Abstract

Political decisions usually involve risks regarding potential outcomes. In an ideal representative system, voters should therefore evaluate politicians not only according to the policies they support, but also according to their inclination to take risks. In this study, we examine whether risk preferences affect voting decisions in an incentivized online experiment. Subjects assigned the role of politicians decide for the voters how much to invest in a risky policy, whereas subjects assigned the role of voters learn about the risk profiles of the politicians and decide whether to re-elect the incumbent or to elect the challenger. The treatments vary the risk and potential reward of the policy politicians can implement as well as the information voters receive about the consequences of a politician’s decision. We find that voters are significantly more likely to elect politicians who propose policies that are in line with the voters’ risk preferences and that politicians adapt to the assumed risk preferences of the voters. If a voter learns that the politician’s decision led to a negative outcome, despite a low probability of such an outcome, she is less likely to re-elect this politician. Furthermore, the results suggest an incumbency advantage independent of institutional advantages.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

As has been powerfully demonstrated during the recent crises, from the COVID-19 pandemic to the war in Ukraine or the climate catastrophe, policy outcomes are subject to a variety of factors that lie beyond the scope of influence and cognition of decision-makers. Policy outcomes are thus – at least from the viewpoint of a politician – subject to chance. Therefore, at the decision-making stage, implementing policies involve risks (Giddens, 1999; Mathijssen et al., 2008). Naturally, some politicians are willing to take greater risks on behalf of their constituents to obtain potentially higher returns while others try to avoid any potential negative consequences as much as possible (Linde & Vis, 2017). The question is whether voters take risk preferences into account when deciding whether to re-elect politicians. If they do, do they prefer politicians who are risk-neutral, averse or affine or do they want politicians to match their own risk preferences?

So far, evidence suggesting that risk preferences affect preferences over representatives or policies is rare (Kratz, 2021). In fact, voters may be subject to an “outcome bias” (Baron & Hershey, 1988), rewarding politicians for positive outcomes and punishing them for negative outcomes, even if these consequences were completely out of the incumbent’s control (e.g., Bagues & Esteve-Volart, 2016; Liberini et al., 2017). Albeit a useful heuristic at times, inferring the quality of a decision from the outcome can be utterly misleading if chance is involved. Hence, the outcome bias can have adverse consequences to the delegation process, potentially rendering voters’ risk preferences obsolete and incentivizing inefficient policies in the short and long run.

In this study, we aim to provide causal evidence on the links between representatives’ risk taking, voters’ risk preferences, political outcomes, and voting behavior. With observational data, this would be a challenging task. Take, for example, the risk NATO member states face to provoke a nuclear conflict with Russia following military aid for Ukraine. More risk-averse voters may support representatives who are against military aid, while more risk-affine voters may support representatives who are in favor of more military aid. It is impossible to determine the actual likelihood of a nuclear conflict conditional on different levels of military aid. The perceived risks may be strongly influenced by ideological beliefs, individual risk preferences, and political framing (Giddens, 1999). The expected gains from supporting Ukraine with military aid may vary as well between individuals. This implies that the same policy is expected to be risk-neutral for one voter and risk-affine or averse for another, since risk preferences are measured as deviation from maximizing the expected utility. Hence, in the field, it is difficult to develop a clean test of the causal influence of risk preferences on the support for representatives.

We employ a novel incentivized online experiment to study this question. The experimental design allows us to elicit risk preferences of subjects in the role of voters and to assess the exact level of risk that subjects in the roles of incumbents or challengers propose to implement over two terms. We examine whether (I) voters are more likely to vote for representatives who take the same level of risk as they would, (II) voters’ electoral decisions are affected by the outcome of a previous decision even when they are clearly informed that this outcome is subject to pure chance, and (III) whether incumbents have an advantage over the challenger all other things being equal. Furthermore, we study the behavior of subjects in the role of politicians. Since politicians are incentivized to get elected and must anticipate the decisions of voters to maximize their chance of getting elected, we can derive how politicians expect voters to decide in the different treatments.

Our main findings are threefold. First, we find a strong influence of voters’ risk preferences on the election probability of politicians. In the experiment, voters are significantly more likely to vote for the politician that proposes a policy that matches their risk preferences and politicians implement a level of risk that they expect the voters to prefer. Second, we find only qualified evidence for an outcome bias. While bad outcomes do affect the re-election probability of incumbents negatively if they have been unlikely, they do not if a negative outcome is more likely than a positive outcome. Positive outcomes never affect the re-election probability significantly, neither when they have been likely or unlikely. Similarly, politicians do not adapt their decisions, irrespective of whether voters learn the outcome before the election or not. Third, everything else being equal, we find subjects are significantly more likely to vote for incumbents than challengers despite any concrete institutional advantages and challengers seem to anticipate their disadvantage.

The Influence of Risk Preferences on Political Preferences and Voting

How risk preferences affect voting behavior is not entirely clear. Based on more general findings from the literature on political representation, we could assume that voters do not only prefer representatives to match their policy preferences, but also prefer politicians to match their risk preferences (Bowler, 2017; Carman, 2007). However, this has not yet been tested directly. Previous research, which is summarized below, has found that risk preferences correlate with political preferences and may also affect voting behavior.

Risk Preferences and Political Preferences

One strand of research examines voting on referenda and assumes that retaining the status quo is perceived as the safer option (Hobolt, 2009). These studies report that risk-averse subjects were less likely to vote for Brexit in 2016 (Henderson et al., 2017; Morisi, 2018), Scotland’s independence in 2014 (Liñeira & Henderson, 2021), Quebec’s sovereignty in 1995 (Nadeau et al., 1999), and are less likely to support Catalan independence (Verge et al., 2015). Other studies try to assess the risks associated with a specific issue and investigate whether risk preferences moderate policy preferences. They find that risk preferences affect support for free trade (Ehrlich & Maestas, 2010), increased welfare spending (Milita et al., 2020), military interventions (Eckles & Schaffner, 2011), inclusive EU politics, and communization of corporations (Kratz, 2021).

