Abstract

This paper provides new evidence of sales sequence-real estate price relations in a setting in which consumption risk and completion risk are both minimized and where agglomeration economies do not pertain. The results illustrate that the monotonic declining price “afternoon effect” or rising price from increasing relative demand documented in auction settings do not extend to real estate transactions in open (non-auction) markets. Instead, we find underlying non-monotonic U-shaped and inverted U-shaped sales sequence-price relations for high-rise and mid-rise developments, respectively, when correcting for unit selectivity effects. The results represent price anomalies in that they are evident after removing the effects of previously identified factors associated with sales sequence-price relations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Sequential sales of similar assets occur regularly in real estate, for example, in new residential subdivisions, industrial parks, and condominium developments. It is not surprising then, that there is a modest but growing literature examining asset pricing in such situations. Simply stated, the law of one price holds that identical assets sold sequentially sell at the same equilibrium price. Otherwise, it is argued, in frictionless markets speculators could buy in the low-price period and arbitrage potential gains. Nonetheless, the literature offers empirical examples of price-sales sequence anomalies that appear to deviate from this pattern. This paper offers new empirical evidence on the sales sequence-price relation for residential developments in a regulatory setting that minimizes consumption risk, completion risk, and agglomeration economies. The analysis uncovers underlying non-monotonic sales sequence-price relations that differ systematically for high-rise and mid-rise developments when correcting for unit selectivity effects. The results represent price anomalies in that they become evident after removing the consumption risk, completion risk, and unit selectivity effects previously identified in the literature as likely factors driving sales sequence-price patterns.

The auction literature provides much of the early motivation for studying price-sales sequence anomalies. Ashenfelter (1989) first observed the so-called “afternoon effect” of declining prices over the sequence of sales in wine and art auctions. He attributes this pattern to risk-averse buyers who are willing to pay a higher price in early periods because the opportunity to buy later is increasingly uncertain as the sales sequence proceeds (Ashenfelter 1989; McAfee and Vincent 1993). On the other hand, prices may rise over the sales sequence because relative demand increases when sold units and the buyers of those units are no longer potential participants as the sequence of auctions proceeds (Van Den Berg et al. 2001). In a different vein, Milgrom and Weber (1982) show that later buyers in the sequence of sales draw information from earlier sales to reduce their valuation risk, leading to different bidding strategies as the sales sequence progresses.

While the auction literature provides early examples and motivation for studying price-sales sequence relations, most real estate in the U.S. is sold in open (non-auction) markets. The extent to which insights from auction markets apply in open markets is not clear. Nonetheless, there is evidence of persistent price effects for lots or housing sold in sequence by developers. Theoretical explanations for these patterns emphasize the role of prices capitalizing the declining consumption risk as new residential developments are completed or the increasing agglomeration economies as new industrial parks or commercial developments fill in (Rauch 1993; Sirmans et al. 1997). The empirical study by Fu and Qian (2014) concludes that speculators do not stabilize prices but instead reinforce momentum effects driving prices from fundamental values. Munneke et al. (2011) find statistically significant increases in selling price over the sales sequence in a low consumption risk environment, although the magnitude of the increases is economically insignificant. The pattern persists even when controlling for differences in sales momentum across development projects.

This paper provides new evidence on the sales price-sales sequence pattern for real estate, controlling for two possible price anomaly sources largely ignored thus far in the real estate literature, namely development scale effects and possible self-selection bias. The data cover market transactions for new condominiums in Singapore. The Singapore condo market has several advantages for studying the relation between selling price and sales sequence. It is standard for developers to offer condo units on the open market (i.e., non-auction) before the development project is completed. The government strictly regulates developers and their handling of buyers’ payments in order to minimize the risk of project failure and to ensure that projects fulfill all of the detailed requirements spelled out in the approved development plan, from development amenities and architectural features to individual unit floor plans. These regulations mean that consumers should not be subject to the types of consumption risk that Sirmans et al. (1997) argue explains rising prices over the sequence of sales observed for single family houses in new developments in the U.S.

The condominium product sold under these regulatory constraints more closely resembles a commodity than do heterogeneous units of detached single family housing. The sale of new condominiums in Singapore therefore yields an excellent opportunity to examine whether the phenomenon of increasing prices observed for single family homes in the literature also holds when housing consumption risk is minimal and invariant through the entire sequence of individual condo unit sales for each development. Applying the theory offered by Sirmans et al. (1997), developers need not sell the first units at a discount to compensate households for greater consumption risk in the Singapore market because consumption risk is unlikely to vary over the sales period. Thus, any price-sequence relation observed in this market is not likely driven by consumption risk effects.

The sample of transactions covers about 20,000 new condominium units sold in Singapore over 1996–2005. The hedonic models include the usual characteristics, controlling for differences in observable features across development projects and individual units as well as broader real estate market conditions. The models include an additional variable indicating the order in which individual units sell within each development. The pooled sample OLS estimates reveal a statistically significant negative relation between sales sequence and price of about 2% in annualized terms, qualitatively similar to Munneke et al. (2011) for a different sample of development projects. In addition, though, our analysis shows that the scale of the development project influences the price-sequence relation. While the pooled sample and high-rise developments (greater than 10 stories) show declining prices over the sales sequence, mid-rise developments (defined as 10 and fewer stories) show the opposite pattern of rising prices over the sales sequence, evidence of development scale effects.

