Abstract

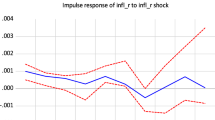

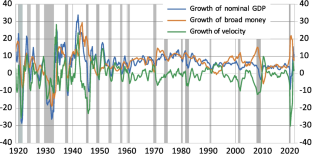

Leading central banks did not anticipate the surge in inflation in 2021 and 2022. In our paper we assess whether changes in the velocity of money and monetary growth (broadly defined) explain long term inflation patterns in the US. We use a hundred-year sample to study the long term and the cyclical behaviour of money velocity. We find that changes in the velocity of money are short lived and revert to its mean. We also characterise the periods where changes in money velocity have kept closer to its mean as those of monetary equilibrium. We use a regime switching model to test for the impact of changes in the amount of money (broadly defined) and in money velocity in inflation over the medium and long term. Our model explains both the non-inflationary outcome of the Global Financial Crisis and the surge in inflation in the aftermath of the Covid-19 pandemic.

Similar content being viewed by others

Data Availability

Data used and sources detailed in footnote 2.

Notes

The relationship between money growth, inflation and money velocity has been modelled for the period 1948–2021 due to the availability of comparable data series since 1948. In Sect. 3 we cover a broader time period, from 1919 to 2021, as it is available for money growth and nominal GDP (on the contrary, for CPI inflation we have data since 1948).

By broad money, we mean a monetary aggregate that includes not just cash in circulation but the majority of bank deposits in the US. In this regard, we have made use of the monetary aggregate M3 calculated by Shadow Government Statistics (http://www.shadowstats.com), for 2006-2021, following the same method and data which the US Federal Reserve used to publish M3 (1959-2006), and broad money from Gordon (1986) for 1919-1958. For nominal GDP: Gross Domestic Product, Billions of Dollars, Quarterly (https://fred.stlouisfed.org) after 1959 and Gordon (1986) for 1919-1958.

We include an intercept in the test coherently with the non-zero value of the mean growth of the velocity, \(\mu_{v}\), and select automatically the number of lags of the test by means of a Schwarz information criterion.

Consumer Price Index for All Urban Consumers: All Items in U.S. City Average, seasonally adjusted (https://fred.stlouisfed.org).

We refer to the spectral gain of the filter \(1 - L^{4}\), which is applied when calculating the annual rate of a time series. The spectral gain measures the increase in amplitude of any specific frequency component of a time series. For the filter \(1 - L^{4}\), the spectral gain in the frequency domain is \(2(1 - \cos 4\omega )\) with \(\omega\) a frequency component. This filter eliminates the trend and seasonal variation components, letting the remaining components pass. Within them, above the year, the fluctuations with a period between 5.3 quarters and 16 quarters have a greater weight (i. e. a normalized gain greater than 0.5).

References

Anderson RG, Bordo M, Duca JV (2017) Money and Velocity during Financial Crises: From the Great Depression to the Great Recession. J Econ Dyn Control 81(August):32–49

Benati L (2009) Long run evidence of money growth and inflation. Working Paper series, No. 1027. European Central Bank

Benati L (2020) Money velocity and the natural rate of interest. J Monet Econ 116:117–134

Benati L, Lucas R, Nicolini JP, Weber W (2019) International Evidence on Long-Run Money Demand. Staff report 587. Federal Reserve Bank of Minneapolis

Borio C, Hofmann B, Zakrajšek E (2023) Does money growth help explain the recent inflation surge? BIS bulletin 67. January 2023. Accessed online

Castañeda J, Congdon T (2020) Inflation, the next threat? Covid Briefing Paper 7. June. Institute of Economic Affairs

Clarida R (2020) U.S. Economic Outlook and Monetary Policy. Speech at the New York Association for Business Economics. New York (via webcast). May 21st 2020

Congdon T (2021) Can monetary policy run out of ammunition? The role of the money-equities-interaction channel in monetary policy. In Economic Affairs. Vol. 41, 1. February 21–37

De Grauwe P, Polan M (2005) Is Inflation Always and Everywhere a Monetary Phenomenon? Scandinavian Journal of Economics 107(2):239–259