Another line of research tries to connect the incumbency advantage (de la Cuesta & Imai, 2016) to risk preferences. Studies have demonstrated that incumbent politicians have an advantage over challengers due to greater name recognition, extra campaign resources, pork-barrel spending, or the deterrence of strong challengers (e.g., Eggers, 2017). In addition, studies have shown that risk-averse individuals are more likely to vote for incumbents than challengers (Eckles et al., 2014; Kam & Simas, 2012; Morgenstern & Zechmeister, 2001) and incumbent parties than challenger parties (Martin, 2022; Steenbergen & Siczek, 2017). The assumed psychological mechanism behind this relationship is that voters perceive challengers as the riskier option. Other psychological explanations encompass anchoring effects, regret avoidance, and inertia (Polites & Karahanna, 2012; Samuelson & Zeckhauser, 1988). Hence, incumbents might have an advantage because they represents the status quo (Morisi et al., 2022), but evidence does not substantiate this view when other institutional advantages are controlled for (Brown, 2014).

The status quo bias and incumbency advantage have been found to be stronger among conservative voters than among liberals (Morisi et al., 2021, 2022). Conservatism also correlates with a lower tolerance for uncertainty, ambiguity, threat, and loss (Jost et al., 2003, 2017). However, risk perceptions of left and right-wing voters depend critically on the political domain (Brandt et al., 2021; Choma et al., 2013), which makes a generalization difficult. While conservatives perceive street crime and terrorism as more dangerous, liberals consider risks associated with the stock market, corporate misconduct, white collar crime or pollution as more severe (Eadeh & Chang, 2020; Fiagbenu & Kessler, 2022; Kroska et al., 2019). The ambivalence is also shown by supporters of right-wing populist parties who are willing to take risks associated with voting for a (radical) challenger party, but less willing to take risks associated with cultural and economic transformations in the wake of globalization (Gründl & Aichholzer, 2020; Steenbergen & Siczek, 2017). In sum, the literature illustrates that risk perceptions vary among voters and are linked to ideological views, which makes it difficult to isolate the influence of risk preferences on political preferences.

Past Outcomes and Voting

Another difficulty arises when risk and performance perceptions change over time. The so-called outcome bias (Baron & Hershey, 1988), closely related to the better-known hindsight bias (Roese & Vohs, 2012), suggests that voters tend to deduce ‘good’ decisions from ‘good’ outcomes and ‘bad’ decisions from ‘bad’ outcomes. However, if the outcome of political decisions is subject to chance, it is possible that a good (or bad) decision under a given set of information leads coincidentally, that is, for reasons beyond the control of politicians, to a bad (or good) outcome. In line with the assumed outcome bias, events supposedly irrelevant to the performance of politicians, such as shark attacks, floods, droughts or the victory of the favorite sports team, have been found to affect the performance evaluation of politicians (Achen & Bartels, 2017; Busby et al., 2017; Healy & Malhotra, 2010). While the robustness of these results are called into question (Fowler & Hall, 2018; Fowler & Montagnes, 2015; Müller & Kneafsey, 2021), evidence does suggest that events that strongly affect economic living conditions but can hardly be influenced by politicians have an effect on individual voting decisions (Bagues & Esteve-Volart, 2016; Liberini et al., 2017).

Under fully controlled experimental conditions, Huber et al. (2012) find that subjects are more likely to re-elect politicians immediately after a lottery win, even if the outcome of the lottery is completely independent from the politician’s performance. Woon (2012) shows that when the decision of a politician leads to a suboptimal outcome by chance, subjects mostly concentrate on the outcome, disregard other cues about the politicians’ qualification, and often vote against their own interests. Subjects also financially reward representatives more when the outcome of a lottery is positive, even when the decision of the representative to invest in this lottery is not in line with their initial risk preferences (Aimone & Pan, 2020; König-Kersting et al., 2021). In sum, this indicates that voters’ risk preferences and representatives’ risk profiles are less relevant once the outcomes become evident to voters.

Evidence regarding representatives’ responses to a potential outcome bias is inconclusive. The literature reports both risky and cautious shifts when people are supposed to take risks on behalf of others (Batteux et al., 2019; Polman & Wu, 2020). Daruvala (2007) finds that representatives use a combination of their own risk preferences and their expectations about the risk preferences of the target group. Accountability mechanisms have also been found to affect risk behavior of subjects in the role of representatives (Pollmann et al., 2014; Sheffer & Loewen, 2019), but whether they try to account for a potential outcome bias among voters has not yet been studied.

Hypotheses

Based on the previous literature, we expect that voters are generally more likely to elect politicians with a risk profile close to their own risk preferences. Everything else being equal, voters should be more likely to re-elect incumbents if they believe that the incumbents’ decisions will be more in line with their own risk preferences than the challengers’ decisions. Since accountability mechanisms like an election amplify the weight put on the preferences of the voters compared to the own preferences, politicians should align their decisions with the expected preferences of voters.

H1-V The closer the voter’s risk preferences to the incumbent’s suggested policy decisions as compared to the challenger’s, the higher the incumbent’s re-election probability is.

H1-P The more risk-averse a politician expects voters to be, the more risk-averse her suggested policy decisions are.

However, if the outcome of a previously implemented policy becomes apparent before the next election, it may influence voters’ electoral decisions – even if the outcome is subject to chance. In turn, politicians who expect that their re-election chances may crucially depend on policy outcomes, maximize their chance to get elected by implementing policies that are unlikely to produce negative outcomes independent of the magnitude of potential societal gains. Therefore, they should be less likely to consider the risk preferences of voters.

H2-V The better the (apparent) outcomes from previous political decisions are for the voters, the higher the re-election probability of the incumbent is.

H2-P If voters will learn the outcome of a policy before the next election, then politicians are more likely to deviate from the expected risk preferences of voters.

