Abstract

The existing empirical literature on export promotion policies is almost exclusively focused on their effects for domestic exporters. This paper contributes to this research by empirically examining the effects of export incentives for third-country exports. Using novel CEPR Global Trade Alert data, the study investigates the impact of Brazilian, Indian and Chinese export incentives on exports of OECD and emerging countries. The findings confirm the existence of negative third-country effects of export incentives and demonstrate that these effects are expectedly larger for foreign exporters who exhibit higher similarity in geography of export with subsidized exporters. These results further point to the importance of destination diversification in export strategies. Following strategic trade theory, the study further examines the moderating effect of industries` proclivity to imperfect competition for third-country effects of export incentives. Whereas Chinese export incentives, as predicted by strategic trade theory, cause largest negative effects in industries with higher proclivity to imperfect competition, Brazilian and Indian export incentives, contrarily, cause larger negative third-country effects in industries with lower proclivity to imperfect competition.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

A growing body of work highlights the importance of geo-economic competition in contemporary world (see, e.g., O'Loughlin and Anselin 1996; Smith 2002; Carmody and Owusu 2007; Lee et al. 2018). Increased competition for trade shares prompt countries to utilize economic tools of geo-economic competition such as formation of trade blocks, trade agreements and often concealed subsidization of exports to achieve strategic goals (Luttwak 1990; O'Loughlin and Anselin 1996). Though there is ample empirical research on trade blocks and trade agreements and their effects for both participating and third/untargeted countries (see, e.g., Dunford and Smith 2000; Baier and Bergstrand 2007; Limão 2007; Conconi et al. 2018; Rodrik 2018; Camagni et al. 2020; Jung 2022), the empirical literature on export promotion/subsidization is more limited and almost exclusively focused on the effects of export promotion policies for domestic producers (see, e.g., Bohman et al. 1991; Tanaka 1991; Arslan and Van Wijnbergen 1993; Kikuchi 1998; Chen et al. 2006; Desai and Hines 2008; Zia 2008; Girma et al. 2009; Tong et al. 2019). However, a major policy question concerns the role of export promotion policies in geo-economic rivalry (see, e.g., Hirono 2019; Hoekman and Nelson 2020). Though it is widely accepted that export promotion policies hurt rival foreign exporters, the supporting empirical evidence is lacking. To the best of our knowledge, this study provides one of the first large-scale conventional empirical evidence on the export incentives` effects for third countries`/rival exporters.

There is a good number of theoretical studies that show that under certain conditions export promotion policies can benefit home countries` exporters though hurting third countries` exporters. In their seminal paper Brander and Spencer (1985) present the strategic trade analysis based on imperfect competition (particularly oligopoly) to explain why export subsidies might be attractive policies from a domestic point of view. They come to a general conclusion that in markets with imperfect competition export subsidies can benefit implemented countries and harm affected (rival) foreign countries because they help subsidized domestic firms to capture market shares of foreign rival firms in international markets. Though Brander-Spencer analysis was criticized for being sensitive to various assumptions (see Krugman (1986) for further discussion), the general intuition of the model is widely accepted and was further developed in a number of studies including Eaton and Grossman (1986, 1988) and others reviewed in Brander (1995) and Spencer and Brander (2008).

At present, direct and indirect export incentives are widespread in the world economy. Indeed, even though WTO prohibits most subsidies directly linked to the volume of exports (WTO Agreement on Subsidies and Countervailing Measures that entered into force in 1995; exception is made for low-income countries), many countries, including middle- and high-income, continue to use export subsidy type incentives as important part of their trade policy (see, for example, Etro (2011) for relevant discussion). According to the Global Trade Alert database, in the period from November 2008 to December 2019, the total number of new export incentives (harmful for third countries) implemented in the World has equaled to 2410.

This study utilizes the novel Global Trade Alert (GTA) database, a recent CEPR initiative that provides the most comprehensive coverage of all types of trade-discriminatory and trade liberalizing measures according to International Monetary Fund note in 2016, to empirically test the effects of export incentives implemented in Brazil, India and China (BIC) in 2009–2018 for exports (disaggregated at six-digit industry level) of OECD and large emerging economies (the list of countries is presented in Appendix A). To count for endogeneity of export incentives, we use the plausibly exogenous instruments` framework (developed by Conley et al. 2012) for estimations.

BIC as source countries of export incentives are very suitable for this project, particularly, due to their rather aggressive export promotion policies in recent years and significant role in the world trade. In Global Trade Alert (GTA) report of CEPR authored by Evenett and Fritz (2015), it has been shown that since the Global Crisis began three of the BRICSFootnote 1—Brazil, India, and China (BIC)—have introduced a large number of additional incentives to inflate exports. Evenett and Fritz (2015, p. 7) note that: “These incentives harm the interests of trading partners that compete in the same markets abroad, boosting the market shares of goods shipped by these three BRICS”. Using detailed product and bilateral trade data, Evenett and Fritz further show that for some countries the percentage of exports harmed by BRICS (particularly BIC) export incentives can be significant.