Nonetheless, the OLS estimates do not account for one possible explanation of changing prices over the sales sequence, that buyers respond to subtle differences in quality across condo units that are not observed in the data. Or, more informed buyers may arrive earlier in the sales process.Footnote 1 Additionally, developer marketing efforts may also generate self-selection effects in the data to the extent that they systematically release blocks of units for sale, which may lead to quality differences in units offered at different points in the sales sequence.Footnote 2 The auction literature provides a similar rationale for selection effects that may drive observed price-sales sequence relations (Ashenfelter and Genesove 1992; Beggs and Graddy 1997; Burguet 2005). Hollans et al. (2013) find rising prices over the first half of the sales sequence of newly developed subdivision lots (4%) but falling prices near the end and attribute the discounts to lower quality lots being developed last; they do not, however, formally test for lot quality selection effects.

Therefore, we also introduce a multinomial selection correction to control for price effects that can arise when choice units tend to sell earlier than less desired units in the sales sequence, regardless of the source of this pattern. The selection-corrected results indicate that the negative price-sales sequence effect observed in our initial OLS estimates are systematically biased as suspected. The selection corrected pooled sample estimates reveal a U-shaped sales sequence-price pattern of declining prices in the early part of the sales sequence followed by rising prices up to project completion. Prices of sales after project completion are stable. With respect to scale effects, the high-rise and mid-rise subsamples yield distinct price patterns. The high-rise sample of development projects exhibits a U-shaped pattern similar to the pooled sample with the addition of slight increases in prices during the post-completion phase. In contrast, the mid-rise sample of development projects exhibits surprisingly stable prices across all development phases except for significantly higher prices in the relatively short period phase before project completion, a pattern that yields a modest inverted U-shape. As stated at the outset, these patterns represent true anomalies in that they are only evident after controlling for the effects thought to drive sales sequence-price relations observed in earlier studies.

The Data

Our study focuses on condominiums in Singapore. We first describe the key institutional features of the market which make it a good setting to study the price sequence effect in the presence of selection. Consistent with the practice in many Asian markets, such as Mainland China, Hong Kong, Malaysia, Singapore, South Korea, and Taiwan, new condominiums are mostly sold before project completion (see Chang and Ward 1993; Fu and Qian 2014; Lai et al. 2004). On average, the time interval from site acquisition to initial marketing of the condominiums in Singapore is two years, and from initial marketing to physical completion and handover of the units is around three years (Ooi and Le 2013).Footnote 3 Since additional costs will be incurred to hold condominium units that remain unsold after the development is completed, the optimal strategy for developers is to sell as many units as possible prior to project completion. On the demand side, the majority of the market participants in the presale market in Singapore are individual buyers, who together account for 96% of trading volume in the sample in Fu and Qian (2014).

A Housing Developer Sale License, which is only granted to developers with good track records, is required before any residential units can be offered for sale in Singapore. Under the Project Account Scheme (PAS) introduced in 1981, buyers pay the purchase price progressively according to defined stages of the construction process. To protect homebuyers from errant developers siphoning off monies received from the progress payments to use for other speculative projects, all sale proceeds from the project must be paid into a project account with a bank, the withdrawal of which can only be for disbursements related to the project. Any remaining surplus monies from the account can only be withdrawn by the developer after the project is completed. By ring-fencing the progress payments, the PAS protects buyers from the risk of losing their money in the unlikely event of the developer entering into bankruptcy before the project is completed. In contrast to other presale markets such as China or Malaysia, Singapore developers almost never default or abandon a development project prematurely (Fu and Qian 2014).

The main source of our data is the Real Estate Information System (REALIS), which is maintained by the Urban Redevelopment Authority (URA), the de facto land use planning and development control authority in Singapore. Our sample comprises a total of 19,510 new residential units within 69 developments in Singapore between 1996 and 2005. The average number of observations in each sampled development is 283. Figure 1 portrays the residential price index for the private housing market in Singapore over the study period. The index rose steadily through 1995 to peak at 169.1 in 1996Q2. Following the introduction of anti-speculation measuresFootnote 4 in 1996 and the Asian Financial Crisis which hit the region in 1997, the housing market in Singapore went into a recession, the private property index falling to a low of 100 in 1998Q4. The housing market sentiment improved between 1999Q1 and 2000Q2, but the recovery was checked by three negative external events, namely the terrorist attack in the U.S. (September 11, 2001), the Bali bombings in Indonesia (October 12, 2002), and the Severe Acute Respiratory Syndrome (SARS) epidemic which hit the region in the first half of 2003. The residential price index declined gradually until 2004Q3, when it started to show modest improvement.

For each transaction, we collect the following information from REALIS: sale price, date of sale, floor area, and floor level of the individual units. The sale price is the agreed purchase price of the property between the developer and a purchaser. It excludes stamp duties, legal and agency fees, and other professional fees. We supplement this information with the internal spatial attributes of each unit with respect to its orientation towards morning sun, evening sun, swimming pool, and exposure to traffic noise from the main road by painstakingly examining the site layout, orientation, amenities and detailed floor plans of the developments. For each of the developments in our sample, we also measure their distance from the Central Business District (CBD) and the closest subway station.