Finally, the incumbency advantage suggests that voters are generally more likely to vote for incumbents. This is attributed to institutional advantages, such as greater name recognition, extra campaign resources, pork-barrel spending, or psychological advantages, such as the risk and uncertainty associated with challengers. If we can control for institutional advantages and the riskiness of challengers, then any remaining incumbency advantage would speak for other psychological reasons associated with the status-quo bias. Assuming that challengers anticipate an incumbency advantage and their own disadvantage, they should then be more likely to deviate from their expectations about voters’ risk preferences than incumbents. In this case, challengers could try to get an edge over an incumbent by offering riskier policies if they perceive the median voter to prefer moderate policies (and consequentially incumbents to offer them) and more moderate policies if they perceive the median voter to be either risk-averse or risk-affine.

H3-V Voters are more likely to vote for the incumbent than for the challenger.

H3-P Challengers are more likely to deviate from the expected risk preferences of voters than incumbents.

In sum, this leaves us with three sets of hypotheses about the role of risk preferences, the outcome bias, and the incumbency advantage. To test these hypotheses, we have to assess the risk preferences of a voter, the level of risk associated with an incumbent’s previously implemented and potential future policies, and the level of risk associated with the political alternative, i.e. the policies supported by challengers. In the next section, we present an experimental design that provides this information.

Experimental Design

To test our hypotheses, we developed an incentivized online experiment. Figure 1 gives an overview of the sequence of the experiment’s four parts. In the first two parts, we elicit risk preferences of the participants. In the third part, subjects play a principal-agent game in which the participants take on the role of politicians – incumbent or challenger – and voters. The politicians suggest a ‘policy’ and the voters must decide whether to re-elect the incumbent, whose suggested policy is implemented in the first term, for a second term or to elect the challenger instead. In a 2 × 2-factorial between-subjects design, we systematically vary the information available to the voters about the outcome of the first term as well as the risk and reward probability of the policies. In the fourth part, we conduct a short survey.

Elicitation of Individual Risk Preferences

In the first and second part of the experiment, we employ a risk allocation task adapted from Gneezy and Potters (1997). In this task, subjects must decide how strongly they want to pursue a ‘safe’ or a ‘risky’ policy. They must allocate 10 points between a safe option that returns the allocated points with certainty and a risky lottery that returns, with a predefined probability, a multiple of the allocated points in case of an ‘upswing’ or loses the allocated points in case of a ‘downswing’. The more points a participant earns during the tasks, the higher the payoff of the participant in the experiment is. Hence, subjects face a trade-off between a safe payoff and a potentially higher payoff that involves the risk of ending up with a lower payoff. We call subjects more risk-averse the more they allocate to the safe policy.

The potential return and the probability of the two outcomes vary between two treatments. In the high risk-reward treatment, the probability of an upswing is 1/3 and the probability of a downswing is 2/3. The potential return of the risky policy is 3.5, which means that all points allocated to the risky policy are multiplied by 3.5 in case of an upswing. In the low risk-reward treatment, the probabilities of upswing and downswing are 2/3 and 1/3 and the return in case of an upswing is 1.75. Hence, the chance of a downswing is lower, but the potential payoff is also lower in the low risk-reward treatment in comparison to the high risk-reward treatment, so that the expected return of the safe and risky policy is exactly equal between the two treatments. Subjects either participate in the high or the low risk-reward treatment and do not switch between the two treatments throughout the different parts of the experiment.

In both parts, subjects make decisions for two consecutive rounds, which are called terms. However, Part 1 and Part 2 differ with respect to the feasible action set between the two terms. In Part 1, subjects take one allocation decision that takes effect for two consecutive terms. In each term, an upswing or a downswing occurs independently from the other outcome with the same probabilities. In Part 2, subjects take three (potentially different) allocation decisions. First, they decide on an allocation for the first term. For the second term, we employ the strategy method. This means subjects decide on how much to allocate to the safe and risky policy for two potential scenarios: They have to make an allocation decision in case an upswing and in case a downswing occurs during the first term. Hence, Part 2 gives participants the option to react to the outcome of the first term and enables us to measure whether subjects take different allocation decisions depending on a prior outcome. The strategy method in Part 2 ensures that the outcome cannot influence decisions in the following parts since we inform participants about the actual outcomes of the lotteries of the first two parts only at the end of the entire experiment.

The expected return of the high and low risk-reward treatment is always 1 point for each point allocated to the safe policy and 1.16 points for each point allocated to the risky policy. Hence, a risk-neutral subject would allocate all 10 available points to the risky policy. Therefore, the first two parts allow us to elicit how risk-averse and consistent subjects decide in these situations.

Principal-Agent Risk Game

In the third and main part of the experiment, we randomly assign participants to the roles of politicians - incumbent or challenger - and voter. Subjects are assigned to groups of three: one voter, one incumbent, and one challenger. Both politicians must decide how to allocate 10 points between the two policies on behalf of the voter for two consecutive terms. Based on the allocation decisions, the voter decides whether to re-elect the incumbent or to elect the challenger for the second term. Since there is only one voter, the voter is always pivotal, which rules out any potential strategic voting considerations.

Participants in the role of incumbent take an allocation decision on behalf of the voter. The incumbent’s decision is implemented in the first term and, if re-elected, the same decision is implemented in the second term. Participants in the role of the challenger suggest an allocation decision for the second term. The politicians’ payoffs do not depend on the outcome of the lottery but on the decisions of the voters. Depending on whether the incumbent is re-elected or the challenger is elected for the second term, the respective elected politician earns 45 points and the other politician earns none. Hence, politicians have a clear financial incentive to get (re-)elected. Since there is no hidden information in this game, politicians possibly increase their chance to get elected by implementing the voter’s preferred decision. Therefore, we ask politicians which allocation they think the voter would want them to implement. If their expectation is correct, they earn 5 additional points. This provides us with incentivized information about their beliefs about the voter’s preferences.

