Abstract

Crop farmers in arid and semi-arid regions face a covariate risk that is of paramount importance, namely, the threat of catastrophic crop loss triggered by natural disasters and climate hazards. Such an occurrence not only jeopardizes the livelihoods of these farmers but may also lead to persistent poverty. Promoting sustainable development requires control over climate-related shocks, which negatively affect the most vulnerable population in the developing world. This study investigates the option of choosing crop area-yield index insurance to mitigate the adverse effects associated with climate stress. In addition, we assessed the amount farmers are willing to pay for an insurance product that insures yields below 70% of the local average in the study area. Our results show that access to extension services and economic association membership offers farmers social capital and encourages their decision to purchase index insurance. We also find that the long-run welfare impact of index insurance policy on vulnerable households could be significant as an alternative insurance mechanism to traditional insurance. This study contributes to filling the gaps on the uptake of index insurance and provide guidance to policymakers in their approach to mitigating the effects of climate change on crop production in Nigeria.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Agricultural production in many underdeveloped countries is a risky endeavor, with climate hazards posing a significant threat to sustainable food security. In Nigeria, the agricultural sector comprises of four primary areas: crop production (accounting for 87.6%), livestock production (8.1%), fish production (3.2%), and forestry (1.1%) (Oruma et al. 2021). The detrimental effects of climate change on crop loss and damage can potentially hinder development by exacerbating both the frequency and intensity of poverty. In this context, climate risk insurance emerges as a crucial tool for disrupting the cycle of vulnerability and poverty by compensating for losses incurred due to catastrophic weather events. Enhancing individuals' ability to manage and mitigate climate risk can significantly reduce their vulnerability and contribute to their long-term social and economic well-being. Implementing climate change adaptation strategies forms an essential component of this endeavor. However, crop insurance uptake remains low in developing countries, primarily stemming from the underdevelopment and ineffectiveness of formal insurance markets in many developing countries (Fonta et al. 2012). Factors such as high administrative costs, moral hazard, adverse selection, and protracted indemnity payment delays have discouraged the utilization of this insurance option (Bulte and Haagsma 2021; Mushonga and Mishi 2022).

Amidst growing concerns about low-income farming households’ vulnerability to climate-related hazards, alternative strategies that enhance resilience are gaining prominence (Clement et al. 2018). Insurance has emerged as a promising tool to safeguard farmers against production shocks and incentivize the adoption of modern farming practices. Index insurance, a relatively novel product, has gained traction in developing countries in the past decade. These schemes have been widely implemented in eastern African nations such as Kenya and Ethiopia, with similar programs in the pipeline for other arid regions including South Africa, Mali, Nigeria, Senegal, Somalia, and Zimbabwe (Amare and Simane 2017). Unlike conventional insurance, which compensates for verified losses, index insurance payouts are triggered by fluctuations in an observable index such as patterns of yield, rainfall, or temperature (Barnett and Mahul 2007; Bulte and Haagsma 2021). The inherent transparency of index insurance offers significant advantages, enabling insurance companies to transfer risk to global reinsurance markets (Bulte and Haagsma 2021). Furthermore, index insurance eliminates the challenges associated with loss-based insurance, such as the complexities of verifying individual losses and the substantial transaction costs involved in monitoring behavior (Miranda and Farrin 2012).

This study investigates the potential of index insurance as a risk-mitigation tool for crop production in Nigeria. In light of the limited research on crop insurance in West Africa, this study deviates from the conventional approach by examining the determinants of area-yield index-based insurance adoption. Additionally, we assessed the willingness-to-pay (WTP) of potential index insurance adopters. While index insurance is yet to be established in Nigeria, this study provides an initial framework for policymakers to develop strategies that alleviate the risks and uncertainties associated with crop production in the country. Understanding the factors driving index insurance adoption is crucial for policymakers to formulate effective public policy measures for the agricultural sector. Our findings are relevant for many arid regions given the shared climate change challenges of water scarcity and drought prevalent in many sub-Saharan African countries (Aina et al. 2023a, b).

The remainder of this paper is organized as follows. Section 2 provides a review of the relevant literature. Section 3 outlines the methodology employed, including a detailed description of the study area and data used. Section 4 presents the findings, and Sect. 5 discusses the key results and concludes with actionable policy implications.

