Abstract

This paper investigates the association between current dividends and analysts’ subsequent earnings forecast errors. This investigation is motivated by the evidence on analyst optimism and Ohlson’s (1991, 1995) fundamental valuation theory that dividends displace future permanent earnings. For the sample period 1985–2016, we document that current dividends are positively correlated with analysts’ future forecast errors, suggesting that analysts potentially ignore the displacement effect of dividends on future earnings. Consistent with theory, this association persists in settings with stable dividends, (i.e., where dividends have limited or no signaling implications) and varies predictably with dividend payouts and cost of capital. We also find that this empirical regularity that analysts do not fully incorporate the effect of dividends on future earnings provides opportunities for arbitrage. More interestingly, we find that the strength of the association between dividends and analysts’ forecast errors has declined over the sample period; this decline appears to correspond with the underlying change in the discount rate over time. The finding that analysts’ do not fully incorporate the implications of current dividends on future earnings is consistent with previously documented inefficiencies in analysts’ use of publicly available information. However, such a systematic association with dividends also suggests that it may be a source of the persistence in analysts’ optimistic bias and thus offers new insights into analyst behavior.

Similar content being viewed by others

Data availability

Data are available from the public sources cite.

Notes

While investors appear to value forecast accuracy, there is also evidence that analysts are not compensated for forecast accuracy (Groysberg et al. 2011). This suggests that there are no incentives for analysts to bias their forecasts upward. Nonetheless, irrespective of whether analysts are making behavioral mistakes or intentionally disregarding information, exploring the sources of any systematic errors remains a worthwhile exercise in understanding analysts’ forecasting behavior.

For example, evidence to date documents that analysts revise their forecasts in response to events such as the announcement of earnings (e.g. Stickel 1989), dividends (e.g. Ely and Mande 1996) and share repurchases (e.g. Bartov 1991). There is also evidence that analysts do not fully incorporate information in past stock prices (Abarbanell 1991), prior forecast errors (Abarbanell and Bernard 1992), and accruals (Bradshaw et al. 2001).

This property of permanent earnings, often referred to as the “dividend displacement property” has been exploited in the fundamental valuation theory of Ohlson (1991), Ohlson and Gao (2006), Ohlson (2008), and Penman (2007), whereby a dollar of dividend reduces future earnings by an amount that is equal to the cost of capital times the amount of dividends.

In practical terms, if the firm chooses not to reduce the asset base by distribution of dividends, it needs to substitute the assets through equivalent borrowing, causing income to go down by interest times the amount borrowed, i.e., dividends. Bhattacharya (1979) uses this cost of borrowing to drive the signaling model. A survey of financial executives indicates that managers treat maintaining dividends “on par with investment decisions” (Brav et al. 2005). The implications are that firms may “cut profitable investments to maintain the dividends” (Edmans, The Wall Street Journal, June 7, 2020) thereby lowering future earnings.

This behavior would be consistent with the researchers’ inability to provide conclusive evidence of dividend signaling.

Such lack of realization, if any, will be an off-equilibrium behavior and cannot be hypothesized.

In examining firm value and the pricing of dividends, Hand and Landsman (2005) find some evidence consistent with dividend displacement in security prices. However, they do not examine the role of dividends in earnings forecasts.

Recent evidence from Benartzi et al. (1997), Nissim and Ziv (2001), and Grullon et al. (2005) has further added to the mixed evidence. See DeAngelo et al. (2007) for an excellent discussion of the dividend literature and Brav et al. (2005) who based on a survey of managers concluded that: “Allen and Michaely (2003) and DeAngelo et al. (2004) provide empirical evidence that signaling models fail in the predictive dimension. Combined with our finding that the assumptions and causal factors within these models are not supported, we conclude that the evidence does not support the signaling models.” Hence our focus is not on signaling.

Nissim and Ziv (2001) control for analysts’ earnings forecasts and use them as an alternative proxy for expected earnings, but their primary interest, unlike ours, is not on whether analysts’ forecasts incorporate and reflect information in dividends.

Although, Loffler (1998) argues that financial analysts’ earnings forecasts do violate properties of rational forecasts.

