Abstract

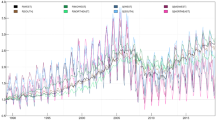

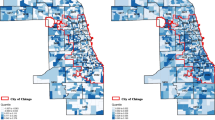

This paper investigates herding behavior in the US residential housing market. The sample period is 1975 M01 to 2015 M06. The study utilizes the housing price index of each of the 50 states and Washington DC to form nine census region-based markets, or portfolios and then employs switching and quantile regressions to examine the spatial and time-varying disparities of housing return dispersions and investors’ herding behavior. The study finds that the degree of herding varies across regimes, regions and conditional distributions. The regime-specific herd formation may be partially originated by extreme housing market conditions, bull and bear housing market conditions, uncertainty in national financial markets, economic recessions and uncertainty of economic policies. The bull housing markets exhibits stronger effects on return dispersion than down markets, which is consistent with the “flight-to-safety” consensus behavior of investors. The study also finds that positive and negative linear and nonlinear returns magnify dispersions in an asymmetric manner. The increase in co-movement and interdependence of state and regional-level housing markets returns among geographically diverse states and regions offer little hope of successful geographical portfolio diversification strategies for U.S housing market investors. Moreover, time-invariant modeling may yield incorrect inferences regarding herd formation in regional housing markets.

Similar content being viewed by others

Notes

Market participants can be demarcated into informed and uninformed participants. Informed participants may comprise professional real estate market analysts, real estate surveyors/appraisers, professional real estate traders and real estate investment trusts-REITs fund managers. They possess very accurate information and their participation in the housing market equals revelation of private signals. Uninformed participants consist of non-professional real estate market investors such as households who invest their savings in the housing market and individuals who buy homes for speculative purposes. This group possesses low-quality or noisy information.

These may include hedgers, speculators, arbitrageurs, institutional and retail investors, Equity fund managers, Financial Analysts stock dealers.

Studies by Harrison (2010) and Foldvary (1997) show that during economic recession, the prices of land are lowest. The reduction in interest rate (through monetary policy interventions) to spur economic expansion reduces the cost of borrowing, increases demand for land (and of course the price of land) and residential houses. The upshot of this trend is rapid burgeoning of construction and economic activities.

See also the influential paper by Carlino and DeFina (1998) which elaborates why regional housing markets respond differently to monetary shocks.

Although it may be argued that the formation of equally-weighted portfolios or regions may skew our results due to different sizes of state-level housing markets, we could not find a reliable weighting variable. Past studies such as Chiang and Zheng (2010) have used equally weighted economic sectors in the study of country-level herding behavior in the stock market.

In this study, our markets refer to the nine regions for the purpose of investigating the herd formation behavior in the US housing market.

For each structural break regression, the estimations are carried out using Newey and West (1987) heteroskedasticity and autocorrelation consistent (HAC) standard errors due to strong correlation among state returns and substantial variation in dispersions. We also use 15 % trimming of the observations in testing for the breaks.

See Koenker (2005) for derivation of and details on quantile regressions.

CCK (2000) use 1 % (99 %) and 5 % (95 %) return distributions to define lower (upper) tails. We also used 1 and 99 % returns distributions and our results remain qualitatively similar.

Zero in this case means that no herding coefficient in the lower tails is statistically significant (See MAT and PAC regions) again reinforcing the dominance of herding behavior in the upper over lower tails of return distributions.

We could also have used the S&P 500 volatility index (VIX) as a measure of uncertainty but the data are available from 1990 while our data run from 1975. To ensure that our results are not spurious, we tested for unit root of the ANFCI using ADF test. The test statistic was −3.679 against a critical value of −3.472 at 1 % significant level. Therefore, ANFCI is stationary.

ANFCI is constructed by Chicago Fed. It is normalized to have a mean of zero. Unlike the national financial condition index (NFCI), ANFCI isolates a component of financial conditions uncorrelated with economic conditions to provide an update on financial conditions relative to current economic conditions. See https://www.chicagofed.org/research/data/nfci/background for additional details

To spur revival of the housing market, the U.S government, through its various organs, took unprecedented steps and intervened in the housing market by injecting liquidity (additional capital) into Fannie Mae and Freddie Mac in 2008, creating a home-buyer tax credit program in 2009 and 2010, launching the Home Affordable Modification Program (HAMP) and implementing the Home Affordable Refinancing Program (HARP). Both HAMP and HARP were set up in March 2009. Even after taking these drastic steps, policy uncertainty remained high and the housing market failed to respond favorably.