2 Previous literature

The literature extensively reports the vulnerability of farmers in low-income countries to environmental risks and the growing recognition of index insurance (Johnson 2021; Mathithibane and Chummun 2022). Despite the initial optimism surrounding index insurance as an effective tool for mitigating weather shocks, several studies have raised concerns regarding its potential efficacy (Clement et al. 2018). Moreover, empirical studies have consistently shown that the adoption rate of index insurance among intended beneficiaries remains low, rarely exceeding 30%. For instance, Chantarat et al. (2013) estimated that index insurance could potentially reduce agricultural loss by 25–40%. However, the design of index insurance contracts continues to face demand-side challenges, with many farmers hesitating to adopt the product. Therefore, a reassessment of the initial optimism regarding index insurance is warranted, and experts are beginning to consider the multifaceted factors that influence insurance demand (Leblois et al. 2014).

A growing number of projects are exploring the use of aggregate performance indicators, rather than individual-specific results, to bridge the gap between insurance demand and supply. Takahashi et al. (2016) investigated index insurance uptake in southern Ethiopia, focusing on the impact of accurate product understanding and pricing on adoption rates. Their study demonstrated that price reductions achieved through randomly distributed coupons had an immediate positive effect on uptake without diminishing demand in subsequent periods owing to price anchoring effects. Clement et al. (2018) investigated the problem of basis risk, which occurs when the index is not well correlated with the actual losses experienced by policyholders, resulting in under- or overcompensation. They highlighted that index insurance design requires high-quality and long-term data on weather, crop yield, and livestock mortality, as well as feedback from community members and farmers, to create indices that better predict individual losses and reduce design errors.

Most studies examining index insurance demand have focused on insurance programs implemented in East African countries. For instance, Bulte and Haagsma (2021) showed that the welfare effects of insurance remain ambiguous even in the absence of transaction costs or basis risk. Their study identified the conditions under which insurance adoption can lead to a reduction in expected income. McPeak et al. (2010) conducted an experimental investigation of index-based insurance in northern Kenya by analyzing gameplay patterns. The study aimed to address the factors that influence household decisions regarding the adoption of index insurance. These factors include the importance of agricultural production to household income, vulnerability of crop production to shocks, idiosyncratic components of loss, and long-term implications of loss on household well-being. However, limited evidence exists to determine whether the extension effort and approach employed in the study effectively increase demand for crop index insurance, which is predicated on informed decision making.

This study contributes to the discourse on climate risk adaptation by examining the adoption of area-yield index-based insurance among smallholder farming households in Nigeria. Building on the work of McPeak et al. (2010) and Amare et al. (2017), we investigate the factors influencing insurance adoption and provide insights that can inform the expansion of this product to other regions within the country. Additionally, we assessed the willingness-to-pay (WTP) of index insurance adopters in Kwara State, Nigeria. Kwara State is a worthy case study due to its significant economic role in Nigeria's North-Central region and its heightened vulnerability to climate change. The state's heavy reliance on rainfall (75%) for its water supply renders it susceptible to severe water shortages during extreme weather events. The adverse impacts of climate change have disproportionately affected key income-generating sectors such as crop production and agri-processing, which are heavily dependent on water availability.

3 Methodology

3.1 Empirical model

Two theoretical perspectives—production and consumption channels—can be employed to analyze the effects of insurance on farmers. The consumption channel examines the consequences after a shock has occurred, while the production channel investigates how insurance could mitigate the price of risks before a shock occurs. To elucidate the demand for index-based insurance among crop farmers in response to production shocks, we present a dynamic model that depicts farmers facing aggregate idiosyncratic production shocks. The model is adapted using techniques from Gollier (2003) and De Nicola (2015) to examine the demand for index insurance. Initially, we develop a model without index insurance (baseline scenario) to analyze the optimal consumption, production, and investment decisions of farmers devoid of index insurance. Subsequently, we incorporate the option of having index insurance to explore how the problem transforms when we consider an insurance mechanism in the analysis.

3.1.1 Modeling without index insurance

Let us consider a farmer (an economic agent) who allocates her income wt+1 between consumption ct and crop-related investment It. It is assumed that this related investment will provide additional income in accordance with a production function with declining marginal returns and unpredictable productivity shocks ε i,t, that capture weather variability, either in terms of rainfall or temperature change. Agents are assumed to be rational and maximize the expected discounted utility. We assume a Von-Neumann Morgenstern utility function that includes the risk attitudes and certainty equivalence of the represented farmers. Therefore, the representative farmer maximizes her expected present discounted utility of consumption denoted Et \({\sum }_{j=0}^{\infty }{\beta }^{j}u(c\)t + j), where utility is a function of consumption c and is given as u(ct) = \(\frac{{c}^{1-\Phi }}{1-\Phi }\). We additionally posit that agents have a constant relative risk aversion utility where \(\Phi\) denotes the coefficient of relative risk aversion.