The voter’s payoff depends on the decisive politician’s allocation decision and the outcome of the lottery in each term. In the first term, the allocation decision of the incumbent is implemented. For the second term, the voter has a choice. After the first term, the voter is informed about the politicians’ decisions and can decide whether to re-elect the incumbent or to elect the challenger for the second term. Additionally, we ask the voters how much they want the politician to allocate between the safe and risky policy before the voter learns about both politicians’ allocation decisions. The election decision allows us to test our first set of hypotheses, H1-V and H1-P. The closer the riskiness of the policy suggested by the incumbent relative to the riskiness of the policy suggested by the challenger is, the higher we expect the probability that the incumbent is re-elected to be. We also expect that politicians adapt to the expected risk preferences of voters in this situation and decide accordingly.

In our 2 × 2 treatment design, we vary the immediacy of the outcome and the risk and reward of the risky policy. In the LT (long-term) treatment, the allocation decision takes effect in the long run, and voters are informed about the outcome of the first term’s lottery only after their voting decision. In the ST (short-term) treatment, the allocation decision takes effect in the short run and voters are informed about the outcome of the first term’s lottery before their voting decision. This implies that in the LT treatment, the voting decision can be affected by the politicians’ allocation decisions but not by the outcome of the first term’s lottery, because it is still unknown. In the ST treatment, the voting decision can be affected by the politicians’ allocation decisions and the outcome of the first term’s lottery. This enables us to test hypotheses H2-V and H2-P. If voters are indeed subject to an outcome bias, the outcome in the ST treatment should then affect the re-election rate of the incumbents accordingly. If politicians anticipate an outcome bias, then they should be less likely to consider the expected risk preferences of voters.

The high and low risk-reward treatments, on the other hand, enable us to infer whether knowing the probability of a positive outcome influences the outcome bias and whether the upswing probability affects the allocation decisions of politicians due to the anticipated outcome bias. The higher downswing probability in the high risk-reward treatment might cause politicians to allocate more to the safe policy and the higher upswing probability in the low risk-reward treatment might cause politicians to allocate more to the risky policy despite the respective higher and lower potential payoffs.

Finally, we can test the third set of hypotheses, H3-V and H3-P, by observing the likelihood of re-electing the incumbent, especially when the two politicians suggest the same policy in the LT treatment. Note that incumbents have no institutional advantage and it is completely clear to the voters which politician supports the riskier policy and, therefore, represents the riskier alternative.

Survey

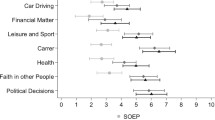

In the final part, participants answer a short questionnaire on socio-economic characteristics (age, gender, income, education, state of residence, immigration background, religion, and experience with experiments), political preferences (left-right scale, interest in politics, trust in politicians, party preferences, preferences over representation), and individual attitudes (risk preferences, positive and negative mindset, responsibility, reciprocity, general trust). Subjects earned 40 points for completing the survey as a participation fee.

Procedures

We conducted the online experiment using the software oTree (Chen et al., 2016). The data was collected via the platform Prolific. We invited subjects from Great Britain who were fluent in English and used a desktop computer or a tablet and excluded subjects using mobile phone devices. Moreover, to exclude potential bots and ensure that all participants properly read and understood the instructions, we included four sets of control questions. Subjects had three tries to answer each set of multiple-choice questions correctly and could re-read the instructions in case they made a mistake. Screenshots of the experiment including the instructions and control questions are attached in the Supplementary Materials.

In sum, our dataset consists of 1059 participants: 507 subjects completed the study between May and June 2021 and 552 completed it in December 2021. They were between 18 and 78 years old, on average 37 years old, and 50.5% were female. Participants took on average 20.5 min for the study and earned £5.30 on average (£2.00–£10.23, 20 points equals 1 Pound). We obtained 116 groups in the ST/high treatment, 115 groups in the ST/low treatment, 61 groups in the LT/high treatment, and 61 groups in the LT/low treatment.

Results

Voters’ Behavior

The 353 individuals assigned the role of voters decide whether to re-elect incumbents for a second term or elect challengers instead. According to H1-V, voters should be more likely to re-elect incumbents the closer their risk preferences match the incumbents’ allocation decisions in comparison to the challengers’ allocation decisions. To test this hypothesis, we calculated the relative distance between the incumbents’ allocation decisions compared to the challengers’ proposal and the voters’ preferences.Footnote 1 The variable can take values between − 10 and 10, with 10 indicating that the incumbent’s decision was 10 points closer to the voter’s preference than the challenger’s suggestion and − 10 indicating that the incumbent was 10 points farther away.

Re-election probability of incumbents according to the relative proximity of the allocation decision to voters’ risk preferences. The dots indicate average re-election probabilities of incumbents, while the line and the grey area indicate predicted probabilities and the 90% confidence interval based on the logistic regression model I in Table 1

Figure 2 displays the average re-election rate of incumbents depending on the relative proximity to the voters. Voters re-elect incumbents in 84.8% of the cases when the incumbents are closer but only in 24.1% of the cases when the challenger is closer. Supporting H1-V, non-parametric tests clearly reject that these proportions are equal to 50% (Proportion test, both p < .01). Apparently, voters elect the politician who wants to implement a policy that is close to their own risk preferences.

When the distance to the preference of the voter is equal for incumbent and challenger, the re-election rate of incumbents is 70.7%. This is also significantly higher than 50% (Proportion test, p < .01). Hence, supporting H3-V, the non-parametric tests suggest that the status of the incumbent provides an advantage in the election. Since incumbents have no institutional advantages and cannot be seen as the safer option in this experiment, we infer that other drivers for the status-quo bias explain this result such as framing, anchoring or inertia.