After arranging the transactions sequentially by contract date, there are two ways to measure the sequential sale effect. A natural way would be to denote the order of sale for each unit incrementally. Alternatively, we could use the number of days that have lapsed between the current sale and the first unit sold in the same development. We adopt the second approach because it captures any time lapse for information from the early transactions to flow to subsequent buyers. This is particularly relevant to situations in which more than one unit is sold in a given day, which is frequently the case during the launch of a condominium project. Moreover, information on earlier sales may not be revealed to subsequent buyers on the same day because the new units are sold by private negotiation (rather than public auction). In this sense, our measure allows for the possibility that, in the very short run, price information transmission may take longer for open market sales than for auction sales.Footnote 5

Table 1 presents the variable definitions and descriptive statistics of the sample and subsamples used in the analysis. The average price of the units in the entire sample is S$796,577. The average unit is located on the eighth floor and has a floor area of 1308 sq. ft. We expect that the sale price will be related positively with the unit floor area and floor level. On the basis that apartments located on the higher floors tend to have better view, be more airy and be exposed to less visual intrusion from neighboring buildings, flats located on higher floors are expected to be more desirable and command a price premium (Ong and Koh 2000; Tse 2002). In addition, 8.0% of the units in our sample are located on “lucky” floors, which we define as those ending with number eight, namely 8th floor, 18th floor, and 28th floor, whilst 12.4% are located on “unlucky” floors, defined as those ending with the number four, namely 4th floor, 14th floor, and 24th floor.Footnote 6 We predict that units located on “lucky” floors will command a price premium while units located on “unlucky” floors will be priced at a discount. We based our prediction on the findings of prior studies which have found that, in areas with a relatively high concentration of Chinese households, superstitions play a significant role in determining house prices. For example, Chau et al. (2001) and Munneke et al. (2011) observed that flats located on “lucky” floors in Hong Kong and Singapore command price premiums of 2.8% and 1.0%, respectively.

Thirty eight percent of the sample enjoys swimming pool views and 20.3% front an arterial road. A number of prior studies, such as Benson et al. (1998), Bond et al. (2002), Chau et al. (2001) and Tse (2002), have found that houses with views of a body of water command a price premium. The Chinese community also commonly associates water with wealth, and accordingly, a view of a body of water would be a desirable feature. Since not every unit in a condominium can be orientated to face the swimming pool, we predict that units facing the swimming pool should command a price premium. Units facing busy roads will be discounted if traffic noise is sufficiently loud and priced at a premium if the value of a permanently unobstructed view is sufficiently great. In particular, we predict the negative externality of facing a busy road may be greater for units located on the lower floors. With regard to units’ orientation to the sun, 28.4% of the units face the morning sun, and 29.9% face the evening sun. Fanning, Grissom and Pearson (1995: 38-39) provide anecdotal evidence and Munneke et al. (2011) provide econometric evidence that orientation to the sun at different times during the day matter. In the tropics, in particular, homes with an afternoon or evening sun exposure suffer bright glare and solar heating that increases cooling costs. Munneke et al. (2011) find that morning and evening exposure price effects differ, with units with west exposure experiencing greater price discounts.

As mentioned earlier, our sample comprises 19,510 new residential units within 69 developments in Singapore sold between 1996 and 2005. To control for variations in the market conditions over time, we include the residential property price index in the hedonic price function. Furthermore, to control for building heterogeneity, we also include a group of variables to pick up the effects of site-specific characteristics, namely site tenure, site location, distance from the CBD and distance from the nearest metro station. In Singapore private residential properties can be built on sites with either freehold or leasehold tenure. About 63% of the sample have 99-year leasehold tenure and 37% have freehold or leasehold tenure of 999 years. Freehold properties are usually more expensive because the interest is owned by the owners in perpetuity (Tu and Bao 2009). Slightly more than 8% of the sample transactions are in the residential district traditionally considered the prime district. Table 1 indicates that the average distance of the developments to a metro station is only 1.2 km and from the CBD is 10.8 km. The short commuting distance is due to Singapore occupying a small physical land area of only 714 square km.Footnote 7

While the relations between these variables and prices has been documented in the literature, their effect on housing choice is less studied. In particular, the location attributes of the developments may influence the speed of sale of the new units. For example, if condominiums that are located in prime residential districts or near the city center are more desirable, it may take a shorter time for units in these developments to be sold; thus, they are more likely to be sold in the early phase of the marketing. Conversely, if leasehold property is less desirable than freehold property, they may take a longer time to be sold, leading to a higher concentration of leasehold units to be sold in the later phase of the development, all else being equal. Similarly, a unit’s internal spatial attributes may also influence buyers’ choice decisions. For example, units facing the pool, have “lucky” numbers, or on the top floor are more popular with potential homebuyers, and hence, they may be sold out first. Conversely, units facing the west, or with “unlucky” numbers may be less popular, and may only be sold in the later phase of marketing. From the perspective of price affordability, smaller units may sell faster because they are cheaper than larger-sized units. Fu and Qian (2014) also note that short-term speculators also prefer flipping smaller units in the condominium projects because they are less costly and hence, more liquid. Our estimation of the selectivity model on the choice sequence of the buyers will also yield additional insights on the most desirable attributes of the units and developments.

