Abstract

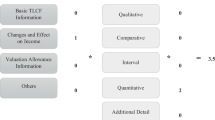

This study examines whether qualitative disclosure in tax footnotes affects the market valuation of tax avoidance activities. We predict that more disclosures in tax footnotes mitigate investors’ concerns over the agency risk of managers engaging in potentially illegal tax avoidance and improve the transparency of firm performance, thus increasing firm valuation. Consistent with the prediction, we find that the market valuation of tax avoidance increases when firms’ tax footnotes disclose more qualitative information related to their tax avoidance activities. We provide several tests to show mechanisms underlying our main findings and mitigate concerns about alternative explanations. Overall, our study suggests that the tax-related disclosures in tax footnotes are useful for investors assessing the value of tax avoidance.

Similar content being viewed by others

Data availability

Data used in this study are available from the sources identified in the study.

Notes

We choose these six factors because the disclosure of these factors is largely voluntary and under a firm’s discretion.

We require all observations in our sample to have foreign operations.

The extant literature provides mixed empirical evidence regarding whether investors react to quantitative information in tax footnotes. For example, Raedy et al. (2011) find that investors do not react to details about the composition of the book-tax difference disclosed in tax footnotes. However, Robinson and Schmidt (2013) suggest that “investors reward firms for low disclosure quality, especially small firms and firms with high proprietary costs” in a setting where there are proprietary costs associated with the disclosure of uncertain tax positions.

Our definition of US multinational firms follows prior research (e.g., Dyreng and Lindsey 2009; Li and Ma 2022). Specifically, from the Compustat population, we first exclude non-US firms whose incorporation code “FIC” is not USA. Then, we further identify US multinational firms as those with non-missing “income taxes – foreign” (TXFO).

Examples of headlines include “Income Taxes, Income Tax Matters, Taxes on Earnings, Income Tax Expense.”

In untabulated tests, we show that our results are robust to excluding any one of these six factors from the construction of the variable.

The frequency of tax holiday disclosure is higher in 2004 and 2005 than in 2003 but is not significantly higher than in the subsequent years. This is consistent with a recent study by Chow et al. (2018), which shows a significant increase in the percentage of US multinational firms that enjoy foreign tax holidays after 2005.

Our proposition is consistent with Balakrishnan et al. (2019), who use the length of MD&A and conference call transcripts as their measures of disclosure quality. We support our proposition with anecdotal evidence from firms involved in recent high-profile tax scandals, e.g., Tyco. Desai (2005) suggests that Tyco’s managers’ rent extraction and resource diversion were facilitated and shielded by the complexity of Tyco’s tax avoidance strategies. Tyco’s income tax footnotes from 1997 to 2001 were very short—282, 123, 188, 187, and 186 words, respectively. Our sample’s lower quartile and median tax footnote lengths are 160 and 398 words, respectively. Thus, Tyco’s tax footnote length during 1997–2001 is below the sample median. The tax footnote of ADT in 1996, the year before it merged with Tyco, contains only reconciling tables with no verbal explanations. Thus, the length of ADT’s income tax footnote in 1996 is zero words.

See the University of Virginia’s Research Data Services website at http://data.library.virginia.edu/using-and-interpreting-cronbachs-alpha/.

In another famous tax scandal, Enron’s DisclosureScore was two in both 1998 and 1999.

All subscripts are suppressed, as all these variables are from the same period.

Book value of total assets and market value of common equity have been incorporated in the calculation of Tobin’s Q. To avoid documenting a mechanic association between size and firm value, we use total sales to measure firm size.

In untabulated tests, our results are robust to controlling for the interactions of Length_10K and Opacity with tax avoidance or excluding TAX_VOL as a control variable.

TRAC Reports Inc. provides data on the probability of IRS audits of income tax returns filed by corporations in different asset classes. See

http://tracfed.syr.edu/index/index.php?layer=admin&ds=audit&tool=corptax&group=boxes&program= .

The sample size is smaller than our main sample, because data on UTBs are available only for years after 2007.

