negative relationship with cross border capital flows, in line with literature on FPI, FDI and international trade. Economic size was not consistently significant as a predictor and the authors concluded that investors might focus on cities rather than countries. Indeed, many of the studies of pricing effects cited below use city rather than country as the unit of investigation, while others have used asset level datasets as we do in this study of gateway markets in the United States.

Very few studies have explored the revealed preferences of cross-border real estate investors for locations and assets within host nations. Two examples are early studies by Gerlowski et al. (1994) and Ford et al. (1998). In the former, the authors examined the location preferences of investors from the UK, Canada and Japan when investing in US real estate over 1980–89. Together, these three nations accounted for more than 50% of foreign private real estate investment in this period.Footnote 2 Gerlowski et al. found that investors from these nations preferred US states with large, developed economies, high personal income levels and growing populations. Ford et al. studied preferences for different types of US real estate: apartment, office, retail and industrial. They examined a range of real estate market variables, including past return rates, construction activity, vacancy rates, cap rates and rent per square foot, based on a profit/return maximization argument. They argued that foreign investors made decisions consistent with profit maximization, selecting property types associated with growth, rising rents, higher construction activity and lower volatility, though a tendency for these investors to choose markets where past growth was high suggested an element of trend-chasing in their real estate investment behavior.

Mauck and Price (2017) compared the domestic and foreign properties held by 699 publicly listed real estate firms to determine if the attributes of their foreign real estate investments were different. Their data covered assets in 84 countries as at Q1 2014, though over half (55%) of the properties were located in the US. Logit models were estimated with both asset and country level variables as explanatory factors. The country level variables were based on those used by Lieser and Groh (2014) and captured economic and institutional characteristics. The authors found that the foreign properties were likely to be larger, but the ownership stakes were smaller. The firms in the sample were more likely to partner with other firms when investing across borders, consistent with findings in the mergers and acquisitions literature. Preferences for particular property types varied according to the attributes of the host country.

Though not focused on cross border investment, Malpezzi and Shilling (2000) offer a useful study of investment preferences for US commercial real estate at the Metropolitan Statistical Area (MSA) level. They compared the holdings of US institutional investors to those of Real Estate Investment Trusts (REITs) with the hypothesis that investments by the former group would be more concentrated in higher quality locations. Relative to the stock of real estate, they found that both institutional investors and REITs tilted their holdings towards quality – defined as larger, higher income and less volatile locations – but this tilt was much more pronounced for institutional investors. The authors argued that this reflected the varying legal and institutional constraints under which each group operated, with a greater degree of risk aversion among institutional fund managers, but they suggest that diversification opportunities might be foregone as a consequence, a theme also explored by Byrne et al. (2013) for UK institutional real estate investors.

While asset and location preferences of cross-border investors have not been subjected to much recent study, there is work on the effects of such investment on commercial real estate pricing at the local level. This has examined whether the presence of foreign investors is associated with lower capitalization rates and, thus, higher prices. McAllister and Nanda (2015) studied cap rate and transaction volume data from 38 US MSA office markets over the period 2001–13. They found that increased foreign investment equated to a statistically significant reduction in cap rates after controlling for other factors: a 10% increase in the proportion of foreign investor transactions corresponded to a c. 80 basis point drop in cap rates based on their results. They also noted that foreign investment was more concentrated than domestic investment, with greater focus on the larger MSA markets, but preferences of cross-border investors were not examined formally.

In similar vein, McAllister and Nanda (2016b) examined 28 European cities over the period 1999–2013, finding that a 10% increase in the proportion of foreign investor transactions corresponded to a 30 basis point fall in office cap rates. Variations in cross-border investment across the cities were noted. Meanwhile, Oikarinen and Falkenbach (2017) analyzed cap rates for the Helsinki prime office market to explore the impact of changes in foreign investor activity. They found that a 10% increase in foreign investment corresponded with a c. 30 basis point drop in cap rates as well. However, while more cross-border investment appears to raise prices, this does not mean that foreign investors pay more for properties than their domestic counterparts. Such results could reflect that the recipient markets become more liquid and attractive to all real estate investors with an increase in the number and range of participants.

