Abstract

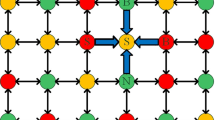

Financial market is a complex evolving dynamic system with high volatilities and noises, and the modeling and the analyzing of financial time series are regarded as the rather challenging tasks in financial research. In this work, by applying the Potts dynamic system, a random financial time series model is developed in an attempt to uncover the empirical laws in finance, where the particles in the Potts model are introduced to imitate the attitudes of market traders. Through the computer simulation on the selected data, we present the numerical research in conjunction with statistical analysis and nonlinear analysis to investigate the volatilities of financial time series. The fluctuation behavior of logarithmic returns of the proposed model is investigated by MCID, q-MCID and EMD-MCID analyses. Furthermore, in order to obtain a robust conclusion, the complex dynamic behaviors of return time series of the model are investigated by using multiaspect chaos-exploring methods, phase space reconstruction, correlation dimension analysis, largest Lyapunov exponent, density of Kolmogorov–Sinai entropy and Kolmogorov–Sinai entropy universality. The corresponding daily return behaviors of SSE, SZSE, S&P500, IXIC, FTSE, Nikkei and AEX are considered for comparison.

Similar content being viewed by others

References

Amaral, L.A.N., Buldyrev, S.V., Havlin, S., Salinger, M.A., Stanley, H.E.: Power law scaling for a system of interacting units with complex internal structure. Phys. Rev. Lett. 80, 1385–1388 (1998)

Bouchaud, J.P., Potters, M.: Theory of Financial Risk and Ferivative Pricing: From Statistical Physics to Risk Management. Cambridge University Press, Cambridge (2003)

Stanley, H.E., Gabaix, X., Gopikrishnan, P., Plerou, V.: Economic fluctuations and statistical physics: the puzzle of large fluctuations. Nonlinear Dyn. 44, 329–340 (2006)

Plerou, V., Rosenow, B., Amaral, L.A.N., Stanley, H.E.: Econophysics: financial time series from a statistical physics point of view. Phys. A 279, 443–456 (2000)

Iori, G.: A threshold model for stock return volatility and trading volume. Int. J. Theor. Appl. Financ. 3, 467–472 (2000)

Peters, E.E.: Fractal Market Analysis: Applying Chaos Theory to Investment and Economics. Wiley, New York (1994)

Tsay, R.S.: Analysis of Financial Time Series. Wiley, Hoboken (2005)

Grech, D., Pamula, G.: Multifractality of nonlinear transformations with application in finances. Acta Phys. Pol. A 123, 529–537 (2013)

Hong, W.J., Wang, J.: Multiscale behavior of financial time series mode l from Potts dynamic system. Nonlinear Dyn. 78, 1065–1077 (2014)

Gabaix, X., Gopikrishanan, P., Plerou, V., Stanley, H.E.: A theory of power-law distributions in financial market fluctuations. Nature 423, 267–270 (2003)

Lamberton, D., Lapeyre, B.: Introduction to Stochastic Calculus Applied to Finance. Chapman and Hall/CRC, London (2000)

Vargas, J.A.R., Grzeidak, E., Hemerly, E.M.: Robust adaptive synchronization of a hyperchaotic finance system. Nonlinear Dyn. 80, 239–248 (2015)

Black, F., Scholes, M.: The pricing of options and corporate liabilities. J. Polit. Econ. 81, 637–654 (1973)

Lux, T.: Estimation of an agent-based model of investor sentiment formation in financial markets. J. Econ. Dyn. Control 36, 1284–1302 (2012)

Lux, T., Marchesi, M.: Scaling and criticality in a stochastic multiagent model of a financial market. Nature 397, 498–500 (1999)

Stauffer, D.: Can percolation theory be applied to the stock market. Ann. Phys. 7, 529–538 (1998)

Wang, F., Wang, J.: Statistical analysis and forecasting of return interval for SSE and model by lattice percolation system and neural network. Comput. Ind. Eng. 62, 198–205 (2012)

Zivot, E., Wang, J.H.: Modeling Financial Time Series with S-PLUS. Springer, New York (2006)

Mike, S., Farmer, J.D.: An empirical behavioral model of liquidity and volatility. J. Econ. Dyn. Control 32, 200–234 (2008)

Zhang, J., Small, M.: Complex network from pseudo periodic time series: topology versus dynamics. Phys. Rev. Lett. 96, 238701 (2006)

Niu, H.L., Wang, J.: Volatility clustering and long memory of financial time series and financial price model. Digit. Signal Process. 23, 489–498 (2013)

Zhang, J.H., Wang, J.: Modeling and simulation of the market fluctuations by the finite range contact systems. Simul. Model. Pract. Theory 18, 910–925 (2010)

Durrett, R.: Lecture Notes on Particle Systems and Percolation. Wadsworth & Brooks, Pacific Grove (1998)

Liggett, T.M.: Stochastic Interacting Systems: Contact Exclusion Processes. Springer, Berlin (1999)

Bornholdt, S., Wagner, F.: Stability of money: phase transitions in an Ising economy. Phys. A 316, 453–468 (2002)

Fang, W., Wang, J.: Fluctuation behaviors of financial time series by a stochastic Ising system on a Sierpinski carpet lattice. Phys. A 392, 4055–4063 (2013)

Elliott, R.J., Siu, T.K., Fung, E.S.: Filtering a nonlinear stochastic volatility model. Nonlinear Dyn. 67, 1295–1313 (2012)

Grollau, S., Rosinberg, M.L., Tarjus, G.: The ferromagnetic \(q\)-state Potts model on three-dimensional lattices: a study for real values of \(q\). Phys. A 296, 460–482 (2001)

