Abstract

We study nominal exchange rate dynamics in the aftermath of U.S. monetary policy announcements. Using high-frequency interest rate and stock price movements around FOMC announcements, we distinguish between pure monetary policy shocks and information shocks, which are associated with new information contained in the announcements. Contractionary pure policy shocks give rise to a strong, but transitory, appreciation on impact. Information shocks also appreciate the exchange rate, but the effect builds up only slowly over time and is highly persistent. Thus, we conclude that although the short-run effects on the exchange rate are primarily due to pure policy shocks, the medium-run response is driven by information effects.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In this paper, we study the response of the U.S. Dollar to information shocks and pure monetary policy shocks in the context of FOMC announcements. Although the effects of monetary policy on exchange rates have been studied in a number of contributions, typically against the backdrop of the Dornbusch (1976) landmark contribution, the overshooting hypothesis (see e.g. Rüth 2020; Inoue and Rossi 2019; Bjørnland 2009; Scholl and Uhlig 2008),Footnote 1 information shocks associated with central bank announcements as a source of exchange rate fluctuations have received less attention. As central bank announcements typically reveal news about the central bank’s assessment of the state of the economy (see e.g. Campbell et al. 2012; Nakamura and Steinsson 2018; Jarocinski and Karadi 2020), financial market participants closely monitor and process information provided by central banks. Thus, information shocks may be a source of exchange rate fluctuations.

A number of recent contributions emphasize the role of information effects for the transmission of monetary policy more generally (Cieslak and Schrimpf 2019; Jarocinski and Karadi 2020; Andrade and Ferroni 2021). Market participants may interpret contractionary (expansionary) policy announcements as the central bank’s reaction to an improved (worsened) economic outlook, which may give rise to more optimistic (pessimistic) views regarding the overall macroeconomic situation. Consider the following example: On January 30th, 2008 the Federal Reserve announced a reduction of the federal funds rate target by 50 basis points. This announcement resulted in a decline in the 3-month federal funds future and although standard textbooks predict an increase in equity prices in such a case, the S&P500 declined as well. The announcement was accompanied by the following statement (Federal Reserve 2008): ”Financial markets remain under considerable stress, and credit has tightened further for some businesses and households. Moreover, recent information indicates a deepening of the housing contraction as well as some softening in labor markets.” Thus, the decline in stock prices, despite the lower federal funds rate target, may have been the result of information effects, i.e. more pessimistic expectations due to the information conveyed with the announcement.

To study how information shocks influence exchange rate dynamics, we disentangle pure monetary policy shocks and information shocks by imposing sign restrictions on high-frequency changes in interest rates and stock prices measured within short time windows around central bank announcements. The main identifying assumption is that a pure policy shock results in a negative co-movement of high-frequency changes in interest rates and stock prices, while an information shock gives rise to a positive co-movement (Jarocinski and Karadi 2020; Jarocinski 2020; Kerssenfischer 2019). Intuitively, a contractionary pure policy shock should lead to higher interest rates and lower expected discounted dividends, which in turn leads to lower stock prices. However, if stock prices increase, despite a monetary tightening and higher interest rates, then the stock market movement is likely to reflect a more optimistic assessment by the central bank conveyed with the policy announcement. Based on these identifying assumptions, we decompose the high-frequency interest rate change into pure policy and information components using rotational sign restrictions as in Jarocinski (2020). The fact that changes in interest rates and stock prices are measured within short windows around announcements ensures that these changes reflect surprises associated with the announcement (Kuttner 2001; Gürkaynak et al. 2005). As a next step, we use the pure policy and information surprise components as instruments in a proxy VAR as in Gertler and Karadi (2015).Footnote 2

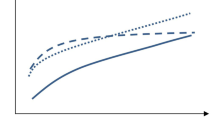

Our results show that, not accounting for information effects, contractionary monetary policy shocks give rise to a sharp appreciation followed by a persistent depreciation of the nominal effective exchange rate consistent with the overshooting model of Dornbusch (1976) and in line with empirical evidence presented in e.g. Bjørnland (2009) and Rüth (2020). Although pure monetary policy and information shocks both contribute to the appreciation, the dynamic patterns induced by these two shocks differ strongly. A pure monetary policy shock appreciates the U.S. Dollar in the short run, but the effect is transitory, in line with the overshooting model. The exchange rate response to an information shock, in contrast, is rather muted on impact but becomes more pronounced over the medium run, resulting in a persistent appreciation. Thus, the behavior of the exchange rate conditional on the information shock is reminiscent of delayed overshooting dynamics in the spirit of Eichenbaum and Evans (1995) and Scholl and Uhlig (2008).

