Abstract

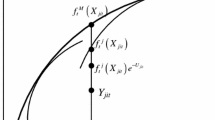

This study employs the newly developed stochastic metafrontier production function by Huang et al. (A new approach to estimating the metafrontier production function based on a stochastic frontier framework. Working paper, Vanderbilt University, National Cheng-chi University, Taiwan, 2012) to compare the technical efficiencies of accounting firms (AFs) among the US, China, and Taiwan, operating under different technologies. Although AFs play an important role in a nation’s capital market, the accounting industry has not attracted much attention to academic researchers. The main difference between the stochastic metafrontier function and the one proposed by Battese et al. (J Prod Anal 21:91–103, 2004) and O’Donnell et al. (Empir Econ 34:231–255, 2008) lies in the second step, where the stochastic frontier approach (SFA) is recommended instead of programming techniques. Taiwan’s AFs are found to have the highest average metafrontier technical efficiency (MTE) and AFs in the US have the highest technology gap ratio (TGR). Nonetheless, the average TGR and MTE values of American AFs are closer to those of Taiwan. The low performance of Chinese AFs may be attributed to government regulations and the lack of market competition. However, the programming technique suggests reverse results for AFs in Taiwan and the US and larger variances for TGR and MTE. Then these three countries’ AFs show decreasing returns to scale, indicating that mergers and acquisitions may not be advantageous for expanding their production scale.

Similar content being viewed by others

Notes

This specification is in line with Battese and Coelli (1992). Note that the assumption that \(u_{i}^{j}\) is a half-normal random variable for all groups of j, instead of a truncated-normal, allows us to compare the technical efficiency of accounting firms in different countries under the same standard, i.e., the distribution of u j i in each group is kept by the same portion of the right-half.

However, the information provided by CICPA only provides data on two types of revenue: auditing and non-auditing service. The accounting and auditing services on US firms comprises compilations, special reports, and reviews in addition to engagement involving the attest function which could be categorized as revenue from auditing services and non-auditing services. The Taiwan’s database on the other hand provided complete data on various revenue items.

Our estimation results show that a little more than a half of the parameter estimates achieve statistical significance. This appears to be acceptable due to the fact that our data set is not large, including only 297, 105, and 300 observations in the US, Taiwan, and China, respectively.

Due to space limitations, we have not listed the coefficient estimation results; interested readers may obtain this data from the author.

The estimation results are quite similar to the ones without the firm size dummy variable. But, including the firm size variable makes this empirical result more intuition about practices. We are grateful to anonymous referee for providing the suggestion.

We have not listed the LP metafrontier estimates, as they are similar to those resulting from the QP model. Interested readers may obtain this data from the author.

References

Banker RD, Chang H, Cunningham R (2003) The public accounting industry production function. J Acc Econ 35(2):255–281

Banker RD, Chang H, Natarajan R (2005) Productivity change, technical progress, and relative efficiency change in the public accounting industry. Manage Sci 51(2):291–304

Banker RD, Chang H, Natarajan R (2007) Estimating DEA technical and allocative inefficiency using aggregate cost or revenue data. J Prod Anal 27:115–121

Battese GE, Coelli TJ (1992) Frontier production functions, technical efficiency and panel data: with application to paddy farmers in India. J Prod Anal 3:153–169

Battese GE, Rao DSP (2002) Technology gap, efficiency and a stochastic metafrontier function. Int J Bus Econ 1:87–93

Battese GE, Rao DSP, O’Donnell CJ (2004) A metafrontier production function for estimation of technical efficiencies and technology gaps for firms operating under different technologies. J Prod Anal 21:91–103

Bos JWB, Schmiedel H (2007) Is there a single frontier in a single European banking market? J Bank Finance 31(7):2081–2102

Bröcheler V, Maijoor S, Witteloostuijn AV (2004) Auditor human capital and audit firm survival The Dutch audit industry in 1930–1992. Acc Organ Soc 29:627–646

Chang H, Choy HL, Cooper WW, Ruefli TW (2009a) Using Malmquist indexes to measure changes in the productivity and efficiency of US accounting firms before and after the Sarbanes–Oxley Act. Omega 37(5):951–960

Chang H, Choy HL, Cooper WW, Parker BR, Ruefli TW (2009b) Measuring productivity growth, technical progress, and efficiency changes of CPA firms prior to, and following the Sarbanes–Oxley Act. Socio-Econ Plan Sci 43(4):221–228

Chang H, Chen J, Duh R, Li S (2011) Productivity growth in the public accounting industry: the roles of information technology and human capital. Audit A J Pract Theory 30(1):21–48

Chen KH (2012) Incorporating risk input into the analysis of bank productivity: application to the Taiwanese banking industry. J Bank Finance 36(7):1911–1927

Cheng TW, Wang KL, Weng CC (2000a) A study of technical efficiencies of CPA firms in Taiwan. Rev Pac Basin Financ Mark Polic 3(1):27–44

Cheng TW, Wang KL, Weng CC (2000b) Economies of scale and scope in Taiwan’s CPA service industry. Appl Econ Lett 7:409–414

Greenwood R, Li SX, Prakash R, Deephouse DL (2005) Reputation, diversification, and organizational explanations of performance in professional service firms. Organ Sci 16(6):661–673

Hayami Y (1969) Sources of agricultural productivity gap among selected countries. Am J Agric Econ 51:564–575

Hayami Y, Ruttan VW (1970) Agricultural productivity differences among countries. Am Econ Rev 60:895–911

Hayami Y, Ruttan VW (1971) Agricultural development: an international perspective. Johns Hopkins University Press, Baltimore

Huang CJ, Huang TH, Liu NH (2012) A new approach to estimating the metafrontier production function based on a stochastic frontier framework. Working paper, Vanderbilt University, National Cheng-chi University (Taiwan)

Knechel WR, Rouse P, Schelleman C (2009) A modified audit production framework: evaluating the relative efficiency of audit engagements. Acc Rev 84(5):1607–1638

Moreira VH, Bravo-Ureta BE (2010) Technical efficiency and metatechnology ratios for dairy farms in three southern cone countries: a stochastic meta-frontier model. J Prod Anal 33(1):33–45

Nordenflycht AV (2010) What is a professional service firm? Toward a theory and taxonomy of knowledge-intensive firms. Acad Manag Rev 35(1):155–174

O’Donnell CJ, Rao DSP, Battese GE (2008) Meta-frontier frameworks for the study of firm-level efficiencies and technology ratios. Empir Econ 34:231–255

O’Keefe TB, King RD, Gaver KM (1994) Audit fees, industry specialization, and compliance with GAAS reporting standards. Audit A J Pract Theory 13:41–55

Parker RH, Morris RD (2001) The influence of U.S. GAAP on the harmony of accounting measurement policies by large companies in the UK and Australia. Abacus 37(3):297–328

Simunic DA (1980) The pricing of audit services: theory and evidence. J Acc Res 18(1):161–190

Acknowledgments

The first author is indebted to the financial support of Ministry of Science and Technology, Taiwan, ROC, with grant number: NSC 100-2410-H-032-036. The three authors are also indebted to anonymous referees for their valuable comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Chang, BG., Huang, TH. & Kuo, CY. A comparison of the technical efficiency of accounting firms among the US, China, and Taiwan under the framework of a stochastic metafrontier production function. J Prod Anal 44, 337–349 (2015). https://doi.org/10.1007/s11123-014-0397-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11123-014-0397-8