The second hypothesis, H2-V, stipulates that voters display an outcome bias. This means that, all other things being equal, voters’ propensity to re-elect incumbents should be affected by the payoff they receive in the first term if they are informed about this payoff – although the payoff depends solely on chance. Voters’ payoffs depend on incumbents’ allocation decisions and on whether an upswing or downswing occurs. After an upswing, payoffs are higher the more points incumbents allocated to the risky policy and after a downswing, payoffs are higher the more points incumbents allocated to the safe policy. Hence, according to the hypothesized outcome bias, a larger investment in the risky policy relative to the challenger’s suggested allocation should increase the incumbent’s chances for re-election when an upswing occurs and the voter is informed about the outcome, while in the case of a downswing, the effect should be in the opposite direction and voters should punish incumbents for their risky decisions. However, comparing the payoffs of the first term to the hypothetical payoffs of the challengers’ allocations indicate that the payoffs have no effect on the re-election probability of incumbents (Mann–Whitney test, p > .10).

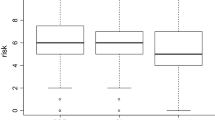

Alternatively, voters might use less demanding heuristics and only take the absolute payoff of the first term into account, which depends on the event. Figure 3 provides an overview of the re-election rate of incumbents across the treatments. If the outcome of the event biases voters, they should be more likely to re-elect incumbents in the short-term treatment after an upswing and be less likely to re-elect incumbents after a downswing in comparison to the long-term treatment in which the outcome of the first term is unknown. We find support for this relationship when the outcome is negative and has been less likely than a positive outcome (low-risk treatment).Footnote 2 In such a case, voters are less likely to re-elect incumbents than after an upswing in the low (Proportion test, p = .03) and high-risk treatment (Proportion test, p = .08), an unknown outcome in the low- (Proportion test, p < .01) and high-risk treatment (proportion tests, p < .01), or a downswing in the high-risk treatment (Proportion test, p = .04). The remaining cases are all insignificantly different from each other, and thus do not support H2-V. A potential interpretation of this finding is that the outcome bias works through an emotional trigger, which is sufficiently strong after an unexpected negative event and is otherwise too weak to affect the decisions in the experiment. An unexpected negative event might also be perceived as a loss, which could imply that loss aversion plays a role in explaining the outcome bias. Moreover, when the outcome is unknown, participants are as likely to re-elect the incumbent as when the outcome is known and positive. This might imply that subjects hold optimistic expectations when they do not know the outcome.

In the following, we discuss the results of logistic regression models. The voter’s decision to re-elect the incumbent or to elect the challenger for the second term is our dependent variable. As independent variables, we control for the treatment variables, the relative proximity of the incumbent’s decision to the risk preferences of the voter (model I), the relative risk associated with the policy suggested by the incumbent and the challenger (model III) and both latter variables (model V). Then, we add the individual-level variables including sociodemographic information, self-reported behavioral attitudes, and political preferences (models II, IV, and VI). Additionally, we perform several robustness checks in which we control for interaction effects and the absolute or relative payoff among the short-term treatments. We report the robustness checks in Table A2-A4 in the Supplementary Materials.

Our main results summarized in Table 1 replicate the results of the non-parametric tests. The relative proximity between the risk the incumbent takes and the preference of the voter has a strong and robust effect on the probability that the incumbent is re-elected across all four models. This supports H1-V. Furthermore, a negative outcome decreases the chance that the incumbent is re-elected. Note, however, that the negative outcome (downswing) has no significantly different effect from the positive outcome (upswing) across any model (each Wald-test, p > .10). Overall, support for H2-V thus remains mixed. Moreover, voters generally show no preference towards politicians who take more or less risk. If the incumbent and the challenger suggest the same level of risk, voters are more likely to vote for the incumbent, which speaks for an incumbency advantage and supports H3-V.

In addition, the robustness checks (Table A2 in the Supplementary Materials) show that the relationship between the relative proximity and the re-election probability of the incumbent is weaker for subjects who believe that the government should stick to its planned policies regardless of what most people think. Also, participants who report to trust politicians more tend to vote more frequently for the incumbent. These results suggest that participants apply their representation preferences to the incentivized delegation game, which speaks to the external validity of the results.

Politicians’ Behavior

We collected data from 353 subjects in the role of incumbents and 353 in the role of challengers. Overall, politicians allocate 4.55 points to the risky policy when they decide in Part 1 for themselves and 4.31 points when they decide in Part 3 for the voters. The difference is statistically significant (paired Wilcoxon-test, p = .01). This means that politicians, whose aim it is to get elected, take a little less risk for others on average than they do for themselves. Incumbents especially take less risks and do so universally across all four treatments (paired Mann–Whitney tests, each p < .05), while challengers take the same level of risk on average (paired Mann–Whitney tests, each p > .10).

Average risk taken by politicians and predicted risk taken based on maximum likelihood estimation in Table 1, model I

In H1-P, we hypothesize that politicians align their decisions to their beliefs about voters’ risk preferences. Indeed, the correlation between politicians’ expectations and their choices is strong and highly significant (corr.: 0.67, p < .01), which supports H1-P. Figure 4 shows the average risk politicians take dependent of their expectation about voters’ preferences. We observe that subjects deviate slightly to the middle of the feasible action set, which can be strategically reasonable if politicians are uncertain about the exact distribution of risk preferences. Interestingly, politicians expect voters to prefer them to take less risks than the politicians have taken for themselves (Wilcoxon-test, p < .01), which explains why incumbents take less risks as delegates than they take for themselves. This is a misperception, however, because voters do not take different levels of risk than politicians in Part 1 (Mann–Whitney-test, p > .10), nor do voters prefer their representatives to take a different level of risk as the voters or politicians have taken for themselves (Mann–Whitney-test, both p > .10).

According to H2-P, politicians should be more likely to deviate from the expected risk preferences of voters, if voters will learn the outcome of the first term. On average politicians deviate by 1.15 points from their expectations. In the ST treatment in which the outcome is known, politicians deviate 0.20 points further from the expected preferences than in the LT treatment in which the outcome of the first term is unknown (Mann–Whitney-test, p = .08). The preferences politicians expect voters to have, do not differ between the two treatments (Mann–Whitney-test, p > .10) nor between incumbents and challengers (Mann–Whitney-test, p > .10). Hence, there is weak evidence supporting H2-P.