Our use of the level of dividend (DPSt) is also motivated by our focus on the effect of dividends on subsequent period earnings. Since Dt-1 is two periods away from the forecast period, theoretically, there is no reason to observe any first order effect on the forecast error of t + 1. Given that we already have Dt, in our model specification, and ∆Dt is nothing more than (Dt – Dt-1), any observed correlation after inclusion of ∆Dt is likely to be spurious.

We use Compustat data item DVPSX_C (adjusted with the cumulative adjustment factor) for our DPS variable. As per Compustat: “This item represents the cash dividends per share for which the ex-dividend dates occurred during the reporting period.” Compustat does not provide a comparable variable that adds up the dividends that were declared during the reporting period. The item is adjusted for all stock splits and stock dividends and, unlike common dividends, excludes payments in preferred stock in lieu of cash, spinoffs, and stock of other corporations. The ex-dividend date of the cash dividend is, in all cases, used to determine the reporting period in which the dividend is included. In cases where dividends are normally paid quarterly but the ex-dividend dates of two dividend payments fall in the same quarter, both dividends will be included in that quarter.

It is calculated as the average forecast across all individual forecasts issued within the 90-day window, which starts 365 days prior to and ends 275 days prior to the earnings announcement date of year t + 1 earnings (EPSt + 1). While all reported results are based on the average forecast, untabulated results based on the median forecast yield inferentially identical results.

Given that the timeline for dividends is declaration date, followed by ex-date, followed by payment date, and in our sample, there is an average (median) of 22.6 (14) days between record date and announcement date of dividends, this provides analysts with sufficient time. This measurement timeline is conceptually like that of Ham et al. (2020).

We examine the effect of financial distress more completely in the section on dividend changes.

While the underlying theoretical argument does not require that variables be scaled, we have done so to be consistent with the literature. Furthermore, winsorizing at 10% and 20% gives comparable results.

If we remove the first two sample years (1985 and 1986) and calculate the average across the annually estimated DPS-coefficients for the sample period 1987 to 2016, the average DPS-coefficients are 0.198, 0.336, 0.043, 0.078, 0.054, and 0.082 for the OLS unscaled, OLS scaled, median unscaled, median scaled, Theil-Sen unscaled, and Theil-Sen scaled regressions, respectively. Thus, most of the larger coefficients, and particularly that of 0.112 for the median -scaled regression, which goes down to 0.078 when we eliminate 1985 and 1986 from the sample, are largely driven by the first two sample years. These results are available from the authors upon request.

Given this robustness, for the remainder of the paper, we report results based on annually estimated median regressions with DPSt, and EPSt.

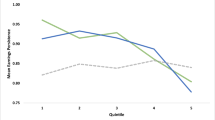

To allocate firms into the transitory and permanent group, we follow Ali et al. (1992). Specifically, we rank firm-year observations by their E/P ratios (= EPSt + 1/Pt). For this table, we omit observations with negative E/P ratios (Jaffe et al. 1989). Each year, we rank firm-years based on E/P ratios into nine portfolios with an equal number of observations. Portfolios 1, 2, 8, and 9 contain observations with transitory earnings. Portfolios 3 to 7 contain observations with persistent earnings.

Although the magnitude of the estimated parameters for TDPS (0.013) and the corresponding parameter estimate of DPS (0.113) are vastly different, careful comparison of the theoretical coefficients suggests that the ratio of the estimated coefficients of TDPS and DPS need not have the same relative order of magnitude as their sample means.

We offer two explanations as to why the coefficient estimates are so vastly different: (a) the sample size for the dividend decrease sample is significantly smaller than the other two subsamples; (b) these are averages from median regressions, and hence the coefficients are not directly comparable to the OLS coefficients, as is evident from Table 4 Panel A, where we present the coefficients from several different estimations.

We also use a more stringent definition requiring that dividends are stable over two and three consecutive years, i.e., we define stable DPS as firms in which the one-year change in dividends was within ± 10%, for each of the one, two, and three preceding years. Untabulated results document that the coefficient on DPSt is positive, irrespective of how long the dividends are held stable.

The above results are subject to the following caveat. First, given significant debate in the literature, appropriate empirical measures of cost of capital, particularly time-varying measures, are not easy to obtain. Second, the results may be sensitive to the choice of the risk-free rate. Third, the cost of capital may not be a cross-sectional constant and may vary from firm to firm, thus introducing noise into the empirical tests.