Consequently, the agent’s optimization baseline problem can be expressed as follows:

Subject to

The total weather shock that the farmer cannot predict at the time investment decisions are made is represented by weather variation ηt+1. Qi is the individual-specific time-variant productivity coefficient, ai represents the assets owned by the agent. However, it is important to note that the idiosyncratic terms Qi and εi,t are both log-normally distributed with mean and variance σ2Q and σ2ε, respectively. It is assumed that farmers cannot adjust the assets with which they are endowed. Assets can be the amount of land detained.

The first-order condition for the optimal capital level is calculated by matching the marginal utility of consumption today with the anticipated discounted marginal utility of consumption tomorrow. The expression is given in Eq. (4).

3.1.2 Modeling with index insurance

To better understand the role index insurance might play, the baseline framework is expanded, and it is assumed that farmers can buy ιt+1 unit(s) of insurance to protect against weather variability that affects crop production and yield. Each unit of purchased insurance pays (1 – ηt+1) to offset any bad weather shocks. The optimization problem thus becomes

Subject to

where the term Ƥt is the actuarially fair price for one unit of weather insurance and is defined as Ƥt = \(\int_{0}^{1} {(1 - \eta )}\) f(η)dη.

Ƥt appears in the transition equation rather than in the budget constraint since it is assumed that agents have credit to pay for the insurance premium and that they can observe their productivity level before insurance purchasing. Following the Bellman principle, the optimization problem can then be rewritten as follows under full insurance:

3.2 Estimation strategy

We employed a logit model framework to investigate the relationship between household factors and a binary response variable that distinguishes adopters (also referred to as potential adopters) from non-adopters. This approach differs from the linear probability model in that the predicted probabilities are constrained within the range 0–1. Logit model estimations reveal a statistically significant association between several explanatory factors and the likelihood of farmers adopting index insurance.

Which can be further reformulated as:

where \({Z}_{i}=({\beta }_{0}+{\beta }_{1}{X}_{i})\)

If \({P}_{i}\) is the likelihood of a respondent being an adopter, then the probability of non-adopters can be written as \({1-P}_{i}\).

Hence

Taking the natural logarithm of the odds ratio establishes a linear relationship between the explanatory variables and probability of adoption. This linear relationship applies not only to the explanatory variables but also to the model parameters. Specifically, the binary logit model can be expressed as the log of the odds ratio in favor of adoption, where \(\frac{{P}_{i}}{1+{P}_{i}}\) represents the ratio of the probability that the farmer will adopt index insurance to the likelihood that they will not adopt it.

where, \({P}_{i}\) is the probability of being an adopter ranging from 0 to 1. \({Z}_{i}\) is a function of \(n\)-explanatory variables (\({X}_{i}\)) and is expressed as:

Similar to Amare et al. (2019), in the logit model, \({\beta }_{0}\) represents the constant term or intercept while \({\beta }_{1}, {\beta }_{2}, {\beta }_{3},\dots {\beta }_{n}\) represents the respective slopes or parameters to be estimated. \({L}_{i}\) is the logarithm of the odds ratio, \({X}_{i}\) is a vector that contains relevant characteristics of the respondent, and \({U}_{i}\) is the error term or disturbance term of the logit model. To estimate the model parameters, we employed the Maximum Likelihood (ML) method following the approach outlined by Gujirati (1995) and Maddala (1992). The dependent variable in the binary logit model is index insurance adoption. Respondents were classified as either adopters or non-adopters, based on their willingness to purchase insurance. Those who indicated a willingness to purchase the index insurance were assigned a value of "1," while those who did not were assigned a value of "0."

3.3 Data

This research was conducted in Kwara State, Nigeria (Fig. 1), which lies entirely within the tropical hinterland and encompasses an estimated 203,833 agricultural households. Over 70% of farmers in the region rely heavily on crop production as their primary source of income (Kwara State Diary 2009). It is situated within the North Central geopolitical zone of Nigeria, shares boundaries with the Republic of Benin, and five states in Nigeria. These states are Niger in the North, Oyo, Osun and Ekiti in the South, and Kogi in the East.

The variation in the mean and the 5-year Moving average of the minimum and maximum temperatures in Kwara state are shown in Fig. 2. The typical annual minimum temperature fluctuated from 21 to 23 degrees Celsius, whereas the annual maximum temperature fluctuated from 31.4 to 33.5 degrees Celsius.

(Source: Adedapo 2020)

5-Year moving temperature average in Kwara State

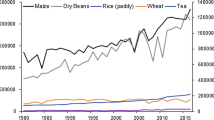

The wet and dry seasons, each lasting approximately six months, are two separate seasons in the region. Rainfall has a considerable impact on the dynamics of crop production in the region as agricultural production is dependent on it. The state experiences yearly rainfall ranging from 57 mm at the lowest point to 145 mm at the highest point. The average annual rainfall in the study area is shown in Fig. 3.