In the empirical tests, we also examine whether the price evolution for presold units is any different from the price evolution for completed units. The presold units are further partitioned into those that are sold in the early stage of the marketing campaign and those sold in the mid-stage of the marketing process. Table 2 reports descriptive statistics for the pooled and development type subsamples partitioned according to when the units are sold within the sale sequence. The data show that 90.9% of the observations in our sample are sold before the condominium developments are physically completed, which is not surprising since the developers will be incurring additional costs to hold the unsold completed condominium units. Out of those that are sold before completion, over three quarters of the units are sold within the early range of the pooled sample. This reflects the practice of developers timing their new launches to coincide with favorable market conditions. To examine the extent to which development scale influences the sales price sequence, we partition the sample into mid-rise (10 and fewer stories) and high-rise (greater than 10 stories) subsamples. Of the 69 complexes, only 12 are 10 stories tall. Real estate professionals in this market typically regard 10–11 stories as the cutoff between mid- and high-rise buildings. In any case, it turns out that including 10 story buildings in the high-rise sample instead of the mid-rise sample does not lead to notable changes in the results.

Empirical Model and Results

OLS Results

In order to explore how the timing/sequencing of sales affects price, we begin by estimating a standard hedonic price model with an additional variable measuring the sales sequence. In general, the price model is

where Pi is the natural log of the selling price of the ith property, Xi is a vector of explanatory variables containing physical and location characteristics, development specific attributes, and the number of days between the contract date of the transaction and the date of the first sale for the development, our sales sequence measure. The error term, vi, is assumed to be normally distributed with mean zero and variance \( {\sigma}_v^2 \). Table 3 reports the OLS estimates of the price function for the pooled sample, as well as the high-rise and mid-rise subsamples.

Overall, the estimate models are significant and explain over 84% of the price variation. Many of the explanatory variables exhibit the expected effects on price. Freehold units and units in prime locations command a significant price premium. As expected, the distance to CBD coefficient is negative and significant in all the models. The U_METROi coefficient, however, is positive and significant, which suggests that the negative externality from pedestrian congestion, noise or other negative externalities from the metro station is stronger than the countervailing positive externality of easy access to mass transportation. The RPIi coefficient, as expected, is positive and strongly significant.

While some similarities exist between the pooled, high-rise, and mid-rise estimates there are also some important differences. For example, the effect of AREAi on sales price is positive as expected and robust across subsamples. The effect of floor LEVELi, on the other hand, is generally positive for both pooled and high-rise samples. In contrast, the mid-rise sample price declines for the first three floors and then rises thereafter. Units on the top floor or ground floor of buildings sell at a discount. The top floor discount may reflect views blemished by visible HVAC systems or other unattractive features on surrounding buildings.Footnote 8 There is, however, another possibility. Most developers in Singapore also sell undeveloped space on the ground and roof levels. These private enclosed spaces, which are usually converted to private gardens, are bundled and sold as part of the floor area of the adjacent residential units. This practice reduces the price per unit area. The sales data, however, do not classify the area of a unit into improved or unimproved space, which makes it impossible to adjust the reported price of a unit for this effect.

The LUCKY_FLOORi effect is significantly positive while the UNLUCKY_FLOORi effect is significantly negative for the pooled sample, the pattern also found by Chau et al. (2001). The LUCKY_FLOORi effect remains significantly positive while the UNLUCKY_FLOORi effect becomes insignificant for the high-rise sample. In contrast, there are no significant LUCKY_FLOORi or UNLUCKY_FLOORi effects in the mid-rise sample. A pool view increases selling price for the pooled sample and each of the building types, while road views are found to increase selling price in the pooled and high-rise sample. Finally, morning sun exposure (AM_SUNi) increases selling price while afternoon sun exposure (PM_SUNi) lowers the selling price for the pooled sample. The differences between the high-rise and mid-rise results for these variables are interesting: morning exposure increases price in high-rise units and decreases price in mid-rise units; afternoon exposure does not affect price in high-rise units but it does reduce price in mid-rise units. It turns out that this difference in high-rise and mid-rise results, however, is driven by the selection bias, as demonstrated below.

Before turning to the effect of the sale sequence on prices, it is important to note that the models also control for the number of days from the first sale to the building completion. The project completion date is known for all developments in the sample, including those for which completion occurs after the sales period used in the analysis (December, 2005). If the duration of the project has its own price effect, not controlling for it might confound the effect of our sales sequence measure – the number of days since the first sale. We include a variable to control for the length of time that the project takes to complete (DEV_DAYSi) in the model to address this potential problem (this and all other measures using numbers of days are divided by 365 in the model to yield estimates in annualized terms). We include a variable to control for the size of the development (DEV_SZi) as well for similar reasons. This approach should provide a clearer estimate of the sequential sales price effect using the number of days from the first sale (DAYSi). Including DAYSi and DEV_DAYSi as separate variables, rather than combining them as a percentage, allows us to disentangle the two separate effects and obtain a direct estimate of the sequential impact. In Table 3, the DEV_DAYSi/365 coefficient estimates indicate that longer time to completion by itself reduces the selling prices of units in the pooled and mid-rise samples, while the DEV_SIZE coefficients indicate higher selling prices in larger developments for all samples.

The coefficient on the main variable of interest, DAYSi/365, indicates statistically significant negative annualized marginal effects of less than 1% for the pooled sample and slightly greater than 2% for the high-rise sample. In contrast, the marginal effects of the sales sequence is positive in the mid-rise sample, the coefficient indicating a significant annualized marginal effect of 1.38%.

