Abstract

Fisher hypothesis is universally accepted as an integral portion of monetary theory and practice, and yet the empirical evidence confirming a full Fisher effect remains scarce and the relationship has been challenged on several theoretical grounds referred to as ‘puzzles’. Our paper suggests the use of continuous wavelet transforms as a unified analytical framework for confronting the different Fisher puzzles in a harmonious way. Taking South Africa as a case study, we focus on the inflation targeting period of 2002:01–2021:02 and use signal-image conversion tools such as wavelet power spectrum, wavelet coherence spectrum and phase-difference dynamics to extract signal features of nominal interest rates and inflation expectations and further explore their dynamic synchronization across a time–frequency plane/domain. Three unique findings emerge from our study. Firstly, across a time domain a full Fisher effect only holds in the pre-financial crisis period. Secondly, across the frequency spectrums, higher frequency oscillations gradually lose relevance to lower frequency oscillations providing evidence of volatility transfer in the Fisher effect. Lastly, the phase-dynamics indicate a consistent positive synchronization throughout the sample period which is line with the traditional Fisher effect. Overall, these findings highlight the success of the South African Reserve Bank in using inflation targeting to steer the expectations of economic agents under the tenures of the last three governors and provide important lessons for other Central banks.

Similar content being viewed by others

1 Introduction

The Fisher effect, which suggests a ‘one-for-one’ co-movement between nominal interest rates and inflation expectations that would leave the real interest rate unchanged, has been traditionally used as a theoretical link for analysing how Central banks adjust their policy rates to changes in inflation expectations. The hypothesized stationarity of the real interest rate is not only an important theoretical condition for the Central bank’s policy reaction function as well as dynamic macroeconomic and forecasting models but further ensures that the purchasing power of savers and investors within financial institutions is protected against long-run changes in inflation and that the financial sector remains market efficient over the steady-state.

Unfortunately, the Fisher hypothesis has been plagued by empirical inconsistencies which are collectively labelled as ‘puzzles’ pertaining to the (i) strength of co-movement between the variables (ii) ‘sign’ of co-movement (negative or positively co-related) (iii) time-variation in co-movement (iv) cyclical-variation in co-movement (v) causal direction in co-movement. The main drawback of existing empirical studies is their failure to simultaneously address these puzzles under a singular comprehensive analytical framework. At best, the most recent studies rely on more advanced nonlinear econometric techniques such as time-varying cointegration models (Panopoulou and Pantelidis 2016), smooth transition (STR) model (Kim et al. 2018), nonlinear autoregressive distributive lag (N-ARDL) model (Ongan and Gocer 2020a, b; Cushman et al. 2022), quantile co-integration (Nazlioglu et al. 2021) which manage to address issues of time-variation, cyclical variation and strength-variation, separately, but fall short of collectively addressing all empirical puzzles.

To overcome the methodological shortcomings of previous literature, our study proposes the use of continuous wavelet transforms (CWT) as a unified framework capable of resolving the ‘empirical inconsistencies’ or ‘puzzles’ observed in the Fisher relationship. The wavelet transforms of a time series can be envisioned in a three-dimensional plane consisting of time, real part and the imaginary/complex part from which the extracted amplitude and phase dynamics allows one to model the synchronization between a pair of variables in time–frequency space. Whilst the use of wavelets as analytical tools has been traditionally reserved for scientists in the fields of mathematics, geophysics, neurosurgery, meteorology, engineering and statistics (Torrence and Compo 1998; Schleicher 2002) only more recently has the methodology gained traction amongst financial economists who primarily use these techniques to examine the time–frequency relationship between international stock co-movement (Rua and Nunes 2009), the Taylor reaction function (Aguiar-Conraria et al. 2018) and the Phillips curve (Fratianni et al. 2022) and a common revelation from these studies is that asymmetries in monetary relations emerge in two forms, firstly, via time-varying changes caused by structural breaks in the data and, secondly, via frequency-variations caused by changing cyclical dynamics in the series e.g. economic and political cycles. However, to the best of our knowledge, no study has applied this method to investigate Fisher’s hypothesis.

We apply continuous wavelets transforms to investigate the Fisher effect for the South African economy which we consider an ideal case study since the country has certain unique features of monetary policy conduct which increases the likelihood of the Fisher effect holding between the policy rate and inflation expectations. For instance, South Africa is the only full-fledged inflation targeter (IT) whose Reserve Bank is completely devoid of government ownership and control (Vermeulen 2021). This allows for the South African Reserve Bank (SARB) to act more independent of government pressure in adjusting the policy rate to achieve price stability and private shareholding further ensures greater accountability from the Central bank (Rossouw 2016). Moreover, the SARB has consistently relied on the traditional use of nominal interest rates as a main policy tool under the IT regime which differs from the unconventional policy of quantitative easing practiced by industrialized Central banks (e.g. Australia, US, UK, the EU and Japan) who have faced ‘liquidity traps’ particularly in the post global financial crisis period. In also differing from other emerging economies which have adopted IT frameworks, the SARB has not abandoned the IT framework (e.g. Brazil), it has not frequently adjusted it’s target to growing inflation pressures (e.g. Hungary, Indonesia, Kazakhstan, Moldova, Romania, Uruguay), nor has any governor being dismissed or resigned before the end of their tenure (e.g. Albania, Argentina, India, Turkey), hence demonstrating the high levels of discipline and commitment practiced by the Central bank in achieving it’s policy objectives.

Altogether, the use of continuous wavelet tools reveals new stylized facts on the co-movements between the nominal interest rates and inflation expectations under the SARB’s IT regime which enables us to gain a deeper understanding of how policymakers respond to changes in inflation expectations and ultimately demonstrate the success of the SARB in steering the expectations of economic agents under the tenures of different governors. We particularly find that under the inflation targeting era the SARB has behaved as a ‘variance-minimizer’ which has been progressively eliminating or smoothing out higher frequency synchronizations between the repo rate and inflation expectations from one governor to the next, which is considered as a sign of good policy conduct (Taylor 2019; Antonakakis et al. 2021). These empirical findings remain robust to disaggregated measures of inflation expectations and alternative measures of nominal interest rates.

The main policy lessons derived from our study are two-fold. Firstly, there are implications for monetary policy conduct in context of recent increases in inflation rates caused by demand and supply related pressures arising from the COVID-19 pandemic and the Russian-Ukraine war. Our findings suggest that Central banks may require to aggressively adjust their policy rates in response to increasing inflation rates and once inflation is ‘tamed’, policymakers should smooth out high frequency oscillations in policy variables. Secondly, our findings have implications for Central bank’s in developing and emerging economies which have set informal inflation targets and/or aspire to be inflation targeters. The main policy lesson for these countries relates to the setting of target rates and constitutional independence of monetary policy required to commit to these targets.

The rest of the study is structured as follows. The next section describes Fishers relationship in context of the South African economy whilst Sect. 3 outlines Fisher’s relationship and documents the different empirical puzzles identified in the literature. Section 4 describes the analytical wavelets the methods used in the study to address the empirical puzzles. Section 5 presents the empirical analysis and Sect. 6 concludes the study.

2 Fishers relation and it’s puzzles

Since its inception by Fisher (1930), many empirical economists have sought to validate Fisher’s hypothesis by regressing inflation expectations (\(\uppi ^{{\text{e}}}\)) on nominal interest rates (i) i.e.

A full Fisher effect is validated if the long-run slope coefficient, \(\upbeta\), which is referred to as Fisher’s coefficient, is equal to unity (i.e. \(\upbeta\) = 1) and this implies that nominal interest rates responds ‘one-for-one’ with changes in inflation expectations. Note that traditional theory speculates on causality running from inflation expectations to nominal interest rates and identifies two channels through which this occurs (Cooray 2003; Westerlund 2008). Firstly, through liquidity effects which arise when anticipated inflation decreases the incentives for holding cash or liquidity and causes economic agents to increase their demand for financial assets which, in turn, increases the supply of loanable funds. This then causes monetary authorities to increase the nominal interest rate in order to control excess liquidity in the money market. Secondly, there are ‘Fisher effects’ reflected when monetary authorities increase their interest rates in response to expected/anticipated increases in inflation and do so as a means of offering a premium on the returns to financial assets, which, in turn, enhances savers and investors hedging capabilities against inflation.