To test whether foreign investors paid more for assets in a given market, Devaney and Scofield (2017) analyzed over 3000 transactions in the New York City office market using techniques from studies of local versus non-local investors (see Ling et al. 2018). The authors found that foreign investors paid more at purchase than domestic investors, but also sold for more when observable features of the asset, location and counterparty involved were held constant. They suggested that the main driver of the price differences found was unobserved differences in quality, with foreign investors targeting higher quality assets. The authors also noted differences in the observable aspects of acquisitions, with foreign investment activity being more concentrated in the Manhattan market and with foreign purchases more likely to be of larger and newer buildings relative to the domestic investor group.

Finally, Crosby et al. (2016) examined pricing for a sample of just under 500 office buildings in Central London during 2010–12. Although not a central feature of their study, the authors included variables in their modelling that related to the national origin and international experience of the purchasers in each transaction.Footnote 3 Hence, their study is notable for trying to differentiate between types of international investor. The authors found that international experience was associated with lower cap rates at the asset / deal level. They noted that this difference might reflect the selection of higher quality assets, further motivating our desire to examine cross-border asset and location preferences in greater detail.

The literature to date provides evidence that cross-border investors exhibit particular preferences for both the nations and areas in which they invest. However, to our knowledge, only Mauck and Price (2017) and Devaney and Scofield (2017) formally examine their preferences for asset level attributes such as size and age, with the latter study confined to one property type in one location. Furthermore, most of the literature has considered foreign investors as a single group and has not examined the preferences of different investor nations individually. Hence, we consider asset and location preferences for cross-border investors in aggregate and for investors from individual countries across a range of property types in the six largest ‘gateway’ metropolitan markets in the United States.

Method

Our study uses data on acquisitions of individual real estate investments within a sample of six major US metros to infer the preferences of cross-border real estate investors for different asset and market attributes. For many of the models that we estimate, the dependent variable is a binary variable that indicates whether a purchase was made by a domestic (US) investor or cross border (non-US) investor, with the value 1 attributed to purchases by foreign investors. Alternatively, the binary variable is used to distinguish domestic purchases from those by investors from a specific nation, where the value of 1 indicates that subset of cross-border acquisitions. A discrete choice logit model is used where modelling of the binary response estimates the probability that each asset is purchased by a foreign investor or by an investor from country h, as appropriate. Thus:

With the basic form (single-level) of the logit model as follows:

Where Xi refer to the characteristics of property i and ei is a matrix of random error term.

The approach represented in Eq. (2) assumes that probabilities of acquisition by a particular investor group are not clustered according to, say, property type or metro. This is unlikely to be the case for two reasons. First, a variable such as metro is likely to capture common regional aspects that will affect the prospective performance and risk for all assets in that area, while type could similarly capture common performance drivers that influence the probability of acquisition. Thus, application of the standard single level logit model would lead to biases in the parameter estimates. Second, we anticipate that the decision making process around acquisitions could be hierarchical, with decisions to allocate capital to particular geographies preceding the search for and selection of individual assets within target markets. Even if this second argument does not hold for the investors that we study, the first argument suggests that a multilevel approach to estimation is prudent.

Multilevel modelling of datasets featuring different cities and submarkets has been applied previously in hedonic studies of residential real estate prices.Footnote 4 Its application in a commercial real estate context has been less common, but Crosby et al. (2016) use multilevel modelling to explain variation in office capitalization rates while Yildirim (2008) uses multilevel modelling in the context of the incidence and timing of default for CMBS loans. In Yildirim, region and property type are identified as the levels assumed to affect incidence of default prior to consideration of loan-specific attributes. While our application is in a different context, it is motivated by similar concerns.

One way to approach multilevel modelling is to control for the difference among metro areas by using random intercepts in the model, which is specified as:

Where Xijk refer to the characteristics of property i of type j located in metro k. The level-2 residual u0k measures the random effect among metros, and eijk is the residual that can vary across each transaction. However, as Crosby et al. (2016) note, it is possible that the groups identified by the level variable not only identify systematic differences in probabilities between observations, but also that group membership will change how asset level covariates influence the probability of the outcome. For instance, the likelihood of selecting industrial properties in Chicago versus New York City might vary owing to the differences in industrial structure between these metro areas. Hence, the preferences for particular property types might vary between geographical areas. To reflect this, we introduce a random effect on property types as a sub-level within metro area (a 3-level random intercept model)Footnote 5:

Alternatively, we specify property type as a random slope variable that can vary within each metro (a 2-level random slope model):

In Model (4), u0k is the level-3 random intercept for the metro-level, while ujkdenotes the level-2 property type-level variation. Meanwhile, in Model (5), parameter Zjkujk captures the variation of property types. Log likelihood tests and intra-class correlation coefficients (ICC) are reported to indicate model performance, where appropriate. Our commentary discusses those variables that appear to be consistently significant factors influencing acquisition of properties by either cross-border investors or investors of specific nationalities across various model specifications.