The Sample Selection Problem

Ashenfelter and Genesove (1992), Beggs and Graddy (1997) and Burguet (2005) argue that price can decline over the sales sequence when buyers choose the most desirable units first in an auction. This is relevant to our open market (non-auction) sales context to the extent that individual condominiums are not entirely homogeneous so that early buyers can obtain choice units with positive attributes, such as a view of the pool. The remaining units, which have fewer superior attributes, will subsequently be sold at a lower price. This line of reasoning implies that the transaction decision and the market price are not independent and the higher prices paid for earlier choices in the sequence may reflect, to some extent, selection bias arising from being able to select one of the higher quality condominium units remaining.

In order to account for this type of selection process, we model the transaction decision as a timing decision as well as a decision to purchase or not. The equation describing the phase of development in which to purchase can be written as

where \( {I}_{si}^{\ast } \) is the underlying response variable (an index of the choices made), ωs are the estimated parameters for development phase s, zsi is a vector of explanatory variables containing physical and location characteristics that influence the sale of the property, and ηsi is the error term. Eq. (2) can be thought of as a reduced-form choice equation where zsi includes xsi and the error term (ηsi) includes the errors of the offering and reservation prices.

We use a two-stage approach outlined in Lee (1982) to control for possible sample selection bias. The correction procedure calls for the introduction of a selection variable, an inverse Mills ratio, to each of the price equations as an explanatory variable. The price equation for a transaction in the sequence subsample s can be written as

where Wsi is the inverse Mills ratio, the selection variable, and σηv is the covariance between η and vs. The selection variable is constructed from the maximum likelihood estimation of the choice eq. (2). The specific maximum likelihood method and the definition of the selection variable depends on the number of response levels represented by the dependent variable in eq. (2). The traditional selection approach is cast in a setting where the choice equation is dichotomous and the Mills ratios are based on the estimates of a probit model. In a model with a polychotomous choice variable, the error term in (2) is assumed to follow an extreme value distribution and the equation is estimated using a multinomial logistic (MNL) procedure. Following Lee (1982, 1983), the error from the MNL is transformed to a standard normal random variable using the J factor which results in an inverse Mills ratio equal to

where Fs and ϕ denote the cumulative and marginal densities of regime s, respectively. Introducing the selection variable into the price equation produces consistent coefficient estimates and also provides a test for the presence of sample selection bias. A significant coefficient on the selection variable indicates that selection bias is present in the model.

Thus, to estimate the price equations, we construct the selection variables using the parameter estimates from the maximum likelihood estimation of the choice Eq. (2). Our application requires that the dependent variable in (2) represents three phases of development in which to purchase: early, middle, and late (i.e., post completion).Footnote 9 Recall our rationales for allowing unit sorting across development phases explained at the outset: buyers may respond to quality differences across units not observed in the data; more informed buyers may arrive earlier in the sales process; or developers may systematically release blocks of units for sale, leading to quality differences in units offered at different points in the sales sequence. While our empirical approach cannot identify which individual rationale applies in this sample, it can indicate the presence of any or all of these effects and allow us to obtain consistent sale sequence price effect estimates when they are present.

In a model with a polychotomous choice variable, the error term in (2) is assumed to follow an extreme value distribution and the equation is estimated using a multinomial logit procedure (MNL). We then estimate the price equation over each of the individual subsamples, including the selection variables with the independent variables. Maddala (1983) notes that it is possible to estimate the total price equations simultaneously through the construction of an unconditional expected total price equation. To find the unconditional total price equation, the probability of event s is multiplied by the price equation for s and then added over all s. The resulting total price equations, under the assumption that the explanatory variables in the separate price equations are the same (xi = x1 = x2 = x3), can be written as

which provides the estimable form of the price equation reported in Table 5. As a final step, we employ a variation of the procedure implemented by Lee (1982) and reiterated by Maddala (1983) to obtain a corrected asymptotic covariance matrix for each of the price equations.

Table 4 reports the estimation results for the MNL regression. The independent variables explain why a unit would be sold in the mid-range and post-completion in the sale sequence, respectively. A negative sign shows a greater likelihood that the unit possessing the particular attribute will be sold in the early phase of development. Conversely, a positive sign indicates a greater likelihood that the unit possessing the particular attribute will be sold in the middle phase or after completion, each relative to the early phase. The independent variables include the unit and project characteristics in the price equation, as well as additional variables to help identify the sales phase selection equation. These additional variables capture development characteristics (standard deviation of unit area within development and height of building) and relative competition from other developments (unsold units from other developments that overlap the midpoint of the subject development’s sales).

The coefficient estimates for the unit characteristics in Table 4 generally confirm that choice units, such as those located on the higher floors or not on an “unlucky” floors, that have a pool or road views are more likely to be sold in the earlier sequence of the sale process. Thus, it appears that the quality-sales sequence phenomenon is relevant to our sample.

Table 5 reports the sample selection corrected hedonic price function estimates. As in the OLS models examined earlier, the dependent variable is the natural logarithm of sale price for individual units. The second stage of the estimation procedure introduces additional variables derived from the MNL to correct for the sample selectivity bias in the price equation; these selection variables are reported at the end of the list of independent variables. We note that the sample selection coefficients (ϕki) are highly significant in all of the models.

The coefficients on most of the property and unit characteristics in Table 5 are significant and exhibit expected signs. While most have the same sign and significance as the uncorrected OLS results reported in Table 3, the morning and afternoon exposure results found in the OLS models are no longer puzzling. After correcting for the underlying selection process, the AM_SUNi coefficients now indicate a significant discount for morning exposure in the pooled and mid-rise samples. The PM_SUNi coefficients now reveal a statistically significant discount for afternoon exposure across all of the samples. Further, the afternoon exposure generates a greater discount than does morning exposure for the pooled sample and individual development types—a result consistent with our expectations. In addition, while units fronting a main road effect was insignificant in the mid-rise sample in the uncorrected OLS results in Table 3, the coefficients on ROAD_VIEWi reported in Table 5 show that these units sell at a premium in high-rise and in mid-rise developments.