Nonetheless, the stability of Fisher’s ‘unit’ coefficient has been challenged on several grounds. Firstly, there is the Mundell-Tobin effect which hypothesizes that under the substitutability of financial assets and (non-interest bearing) real money balances, an anticipated increase in inflation produces a negative impact on real bond yields via wealth effects thereby producing a negative Fisher coefficient (i.e. \(\upbeta\) < 0) (Mundell 1963). Secondly, there is the tax effect advocated by Darby (1975) and Feldstein (1976) in which nominal interest rates rises more than ‘one-for-one’ to ensure that the after-tax returns remain unchanged and hence assumes that the Fisher coefficient is greater than unity (i.e. \(\upbeta\) > 1). Thirdly, there is the inverted Fisher effect hypothesized by Carmicheal and Stebbing (1983) as well as Placone and Wallace (1987) who suggested that under conditions of high substitutability between regulated and nonregulated financial assets, the after-tax return on financial assets (i.e. after-tax nominal interest rate) can be constant over the steady-state with real interest rate moving inversely one-for-one with the inflation rate such that Fisher’s coefficient is negative unity (i.e. \(\upbeta\) = − 1).

Fourthly, there are time varying effects in Fisher coefficient which the literature attributes to structural changes in the earlier international monetary system such the transition from the Gold Standard to the interwar periods (Amsler 1986; Barksy 1987), to the Bretton Woods system of exchange rates (Barksy and de Long 1991; Mishkin 1992), to increased deregulation of financial systems in the 1980’s and 1990’s (Choudhry et al. 1991). Some recent literature further attributes the time-variation in Fisher effect to domestic changes in monetary policy regimes for individual countries (Christopolous and Leon-Ledesma 2007; Kose et al. 2012; Sanchez-Fung 2019; Berument and Froyen 2021). Fifthly, cyclical variations have been also observed in Fisher’s coefficient in which a stronger Fisher effect holds during periods of rising inflation or economic recessions (Ongan and Gocer 2020a, b), and this effect weakens during periods of decreasing and lower quantile distributions of inflation (Tsong and Lee 2013; Cal 2018). Other researchers have found the Fisher coefficient to vary depending on whether inflation is above a certain threshold or not (i.e. high and low inflation regimes), although different authors establish different threshold estimates for different empirical samples (Million 2004; Christopoulos and Leon-Ledesma 2007; Kim et al. 2018). Lastly, the causal dynamics of the traditional Fisher effect have been recently challenged by the so-called ‘NeoFisher hypothesis’ and speculates on reverse causality in which an increase in expected inflation is caused by an increase in nominal interest rates (Cochrane 2016; Amano et al. 2016; Williamson 2018; Uribe 2018). This hypothesis has emerged as an explanation for why the decrease in nominal interest rates (i.e. expansionary monetary policy) experienced in industrialized economies with ‘close-to-zero’ rates has not increased inflation as depicted by the conventional monetary transmission mechanism.

Collectively, the described ‘puzzles’ confronting the Fisher effect are related to empirical features of the relationship such as (i) the sign of the relationship (i.e. negative or positive) (ii) the strength of the relationship (i.e. strong or weak co-movement) (iii) time-variation in the Fisher coefficient (iv) cyclical variation in the Fisher coefficient (v) causal direction of the relationship. Despite the wide variety of econometric tools that have been used by different authors to address some of these puzzles, previous studies have not yet utilized methods which can simultaneously address all these puzzles in a unified framework/manner.

For instance, most earlier empirical works relied on ordinary least squares (OLS) methods to estimate Fisher coefficient for industrialized economies (Fama 1975; Paul 1984; Amsler 1986; Barksy 1987; Barksy and de Long 1991; Mishkin 1992; Wong and Wu 2003). One notable shortcoming with least squares estimates, is that they are susceptible to being spurious if the series are found to be nonstationary. Moreover, OLS only offers static information on sign and strength of the relationship and yet fails to provide information on time and cyclical variation as well as causal effects existing amongst the series. Another strand of studies can be identified which utilizes cointegration methods such the Engle and Granger (1987), vector error correction model (VECM) or the autoregressive distributive lag (ARDL) model (Atkins 1989; Maozzami 1990; Garcia and Zapata 1991; Mishkin and Simon 1995; Wallace and Warner 1993; Pelaez 1995; Crowder and Hoffman 1996; Payne and Ewing 1997; Koustas and Serletis 1999; Berument and Jelassi 2002; Fahmy and Kandil 2003; Granville and Mallick 2004; Nusair 2008; Yaya 2015). Whilst these cointegration methodologies present advantages of being able to capture short-run and long-run relationships, speed of adjustment back equilibrium after a shock as well as offering a framework for testing for causal effects, they provide little information on the time-varying strength of the Fisher effect.

More recent studies have relied on nonlinear econometric frameworks such as the Markov switching model (Evans and Lewis 1995; Jochmann and Koop 2014; Sugita 2017), threshold cointegration models (Dutt and Ghosh 2007); smooth transition regression (STR) model (Christopoulos and Leon-Ledesma 2007; Kim et al. 2018), the quantile cointegration analysis (Tsong and Lee 2013; Cal 2018), the fractional cointegration methods (Kasman et al. 2006; Jensen 2009; Caporale and Gil-Alana 2019), nonlinear granger causality tests (Dogan et al. 2020) and nonlinear autoregressive distributive lag (ARDL) model (Ongan and Gocer 2018, 2020a, b). Whilst these frameworks provide valuable information on the long-memory or nonlinear cointegration nature of the Fishers effect, the time-variation of the Fisher coefficient across different structural break as well as the cyclical variation of the coefficient across different distributions of inflation, these methods fall short of providing a unified framework for simultaneously evaluating time – cyclical variation in the Fisher effect.

Our study proposes the use of continuous wavelet transforms to overcome the analytical shortcomings of econometric tools used in previous studies which share a common feature of being strictly localized in time thus providing no information on possible frequency relationships between the variables. In differing from other analytical methods used in the literature, wavelets capture the synchronization between nominal interest rates and inflation expectations, across 5 dimensions. Firstly, it describes the co-movement from a time-varying dimension. Secondly, it describes the co-movement from frequency-varying dimension. Thirdly, it describes the co-movement from strength-varying dimension. Fourthly, it describes the co-movement from in-phase (positive co-movement) or anti-phase (negative co-movement) dimension. Lastly, it describes the co-movement from lead-lag (causality) dimension. Altogether, this allows us to derive a more complete picture on Fisher’s hypothesis for South Africa as our sample country.

3 Fisher effect and the South African economy

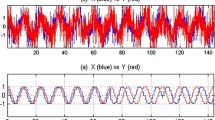

For the case of South African Reserve Bank (SARB), which is the focus of our study, the time series plot between the Central bank’s policy instrument, the repo rate, and survey-based inflation expectations compiled by the Bureau of Economic Research (BER), as presented in Fig. 1, provides visual evidence of a strong co-movement between the variables under the inflation targeting regime. We point this out, because previous literature which have examined the relationship between nominal interest rates and inflation expectations for South Africa, fail to capture the observed strong correlation between the series (Wesso 2000; Mitchell-Innes et al. 2007; Alangideal and Panagiotidis 2010; Phiri and Lusanga 2011; Yaya 2015; Bahmani-Oskooee et al. 2016; Nemushungwa 2016; Bayat et al.2016). This even holds true for studies which have used time series data strictly covering the inflation targeting regime (Mitchell-Innes et al. 2007; Phiri and Lusanga 2011; Yaya 2015; Bahmani-Oskooee et al. 2016; Nemushungwa 2016; Bayat et al. 2016; Phiri and Mbekeni 2021). Table 2 in the appendix provide a more detailed summary of previous South African literature.

Upon closer inspection of Fig. 1, we observe that the co-movement between nominal interest rates and inflation expectations in South Africa is not monotonic and it is thus unlikely that the SARB has responded to changes in inflation in a uniform manner (Naraidoo and Gupta 2010; Naraidoo and Raputsoane 2010, 2011). We particular observe that during periods when inflation expectations breached the upper limit of its mandated 3–6 percent target, that is, (i) at the start of the regime in 2002 as the economy inherited high inflation courtesy of the contagion effects of the Asian financial crisis (AFC) of 1998–2000 and the 9/11 US attacks of 2001, and, (ii) during the periods of the 2004–06 commodity boom and the 2007–2008 global financial crisis (GFC), the SARB vigorously manipulated the repo rate in efforts to stabilize inflation within its target (Bonga-Bonga and Kabundi 2011). It is only in periods subsequent to the GFC in which inflation was lowered and contained within its target and this has allowed the central bank to relax its preference on inflation and assign more weight on other macroprudential objectives in the post-GFC period (Khan and de Jager 2011; Padayachee 2015).