Inger et al. (2018) suggest that less readable footnotes increase the valuation of tax avoidance. In untabulated analysis, we find that firms tend to have less readable tax footnotes when they disclose more information in these footnotes. This negative association is likely because discussions in tax footnotes become longer and more complex when firms disclose more information related to tax avoidance. Therefore, while Inger et al. (2018) interpret this finding based on proprietary costs, we suggest that another possible explanation is that firms with less readable footnotes disclose more information, which mitigates investors’ perceived agency costs and improves transparency.

References

Amihud, Y. 2002. Illiquidity and stock returns: Cross-section and time-series effects. Journal of Financial Markets 5 (1): 31–56.

Balakrishnan, K., J.L. Blouin, and W.R. Guay. 2019. Tax aggressiveness and corporate transparency. The Accounting Review 94 (1): 45–69.

Barron, O.E., D. Byard, C. Kile, and E.J. Riedl. 2002. High-technology intangibles and analysts’ forecasts. Journal of Accounting Research 40 (2): 289–312.

Blaylock, B.S. 2016. Is tax avoidance associated with economically significant rent extraction among U.S. firms? Contemporary Accounting Research 33 (3): 1013–1043.

Bonsall, S., IV, K. Koharki, and L. Watson. 2017. Deciphering tax avoidance: Evidence from credit rating disagreements. Contemporary Accounting Research 34 (2): 818–848.

Botosan, C. 1997. Disclosure level and the cost of equity capital. The Accounting Review 72 (3): 323–349.

Bozanic, Z., J. Hoopes, J. Thornock, and B. Williams. 2017. IRS attention. Journal of Accounting Research 55 (1): 79–114.

Campbell, J.L., H. Chen, D.S. Dhaliwal, H. Lu, and L.B. Steele. 2014. The information content of mandatory risk factor disclosures in corporate filings. Review of Accounting Studies 19 (1): 396–455.

Chen, T., J. Harford, and C. Lin. 2015. Do analysts matter for governance? Evidence from natural experiments. Journal of Financial Economics 115 (2): 383–410.

Chiu, T., Y. Guan, and J.-B. Kim. 2018. The effect of risk factor disclosures on the pricing of credit default swaps. Contemporary Accounting Research 35 (4): 2191–2224.

Chow, T., J. Hoopes, and E. Maydew. 2018 U.S. Firms on foreign (tax) holidays. Kenan Institute of Private Enterprise Research Paper No. 18–3, Available at SSRN: https://ssrn.com/abstract=3018819 or https://doi.org/10.2139/ssrn.3018819

Chow, T., K. Klassen, and Y. Liu. 2016. Targets’ tax shelter participation and takeover premiums. Contemporary Accounting Research 33 (4): 1440–1472.

Core, J.E., W. Guay, and D.F. Larcker. 2008. The power of the pen and executive compensation. Journal of Financial Economics 88 (1): 1–25.

Correia, M.M. 2014. Political connections and SEC enforcement. Journal of Accounting and Economics 57 (2–3): 241–262.

Crocker, K., and J. Slemrod. 2005. Corporate tax evasion with agency costs. Journal of Public Economics 89 (9–10): 1593–1610.

Cronbach, L. 1951. Coefficient alpha and internal structure of tests. Psychometrika 16 (3): 297–334.

Das, S., K. Hong, and K. Kim. 2013. Earnings smoothing, cash flow volatility, and CEO cash bonus. The Financial Review 48 (1): 123–150.

Daske, H., L. Hail, C. Leuz, and R. Verdi. 2008. Mandatory IFRS adoption around the world: Early evidence. Journal of Accounting Research 46 (5): 1085–1142.

De Simone, L., L.F. Mills, and B. Stomberg. 2019 What does income mobility reveal about the tax risk-reward tradeoff? Working paper

Dechow, P.M., and I.D. Dichev. 2002. The quality of accruals and earnings: The role of accrual estimation errors. The Accounting Review 77 (s-1): 35–59.

Desai, M. 2005. The degradation of reported corporate profits. Journal of Economic Perspectives 19 (4): 171–192.