The point estimates show that after controlling for unit size, floor level, and orientation, units situated on the top most level of a residential block sell at a discount, but not all the estimates are significant. On the other hand, ground floor units are consistently discounted between 7 and 9%. These discounts, however, do not mean that units located on the ground floor and top floors are unpopular. Indeed, results of the earlier MNL model show that units located on the ground level tend to be sold earlier in the sale sequence. The apparent contradiction between price and popularity can be attributed to the fact explained earlier, that units on the ground are usually sold with private enclosed space, a practice that reduces the measured price per square foot.

Turning to our main concern, we allow for different sales sequence marginal effects in early sequence, mid-sequence, and post completion subsamples by including variables in the model interacting DAYSi/365 and the endogenous dummy variables representing the three sales phases. The coefficient on product of the DAYSi/365 variable and the early sequence dummy captures the marginal effect of the sales sequence during the early period. Note that the DAYSi/365 coefficients indicate annualized effects.

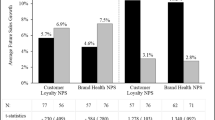

Looking at the estimates on these variables in Table 5, we observe statistically significant coefficients on the interactive terms for nearly all of the sales sequence phases. For the pooled model, units sold in the early sales subsample exhibit a statistically significant negative sales sequence effect on selling price while units sold in the mid-subsample exhibit a significantly positive sales sequence effect on price. Prices remain stable (insignificant marginal effect) for sales after project completion. Ignoring the fact that every condominium unit has a nonzero probability of selling in each of the sales sequence intervals regardless of when it actually sold in the sequence, the marginal effect is estimated by scaling the coefficient on the interactive term by its respective average probability. For example, the annual rate of decline over the first phase is 3.872%, the coefficient of −0.051 times the probability of a sale in the first interval (0.7593). Over the second phase, the model predicts an annual rate of increase of nearly 3.5%.Footnote 10 The price change in the post-completion phase is insignificant.

The high-rise and mid-rise sample results differ from the pooled results. For mid-rise developments, the early sales sequence exhibits a positive and statistically significant DAYSi effect. The probability scaled annual price increase over this interval is 1.51%. The mid- and post-completion sales sequences, however, reveal a negative DAYSi effect on price with a 4.29% annual rate decline over the mid-sale sequence and a 1.89% decline over the post completion period.

The high-rise price-sales sequence relation differs from the mid-rise pattern. Sales in the early sales sequence period exhibit falling prices (1.92% annual decline) while sales during the middle sales sequence exhibit stable prices. The post completion period, like for mid-rise developments, exhibits a price decline (1.26% annually). Once we allow for differences between high-rise and mid-rise developments, we find differing sales sequence effects on price. This contrasts with Mayer (1998) who finds no evidence of the declining price anomaly for condominium sales in Los Angeles from 1970 to 1991 and for both condominium and single-family home sales in Dallas from 1970 to 1991.

While the analysis of marginal effects provides some insight into the price-sequence pattern, it does not reflect fully the pricing implications of the model. To gain more insight into the relationship between sales sequence and prices, we examine the overall price pattern over the development phases. To do so, we construct the price index, PI, using on the estimates of the price effects from the endogenous dummy variables and their interaction terms. The index is calculated as

where %DEV_DAYSi is the number of days since first sale in the development deflated by the number of days from the first sale to project completion. The mean probability of a sale in each sale sequence interval is calculated for each sales sequence phase (subsample). For example, Φ11 represents the average probability of a unit selling in the first sales sequence interval over the first sale sequence interval and Φ12 represents the average probability of a unit selling in the first sales sequence interval when it actually sells in the second interval, etc.

Figure 2, Panel A depicts the calculated price index over the sales sequence for the different samples. The index indicates most of the price change over the sequence of sales reflects the endogenous intercept terms for each interval (the first term in Eq. 6) rather than the marginal effects within each interval. An unfortunate artifice of the sample selection correction framework is that the sales sequence phase effects appear to create discontinuities in the price index at the boundary of each phase; nonetheless, the general shape implied by the three phases and the marginal changes within the phases provide sufficient insight into the broad sales sequence-price patterns for the different types of property. For example, in the pooled sample, prices decline 23.8% from the first sale to completion, with a 6 percentage point increase in price post-completion. The annualized price changes over the sales sequence within each interval are −2.04%, 0.87%, −0.17%, respectively. The broad pattern is roughly U-shaped.

Price Sequence Index over Development Cycle. Note: The price indices are generated using the endogenous dummy variables and their interaction terms from Table 5 estimates (panel a) and Table 6 estimates (panel b). The index is calculated as outlined in Eq. (6) using the mean probability of a sale in each sale sequence interval (subsample). The horizontal access represents the sales sequence. Specifically, the number of days from the date of the first sale divided by the total number of days from the first sale until the date an occupation permit was obtained

Turning to the high-rise sample in Fig. 2 panel A, we find a similar U-shaped price pattern. Prices decline from the first sale to completion (27.77%) and rise 7 percentage points post-completion. Marginal price changes within sales sequence phases in the figure, however, exhibit a consistently negative annual average price change of −2.26%, −1.63%, and − 2.26%, respectively. In contrast, the mid-rise sample exhibits an increase in prices over the sales sequence of first sales to completion of 8.78%. The post-completion period has a 13.69 percentage point price decline with a slight annual rate of increase within the first sales sequence interval (0.88%) followed by declines within the remaining two sales sequence intervals (−3.70% and − 2.07%, respectively).