To explore these delayed overshooting patterns in greater detail, we estimate the responses of ex-post deviations from uncovered interest rate parity (UIP).Footnote 3 While previous papers such as Müller et al. (2019) or Rüth (2020) include similar exercises, they do not distinguish between policy and information shocks. Despite the persistent exchange rate response after an information shock, we do not detect any noteworthy reactions of UIP deviations neither to the information shock nor to the pure policy shock. Thus, the exchange rate and interest rates jointly adjust in line with UIP, despite stark differences in the exchange rate responses. That is, the persistent exchange rate response to the information shock is accompanied by appropriate changes in interest rates, which is in line with a number of recent studies that document persistent effects of information shocks on interest rates.Footnote 4

Although the exchange rate response triggered by the information shock is less precisely estimated, the historical decomposition shows that due to the higher persistence of its effects, which accumulate over time, the information shock contributes substantially to exchange rate dynamics. To the extent that persistent changes in the exchange rate are likely to induce more pronounced effects on the economy, our results suggest that the implications of exchange rate fluctuations should crucially depend on the type of shock that gives rise to these fluctuations.Footnote 5 In fact, it may be primarily new information about the macroeconomic environment, rather than the announcement of the actual policy itself, that results in sizeable effects associated with policy-induced variations in the exchange rate.

Given the strong influence of information shocks on exchange rate dynamics, our findings suggest that accounting for the potentially counteracting effects that the information revealed by central bank announcements exerts, contributes to a better understanding of exchange rate movements overall. In addition, our estimates may help to calibrate structural models of the monetary transmission mechanism, which increasingly incorporate information shocks (e.g. Jarocinski and Karadi 2020).

Our analysis is related to several strands of the literature. The response of the exchange rate to monetary policy shocks has been studied in a number of contributions. Several papers analyze whether exchange rate dynamics are consistent with the exchange rate overshooting model of Dornbusch (1976). Eichenbaum and Evans (1995) and Grilli and Roubini (1995, 1996) find evidence for delayed overshooting, i.e., a smaller response of the exchange rate in the short term than in the long term (see also Froot and Thaler 1990). Similarly, MacDonald and Popiel (2020) use ordering restrictions to identify unconventional monetary policy shocks in the U.S and Canada and find that the bilateral exchange rate response reaches its maximum only after more than a year following an U.S. policy shock. The maximum response after a Canadian unconventional policy shock is reached closer to the impact period, however. Scholl and Uhlig (2008) use sign restrictions to identify policy shocks and find that the maximum appreciation occurs only after 1 to 2 years. In contrast, Faust and Rogers (2003) estimate the maximum exchange rate responses at horizons that are close to the impact period. Dery and Serletis (2021) obtain similar results using a combination of zero and sign restrictions for identification. Bjørnland (2009) identifies monetary policy shocks by imposing long-run monetary neutrality restrictions and finds real exchange rate responses consistent with Dornbusch (1976) for a number of countries. Inoue and Rossi (2019) identify monetary policy shocks as changes in the whole yield curve in response to monetary policy surprises and also find support for exchange rate overshooting. Müller et al. (2019) use narrative monetary policy shocks and a local projections framework and find evidence in favor of delayed overshooting. In contrast to these studies, we use a high-frequency identification approach and emphasize the role of new information conveyed at central bank announcements.

Methodologically, our paper is most closely related to Rogers et al. (2018) and Rüth (2020). These two contributions use proxy VARs in combination with high-frequency instruments to identify policy shocks and find evidence in favor of overshooting. While these authors do not explicitly consider information shocks, we contribute to this branch of the literature by exploring the exchange rate effects of new information conveyed at central bank announcements.Footnote 6

The paper is structured as follows: Sect. 2 describes our econometric approach and the data we use in our estimations. Section 3 presents our main findings, which include impulse response functions as well as a historical decomposition. Afterwards, Sect. 4 contains a battery of robustness checks and finally, Sect. 5 concludes.

2 Estimation and Data

We estimate the following reduced-form VAR model:

where yt is the vector of endogenous variables, c is a vector of constant terms, the matrices Bj contain the autoregressive coefficients, and ut is a vector of error terms with ut ∼ N (0, Σ). We set p = 6 in our baseline specification.Footnote 7

The choice of endogenous variables closely follows Gertler and Karadi (2015) and Jarocinski and Karadi (2020).Footnote 8 We include the 1-year government bond yield (GS1) as a policy indicator, which should be affected by conventional policy and forward guidance. As the main macroe- conomic variables, we use industrial production (IP) and the consumer price index (CPI). To capture financial markets financial conditions as channels for policy transmission, we include the S&P500 stock market index (S&P500) and the excess bond premium (EBP). And finally, we include the spot nominal effective exchange rate index (NEER).

We take logs of IP, CPI, S&P500, and the exchange rate index and multiply the resulting series by 100. The remaining series are included without any transformations. While we focus on the NEER in our baseline analysis, we also estimate the model with bilateral exchange rates and excess returns that measure deviations from the UIP in Sect. 3.2. We define spot exchange rates as the price of one unit of foreign currency in terms of U.S. Dollars. The data ranges from 1984M2 to 2016M12.Footnote 9 Table 1 provides details about the variables and the data sources.