To ensure that our results are not spurious, we tested for unit root of the EPU index using ADF test. The test statistic was −4.547 against a critical value of −3.472 at 1 % significant level. We reject the null of unit root.

See www.PolicyUncertainty.com for details and data. EPU is also available for Germany, France, Italy, Spain and Europe.

References

Ades, A., & Chua, H. B. (1997). Thy neighbor’s curse: regional instability and economic growth. Journal of Economic Growth, 2(3), 279–304.

Bachmann, R., Elstner, S., & Sims, E. R. (2010). Uncertainty and economic activity: evidence from business survey data. American Economic Journal: Macroeconomics, 5(2), 217–249.

Bai, J., & Perron, P. (2003). Computation and analysis of multiple structural change models. Journal of Applied Econometrics, 18, 1–22.

Baker, D. (2005). Housing bubble fact sheet, CEPR issue brief, Centre for Economic Policy Research.

Baker, S.R., Bloom, N., & Davis, S.J. (2013). Measuring economic policy uncertainty. Working Paper No. 13–02, Booth School of Business, The University of Chicago.

Barnes, M., & Hughes, A.W. (2002). A quantile regression analysis of the cross section of stock market returns, FRB Boston Working Paper series No. 02–2, Federal Reserve Bank of Boston.

Baur, D. (2006). Multivariate market association and its extremes. Journal of International Financial Markets Institutions and Money, 16, 355–369.

Bekaert, G., & Wu, G. (2000). Asymmetric volatility and risk in equity markets. Review of Financial Studies, 13, 1–42.

Bernanke, B. S. (1983). Irreversibility, uncertainty, and cyclical investment. The Quarterly Journal of Economics, 98(1), 85–106.

Bernanke, B.S., Gertler, M., & Gilchrist, S. (1999). The financial accelerator in a quantitative business cycle framework. In Handbooks in Economics, 15, 1999. Amsterdam: Elsevier, 1341–1393.

Bikhchandani, S., Hirshleifer, D., & Welch, I. (1992). A theory of fads, fashion, custom and cultural changes as informational cascades. Journal of Political Economy, 100, 992–1026.

Bikhchandani, S., & Sharma, S. (2001). Herd behavior in financial markets. IMF staff papers. International Monetary Fund, 47(3), 279–310. doi:10.2307/3867650.

Brunnermeier, M. (2009). Deciphering the liquidity and credit crunch 2007–08. Journal of Economic Perspectives, 23, 77–100.

Carlino, G. A., & DeFina, R. H. (1998). The differential regional effects of monetary policy. The Review of Economics and Statistics, 80, 572–587.

Carlino, G.A., & DeFina, R.H. (1999). Do states respond differently to changes in monetary policy? Business Review, Federal Reserve Bank of Philadelphia (July/August), 17–27.

Chang, E. C., Cheng, J. W., & Khorana, A. (2000). An examination of herd behavior in equity markets: an international perspective. Journal of Banking and Finance, 24, 1651–1679.

Chevalier, J., & Ellison, G. (1999). Are some mutual fund managers better than others? Cross-sectional patterns in behavior and performance. Journal of Finance, 54, 875–899.

Chiang, T. C., & Zheng, D. (2010). An empirical analysis of herd behavior in global stock markets. Journal of Banking and Finance, 34, 1911–1921.

Chiang, T. C., Li, J., & Tan, L. (2010). Empirical investigation of herding behavior in Chinese stock markets: Evidence from quantile regression analysis. Global Finance Journal, 21, 111–124.

Chiang, T. C., Tan, L., Li, J., & Nelling, E. (2013). Dynamic herding behavior in pacific-basin markets: evidence and implications. Multinational Finance Journal, 17(3–4), 165–200.

Christie, W. G., & Huang, R. D. (1995). Following the pied piper: do individual returns herd around the market? Financial Analysts Journal, 51, 31–37.

Collard, F., Dellas, H., Diba, B., & Loisel, O. (2012). Optimal monetary and prudential policies. CREST Working Paper No. 2012-34, Bank of France Working Paper No. 413.