The results demonstrate that negative effects of export incentives for rival countries` exporters tend to arise particularly in rival countries that exhibit high similarity in geography of export destinations with a country-source of export incentives. Accordingly, the study adds to the debate on geographical diversification of export (the geographical extensive margin of trade) and its role in enhancing trade, particularly in developing countries (see, e.g., Shepherd 2010; Nicita and Rollo 2015; Xuefeng and Yaşar 2016). Indeed, previous studies suggest that growth at the geographical extensive margin is an important mechanism through which developing countries can become more integrated in the world trading system (see, e.g., Evenett and Venables 2002; Brenton and Newfarmer 2007; Shepherd 2010). According to our results and taken into consideration the construction of our index that measures similarity in geography of export destinations, countries that have higher geographical export diversification will tend to have lower similarity in geography of export destinations with their potential export rivals and, hence, will be more immune to their harmful export promotion policies.

Our study also yields insights on the moderating role of industries` proclivity to imperfect competition for third-country effects of export incentives. On one hand, according to strategic trade theory, the imperfect competition (particularly, oligopoly) itself, in contrast with perfect competition, is a condition for the third-country negative effects of export incentives. On the other hand, large oligopolistic firms can be more prepared to intensified competition in international markets compared to smaller firms of perfectly competitive industries. In our empirical test the strategic trade theory prediction has been confirmed only for Chinese export incentives. Brazilian and Indian export incentives, contrarily, caused larger negative third-country effects in industries with lower proclivity to imperfect competition. The plausible explanation appears to lie in the differences in competitiveness between Chinese, on one hand, and Brazilian and Indian companies, on the other. On average, Chinese companies are significantly larger and more competitive compared to their Brazilian and Indian counterparts, and, hence, strategic export policy of China is more likely to be successful when considered against developed countries (that largely constitute our sample of third countries).

The paper is organized as follows. In the next section we briefly discuss Global Trade Alert data on BIC export incentives. Section 3 presents empirical framework while Sect. 4 delivers results. Finally, Sect. 5 offers conclusions.

2 Export Incentives in Brazil, India, and China

In this section, we briefly overview the data on recent BIC`s export incentives used in empirical analysis of this study (their summary is also provided in Online Appendix). We should note that we focus on these three large emerging markets due to their exceptional role in global trade/export and the highest intensity of export promotion policies in the world economy in the studied period (see Evenett and Fritz 2015). The data comes from Global Trade Alert (GTA) database of CEPR. This database includes trade measures implemented from November 2008 to present. On Figs. 1, 2, 3 we visualize timing and sectoral coverage of BIC export incentivesFootnote 2 for the period of 2008 – 2018.

Timing and sectoral coverage of Brazilian export incentives in 2008–2018. Source: GTA database. Note: Each square represents one export incentive. Starting and ending dates determine the square`s width. Sectoral coverage determines the height. The number of affected 3-digit industries was computed considering 43 affected countries in the study

Timing and sectoral coverage of Indian export incentives in 2008–2018. Source: GTA database. Note: Each square represents one export incentive. Starting and ending dates determine the square`s width. Sectoral coverage determines the height. The number of affected 3-digit industries was computed considering 43 affected countries in the study

Timing and sectoral coverage of Chinese export incentives in 2008–2018. Source: GTA database. Note: Each square represents one export incentive. Starting and ending dates determine the square`s width. Sectoral coverage determines the height. The number of affected 3-digit industries was computed considering 43 affected countries in the study

First, we can observe that Brazil and China have implemented significantly fewer export incentives than India (11 and 20 incentives in Brazil and China, respectively, versus 131 in India). This observation has several explanations. First, we can notice from the Figure and Online Appendix that India has implemented numerous small-scale measures, which affect few sectors and countries (often one sector and/or one country) and are not long-lasting. On the other hand, though Brazil and China have implemented much fewer measures, most of them have rather large scale, i.e. affect multiple sectors and countries and last over long periods. Second, both Brazil and China are members of World Trade Organization (from 1995 and 2001, respectively) and WTO prohibits most subsidies directly linked to the volume of exports (WTO Agreement on Subsidies and Countervailing Measures). On the other hand, India, though also a member of WTO from 1995, like other low-income countries, has been exempted from the WTO prohibition of export subsidies.

The other particularity is that most Chinese export incentives have been implemented in the beginning of the studied period and all lasted until its end (all incentives have “open ended” removal date). Due to global financial crisis, Chinese export started to decline in 2008. As China pursues export-led growth model, Chinese government activated its export promotion policies in 2008–2009 to overcome negative consequences of the global crisis for export and did not roll them back.

By contrast, Brazilian government intensified its export promotion policies in 2013–2015. In 2010, Brazilian GDP growth was 7.5%. By 2014, it has dropped to 0.5%. One of the key drivers of this decline has been a decrease in Brazilian export. To revive Brazilian economy, its then-president and government have prepared a new export promotion plan (STRATFOR 2015).

Sectoral priorities of BIC export incentives are rather similar. Machinery, chemicals and iron and steel products dominate export promotion policies in all three BIC. However, there are also some unique promoted sectors that to some extent reflect comparative advantage of each BIC country. Finally, tax-based export incentives (versus export subsidies and other types of trade finance) dominate in all three countries (see Online Appendix for details).

3 Data and Method

3.1 Baseline Framework

To estimate third-country effects of BIC export incentives we utilize the following empirical specification:

where \({EXP}_{cit}\) is country c (1, …, 43) export in USD in six-digit industry i (HS6 2007) in year t (2009, …, 2018). Countries c include 43 countries (OECD countries and emerging markets listed in Appendix A), which are major players in the global trade. Data on export comes from UN COMTRADE.

