Abstract

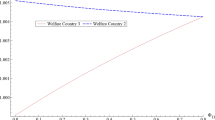

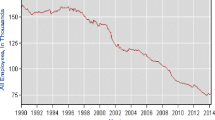

We devise a model in which domestic firms do applied R&D, which can be subsidized by the government, and foreign firms with superior technology can enter in the domestic market. Foreign Direct Investment can act as a substitute of subsidies to improve domestic R&D, the share of domestic leading firms and consumption. Relatively closed economies may benefit from R&D subsidization while relatively open economies may not. For relatively low growth of the technological frontier, it is optimal to subsidize R&D and close the economy to foreign investment but the opposite happens for relatively high growth. Numerical simulations show the economy dynamics after policy experiments.

Similar content being viewed by others

Notes

Governments can use trade policy to promote or not the technology imports. In that sense the openness to technological imports is a policy-influenced variable (see, e.g., Herrendorf and Teixeira2002).

Openness in this model is defined as openness to foreign direct investment.

(Gersbach et al. 2010) study the effect of openness on the interplay between basic and applied research. However, their model is static and, furthermore, the possibility of subsidies to private R&D expenditure is not considered.

We focus on the case that s r is positive—i.e., a subsidy—which is the most realistic case. However a tax to R&D could also be considered. In this case, the income raised by the government could be rebated to households as lump-sum transfers.

This reflects the fact that foreign firms produce the intermediate good within the country.

This is the average between 1990 and 2000, the decade in which TFP grew at its highest rate when compared to any other decade between 1870 and 2000, according to (Baier et al. 2006). Klenow and Rodriguez-Clare (2005), p. 839, used a value of 1.5 % for the average TFP growth in OECD countries between 1960 and 2000.

At the steady state, consumption and income grow at a rate γ 1 − α − 1.

It is computed from the definition of the growth rate of the technological frontier as the solution to (1+0.015)10 = g (1 − α)/α, with α = 0.4.

Parameter values are restricted so that the condition (31) is satisfied, which ensures the existence of a steady state.

We have limited the optimal s r to be zero in the figures. Actually, without such a restriction, the optimal subsidy rate would be negative, implying that for most degrees of openness the economy should tax R&D instead of subsidizing it.

This is the reason why the corresponding figure is not depicted.

This happens at γ = 1.68.

Actually, we represent the value of detrended consumption; i.e., \(\tilde c_{t}= g^{-(1-\alpha )t}c_{t}\), which is constant in the steady state.

The terms in \(L_{A_{1}}^{\lambda }\) and \(L_{A_{1}}^{1-\lambda }\) should be interchanged if λ < 1/2, but it does not affect to the following argument.

References

Aizenman J, Jinjarak Y (2012) Capital flows and economic growth in the era of financial integration and crisis, 19902010. Open Econ Rev 24(3):371–396

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60(2):323–351

Alvarez-Pelaez MJ, Groth C (2005) Too little or too much R&D? Eur Econ Rev 49(2):437–456

Baier S, Dwyer G, Tamura R (2006) How important are capital and total factor productivity for economic growth. Econ Inq 44(1):23–49

Baldwin R, Braconier H, Forslid R (2005) Multinationals, endogenous growth, and technological spillovers: theory and evidence. Rev Int Econ 13(5):945–963

Baltabaev B (2014) Foreign direct investment and total factor productivity growth: new macro-evidence. World Econ 37(2):311–334

Bloom N, Griffith R, Reenen J (2002) Do R&D tax credits work? Evidence from a panel of countries 1979-1997. J Public Econ 85(1):1–31

Bye B, Faehn T, Grunfeld L (2011) Growth and innovation policy in a small open econom: should you stimulate domestic R&D or exports? The B. E. J Econ Anal Policy 11(1):1–41

Cieslik A, Ryan M (2013) Productivity differences and foreign market entry in an oligopolistic industry. Open Econ Rev 23(3):551–557

Coe D, Helpman E (1995) International R&D spillovers. Eur Econ Rev 39(5):859–887

Coe D, Helpman E, Hoffmaister A (2009) International R&D spillovers and institutions. Eur Econ Rev 53(7):723–741

Engelbrecht H-J (1997) International R&D spillovers, human capital and productivity in OECD economies: an empirical investigation. Eur Econ Rev 41(8):1479–1488

Gersbach H, Schneider M, Schneller O (2010) Optimal mix of applied and basic research, distance to frontier and openness. CEPR Discussion Papers 7795, Center for Economic Policy Research

Gersbach H, Schneider M, Schneller O (2013) Basic research, openness and convergence. J Econ Growth 18(1):33–68

Gómez MA, Sequeira TN (2014) Should the US increase subsidies to R&D?lessons from an endogenous growth theory. Oxf Econ Pap 66(1):254–282

Grossman GM, Helpman E (1991) Innovation and Growth in the Global Economy. MIT Press, Cambridge

Grossmann V, Steger T, Trimborn T (2014) Quantifying optimal growth policy. forthcoming

Herrendorf B, Teixeira A (2002) How trade policy affects technology adoption and productivity? CEPR Discussion Papers 3486, Center for Economic Policy Research

Jameson GJO (2006) Counting zeros of generalised polynomials: Descarte’s rule of signs and Laguerre’s extensions. Math Gaz 90(518):223–234

Jones CI, Williams JC (2000) Too much of a good thing? The economics of investment in R&D. J Econ Growth 5(1):65–85

Ka-Yiu Fung M (1994) Technology policies, technology transfer by multinacional entreprises and R&D activities in LDCs. Open Econ Rev 5(3):275–287