The data collection for this study employed a mixed-method approach, encompassing focus group discussions, key informant interviews, and household surveys with 376 randomly sampled households. A focus group discussion involving development agents, community leaders, and local-level coordinators of economic associations was conducted to gain a deeper understanding of respondents' socioeconomic characteristics and associated risk profiles. Our primary survey targeted crop farmers who had already utilized traditional insurance, based on information obtained from the Nigerian Agricultural Insurance Corporation (NAIC). Eight out of the 16 Local Government Areas (LGAs) in Kwara State were randomly selected, and subsequently, 47 farming household heads were randomly chosen from each of the eight LGAs, resulting in a total of 376 respondents. The survey also gathered supplementary information on the effectiveness of farmers' climate risk management strategies, and the results were evaluated relative to the mean. It was found that only 89 respondents perceived the traditional insurance provided by NAIC as effective for risk management, highlighting the need for an alternative and more efficacious risk-mitigation tool, such as index insurance. Among the various risk management strategies employed, income from other business sources was ranked highest, with 42% of the respondents confirming its effectiveness. Other strategies include the planting of stress-tolerant crop varieties, irrigation efficiency, and implementation of water harvesting technologies. The challenges associated with traditional insurance were also discussed, such as the widespread denial of claims, which left farmers uncompensated for their losses despite having purchased insurance policies, a finding consistent with previous studies (Barnett and Mahul 2007; NARF 2014).

4 Results and discussion

4.1 Socioeconomic summary

The key sociodemographic characteristics of the respondents are summarized in Table 1. The majority of the respondents (56.4%) had education beyond the secondary level. This finding aligns with Trang (2013), who suggests that a higher proportion of educated farmers is more likely to have an advantage in adopting insurance. Additionally, a substantial number of respondents (65.2%) were members of at least one economic association that could enhance their access to resources and networks that support crop management. Notably, 274 of the 376 respondents had a secondary source of income, and approximately 38% were classified as low-income earners.

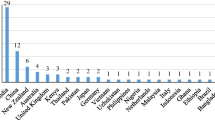

The magnitude and frequency of weather-related stressors have a negative effect on crop production and overall growth (Sivakumar and Motha 2007). We conducted a ranking exercise based on the responses of survey participants to identify the specific weather risks faced by crop farmers. This approach enabled us to categorize distinct types of weather-related risks and design more targeted policy interventions to address the challenges encountered by farmers. As shown in Fig. 4, the majority of farmers strongly agree that high temperatures and droughts pose the most significant weather risks to crop production. Notably, floods, excessive rainfall, and fire outbreaks were the least likely risks faced by most respondents. Based on these findings, our study further investigates the factors influencing the adoption of index insurance as a risk management tool in the face of drought and extreme weather events.

4.2 Determinants of index insurance adoption

The results presented in Table 2 highlight a significant difference between index insurance adopters and non-adopters in terms of access to extension services and membership in economic associations. A substantial proportion of adopters have access to extension services and belong to economic associations, whereas non-adopters generally lack such access and membership. Additionally, the findings suggest that adopters tend to have less than ten years of farming experience, possess secondary school education, and engage in off-farm income activities. The chi-square test confirmed the statistical significance (p < 0.000) of the differences between index insurance adopters and non-adopters. This finding indicates that respondents with limited access to extension services and those without alternative income sources are less likely to adopt index insurance. This could be attributed to the use of off-farm income to supplement the index insurance premium payments, a pattern observed in similar studies by Amare et al. (2019) and Skees and Barnett (2006).

Our findings also suggest that farmers with higher off-farm income generally possess a stronger payment capacity than those with low or no off-farm income. Economic association membership served as a proxy for social capital in this study, reflecting the ability of farmers to internalize economic externalities and facilitate their adoption of climate adaptation measures. The chi-squared test revealed a statistically significant association between social capital and index insurance adoption, with a p-value of 0.000. This implies that farmers with stronger social ties, particularly those involved in locally organized social groups, are more likely to adopt index insurance. It is plausible that similar patterns exist for the remaining factors listed in Table 2.