As well as estimating logit models, we report further multilevel regression models using the subset of purchases by cross-border investors. In these models, the dependent variable measures the degree of similarity between the US and the investor home nation on specific, selected criteria, while the independent variables remain the same. The criteria relate to economic, cultural and institutional attributes of the nations in the sample. Essentially, these models test whether there are systematic differences in the attributes of assets acquired by investors from nations that are ostensibly more like the US. The selected indicators of national cultural and institutional attributes are discussed in the data section below.

Some studies raise concerns as to whether estimation of multilevel models would be influenced by small group numbers in the higher levels (see Hox et al. 2017, as a recent example). Yet limited group numbers might be inevitable when testing ideas for specific geographic areas. For example, Giuliano et al. (2010) conduct the multilevel test based on five counties of the Los Angeles region. Theall et al. (2011) have studied the condition with very small group numbers and suggest that a size of less than 5 groups may fail to detect group-level effects. However, Bryan and Jenkins (2016) note that, despite the downward biased variance in random intercepts, estimations of the fixed part and random slope part of a multilevel model should be unbiased “even if group number is as small as 10”. To address this potential issue, we employ county as an alternative geographical level variable to metro for the empirical tests.

Data

Data on private real estate investment acquisitions were provided by Real Capital Analytics (RCA). The data comprise observations of transactions in six US metro areas: Boston, Chicago, Los Angeles, New York, San Francisco and Washington DC.Footnote 6 As noted earlier, these cities are typically seen as gateway markets for cross-border real estate investment into the US. The data span 2003 Q1 to 2016 Q3, and include transactions in the apartment, retail, office and industrial sectors. RCA records transactions above a threshold of $2.5 million and the details for these are gathered from multiple sources including brokerage firms, investors, listing services, press reports and other public records. Information held on each transaction includes date of the transaction, the property address and location, price paid and, where known, details of the buyers and sellers such as the name, type and nationality of each party.

Some transactions were not usable for this study. First, records for portfolio deals were removed where these did not identify the individual assets that had been purchased. Second, records were removed if the buyer was a Limited Liability Corporation (LLC). LLCs are recorded in the data as US investors, but the structure was popular with foreign investors in this period owing to its liability and tax advantages, particularly in the context of FIRPTA.Footnote 7 Hence, the LLC designation obscures the true origin of the investment capital, whether foreign or domestic, and the specific nationality of the investor from being observed. So we dropped these cases in preference to treating them arbitrarily as domestic or cross-border investors. These steps resulted in a final sample of 67,538 observations for analysis. The samples used for individual models then varied according to model specification and the availability of individual variables used.

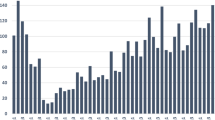

There was a strong temporal pattern in transaction activity over the period studied, with volumes rising from 2003 to 2007, dropping sharply to a trough in 2009 and recovering again ahead of a peak in both the number and value of transactions in 2015. In terms of property type, most records were for transactions of apartment buildings, at 21,293 observations, while the smallest number of records were for retail, at 13,719 observations. The office sector was largest in terms of value transacted, accounting for 49% of dollar volume traded. Table 1 shows the sample size for each of the six metros. It also shows sample sizes for acquisitions by buyers from four specific nations – Canada, the UK, Germany and China/Hong Kong, which were the largest source nations for inbound cross-border real estate investment in terms of number of deals in this period. For our analysis, these nations offer diversity in terms of geographic proximity, linguistic familiarity and degree of similarity in market cultures and institutions to the United States.

It can be seen from Table 1 that New York is dominant in terms of the value of transactions. This accords with other studies of transaction activity in the US (McAllister and Nanda 2015; Devaney et al. 2017). Los Angeles is slightly ahead of New York in the number of deals, each metro having around a 30% share of the dataset. For cross-border investors, New York is dominant in terms of both the number and value of transactions. Cross-border investors only have a small share of total transaction activity (at 4.1%), but a much larger share of the dollar volume traded (at 13.4%). This indicates that cross-border investor acquisitions are larger in magnitude on average. Canada has the largest sample size among the non-US buyer nations, with twice as many purchases by Canadian investors versus the next largest foreign investor nation.