These tests are only indicative and, given that observed prices are typically cum-dividend, isolating the direct effect of dividends as reflected in the underlying discounted cash flow-based valuation model may warrant greater rigor.

This conclusion is subject to the caveat that, while the T-bill rate decreases monotonically during the sample period, the DPS coefficient has a large drop between 1985 and 1987 and does not have a monotonic declining pattern after that (Figure 2). Thus, the correlation of 0.381 may also be driven by a few sample years.

Some may argue that, given analysts’ lack of incentive for accurate forecasts (Groysberg et al. 2011), they may often forego costly information processing. However, given the saliency of dividend information and the ease of multiplying DPSt by the cost of capital (r) in a simple spreadsheet model makes such an argument weak, relative to, for example, leases and pensions, which may need to be extracted from footnote disclosures.

A more direct and convincing test would warrant the use of individual analysts’ forecasts and future work examining whether there are differences in individual analysts’ ability to parse dividend information could add to our understanding of analyst behavior.

Additionally, we will need a"(⋅) < 0 to be able to invoke the single crossing property to drive an equilibrium.

They also examine the least absolute deviation, which resembles in spirit to mean absolute deviation. While they find that least absolute deviation is better than OLS in some circumstances, it does not address heteroscedasticity which the Theil-Sen estimator does.

This may lead the casual observer to think that in spirit Theil-Sen is akin to bootstrapping. However, traditional bootstrapping is typically used as a solution to a small sample problem, whereby resampling from a limited sample is used to improve the power of the parametric statistical tests. Thus, in traditional bootstrapping, sampling with replacement leads to parameter estimates through OLS that remain parametric. In contrast, the Theil-Sen estimation, being nonparametric, does not require any underlying distributional assumptions and the parameter estimates are asymptotically efficient. Hence, while it may appear that Theil-Sen is similar in spirit to traditional bootstrapping within the parametric framework, in theory, Theil-Sen estimation is an improvement over the commonly used bootstrapping approach where there is sampling with replacement. This makes the estimation technique more appealing and versatile, particularly in settings such as in accounting and finance where the underlying distributions of the variables are not well known.

We thank Jim Ohlson and Seil Kim for generously sharing their SAS code for the Theil-Sen estimation approach with us.

While we are estimating IOS as the first principal component of the following three variables (i.e., MVGROW, MBASS, and RDASS), Kumar and Krishnan (2008) include INVINT, a measure of investment intensity. In our sample, the requirement to have nonmissing values for INVINT would have led to a substantial reduction in sample size. The IOS measure estimated with and without INVINT have a high positive correlation of 0.744.

References

Abarbanell, J.S. 1991. Do analysts’ earnings forecasts incorporate information in prior stock price changes? Journal of Accounting and Economics 14 (2): 147–165.

Abarbanell, J.S., and V.L. Bernard. 1992. Tests of analysts’ overreaction/underreaction to earnings information as an explanation for anomalous stock price behavior. Journal of Finance 47 (3): 1181–1207.

Ali, A., A. Klein, and J. Rosenfeld. 1992. Analysts’ use of information about permanent and transitory earnings components in forecasting annual EPS. The Accounting Review 67 (1): 183–198.

Allen, F., and R. Michaely. 2003. Payout plicy. Handbook of the Economics of Finance 1: 337–429.

Ang, J.S., and S.J. Ciccone. 2009. Dividend irrelevance policy. In Dividends and dividend policy, ed. H. Kent Baker, 97–113. Wiley& Sons.

Baber, W.R., S.N. Janakiraman, and S.H. Kang. 1996. Investment opportunities and the structure of executive compensation. Journal of Accounting and Economics 21 (3): 297–318.

Barth, M., and S. Kallapur. 1996. The effects of cross-sectional scale differences on regression results in empirical accounting research. Contemporary Accounting Research 13 (2).

Bartov, E. 1991. Open-market stock repurchases as signals for earnings and risk changes. Journal of Accounting and Economics 14 (3): 275–294.