Conrad, J., Gultekin, M., & Kaul, G. (1991). Asymmetric predictability of conditional variances. Review of Financial Studies, 4, 597–622.

Crawford, G., & Fratantoni, M. (2003). Assessing the forecasting performance of regime-switching, ARIMA and GARCH models of house prices. Real Estate Economics, 31, 223–243.

Davig, T. (2004). Regime-switching debt and taxation. Journal of Monetary Economics, 51, 837–859.

Demirer, R., & Kutan, A. M. (2006). Does herding behavior exist in Chinese stock markets? Journal of International Financial Markets Institutions and Money, 16, 123–142.

Demirer, R., Kutan, A. M., & Chen, C. (2010). Do investors herd in emerging stock markets? Evidence from the Taiwanese market. Journal of Economic Behavior & Organization, 76, 283–295.

Devenow, A., & Welch, I. (1996). Rational herding in financial economics. European Economic Review, 40, 603–615.

Duffee, G.R. (2001). Asymmetric cross-sectional dispersion in stock returns: Evidence and implications. Working Papers in Applied Economic Theory, Federal Reserve Bank of San Francisco, No. 2000–18.

Economou, F., Kostakis, A., & Philippas, N. (2011). Cross-country effects in herding behavior: evidence from four South European markets. Journal of International Financial Markets, Institutions & Money, 21, 443–460.

European Central Bank. (2007). Progress towards a framework for financial stability assessment, speech by José-Manuel González-Páramo, Member of the Executive Board of the ECB, OECD World Forum on “Statistics, Knowledge and Policy”, Istanbul, 28 June.

Foldvary, F. (1997). The business cycle: a georgist-austrian synthesis. American Journal of Economics and Sociology, 56(4), 521–541.

Gadanecz, B., & Jayaram, K. (2008). Measures of financial stability - A review. In: Proceedings of the IFC Conference on "Measuring financial innovation and its impact", Basel, 26–27 August 2008

Gleason, K. C., Mathur, I., & Peterson, M. A. (2004). Analysis of intraday herding behavior among the sector ETFs. Journal of Empirical Finance, 11, 681–694.

Goodfellow, C., Bohl, M. T., & Gebka, B. (2009). Together we invest? Individual and institutional investors’ trading behavior in Poland. International Review of Financial Analysis, 18, 212–221.

Goyal, A., & Santa-Clara, P. (2003). Idiosyncratic risk matters! Journal of Finance, 58(3), 975–1008.

Gündüz, Y., & Orcun, K. (2014). Impacts of the financial crisis on Eurozone sovereign CDS spreads. Journal of International Money and Finance, 49, 425–442.

Gupta, R., & Kabundi, A. (2010). The effect of monetary policy on house price inflation: A factor augmented vector autoregression (FAVAR) approach. Journal of Economic Studies, 37(6), 616–626.

Gupta, R., & Miller, S. M. (2012). The time series properties of house prices: a case study of the Southern California market. Journal of Real Estate Finance and Economics, 44, 339–361.

Hamilton, J. D. (1988). Rational-expectations econometric analysis of changes in regime: an investigation of the term structure of interest rates. Journal of Economic Dynamics and Control, 12, 385–423.

Hamilton, J.D. (2005). What’s real about the business cycle? NBER Working Paper Series, National Bureau of Economic Research.

Harrison, F. (2010). Boom bust: House prices, Banking and the depression of 2010, London: Shepheard-Walwyn. www.shepheard-walwyn.co.uk.

Hirshleifer, D., & Teoh, S. H. (2003). Herd behavior and cascading in capital markets: a review and synthesis. European Financial Management, 9, 25–66.

Hong, Y., Tu, J., & Zhou, G. (2007). Asymmetries in stock returns: statistical tests and economic evaluation. Review of Financial Studies, 20(5), 1547–1581.

Hoyt, H. (1970). The urban real estate cycle-performances and prospects. Urban Land Institute Technical Bulletin; No. 38, 537–547. Urban Land Institute, Washington.

Hwang, S., & Salmon, M. (2004). Market stress and herding. Journal of Empirical Finance, 11, 585–616.

Jarque, C. M., & Bera, A. K. (1987). A test for normality of observations and regression residuals. International Statistical Review, 55(2), 163–172.

Kennedy, P. (2008). A guide to econometrics. Malden: Blackwell Publishing.