The third hypothesis, H3-P, stipulates that challengers are more likely to deviate from the expected preferences than incumbents if they anticipate an incumbency advantage. In fact, challengers deviate significantly further from their expectations than incumbents do (Mann–Whitney-test, p < .01) and also more frequently (Proportion test, p < .01). This result is robust across all four treatments (Mann–Whitney-tests, each p < .01). Furthermore, the result is not caused by differences in expectations, own risk preferences, or risk taking: On average, challengers have similar risk preferences (Mann–Whitney-test, p > .10) and take a similar level of risk as incumbents (Mann–Whitney-test, p > .10). Since challengers are more likely to deviate from their expected preferences, they are more likely than incumbents to implement the level of risk they have taken for themselves.

Overall, it appears the level of risk politicians take depends on their beliefs about voters’ preferences, their own position, and, to a lesser extent, whether voters will learn the outcome. It is noteworthy, however, that the decisions politicians take on behalf of voters also correlate with the decisions they take for themselves (Pearson corr.: 0.54, p < .01) and that their own risk preferences correlate with the expectations they have over the preferences of voters (Pearson corr.: 0.49, p < .01). Hence, to disentangle the relationship between preferences, expectations, treatments, positions, and decisions further, we estimate maximum likelihood regression models. Table 2 shows the maximum likelihood estimations which explain the choices of politicians as a function of all these variables as well as the individual background variables.

Our results suggest the decisions of the politicians are mainly driven by their expectations regarding the voters’ preferences and their own preferences. The influence of expectations is significantly stronger than the influence of their own preferences (Wald test, each p < .01). Although the expectations do not offset the influence of the own preferences completely, the evidence clearly supports H1-P, stating that the choices of politicians align with their expectations about voters’ preferences. However, rejecting H2-P, the results do not indicate politicians deviate stronger from their expectations when the outcome of the first term will be shown to the voters. The regression models support H3-P, showing that challengers systematically deviate from their expectations. Basically, challengers risk significantly more when they expect the median voter to be risk-averse and react significantly less to the expected risk preferences when they expect voters to be more risk-affine. Additionally, we find that subjects who report to be more risk-seeking, who place themselves further to the right on a political left-right scale and who claim to be more interested in politics allocate more points to the risky policy (see Table A5 in the Supplementary Materials).

Conclusion

In this study, we examine the role of risk preferences, outcome bias, and incumbency advantage in the political delegation process. The online experiment breaks the complex relationship between these factors down into a few observable variables and allows us to determine causal relationships. Overall, our results clearly suggest that people prefer representatives who take decisions that align with their own risk preferences. Furthermore, our study suggests that when subjects are fully aware that the outcome of the decision is subject to chance, they exhibit an outcome bias only in specific cases. Finally, we find that incumbents have an advantage over challengers even when we control for institutional advantages. All three main results are apparent when we analyze voting behavior as well as when we examine the decisions of politicians who must anticipate voters’ behavior to get elected.

Taken together, our findings imply that if voters and representatives are aware of the uncertainty inherent to political decisions, risk preferences and risk-taking matter in the political delegation process. Is it generally advisable for politicians to support risky or safe policies? We find that representatives maximize their chance to get elected by responding to voters’ individual risk preferences. This can be positive because representatives cannot ignore voter’s risk preferences but this can also be negative if voter’s risk perceptions are biased. Previous literature suggests that whether public problems are seen as risky or not is ideologically driven. From the perspective of a representative, it is reasonable to decide how much risk to take when implementing policies based on the electorate and subject at hand. Our results demonstrate as well how different the risk preferences of voters are even when the riskiness of the implemented policy is salient, objective, assessable, and clearly communicated.

It is striking that voters strongly prefer politicians that are responsive to their risk preferences, as voters could have also preferred trustees. Even if voters value politicians who match a certain level of risk, it is not obvious whether the risks subjects take for themselves match the risks they prefer politicians to take on behalf of them. Furthermore, when people assess risks, the outcome potentially distorts the perceived risk of the policies in hindsight. Previous evidence suggests, for example, that outcomes can critically bias the quality attributed to politicians (Woon, 2012). In this study, in which voters have complete information and we can exclude any reason to differentiate based on the performance of representatives, previous outcomes play a relatively minor role for the re-election of incumbents. This suggests that the outcome bias is likely driven by the misattribution of responsibilities. The emotional effect of a positive or negative outcome appears to have a comparably weaker effect on voting decisions. Since the outcome bias is strongest after an unlikely negative outcome, the results may indicate that loss aversion plays a role in explaining the part of the outcome bias that is triggered by emotions.

Finally, our results offer further evidence for the frequently observed advantage of incumbents in elections (de la Cuesta & Imai, 2016). Since we can control for any institutional advantage of the incumbent, for any qualitative differences and for uncertainty regarding the challenger, the only explanations left for the incumbency advantage is the status-quo bias. At least with this restricted set of information about the candidates (Brown, 2014), incumbents do seem to have an advantage even without institutional advantages. We also find that challengers adapt their behavior to the incumbency advantage by reacting less to their expectations about the voters’ preferences. Instead challengers are more influenced by their own preferences and strategically shift to the center of the policy space.

In sum, our study provides novel and internally valid evidence to improve our understanding of the role of risk in the delegation process. Naturally, however, any methodology comes with advantages and disadvantages. As such, an online experiment usually comes with certain reservations about the external validity of the results. Our participants are randomly drawn from a survey sample and we have not been merely asking the subjects whether they care about the level of risk when policies are implemented but they take decisions that have actual financial consequences. Thus, we analyze real and not hypothetical decisions. Nevertheless, these decisions are taken in a much simpler context than in other environments, focusing on risk preferences while leaving other policy dimensions aside. This simple context allows us to isolate the effect of risk preferences in delegated decisions and shows that, in principle, subjects evaluate the risks implemented by politicians. We regard this simplification as a strength of our design because we can focus on a specific factor which would otherwise have been difficult to isolate with observational data. Simultaneously, we are aware that real politics outside this experimental environment are far from being that simple.