We apply a high-frequency identification approach and use pure policy and information surprises as instruments in a proxy VAR (Gertler and Karadi 2015; Caldara and Herbst 2019; Paul 2020; Swanson 2021). In contrast to ordering and sign restrictions on the impulse response functions, the high-frequency identification approach has the advantage that no restrictions on impulse response functions are needed, which allows us to remain agnostic with respect to how the endogenous variables respond to pure policy and information shocks. An additional advantage of the proxy VAR is that it can account for measurement error in the surprise measures that could bias the estimated impulse responses (Rüth 2020). And although high-frequency identification can be combined with a Cholesky decomposition (Plagborg-Møller and Wolf 2021), the proxy VAR has the advantage that we can estimate the model using a sample that starts in 1984, although data for the instruments are only available from 1990M2 on. By doing so, we obtain more efficient estimates (Gertler and Karadi 2015; Rüth 2020).

To construct instruments, we use high-frequency changes in interest rates and stock prices between 10 minutes before and 20 minutes after a FOMC announcement, which we take from Jarocinski and Karadi (2020). Specifically, we use the 3-month federal funds future rate as an interest rate surprise. Gertler and Karadi (2015) and Jarocinski and Karadi (2020) emphasize that this series comprises surprises in actual policy rate changes as well as a short term forward guidance component. As a stock market surprise, we use the S&P500 index, as is standard in the literature (e.g. Cieslak and Schrimpf 2019; Jarocinski and Karadi 2020). Since only the announcement by the central bank should have a systematic effect on interest rates and financial market variables within such a short time period, these high-frequency changes can be interpreted as broad policy surprises, i.e., they should be correlated with the pure policy shock and the information shock but not with other shocks (see e.g. Kuttner 2001; Gürkaynak et al. 2005; Hamilton 2008; Miranda-Agrippino 2016). The surprise series are based only on scheduled FOMC meetings between 1990M2 to 2016M12.Footnote 10

We decompose the interest rate surprise into two orthogonal components: the pure policy surprise, mpt, and the information surprise, cbit. To do so, we impose two key identifying assumptions.Footnote 11 First, we assume that a pure policy shock gives rise to a negative co-movement of interest rate and stock price surprises. A pure policy shock typically induces contractionary effects on the economy, resulting in lower expected dividends. In addition, the lower future dividends are discounted at a higher rate. Both these effects should lead to a decline in stock market prices. Indeed, there is strong empirical evidence that a contractionary policy shock is followed by lower stock market prices (Miranda-Agrippino and Ricco 2018; Paul 2020; Swanson 2021).

The second key identifying assumption is that an information shock moves interest rate and equity prices in the same direction. The central bank typically has an informational edge over private market participants (Romer and Romer 2000), and central bank announcements convey part of the central bank’s private information. The announcement of a policy contraction, for instance, may be a response to an improved economic outlook. Market participants may therefore interpret such an announcement as a signal for an economic outlook that is better than previously expected. In line with this argument, Campbell et al. (2012) and Mitchell and Pearce (2020) find that contractionary policy announcements increase inflation and output growth expectations of private forecasters. Since this implies expansionary effects, we assume that stock market prices increase as a result. This assumption is backed up by empirical studies that find higher stock prices after an interest rate increasing information shock (see e.g. Miranda-Agrippino and Ricco 2018; Kerssenfischer 2019; Jarocinski and Karadi 2020).

Of the 161 FOMC announcements in our sample that have a non-zero effect on the surprises in the federal funds rate future and the S&P500, 53 are characterized by a positive co-movement of these surprise measures. In other words, about a third of these policy announcements lead to a financial market reaction that is consistent with what we would expect after a central bank information shock.

We follow Jarocinski (2020) and use rotational sign restrictions to decompose the interest rate surprise into a pure policy component and an information component,Footnote 12 and we use the orthogonalized surprises as instruments for the shocks of interest in the proxy VAR. Footnote 13 As a starting point for the rotational sign restrictions approach, we define a T + p × 2 matrix M that contains the monthly aggregated high-frequency changes in the 3-month federal funds future rate, i, and in the S&P500, s, and where T is the sample size. To decompose i into two orthogonal components mp and cbi, we first calculate the QR-decomposition of M , such that:

where I2 is an identity matrix of dimension 2 and the diagonal elements in R are restricted to be positive. Next, we rotate the orthogonal components in Q using the following rotation matrix:

where α is the inverse cosine of \(\sqrt[2]{\lambda }\) . To determine λ, we follow Jarocinski (2020) and define a modified vector of interest rate surprises where we set the values in the vector i to zero if both surprises have the same sign, as this indicates a dominant information shock in period t. This is essentially the poor man’s sign restriction approach discussed in Jarocinski and Karadi (2020) as an alternative method to disentangle pure policy and information shocks. Using this vector of modified surprises, we calculate λ as the variance associated with the non-zero entries in this vector relative to the variance of the original vector i. And based on this value for λ, which is 86 percent, we calculate α.Footnote 14

Finally, we use the following matrix D to scale the orthogonalized surprises such that they add up to the broad policy surprise i:

Combining these steps, we calculate the orthogonalized surprises as [mp, cbi] = QPD and use these two surprises as instruments for the 1-year government bond yield in a proxy VAR. As in Montiel Olea et al. (2021), we calculate the impact responses to the two orthogonal shocks as:

where up is a vector containing the residuals in the policy indicator equation and mp and cbi are vectors including the pure policy surprise respectively the information surprise.Footnote 15 The two coefficients δmp and δcbi capture the contemporaneous effects of the pure policy shock and the information shock on the variables in the system. We scale these coefficients such that each of the identified shocks induces a unit increase in the 1-year government bond yield on impact.