Table 3 reveals that access to loans significantly and positively influences the likelihood of adopting index insurance, at a p-value of less than 1%. For individuals with access to loans, the likelihood of implementing index insurance increases by a factor of 10.515. This implies that having access to loan enhances one's ability to pay index insurance premiums. This outcome stems from the fact that individuals in poverty are less able to accumulate resources for risk transfer and climate change-related risk management. Therefore, inadequate financial resources among farmers pose a significant barrier to improving index insurance demand. Similar to the findings of Nshakira-Rukundo et al. (2021), the potential insurance market is divided between farmers with higher incomes seeking greater protection and those with lower incomes.

The distance from a respondent's residence to the weather station was found to significantly and negatively impact the likelihood of index insurance adoption. Farmers' limited access to climate data and distance from weather stations could explain the lack of index insurance purchases. Table 3 also shows that at a significance level of less than 1%, those who belong to local economic associations are more likely to adopt the insurance product. Specifically, the odds ratio in favor of index insurance adoption increases by a factor of 10.015 for such farmers. This result aligns with the findings of earlier studies on technology adoption (Abugri et al. 2015). In our study, only the sex of respondents did not significantly influenced the likelihood of adopting index insurance. However, our results show a negative correlation between education level and index insurance adoption, in line with the findings of Takahashi et al. (2016). This unexpected result suggests that years of formal education may not always be an effective predictor of index insurance adoption, as farmers may not solely rely on formal education when making practical farm-level decisions on crop production. Additionally, our analysis indicates that age negatively correlates with the likelihood of adopting index insurance, suggesting that younger respondents are more likely to rely on index insurance, while older respondents may be more risk-averse due to higher resource constraints from family demands. This finding aligns partly with the coefficient estimates of marital status, which suggest that respondents that are married are more likely to adopt index insurance.

4.3 Willingness to pay valuation

Willingness to Pay (WTP) refers to the maximum amount a farmer is prepared to spend on an index insurance product based on payouts linked to an easily measurable index of factors, such as average yields that predict individual losses, given their income, risk tolerance, and other personal circumstances. In area-yield index insurance, indemnity is calculated using the average yield harvested in a specific region. The insured yield typically ranges from 50 to 90% of the local average. If the average yield in the area falls below the insured yield, the policyholder receives an indemnity. This WTP value can be determined using the Contingent Valuation Method (CVM). Although the CVM is commonly used to evaluate non-market environmental initiatives, it is increasingly employed to assess private market goods and services (Steigenberger et al. 2022). Generally, two methods are used to calculate WTP under CVM: the closed-ended format, often known as a referendum or the "take it or leave it" strategy, and the open-ended format. The closed-ended format restricts respondents to preselected options, while the open-ended format allows them to provide their own WTP values.

To assess the actual amount farmers would be willing to pay for an area-yield index-based insurance product that ensures yields below 70% of the local average, this study employed the open-ended contingent valuation approach. If the average yield in the area falls below the insured yield, the policyholder receives an indemnity. This insured yield level was determined based on the average threshold at which the respondents' losses were considered adverse, as identified through a focus group discussion. The open-ended contingent valuation approach was chosen because it is less susceptible to anchoring bias and does not provide respondents with information about the potential value of change. Additionally, the approach is suitable because index insurance has not yet been established in Nigeria, and all respondents in this study currently utilize the traditional insurance program to mitigate weather-related risks. Consistent with Fonta et al. (2012), the open-ended contingent valuation technique is also valuable, as it allows for an easy evaluation of the mean amount adopters are willing to pay for the index insurance product.

Our analysis focused on respondents' answers and their implications for their WTP for the scheme. As emphasized by Fonta et al. (2012), it is crucial to differentiate between valid and invalid responses for analysis. Table 4 shows that out of 376 completed interviews, 81 (21.5%) provided invalid responses to the valuation question. These invalid responses were categorized as protest bids (67) and outliers (14). Protest bidders included respondents who claimed they could not afford the scheme because of budgetary constraints (27), those who believed traditional insurance was sufficient (15), and those who believed it was the government's responsibility (25). Outliers were those respondents whose maximum WTP exceeded their income (14).

The presence of invalid responses in Table 4 raises concerns about potential sample selection bias, which could have significant consequences for the analysis. For example, if the valuation function is used to assess theoretical validity, the analysis can produce inconsistent estimates, similar to those reported by Maddala (1983). In addition, the aggregated WTP values and estimated benefit measures may be inaccurate. To test for sample selection bias, we compared the means of household characteristics between the two groups, following the approach outlined by Fonta et al. (2012). Substantial differences may indicate the presence of sample selection bias. As shown in Table 5, no significant differences were observed for any of the factors between the two groups of respondents. These findings indicate the absence of sample selection bias when invalid responses are excluded from the econometric analysis.