Desai, M., and D. Dharmapala. 2006. Corporate tax avoidance and high-powered incentives. Journal of Financial Economics 79 (1): 145–179.

Desai, M., and D. Dharmapala. 2009a. Corporate tax avoidance and firm value. Review of Economics and Statistics 91 (3): 537–546.

Desai, M., and D. Dharmapala. 2009b. Earnings management, corporate tax shelters, and book-tax alignment. National Tax Journal 62 (1): 169–186.

Desai, M., I. Dyck, and L. Zingales. 2007. Theft and taxes. Journal of Financial Economics 84 (3): 591–623.

Drake, K.D., S.J. Lusch, and J. Stekelberg. 2019. Does tax risk affect investor valuation of tax avoidance? Journal of Accounting, Auditing & Finance 34 (1): 151–176.

Dyreng, S.D., M. Hanlon, E.L. Maydew, and J.R. Thornock. 2017. Changes in corporate effective tax rates over the past 25 years. Journal of Financial Economics 124 (3): 441–463.

Dyreng, S.D., J.L. Hoopes, and J.H. Wilde. 2016. Public pressure and corporate tax behavior. Journal of Accounting Research 54 (1): 147–186.

Dyreng, S.D., and B.P. Lindsey. 2009. Using financial accounting data to examine the effect of foreign operations located in tax havens and other countries on U.S. multinational firms’ tax rates. Journal of Accounting Research 47 (5): 1283–1316.

Erickson, M., S. Heitzman, and X. Zhang. 2013. Tax-motivated loss shifting. The Accounting Review 88 (5): 1657–1682.

Fang, V., T. Noe, and S. Tice. 2009. Stock market liquidity and firm value. Journal of Financial Economics 94 (1): 150–169.

Gleason, C., and L. Mills. 2002. Materiality and contingent tax liability reporting. The Accounting Review 77 (2): 317–342.

Goh, B. W., C.Y. Lim, T. Shevlin, and Y. Zang. 2015 Tax aggressiveness and auditor resignation. Working paper, Singapore Management University

Graham, J., M. Hanlon, T. Shevlin, and N. Shroff. 2014. Incentives for tax planning and avoidance: Evidence from the field. The Accounting Review 89 (3): 991–1023.

Gupta, S., and R. Laux. 2008 Do firms use tax cushion reversals to meet earnings targets? Working paper, Michigan State University

Hanlon, M., and J. Slemrod. 2009. What does tax aggressiveness signal? Evidence from stock price reactions to news about tax shelter involvement. Journal of Public Economics 93 (1–2): 126–141.

Hasan, I., C.-K. Hoi, Q. Wu, and H. Zhang. 2014. Beauty is in the eye of the beholder: The effect of corporate tax avoidance on the cost of bank loans. Journal of Financial Economics 113 (1): 109–130.

Heitzman, S., and M. Ogneva. 2019. Industry tax planning and stock returns. The Accounting Review 94 (5): 219–246.

Hirshleifer, D., and S. Teoh. 2003. Limited attention, information disclosure, and financial reporting. Journal of Accounting and Economics 36 (1–3): 337–386.

Hope, O.-K., and H. Lu. 2020. Economic consequences of corporate governance disclosure: Evidence from the 2006 SEC regulation on related-party transactions. The Accounting Review 95 (4): 263–290.

Hope, O.-K., M. Ma, and W. Thomas. 2013. Tax avoidance and geographic earnings disclosure. Journal of Accounting and Economics 56 (2–3): 170–189.

Hutchens, M., and S. Rego. 2015 Does greater tax risk lead to increased firm risk? Working paper, Indiana University

Inger, K. 2014. Relative valuation of alternative methods of tax avoidance. Journal of the American Taxation Association 36 (1): 27–55.

Inger, K.K., M.D. Meckfessel, M. Zhou, and W. Fan. 2018. An examination of the impact of tax avoidance on the readability of tax footnotes. Journal of the American Taxation Association 40 (1): 1–29.

Jaccard, J., R. Turrisi, and C. Wan. 1990. Interaction effects in multiple regression. Sage.