Bebchuk, L. A., A. Cohen, C. C. Y. Wang, and L. A. B. Harvard. 2011. Staggered boards and the wealth of shareholders: Evidence from two natural experiments. NBER Working Paper. https://www.nber.org/papers/w17127. Accessed 1 May 2020

Benartzi, S., R. Michaely, and R. Thaler. 1997. Do changes in dividends signal the future or the past? The Journal of Finance 52 (3): 1007–1034.

Bhattacharya, S. 1979. Imperfect information, dividend policy, and “the bird in the hand” fallacy. The Bell Journal of Economics 10 (1): 259–270.

Botosan, C.A., and M.A. Plumlee. 2005. Assessing alternative proxies for the expected risk premium. The Accounting Review 80 (1): 21–53.

Bradshaw, M. T. 2011. Analysts’ forecasts: What do we know after decades of work? SSRN ELibrary. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1880339. Accessed 1 May 2020

Bradshaw, M.T., S.A. Richardson, and R.G. Sloan. 2001. Do analysts and auditors use information in accruals? Journal of Accounting Research 39 (1): 45–74.

Brav, A., J.R. Graham, C.R. Harvey, and R. Michaely. 2005. Payout policy in the 21st century. Journal of Financial Economics 77 (3): 483–527.

Brown, L.D. 1993. Earnings forecasting research: Its implications for capital markets research. International Journal of Forecasting 9 (3): 295–320.

Brown, L.D. 1997. Earnings surprise research: Synthesis and perspectives. Financial Analysts Journal 53 (2): 13–19.

Brown, L.D. 2001. A temporal analysis of earnings surprises: Profits versus losses. Journal of Accounting Research 39 (2): 221.

Cohen, G., and J. Yagil. 2009. Why do financially distressed firms pay dividends? Applied Economics Letters 16 (12): 1201–1204.

Core, J.E., W.R. Guay, and T.O. Rusticus. 2006. Does weak governance cause weak stock returns? An examination of firm operating performance and investors’ expectations. The Journal of Finance 61 (2): 655–687.

Das, S., C.B. Levine, and K. Sivaramakrishnan. 1998. Earnings predictability and bias in analysts’ earnings forecasts. The Accounting Review 73 (2): 277–294.

DeAngelo, H., and L. DeAngelo. 1990. Dividend policy and financial distress: An empirical investigation of troubled NYSE firms. The Journal of Finance 45 (5): 1415–1431.

DeAngelo, H., L. DeAngelo, and D.J. Skinner. 2004. Are dividends disappearing? Dividend concentration and the consolidation of earnings. Journal of Financial Economics 72 (3): 425–456.

DeAngelo, H., L. DeAngelo, and D.J. Skinner. 2007. Corporate payout policy. Foundations and Trends in Finance 3 (2–3): 95–287.

Dugar, A., and S. Nathan. 1995. The effect of investment banking relationships on financial analysts’ earnings forecasts and investment recommendations. Contemporary Accounting Research 12 (1): 131–160.

Easterwood, J.C., and S.R. Nutt. 1999. Inefficiency in analysts’ earnings forecasts: Systematic misreaction or systematic optimism? The Journal of Finance 54 (5): 1777–1797.

Easton, P. 2009. Estimating the cost of capital implied by market prices and accounting data. Foundations and Trends in Accounting 2 (4): 241–364.

Easton, P., M. Kapons, P. Kelly, and A. Neuhierl. 2020. Attrition bias and inferences regarding earnings properties: Evidence from Compustat data, Working Paper, University of Notre Dame. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3040354. Accessed 1 May 2020

Easton, P.D., and G.A. Sommers. 2003. Scale and the scale effect in market-based accounting research. Journal of Business Finance and Accounting 30 (1–2): 25–56.

Edmans, A. 2020. Why many people misunderstand dividends, and the danger it does. Wall Street Journal, June 7: 2020.

Elgers, P.T., and M.H. Lo. 1994. Reductions in analysts' annual earnings forecast errors using information in prior earnings and security returns. Journal of Accounting Research 32 (2): 290–303.

Ely, K.M., and V. Mande. 1996. The interdependent use of earnings and dividends in financial analyst’s earnings forecasts. Contemporary Accounting Research 13 (2): 435–456.

Evans, M., K. Njoroge, and K. Yong. 2017. An examination of the statistical significance and economic relevance of profitability and earnings forecasts from models and analysts. Contemporary Accounting Research 34 (3): 1453–1488.

