Abstract

We examine whether unscheduled communication of members of the European Central Bank’s (ECB) Governing Council affects financial market comovements. To assess comovements, we employ well-defined measures of stock market and government bond yield coexceedances, i.e., the measures of whether markets jointly decrease or increase and by how much. We use the daily data from 2008 to 2014 for the four largest euro area countries, Germany, France, Italy and Spain, in a quantile regression framework and control for persistence in coexceedances and a comprehensive set of relevant factors capturing returns and volatility in various segments of financial markets. We find that central bank communication often contributes to greater coexceedances but only when there are extreme events in the financial markets. The results also suggest that markets perceive the ECB’s communication as a euro area-wide shock, but propagation of this shock depends on the financial (in)stability of individual euro area countries.

Similar content being viewed by others

Notes

We understand unscheduled communication to be any verbal or written statement by a member of a policy-making body (the Governing Council in the case of the ECB, i.e., the executive board of the ECB and national central bank governors) that occurs outside of any scheduled release of a central bank.

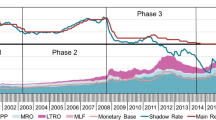

In our sample, a secondary market purchase program is actively helping to restore confidence in the segment of Italian and Spanish bond market and 3-year long-term refinancing operations are more broadly helping to improve liquidity conditions in the stressed markets of the euro area.

References

Albuquerque R, Vega C (2009) Economic news and international stock market co-movement. Rev Financ 13(3):401–465

Bae K-H, Karolyi GA, Stulz RM (2003) A new approach to measuring financial contagion. Rev Financ Stud 16(3):717–763

Baruník J, Kočenda E, Vácha L (2016) Gold, oil, and stocks: dynamic correlations. Int Rev Econ Financ 42:186–201

Baur D, Schulze N (2005) Coexceedances in financial markets - a quantile regression analysis of contagion. Emerg Mark Rev 6(1):21–43

Beck M-K, Hayo B, Neuenkirch M (2013) Central bank communication and correlation between financial markets: Canada and the United States. J Int Econ Econ Policy 10(2):277–296

Bekaert G, Ehrmann M, Fratzscher M, Mehl A (2014) The global crisis and equity market contagion. J Financ 69(6):2597–2649

Belke A (2018) Central bank communication and transparency: the ECB and the European Parliament. Int J of Monet Econ Financ 11(5):416–435

Blinder ASM, Ehrmann M, Fratzscher JDH, Jansen D-J (2008) Central bank communication and monetary policy: A survey of theory and evidence. J Econ Lit 46(4):910–945

Blinder A, Ehrmann M, De Haan J, Jansen D-J (2017) Necessity as the mother of invention: monetary policy after the crisis. Econ Policy 32(92):707–755

Born B, Ehrmann M, Fratzscher M (2014) Central bank communication on financial stability. Econ J 124(577):701–734

Briere M (2006) "Market reactions to central bank communication policies: Reading interest rate options smiles", Working Papers CEB 38, ULB - Universite Libre de Bruxelles

Brunnermeier MK, Pedersen LH (2009) Market liquidity and funding liquidity. Rev Financ Stud 22(6):2201–2238

Caballero RJ, Krishnamurthy A (2008) Collective risk management in a flight to quality episode. J Financ 63(5):2195–2230

Cieslak A, Schrimpf A (2019) Non-monetary news in central bank communication. J Int Econ 118:295–315

Coenen G, Ehrmann M, Gaballo G, Hoffmann P, Nakov A, Nardelli S, Persson E, Strasser G (2017) "Communication of monetary policy in unconventional times", European Central Bank working paper, No. 2080

Coenen G, Ehrmann M, Gaballo G, Hoffmann P, Nakov A, Nardelli S, Persson E, Strasser G (2018) More, and more forward-looking: central bank communication after the crisis. In: Eijffinger S, Masciandaro D (eds) Hawks and doves: deeds and words - economics and politics of monetary policymaking, a VoxEU.org eBook. CEPR Press, London

Dincer N, Eichengreen B (2014) Central bank transparency and independence: updates and new measures. Int J Cent Bank 10(1):189–253

Ehrmann M, Fratzscher M (2007a) Communication by central bank committee members: different strategies, same effectiveness? J Money Credit Bank 39(2–3):509–541

Ehrmann M, Fratzscher M (2007b) The timing of central bank communication. Eur J Polit Econ 23(1):124–145

Forbes KJ, Rigobon R (2002) No contagion, only interdependence: measuring stock market comovements. J Financ 57(5):2223–2261

Gertler P, Horvath R (2018) Central bank communication and financial markets: high-frequency evidence. J Financ Stab 36:336–345

Guo F, Chen CR, Huang YS (2011) Markets contagion during financial crisis: a regime-switching approach. Int Rev Econ Financ 20(1):95–109

Hansen S, McMahon M (2018) How central bank communication generates market news. In: Eijffinger S, Masciandaro D (eds) Hawks and doves: deeds and words - economics and politics of monetary policymaking, a VoxEU.org eBook. CEPR Press, London

Hayo B, Neuenkirch M (2012) Domestic or U.S. news: what drives Canadian financial markets? Econ Inq 50(3):690–706

Hayo B, Kutan AM, Neuenkirch M (2010) The impact of U.S. central bank communication on European and pacific equity markets. Econ Lett 108(2):172–174

Hayo B, Kutan A, Neuenkirch M (2015) Financial market reaction to Federal Reserve communications: does the global financial crisis make a difference? Empirica 42(1):185–203

Horváth R, Lyocsa S (2018) Stock market contagion: a new approach. Open Econ Rev:391–412

Horváth R, Vaško D (2016) Central bank transparency and financial stability. J Financ Stab 22:45–56

Horváth R, Baumohl E, Lyocsa S (2018) Stock market contagion in central and Eastern Europe: unexpected volatility and extreme co-exceedance. Eur J Financ 24(5):391–412

Leombroni, M. & A. Vedolin, & G. Venter & P. Whelan (2018) Central Bank communication and the yield curve. CEPR Discussion Paper No. DP12970

Longin F, Solnik B (2001) Extreme correlation of international equity markets. J Financ 56(2):649–679

Matejka F, Steiner J, Stewart C (2017) Rational inattention dynamics: inertia and delay in decision-making. Econometrica 85(2):521–553

Pastor L, Veronesi P (2012) Uncertainty about government policy and stock prices. J Financ 67(4):1219–1264

Ranaldo A, Rossi E (2010) The reaction of asset markets to Swiss National Bank communication. J Int Money Financ 29(3):486–503

Acknowledgements

We thank two anonymous referees, Ansgar Belke, Michal Hlavacek, Stefan Lyocsa and Jakub Seidler for their helpful comments. The views in this paper do not represent the views of the National Bank of Slovakia. Horvath appreciate the support of the Grant Agency of the Czech Republic, no. 19-15650S. Online Appendix is available at http://ies.fsv.cuni.cz/en/staff/horvath.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

ESM 1

(DOCX 252 kb)

Rights and permissions

About this article

Cite this article

Gertler, P., Horváth, R. & Jonášová, J. Central Bank Communication and Financial Market Comovements in the Euro Area. Open Econ Rev 31, 257–272 (2020). https://doi.org/10.1007/s11079-019-09561-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-019-09561-7