Whilst the time-varying relationship between nominal interest rates and inflation expectations corresponding to the SARB’s changing preferences during the inflation targeting era are easily detectable from mere visual appreciation of the time-series plots in Fig. 1 (which we consider as part of the reason why linear econometric models used in previous South African studies failed to establish the Fisher effect), this current study argues that the problems do not end here, as there are possible frequency-varying correlations which are not easily detectable by observing time-series plots or empirically relying on time-domain analytical techniques.

There exist several academically-motivated reasons which make us speculate as to why the adjustment of nominal interest rates to inflation expectations may be frequency-specific, particularly for an inflation targeter such as South Africa. Take for starters, Brock et al. (2008) who characterize the behaviour of a ‘forward-looking’ policymaker as being a ‘variance-minimizer’ across the frequency domain and find that the design limit on the choice of policy rules involves trade-offs across frequency-specific fluctuations in policy target variables. In context of policy uncertainty, Onatski and Williams (2003) find that measured uncertainty in US monetary policy framework increases at high frequency components of policy variables whilst low frequency fluctuations exert the most impact on policy and are the potentially the most harmful to the economy. More recently, Ashley et al. (2011) present frequency-dependent extensions of the US Taylor response function in which the central bank’s response to policy variables are frequency dependent and finds that the FOMC has responded differently to persistent innovation to inflation than it has to more transitionary fluctuations.

Interestingly, we also observe a smaller, and largely ignored, strand of earlier empirical studies which have debated whether Fisher’s relationship can be quantified in the frequency domain using spectral analysis (Summers 1982, 1986; Barsky 1987, Barsky and Dougan 1987; Viren 1987). Summers (1982, 1986) was the first to demonstrate that the magnitude of the US Fisher coefficient estimates is frequency-varying across different monetary regimes, with estimates of above unity being found at high frequencies relationships during the Bretton Woods system. Barthhold and Dougan (1987) extend on Summers (1982, 1986) using US tax exempt municipal bond and find similar frequency variation in the Fisher coefficient although the estimates are quite below unity. Using a larger sample of 6 industrialized economies, Viren (1987) finds that the spectral densities of the nominal interest rates and inflation expectations are very different in all countries and that their coherencies reveal a weak Fisher effect particularly at higher frequencies.

However, we point out that the main shortcoming of this previous cluster of studies is their strict reliance on spectral analysis which only allows the researcher to determine the amplitude and frequency relationship between nominal interest rates and inflation but does not simultaneously take into consideration the time-varying properties of the data. In other words, frequency domain analysis is an excellent tool for dissecting and extracting the different frequency components contained within a signal or time series (i.e. high frequency or spectral resolution), and yet it does so over an entire time window such that one cannot trace where the different frequency components occur over time (i.e. poor time or location resolution).

To overcome the limitations of spectral regression analysis, our study makes use of continuous wavelet transforms to examine the Fisher effect for the South African economy across a time–frequency space and we carry out our empirical analysis in two interrelated stages. Firstly, we make use of the wavelet power spectrum (WPS) to extract the different individual cyclical components of the repo rate and inflation expectations across a time-scale plane. Secondly, we make use of the cross- wavelet power spectrum (CWPS) between the two series to compute the wavelet coherence and phase-dynamics which we use to depict the synchronization or co-movement between the variables across a time–frequency dimension. The details of these methods are discussed in the following section.

4 Methods

Wavelet analysis is known to be a time-scale analysis that decomposes data in different components of the frequency and surveys each component in terms of resolution proportional to its scale. The wavelet theory was introduced first in the mid-1980s by Grossman and Morlet (1984) and Goupillaud et al. (1984) but quickly became popularized in other fields of science such as neurosurgery and geophysics (Torrence and Compo 1998) and only more recently has the methodology gained traction amongst financial economists (Rua and Nunes 2009; Rua 2012). Wavelets are small waves that grow and decay in a limited time-period and are made up of two distinct parameters: time (\(\uptau\)) and scale (s). Wavelet analysis is based on the convolution of the time series with a set of ‘daughter’ wavelets and are used to decompose a signal or time series across a time–frequency plane. These transforms can either be discrete (returns data vector of the same length as the input signal) or continuous (returns an output vector which is one dimension higher than the input). In our study, we focus on continuous wavelet transforms (CWT) which are defined as:

In its strict definition, the CWT provides a representation in the space of scale (dilation) and translation, \(\uptau\), but with the appropriate choice of mother wavelet, \(\uppsi\), it can be used to measure the power spectrum locally. To explore the instantaneous phase information in the time-scale plane, an approximately analytical complex mother wavelet is desirable. There exists many ‘families’ of complex wavelets with different properties (Mexcan Hat, Haar etc.). In this study we focus on complex Morlet wavelets which is a complex sinusoid modulate by a Gaussian envelope:

where \(\upomega _{{\text{c}}} = 2\uppi {\text{f}}_{{\text{c}}}\) is the angular frequency of the wavelet and determines the number of oscillations of the complex sinusoid inside the Gaussian. To ensure Eq. (3) is admissible as a wavelet, with a zero-mean function, the angular frequency is set at \(\upomega _{{\text{c}}}\) = 6 whilst the term \(\uppi ^{{ - \frac{1}{4}}}\) ensures the wavelet has unit energy. Since the wavelet function is complex, the wavelet transform is also complex and can be divide into a real and imaginary part and the wavelet power spectrum (WPS) for a discrete series measures the variance of a time series across a time-scale dimension i.e.

To extend the framework to the bi-variate case in which we seek to examine the co-movement between a pair of time series x(t) and y(t) in time–frequency domain, we firstly define their WPS as |Wx(\(\uptau\), s)|2 and |Wy(\(\uptau\), s)|2, respectively, and then compute their Cross-Wavelet Power Spectrum (CWPS), which is analogous to the covariance between x(t) and y(t) in time–frequency domain.

Then finally the wavelet coherence, which is analogous to the correlation between x(t) and y(t) across time and frequency, is computed as the ratio of the cross spectrum to the product of the spectrums of the individual series i.e.

where S is a smoothing operator in both time and scale. To distinguish between negative and positive correlation between a pair of time series as well as identifying lead-lag causal relationships between the variables, we make use of phase difference dynamics we are defined as:

where \(\upphi _{{{\text{x}},{\text{y}}}}\) is parametrized in radians, bound between \(\uppi\) and \({ - \pi }\). If \(\upphi _{{{\text{x}},{\text{y}}}}\) ∈ (0, \(\frac{\pi }{2}\)) and \(\upphi _{{{\text{x}},{\text{y}}}}\) ∈ (0, \(- \frac{\pi }{2}\)), then the series are said to be in-phase (positive correlation) with y leading x in the former and x leading y in the latter. Conversely, If \(\upphi _{{{\text{x}},{\text{y}}}}\) ∈ (\(\frac{\pi }{2}\), \(\uppi\)) and \(\upphi _{{{\text{x}},{\text{y}}}}\) ∈ (\(- \frac{\pi }{2}\), \({ - \pi }\)), then the series are said to be in an anti-phase (negative correlation) with x leading y in the former and y leading x in the latter. A phase-difference of zero implies co-movement between the pair of series at the specified frequency.

5 Data and empirical analysis

5.1 Data

To analyse the Fisher effect, two time series variables, namely nominal interest rates and inflation expectations, are required and we source these variables from the SARB’s online statistical database at quarterly intervals over a sample period of 2002:01–2021:02 i.e. inflation targeting era. Firstly, we use the repo rate as primary measure of nominal interest rates in the analysis. Secondly, we use the inflation expectations series which we collect for 4 classes of economic agents i.e. (ii) inflation expectations for all surveyed participants (iii) inflation expectations for financial analysts (iv) inflation expectations for business representatives (v) inflation expectations for trade union representatives. Lastly, we employ the 3–5 year bond yield and the 5–10 year bond yield as proxy measures of medium-term and long-term nominal interest rates in the sensitivity analysis.