The Wald-statistics for the covariance between our instruments and the residuals in the policy indicator equation as well as for the covariance between the instruments and the full vector of reduced form residuals suggest that our instruments are relevant. Finally, we follow Montiel Olea et al. (2021) and use the delta-method to calculate asymptotically valid confidence bands.Footnote 16

3 Results

3.1 Effective Exchange Rate

Figure 1 displays the main results. The solid lines show the point estimates and the shaded areas represent 68 percent and 90 percent confidence bands. As a first analysis, we show the responses to a broad policy shock, that is, without taking information effects into account, in the first column of the figure. A contractionary monetary policy shock gives rise to persistent declines in industrial production and the CPI. While the stock market declines, the 1-year bond yield and the excess bond premium increase, indicating tighter financing conditions. These responses are in line with the existing literature (see e.g. Gertler and Karadi 2015; Miranda-Agrippino and Ricco 2018; Caldara and Herbst 2019). The exchange rate appreciates significantly in effective terms on impact and in the first month after the shock. This initial appreciation is followed by a slow and highly persistent depreciation back to the pre-shock level. Since the maximum response, which is about 5 percent, occurs within the first quarter after the shock, we interpret these dynamics as being in line with the exchange rate overshooting model of Dornbusch (1976) and with the empirical evidence presented in Rüth (2020) and Bjørnland (2009), among others.

Next, we distinguish between pure policy shocks and information shocks. The responses to a pure policy shock are displayed in the second column of Figure 1 and the third column shows the responses to an information shock. The pure policy shock induces contractionary effects, with persistent declines in production, consumer prices and equity prices as well as tightened financing conditions. The information shock, in contrast, exerts only a small effect on industrial production, but leads to higher consumer prices. Stock market prices increase and the lower excess bond premium declines.

Turning to the exchange rate, we see that although the exchange rate appreciates in response to either of the two shocks, the timing of the effects differs strongly. While the maximum response to the pure shock occurs close to impact, as in the case of the broad shock, the response is less persistent than in the first column of the figure, where the point estimate remains below zero for all horizons shown in the figure. The information shock has essentially no effect on the exchange rate in the short run, but the effect builds up over time and becomes more pronounced over the medium run and reaches its maximum roughly 2 years after the shock. Thus, for the case of the information shock we detect a persistent appreciation that is reminiscent of delayed overshooting dynamics. In general, the more persistent response of the exchange rate to an information shock is in line with the interest rate responses shown in Figure 1. The information shock generates an interest rate response that is substantially more persistent than the response to the pure shock, a result which is well-documented in the recent literature (see e.g. Jarocinski and Karadi 2020; Breitenlechner et al. 2021; Pinchetti and Szczepaniak 2021). Still, the delayed exchange rate appreciation that follows an information shock hints at a violation of the UIP condition.Footnote 17

Although the medium-run response of the exchange rate to the information shock is of a similar order of magnitude as the short-run response to the pure policy shock, it is somewhat less precisely estimated as indicated by the rather wide confidence bands at higher horizons. Still, the response is significant on the 68% level, indicating a systematic effect of the information shock on the exchange rate. Overall, it appears that the persistence of the response to the broad shock in the first column is largely the result of information effects.

To compare the contributions of pure policy and information shocks quantitatively, Fig. 2 presents the historical decomposition of the nominal effective exchange rate, which we obtain by following the approach suggested in Montiel Olea et al. (2021). The figure depicts the nominal effective exchange rate (black line) on the right axis together with the contributions of the two identified shocks on the left axis. It has to be noted that since the two shocks are only identified up to a scaling factor, only the relative size of the contributions can be interpreted.

Figure 2 shows that the contributions of the pure policy shock fluctuate stronger than those associated with the information shock, which is likely due to the substantially more persistent effects generated by the information shock, as discussed above. In other words, the figure indicates that pure policy shocks are more relevant when the exchange rate is subject to sharp, but short-lived movements, such as the appreciation in late 2008. Longer-lasting movements, in contrast, are primarily due to the slowly accumulating effects of the information shock.

3.2 Bilateral Exchange Rates and Deviations from UIP

To study the effect of monetary policy on foreign exchange markets in more detail and take potential heterogeneities into account, we now estimate separate VAR models including bilateral exchange rates. To do so, we replace the effective exchange rate index by either the British Pound, the Japanese Yen, or the Canadian Dollar exchange rate.Footnote 18

Figure 3 displays responses of these bilateral exchange rates after broad and pure policy shocks as well as information shocks.Footnote 19 We see that the appreciation of the Dollar against the British Pound is more persistent compared to the other exchange rates. And while the persistence is again strongly driven by the information shock in this case, the response to the pure shock is also more persistent than for the other exchange rates. The figure also shows that although the information shock gives rise to a delayed appreciation in general, with only small effects on impact, the U. S. Dollar initially depreciates against the Canadian Dollar, which is partly the reason for the dampened impact response to the broad policy shock. Nevertheless, over time the U.S. Dollar appreciates slowly in response to the information shock, similar to our baseline results. Overall, we conclude that the results for bilateral exchange exchange rates are largely similar to our findings for the nominal effective exchange rate.