Fama, E.F., and J.D. MacBeth. 1973. Risk, return, and equilibrium: Empirical tests. Journal of Political Economy 81 (3): 607–636.

Frankel, R., S.P. Kothari, and J. Weber. 2006. Determinants of the informativeness of analyst research. Journal of Accounting and Economics 41 (1–2): 29–54.

Glasscock R., O. Korenok, J. Dorminey. 2022. Spurious correlation due to scaling. Journal of Accounting, Auditing & Finance. December https://doi.org/10.1177/0148558X211063704.

Groysberg, B., P. Healy, N. Nohria, and G. Serafeim. 2011. What factors drive analyst forecasts? Financial Analysts Journal 67 (4): 18–29.

Grullon, G., and R. Michaely. 2002. Dividends, share repurchases, and the substitution hypothesis. The Journal of Finance 57 (4): 1649–1684.

Grullon, G., R. Michaely, S. Benartzi, and R.H. Thaler. 2005. Dividend changes do not signal changes in future profitability. Journal of Business 78 (5): 1659–1682.

Ham, C., Z. Kaplan, and M.T. Leary. 2020. Do dividends convey information about future earnings? Journal of Financial Economics 136 (2): 547–570.

Hand, J.R.M., and W.R. Landsman. 2005. The pricing of dividends in equity valuation. Journal of Business Finance & Accounting 32 (3–4): 435–469.

Hughes, J.S., J. Liu, and J., and W. Su. 2008. On the relation between predictable market returns and predictable analyst forecast errors. Review of Accounting Studies 13 (2): 266–291.

Jaffe, J., D.B. Keim, and R. Westerfield. 1989. Earnings yields, market values, and stock returns. The Journal of Finance 44: 135–148.

Keane, M.P., and D.E. Runkle. 1998. Are financial Analysts' forecasts of corporate profits rational? Journal of Political Economy 106 (4): 768–805.

Koch, A.S., and A.X. Sun. 2004. Dividend changes and the persistence of past earnings changes. The Journal of Finance 59 (5): 2093–2116.

Koenker, R. 2005. Quantile regression. Cambridge University Press.

Kumar, K.R., and G.V. Krishnan. 2008. The value-relevance of cash flows and accruals: The role of investment opportunities. The Accounting Review 83 (4): 997–1040.

Lang, L.H.P., and R.H. Litzenberger. 1989. Dividend announcements: Cash flow signaling vs. free cash flow hypothesis? Journal of Financial Economics 24 (1): 181–191.

Leone, A. J., M. Minutti-Meza, and C. E. Wasley. 2017. Influential observations and inference in accounting research. https://papers.ssrn.com/abstract=2407967. Accessed 1 May 2020

Lin, H., and M.F. McNichols. 1998. Underwriting relationships, analysts’ earnings forecasts and investment recommendations. Journal of Accounting and Economics 25 (1): 101–127.

Lintner, J. 1956. Distribution of incomes of corporations among dividends, retained earnings, and taxes. The American Economic Review 46 (2): 97–113.

Loffler, G. 1998. Biases in analyst forecasts: Cognitive, strategic or second-best? International Journal of Forecasting 14: 261–275.

Lys, T., and L.G. Soo. 1995. Analysts’ forecast precision as a response to competition. Journal of Accounting, Auditing & Finance 10 (4): 751–765.

Mendenhall, R.R. 1991. Evidence on the possible underweighting of earnings-related information. Journal of Accounting Research 29: 170–179.

Michaely, R., and K. Womack. 2005. Market efficiency and biases in brokerage recommendations. Advances in Behavioral Finance Volume II. Princeton University Press.

Nissim, D., and S.H. Penman. 2001. Ratio analysis and equity valuation: From research to practice. Review of Accounting Studies 6: 109–154.

Nissim, D., and A. Ziv. 2001. Dividend changes and future profitability. The Journal of Finance 56 (6): 2111–2133.

Ofer, A.R., and D.R. Siegel. 1987. Corporate financial policy, information, and market expectations: An empirical investigation of dividends. The Journal of Finance 42 (4): 889–911.