Table 1 presents the descriptive statistics (panel A), integration properties (panel B) and correlation matrix (panel C) of the time series variables. From panel A, we observe that on average the nominal interest rates have been higher than inflation expectations implying a positive real interest across our sample period. Moreover, with the exception of financial analyst expectations, the remaining measures of inflation expectations have averaged values within the 3–6 percent target band. We also observe low levels of volatility and skewness in the time series although we find evidence of kurtosis which ultimately causes non-normality of in all variables as reflected by the Jarque–Bera (J–B) statistic. From panel B, ADF and DF-GLS unit root test results present mixed evidences on the integration properties of the time series and only find consistent rejection of the unit root null hypothesis for all expectations and trade union expectations i.e. I(0) variables. Nonetheless, the general inconclusiveness of the order of integration as no bearing on the suitability of time series for wavelets which are applicable to both stationary and nonstationary variables (Aguiar-Conraria and Soares 2010, 2014). From panel C, the correlation coefficients between nominal interest rates and inflation expectations produce estimates less than unity hence advocating for partial Fisher effects. Note that these preliminary findings are consistent with the those previous obtained by Mitchell-Innes et al. (2007), Phiri and Lusanga, (2011) and Nemushungwa (2016); for similar South African data. However, the correlation analysis is does not take into consideration time and cyclical variation in the data and we address these shortcomings in our main analysis presented in the following sections.

5.2 Wavelet power spectrum of time series

Figure 2 presents the time series plots of the SARB’S repo alongside the disaggregated measure of inflation expectations whereas Figs. 3, 4, 5, 6 and 7 presents the corresponding wavelet power spectrum (WPS) plots of the transformed series across a time–frequency plane. Whilst the time series plots allow us to observe how the variables evolve across the time domain, the WPS extracts specific information on the distribution of energy of time series at different scales and provides information about how much frequency band has contributed to the energy of the series over different time interval. In the WPS plot, time axis is plot on the horizontal axis and the frequency is measured along the vertical axis as the inverse of time/scale i.e. s = 1/f, such that higher (lower) frequencies correspond to shorter (longer) time periods. The intensity of the variation is represented by contour colours in the spectrum plot which ranges from strong variation or intensity (warmer colours) to weak variation or intensity (cooler colours).

From the onset is easy to visually observe that all the time series under observation have similar signal extraction features in both the time and frequency plane. For instance, between the period of 2002 and 2010, the WPS identifies dominant cyclical oscillations ranging between 16 and 32 quarters (4–8 years) for all observed variables and this is indicated by the warm colour contours existing across this time interval. However, after 2014, the WPS indicates that shorter cycles of between 16 and 24 quarters (4–6 years) generally lose relevance to longer cycles of between 24 and 32 quarters (6–8 years) and the statistical significance of the power spectrum becomes thinner. According to Aguiar-Conraria et al. (2018), such volatility transfer in inflation rate illustrates the subsequent anchoring of inflation expectations and a prolonged period of low inflation and low variance.

An interesting feature of the WPS plots is that they allow us to discern multiple structural changes reflected by the varying strength and size of the cyclical oscillations in the policy rate and inflation expectations data. Firstly, we observe general changes in the strength of cyclical oscillations of the data corresponding to the pre- and the post-financial crisis eras, which switches from strong variability in the pre-crisis period to weaker variability in the post-crisis period. Secondly, we can also observe other distinct changes in the cyclical oscillations corresponding the different tenures of three Reserve Bank governors who have headed the SARB’s monetary policy committee (MPC) instituted under the inflation targeting regime. For instance, during the tenure of Governor Tito Mboweni between 1999 and 2009, which corresponds to the pre-crisis era, we observe high variability in both the policy rate and inflation expectations, which fits perfectly with narrative of the SARB acting over aggressively towards high inflation variability attributed to Asian financial crisis of 2000 and the 2007–2008 global financial crisis (Khan and de Jager 2011; Padayachee 2015). Under the tenure of governor Marcus Gill, between 2009 and 2014, which corresponds to the period of ‘initial recovery’ in the post-financial crisis, we observe a diminished strength in the variability of both the policy rate and inflation expectations variables. Finally, under the ongoing tenure of Governor Lesetja Kganyago (2014-present), we observe a decrease in the size of the frequency components with some higher frequency being eliminated from the cyclical oscillations.

5.3 Wavelet coherence and phase dynamics

In this section of the paper we present the wavelet coherence spectrum plots between the repo rate and the disaggregated measures of inflation expectations and these plots identify the regions of similar correlation between a pair of time series across a time–frequency plane. The intensity of the co-movement is represented by colour code in the spectrum plot which ranges from strong cyclical co-movements (warm colours) to weak cyclical co-movement (cold colours). On one hand, a full Fisher effect would be indicated by the red contour in the coherence spectrum plot and this is analogous to a unity correlation coefficient across a time–frequency space. On the other hand, the less warm colours represent a partial-Fisher effect in which the correlation coefficient is less than unity in the time–frequency domain. The faint white lines surrounding the regions of observed correlation indicate the 5% significance level whereas curved ‘inverted U-shaped’ line represents the cone of influence and indicates the edge-effects.

The phase difference dynamics provide additional information on the delay or synchronization between the two series and the phase information is represented by the arrow orientation in the coherence spectrum plot. The right pointed arrow indicates ‘phase-in’ dynamics between the series which is analogous to a positive co-relationship and thus a Fisher effect. The right pointed arrow indicates ‘phase-out’ synchronization between the series which is analogous to a negative co-movement which, in turn, reflects the Mundell-Tobin effect. The arrows point north imply that y leads x by \({\uppi /2}\) (inflation expectations granger cause nominal interest rates ~ traditional Fisher effect) whilst arrows pointing down implies that x leads y by \({\uppi /2}\) (nominal interest rates granger causes inflation expectations ~ NeoFisher effect). Moreover, the arrows facing north-east and south-west indicate that y is leading x, whilst the arrows facing north west and south east imply that x is leading y.

Figures 8, 9, 10, and 11 present the wavelet coherence plots and phase difference dynamics for the repo rate against the disaggregated measures of inflation expectations. It is interesting to note that the time–frequency co-movement detected between the time series is very similar across the different categories of inflation expectations, and these similarities can be summarized in four observations. Firstly, from a time perspective, we find significant co-movements between the time series throughout the entire inflation-targeting regime, although we observe stronger Fisher effects with a larger range of cyclical oscillations in the pre-crisis period and find that the strength of these effects and the size of oscillation bands weaken during the post-crisis period. Secondly, from a frequency perspective significant co-movement occur across frequency bands of 8 to 40 quarters (2–10 years), although as one moves across the time domain, the lower frequency components lose significance to higher frequency components, particularly between 2010 and 2016. Thirdly, from the strength perspective, we observe strong co-movements between nominal interest rates and inflation expectations in the pre-financial crisis period particularly at frequency cycles of between 16 and 32 quarters (4–6 years) where the red contour colours indicate the region of ‘one-for-one’ synchronization between the variables. In other regions, the contour colours vary between yellow and green which symbolizes a partial Fisher effect predominantly existing in the post-financial crisis period. Fourthly, from the phase dynamics we observe that most arrows point either right or north east, which indicates a positive co-movement between the series with inflation expectations leading the repo rate at different phase angles i.e. traditional Fisher effect. These phase dynamics are consistent across the different time and frequency regions where significant co-movements are detected.