A central assumption in the overshooting model of Dornbusch (1976) is that UIP holds. Hence, we can interpret the delayed overshooting patterns that we observe in Fig. 3 in response to an information shock as an indication of a violation of the UIP, conditional on the information shock. UIP implies that the interest rate differential between foreign and U.S. interest rates is offset by an expected depreciation of the dollar exchange rate over the holding period of a bond. Any deviation from the UIP gives rise to ex-post excess returns for investors who short the currency with the lower interest rate to benefit from the higher interest rates and an exchange rate appreciation implied by delayed overshooting. To perform a direct evaluation of UIP in the aftermath of policy announcements, we replace the bilateral exchange rates with ex-post deviations from UIP, re-estimate the VAR and calculate their responses to pure monetary policy and information shocks. We calculate the ex-post excess returns as:

where st is the exchange rate, \({i}_{t-h}^{*}\)and \({i}_{t-h}\) are the annualized foreign and U.S. money market interest rates for either one month (h = 1) or three months (h = 3) in period t − h. The factor 1200/h adjusts the annualized interest rate differential to either monthly or quarterly returns. As stated, a decline in st denotes an appreciation of the Dollar. Thus, the (ex-post) return reflects the return of an investor who shortens the U.S. Dollar in t − h (home country) and goes long in the foreign currency. Proceeds from this transaction, which are composed out of the interest rate differential i∗− it−h and the percentage appreciation or depreciation of the exchange rate from period t − h to t, are settled in period t. If λh < 0, the investor receives a negative return from the transaction.

Figures 4 and 5 show the responses of the monthly and quarterly ex-post UIP deviations, respectively. We see that broad monetary policy shocks give rise to only short-lived monthly and quarterly deviations from UIP, which is in line with Rüth (2020) and Bjørnland (2009), among others. Note that the responses of the UIP deviations are conditional on the monetary policy shock and do not necessarily tell us much about whether or not UIP holds unconditionally.Footnote 20

We also see that the responses to the broad shock mirror the responses to the pure shock in the second column of the figure, similar to our findings for the exchange rate responses.

The responses to the information shock are shown in last column. Interestingly, although the exchange rate responses to the information shock in Fig. 3 are rather persistent, the UIP deviations respond only slightly more persistently to the information shock than to the pure policy shock. For the Japanese Yen, the response of the UIP deviation is somewhat more persistent, but still small. Overall, we conclude that the persistence of the exchange rate responses to the information shock is only to a small extent mirrored in the responses of the ex-post UIP deviations. This may be partly due to the fact that although the exchange rate responses display a higher degree of persistence, most of the appreciation still occurs within the first few months after the shock and the exchange remains rather stable afterwards. Thus, even in the aftermath of an information shock, the contribution of the exchange rate movement to the UIP deviation vanishes quickly.

4 Robustness Analysis

In this section, we support our results by a number of robustness checks. First, we check the sensitivity of the results to the choice of the number of autoregressive lags. Thus, Figs. 6, 7, 8 and 9 present results for models with p = 4, p = 8, p = 10, and p = 12 lags. For the models with higher lag orders, the error bands are somewhat wider than what we obtain with the baseline specification, which might be due to the larger number of estimated parameters. Nevertheless, our main conclusions are robust with respect to the number of included lags.

Next, we estimate two models with alternative variables measuring economic activity and prices. First, we use the unemployment rate instead of industrial production as a broader measure for economic activity. And we replace industrial production and the consumer price index with GDP and GDP deflator from Jarocinski and Karadi (2020), who use the methodology of Stock and Watson (2010) to obtain interpolated monthly series. Both, GDP and the unem- ployment rate can be considered to be broader measures for economic activity, while the GDP deflator is based on producer prices instead of consumer prices. Although these measures are highly correlated, they may still cover somewhat different components of the monetary transmission mechanism and its effect on the exchange rate.Footnote 21 Figures 10 and 11 yield responses to the broad and pure policy shock that are consistent with standard macroeconomic theory and closely resemble our baseline findings. Figure 10 suggests that the information shock leads to a decrease in the unemployment rate. Looking at the exchange rate, we see that the response is again similar to the baseline results, although the information shock induces a depreciation on impact, prior to the persistent appreciation familiar from Fig. 1. Figure 11 shows a small expansionary GDP response following the information shock, which is somewhat in contrast to the slightly decreasing response of industrial production in Fig. 1. Overall, the responses are similar to our baseline results.