In the absence of a significant sample selection bias, the mean WTP value for the index insurance pilot initiative was estimated using a subsample of valid responses. Table 6 presents the estimated results. The mean WTP for area-yield crop index-based insurance is estimated to be ₦13,524 (1.8%) monthly, with interval estimates ranging from ₦9,552 to ₦16,996. While premiums for conventional agricultural insurance in Nigeria typically range from 2 to 5% of the insured value (Babalola 2014), our estimate is slightly less expensive. This can be attributed to the varying product coverage typically offered by traditional insurance contracts. It is important to note that the ongoing index insurance pilot in Nigeria lacks a standardized process to develop and charge insurance rates. The estimated WTP value from our analysis provides a valuable reference point for the index insurance premium rate determination.

4.4 Limitation of the study

While our study has yielded valuable insights into the adoption of index insurance among farmers, it is important to acknowledge a limitation of our exclusive focus on crop production. We recognize that farmers in developing countries, including Nigeria, have access to a diverse array of insurance programs designed to mitigate climate-related risks. This spectrum includes options such as revenue insurance and commodity price insurance, each of which serves as an alternative risk management strategy. Furthermore, the influence of familial and social support networks cannot be understood as they contribute significantly to the resilience of agricultural communities.

In Nigeria and many other African countries, the low participation rates observed in formal insurance programs may be attributed to the availability and reliance on these alternative risk management strategies. As highlighted in the literature (Abdul Mumin et al. 2022; Ramsawak 2022), the interconnectedness of these factors must be considered when examining the dynamics of insurance adoption in agricultural settings. Future research could explore the interplay between formal insurance programs, alternative risk-management strategies, and social support networks to develop a more comprehensive understanding of the factors influencing farmers' choices in mitigating climate-related risks.

5 Conclusion and policy implications

Index-based insurance offers a promising strategy for managing agricultural risks and mitigating the impacts of natural disasters and climate hazards on crop farmers. This insurance helps farmers limit losses from various threats, including droughts, floods, rainfall fluctuations, temperature fluctuations, dry spells, and heatwaves. In this study, the area-yield index-based insurance product insures yields below 70% of the local average. If the average yield in the area falls short of the insured yield, the policyholder receives an indemnity. Index insurance offers several benefits, including minimizing moral hazards and adverse selection, facilitating fast payouts during emergencies, encouraging increased investment in production inputs, and enhancing resilience to food insecurity. By providing a safety net, agricultural insurance helps farmers and households escape poverty in many regions directly affected by weather shocks and natural catastrophes.

Unfortunately, the uptake of agricultural insurance in sub-Saharan Africa remains the lowest (Nshakira-Rukundo et al. 2021). Instead, smallholder farmers continue to rely on less effective mechanisms, such as asset depletion (Yilma et al. 2017) and savings, even when insurance options are available (Delavallade et al. 2015). Africa accounts for only 0.5% of the global insurance market, whereas Europe, North America, and Asia account for 20%, 55%, and 20%, respectively, of the total agricultural insurance premium globally. The coverage and uptake of the few programs being established, particularly those in West Africa, are still severely low (Fonta et al. 2012).

This study investigates the critical factors influencing the uptake of crop index insurance in Kwara state, Nigeria. We also estimate the WTP value of index insurance adopters. Index insurance is a financial product that requires careful implementation, and its widespread adoption necessitates a clear and well-articulated policy that considers the target farmers' characteristics to encourage acceptance. The findings from this study contribute to filling the gaps related to promoting the uptake of index insurance and provide guidance to policymakers in their approach to mitigating the effects of climate change on crop production in Nigeria. This study is one of the first to estimate the factors that drive the adoption of an index insurance scheme in Nigeria. In this respect, our study highlights the need to combine access to loans with the use of index insurance so that households with limited cash can afford insurance. Considering insurance and credit as complementary, rather than substitutes, is crucial for managing the risks posed by severe climate shocks and extremes. Therefore, it is essential to rethink the relationship between these two financial tools to manage risks effectively.

Furthermore, access to extension services and economic association membership offers farmers social capital and encourages their decision to purchase index insurance. Since most farmers have no prior experience with index insurance, there is a need to explain the basic concept of insurance payouts, risk mitigation, and the implications of adoption on overall household welfare. Training and financial literacy on insurance should be provided through organized social groups to farmers to enhance their knowledge of climate risk perception and minimize any potential ambiguity that may arise from misperceptions (Getahun and Chotai et al. 2022). This is expected to reduce the stress on the farming community. When farming households feel secure about adopting index insurance, they can speculate in a favorable market, sell at the best price, and presumably increase their income and crop production. Ultimately, this may promote economic development and reduce poverty.