McAllister and Nanda (2015) note some issues around the classification of investors as ‘foreign’, particularly in the context that global institutional investors might have regional offices in a number of major cities and employ local staff in those offices to make real estate investment decisions. Furthermore, institutional investors are likely to invest not only on their own account, but also on behalf of other investors with varying national and organizational backgrounds. We acknowledge the limitations that this places on our analysis and we anticipate that it will reduce the scale and statistical significance of any observed differences between domestic and cross-border investors in our data. Nonetheless, we are interested in examining what differences in investment activity remain in the context of more globalized real estate investment markets.Footnote 8

It was noted earlier that domestic economic conditions, investment opportunities and institutional factors could affect cross-border investor choices. Empirical testing of such ideas relies on proxy measures for economic and institutional conditions. Four sets of proxy variables were used here. First, indexes compiled by Hofstede were used to capture differences in national culture. Second, indicators from the CEPII Institutional Profiles Database were employed to detect differences in national economic and social institutions. Third, the Real Estate Investment Attractiveness (REIA) index constructed by Lieser and Groh (2011) was used to represent real estate market attributes and opportunities. Finally, log of real GDP per capita was used to measure differences in national wealth and economic development.Footnote 9

In each case, the difference between figure(s) for the US as the host market and that of the home market of the investor was calculated; Euclidean distance in the case of the Hofstede and CEPII datasets where there were multiple underlying indicators, and arithmetic difference for the REIA and GDP per capital series. However, the distribution of cross-border real estate investors across nations is not spread evenly. This could distort analysis that uses all of the cross-border investors, particularly if there are nation-specific factors affecting the behavior of investors from the principal source nations. So this motivates examination of investors from the individual countries identified in Table 1 to identify how choices have varied within the sample of cross-border investor nations.

Measures relating to the nature or location of the buildings traded form the independent variables for the analysis and these are drawn primarily from the RCA dataset. Table 2 reports summary statistics, pooling data for the six metros but continuing to distinguish domestic and cross-border investors. Based on earlier discussion, we expect cross-border investors to prefer newer, larger and higher quality assets. This appears to be evident from the descriptive statistics in Table 2; the average age of assets bought by cross-border investors is lower, the average size is larger and a higher proportion of acquisitions are made in CBD locations.Footnote 10 It also seems that cross border investors are more likely to purchase assets in the office sector. However, the differences are not yet tested statistically with controls for the influence of other factors.

That such differences are apparent need not be viewed as the product of irrational behavior in asset selection. For example, they might reflect differences in liquidity or risk-return preferences between domestic and cross-border investors, and among different nationality groups. Different locations and grades of asset will vary in their prospective returns and risks, and thus in their attractiveness to different investors. We do not observe the expected return or risk for each asset as at the time of acquisition, but we do have data from the National Council of Real Estate Investment Fiduciaries (NCREIF) on past total return rates for the property type and MSA relevant to each asset in question. In particular, we focus on the relevant annualized return rate for the three years prior to each transaction. This allows us to test whether past performance for the type of property in the area concerned has an influence on asset selection by different investor groups, alongside other variables.

Results

Our first results are shown in Table 3 and these compare the investment choices of cross-border investors to those of domestic buyers of US commercial real estate. Cross-border investors are treated as a single group at this stage. Although we argued that this may be inappropriate, these results provide a reference point for later tests that examine specific nationalities in more detail.

Model (1) in Table 3 is a single level discrete choice logit. It assumes that the effects of different variables on probability of selection are independent of one another. This implies that preferences for location, type and asset attributes are determined simultaneously. Yet decisions to invest in certain metros might precede detailed stock selection, so various multilevel models are presented in columns (2) to (7) that account for clustering in the probability of selection across observations and so allow preferences for particular attributes to be examined conditional on an initial selection step having occurred. Models (2) to (4) use metro as the primary grouping variable while models (5) to (7) use counties as a robustness check.Footnote 11 The variance terms for the random part of the multilevel models are typically significant, except when metro is used alone as a random intercept. Yet the ICCs for the random intercept models are low, which suggests that only a small proportion of the variance in selection decisions is captured by the random intercept variables in each case.

The results suggest that there are some strong influences on the probability of a property being acquired by cross-border investors. The conventional model suggests geographical preferences, with cross-border investors less likely than their domestic counterparts to acquire assets in Los Angeles, San Francisco and New York City relative to Boston as the reference location, though it should be stressed that all six metros were popular for cross-border investment in this period. The coefficients for model (1) indicate positive preferences for the industrial, office and retail sectors relative to apartments. Results for other models show that these preferences are maintained even when the likelihood of choosing a specific location has been taken into account. Unreported year fixed effects suggest that cross-border investment was relatively more important in 2010–11 and 2015–16.