As a next step, we consider different monetary policy instruments. In particular, we replace the 3-month federal funds future surprise with the first principal component of surprises in the current month and 3-month federal funds rate and the 2-quarter, 3-quarter, and 4-quarter eurodollar future as an interest rate surprise, which we take from Jarocinski and Karadi (2020).Footnote 22

This surprise measure contains forward guidance elements to a larger degree.Footnote 23 Figure 12 shows that the results based on this instrument are in line with our baseline results.

Finally, we consider the methodology from Jarocinski and Karadi (2020), which differs from our baseline model in several aspects. The model is estimated with Bayesian methods and a Minnesota-type prior. The surprises in the 3-month federal funds future and the S&P500 are added as endogenous variables. And although the same sign restrictions as in Sect. 2 are used, the restrictions are imposed on the responses of two surprise measures in the VAR. Apart from the two surprise measures, we use the same endogenous variables as in our baseline analysis and we set the lag length to 6. Figure 13 illustrates the results. Interestingly, despite the results are based on a relatively different methodology, they are still quite similar as in Fig. 1. With respect to the exchange rate, our main conclusion remain valid.

IRFs, Jarocinski and Karadi (2020) Model

5 Conclusion

In this paper, we investigate exchange rate responses after policy announcements and distinguish between pure monetary policy shocks and information shocks, which are the result of new information conveyed in central bank announcements. We apply rotational sign restrictions as in Jarocinski (2020) to decompose high-frequency changes in the interest rate into a pure policy surprise and an information surprise and use these two orthogonal components as instruments in a proxy VAR to study the role of pure monetary policy and information shocks for exchange rate movements.

We find that although pure monetary policy shocks as well as information shocks give rise to exchange rate fluctuations, the dynamics generated by these two types of shock differ. Contractionary pure policy shocks evoke an appreciation on impact in line with the exchange rate overshooting model of Dornbusch (1976). While the response to pure policy shocks is initially pronounced, it is also transitory. Information shocks, in contrast, give rise to a delayed, albeit highly persistent, appreciation. And due to their persistent effects, information shocks contribute strongly to exchange rate fluctuations throughout the sample, as illustrated by a historical decomposition.

Our results suggest that the exchange rate channel of monetary policy does not only transmit pure policy shocks, but also information shocks. And these information shocks, due to their persistent effects, may play an even more prominent role than pure policy shocks in terms of macroeconomic implications. While a detailed analysis of these implications is beyond the scope of the paper, it represents an interesting avenue for future research.

Notes

Dornbusch (1976) overshooting hypothesis builds on a synthesis of the uncovered interest parity (UIP), purchasing power parity, and liquidity effects and holds that an increase in domestic interest rates relative to foreign interest rates leads to an immediate appreciation followed by a persistent depreciation of the domestic currency. A textbook treatment of the nexus of Dornbusch’s overshooting model and UIP is available in e.g. Obstfeld and Rogoff (1996).

Several studies find that information effects exert economically significant and persistent effects on interest rates (Jarocinski 2020; Jarocinski and Karadi 2020; Breitenlechner et al. 2021; Pinchetti and Szczepaniak 2021). Andrade and Ferroni (2021) find larger interest rate responses to information shocks around policy announcements than to pure policy shocks, while Cieslak and Schrimpf (2019) find evidence that information effects on impact account for a larger share in the variance decomposition of bond yields of different maturities.

Forbes et al. (2018) distinguish between different types of macroeconomic shocks and find that the degree of exchange rate pass-through depends on the shock. Although the analysis does not disentangle pure policy and information shocks, it shows that the type of shock triggering exchange rate adjustments matters for their implications.

Although information criteria suggest lower lag orders (AIC: 4 lags and BIC: 2 lags), we use 6 lags to appropriately capture the dynamics of the endogenous variables in our baseline estimation, taking into account that information criteria may underestimate the true lag length (Kilian 2001; Kilian and Lütkepohl 2017). In the robustness analysis we show that our results are not sensitive to the lag order.

In the robustness analysis we consider alternative sets of endogenous variables.

The start of the sample coincides roughly with the beginning of the Great Moderation and the end date is determined by the availability of high-frequency data.

Nakamura and Steinsson (2018) argue that unscheduled meetings may be arranged in response to other macroeconomic shocks and that these meetings should therefore be excluded. In addition, if unscheduled meetings are not expected by market participants, the pre-meeting asset prices may not capture the expected effect of the policy announcement (Caldara and Herbst 2019).

Andrade and Ferroni (2021) use a similar approach.

The approach suggested in Jarocinski and Karadi (2020) also disentangles policy and information effects, but it includes the surprise measures as internal instruments, i.e., as endogenous variables, which is not compatible with a proxy VAR. As a robustness analysis, we analyze information effects using the approach suggested in Jarocinski and Karadi (2020).

Other approaches, such as the standard sign restrictions approach in Jarocinski and Karadi (2020), treat every rotation consistent with the sign restrictions as equally likely, which would include all rotations calculated using values for λ ranging from 17.89 to 100 percent in our application. Thus, even extremely low values for λ would be possible, which seems rather unlikely considering our estimated variance share of λ = 86 percent as a reference (see Jarocinski 2020, for further details).