This study revealed that the mean WTP for index insurance products was ₦13,524 in the study area. However, our estimate suggests a 1.8% premium for insurance, which is slightly lower than that currently being charged for traditional agricultural insurance in Nigeria (2–5%). This result implies that premium costs can be a strong barrier to insurance uptake. This also indicates that the long-run welfare impact of the index insurance policy on vulnerable households could be significant as an alternative insurance mechanism to traditional insurance. Therefore, policy decisions should focus on initiatives such as cash transfers and income support programs to help poor farmers protect themselves against shocks and take advantage of index insurance programs. The first step may require initial targeting of farming clusters with similar risk profiles. This is crucial, especially in regions where expensive alternative risk management measures and severe crop losses may trap households in poverty.

Overall, our results suggest that index insurance policies can play a critical role in mitigating the impacts of extreme events and supporting climate resilience among agricultural communities. However, addressing the challenges of regional variation of extreme events, type of agricultural activity, insurance uptake, affordability, complementarity of insurance and credit, social capital, financial literacy, targeting vulnerable households, and premium costs is crucial to ensure the effectiveness and sustainability of these programs.

References

Abdul Mumin Y, Abdulai A, Goetz R (2022) The role of social networks in the adoption of competing new technologies in Ghana. J Agric Econ 1:1–24. https://doi.org/10.1111/1477-9552.12517

Abugri S, Amikuzuno J, Daadi E (2015) Looking out for a better mitigation strategy: small-holder farmers’ willingness to pay for drought-index crop insurance premium in the northern region of Ghana. Agric Food Sec 6(71):1–9. https://doi.org/10.1186/s40066-017-0152-2

Adedapo A (2020) Trend analysis of temperature and humidity in Kwara State, Nigeria. J Environ Geog 13:(3–4). https://doi.org/10.2478/jengeo-2020-0011

Aina IV, Thiam DR, Dinar A (2023a) Substitution of piped water and self-supplied groundwater: the case of residential water in South Africa. Util Policy 80:101480. https://doi.org/10.1016/j.jup.2022.101480

Aina IV, Thiam DR, Dinar A (2023b) Economics of household preferences for watersaving technologies in urban South Africa. J Environ Manage 339:117953. https://doi.org/10.1016/j.jenvman.2023.117953

Amare A, Simane B (2017) Determinants of small-holder farmers’ decision to adopt adaptation options to climate change and variability in the Muger Sub-basin of the Upper Blue Nile basin of Ethiopia. Agric Food Sec 6(64):1–20. https://doi.org/10.1186/s40066-017-0144-2

Amare A, Simane B, Nyangaga J, Defisa A, Hamza D, Gurmessa B (2019) Index based livestock insurance to manage climate risks in Borena zone of southern Oromia, Ethiopia. Clim Risk Manag 25:100191. https://doi.org/10.1016/j.crm.2019.100191

Babalola DA (2014) Determinants of farmers’ adoption of agricultural insurance: the case of poultry farmers in Abeokuta metropolis of Ogun state, Nigeria. Br Poult Sci 3(2):36–41. https://doi.org/10.5829/idosi.bjps.2014.3.2.83216

Barnett BJ, Mahul O (2007) Weather index insurance for agriculture and rural area in lower-income countries. Am J Agric Econ 89(5):1241–1247

Bulte E, Haagsma R (2021) The welfare effects of index-based livestock insurance: livestock herding on communal lands. Environ Resour Econ 78:587–613. https://doi.org/10.1007/s10640-021-00545-1

Chantarat S, Mude AG, Barrett CB, Carter MR (2013) Designing index-based livestock insurance for managing asset risk in Northern Kenya. J Risk Insurance 80(1):205–237

Clement KY, Botzen WJW, Brouwer R, Aerts JCJH (2018) A global review of the impact of basis risk on the functioning of and demand for index insurance. Int J Disaster Risk Reduct 28:845–885

De Nicola F (2015) The impact of weather insurance on consumption, investment, and welfare. Quant Econ 6:635–661

Delavallade C, Dizon F, Hill RV, Petraud JP (2015) Managing risk with insurance and savings: experimental evidence for male and female farm managers in West Africa. International Food Policy Research Institute (IFPRI), Washington DC

Fonta WM, Sanfo S, Kedir AM (2012) Estimating farmers’ willingness to pay for weather index-based crop insurance uptake in West Africa: insight from a pilot initiative in Southwestern Burkina Faso. Agric Food Econ 6(1):1–11

Getahun G, Chotai N (2022) Factors influencing the level of benefits derived from social group participation: a study in Eastern Wollega Zone, Oromia, Ethiopia. Soc Sustain 4(1):11–24. https://doi.org/10.38157/societysustainability.v4i1.374