Klenow PJ, Rodriguez-Clare A (2005) Externalities and growth. In: Aghion P, Durlauf S (eds) Handbook of Economic Growth, vol 1. Elsevier, pp 817–861

Segerstrom PS (2000) The long-run growth effects of R&D subsidies. J Econ Growth 5(3):277–305

Tanaka H, Iwaisako T (2014) Intellectual property rights and foreign direct investment: a welfare analysis. Eur Econ Rev 67(C):107–124

Varga J, Roeger W, Veld J (2014) Growth effects of structural reforms in Europe: the case of Greece, Italy, Spain and Portugal. Empirica 41(2):323–363

Acknowledgments

The authors acknowledge valuable contributions of two anonymous referees and the Editor. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Additional information

I gratefully acknowledge financial support from the Spanish Ministry of Economics and Competitiveness through grant ECO2011-25490.

I gratefully acknowledge financial support from FCT and FEDER/COMPETE through grants UID/ECO/04007/2013 and POCI-01-0145-FEDER-007659.

Appendix A: Proofs

Appendix A: Proofs

Proof of Proposition 1

Equation 20 is obtained from Eq. 19, using that \(s_{1,t}=s_{1,t-1}=\bar s_{1}\). Equation 21 and (22) result from Eqs. 15 and (16). Substituting (20) into (18), and rearranging terms, we get Eq. 23, which is a generalized polynomial whose coefficients are ordered in decreasing order.Footnote 14 If the coefficient of \(L_{A_{1}}\) is nonnegative, there is only one sign change in the sequence of coefficients and, therefore, there is exactly one root in (0, ∞ ) (see Jameson2006). If the coefficient of \(L_{A_{1}}\) is negative, there are two changes of sign and, therefore, there are zero or two roots. Given that p(0) < 0 and

there is exactly one feasible solution \(\bar L_{A_{1}}\in (0,(1/\theta )^{1/\lambda })\) to Eq. 23—and, as \(\bar L_{A_{2}}=\eta ^{1/(1-\lambda )} \bar L_{A_{1}}\), we also have that \(\bar L_{A_{2}}\in (0,(1/(\eta \theta ))^{1/\lambda })\). Now, Eq. 20 entails that \(\bar s_{1}\in (0,1)\), which proves that there is a unique feasible steady state.

To prove stability, let us differentiate s 1,t in Eq. 19 with respect to s 1,t−1 to obtain that

Implicit differentiation of Eq. 18 entails that

where

and, using Eq. 18,

Evaluating d s 1,t /d s 1,t−1 at the steady state, after simplification, we get that

Hence, it must be that d s 1,t /d s 1,t − 1∈(0, 1) at the steady state and, therefore, the steady state is stable. □

Proof Proof of Proposition 2

Differentiating Eq. 24 and evaluating at the steady state we have that

and \(\partial h/\partial L_{A_{1}}>0\) is given by Eq. 32 after replacing s 1,t−1 with \(\bar s_{1}\). Differentiating (25) we get

Let A denote the matrix

Using the former results on the sign of the derivatives, we have that detA < 0.

Let us first study the effect on the skilled labor devoted to research. Using the implicit function theorem, we get that

Hence, an increase in the subsidy to R&D increases the skilled labor devoted to applied research. From Eq. 37 we have that sign dL̄ A 1/dσ) = −sign(∂h/∂σ) = sign [1 − (γ − 1) (1 − s̄1)]. If γ ≤ 2, we immediately have that \(d\bar L_{A_{1}}/d\sigma >0\). If γ > 2, using Eq. 20, we have that \(d\bar L_{A_{1}}/d\sigma =0\) —i.e., \((\gamma -1)(1-\bar s_{1})=1\)— if

Substituting \(\tilde L_{A_{1}}\) into Eq. 23, and denoting \({\Theta }=p(\tilde L_{A_{1}})\), we get Eq. 26. Hence, we immediately have that \(d\bar L_{A_{1}}/d\sigma >0\) if γ ≤ 2 or if γ > 2 and Θ < 0; \(d\bar L_{A_{1}}/d\sigma =0\) if γ > 2 and Θ=0, and \(d\bar L_{A_{1}}/d\sigma <0\) if γ > 2 and Θ > 0.

The effects of the subsidy to R&D and openness on the steady-state fraction of state 1 can be easily obtained by differentiation of Eq. 20:

which entails that sign(ds̄ 1/d) = sign (dL̄ A1 dσ). In any case, we have that \(\bar s_{1}\) and \(\bar L_{A_{1}}\) evolve in the same direction. Skilled labor devoted to R&D is given by

where we have used Eq. 21 and that \(L_{A_{2}}=\eta ^{1/(1-\lambda )}L_{A_{1}}\). Differentiating the former expression with respect to x, where x can stand for s r or σ, we get that

Given that \(\bar s_{1}\) and \(\bar L_{A_{1}}\) evolve in the same direction, skilled labor devoted to research \(\bar L_{R}\) does so. This completes the proof. □

Proof Proof of Lemma 1

Noting that Eq. 36 entails that

after simplification, we have that

Furthermore, we have that ∂Υ/∂ s 1 = (1 − τ f )(1 − α)α σ+(γ−1)(1 − σ)/γ > 0, and thus, using Eq. 38, we get that

□

Rights and permissions

About this article

Cite this article

Gómez, M.A., Sequeira, T.N. R&D Subsidies and Foreign Direct Investment. Open Econ Rev 27, 769–793 (2016). https://doi.org/10.1007/s11079-016-9390-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-016-9390-3