Results for the variable measuring past performance of the submarket (as defined by MSA and property type) suggests that cross-border acquisitions were more likely where past returns had been higher, even though this offers no guarantee that future returns will be strong. This finding is consistent across all models and is in line with the findings of Ford et al. (1998),Footnote 12 though the magnitude of the effect diminishes in a multilevel setting. For asset attributes, the results are less surprising, with larger, taller and newer properties all more likely to be preferred by foreign buyers, as well as buildings in CBD locations. There is a positive relationship between fractional interests and cross-border acquisitions. Preferences for larger assets and fractional interests are consistent with the results of Mauck and Price (2017). It is assumed that cross-border investors face higher information and transaction costs, so it is logical this group prefers deals that allow them to place large amounts of capital in better known and better monitored locations. However, a preference for fractional stakes suggests there is interest in sharing the risks of owning newer, larger ‘trophy’ properties rather than holding them outright.

Preferences that emerge when cross-border investors are examined in aggregate might not hold for investors from different nations. We test for this possibility in two ways; distinguishing buyers according to proxy measures for the cultural, economic and institutional conditions in their home country and looking at buyers from individual nations where sample sizes are sufficiently large. Table 4 reports results for the former case, each panel indicating where a different set of proxy measures was used to create the dependent variable for analysis. These models are restricted to cross-border (non-US) buyers alone and they indicate whether particular asset attributes are more or less associated with investors that are more distant from the US in cultural, economic or institutional terms.

While the earlier results match our expectations, results in Table 4 are more difficult to rationalize. A larger value for the dependent variable indicates a more ‘distant’ investor who, arguably, faces more costs and barriers and who might prefer larger or newer assets in more central locations as a consequence. Yet the results in Table 4 show that size is negatively related and age is positively related to ‘distance’. In contrast, the preferences for fractional ownership and against renovation opportunities do fit the notion of greater costs for investors from more ‘distant’ and (mostly) less developed economies. The absence of a clear picture could reflect issues noted above in regard to investor classification, use of proxy variables and the dominance of certain nations in the cross-border sample. However, it might reflect variations in the scale of investors domiciled in different nations or the influence of peer and diaspora effects that we cannot capture in our analysis. This suggests that a closer look at samples from individual nations is needed to build a clearer picture.

Table 5 presents the results for models that focus on investors from specific nationalities. These models compare their purchases to those made by US investors over the same period. Canadian investors are the subject of panel A, British investors are examined in panel B, German investors are examined in panel C and Chinese investors are examined in panel D. Once again, for brevity, only multilevel models that use metro as the main level variable are reported.

The relative geographical proximity of Canadian investors, together with linguisitic familiarity and similarity in market cultures, leads us to anticipate that they will show less variation from domestic investors in what they purchase when compared to other cross-border investors. Looking at panel A, it can be seen that preferences for property types are much more muted than for cross-border investors in aggregate. There is no marked preference for other property types at the expense of apartments as the base type (in fact, the reverse appears to be true in model 1). This might reflect greater familiarity among Canadian buyers with apartment investments than, say, investors from the UK or China. Tenancy agreements and lease terms for apartment investments are similar in Canada and the US, and institutional investors in both countries have been active in the apartment sector for much longer than UK institutional investors, for example.

However, Canadian investors mirrored other cross-border investors with their relative preferences for larger, taller and newer assets, and CBD locations. A positive link between past performance in a submarket and acquisitons is also apparent. Greater differences were anticipated for British investors given their reduced proximity and cultural similarity. Yet results in panel B suggest that British buyers showed little variation from domestic investors in their property type selections and only muted differences at best in regard to the size or height of buildings acquired. Nonetheless, statistically significant preferences for newer assets and CBD locations can be inferred from the results. There is no consistently significant link to past return rates apparent for the British buyers in this sample, but the size and sign of the coefficients is consistent with choosing types and areas with better historical performance.