As a robustness check of the stability of the estimates and the consistency of the results, we add an additional development phase to the model. The models represent the results of a grid search of the combinations of subsample partitions of the sales sequence phases using 5% intervals falling within 10% and 90%. Table 6 presents the estimates for this approach. Note that for the pooled sample, all of the coefficient estimates for the unit, development, and market variables remain of the same sign and significance. For the high-rise sample, the coefficient of LUCKY_FLOORi and UNLUCKY_FLOORi become significant and are of expected sign. The estimate on LEVEL_SQi becomes significant. In the mid-rise model, the LEVELi (the result still shows an increase in price with increased height due to the square level terms) and the AM_SUNi estimates are now insignificant. Other than these changes, all other estimates retain the signs and significance found in the earlier models for the unit, development, and market variables in both the high-rise and mid-rise samples. Figure 2, Panel B shows the price index for the sales sequence for the models that partition the sales sequence into 4 intervals or development phases. The overall pattern remains the same as observed for the earlier models. The pooled price index shows a decline in the middle portion of the sales sequence with an increase post-completion. However, the post-completion price level remains below those of the initial sales. The high-rise price index shows higher prices through the first half of the sales sequence with a decline followed by a slight post-completion increase. The mid-rise model shows a slightly larger decrease post-completion. Nonetheless, the broad pattern in each case remains remarkably similar to the corresponding earlier model partitioning the sales sequence into 3 intervals.

Conclusions

It is not unusual in real estate markets to observe similar assets being sold in sequence. The literature identifies several rationales for sales sequence effects on prices in open (non-auction) markets: consumption risk when units are heterogeneous and the built-out characteristics of the development are uncertain until completion; the risk that the development will not be completed successfully; the benefit of agglomeration economies that do not accrue until a critical mass is reached in the development; and the notion that choice units tend to sell early in the sequence. The existing literature does not yet offer sufficient evidence on the extent to which price varies over the sales sequence in the absence of these effects.

This paper adds to the body of empirical evidence on the price-sales sequence pattern, testing for development scale effects and unit selection effects driven by buyer or developer behavior with respect to unobserved differences in unit quality. We examine the sequential sales of new condominiums in a setting in which it appears that both consumption risk and completion risk are minimized and where production agglomeration economies do not pertain. We control for development scale effects by splitting the sample into high-rise and mid-rise developments and control each model for possible selection bias in the estimated sequence-price relation with a selection correction procedure. The results differ across high-rise and mid-rise developments, revealing development scale effects. In addition, choice condominium units do tend to sell earlier in the sequence. The sales sequence and price relations found after correcting for selection effects differ from the OLS estimates, indicating that the latter are biased.

What is remarkable is that once these factors are controlled—consumption risk, completion risk, scale effects and selection effects—we find nonmonotic sales sequence-price patterns. Sirmans et al. (1997) argue that changing consumption risk over the sales sequence drives the type of price-sequence pattern they observe for new residential construction and lot sales. The results reported here open the possibility that the price-sales sequence relation need not disappear when consumption risk effects are minimized. Hollans et al. (2013) argue that such selection effects may be responsible for their nonmonotonic sales sequence-price results they find for new residential construction. Our estimates suggest the selection process may have surprising implications for the observed sequence-price relation. After all, we find nonmonotonic sales sequence-price relations only when selection effects are removed. More generally, when early buyers in a multiple-unit development have and do exercise their option to select the more desirable units, their behavior may obscure the true underlying sales sequence-price patterns and even largely overshadow the presence of pricing anomalies attributable to something other than the various factors already identified in the literature. More empirical studies of different real estate products in different markets is needed to ascertain the extent to which the types of pricing anomalies found here are idiosyncratic or apply broadly.

Notes

We thank an anonymous referee for this point.

Developers may also systematically change asking prices over time in order to meet sales goals at different stages of project completion. As in many real estate markets, sales prices in our sample are not the same as asking prices. Nonetheless, we expect developers’ pricing strategies to reflect current market conditions.

In Singapore developers can begin preselling as soon as the construction permit is obtained; in contrast, developers in other presale markets such as Hong Kong can only start selling when construction is close to completion (Fu and Qian 2014).

The anti-speculation measures announced on May 15, 1996 include a tax of 100%, 66%, and 33% on the gains from disposal if the property is sold within the first, second, and third year of purchase, respectively. In addition, buyers of residential properties are required to pay 20% of the purchase price in cash. They are also not allowed to use their pension fund to cover stamp duties related to property transactions.

Our measurement of the sequential sale effect can also account for possible missing observations due to incomplete transaction data. The transaction database is based on caveats lodged by the purchasers to protect their interest soon after an option to purchase a property is exercised. Essentially, caveats are legal documents lodged by home purchasers through their lawyers with the Singapore Land Authority to register their legal interest in the property. Typically, caveats are lodged two to three weeks after a purchaser signs an option to purchase at the show flat. Since it is not mandatory to lodge a caveat, it is technically possible that the transaction database does not include all the units sold directly by the developers. However, any omission is likely to be small in practice since most home purchases involved mortgage loans, in which case the solicitors acting on behalf of the banks would insist on lodging a caveat to protect their clients’ interest in the property. Finally, while private owners can re-sell their units before the development is completed, these transactions are not included in our data. Our measurement of the sequential sale effect allows for missing transaction data from this source as well.