Ohlson, J. 2008. Risk, growth, and permanent earnings. Working Paper, New York University Stern School of Business. https://www.nowpublishers.com/article/DownloadSummary/ACC-001. Accessed 1 May 2020

Ohlson, J., and E. Johannesson. 2016. Equity value as a function of (eps1, eps2, dps1, bvps, beta): Concepts and realities. Abacus 52 (1): 70–99.

Ohlson, J., and Z. Gao. 2006. Earnings, earnings growth and value. Foundations & Trends in Accounting 1 (1): 1–70.

Ohlson, J.A. 1991. The theory of value and earnings, and an introduction to the Ball-Brown Analysis. Contemporary Accounting Research. 8 (1): 1–19.

Ohlson, J.A. 1995. Earnings, book values, and dividends in equity valuation. Contemporary Accounting Research 11 (2): 661–687.

Ohlson, James A., and S. Kim. 2015. Linear valuation without OLS: The Theil-Sen estimation approach. Review of Accounting Studies 20 (1): 395–435.

Peng, H., S. Wang, and X. Wang. 2008. Consistency and asymptotic distribution of the Theil-Sen estimator. Journal of Statistical Planning and Inference 138 (6): 1836–1850.

Penman, S.H. 2007. Financial statement analysis and security valuation. McGraw-Hill.

Penman, S.H., and T. Sougiannis. 1997. The dividend displacement property and the substitution of anticipated earnings for dividends in equity valuation. The Accounting Review 72 (1): 1–21.

Richardson, S., S.H. Teoh, and P.D. Wysocki. 2004. The walk-down to beatable analyst forecasts: The role of equity issuance and insider trading incentives. Contemporary Accounting Research 21 (4): 885–924.

Schipper, K. 1991. Commentary on analysts’ forecasts. Accounting Horizons 5 (4): 105–121.

Sen, P.K. 1968. Estimates of the regression coefficient based on Kendall’s tau. Journal of the American Statistical Association 63 (324): 1379–1389.

So, E. 2013. A new approach to predicting analyst forecast errors: Do investors overweight analyst forecasts? Journal of Financial Economics 108 (3): 615–640.

Stickel, S.E. 1989. The timing of and incentives for annual earnings forecasts near interim earnings announcements. Journal of Accounting and Economics 11 (2–3): 275–292.

Theil, H. 1950. A rank-invariant method of linear and polynomial regression analysis, 1-2; confidence regions for the parameters of linear regression equations in two, three and more variables. Indagationes Mathematicae 1 (2).

Tian, H., A. Yim, and D. Newton. 2021. Tail heaviness, asymmetry, and profitability forecasting by quantile regression. Management Science. 55 (12).

Wilcox, R.R. 2010. Fundamentals of modern statistical methods: Substantially improving power and accuracy, 2nd Edition. Springer.

Yoon, P.S., and L.T. Starks. 1995. Signaling, investment opportunities, and dividend announcements. Review of Financial Studies 8 (4): 995–1018.

Acknowledgments

This paper has benefitted from extensive discussions with Peter Easton and Jim Ohlson. It has also benefitted from the comments and suggestions of two anonymous reviewers, Larry Brown, Jing Cheng, Hemang Desai, Siyi Li, Stan Markov, Partha Mohanram, Stephen Penman, Naomi Soderstrom, Theodore Sougiannis, Christopher Stewart, Albert Tsang, and seminar participants at Monfort Research Seminar at University of Northern Colorado, Southern Methodist University, Universität Regensburg Germany, Università degli studi di Trieste Italy, University of Melbourne, University of Sydney, University of Washington at Bothell, the Annual meetings of the Asian Academic Accountants Association, the 2017 American Accounting Association’s Western Region, the 2017 Annual Meetings of the American Accounting Association, the 2019 Annual Congress of the European Accounting Association, the 2019 6th Annual Colorado Accounting Research Symposium, and the 2020 China Accounting and Finance Review Fundamental Analysis Symposium.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix I Characterization of Analysts’ Forecast Error

If earnings can be characterized by a normal growth process, where the future earnings reflect growth at the cost of capital (r) over current earnings, the permanent earnings process can be modelled for the dividend displacement effect as follows.

where xt + 1, xt, dt, and r stand for one-year ahead earnings, current earnings, current dividends, and cost of capital (risk-free rate adjusted for equity premium), respectively. Further, an additional earnings growth process (denoted by α) will make the earnings dynamics to be as follows.