Jung, D., and D. Pulliam. 2006. Predictive ability of the valuation allowance for deferred tax assets. Academy of Accounting and Financial Studies Journal 10 (2): 49–70.

Law, K., and L.F. Mills. 2015. Taxes and financial constraints: Evidence from linguistic cues. Journal of Accounting Research 53 (4): 777–819.

Lehavy, R., F. Li, and K. Merkley. 2011. The effect of annual report readability on analyst following and the properties of their earnings forecasts. The Accounting Review 86 (3): 1087–1115.

Levesque, T.J., T. Libby, R. Mathieu, and S.W.G. Robb. 2010. The effect of director monitoring on bid and ask spreads. Journal of International Accounting Research 9 (2): 45–65.

Li, F. 2008. Annual report readability, current earnings, and earnings persistence. Journal of Accounting and Economics 45 (2–3): 221–247.

Li, Y., and M. Ma. 2022 Are tax havens and offshore financial centers cracked down on? A study on the international standard of exchange of information on request. The Accounting Review. Forthcoming

Liu, J., D. Nissim, and J. Thomas. 2002. Equity valuation using multiples. Journal of Accounting Research 40 (1): 135–172.

Loughran, T., and B. McDonald. 2014. Measuring readability in financial disclosures. Journal of Finance 69 (4): 1643–1671.

Ma, M., and W.B. Thomas. 2020. Legal environment and corporate tax avoidance: Evidence from state tax codes. Journal of the American Taxation Association 42 (2): 57–83.

McGill, G., and E. Outslay. 2004. Lost in translation: Detecting tax shelter activity in financial statements. National Tax Journal 57 (3): 739–756.

Mills, L. 1998. Book-tax differences and internal revenue service audit adjustments. Journal of Accounting Research 36 (2): 343–356.

Mills, L., S. Nutter, and C. Schwab. 2013. The effect of political sensitivity and bargaining power on taxes: Evidence from federal contractors. The Accounting Review 88 (3): 977–1005.

Minton, B.A., C.M. Schrand, and B.R. Walther. 2002. The role of volatility in forecasting. Review of Accounting Studies 7: 195–215.

Muller, K.A., III, and E.J. Riedl. 2002. External monitoring of property appraisal estimates and information asymmetry. Journal of Accounting Research 40 (3): 865–881.

Platikanova, P., and M.M. Mattei. 2016. Firm geographic dispersion and financial analysts’ forecasts. Journal of Banking and Finance 64 (1): 71–89.

Raedy, J., J. Seidman, and D. Shackelford. 2011 Is there information content in the tax footnote? Available at SSRN: https://ssrn.com/abstract=1759266.

Robinson, L., and A. Schmidt. 2013. Firm and investor responses to uncertain tax benefit disclosure requirements. The Journal of the American Taxation Association 35 (2): 85–120.

Thomas, S. 2002. Firm diversification and asymmetric information: Evidence from analysts’ forecasts and earnings announcements. Journal of Financial Economics 64 (3): 373–396.

Wilson, R. 2009. An examination of corporate tax shelter participants. The Accounting Review 84 (3): 969–999.

Acknowledgments

We are thankful for comments from Jennifer Blouin, Editor, an anonymous reviewer, Jared Moore (Discussant), Jane Zhang (Discussant), and seminar participants at the American Tax Association (ATA) midyear meeting (Phoenix), the American Accounting Association (AAA) annual meeting (San Diego), Oregon State University, Huazhong University of Science and Technology, and Central University of Finance and Economics. Thomas Omer acknowledges support from the Delmar Lienemann Sr. Chair of Accounting. Le Luo acknowledges financial support from the National Natural Science Foundation of China (Grant No. 72272170).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

Appendix B

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Luo, L., Ma, M.S., Omer, T.C. et al. Tax avoidance and firm value: does qualitative disclosure in the tax footnote matter?. Rev Account Stud (2023). https://doi.org/10.1007/s11142-023-09773-w

Accepted:

Published:

DOI: https://doi.org/10.1007/s11142-023-09773-w