In addition to physical distance, German and Chinese investors experience greater differences in language, institutions and market culture. We find that the sector patterns for these investors are more distinct, indicating preferences for industrial, office and retail assets over apartments as the base type. The intraclass correlation coefficients show that metro and sector explain much more variation in selection decisions than in earlier models. Yet temporal patterns captured by year fixed effects (unreported) vary from the aggregate pattern. For example, German investors were less likely to acquire assets during the market upswing in 2005–07, while Chinese investors were more frequent from 2013 onwards. The trend continued through 2016, the high-water mark for Chinese investment to the US, with the bulk of the capital originating from private firms (see Koch-Weser and Ditz 2015). This movement of investment capital away from China coincided with relaxations by China’s central bank on restrictions on lending to private firms. The increased availability of debt capital led to a sharp spike in borrowing by private firms (see Jilani and Cheng 2018). A significant portion of borrowed capital was used to finance purchases of US commercial real estate assets.

Results reported in panels C and D of Table 5 for other variables are more mixed, but broadly in line with earlier insights. The coefficients suggest that German and Chinese investors preferred larger properties and CBD locations, that Chinese investors preferred taller buildings and avoided renovation opportunities, and that German investors preferred newer properties. In general, the findings support the expected outcome that larger and higher quality assets in more central areas are preferred by cross-border investors since these can easily accommodate the desire to invest significant capital without undue search and information costs. However, unlike Canadian buyers and cross-border investors overall, there is no evidence that investors from either Germany or China favoured submarkets where the past performance had been strong.

The results so far are based on a mix of investor types that include insurance companies, REITs, private investors and others. A potential concern is that the results are influenced by differences in the mix of investor types between the US and foreign groups. If a greater proportion of cross-border investors are insurance companies and pension funds, then findings could be an artefact of institutional investor rather than cross-border investor preferences. As a robustness check, all models were re-run on the subset of purchases by institutional investors and public real estate companies.Footnote 13 Results relating to cross-border investors in aggregate are shown in Table 6. These results are strongly supportive of our earlier findings.Footnote 14 There are no notable changes in model performance or variance parameters versus the full sample (cf. Table 3), and the coefficients are similarly signed and statistically significant. The main exception is with regard to asset size where coefficients are smaller in magnitude and statistical significance is weaker. Yet preferences for newer assets and more central locations remain, as does the greater likelihood for cross-border investors to choose market segments with better historical return rates.

Conclusion

Rising cross-border investment in private commercial real estate markets has led to research on the motives for investing in different nations. The motives include push factors such as economic policies and limited opportunities in the home market, and pull factors such as expected returns and diversification benefits from the host market. However, risk-return benefits must be weighed against higher search, information and transaction costs in unfamiliar markets. This applies not just to the selection of countries in which to invest, but also to the selection of locations and assets within target nations. Yet this issue has been largely neglected in real estate research. Moreover, cross-border investors are often treated as a single group within recent studies, whereas there is considerable diversity in preferences between groups and this is affected by the perspectives and constraints guiding investors based in different nations.

We used an extensive dataset of US commercial real estate transactions to identify the factors that most affected the probability of sale to a non-US investor over 2003–16, a period that includes a major market cycle. Six major ‘gateway’ markets for cross-border investment were identified in which there was sufficient scale and depth of foreign investment activity to identify and separate out cross-border investors both in aggregate and from specific nations. Canada, the UK, Germany and China/Hong Kong were identified as the main source nations for inbound commercial real estate investment in this sample, countries that vary in their geographical proximity, culture and domestic investment opportunities. We find that cross-border investors in general focus on larger assets, newer assets and CBD locations, consistent with maximizing efficiency of investment within the most transparent and best researched submarkets, but preferences for specific metros and property types varied across the different national groups studied.

This work is among only a small collection of studies to consider foreign investment issues with asset level data. It applies multilevel logit techniques in recognition of the decision making stages and area-related attributes likely to influence the selection of individual assets. The use of metros as a key variable in this framework reflects how investors target particular metros and MSAs in their search for investment product. Studying investors from the top four source nations for cross-border investment individually allowed us to examine whether different groups of foreign investors exhibited different preferences relative to their US counterparts. This is an important component of this study as the preferences of different cross-border investor groups are lost when they are aggregated together.

Among other important findings is the apparent propensity of cross-border investors to follow past performance more than domestic investors when selecting areas and property types. This raises questions as to whether cross-border investors exhibit return chasing behavior or simply require greater evidence of a track record in a submarket before investing, the result of greater information and transaction costs versus domestic buyers. We found that trend chasing was not common for all cross-border investors; it was most marked in the case of Canadian investors in US real estate. This and other findings raise an important methodological implication for future research. While it is common to study cross-border real estate investors in aggregate (possibly because of the data available), we believe that more research is needed on the investment decisions and motivations of different investor groups in globalized commercial real estate investment markets.