Gertler and Karadi (2015) estimate the contemporaneous response with a two stage approach. First, they regress the residuals from the policy indicator equation on the instruments and estimate the component in the residuals predicted by the instruments. In the second stage, they regress this component on the residuals in the policy indicator equation to estimate the impact effects. Up to scale, estimating δmp and δcbi as in Eq. (5) is equivalent to the following approach:

$$\begin{aligned}&u_{t}{^{mp}} = \gamma {^{0}} + \gamma {^{mp}}\,mpt + \gamma {^{cbi}}\,cbi_{t} + \eta_{t},\\& u_{t}{^{mp}}=\gamma {^{\mathrm{mp}}} \;\mathrm {mp}_{t},\\& u_{t}{^{cbi}} = \gamma {^{\mathrm{cbi}}}\; cbi_{t},\\& u_{t} = \delta {^{\mathrm{mp}}} u_{t}{^{\mathrm{mp}}}+\delta {^{\mathrm{cbi}}}u_{t}^{\mathrm{cbi}}+v_{t}\end{aligned}$$where the only difference to Gertler and Karadi (2015) is that the last three equations do not include constants, since we use two surprises in a single model to identify two shocks. We also estimated responses to the shocks in two separate models containing only a single instrument as in Gertler and Karadi (2015) and obtained virtually identical responses.

Many contributions in the proxy VAR literature calculate error bands using a wild bootstrap algorithm. However, Brüggemann et al. (2016) and Jentsch and Lunsford (2016) show that error bands based on this methodology are asymptotically invalid, which is why we use the approach of Montiel Olea et al. (2021).

Unfortunately, for the case of the NEER we lack a foreign synthetic interest rate to that would allow us to study deviations from UIP. In Sect. 3.2, we study deviations from UIP using bilateral exchange rates and corresponding interest rates.

We choose these exchange rates since we want to focus on exchange rates to other G7 countries. Due to limited data availability, we abstract from an analysis of the U.S. Dollar-Euro exchange rate and estimate the VAR with the U.S. Dollar-Japanese Yen exchange rate and with the U.S. Dollar-Canadian Dollar exchange rate with data starting in 1985M12. For more details, please see Table 1.

In this figure we do not show the responses of the macroeconomic variables, which closely resemble the responses in the baseline model shown in Fig. 1.

The reason why we do not use these variables already in the baseline model is that GDP and GDP deflator have to be interpolated to be available at monthly frequency, while the unemployment rate may respond with a delay.

A drawback of this measure is, however, that eurodollar futures are not as liquid as federal funds futures (see e.g. Jarocinski and Karadi 2020).

References

Afat D, Frömmel M (2021) A panel data analysis of uncovered interest parity and time-varying risk premium. Open Econ Rev 32:507–526

Anderl C, Caporale GM (2022) Testing for UIP-type relationships: Nonlinearities, monetary announcements and interest rate expectations. Open Econ Rev Forthcoming

Andrade P, Ferroni F (2021) Delphic and Odyssean monetary policy shocks: Evidence from the euro area. J Monet Econ 117:816–832

Bjørnland HC (2009) Monetary policy and exchange rate overshooting: Dornbusch was right after all. J Int Econ 79:64–77

Breitenlechner M, Gründler D, Scharler J (2021) Unconventional monetary policy announcements and information shocks in the U.S. J Macroecon 67:103283

Brüggemann R, Jentsch C, Trenkler C (2016) Inference in VARs with conditional heteroskedasticity of unknown form. J Econometr 191:69–85

Burnside C, Eichenbaum M, Kleshchelski I, Rebelo S (2011) Do peso problems explain the returns to the carry trade? Rev Financial Stud 24:853–891

Caldara D, Herbst E (2019) Monetary policy, real activity, and credit spreads: Evidence from Bayesian proxy SVARs. Am Econ J Macroecon 11:157–192

Campbell JR, Evans CL, Fisher JD, Justiniano A, Calomiris CW, Woodford M (2012) Macroeconomic effects of Federal Reserve forward guidance. Brook Pap Econ Act 1–80

Cieslak A, Schrimpf A (2019) Non-monetary news in central bank communication. J Int Econ 118:293–315

Dery C, Serletis A (2021) The relative importance of monetary policy, uncertainty, and financial shocks. Open Econ Rev 32:311–333

Dornbusch R (1976) Expectations and exchange rate dynamics. J Political Econ 84:1161–1176

Eichenbaum M, Evans CL (1995) Some empirical evidence on the effects of shocks to monetary policy on exchange rates. Quart J Econ 110:975–1009

Fama EF (1984) Forward and spot exchange rates. J Monet Econ 14:319–338

Faust J, Rogers JH (2003) Monetary policy’s role in exchange rate behavior. J Monet Econ 50:1403–1424

Favara G, Gilchrist S, Lewis KF, Zakrajsek E (2016) Updating the recession risk and the excess bond premium. FEDS Notes. Board of Governors of the Federal Reserve System, Washington

Federal Reserve (2008) FOMC statement. Press Release. Board of Governors of the Federal Reserve System. https://www.federalreserve.gov/newsevents/pressreleases/monetary20080130a.html. Accessed 17 May 2022