In the specification we include one explanatory variable, two moderating variables and their interaction terms of all levels. The explanatory variable, denoted by \(\mathrm{E}{{\mathrm{I}}_{\mathrm{Y}}}_{\mathrm{cit}}\), is the number of export incentives implemented in six-digit HS industry iFootnote 3 in country Y (hereafter Y represents Brazil (BR), India (IN) or China (CH)) which have been in force in a year t (2009,…, 2018) and have affected country c. For example, if in Brazil three export incentives, which included industry i = 020,110 (meat; of bovine animals, carcasses and half-carcasses, fresh or chilled) as affected product and USA as affected country, were in force in the year of 2010, the observation of \(\mathrm{E}{{\mathrm{I}}_{\mathrm{BR}}}_{\mathrm{cit}}\) for t = 2010, i = 020,110 and c = USA equals to 3. If a measure was in force in a year t less than one year, we used the following formula: z/365(6) where z is the number of days the measure was in force in a year t. If in the above example, first measure was in force for 90 days in 2010, second – for 180 days and third – for 330 days, then the respective observation would equal to 90/365 + 180/365 + 330/365 = 0.25 + 0.5 + 0.9 = 1.65 instead of 3. Data on export incentives comes from Global Trade Alert (GTA) database.Footnote 4 Though the used indicator does not consider the magnitude of each incentive, this might be the best possible measure that allows to include multiple types of export incentives since in practical terms it does not seem possible to compute comparable magnitudes of export incentives of various types.

Next, we turn to the moderating variables. In the empirical settings of this study we consider multiple countries and industries. Theoretically, third-country negative effects of export incentives would primarily arise for those foreign exporters that directly compete with subsidized exporters in the same export markets. Though indirect negative third-country effects are also possible if the world prices change (particularly decrease) as a result of export policy in a large country, these indirect effects are expected to be less significant. Furthermore, counting for such indirect effects is not straightforward and consequently could lead to complications in results` interpretation. Hence, in this study we count only for direct third-country effects. For this we need to introduce a measure that would reflect the extent at which exporters of implementing and affected countries present in the same foreign markets at refined industry level. We introduce the similarity index of geographical distribution of exports in six-digit HS industry i between implementing country Y and affected country c computed for cumulative exports in 2004–2008Footnote 5 and denoted by \({{GESI}_{\mathrm{Y}}}_{\mathrm{ci}}\) (Geographical Export Similarity Index) in Eq. (1). We compute similarity indices for the lagged period to avoid possible endogeneity bias. In particular, implementation of export incentives in one country can push exporters in affected third countries to redirect their exports to alternative export destinations that are less accessible for exporters from the country-source of export incentive. This implies negative relationship between the measure of export incentives and respective similarity index in the same year.

Export similarity index was developed by Finger and Kreinin (1979) and was initially intended to measure product/industrial similarity between exports of two countries to the same third country/the world. We transform this index to measure geographical similarity of exports of the same product/industry between two countries in the following way:

where:

\({X}_{Yi}^{b}\) is the amount of export in six-digit HS industry i from country Y (Brazil, India or China) to country b (1, …, n) in 2004–2008 (as cumulative);

\({X}_{Yiw}\) is the amount of export in six-digit HS industry i from country Y (Brazil, India or China) to the world in 2004–2008 (as cumulative);

\({X}_{ci}^{b}\) is the amount of export in six-digit HS industry i from country c to country b (1, …, n) in 2004–2008 (as cumulative);

\({X}_{ciw}\) is the amount of export in six-digit HS industry i from country c to the world in 2004–2008 (as cumulative); where countries b are all countries (n number) in the world, for which relevant data is available.

As original index, export destination-based similarity index ranges from 0 to 1 where 0 reflects no similarity and 1 – full similarity. In Appendix B, we present descriptive statistics of GESIs for each affected country. In general, all three BIC exhibit higher similarity in geography of export destinations with their neighbors (i.e., countries located in the same geographical region), USA, Canada and selected European countries.

Since the theoretical intuition of this study is based on strategic trade policy theory that refers to trade policy (particularly export subsidization) that affects the outcome of strategic interactions between firms in an actual or potential international oligopoly (Spencer and Brander 2008), we could expect negative third-country effects of export incentives particularly in industries with higher proclivity to imperfect competition. To empirically test this, we introduce a second moderating variable that measures the proclivity to imperfect competition in an industry i. As a plausible proxy we utilize Herfindahl–Hirschman index (HHI) for 50 largest companies in US reported by US Census Bureau for the year 2007. Data for the index are organized and classified by the North American Industry Classification System (NAICS). We convert the data into HS classification (six-digit HS industries) using HS-NAICS concordance of Pierce and Schott (2012). We further perform time adjustment (not industry-specific; on annual basis) of the indices using the time dynamics of overall US HH Market concentration index in 2007–2017 reported by World Integrated Trade Solution (WITS). Though we use the US HHI as an approximation of the universe HHI, considering the leading position of the US in the world economy, it can be assumed that market concentration in US industries largely determine the respective industries` concentration trends in the world, at least in the developed countries and advanced emerging markets considered in this study.