Notes

Nonetheless, a strategy of focusing on, say, major CBD office markets in global cities might be counter-productive for wider diversification objectives. This issue lies outside the scope of this paper, but see Lizieri and Pain (2014) for further discussion.

In keeping with this work, we identify nations for specific analysis based on their importance in the overall total of inbound cross-border investment.

Here, international experience included both foreign investors and domestic investors that were known to have international scope in their investment activities.

See Leishman et al. (2013) for a review.

Alternatively, a cross-classified random intercept model can take metro and sector as parallel level 2 factors but the cross-classified specification does not fit in this sample, so we do not provide this result.

For Boston, Chicago and DC, the metro areas defined by RCA broadly matched the OMB defined Metropolitan Statistical Areas. For New York City, the sample included deals from adjoining MSAs in Connecticut. In the cases of Los Angeles and San Francisco, metro areas matched the corresponding Combined Statistical Areas. Thus, the San Francisco dataset included transactions for San Jose, while the Los Angeles dataset included deals from Riverside and San Bernardino counties.

FIRPTA is the Foreign Investment in Real Property Tax Act. This imposed additional taxation on foreign real estate investors throughout the study period, but could be avoided by creating a US-domiciled holding structure. See Devaney and Scofield (2017) for further discussion.

Some observations in the dataset have two organizations listed as buyers. Where one of these is domestic and the other foreign, we classify the purchase as foreign and use the foreign nationality in the analysis. If both organizations are foreign, which is more unusual, we classify the purchase as foreign, but we do not attribute a specific nationality to the transaction.

See geerthofstede.com and Hofstede (2001) for discussion of the culture measures. The CEPII Institutional Profiles Database can be accessed at www.cepii.fr/institutions/EN/ipd.asp. We tested the World Bank Ease of Doing Business index and the Heritage Foundation Index of Economic Freedom as well. Results using these generated qualitiatively similar findings to those that follow.

The means of the dichotomous variables indicate the frequency with which that feature is observed in the data.

Sample sizes for the models that use counties are smaller as we remove those counties that had fewer than 20 transactions recorded to overcome estimation problems.

It contrasts with more recent findings for US institutional investors presented by Fisher et al. (2009) which suggest that return chasing is not evident from the capital flows of NCREIF investors.

The RCA definition of institutions covers insurance companies, pension funds and investment management firms, while the definition of publicly listed real estate firms covers listed Real Estate Investment Trusts and Real Estate Operating Companies.

Reduced sample sizes meant that not all models for individual nationalities could be estimated reliably, but the results for those that could be estimated were consistent with those discussed already, and can be obtained from the authors on request.

References

Bryan, M. L., & Jenkins, S. P. (2016). Regression analysis of country effects using multilevel data: A cautionary tale. European Sociological Review, 32(1), 3–22.

Byrne, P., Jackson, C., & Lee, S. (2013). Bias or rationality? The case of UK commercial real estate investment. Journal of European Real Estate Research, 6(1), 6–33.

Crosby, N., Jackson, C., & Orr, A. (2016). Refining the real estate pricing model. Journal of Property Research, 33(4), 332–358.

Devaney, S., McAllister, P., & Nanda, A. (2017). Which Factors Determine Transaction Activity across U.S. Metropolitan Office Markets? Journal of Portfolio Management, 43(6), 90–104.

Devaney, S., & Scofield, D. (2017). Do ‘foreigners’ pay more? The effects of investor type and nationality on office transaction prices in New York City. Journal of Property Research, 34(1), 1–18.

Fisher, J., Ling, D. C., & Naranjo, A. (2009). Institutional Capital Flows and Return Dynamics in Private Commercial Real Estate Markets. Real Estate Economics, 37(1), 85–116.

Ford, D., Fung, H. G., & Gerlowski, D. (1998). Factors affecting foreign investor choice in types of U. S. real estate. Journal of Real Estate Research, 16(1), 99–111.

Fuerst, F., Milcheva, S., & Baum, A. (2015). Cross-border capital flows into real estate. Real Estate Finance, 31(3), 103–122.

Gerlowski, D., Fung, H. G., & Ford, D. (1994). The location of foreign direct investment for U.S. real estate: An empirical analysis. Land Economics, 70(3), 286–293.

Geurts, T., & Jaffe, A. (1996). Risk and Real Estate Investment: An International Perspective. Journal of Real Estate Research, 11(2), 117–130.