The number eight is considered a lucky number because it sounds like “prosperity” in Chinese. Conversely, the number four is considered an unlucky number because it sounds like the word “death”.

The mainland of Singapore measures 50 km from east to west and 26 km from north to south.

We thank an anonymous referee for suggesting this possible explanation.

The partitions of the sample into these sequence subsamples are the partitions that maximize second stage model fit. This requires re-estimating the MNL model and second stage price equations for all feasible partitions and then optimizing over goodness-of-fit in the selection-corrected price function. For the three development phase models, the breakpoint was varied using 1 percentage point increment from first sale to the completion of the development.

The probability of a sale in the second phase based on the second phase sample is 34.02%.

References

Ashenfelter, O. (1989). How auctions work for wine and art. Journal of Economic Perspectives, 3(3), 23–36.

Ashenfelter, O., & Genesove, D. (1992). Testing for price anomalies in real-estate auctions. American Economic Review, 82(2), 501–505.

Beggs, A., & Graddy, K. (1997). Declining values and the afternoon effect: Evidence from the art auctions. RAND Journal of Economics, 28(3), 544–565.

Benson, E. D., Hansen, J. L., Schwartz, A. L., & Smersh, G. (1998). Pricing residential amenities: The value of a view. Journal of Real Estate Finance and Economics, 16(1), 55–73.

Bond, M. T., Seiler, V. L., & Seiler, M. J. (2002). Residential real estate prices: A room with a view. Journal of Real Estate Research, 23(1/2), 129–137.

Burguet, R. (2005). The condominium problem; auctions for substitutes. Review of Economic Design, 9(2), 73–90.

Chang, C. O., & Ward, C. W. R. (1993). Forward pricing and the housing market: The pre-sales housing system in Taiwan. Journal of Property Research, 10(3), 217–227.

Chau, K. W., Ma, V. S. M., & Ho, D. C. W. (2001). The pricing of “luckiness” in the apartment market. Journal of Real Estate Literature, 9(1), 31–40.

Fanning, S. F., Grissom, T. V., & Pearson, T. D. (1995). Market analysis for valuation appraisals. Appraisal: Institute.

Fu, Y., & Qian, W. (2014). Speculators and price overreaction in the housing market. Real Estate Economics, 42(4), 977–1007.

Hollans, H., Martin, R. W., & Munneke, H. J. (2013). Measuring price behavior in new residential subdivisions. Journal of Real Estate Finance and Economics, 47(2), 227–242.

Lai, R. N., Wang, K., & Zhou, Y. (2004). Sale before completion of development: Pricing and strategy. Real Estate Economics, 32(2), 329–357.

Lee, L. F. (1982). Some approaches to the correction of selectivity Bias. Review of Economic Studies, 49(3), 355–372.

Lee, L. F. (1983). Generalized econometrics models with selectivity. Econometrica, 51(2), 507–512.

Maddala, G. S. (1983). Limited dependent and qualitative variables in econometrics. Cambridge: Cambridge University Press.

Mayer, C. J. (1998). Assessing the performance of real estate auctions. Real Estate Economics, 26(1), 41–66.

McAfee, R. P., & Vincent, D. (1993). The declining price anomaly. Journal of Economic Theory, 60(1), 191–212.

Milgrom, & Weber. (1982). A theory of auctions and competitive bidding. Econometrica, 50(5), 1089–1122.

Munneke, H. J., Ooi, J. T. L., Sirmans, C. F., & Turnbull, G. K. (2011). Sequence of sales of similar assets: The law of one price and real estate. Journal of Regional Science, 51(2), 355–370.

Ong, S. E., & Koh, Y. C. (2000). Time on-market and price trade-offs in high-rise housing sub-markets. Urban Studies, 37(11), 2057–2071.

Ooi, J. T. L., & Le, T. T. T. (2013). The spillover effects of infill developments on local housing prices. Regional Science and Urban Economics, 43(6), 850–861.

Rauch, J. E. (1993). Does history matter only when it matters little? The case of City-industry location. Quarterly Journal of Economics, 108(3), 843–867.

Sirmans, C. F., Turnbull, G. K., & Dombrow, J. (1997). Residential development, risk, and land prices. Journal of Regional Science, 37(4), 613–628.

Tse, R. Y. C. (2002). Estimating Neighbourhood effects in house prices: Towards a new hedonic model approach. Urban Studies, 39(7), 1165–1180.

Tu, Y., & Bao, H. X. H. (2009). Property rights and housing value: The impacts of political stability. Real Estate Economics, 37(2), 235–257.

Van Den Berg, G., Van Ours, J. C., & Pradhan, M. P. (2001). The declining price anomaly in Dutch Dutch rose auctions. American Economic Review, 91(4), 1055–1062.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Munneke, H.J., Ooi, J.T.L., Sirmans, C.F. et al. Testing for Price Anomalies in Sequential Sales. J Real Estate Finan Econ 58, 517–543 (2019). https://doi.org/10.1007/s11146-018-9660-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-018-9660-5