Abstract

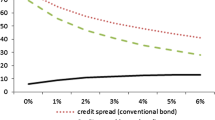

More recently, investors’ preference for green bonds is of particular interest for researchers. The possible non-pecuniary motive in sustainable finance can be identified by the green bond premium. But no consensus has been achieved owing to differences in samples and market settings. This paper specifically focuses on the estimation of the green bond premium in China. We introduced three issuance motivation theories to explain the drivers of green premium and convinced them through a set of empirical tests. The propensity score matching method was employed to claim that compared with matched conventional bonds, green bonds are priced at an average negative premium of 7.8bps, implying that green projects may be issued at a lower cost. Considering that a financial group has a higher negative premium than a corporate group, green financing for sustainable development is still led by indirect finance. Furthermore, empirical results convince that a negative premium is pronounced for state-owned enterprises and varies across the financial and corporate groups. Central SOEs have more advantage in raising funds than local SOEs. In addition, the effect of ownership on the green premium will significantly change if bond issues with a third-party verification. The role of verification is important in reducing information asymmetry and avoiding greenwashing behavior. We suggest that financial resources need to be properly allocated to the real enterprises through third-party verification or government supportive measures.

Similar content being viewed by others

References

Barclays (2015) The Cost of Being Green. Credit Research. https://www.environmental-finance.com/assets/files

Bauer, R., Hann, D (2014) Corporate environmental management and credit risk. Working paper. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1660470

Caroline Flammer (2018) Corporate green bonds. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3125518

Chava S (2014) Environmental externalities and cost of capital. Manage Sci 60(9):2223–2247. https://doi.org/10.1287/mnsc.2013.1863

Dhaliwal D, Li O, Tsang A, Yang Y (2011) Voluntary nonfinancial disclosure and the cost of equity capital: the initiation of corporate social responsibility reporting. The Accounting Review 86(1):59–100

Ehlers T, Packer F (2017) Green bond finance and certification. BIS Quarterly Review 9:89–104

El Ghoul S, Guedhami O, Kwok CC, Mishra DR (2011) Does corporate social responsibility affect the cost of capital? J Bank Finance 35:2388–2406

Heinkel R, Kraus A, Zechner J (2001) The effect of green investment on corporate behavior. J Financ Quant Anal 36:377–389

HSBC (2016) Green Bonds 2.0. Fixed Income Credit report. https://tinyurl.com/ve9ujsr

Jiraporn P, Jiraporn N, Boeprasert A, Chang K (2014) Does corporate social responsibility (CSR) improve credit ratings? evidence from geographic identification. Financ Manage 43(3):505–531

Karpf A, Mandel A (2018) The changing value of the ‘green’ label on the US municipal bond market. Nat. Clim. Change 8:161–165. https://doi.org/10.1038/s41558-017-0062-0

Krüger P (2015) Corporate goodness and shareholder wealth. J. Financial Econ. 115(2):304–329. https://doi.org/10.1016/j.jfineco.2014.09.008

Lyon TP, Montgomery AW (2015) The means and end of greenwash. Organization and Environment 28(2):223–249. https://doi.org/10.1177/1086026615575332

Malcolm Baker,et al (2018) Financing the response to climate change:The pricing and ownership of U.S. green bonds. Working Paper, NBER

Maria Jua Bachelet (2019) The Green Bonds Premium Puzzle: The role of issuer characteristics and third-party verification. Sustainability 11(4):1098. https://doi.org/10.3390/su11041098

Oikonomou I, Brooks C, Pavelin S (2014) The effects of corporate social performance on the cost of corporate debt and credit ratings. The Financial Review 49:49–75

Pearson J (2010) Are we doing the right thing. J Corp Citizsh 37:37–40

Sharfman M, Fernando C (2008) Environmental risk management and the cost of capital. Strategic Manag J 29:569–592. https://doi.org/10.1002/smj.678

Shurey D (2016) Guide to green bonds on the bloomberg terminal/interviewer: B. N. E. Finance Bloomberg New Energy Finance Note. Bloomberg New Energy Finance

Shurey D (2017) Investors are willing to pay a green’premium/interviewer: B. N. E. Finance. Bloomberg New Energy Finance Note. Bloomberg New Energy Finance

Ehlers T (2017) Green bond finance and certification. BIS Quarterly Review 9:89–104

Wang J, Chen X, Li X, Yu J, Zhong R (2020) The market reaction to green bond issuance: Evidence from China. Pacific-Basin Finance J. https://doi.org/10.1016/j.pacfin.2020.101294

Zerbib OD (2019) The effect of pro-environmental preferences on bond prices. J Bank Finance 98:39–60. https://doi.org/10.1016/j.jbankfin.2018.10.012

Acknowledgements

We thank the Editor and two anonymous reviewers for their valuable comments, which significantly improved this article.

Funding

This article was supported by the Ministry of Education of China, General project of humanities and social sciences research (Grant No.19YJC790110).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interests

The authors declare that they have no known conflict of interest that could influence the work presented in this paper.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Sheng, Q., Zheng, X. & Zhong, N. Financing for sustainability: Empirical analysis of green bond premium and issuer heterogeneity. Nat Hazards 107, 2641–2651 (2021). https://doi.org/10.1007/s11069-021-04540-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11069-021-04540-z