De Santis R (2012) Quantity theory is alive. The role of international portfolio shifts. Working Paper series, 1435. European Central Bank

Dery C, Serletis A (2023) Macroeconomic Fluctuations in the United States: The Role of Monetary and Fiscal Policy Shocks. Open Economies Review. February

European Central Bank (2022) Overview of monetary policy strategy. European Central Bank, 2022. Available online: https://www.ecb.europa.eu/home/search/review/html/ecb.strategyreview_monpol_strategy_overview.en.html

Federal Reserve Board of Governors 2020 (2020) Statement on Longer-Run Goals and Monetary Policy Strategy. Press release. August 27th 2020

Friedman M (1956) Studies in the Quantity Theory of Money. University of Chicago Press, Chicago

Gao H, Kulish M, Nicolini JP (2020) Two illustrations of the quantity theory of money reloaded. Working Paper 774. Federal Reserve Bank of Minneapolis

Gordon RJ (ed) (1986) The American Business Cycle. University of Chicago Press, for the National Bureau of Economic Research, Chicago, pp 803–806

Greenwood J, Hanke S (2022) On monetary growth and inflation in leading economies, 2021–22: Relative prices and the overall price level. In Economic Affairs July 42(2):288–306

Haas J, Neely C, Emmons W (2020) Responses of International Central Banks to the Covid-19 Crisis. Federal Reserve Bank of St. Louis Working Review, 102(4):October

Hall S, Swamy P, Tavlas G (2012) Milton Friedman, the demand for money and the ECB monetary policy strategy. Federal Reserve Bank of St. Louis Review. May-June, 153–185

Hamilton JD (1989) A New Approach to the Economic Analysis of Nonstationary Time Series and the Business Cycle. Econometrica 57(2):357–384

Hanke S, Ma Z, Cheng R (2022) On the Quantity Theory of Money: some monetary facts. Studies in Applied Economics, Num. 224, December. Johns Hopkins Institute for Applied Economics, Global Health, and the Study of Business Enterprise

Kim CJ, Nelson CR (1999) State-Space Models with Regime Switching. The MIT Press, Cambridge

King M (2021) Monetary Policy in a World of Radical Uncertainty. IIMR Public Lecture, November 2021. Accessed online

Lucas R (1980) Two illustrations of the quantity theory of money. Am Econ Rev 70(5):1005–1014

Lucas R (1996) Nobel lecture: monetary neutrality. J Polit Econ 104(4):661–682

Milas C (2009) Does high M4 money growth trigger large increases in UK inflation? Evidence from a regime-switching model. Oxford Econ Pap 6(1):168–182

Nelson E (2008) Why money growth determines inflation in the long run: answering the Woodford critique. Working Paper 13. Federal Reserve Bank of St. Louis

Papadia F, Cadamuro L (2021) Does money growth tell us anything about inflation?. Working Paper 11. Bruegel

Powell J (2021a) Semi-annual Monetary Policy Report to US Congress. February 23rd. Accessed online

Powell J (2021b) House Financial Services Committee. December 1st. Accessed online

Reynard S (2023) Central bank balance sheet, money and inflation. Econ Lett 224. March. Accessed online

Schnabel I (2020) The ECB’s monetary policy during the coronavirus crisis – necessary, suitable and proportionate. Berlin Economic Roundtable. 2nd July 2020. Accessed online

Teles P, Uhlig H (2013). Is quantity theory still alive? Working Paper 1605. European Central Bank

Acknowledgements

We want to thank Guillermo Sagnier for his excellent research assistance. Financial support of Universidad Francisco de Vitoria to this research is also acknowledged. We thank the referees for their comments, as well those from the attendees and fellow contributors to the ‘2022 Institute of International Monetary Research Conference’—where an earlier version of the paper was presented.

Funding

Universidad Francisco de Vitoria.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Castañeda, J.E., Cendejas, J.L. Money Growth, Money Velocity and Inflation in the US, 1948–2021. Open Econ Rev (2023). https://doi.org/10.1007/s11079-023-09739-0

Accepted:

Published:

DOI: https://doi.org/10.1007/s11079-023-09739-0