Finally, we control for country by year fixed effects and use heteroskedasticity-robust standard errors clustered at the country-industry-year level to deal with potential heteroskedasticity and serial correlation problems (see Bertrand et al. 2004). For estimation we utilize the Poisson Pseudo Maximum Likelihood (PPML) as is commonly recommended (see, e.g., Head and Mayer 2014; Larch and Yotov 2016). PPML estimation is the most common method employed for structural gravity models in the recent trade literature, as it is robust to heteroscedasticity, it can deal with zero trade, and it can incorporate the theoretical constructs of multilateral resistances discussed by Anderson and Wincoop (2003).

3.2 Identification Strategy

The sensitive issue of the export incentives` variable is the concern of possible endogeneity of export policies. In particular, the timing of trade reform might have reflected BIC`s authorities` perceptions of domestic industries` potential to face foreign competition. If policy makers implement export incentives based on sectoral trade performance of domestic and foreign exporters, we could run into serious causality issues. Export incentives could, for example, be granted for sectors with the best performance of domestic exporters or for sectors where foreign competition is strong. The political strength of labor as well as business is also often cited as a determinant of domestic trade policy (Topalova and Khandelwal 2011). Hence, it is important to verify that incentives were set independently of industries` expected exports, lobbying activities and particularly severity of foreign competition since our dependent variable represents foreign exports.

Accordingly, to improve the identification of the export incentives` variable, we utilize average duty rate in a respective BIC country in six-digit industry i in the distant past (the year of 1997; the data is available from 1996) as its instrument. Data comes from WTO Tariff download facility. It can be suggested that domestic (BIC) tariff policies in relatively distant past correlate with present domestic (BIC) export policies though not having significant relationship with present foreign export flows. Indeed, the dominant development strategy for many developing economies from the World War II until the 70 s-80 s was import-substitution. However, gradually countries started to substitute it by export promotion as the main trade strategy. Hence, it is plausible to assume that industrial patterns of these policies correlate.

The important issue is that in our baseline specification (1), the endogenous indicator of export incentives interacts with two moderating variables, which we assume to be exogenous. Hence, the respective three interaction terms with the endogenous indicator of export incentives, two two-way (\(\mathrm{E}{{\mathrm{I}}_{\mathrm{Y}}}_{\mathrm{cit}}\times {GESI}_{{Y}_{ci}}\) and \(\mathrm{E}{{\mathrm{I}}_{\mathrm{Y}}}_{\mathrm{cit}}\times {HHI}_{i}\)) and one three-way (\(\mathrm{E}{{\mathrm{I}}_{\mathrm{Y}}}_{\mathrm{cit}}\times {GESI}_{{Y}_{ci}}\times {HHI}_{i}\)), also suffer from endogeneity problem. To address these multiple endogeneity issues, we follow the recommendation of Wooldridge (2010) and in the first stage of the instrumental variable estimation procedure utilize an average duty rate in a BIC country Y in six-digit HS industry i in the year of 1997, \({{ADR}_{Y}}_{i, 1997}\), and its two-way and three-way interaction terms with two exogenous moderating variables, \({GESI}_{{Y}_{ci}}\) and \({HHI}_{i}\), as instruments for export incentives` variable \(\mathrm{E}{{\mathrm{I}}_{\mathrm{Y}}}_{\mathrm{cit}}\) and its interaction terms with exogenous moderating variables:

where \(Endogenous\; variable=\begin{array}{c}{EI}_{{Y}_{cit}}\\ \mathrm{E}{{\mathrm{I}}_{\mathrm{Y}}}_{\mathrm{cit}}\times {GESI}_{{Y}_{ci}}\\ \mathrm{E}{{\mathrm{I}}_{\mathrm{Y}}}_{\mathrm{cit}}\times {HHI}_{i}\\ \mathrm{E}{{\mathrm{I}}_{\mathrm{Y}}}_{\mathrm{cit}}\times {GESI}_{{Y}_{ci}}\times {HHI}_{i}\end{array}\).

It should be noted that in specification (3) we also include all the exogenous variables in the model, namely, two exogenous moderating variables and their interaction term, and country-by-year fixed effects as commonly recommended (Wooldridge 2010).

The validity of the instrumental variable estimation depends on two conditions. The first one is the relevance condition, i.e., that the instrumental variables are significantly correlated with the explanatory variable of interest. This can be confirmed by the significance of coefficients βn's in Eq. (3). The second condition is the exclusion restriction, i.e., that the instrumental variable does not affect the outcome variable through channels other than the regressor of interest. This restriction needs further consideration.

There is a potential threat to the exclusion restriction of the average duty rate in distant past as an instrument for present trade policies in BIC. BIC import-substitution policies in the past could affect trade policies and, consequently, export development of third countries in the past that in turn partially determines their export patterns at present. To respond to this concern, we consider the imperfect instrumental variable literature that relaxes the exogeneity assumption of instrumental variables, particularly, the plausibly exogenous instruments` framework developed by Conley et al. (2012). If we generalize our instrumental variable equation, we get:

where \({\gamma }_{n}{^{\prime}}s\) captures the effects of instrumental variables on the dependent variable \({EXP}_{cit}\) through channels other than the explanatory variable \({EI}_{{Y}_{cit}}\) and its respective interactions with moderating variables. With estimated \({\gamma }_{n}{^{\prime}}s\), we can identify the true value of \({a}_{n}{^{\prime}}s\) in the following equation:

where \(\widetilde{{EXP}_{cit}}\equiv {EXP}_{cit}-{(\gamma }_{1}{{ADR}_{Y}}_{i, 1997}+{\gamma }_{2}{{ADR}_{Y}}_{i, 1997}\times {GESI}_{{Y}_{ci}}+{\gamma }_{3}{{ADR}_{Y}}_{i, 1997}\times {HHI}_{i}+{\gamma }_{4}{{ADR}_{Y}}_{i, 1997}\times {GESI}_{{Y}_{ci}}\times {HHI}_{i})\).