Therefore, to strengthen external validity, future studies could gradually increase the complexity of the situation, e.g. by increasing the number of voters, by enabling individuals to select into the role of a politician, or by adding and varying the policy context. Thereby, researchers could examine to what extent ideological preferences and risk preferences are interconnected and what role risk preferences play when compared to risk perceptions and expected policy gains. Furthermore, to assess the scope of our findings, future studies could compare the influence of risk preferences and the inclination of representatives to take risks across different electoral contexts. For instance, the importance of voters’ and politicians’ risk preferences might increase when the uncertainty of policy outcomes is more salient, candidates’ personalities are more strongly framed in terms of risk-affinity or risk-aversion, or the electoral system is more personalized.

Data Availability

The data files are available at: https://doi.org/10.23663/x2692

Notes

We use the voter’s preferences as specified by the voter in part 3 of the experiment. The results remain robust if we take the risk preferences as elicited in part 1 or part 2 after an up- or downswing, respectively. The decisions in part 1 and 2 are not significantly different from the preferences in part 3 (paired Mann-Whitney tests, each p > .10). For more information, see Tables A6-A9 in the Supplementary Materials.

Please note that these differences are statistically significant despite the overlapping confidence intervals of the mean re-election rates in Fig. 3.

References

Achen, C., & Bartels, L. (2017). Blind retrospection: Electoral responses to droughts, Floods, and Shark Attacks. Democracy for realists. Princeton University Press.

Aimone, J., & Pan, X. (2020). Blameable and imperfect: A study of risk-taking and accountability. Journal of Economic Behavior & Organization, 172, 196–216.

Bagues, M., & Esteve-Volart, B. (2016). Politicians’ luck of the draw: Evidence from the Spanish Christmas lottery. Journal of Political Economy,124(5), 1269–1294.

Baron, J., & Hershey, J. (1988). Outcome Bias in decision evaluation. Journal of Personality and Social Psychology, 54(4), 569–579.

Batteux, E., Ferguson, E., & Tunney, R. (2019). Do our risk preferences change when we make decisions for others? A Meta-analysis of self-other differences in decisions involving risk. PLoS ONE, 14(5), e0216566.

Bowler, S. (2017). Trustees, delegates, and responsiveness in comparative perspective. Comparative Political Studies,50(6), 766–793.

Brandt, M., Turner-Zwinkels, F., Karapirinler, B., Van Leeuwen, F., Bender, M., van Osch, Y., & Adams, B. (2021). The Association between threat and politics depends on the type of threat, the political domain, and the Country. Personality and Social Psychology Bulletin,47(2), 324–343.

Brown, A. (2014). Voters don’t care much about incumbency. Journal of Experimental Political Science,1(2), 132–143.

Busby, E., Druckman, J., & Fredendall, A. (2017). The political relevance of irrelevant events. The Journal of Politics, 79(1), 346–350.

Carman, C. (2007). Assessing preferences for political representation in the US. Journal of Elections Public Opinion & Parties, 17(1), 1–19.

Chen, D., Schonger, M., & Wickens, C. (2016). oTree—An Open-source platform for Laboratory, Online, and Field experiments. Journal of Behavioral and Experimental Finance, 9, 88–97.

Choma, B., Hanoch, Y., Gummerum, M., & Hodson, G. (2013). Relations between risk perceptions and Socio-political ideology are domain- and ideology- dependent. Personality and Individual Differences, 54(1), 29–34.

Daruvala, D. (2007). Gender, risk and stereotypes. Journal of Risk and Uncertainty,35(3), 265–283.

de la Cuesta, B., & Imai, K. (2016). Misunderstandings about the regression discontinuity design in the study of Close elections. Annual Review of Political Science,19(1), 375–396.

Eadeh, F., & Chang, K. (2020). Can threat increase support for Liberalism? New insights into the relationship between threat and political attitudes. Social Psychological and Personality Science, 11(1), 88–96.

Eckles, D., & Schaffner, B. (2011). Risk tolerance and support for potential military interventions. Public Opinion Quarterly, 75(3), 533–544.

Eckles, D., Kam, C., Maestas, C., & Schaffner, B. (2014). Risk attitudes and the incumbency advantage. Political Behavior,36, 731–749.

Eggers, A. (2017). Quality-based explanations of Incumbency effects. The Journal of Politics,79(4), 1315–1328.

Ehrlich, S., & Maestas, C. (2010). Risk orientation, risk exposure, and policy opinions: The case of Free Trade. Political Psychology, 31(5), 657–684.

Fiagbenu, M., & Kessler, T. (2022). Fear and loathing of wall street: Political liberalism, uncertainty, and threat management in a dangerous economic world. Political Psychology,43(6), 1101–1121.

Fowler, A., & Hall, A. (2018). Do Shark Attacks Influence Presidential elections? Reassessing a Prominent Finding on Voter competence. The Journal of Politics, 80(4), 1423–1437.

Fowler, A., & Montagnes, B. (2015). College football, elections, and false-positive results in observational research. Proceedings of the National Academy of Sciences,112(45), 13800–13804.

Giddens, A. (1999). Risk and responsibility. The Modern Law Review, 62(1), 1–10.

Gneezy, U., & Potters, J. (1997). An experiment on risk taking and evaluation periods. The Quarterly Journal of Economics,112(2), 631–645.

Gründl, J., & Aichholzer, J. (2020). Support for the populist radical right: Between uncertainty avoidance and risky choice. Political Psychology, 41(4), 641–659.

Healy, A., & Malhotra, N. (2010). Random events, economic losses, and retrospective Voting: Implications for democratic competence. Quarterly Journal of Political Science,5(2), 193–208.

Henderson, A., Jeffery, C., Wincott, D., Jones, W., & R,. (2017). How Brexit was made in England. The British Journal of Politics and International Relations, 19(4), 631–646.

Hobolt, S. (2009). Europe in question: Referendums on European integration. Oxford University Press.