Ananikian, N., Artuso, R., Chakhmakhchyan, L.: Superstable cycles for antiferromagnetic Q-state Potts and three-site interaction Ising models on recursive lattices. Commun. Nonlinear Sci. Numer. Simul. 19, 3671–3678 (2014)

Baxter, R.J.: Potts model at the critical temperature. J. Phys. C Solid State Phys. 6, 445 (1973)

Deng, Y., Bl\(\ddot{o}\)te, H.W.J., Nienhuis, B.: Backbone exponents of the two-dimensional \(q\)-state Potts model: a Monte Carlo investigation. Phys. Rev. E 69, 026114 (2004)

Hartmann, A.K.: Calculation of partition functions by measuring component distributions. Phys. Rev. Lett. 94, 05060 (2005)

Wu, F.Y.: The potts model. Rev. Mod. Phys. 54, 235–268 (1982)

Ross, S.M.: An Introduction to Mathematical Finance. Cambridge University Press, Cambridge (1999)

Gabaix, X.: Power laws in economics and finance. Annu. Rev. Econ. 1, 255–294 (2009)

Liu, D.: Particle-scale modelling of financial price dynamics. Commun. Nonlinear Sci. Numer. Simul. 43, 282–295 (2017)

Fang, W., Wang, J.: Statistical properties and mutifractal behavior of market returns by Ising dynamic systems. Int. J. Mod. Phys. C 23, 1250023 (2012)

Gabaix, X., Gopikrishnan, P., Plerou, V., Stanley, H.E.: Are stock market crashes outliers. Working Paper, Massachusetts Institute of Technology (2005)

Grau-Carles, P.: Long-range power-law correlations in stock returns. Phys. A 299, 521–527 (2001)

Gustavo, E.A.P.A.B., Eamonn, J.K., Oben, M.T., Vinícius, M.A.S.: CID: an efficient complexity-invariant distance for time series. Data Min. Knowl. Discov. 28, 634–669 (2014)

Huang, N.E., Zheng, S., Long, S.R., Wu, M.C., Shih, H.H., Zheng, Q., Yen, N.C., Tung, C.C., Liu, H.H.: The empirical mode decomposition and the Hilbert spectrum for nonlinear and nonstationary time series ayalysis. Proc. R. Soc. Lond. Ser. A 454, 903–995 (1998)

Huang, Y.X., Schmitt, F.G., Hermand, J.P., et al.: Arbitraryorder Hilbert spectral analysis for time series possessing scaling statistics: comparison study with detrended fluctuation analysis and wavelet leaders. Phys. Rev. E 84, 016208 (2011)

Qian, X.Y., Gu, G.F., Zhou, W.X.: Modified detrended fluctuation analysis based on empirical mode decomposition for the characterization of antipersistent processes. Phys. A 390, 4388–4395 (2011)

Guhathakurta, K., Mukherjee, I., Chowdury, A.R.: Empirical mode decomposition analysis of two different financial time series and their comparison. Chaos Solitons Fractals 37, 1214–1227 (2008)

Niu, H.L., Wang, J.: Phase and multifractality analyses of random price time series by finite-range interacting biased voter system. Comput. Stat. 29, 1045–1063 (2014)

Zhang, B., Wang, J., Fang, W.: Volatility behavior of visibility graph EMD financial time series from Ising interacting system. Phys. A 432, 301–314 (2015)

Wu, Z., Huang, N.E.: Ensemble empirical mode decomposition: a noise-assisted data analysis method. Adv. Adapt. Data Anal. 1, 1–41 (2009)

Fang, S.C., Chan, H.L.: Human identification by quantifying similarity and dissimilarity in electrocardiogram phase space. Pattern Recognit. 42, 1824–1831 (2009)

Takens, F.: Detecting Strange Attractors Inturbulence. Springer, Berlin (1981)

Packard, N.H., Crutchfield, J.P., Farmer, J.D., Shaw, R.S.: Geometry from a time series. Phys. Rev. Lett. 45, 712 (1980)

Fraser, A.M., Swinney, H.L.: Independent coordinates for strange attractors from mutual information. Phys. Rev. A 33, 1134–1140 (1986)

Kennel, M.B., Brown, R., Abarbanel, H.D.I.: Determin- ing embedding dimension for phase-space reconstruction using a geometrical construction. Phys. Rev. A 45, 3403 (1992)

Grassberger, P., Procaccia, I.: Measuring the strangeness of strange attractors. Phys. A 9, 189–208 (1983)

Rosenstein, M.T., Collins, J.J., De Luca, C.J.: A practical method for calculating largest Lyapunov exponents from small data sets. Phys. D Nonlinear Phenom. 65, 117–134 (1993)

Wolf, A., Swift, J.B., Swinney, H.L., Vastano, J.A.: Determining Lyapunov exponents from a time series. Phys. D Nonlinear Phenom. 16, 285–317 (1985)

Zhang, Y.Q., Wang, X.Y.: A new image encryption algorithm based on non-adjacent coupled map lattices. Appl. Soft Comput. 26, 10–20 (2015)

Zhang, Y.Q., Wang, X.Y.: A symmetric image encryption algorithm based on mixed linear-nonlinear coupled map lattice. Inf. Sci. 273, 329–351 (2014)

Zhang, Y.Q., Wang, X.Y.: Spatiotemporal chaos in mixed linear–nonlinear coupled logistic map lattice. Phys. A 402, 104–118 (2014)

Acknowledgements

The authors were supported by National Natural Science Foundation of China, Grant No. 71271026.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Wang, J., Wang, J. Measuring the correlation complexity between return series by multiscale complex analysis on Potts dynamics. Nonlinear Dyn 89, 2703–2721 (2017). https://doi.org/10.1007/s11071-017-3619-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11071-017-3619-6