To estimate \({\gamma }_{n}{^{\prime}}s\), we follow the practice by Nunn and Wantchekon (2011) and Liu and Lu (2015) and exploit the fact that some industries in BIC countries have not been targeted by export promotion policies in the studied period of 2009–2018. Hence, a regression of \({EXP}_{cit}\) on \({{ADR}_{Y}}_{i, 1997}\), \({{ADR}_{Y}}_{i, 1997}\times {GESI}_{{Y}_{ci}}\), \({{ADR}_{Y}}_{i, 1997}\times {HHI}_{i}\) and \({{ADR}_{Y}}_{i, 1997}\times {GESI}_{{Y}_{ci}}\times {HHI}_{i}\) along with the same set of controls (exogenous moderating variables, their interaction term and country by year fixed effects) in the sample of untargeted industries captures all the effects of instruments on \({EXP}_{cit}\) through channels other than \(\mathrm{E}{{\mathrm{I}}_{\mathrm{Y}}}_{\mathrm{cit}}\) and its interaction terms with moderating exogenous variables, giving us an estimation of \({\gamma }_{n}{^{\prime}}s\). Then we can calculate the dependent variable \(\widetilde{{EXP}_{cit}}\equiv {EXP}_{cit}-{(\gamma }_{1}{{ADR}_{Y}}_{i, 1997}+{\gamma }_{2}{{ADR}_{Y}}_{i, 1997}\times {GESI}_{{Y}_{ci}}+{\gamma }_{3}{{ADR}_{Y}}_{i, 1997}\times {HHI}_{i}\;+\;{\gamma }_{4}{{ADR}_{Y}}_{i, 1997}\times {GESI}_{{Y}_{ci}}\times {HHI}_{i})\) in Eq. (5) and identify \({a}_{n}{^{\prime}}s\) using \({ADR}_{i,1997}\) and its interaction terms with moderating exogenous variables as valid instruments.

Other studies that have been using similar approach (PPML with instrumented variables) include Felbermayr and Gröschl (2011) and De Oliveira and Peridy (2019).

4 Empirical Results

In Tables 1, 2, 3 we first report results with raw data, i.e., of Eq. (1) without counting for endogeneity issues. PPML model with multiple fixed effects has been used for estimation (see Santos Silva and Tenreyro (2015) for details). The descriptive statistics and correlation matrix of raw data variables is provided in Appendix C.

First, we should note that R-squared coefficients are between 0.3 and 0.4 that can be considered as rather high for such type of models. As can be seen from the raw data results, though the direct coefficients of export incentives` variables (\({EI}_{cit}\)) are all positive, the coefficients of their two-way interaction terms with export destination-based similarity index and Herfindahl–Hirschman index are negative. In general, these results suggest that negative third-country effects of export incentives tend to arise between countries that compete in the same export markets and in industries with higher proclivity to imperfect competition. For China we also find negative coefficient of the three-way interaction term between Chinese export incentives` variable, export destination-based similarity and Herfindahl–Hirschman indices. This indicates that largest third-country negative effects of Chinese export incentives tend to concentrate in countries that compete in the same export markets with China and in industries with high proclivity to imperfect competition.

The second stage results of the plausibly exogenous instruments` approach are reported in Tables 4–5.Footnote 6 In Appendix E, first-stage results (of Eq. 3) for the full models (Models 3, 6 and 9 in Table 4) are presented. First stage equations and respective corrections of the dependent variable for plausibly exogenous instruments of the reduced models (Models 1, 2, 4, 5, 7 and 8 in Table 4) have been estimated separately since the number of instruments and exogenous variables decreases accordingly (the results are available upon request). PPML model with multiple fixed effects has been used for estimation in both stages.

From the first stage estimation results (see Appendix E) we can observe that most \({\beta }_{n}{^{\prime}}s\) of Eq. (3) are highly statistically significant that confirms the relevance of our instrumental variables.

In the second stage we consistently find highly statistically significant coefficients of all variables (including interaction terms) in all models. In general, the results do not differ substantially from the raw data results presented in Tables 1–3. The coefficients of two-way interaction terms between BIC export incentives` variables and export destination-based similarity indices are negative and highly statistically significant in all models. This confirms our expectations that those foreign exporters, who compete with subsidized exporters in the same export markets, experience higher negative effects for their exports. The coefficients of two-way interaction terms between export incentives` variables and Herfindahl–Hirschman index are also negative and highly statistically significant in all models except Model 2 of Table 4 (reduced model for differential effects of Brazilian export incentives between industries with higher and lower HHI) and Model 3 of Table 5 (full model for China). In the latter two models the respective coefficients are positive and statistically significant. This suggests that the moderating effect of HHI is ambiguous and needs further discussion (see graphical analysis).