Next we model the forecasting process. The growth rate α is part of the private knowledge of the manager that is subject to signaling. Assume that the (positive) signaling effect is also interpreted by the market (analysts), making the earnings growth (over and above the normal increase due to cost of capital) an increasing function of current dividend (dt), such that the growth α (dt) is the additional effect on earnings.Footnote 33 Adding the signaling effect to the displacement effect and assuming that the cost of capital r is part of the common knowledge, the forecasted earnings corresponding to (A1b) becomes:

As shown in Eq. (A2), the growth and the signaling effect will at least partly offset the dividend displacement effect through earnings growth. Earnings may be affected by other factors such as macroeconomic changes. To allow for these factors, we modify Eq. (A1b) to derive Eq. (A3), where η represents n other factors (with a coefficient γ; firm subscripts omitted) that could influence earnings, and εt + 1 denotes a (random) transitory component.

Besides the inferred growth from the signal, analysts’ earnings forecasts are likely to be based on the other information available that may be common to management and analysts. However, analysts’ forecasts may only include a subset of the other macroeconomic factors, say, p factors out of n where p < n. If we allow for the possibility that the parameter r, which represents the interest rate, is part of common knowledge and is not misestimated by analysts, then we can represent analysts’ forecast errors as follows.

where \({x}_t^{t+1}\) is the forecast of earnings xt + 1 at time t. Note that the ERR variable in Eq. (A4a) is independent of any earnings displacement. In fact, for efficient signaling to work, the recipient of the signal, in this case the analysts, must be able to correctly read the signal. Otherwise a signaling equilibrium cannot exist. Therefore α(dt) must be equal to α. If so, ERRt + 1 must be based on the transitory (random) component and the effects of other missing variables, or

But suppose the analyst forecast process is not fully efficient in that a) it does not fully capture the effect of dividends and instead makes an adjustment equal to r’d, where r’d is the adjustment rate assumed by the analysts and b) does not completely account for the growth signaled, then the ERR would be as follows.

Hence the following specification,

captures the separate effects of signaling and dividend displacement. The signaling effect will be captured in α, the coefficient on earnings, whereby a positive sign will reflect optimistic bias (overreaction to signal) and a negative sign will reflect a pessimistic bias (underreaction to signal), with zero coefficient reflecting an efficient reaction. Similarly, a positive sign on β will indicate analysts’ underreaction to the dividend displacement effect and a negative sign would indicate an overreaction to the dividend displacement effect, with a zero-coefficient indicating a proper accounting of dividend effect in their forecasts.

The factors represented by η are the control variables that may help explain the magnitude of the analyst forecast errors. The use of forecast error as the dependent variable in our tests using Eq. (A4d) also allows us to examine a proxy for permanent earnings that we expect the analysts to issue. Finally, since we do not focus on signaling, we refrain from any analysis of α.

Appendix II: Theil-Sen Estimation

Theil-Sen estimation is a method for robust linear regression that chooses the median slope among all lines of groups through n-dimensional sample points (where n is the number of parameters estimated). Ohlson and Kim (2015) examined the implications of using the Theil-Sen estimation and show that it is a robust alternative to OLS for applications in accounting and finance.Footnote 34 They also compared the results with traditional OLS estimators and concluded that the “TS estimator ought to be viewed as a competitive alternative to OLS approaches.”

The estimation process consists of randomly selecting subsamples with replacement and then estimating regression parameters (slope and intercept) from these subsamples. The Theil-Sen estimate of each parameter is the median of a finite number of subsamples (e.g., 5000). The estimation uses the sampling procedure to estimate the coefficients and intercepts and hence uses the entire dataset without being affected by any outlier problem. Thus the standard errors and confidence intervals for the Theil-Sen estimator are obtained through a sampling process akin to bootstrapping.Footnote 35 Further, Theil-Sen estimation, being nonparametric, does not require any underlying distributional assumptions. It competes well against nonrobust least squares, even for normally distributed data in terms of statistical power. Theil-Sen has been shown to have the properties of robust estimation and details its asymptotic and unbiased properties are discussed by Wilcox (2010) and Peng et al. (2008).