Gollier C (2003) To insure or not to insure: an Insurance Puzzle. Geneva Papers Risk Ins Theory 28:5–24

Gujirati DN (1995) Basic econometrics. McGraw-Hill Co, New York

Johnson L (2021) Rescaling index insurance for climate and development in Africa. Ecomy Soc 50(2):248–274. https://doi.org/10.1080/03085147.2020.1853364

Kwara State Diary (2009) The government and people of Kwara State of Nigeria. Ilesanmi Printing Press, Kwara State

Leblois A, Quirion P, Alhassane A, Traoré S (2014) Weather index drought insurance: an ex-ante evaluation for millet growers in Niger. Environ Resour Econ 57:527–551

Maddala GS (1992) Introduction to econometrics. Macmillan Publishing Company, New York

Maddala GS (1983) Limited-dependent variables and qualitative variables in econometrics. Cambridge University Press, Cambridge

Mathithibane MS, Chummun BZ (2022) Weather index insurance in South Africa: an integrated approach to farmers’ willingness-to-pay intentions. Afr Rev Econ Finance 14(1):104–134. https://doi.org/10.10520/ejc-aref_v14_n1_a4

McPeak J, Chantarat S, Mude AG (2010) Explaining index-based livestock insurance to pastoralists. Agric Finance Rev 70(3):333–352

Miranda MJ, Farrin K (2012) Index insurance for developing countries. Appl Econ Perspect Policy 34(3):391–427

Mushonga FB, Mishi S (2022) Natural hazard insurance demand: a systematic review. J Disaster Risk Stud 14(1):1223. https://doi.org/10.4102/jamba.v14i1.1223

National Agricultural Resilience Framework (NARF) (2014) Making Nigerian agriculture resilient to climate change. A Report by the advisory committee on agricultural resilience in Nigeria (ACORN)

Nshakira-Rukundo E, Kamau J, Baumüller H (2021) Determinants of uptake and strategies to improve agricultural insurance in Africa: a review. Environ Dev Econ 26(5–6):605–631. https://doi.org/10.1017/S1355770X21000085

Oruma SO, Misra S, Fernandez-Sanz L (2021) Agriculture 4.0: an implementation framework for food security attainment in Nigeria’s post-covid-19 era. IEEE Access 9:83592–83627. https://doi.org/10.1109/ACCESS.2021.3086453

Ramsawak RA (2022) Climate shocks and social networks: understanding adaptation among rural Indian households. Climate 10:149. https://doi.org/10.3390/cli10100149

Sivakumar MVK, Motha RP (2007) Managing weather and climate risks in agriculture. Springer, Berlin

Skees JR, Barnett BJ (2006) Enhancing microfinance using index-based risk-transfer products. Agric Finance Rev 66(2):235–250

Steigenberger C, Flatscher-Thoeni M, Siebert U (2022) Determinants of willingness to pay for health services: a systematic review of contingent valuation studies. Eur J Health Econ 23:1455–1482

Takahashi K, Ikegami M, Sheahan M, Barrett CB (2016) Experimental evidence on the drivers of index-based livestock insurance demand in southern Ethiopia. World Dev 78:324–340

Trang NM (2013) Willingness to pay for area yield index insurance of rice farmers in the Mekong Delta, Vietnam. Dissertation, Wageningen University and Research Centre

Yilma Z, Mebratie A, Sparrow R, Abebaw D, Alemu G, Bedi AS (2017) Coping with shocks in rural Ethiopia. J Dev Stud 50:1009–1024

Acknowledgements

An earlier version of this paper benefitted from comments during sessions at the 30th International Conference of Agricultural Economists (ICAE) and the Annual Bank Conference on Development Economics.

Funding

Open access funding provided by University of Cape Town. The authors declare that no funds, grants, or other support were received during the preparation of this manuscript.

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Material preparation, data collection and analysis were performed by Ifedotun Aina, Opeyemi Ayinde, Djiby Thiam and Mario Miranda. The first draft of the manuscript was written by Ifedotun Aina, and all authors commented on previous versions of the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Competing interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Ethical approval

We declare that this submission follows the policies of Springer’s Natural Hazards journal as outlined in the Ethical Responsibilities of Authors submission guidelines.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Aina, I., Ayinde, O., Thiam, D. et al. Crop index insurance as a tool for climate resilience: lessons from smallholder farmers in Nigeria. Nat Hazards 120, 4811–4828 (2024). https://doi.org/10.1007/s11069-023-06388-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11069-023-06388-x