As for the three-way interaction terms, their interpretation is more cumbersome and, hence, we utilize graphical tools for their analysis. First, to make the graphical presentation more transparent, on Figs. 4 and 5 we plot two-way interaction effects based on Models 1 and 2 for the effects of Brazilian, Indian, and Chinese export incentives, in respective Tables (4, 5 and 6). It should be noted that because of scale issues, we do not exponentiate the predicted values of the dependent variable and, hence, they can be treated as log transformed. Since we are interested in the slopes rather than in values, this approach is supposed to be appropriate.

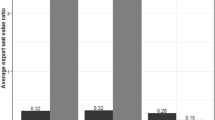

Graphical plot of two-way interaction effects between BIC export incentives and export destination-based similarity index. Note: High and low export destination-based similarity indices were computed as maximum index minus its one standard deviation and minimum index plus its one standard deviation, respectively. Graphs are based on Models 1 (Brazil), 4 (India) and 7 (China) of Table 5

Graphical plot of two-way interaction effects between BIC export incentives and Herfindahl–Hirschman index. Note: High and low Herfindahl–Hirschman indices were computed as maximum index minus its one standard deviation and minimum index plus its one standard deviation, respectively. Graphs are based on Models 2 (Brazil), 5 (India) and 8 (China) of Table 5

As we can observe, the change in the effects between high and low values of the indices is significantly more visible for the interaction term of export incentives` variable with geographical export similarity index. This is especially evident for the third-country effects of Brazilian and Indian export incentives, which turn from negative to positive when the export destination-based similarity index turns from high to low. Chinese export incentives are negatively associated with export of all countries irrespective their similarity with China in geographical distribution of export. However, negative effects slightly increase when similarity increases.

Graphical analysis of the two-way interaction effects between BIC export incentives and Herfindahl–Hirschman index does not exhibit a clear difference between the effects in industries with high and low levels of Herfindahl–Hirschman index.

On Figs. 6, 7 and 8 we plot three-way interactions between export incentives` variable, export destination-based similarity and Herfindahl–Hirschman indices for the effects of Brazilian, Indian and Chinese export incentives, respectively.

Graphical plot of the three-way interaction effect between Brazilian export incentives, export destination-based similarity index between Brazil and affected countries and Herfindahl–Hirschman Index. Note: High values of GESI and HHI were computed as maximum minus one standard deviation. Respective low values were computed as minimum plus one standard deviation. Graph is based on Model 3 (Brazil) of Table 6

Graphical plot of the three-way interaction effect between Indian export incentives, export destination-based similarity index between India and affected countries and Herfindahl–Hirschman Index. Note: High values of GESI and HHI were computed as maximum minus one standard deviation. Respective low values were computed as minimum plus one standard deviation. Graph is based on Model 6 (india) of Table 6

Graphical plot of the three-way interaction effect between Chinese export incentives, export destination-based similarity index between China and affected countries and Herfindahl–Hirschman Index. Note: High values of GESI and HHI were computed as maximum minus one standard deviation. Respective low values were computed as minimum plus one standard deviation. Graph is based on Model 9 (China) of Table 6

As can be observed from the graphs, high similarity in geography of export destinations between source country of incentives and third country is almost prerequisite for the third-country negative effects of export incentives. Only Chinese export incentives negatively affect exports of third countries even if the formers do not exhibit high similarity in geography of their exports with China.

However, the moderating effect of the industries` proclivity to imperfect competition is ambiguous. Brazilian export incentives negatively affect only foreign exporters that compete with Brazilian exporters in the same export markets (high similarity index) in industries with lower proclivity to imperfect competition (low Herfindahl–Hirschman index). Indian export incentives negatively affect foreign exporters that compete with Indian exporters in the same export markets (high similarity index) in all industries irrespective their proclivity to imperfect competition though the negative effects are slightly stronger when Herfindahl–Hirschman index is low (i.e. in industries with lower proclivity to imperfect competition). On the other hand, the largest negative effects of Chinese export incentives come to foreign exporters that compete with Chinese exporters in the same export markets and in industries with higher proclivity to imperfect competition (high similarity index and high Herfindahl–Hirschman index). However, the third-country effects of Chinese export incentives are also negative for the other three combinations of export similarity and Herfindahl–Hirschman indices though being significantly milder.

These findings suggest that the relative size of third-country negative effects in industries with different proclivity to imperfect competition depends on individual characteristics of implementing and affected countries, their interplay and strategies that national governments pursue in their export promotion policies. In recent decades China has emerged as a key actor in world trade and at present compete head-to-head with the USA in international markets. The rise of Chinese global companies has been also impressive. China has had 119 “Fortune Global 500” companies in 2019 versus 121 US companies. India and Brazil have had 10 and 8 companies, respectively. Furthermore, one of the core objectives of China`s sustainable trade strategy is to promote Chinese firms (including multinationals) (Jian and Evenett 2010). Hence, on average, Chinese export incentives target significantly larger companies (compared to Brazil and India), which have potential to compete with largest companies of the developed and advanced emerging countries considered in the set of rival countries in this study.

5 Conclusions

This paper was stimulated by the need to provide large-scale empirical evidence on the existence of third-country effects of export promotional policies. This has been a blind spot in empirical literature for a long time though well-established relevant theoretical models have been developed already in the 1980s. The issue gets additional importance in the present-day times of rising geo-economic tensions that calls for rethinking export promotion rules at supra-national level (Hoekman and Nelson 2020). We examined the effects of export incentives implemented in Brazil, India and China in 2009–2018 for exports of OECD and selected emerging countries. In the analysis we used novel CEPR Global Trade Alert data on export incentives that is reported at refined industry level (six-digit HS industry) and connects implementing and affected countries.

