Abstract

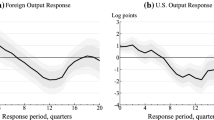

This paper proposes a method for assessing international spillovers from nominal demand shocks. It quantifies the impact of a shock in the crisis country on all other countries. The paper concludes that the network effects in shock spillovers can be substantial, comparable, and often exceed the initial shock. Individual countries may amplify, absorb, or block spillovers. Most developed countries pass-through shocks, whereas low-income countries and oil exporters tend to block shock spillovers. The method is used to study demand shocks originating from a large and medium country, China and Ukraine respectively.

Similar content being viewed by others

Change history

26 June 2018

The original version of the article unfortunately contained a mistake. The Annex table was distorted and some columns were out of order. The corrected version is presented below.

Notes

The number of lags for this specification can be any but empirically the largest impact on imports have export revenue in the previous period.

The elasticity of import dependency on exports revenue can be also learned from a simple import demand function. For small changes in values, the elasticity can be estimated in logarithms or absolute changes in the case if nominal values of the intercept are significant and dominate the log-level parameters. As this is the case in the trade data, an equation

$$ {\varDelta M}_{t-n}^i/{M}_t^i={\alpha}_t+{\beta}_t{\varDelta X}_{t-n}^i/{X}_t^i+{\gamma}_t\left({\varDelta Y}_{t-n}^i/{Y}_t^i-{\varDelta X}_{t-n}^i/{X}_t^i\right)+{\delta}_t\left(\varDelta 1/ ToT\right)+{\varepsilon}_t $$can be estimated for each country i. However, in the context of this model, which is based on bilateral trade flows, import demand functions should also be estimated on a bilateral basis, which with impossible with the existing data.

The original shock can be set as percent r of a country’s GDP \( \left(\Delta \overrightarrow{M}= rY\right) \) and the final impact can be calculated also in percent of GDP. But for the calculation of the spillover within the cascade, the shock should be measured directly in dollars to ensure additivity of spillover effects for each affected country.

References

Arize AC (2002) Imports and exports in 50 countries: tests of cointegration and structural breaks. Int Rev Econ Financ 11(1):101–115

Aslam A, Boz E, Cerutti E, Ribeiro MP, Topalova P (2016) Global trade: what’s behind the slowdown? World Economic Outlook, International Monetary Fund, Washington, DC

Cerdeiro D, Wirkierman A (2008) International trade transmission channel of a local crisis: a simple model. Económica 54

Ericsson N (2011) Empirical modeling of economic time series,” IMF Course Lecture Notes

Fronczak A, Fronczak P (2012) Statistical mechanics of the international trade network. Physical review E 85, arXiv:1104.2606v2, 85

Fruchterman TMJ, Reingold EM (1991) Graph drawing by force-directed placement. Software: Practice and Experience 21(11):1129–1164

Husted S (1992) The emerging U.S. current account deficit in the 1980s: a Cointegration analysis. Rev Econ Stat 74(1):159–166

Jackson M (2010) Social and economic networks, Princeton University Press, 504 p

Kali R, Rayes J (2010) Financial contagion on the international trade network. Econ Inq 48(4):1072–1101

Kireyev A, Leonidov A (2016) China’s Imports Slowdown: Spillovers, Spillins and Spillbacks. IMF Working Paper, 16/51

Kivelä M, Arenas A, Barthelemy M, Gleeson J, Moreno Y, Porter M (2014) “Multilayer Networks,” arXiv:1309.7233v4 [physics.soc-ph]

Mastrandrea R, Squartini T, Fagiolo G, Garlaschelli D (2014) Intensive and extensive biases in economic networks: reconstructing the world trade multiplex, arXiv: 1402.4171

Morin M, Schwellnus C (2014) An update of the OECD. International Trade Equations, OECD Economics Department. Working Papers, No. 1129, OECD Publishing, Paris

Narayan PK (2005) The saving and investment nexus for China: evidence from cointegration tests. Appl Econ 37(17):1979–1990

Newman M (2010) Networks: an Introduction, Oxford University Press, 805 p

Nordlund C (2010) Social Ecography: International trade, network analysis, and an Emmanuelian conceptualization of ecological unequal exchange. PhD dissertation, Lund, Lund University

United Nations (2014) Commodity Trade Statistics Database (UN Comtrade) http://comtrade.un.org/db/help/uReadMeFirst.aspx

Vidon E (2011) US trade spillovers: typical response to US activity. In: The United States Spillover Report, IMF Country Report No. 11/203, https://www.imf.org/en/Publications/CR/Issues/2016/12/31/The-United-States-Spillover-Report-2011-Article-IV-Consultation-25083

Author information

Authors and Affiliations

Corresponding author

Additional information

The original version of this article was revised: The Annex table was distorted and some columns were out of order. The corrected version is presented below.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Kireyev, A., Leonidov, A. Network Effects of International Shocks and Spillovers. Netw Spat Econ 18, 805–836 (2018). https://doi.org/10.1007/s11067-018-9400-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11067-018-9400-7