To empirically implement the Theil-Sen estimation approach, we use the procedure outlined by Ohlson and Kim (2015).Footnote 36 Within each year, we first randomly draw 5000 subsamples with N observations (where N is the number of regression parameters estimated). Next we regress the dependent variable Yi,t on the N-1 independent variables. Specifically, we run 5000 such regressions for each of the 32 sample years. For each of these 5000 regressions, we get N regression parameters (i.e., intercept and the β and γ coefficients). Third, within each year, we take the median of each regression parameter from the 5000 estimated parameters, yielding N regression parameter medians for each year. These N regression parameter medians represent one set of parameter estimates for each sample year.

Finally, to test whether the regression parameters are statistically different from zero, we follow an approach similar to that of Fama and MacBeth (1973). Specifically, for each of the N parameter estimates in a given year, we use the distribution of the 32 annual medians to calculate time-series averages, conduct t-tests, and determine the reported p values. Since each regression is estimated by year, a given firm can show up once or not at all in a single regression. Hence it is not necessary, nor possible, to include firm or year fixed effects in the Theil-Sen approach.

Appendix III: Variable Definitions

ATit | Total Assets (in millions of dollars). |

BETAit | The firm-year specific year-end Beta estimates (BETAV) from the Center for Research in Security Prices (CRSP). |

DPSit | Annual dividend per share from Compustat (DVPSX_C / ADJEX_C). |

ΔDPSit | DPSit – DPSit-1 (in $). |

ERRit + 1 | FEPSit + 1 – EPSit + 1. |

EPSit + 1 | Actual EPS from IBES for fiscal period t + 1 (in $). |

ΔEPSit | EPSit – EPSit-1 (in $). |

FEPSit + 1 | Consensus forecast of EPSt + 1, calculated as the average of the forecasts issued shortly (~90 days) after the Earnings Announcement Date of EPSt. from the IBES detail file. |

FDPSit + 1 | Consensus forecast of DPSt + 1, calculated as the average of the forecasts issued shortly (~90 days) after the Earnings Announcement Date of EPSt. from the IBES detail file. |

FDPSit + 2 | Consensus forecast of DPSt + 2, calculated as the average of the forecasts issued shortly (~90 days) after the Earnings Announcement Date of EPSt. from the IBES detail file. |

IOSit | A firm-year specific measure of investment opportunities estimated as the first principal component, similar to Baber et al. (1996) and Kumar and Krishnan (2008), from a factor analysis of growth in market value (MVGROW), the market-to-book ratio of total assets (MBASS), and the ratio of research and development expense to total assets (RDASS). These variables are calculated as follows (Compustat variables in italics)Footnote 37. |

MVGROWit | MVALit/MVALit-1, where MVAL = AT – CEQ + PRCC_F *CSHO |

MBASSit | MVALit / ATit |

RDASSit | XRDit / ATit |

NESTit | Number of analysts following firm i in year t-1. |

PEGit | The cost of capital for firm i in year t, estimated following Botosan and Plumlee (2005): |

\({PEG}_{it-1}=\sqrt{\frac{FEPS_{it+1}-{FEPS}_{it}}{PRICE_{t-1}}}\) | |

REPOit | Share repurchases, calculated as the difference between Purchase of Common and Preferred Stock (PRSTKC) and Preferred Stock Redemption Value (PSTKRV), as in. |

TDPSit | Total Dividends per Share (TDPS) is a more comprehensive measure of dividends, which includes share repurchases (REPO). We follow Grullon and Michaely (2002) in how we measure TDPS. |

σNIQit | Earnings variability, measured as the standard deviation of quarterly earnings estimated over the previous eight quarters, where missing values are omitted. |

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Das, S., Schaberl, P.D. & Sen, P.K. Analysts’ use of dividends in earnings forecasts. Rev Account Stud 29, 1192–1234 (2024). https://doi.org/10.1007/s11142-022-09735-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-022-09735-8

Keywords

- Analysts’ forecast errors

- Analyst inefficiency

- Analysts’ optimistic Bias

- Dividends

- Dividend displacement

- Earnings forecasts

- Median regression

- Theil-Sen estimator