Repo rate versus all expectations. Note: The white contour line represents the significance level. The power of correlation ranges from blue colour (weak correlation) to red colour (strong correlation). The arrow notations, \(\uparrow\), \(\nearrow\), \(\to\), \(\searrow\), (\(\downarrow\), \(\swarrow\), \(\leftarrow\), \(\nwarrow\)) indicate that a positive (negative) relationship between the series. The arrow notations,\(\uparrow\), \(\nearrow\), \(\to\), \(\swarrow\),\(\leftarrow\), (\(\searrow\),\(\downarrow\),\(\nwarrow\)) indicate that nominal interest rates are leading (lagging) inflation rates

Repo rate versus financial sector expectations. Note: The white contour line represents the significance level. The power of correlation ranges from blue colour (weak correlation) to red colour (strong correlation). The arrow notations, \(\uparrow\), \(\nearrow\), \(\to\), \(\searrow\), (\(\downarrow\), \(\swarrow\), \(\leftarrow\), \(\nwarrow\)) indicate that a positive (negative) relationship between the series. The arrow notations,\(\uparrow\), \(\nearrow\), \(\to\), \(\swarrow\),\(\leftarrow\), (\(\searrow\),\(\downarrow\),\(\nwarrow\)) indicate that nominal interest rates are leading (lagging) inflation rates

Repo rate versus business representations expectations. Note: The white contour line represents the significance level. The power of correlation ranges from blue colour (weak correlation) to red colour (strong correlation). The arrow notations, \(\uparrow\), \(\nearrow\), \(\to\), \(\searrow\), (\(\downarrow\), \(\swarrow\), \(\leftarrow\), \(\nwarrow\)) indicate that a positive (negative) relationship between the series. The arrow notations,\(\uparrow\), \(\nearrow\), \(\to\), \(\swarrow\),\(\leftarrow\), (\(\searrow\),\(\downarrow\),\(\nwarrow\)) indicate that nominal interest rates are leading (lagging) inflation rates

Repo rate versus trade union representations expectations. Note: The white contour line represents the significance level. The power of correlation ranges from blue colour (weak correlation) to red colour (strong correlation). The arrow notations, \(\uparrow\), \(\nearrow\), \(\to\), \(\searrow\), (\(\downarrow\), \(\swarrow\), \(\leftarrow\), \(\nwarrow\)) indicate that a positive (negative) relationship between the series. The arrow notations,\(\uparrow\), \(\nearrow\), \(\to\), \(\swarrow\),\(\leftarrow\), (\(\searrow\),\(\downarrow\),\(\nwarrow\)) indicate that nominal interest rates are leading (lagging) inflation rates

The wavelet coherence plots and phase dynamics allow us to visually trace structural events which account for the varying Fisher coefficient across a time–frequency plane and we find that the structural changes reflected by the varying strength and size of the cyclical oscillations are attributed to periods of crisis and changes in tenures of different Reserve Bank governors. Firstly, under governor Mboweni between 2002 and 2011, we observe a Full Fisher effect at cyclical frequencies of 16 and 32 quarters (4–6 years) and this reflects the aggressive stance taken by the Reserve Bank to keep inflation within it’s target. We particularly note that the Fisher effect is ‘strongest’ between 2004 and 2009 which is a period of rising inflation associated with commodity boom of the 2000’s and the global financial meltdown of 2007–2009. This finding collaborates with previous nonlinear studies which find stronger Fisher effects during rising periods of inflation (Ongan and Gocer 2018; 2020a, 2020b) or at higher distributions of inflation (Christopoulos and Leon-Ledesma 2007; Tsong and Lee 2013; Cal 2018; Kim et al. 2018). Secondly, under the tenure of governor Marcus Gill (2011–2015), which presents a period of falling inflation immediate following/in the post-financial crisis, the Fisher effect weakens, and the regions of significance are dominated by yellow (i.e. ‘semi-strong’ correlation) and green (i.e. ‘mild’ correlation) colours contours at lower and higher frequencies, respectively. This finding fits well with narrative of the Reserve Bank re-thinking it’s policy approach in the post-financial crisis by placing less emphasis on price stability and adding preference to include other macropudential objectives as part of it’s policy toolkit (Khan and de Jager 2011; Padayachee 2015). It is also under the tenure of governor Marcus Gill that we begin to see evidence of volatility shifting from higher frequency components to lower frequency components implying that, in the post-financial crisis era, the Reserve Bank has been smoothing out interest rates and inflation expectations in a synchronized fashion.

5.4 Sensitivity analysis

So far, our study has focused on the repo rate as the measure of nominal interest rates and in this section, we provide a sensitivity analysis in which we employ medium-term and long-term bond yields as alternative measures of interest rates. The literature provides two general reasons as to why medium-term to long-term market rates may be preferred to short-term policy rate as a measure of nominal interest rates in the Fisher equation. Firstly, unlike the policy rate, the medium to long term markets are not under the direct control of Central bank and their adjustments to inflation (expectations) may differ. Secondly, there is very little theoretical reasoning to assume that short-term nominal interest rates can be interpreted as long-run predicators of inflation (Ribba 2011). Lastly, many investors and market participants are more concerned with yields from bonds with longer maturity date which are directly linked to long-term financial decisions (Benazic 2013).

Figure 12 present the time series plots of the 3–5 year bond yield and the 5–10 year bond yield whilst Figs. 13 and 14 present their corresponding WPS plot to depict the evolution of these series over a time–frequency space. In similarity to the WPS for the repo, the WPS of both the medium-term and long-term interests indicates regions of dominant variability between frequency bands of 16 and 32 quarters (4–8 years). Moreover, we additional identify smaller band of high frequency oscillations of 8 to 12 quarters (2–3 years) between 2003 and 2005. Also in similarity to the case of short-term interest rates, the WPS provides evidence of volatility shifting in both medium-term and long-term yield rates and in this case, three distinct phases are observed. Firstly, we observe that the high frequency oscillations 8 to 12 quarters (2–3 years) between 2003 and 2005 are eliminated from 2007 onwards. Secondly, the lower frequency components of 16 to 20 quarters (4–5 years) are eliminated between 2005 and 2011, leaving low frequency bands of 20 to 32 quarters (5–8 years). Lastly, from 2012 onwards, all strong variation in the low frequency oscillations weakness, as indicated by the ‘cooling’ of colour contours, and particularly for the case of long-term nominal interest rates, there is very little variability in nominal interest rates after 2015, that is under the tenure of governor Kganyago.

Figures 15, 16, 17, 18 and 19 present the wavelet coherence plots for medium term yield against the disaggregate measures of inflation expectations whilst Figs. 19, 20, 21 and 22 present those for the long-term yield against the disaggregate measures of inflation expectations. Collectively, we summarize our observations from the wavelet coherence plots in three findings. Firstly, judging by the colour contours, we observe strong co-movements between the time-series at frequency oscillations of 20 to 32 quarters (5–6 years) in the pre-crisis or governor Mboweni era. Note that these co-movements are strong when medium-term yields are used as a measure of nominal interest rates, as shown by the red colour contours in Figs. 15, 16, 17 and 18, whilst they are weaker when long term yields are employed, as shown by the yellow contours in Figs. 19, 20, 21 and 22. Secondly, we observe cyclical oscillations at higher frequencies of between 8 and 12 quarters (2–3 years) during the 2007–2009 period corresponding to the financial crisis. We note that these high frequency components were not observed when the short-term policy rate was used as proxy for interest rates and are only detectable for medium to long term interest rates. Thirdly, we still find evidence of volatility transfer across the three Central bank governors, with cyclical oscillation of 0 to 8 quarters (0–2 years) are eliminated by 2011 during Governor Mboweni’s tenure, and then again between 2011 and 2016, that is during Governor Gill’s tenure, cyclical oscillations of 8 to 20 quarters (2–5 years) are eliminated, with only cyclical components of 20 to 32 quarters (5–8 years) existing during Governor Kganyago’s tenure.

3–5 year bond yield versus all expectations. Note: The white contour line represents the significance level. The power of correlation ranges from blue colour (weak correlation) to red colour (strong correlation). The arrow notations, \(\uparrow\), \(\nearrow\), \(\to\), \(\searrow\), (\(\downarrow\), \(\swarrow\), \(\leftarrow\), \(\nwarrow\)) indicate that a positive (negative) relationship between the series. The arrow notations,\(\uparrow\), \(\nearrow\), \(\to\), \(\swarrow\),\(\leftarrow\), (\(\searrow\),\(\downarrow\),\(\nwarrow\)) indicate that nominal interest rates are leading (lagging) inflation rates

3–5 year bond yield versus financial sector expectations. Note: The white contour line represents the significance level. The power of correlation ranges from blue colour (weak correlation) to red colour (strong correlation). The arrow notations, \(\uparrow\), \(\nearrow\), \(\to\), \(\searrow\), (\(\downarrow\), \(\swarrow\), \(\leftarrow\), \(\nwarrow\)) indicate that a positive (negative) relationship between the series. The arrow notations,\(\uparrow\), \(\nearrow\), \(\to\), \(\swarrow\),\(\leftarrow\), (\(\searrow\),\(\downarrow\),\(\nwarrow\)) indicate that nominal interest rates are leading (lagging) inflation rates