Our empirical analysis confirms the presence of negative effects of export incentives for third countries` exports. It further shows that these negative effects tend to arise particularly in rival countries that have high similarity in geography of export destinations with country-source of incentives. The study also finds that while Chinese export incentives cause largest negative third-country effects in industries with higher proclivity to imperfect competition (as predicted by strategic trade theory), the respective results for the effects of Brazilian and Indian incentives are converse. In a broader context, these findings indicate that strategic trade policies can be effective particularly in big actors of the world economy, like China, for example Tables 7, 8, 9, 10, 11, 12, 13, 14, 15.

Data Availability

The author states that in this paper she uses publicly available data, downloaded from official datasets, and the sources are mentioned in the text.

Notes

BRICS is an acronym for Brazil, Russia, India, China and South Africa.

In this study, we include only those measures, which are implemented and almost certainly discriminate against foreign commercial interests (marked as “Red” in GTA database).

Reported in HS6 2012 and converted into HS6 2007 using respective United Nations` conversion table.

The information on export incentives used in computations is presented in Online Appendix.

Export data is reported in HS6 2002 and then converted into HS6 2007 using respective United Nations` conversion table.

In Appendix D, the second stage results of ordinary instrumental variable framework (i.e. without adjustment of the dependent variable) are provided.

References

Anderson JE, Van Wincoop E (2003) Gravity with gravitas: A solution to the border puzzle. American Economic Review 93(1):170–192

Arslan I, Van Wijnbergen S (1993) Export incentives, exchange rate policy and export growth in Turkey. Rev Econom Stat 128–133

Baier SL, Bergstrand JH (2007) Do free trade agreements actually increase members’ international trade? J Int Econ 71(1):72–95

Bertrand M, Duflo E, Mullainathan S (2004) How much should we trust differences-in-differences estimates? Q J Econ 119(1):249–275

Bohman M, Carter CA, Dorfman JH (1991) The welfare effects of targeted export subsidies: a general equilibrium approach. Am J Agr Econ 73(3):693–702

Brander JA (1995) Strategic trade policy. Handb Int Econ 3:1395–1455

Brander JA, Spencer BJ (1985) Export subsidies and international market share rivalry. J Int Econ 18(1):83–100

Brenton P, Newfarmer R (2007) Watching more than the discovery channel: export cycles and diversification in development. The World Bank

Camagni R, Capello R, Cerisola S, Fratesi U (2020) Fighting Gravity: Institutional Changes and Regional Disparities in the EU. Econom Geograph 1–29

Carmody PR, Owusu FY (2007) Competing hegemons? Chinese versus American geo-economic strategies in Africa. Polit Geogr 26(5):504–524

Chen CH, Mai CC, Yu HC (2006) The effect of export tax rebates on export performance: Theory and evidence from China. China Econ Rev 17(2):226–235

Conconi P, García-Santana M, Puccio L, Venturini R (2018) From final goods to inputs: the protectionist effect of rules of origin. American Economic Review 108(8):2335–2365

Conley TG, Hansen CB, Rossi PE (2012) Plausibly exogenous. Rev Econ Stat 94(1):260–272

Desai MA, Hines JR Jr (2008) Market reactions to export subsidies. J Int Econ 74(2):459–474

De Oliveira GF, Peridy N (2019) The trade-reducing effects of market power in international ports. Economics Bulletin 39(4):2674–2687

Dunford M, Smith A (2000) Catching up or falling behind? Economic performance and regional trajectories in the “New Europe.” Econ Geogr 76(2):169–195

Eaton J, Grossman GM (1986) Optimal trade and industrial policy under oligopoly. Q J Econ 101(2):383–406

Eaton J, Grossman GM (1988) Trade and industrial policy under oligopoly: Reply. Q J Econ 103(3):603–607

Evenett SJ, Fritz J (2015) BRICS Trade Strategy: time for a rethink. The 17th GTA report

Evenett SJ, Venables AJ (2002) Export growth in developing countries: Market entry and bilateral trade flows (pp. 1–42). mimeo

Etro F (2011) Endogenous market structures and strategic trade policy. Int Econ Rev 52(1):63–84

Felbermayr G, Gröschl J (2011) Natural Disasters and the Effect of Trade on Income: A New IV Approach (No. 3541). CESifo working paper

Finger JM, Kreinin ME (1979) A Measure ofExport Similarity’and Its Possible Uses. Econ J 89(356):905–912

Girma S, Gong Y, Görg H, Yu Z (2009) Can production subsidies explain China’s export performance? Evidence from firm-level data. Scandinavian Journal of Economics 111(4):863–891

Head K, Mayer T (2014) Gravity equations: Workhorse, toolkit, and cookbook. In Handbook of international economics (Vol. 4, pp. 131–195). Elsevier

Hirono M (2019) Asymmetrical rivalry between China and Japan in Africa: to what extent has Sino-Japan rivalry become a global phenomenon? Pac Rev 32(5):831–862

Hoekman B, Nelson D (2020) Rethinking international subsidy rules. The World Economy 43(12):3104–3132