Giuliano, G., Gordon, P., Pan, Q., & Park, J. (2010). Accessibility and residential land values: some tests with new measures. Urban Studies, 47(14), 3103–3130.

Hofstede, G. (2001). Culture's Consequences: Comparing Values, Behaviors, Institutions and Organizations Across Nations. (2e). Thousand Oaks: Sage Publications.

Holsapple, E. J., Ozawa, T., & Olienyk, J. (2006). Foreign “direct” and “portfolio” investment in real estate. Journal of Real Estate Portfolio Management, 12(1), 37–47.

Hox, J. J., Moerbeek, M., & van de Schoot, R. (2017). Multilevel analysis: Techniques and applications. (3e). New York: Routledge.

Jilani, H., & Cheng, A. (2018). Chinese Investment in the U.S. Tanks Amid Major Policy Crackdowns. Foreign Policy, July 6, 2018.

Koch-Weser, I., & Ditz, G. (2015). Chinese investment in the United States: recent trends in real estate, industry, and investment promotion. US-China Economic and Security Review Commission. https://www.uscc.gov/sites/default/files/Research/Ch%20invt%20paper_2%2026%2015.pdf. Accessed 25 Nov 2018.

Leishman, C., Costello, G., Rowley, S., & Watkins, C. (2013). The Predictive Performance of Multilevel Models of Housing Sub-markets: A Comparative Analysis. Urban Studies, 50(6), 1201–1220.

Lieser, K., & Groh, A. P. (2011). The Attractiveness of 66 Countries for Institutional Real Estate Investments. Journal of Real Estate Portfolio Management, 17(3), 191–211.

Lieser, K., & Groh, A. P. (2014). The Determinants of International Commercial Real Estate Investment. Journal of Real Estate Finance and Economics, 48(4), 611–659.

Ling, D. C., Naranjo, A., & Petrova, M. T. (2018). Search Costs, Behavioral Biases, and Information Intermediary Effects. Journal of Real Estate Finance and Economics, 57(1), 114–151.

Lizieri, C., & Pain, K. (2014). International Office Investment in Global Cities: The Production of Financial Space and Systemic Risk. Regional Studies, 48(3), 439–455.

Malpezzi, S., & Shilling, J. (2000). Institutional investors tilt their real estate holdings toward quality, too. Journal of Real Estate Finance and Economics, 21(2), 113–140.

Mauck, N., & Price, S. M. (2017). Determinants of foreign versus domestic real estate investment: Property level evidence from listed real estate investment firms. Journal of Real Estate Finance and Economics, 54(1), 17–57.

McAllister, P., & Nanda, A. (2015). Does foreign investment affect U.S. office real estate prices? Journal of Portfolio Management, 41(6), 38–47.

McAllister, P., & Nanda, A. (2016a). Does real estate defy gravity? An analysis of foreign real estate investment flows. Review of International Economics, 25(4), 924–948.

McAllister, P., & Nanda, A. (2016b). Do foreign buyers compress office real estate cap rates? Journal of Real Estate Research, 38(4), 569–594.

Oikarinen, E., & Falkenbach, H. (2017). Foreign investors’ influence on the real estate market capitalization rate - evidence from a small open economy. Applied Economics, 49(32), 3141–3155.

Sirmans, C. F., & Worzala, E. (2003). International direct real estate investment: A review of the literature. Urban Studies, 40(5–6), 1081–1114.

Theall, K. P., Scribner, R., Broyles, S., Yu, Q., Chotalia, J., Simonsen, N., Schonlau, M., & Carlin, B. P. (2011). Impact of small group size on neighbourhood influences in multilevel models. Journal of Epidemiology & Community Health, 65(8), 688–695.

Yildirim, Y. (2008). Estimating Default Probabilities of CMBS Loans with Clustering and Heavy Censoring. Journal of Real Estate Finance and Economics, 37(2), 93–111.

Acknowledgements

We thank Real Capital Analytics for access to the data used in this research and we thank the participants at the 2017 American Real Estate Society meeting for feedback. We also thank the editor and reviewers for their suggestions. Any errors are the responsibility of the authors.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Devaney, S., Scofield, D. & Zhang, F. Only the Best? Exploring Cross-Border Investor Preferences in US Gateway Cities. J Real Estate Finan Econ 59, 490–513 (2019). https://doi.org/10.1007/s11146-018-9690-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-018-9690-z