3–5 year bond yield versus business representatives expectations. Note: The white contour line represents the significance level. The power of correlation ranges from blue colour (weak correlation) to red colour (strong correlation). The arrow notations, \(\uparrow\), \(\nearrow\), \(\to\), \(\searrow\), (\(\downarrow\), \(\swarrow\), \(\leftarrow\), \(\nwarrow\)) indicate that a positive (negative) relationship between the series. The arrow notations,\(\uparrow\), \(\nearrow\), \(\to\), \(\swarrow\),\(\leftarrow\), (\(\searrow\),\(\downarrow\),\(\nwarrow\)) indicate that nominal interest rates are leading (lagging) inflation rates

3–5 year bond yield versus trade union representatives expectations. Note: The white contour line represents the significance level. The power of correlation ranges from blue colour (weak correlation) to red colour (strong correlation). The arrow notations, \(\uparrow\), \(\nearrow\), \(\to\), \(\searrow\), (\(\downarrow\), \(\swarrow\), \(\leftarrow\), \(\nwarrow\)) indicate that a positive (negative) relationship between the series. The arrow notations,\(\uparrow\), \(\nearrow\), \(\to\), \(\swarrow\),\(\leftarrow\), (\(\searrow\),\(\downarrow\),\(\nwarrow\)) indicate that nominal interest rates are leading (lagging) inflation rates

5–10 year bond yield versus all expectations. Note: The white contour line represents the significance level. The power of correlation ranges from blue colour (weak correlation) to red colour (strong correlation). The arrow notations, \(\uparrow\), \(\nearrow\), \(\to\), \(\searrow\), (\(\downarrow\), \(\swarrow\), \(\leftarrow\), \(\nwarrow\)) indicate that a positive (negative) relationship between the series. The arrow notations,\(\uparrow\), \(\nearrow\), \(\to\), \(\swarrow\),\(\leftarrow\), (\(\searrow\),\(\downarrow\),\(\nwarrow\)) indicate that nominal interest rates are leading (lagging) inflation rates

5–10 year bond yield versus financial sector expectations. Note: The white contour line represents the significance level. The power of correlation ranges from blue colour (weak correlation) to red colour (strong correlation). The arrow notations, \(\uparrow\), \(\nearrow\), \(\to\), \(\searrow\), (\(\downarrow\), \(\swarrow\), \(\leftarrow\), \(\nwarrow\)) indicate that a positive (negative) relationship between the series. The arrow notations,\(\uparrow\), \(\nearrow\), \(\to\), \(\swarrow\),\(\leftarrow\), (\(\searrow\),\(\downarrow\),\(\nwarrow\)) indicate that nominal interest rates are leading (lagging) inflation rates

5–10 year bond yield versus business representatives expectations. Note: The white contour line represents the significance level. The power of correlation ranges from blue colour (weak correlation) to red colour (strong correlation). The arrow notations, \(\uparrow\), \(\nearrow\), \(\to\), \(\searrow\), (\(\downarrow\), \(\swarrow\), \(\leftarrow\), \(\nwarrow\)) indicate that a positive (negative) relationship between the series. The arrow notations,\(\uparrow\), \(\nearrow\), \(\to\), \(\swarrow\),\(\leftarrow\), (\(\searrow\),\(\downarrow\),\(\nwarrow\)) indicate that nominal interest rates are leading (lagging) inflation rates

5–10 year bond yield versus trade union representatives expectations. Note: The white contour line represents the significance level. The power of correlation ranges from blue colour (weak correlation) to red colour (strong correlation). The arrow notations, \(\uparrow\), \(\nearrow\), \(\to\), \(\searrow\), (\(\downarrow\), \(\swarrow\), \(\leftarrow\), \(\nwarrow\)) indicate that a positive (negative) relationship between the series. The arrow notations,\(\uparrow\), \(\nearrow\), \(\to\), \(\swarrow\),\(\leftarrow\), (\(\searrow\),\(\downarrow\),\(\nwarrow\)) indicate that nominal interest rates are leading (lagging) inflation rates

6 Conclusions

This study demonstrates that continuous wavelet transforms can be used as a unified framework to simultaneously address empirical puzzles existing in Fishers hypothesis relating to the magnitude (strength) of the Fisher effect, time variation in the relationship, cyclical variation in the relationship, the sign on Fisher’s coefficient (negative or positive) and causal effects between nominal interest rate and inflation expectations. These wavelet tools allow us to extract the time signal features of the individual nominal interest rates and inflation expectations series across a time–frequency space, and further examine the co-movements or synchronization of the series in a time–frequency plane. Therefore, in differing from previous studies which either rely on time-domain econometric methods which have poor frequency resolution, our study shows that a time–frequency analysis of the Fisher effects can portray/provide a ‘clearer’ and more complete picture on the relationship.

Taking South Africa as a case study, our study presents a time–frequency analysis of the Fisher effect during a period of inflation targeting (i.e. 2001:q1 to 2021:q1) and we rely on a host of wavelet transform tools inclusive of the wavelet power spectrum, the wavelet coherence spectrum and phase-difference dynamics. One on hand, the wavelet power spectrums indicate that the nominal interest rates and inflation exceptions have had similar signal features and since the inception of the inflation targeting, both series have experienced reductions in cyclical oscillations, with higher frequency oscillations losing relevance to lower frequency oscillations. On the other hand, the wavelet coherence spectrum and phase dynamics, similarly show that synchronized co-movements between the time series has progressive weakened and is increasingly characterized by low-frequency relationship.

From an empirical perspective, our findings knit together ‘bits and pieces’ of conflicting evidences from previous South African studies in a cohesive manner. Firstly, whilst most previous literature find a weak Fisher effect in South Africa during the inflation targeting era across an entire time domain, our study demonstrates that these partial effects are dominant at higher-frequency co-movements in the pre-crisis and at lower-frequencies in the post-crisis periods. Secondly, some studies fail to find any Fisher effect in the data. Our results show that many higher-frequency co-movements are eliminated in the post-crisis period and the Fisher effect can only be detected at a smaller band of lower frequency components. Thirdly, a few other studies, find that Fisher effect is nonlinear and holds during periods of higher or rising inflation, and our findings concur with these intuitions as we similarly observe stronger Fisher effects during the periods of increasing inflation associated with the global financial crisis. Lastly, the phase dynamics found in our study indicate causal relations from inflation expectations to nominal interest rates at different frequency components across the entire time window and this finding is consistent with the causal dynamics depict in the traditional Fisher hypothesis.

Moreover, the findings from this study also help identify structural changes reflected by the varying strength and size of the cyclical oscillations which can be linked to changing policy preferences under the tenures of the different Reserve Bank governors who have been sequentially responsible for heading the inflation targeting framework. We find that whilst the Fisher effect predominantly exists at low-frequency correlations (20–30 quarter cycles) throughout the entire IT era, the ‘one-for-one’ effect strictly exists under governor Mboweni’s era which corresponds to a period of the aggressive use of the policy rate to keep inflation within the target. Conversely, under the tenures of governors Gill and Kganyago, when a less aggressive policy stance was taken, the magnitude of the Fisher effect weakens, and all higher frequency co-movements are eliminated leaving only low frequency correlations. Combined, these results demonstrate the success of the SARB in steering the expectations of different economic agents and further show that the Reserve Bank has been increasingly behaving as a ‘variance-minimizer, which recent literature considers as signs of good policy conduct.

Altogether, there two main policy lessons to be learnt from our study. Firstly, considering the recent increases in inflation rates attributed to the COVID-19 pandemic and the Russian-Ukraine conflict, Central banks worldwide may need to respond in a one-for-one manner to changes in inflation expectations, similar to the way the SARB aggressively responded to the increasing inflation experienced during the previous global financial crisis. Once inflation stabilizes and starts to fall, Central banks should focus on smoothing/eliminating short-run frequencies in the policy variables. Secondly, considering the recent increase in the number of developing and emerging economies which have adopted informal inflation targets and/or are aspiring to be fully fledged inflation targeters, there are lessons to be learnt from South Africa’s experience which can benefit these Central bank’s. For instance, these Central banks should be cautious in setting high inflation targets ranging into double digits, such as the case for Ghana, Malawi, Pakistan and South Sudan, as this encourages monetary authorities/policymakers to behave more conservatively and only raise their policy rates when inflation build-up is already high. This puts these countries at risk of experiencing ‘runaway inflation’. Moreover, Central banks need to take constitutional measures to ensuring that monetary authorities can make policy decisions independent from that of government influence. Many inflation targeters in emerging economies have mandates which give the government powers to remove the Central bank governors before the end of their tenures. Our study shows that the variance minimization of policy variables after a period of crisis needs to be consistently pursued across consecutive central bank governors and notably developing ad emerging economies which have recently fired their governors tend to have experienced problems controlling inflation in the post global financial crisis period e.g. Argentina, Zambia, South Sudan, Sri Lanka, Nepal, Sierra Leone, Turkey, Zambia.