Jian L, Evenett CSJ (2010) What Commercial Policies Can Promote China’s Sustainable Trade Strategy?. Winnipeg: International Institute for Sustainable Development (IISD)

Jung B (2022) The Trade Effects of the EU-South Korea Free Trade Agreement: Heterogeneity across Time, Country Pairs, and Directions of Trade within Country Pairs. Open Eco Rev 1–40

Kikuchi T (1998) Strategic export policy in a differentiated duopoly: a note. Open Econ Rev 9(4):315–325

Krugman PR (1986) Industrial organization and international trade

Larch M, Yotov Y (2016) General equilibrium trade policy analysis with structural gravity

Lee SO, Wainwright J, Glassman J (2018) Geopolitical economy and the production of territory: The case of US–China geopolitical-economic competition in Asia. Environment and Planning a: Economy and Space 50(2):416–436

Limão N (2007) Are preferential trade agreements with non-trade objectives a stumbling block for multilateral liberalization? Rev Econ Stud 74(3):821–855

Liu Q, Lu Y (2015) Firm investment and exporting: Evidence from China’s value-added tax reform. J Int Econ 97(2):392–403

Luttwak EN (1990) From geopolitics to geo-economics: Logic of conflict, grammar of commerce. The National Interest 20:17–23

Nicita A, Rollo V (2015) Market access conditions and sub-Saharan Africa’s exports diversification. World Dev 68:254–263

Nunn N, Wantchekon L (2011) The slave trade and the origins of mistrust in Africa. American Economic Review 101(7):3221–3252

O’Loughlin J, Anselin L (1996) Geo-economic competition and trade bloc formation: United States, German, and Japanese exports, 1968–1992. Econ Geogr 72(2):131–160

Pierce JR, Schott PK (2012) A concordance between ten-digit US Harmonized System Codes and SIC/NAICS product classes and industries. J Econ Soc Meas 37(1–2):61–96

Rodrik D (2018) What do trade agreements really do? Journal of Economic Perspectives 32(2):73–90

Santos Silva J, Tenreyro S (2015) PPML: Stata module to perform Poisson pseudo-maximum likelihood estimation

Shepherd B (2010) Geographical diversification of developing country exports. World Dev 38(9):1217–1228

Smith A (2002) Imagining geographies of the ‘new Europe’: geo-economic power and the new European architecture of integration. Polit Geogr 21(5):647–670

Spencer B, Brander JA (2008) Strategic trade policy. The New Palgrave Dictionary of Economics, ed. by SN Durlauf and LE Blume, Basingstoke, Hampshire: Palgrave Macmillan.

STRATFOR Jan 19 (2015) The Difficulties Facing Brazil's New Export Plan. Finger

Tanaka Y (1991) The incentive for export subsidies under imperfect competition. Open Econ Rev 2(3):275–284

Tong LA, Pham CS, Ulubaşoğlu MA (2019) The Effects of Farm Subsidies on Farm Exports in the United States. Am J Agr Econ 101(4):1277–1304

Topalova P, Khandelwal A (2011) Trade liberalization and firm productivity: The case of India. Rev Econ Stat 93(3):995–1009

Wooldridge JM (2010) Econometric analysis of cross section and panel data. MIT press

Xuefeng Q, Yaşar M (2016) Export market diversification and firm productivity: evidence from a large developing country. World Dev 82:28–47

Zia BH (2008) Export incentives, financial constraints, and the (mis) allocation of credit: Micro-level evidence from subsidized export loans. J Financ Econ 87(2):498–527

Acknowledgement

I am particularly grateful for helpful comments and suggestions to the Editor George Tavlas, two anonymous referees, Pol Antras, Igor Bagayev, Robin Burgess, Ron Davies, Taiji Furusawa, Pertti Haaparanta, Vera Ivanova, Peter Neary, Yao Pan, Mark Razhev, Zuzanna Studnicka, Roman Stöllinger, Otto Toivanen, John Whalley and participants in various seminar and conference presentations.

Funding

Open Access funding provided by Hanken School of Economics.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

I would like to thank the Editor George Tavlas and two anonymous referees for their very helpful comments on earlier version of this paper.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendices

Appendices

1.1 Appendix A: List of Affected Countries

Argentina, Australia, Austria, Belgium, Canada, Chile, Colombia, Czechia, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Israel, Italy, Japan, Korea, Latvia, Lithuania, Luxembourg, Malaysia, Mexico, Netherlands, NewZealand, Norway, Peru, Poland, Portugal, Russia, Slovakia, Slovenia, Spain, Sweden, Switzerland, Thailand, Turkey, United Kingdom, United States of America, Uruguay.

1.2 Appendix B: Descriptive Statistics of GESIs for Affected Countries

1.3 Appendix C: Correlation Matrix and Descriptive Statistics for Raw Data

1.4 Appendix D: Second Stage Results for Full Models Under Ordinary Instrumental Variable Framework

1.5 Appendix E: First Stage Estimation Results

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Ledyaeva, S. Third-Country Effects of Export Incentives. Open Econ Rev 35, 71–98 (2024). https://doi.org/10.1007/s11079-023-09714-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-023-09714-9

Keywords

- Export incentives

- Third-country effects

- Similarity in geography of export destinations

- Market concentration

- Proclivity to imperfect competition