Koenker, R. (2005). Quantile regression. Cambridge: Cambridge University Press.

Lakonishok, J., Shleifer, A., & Vishny, R. W. (1992). The impact of institutional trading on stock prices. Journal of Financial Economics, 32, 23–44.

Longin, F., & Solnik, B. (2001). Extreme correlation of international equity markets. Journal of Finance, 56, 649–676.

Miao, H., Ramchander, S., & Simpson, M. W. (2011). Return and volatility transmission in U.S. Housing markets. Real Estate Economics, 39(4), 701–741.

Miles, W. (2009). Volatility clustering in U.S home prices. Journal of Real Estate Research, 30(1), 73–90.

Morelli, D. (2010). European capital market integration: an empirical study based on a European asset pricing model. Journal of International Financial Markets Institutions and Money, 20, 363–375.

Newey, W. K., & West, K. (1987). A simple positive semi-definite, heteroskedasticity and autocorrelation consistent covariance matrix. Econometrica, 55, 703–708.

Nofsinger, J., & Sias, R. (1999). Herding and feedback trading by institutional and individual investors. Journal of Finance, 54, 2263–2295.

Philippas, N., Economou, F., Babalos, V., & Kostakis, A. (2013). Herding behavior in REITs: novel tests and the role of financial crisis. International Review of Financial Analysis, 29, 166–174.

Quigley, J. M. (2002). Transaction costs and housing markets. In A. O’Sullivan & K. Gilb (Eds.), Housing markets and public policy (pp. 54–64). Malden: Blackwell Publishing.

Sapienza, P., Guiso, L., & Zingales, L. (2013). The determinants of attitudes towards strategic default on mortgages. Journal of Finance, 68(4), 1473–1515.

Shiller, R. (2007). Understanding recent trends in house prices and home ownership. http://EconPapers.repec.org/RePEc:cwl:cwldpp:1630.

Shin, H. S. (2010). Risk and liquidity, Clarendon lectures in Finance. Oxford: Oxford University Press.

Solnik, B., & Roulet, J. (2000). Dispersion as cross-sectional correlation. Financial Analysts Journal, 56(1), 54–61.

Stephens, M. (2012). Tackling housing market volatility in the UK. Part I: long- and short-term volatility. International Journal of Housing Policy, 12(3), 367–380.

Stock, J. H., & Watson, M. W. (2003). Forecasting output and inflation: the role of asset prices. Journal of Economic Literature, 41(3), 788–829.

Tan, L., Chiang, T. C., Mason, J. R., & Nelling, E. (2008). Herding behavior in Chinese stock markets: an examination of A and B shares. Pacific-Basin Finance Journal, 16, 61–77.

Van Ommeren, J. (2008). Transaction costs in housing markets. Unpublished working paper.

Vargas-Silva, C. (2008a). Monetary policy and the US housing market: a VAR analysis imposing sign restrictions. Journal of Macroeconomics, 30, 977–990.

Vargas-Silva, C. (2008b). The effect of monetary policy on housing: a Factor- Augmented Vector Autoregression (FAVAR) approach. Applied Economics Letters, 15(10), 749–752.

Welch, I. (2000). Herding among security analysts. Journal of Financial Economics, 58(3), 369–396.

Wheaton, W. C., & Nechayev, G. (2008). The 1998–2005 housing “bubble” and the current “correction”: what’s different this time? Journal of Real Estate Research, 30(1), 1–26.

Zhu, B., Füss, R., & Rottke, N. B. (2013). Spatial linkages in returns and volatilities among U.S. Regional housing markets. Real Estate Economics, 41(1), 29–64.

Zhou, J., & Anderson, R. I. (2013). An empirical investigation of herding behavior in the U.S. REIT Market. Journal of Real Estate Finance & Economics, 47, 83–108.

Acknowledgments

We are greatly indebted to Professor Emeritus John M. Dunaway for reading our manuscript, providing some valuable insights and redacting the original manuscript.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Ngene, G.M., Sohn, D.P. & Hassan, M.K. Time-Varying and Spatial Herding Behavior in the US Housing Market: Evidence from Direct Housing Prices. J Real Estate Finan Econ 54, 482–514 (2017). https://doi.org/10.1007/s11146-016-9552-5

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-016-9552-5