As a natural development to this study, we recommend that future research expand the use of wavelet coherence analysis to examine the Fisher effect in time–frequency space for other Central banks who have adopted fixed or crawling peg exchange rates regimes and use the finds to evaluate the success of monetary policy conduct. Similar analysis can be further used to evaluate the synchronization and effectiveness of monetary policy for economies which have formed or aspire to form a currency union.

References

Aguiar-Conraria, L., Soares, M.: The continuous wavelet transform: moving beyond uni- and bi-variate analysis. J. Econ. Surv. 28(2), 344–375 (2014)

Aguiar-Conraria, L., Martins, M., Soares, M.: Estimating the Taylor rule in a time-frequency domain. J. Macroecon. 57, 122–137 (2018)

Aguiar-Conraria L., Soares M.: The continuous wavelet transform: a primer. NIPE Working Paper No. 23, August (2010)

Alagidede, I., Panagiotidis, T.: Can common stocks provide a hedge against inflation? Evidence from African countries. Rev. Financ. Econ. 19(3), 91–100 (2010)

Amano R., Carter T., Mendes R.: A primer on Neo-Fisherian economics. Bank of Canada Staff Analytical Notes 16–14, September (2016)

Amsler, C.: The Fisher effect: sometimes inverted, sometimes not? South. Econ. J. 52(3), 832–835 (1986)

Antonakakis, N., Christou, C., Gil-Alana, L., Gupta, R.: Inflation-targeting and inflation volatility: international evidence from the cosine-squared cepstrum. Int Econ 167, 29–38 (2021)

Ashley, R., Tsang, K., Verbrugge, R.: Frequency dependence in a real-time monetary policy rule. SSRN Electron. J. (2011). https://doi.org/10.2139/ssrn.1543928

Atkins, F.: Co-integration, error correction and the Fisher effect. Appl. Econ. 21(12), 1611–1620 (1989)

Bahmani-Oskooee, M., Li, J.-P., Chang, T.: Revisiting Fisher equation in BRICS countries. J. Glob. Econ. 4(3), 1–3 (2016)

Barksy, R., de Long, J.: Forecasting pre-World War 1 inflation: the Fisher effect and the Gold Standard. Q. J. Econ. 106(3), 815–836 (1991)

Barsky, R.: The Fisher hypothesis and the forecastability and persistence of inflation. J. Monet. Econ. 19(1), 3–24 (1987)

Barthold, T., Dougan, W.: Interest rates and inflation in the frequency domain: new evidence. Econ. Lett. 24(1), 19–25 (1987)

Bayat, T., Kayhan, S., Tasar, İ: Re-visiting Fisher effect for fragile five economies. J. Cent. Bank. Theory Pract. 2, 203–218 (2018)

Bayat, T., Kayhan, S., and Tasar, I.: Re-visiting Fisher effect for the fragile five economies. J. Cent. Bank. Theory Pract, 7(2), 203–218 (2016)

Benazic, M.: Testing the Fisher effect in Croatia: an empirical investigation. Econ. Res. Ekon. Istraz. 26(s1), 83–102 (2013)

Berument, H., Froyen, R.: The Fisher effect on long-term U.K. interest rates in alternative monetary regimes: 1844–2018. Appl. Econ. 53(33), 3795–3809 (2021)

Berument, H., Jelassi, M.: The Fisher hypothesis: a multi-country analysis. Appl. Econ. 34(13), 1645–1655 (2002)

Bonga-Bonga, L., Kabundi, A.: Monetary policy and inflation in South Africa: an empirical analysis. Afr. Finance J. 13(2), 25–37 (2011)

Bosupeng, M.: The fisher effect using differences in the deterministic term. Int. J Latest Trends Financ. Econ. Sci. 4(5), 1031–1040 (2015)

Brock, W., Durlauf, S., Rondina, G.: Frequency specific effects of stabilization policies. Am. Econ. Rev. 98(2), 241–245 (2008)

Cal, Y.: Testing the Fisher effects in the US. Econ. Bull. 38(2), 1014–1027 (2018)

Caporale, G., Gil-Alana, L.: Testing the Fisher hypothesis in the G-7 countries using I(d) techniques. Int. Econ. 159, 140–150 (2019)

Carmicheal, J., Stebbing, P.: Fisher’s paradox and the theory of interest. Am. Econ. Rev. 73(4), 619–630 (1983)

Choudhry, T., Placone, D., Wallace, M.: Changes in the Fisher effect in the 1980’s: evidence from various models. J. Econ. Bus. 43(1), 59–68 (1991)

Christopoulos, D., Leon-Ledesma, M.: A long-run non-linear approach to the Fisher effect. J. Money Credit Bank. 39(2/3), 543–559 (2007)

Cochrane J.: Do higher interest rates raise or lower inflation? Hoover Institute Working Paper, February (2016)

Cooray, A.: The Fisher effect: a survey. Singap. Econ. Rev. 48(2), 135–150 (2003)

Crowder, W., Hoffman, D.: The long-run relationship between nominal interest rates and inflation: the Fisher effect revisited. J. Money Credit Bank. 28(1), 102–118 (1996)

Cushman D., de Vita G., Trachanas E.: IS the Fisher effect asymmetric? Cointegration analysis and expectations measurements. Int. J. Finance Econ. (forthcoming) (2022)

Darby, M.: The financial and tax effects of monetary policy on interest rates. Econ. Inq. 13(2), 266–276 (1975)

Dogan, I., Orun, E., Aydin, B., Afsal, M.: Non-parametric analysis of the relationship between inflation and interest rate in the context of Fisher effect for Turkish economy. Int. Rev. Appl. Econ. 34(6), 758–768 (2020)

Dutt, S., Ghosh, D.: A threshold cointegration test of the Fisher hypothesis: case study of 5 European countries. Southwest. Econ. Rev. 31(1), 41–50 (2007)

Engle, R., Granger C.: Cointegration and error correction: Representation, estimation, and testing. Econometrica 55(2), 251–276 (1987)

Evans, M., Lewis, K.: Do expected shifts in inflation affect estimates of the long-run fisher relation? J. Finance 50(1), 225–253 (1995)

Fahmy, Y., Kandil, M.: The Fisher effect: new evidence and implications. Int. Rev. Econ. Finance 12(4), 451–465 (2003)

Fama, E.: Short-term interest rates as predicators of inflation. Am. Econ. Rev. 65(3), 269–282 (1975)

Feldstein, M.: Inflation, income taxes, and the rate of interest: theoretical analysis. Am. Econ. Rev. 66(5), 809–820 (1976)

Fisher, I.: The Theory of Interest Rates. MacMillan: New York (1930)

Fratianni, M., Gallegati, M., Giri, F.: The medium-run Phillips curve: a time-frequency investigation for the UK. J. Macroecon. 73, e103450 (2022)

Garcia, P., Zapata, H.: Co-integration, error correction and the Fisher effect: a clarification. Appl. Econ. 23(8), 1367–1368 (1991)

Goupillaud, P., Grossman, A., Morlet, J.: Cycle-octave and related transforms in seismic signal analysis. Geoexploration 23, 85–102 (1984)

Granville, B., Mallick, S.: Fisher hypothesis: UK evidence over a century. Appl. Econ. Lett. 11(2), 87–90 (2004)

Grossman, A., Morlet, J.: Decomposition of Hardy functions into square integrable wavelets of constant shape. SIAM J Math Anal 15, 723–726 (1984)

Jensen, M.: The long-run Fisher effect: can it be tested? J. Money Credit Bank. 41(1), 221–231 (2009)

Jochmann, M., Koop, G.: Regime-switching cointegration. Stud. Nonlinear Dyn. Econom. 19(1), 35–48 (2014)