Huber, G., Hill, S., & Lenz, G. (2012). Sources of bias in retrospective decision making: Experimental evidence on voters’ limitations in controlling incumbents. The American Political Science Review,106(4), 720–741.

Jost, J., Glaser, J., Kruglanski, A., & Sulloway, J. (2003). Exceptions that prove the rule—Using a theory of motivated social cognition to account for ideological incongruities and political anomalies: Reply to Greenberg and Jonas (2003). Psychological Bulletin,129, 383–393.

Jost, J., Stern, C., Rule, N., & Sterling, J. (2017). The politics of fear: Is there an ideological asymmetry in existential motivation? Social Cognition, 35(4), 324–353.

Kam, C., & Simas, E. (2012). Risk attitudes, candidate characteristics, and vote choice. The Public Opinion Quarterly,76(4), 747–760.

König-Kersting, C., Pollmann, M., Potters, J., & Trautmann, S. (2021). Good decision vs. good results: Outcome bias in the evaluation of financial agents. Theory and Decision, 90(1), 31–61.

Kratz, A. (2021). Der Einfluss der Risikotoleranz auf die Beurteilung von Politikvorschlägen. Inauguraldissertation, Universität Mannheim.

Kroska, A., Schmidt, M., & Schleifer, C. (2019). Political ideology and concerns about White-Collar Crime: Exploring the switch hypothesis. Social Science Quarterly, 100(5), 1685–1698.

Liberini, F., Redoano, M., & Proto, E. (2017). Happy voters. Journal of Public Economics,146, 41–57.

Linde, J., & Vis, B. (2017). Do politicians take risks like the rest of us? An experimental test of prospect theory under MPs. Political Psychology, 38(1), 101–117.

Liñeira, R., & Henderson, A. (2021). Risk attitudes and independence vote choice. Political Behavior,43(2), 541–560.

Martin, D. (2022). Risk attitudes and the propensity to vote for a new party in multi-party systems. Acta Politica,57(1), 1–20.

Mathijssen, J., Petersen, A., Besseling, P., Rahman, A., & Don, H. (2008). Dealing with uncertainty in policymaking. CPB/PBL/Rand Europe.

Milita, K., Bunch, J., & Yeganeh, S. (2020). It could happen to you: How perceptions of personal risk shape support for social welfare policy in the American States. Journal of Public Policy,40(4), 535–552.

Morgenstern, S., & Zechmeister, E. (2001). Better the devil you know than the saint you don’t? Risk propensity and vote choice in Mexico. The Journal of Politics,63(1), 93–119.

Morisi, D. (2018). Choosing the risky option: Information and risk propensity in referendum campaigns. Public Opinion Quarterly,82(3), 447–469.

Morisi, D., Colombo, C., & De Angelis, A. (2021). Who is afraid of a change? Ideological differences in support for the status quo in direct democracy. Journal of Elections Public Opinion and Parties,31(3), 309–328.

Morisi, D., Jost, J., Panagopoulos, C., & Valtonen, J. (2022). Is there an ideological asymmetry in the Incumbency Effect? Evidence from U.S. Congressional elections. Social Psychological and Personality Science, 13(6), 1069–1079.

Müller, S., & Kneafsey, L. (2023). Evidence for the irrelevance of irrelevant events. Political Science Research and Methods, 11(2), 311–327.

Nadeau, R., Martin, P., & Blais, A. (1999). Attitude towards risk-taking and individual choice in the Quebec referendum on Sovereignty. British Journal of Political Science,29(3), 523–539.

Polites, G., & Karahanna, E. (2012). Shackled to the Status Quo: The Inhibiting effects of incumbent system habit, switching costs, and inertia on new system acceptance. MIS Quarterly, 36(1), 21–42.

Pollmann, M., Potters, J., & Trautmann, S. (2014). Risk taking by agents: The role of ex-ante and ex-post accountability. Economics Letters,123(3), 387–390.

Polman, E., & Wu, K. (2020). Decision making for others involving risk: A review and meta-analysis. Journal of Economic Psychology,72(2020), 102184.

Roese, N., & Vohs, K. (2012). Hindsight Bias. Perspectives on Psychological Science, 7(5), 411–426.

Samuelson, W., & Zeckhauser, R. (1988). Status quo bias in decision making. Journal of Risk and Uncertainty,1(1), 7–59.

Sheffer, L., & Loewen, P. (2019). Accountability, framing effects, and risk-seeking by elected representatives: An experimental study with American local politicians. Political Research Quarterly,72(1), 49–62.

Steenbergen, M., & Siczek, T. (2017). Better the devil you know? Risk-taking, globalization and populism in Great Britain. European Union Politics,18(1), 119–136.

Verge, T., Guinjoan, M., & Rodon, T. (2015). Risk aversion, gender, and constitutional change. Politics & Gender,11(03), 499–521.

Woon, J. (2012). Democratic accountability and retrospective voting: A laboratory experiment. American Journal of Political Science,56(4), 913–930.

Acknowledgements

We would like to thank Marc Debus for his invaluable support enabling us to work on this project and various colleagues, especially Fabian Kalleitner and Michael Jankowski, for their helpful comments on previous versions of the article. We are also grateful for the suggestions and feedback of the conference attendees of the ECPR 2021, AKHET 2021, TU Clausthal workshop 2022 and EPSA 2022.

Funding

Open Access funding was enabled and organized by Projekt DEAL. Funding for the survey data collection was provided by the Mannheim Centre for European Social Research (MZES) and the Carl Ossietzky University of Oldenburg.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical Approval

This study was approved by the German Association for Experimental Economic Research e.V. (No. jeeMHER2).

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary Information

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Schwaninger, M.C., Mühlböck, M. & Sauermann, J. Risk Preferences in the Delegation Process. Polit Behav (2023). https://doi.org/10.1007/s11109-023-09908-4

Accepted:

Published:

DOI: https://doi.org/10.1007/s11109-023-09908-4