Forbes K, Hjortsoe I, Nenova T (2018) The shocks matter: Improving our estimates of exchange rate pass-through. J Int Econ 114:255–275

Froot KA, Thaler RH (1990) Anomalies: Foreign exchange. J Econ Perspect 4:179–192

Gertler M, Karadi P (2015) Monetary policy surprises, credit costs, and economic activity. Am Econ J Macroecon 7:44–76

Grilli V, Roubini N (1995) Liquidity and exchange rates: Puzzling evidence from the G-7 countries. Yale University, Mimeo

Grilli V, Roubini N (1996) Liquidity models in open economies: Theory and empirical evidence. Eur Econ Rev 40:847–859

Gürkaynak RS, Sack B, Swanson ET (2005) Do actions speak louder than words? The response of asset prices to monetary policy actions and statements. Int J Central Bank 1:55–93

Hamilton JD (2008) Daily monetary policy shocks and new home sales. J Monet Econ 55:1171–1190

Inoue A, Rossi B (2019) The effects of conventional and unconventional monetary policy on exchange rates. J Int Econ 118:419–447

Jarocinski M (2020) Central bank information effects and transatlantic spillovers. ECB Working Paper 2482/2020. Eur Central Bank

Jarocinski M, Karadi P (2020) Deconstructing monetary policy surprises – the role of infor- mation shocks. Am Econ J Macroecon 12:1–43

Jentsch C, Lunsford KG (2016) Proxy SVARs: Asymptotic theory, bootstrap inference, and the effects of income tax changes in the United States. Work Pap 16–19. Federal Reserve Bank of Cleveland

Kerssenfischer M (2019) Information effects of euro area monetary policy: New evidence from high-frequency futures data. Bundesbank Discussion Paper 07/2019. Deutsche Bundesbank

Kilian L (2001) Impulse response analysis in vector autoregressions with unknown lag order. J Forecast 20:161–179

Kilian L, Lütkepohl H (2017) Structural vector autoregressive analysis. Cambridge University Press

Kuttner KN (2001) Monetary policy surprises and interest rates: Evidence from the Fed funds futures market. J Monet Econ 47:523–544

Lustig H, Verdelhan A (2007) The cross section of foreign currency risk premia and consumption growth risk. Am Econ Rev 97:89–117

MacDonald M, Popiel MK (2020) Unconventional monetary policy in a small open economy. Open Econ Rev 31:1061–1115

Miranda-Agrippino S (2016) Unsurprising shocks: Information, premia, and the monetary transmission. Staff Working Paper 626. Bank of England

Miranda-Agrippino S, Ricco G (2018) The transmission of monetary policy shocks. CEPR Discussion Papers 13396. Centre Econ Policy Res

Mitchell K, Pearce DK (2020) How did unconventional monetary policy affect economic forecasts? Contemp Econ Policy 38:206–220

Montiel Olea JL, Stock JH, Watson MW et al (2021) Inference in structural vector autoregressions identified with an external instrument. J Econometr 225:74–87

Müller GJ, Wolf M, Hettig T (2019) Exchange Rate Undershooting: Evidence and Theory. CEPR Discussion Paper 13597. CEPR Discuss Pap

Nakamura E, Steinsson J (2018) High-frequency identification of monetary non-neutrality: The information effect. Quart J Econ 133:1283–1330

Obstfeld M, Rogoff KS (1996) Foundations of International Macroeconomics. MIT Press, Cambridge

Paul P (2020) The time-varying effect of monetary policy on asset prices. Rev Econ Stat 102:690–704

Pinchetti M, Szczepaniak A (2021) Global spillovers of the Fed information effect. Bank England Work Pap 952. Bank of England

Plagborg-Møller M, Wolf CK (2021) Local projections and vars estimate the same impulse responses. Econometrica 89:955–980

Rogers JH, Scotti C, Wright JH (2018) Unconventional monetary policy and international risk premia. J Money Credit Bank 50:1827–1850

Romer CD, Romer DH (2000) Federal Reserve information and the behavior of interest rates. Am Econ Rev 90:429–457

Rüth SK (2020) Shifts in monetary policy and exchange rate dynamics: Is Dornbusch’s overshooting hypothesis intact, after all? J Int Econ 126:103344

Scholl A, Uhlig H (2008) New evidence on the puzzles: Results from agnostic identification on monetary policy and exchange rates. J Int Econ 76:1–13

Stock HJ, Watson MW (2010) Monthly GDP and GNI. Res Memo

Swanson ET (2021) Measuring the effects of federal reserve forward guidance and asset purchases on financial markets. J Monet Econ 118:32–53

Acknowledgements

We are grateful to the Editor, George Tavlas, and two anonymous referees for their comments and suggestions.

Funding

Open Access funding enabled and organized by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Gründler, D., Mayer, E. & Scharler, J. Monetary Policy Announcements, Information Shocks, and Exchange Rate Dynamics. Open Econ Rev 34, 341–369 (2023). https://doi.org/10.1007/s11079-022-09682-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-022-09682-6