Kasman, S., Kasman, A., Turgutlu, E.: The Fisher hypothesis revisited: a fractional cointegration analysis. Emerg. Mark. Finance Trade 42(6), 59–76 (2006)

Khan, B., de Jager, S.: An assessment of inflation targeting and its implications in South Africa. Econ. History Dev. Reg. 26(1), 73–93 (2011)

Kim, D., Lin, S., Hsieh, J., Suen, Y.: The Fisher equation: a nonlinear panel data approach. Emerg. Mark. Finance 54(1), 162–180 (2018)

Kose, N., Emirmahmutoglu, F., Aksoy, S.: The interest rate-inflation relationship under an inflation targeting regime”: the case of turkey. J. Asian Econ. 23(4), 476–485 (2012)

Koustas, Z., Serletis, A.: On the Fisher effect. J. Monet. Econ. 44(1), 105–130 (1999)

Maozzami, B.: Interest rates and inflationary expectations: long-run equilibrium and short-run adjustment. J. Bank. Finance 14(6), 1163–1170 (1990)

Million, N.: Central bank’s interventions and the Fisher hypothesis: a threshold cointegration investigation. Econ. Model. 21(6), 1051–1064 (2004)

Mishkin, F.: Is the Fisher effect for real? A re-examination of the relationship between inflation and interest rates. J. Monet. Econ. 30(2), 195–215 (1992)

Mishkin, F., Simon, J.: An empirical examination of the Fisher effect in Australia. Econ. Rec. 71(3), 217–229 (1995)

Mitchell-Innes, H., Aziakpono, M., Faure, A.: Inflation targeting and the Fisher effect in South Africa: an empirical investigation. S. Afr. J. Econ. 75(4), 693–707 (2007)

Mundell, R.: Inflation and real interest. J. Polit. Econ. 71, 280–283 (1963)

Naraidoo, R., Gupta, R.: Modeling monetary policy in South Africa: focus on inflation targeting era using a simple learning rule. Int. Bus. Econ. Res. J. 9(12), 89–98 (2010)

Naraidoo, R., Raputsoane, L.: Zone-targeting monetary policy preferences and financial market conditions: a flexible non-linear policy reaction function of the SARB monetary policy. S. Afr. J. Econ. 78(4), 400–417 (2010)

Naraidoo, R., Raputsoane, L.: Optimal monetary policy reaction function in a model with target zones and asymmetric preferences for South Africa. Econ. Model. 28(1), 251–258 (2011)

Nazlioglu S., Gurel S., Gunes S., Kilic E.: Asymmetric Fisher effect in inflation targeting emerging economies: evidence from quantile cointegration. Appl. Econ. Lett. (forthcoming) (2021)

Nemushungwa A.:An empirical study on the Fisher effects and the dynamic relation between nominal interest rates and inflation in South Africa. AP16 Mauritius Conference. Ebene-Mauritius: Global Bizresearch (2016)

Nusair, S.: Testing for the Fisher hypothesis under regime shifts: an application to Asian countries. Int. Econ. J. 22(2), 273–284 (2008)

Onatski, A., Williams, N.: Modeling model uncertainty. J. Eur. Econ. Assoc. 1(5), 1087–1122 (2003)

Ongan, I., Gocer, S.: Interest rates, inflation and partial Fisher effects under nonlinearity: evidence from Canada. Econ. Bull. 38(4), 1957–1969 (2018)

Ongan, I., Gocer, S.: The relationship between inflation and interest rates in the UK: the nonlinear ARDL approach. J. Cent. Bank. Theory Pract. 9(3), 77–86 (2020a)

Ongan, I., Gocer, S.: Testing fisher effect for the USA: application of nonlinear ARDL model. J. Financ. Econ. Policy 12(2), 293–304 (2020b)

Padayachee, V.: South African Reserve Bank independence: the debate revisited. Transform. Crit. Perspect. South. Afr. 89, 1–25 (2015)

Panopoulou, E., Pantelidis, T.: The Fisher effect in the presence of time-varying coefficients. Comput. Stat. Data Anal. 100, 495–511 (2016)

Paul, T.: Interest rates and the Fisher effect in India. Econ. Lett. 14(1), 17–22 (1984)

Payne, J., Ewing, B.: Evidence from lesser developed countries on the fisher hypothesis: a cointegration analysis. Appl. Econ. Lett. 4(11), 683–687 (1997)

Pelaez, R.: The fisher effect: reprise. J. Macroecon. 17(2), 333–346 (1995)

Phiri, A., Lusanga, P.: Can asymmetries account for the empirical failure of the Fisher effect in South Africa? Econ. Bull. 31(3), 1968–1979 (2011)

Phiri, A., Mbekeni, L.: Fisher's hypothesis, survey-based expectations and asymmetric adjustments: empirical evidence from South Africa. Int. Econ. Econ. Policy 18, 825–846 (2021)

Placone, D., Wallace, M.S.: Money deregulation and inverting the inverted Fisher effect. Econ. Lett. 24(4), 335–338 (1987)

Ribba, A.: On some neglected implications of the Fisher effect. Empir. Econ. 40(2), 451–470 (2011)

Rossouw, J.: Private shareholding: an analysis of an eclectic group of central banks. S. Afr. J. Econ. Manag. Sci. 19(1), 150–159 (2016)

Rua, A.: Wavelet in economics. Banco Port. Econ. Bull. 8, 71–79 (2012)

Rua, A., Nunes, L.: International comovement of stock returns: a wavelet analysis. J. Empir. Finance 16(4), 632–639 (2009)

Sanchez-Fung, J.: Interest rates, inflation, and the Fisher effect in China. Macroecon. Finance Emerg. Mark. Econ. 12(2), 124–133 (2019)

Schleicher, C.: An introduction to wavelets for economists. Bank of Canada Working Paper No. 2002–03, January (2002)

Sugita, K.: Non-linear analysis of the Fisher effect: in the case of Japan. Int. J. Econ. Finance 9(11), 1–9 (2017)

Summers, L.: Estimating long-run relationship between interest rates and inflation: a response to McCallum. J. Monet. Econ. 18(1), 77–86 (1986)

Summers, L.: The non-adjustment of nominal interest rates: the study of the Fisher effect. NBER Working Paper No. 836, January (1982)

Taylor, J.: Inflation targeting in high inflation emerging economies: lessons about rules and instruments. J. Appl. Econ. 22(1), 103–116 (2019)

Torrence, C., Compo, G.P.: A practical guide to wavelet analysis. Bull. Am. Meteorol. Soc. 79(1), 61–78 (1998)

Tsong, C., Lee, C.: Quantile cointegration analysis of the Fisher hypothesis. J. Macroecon. 35(C), 186–198 (2013)

Uribe, M.: The Neo-Fisher effect: Econometric evidence from empirical and optimizing models. NBER Working Paper No. 25089, September (2018)

Vermeulen, C.: One hundred years of private shareholding in the South African Reserve Bank. Econ. History Dev. Reg. 36(2), 245–263 (2021)

Viren, M.: Inflation and interest rates: some time series evidence from 6 OECD countries. Empir. Econ. 12, 51–66 (1987)

Wallace, M., Warner, J.: The Fisher effect and the term structure of interest rates: test of cointegration. Rev. Econ. Stat. 75(2), 320–324 (1993)

Wesso, G.R.: Long-term yield bonds and future inflation in South Africa: a vector error-correction analysis. Q. Bull. S. Afr. Reserve Bank 9, 72–84 (2000)

Westerlund, J.: Panel cointegration tests of the Fisher effect. J. Appl. Economet. 23(2), 193–233 (2008)

Williamson, S.: Inflation control: do Central banks have it right? Federal Reserve Bank St. Louis 100(2), 127–150 (2018)

Wong, K., Wu, H.: Testing Fisher hypothesis in long horizons for G7 and eight Asian countries. Appl. Econ. Lett. 10(14), 917–923 (2003)

Yaya, K.: Testing the long-run fisher effect in Selected African countries: evidence from ARDL bounds test. Int. J. Econ. Finance 7(2), 168–175 (2015)

Funding

The authors have not disclosed any funding.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author has nothing to declare.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Phiri, A. Fisher’s hypothesis in time–frequency space: a premier using South Africa as a case study. Qual Quant 57, 4255–4284 (2023). https://doi.org/10.1007/s11135-022-01561-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-022-01561-z