Abstract

Owing to the dynamic nature of the financial industry, determining accurate stock market forecasts remains a significant challenge. Traditional forecasting methods often struggle to capture the intricate and volatile dynamics of stock price movements. Similarly numerous strategies for stock market prediction have been presented, precise prediction in this field still requires attention. Based on this insight, a novel sequential training model is proposed by adopting the optimal feature selection procedure. In order to determine stock price predictions, primarily financial Nifty data is obtained from the corresponding source. After acquiring financial data, the feature extraction phase is used to extract features from fundamental analysis, such as the Relative Strength Index, Rate of Change, Average True Range, and Exponential Moving Average. Additionally, statistical characteristics such as mean, standard deviation, variance, skewness, and kurtosis are derived from the stock market data. In order to select parameters, the fitness dependent randomised tunicate swarm optimization technique is utilized after the features have been retrieved. Feature selection improves the deep learning process and increases prediction capability by selecting the most important variables and eliminating irrelevant features. A novel sequential training technique is introduced aimed at forecasting stock market trends by leveraging the chosen features. The suggested approach undergoes comprehensive testing, evaluating its predictive capability using accuracy, precision, and recall metrics, implemented towards enhancing future stock price forecasts.

Similar content being viewed by others

References

Vijh M, Chandola D, Tikkiwal VA, Kumar A (2020) Stock closing price prediction using machine learning techniques. Procedia Comput Sci 167:599–606

Nabipour M, Nayyeri P, Jabani H, Shahab S, Mosavi A (2020) Predicting stock market trends using machine learning and deep learning algorithms via continuous and binary data; a comparative analysis. IEEE Access 8:150199–150212

Nikou M, Mansourfar G, Bagherzadeh J (2019) Stock price prediction using DEEP learning algorithm and its comparison with machine learning algorithms. Intell Syst Account Finan Manag 26(4):164–174

Pathak A, Shetty NP (2019) Indian stock market prediction using machine learning and sentiment analysis. In: Proceedings of the International Conference on CIDM 2017. Computational Intelligence in Data Mining. Springer, Singapore, pp 595–603

Lee TK, Cho JH, Kwon DS, Sohn SY (2019) Global stock market investment strategies based on financial network indicators using machine learning techniques. Expert Syst Appl 117:228–242

Khan W, Malik U, Ghazanfar MA, Azam MA, Alyoubi KH, Alfakeeh AS (2020) Predicting stock market trends using machine learning algorithms via public sentiment and political situation analysis. Soft Comput 24(15):11019–11043

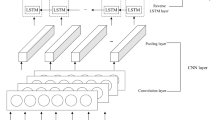

Moghar A, Hamiche M (2020) Stock market prediction using LSTM recurrent neural network. Procedia Comput Sci 170:1168–1173

Parray IR, Khurana SS, Kumar M, Altalbe AA (2020) Time series data analysis of stock price movement using machine learning techniques. Soft Comput 24(21):16509–16517

Nti IK, Adekoya AF, Weyori BA (2020) A systematic review of fundamental and technical analysis of stock market predictions. Artif Intell Rev 53(4):3007–3057

Chatzis SP, Siakoulis V, Petropoulos A, Stavroulakis E, Vlachogiannakis N (2018) Forecasting stock market crisis events using deep and statistical machine learning techniques. Expert Syst Appl 112:353–371

Gurav U, Sidnal N (2018) Predict stock market behavior: role of machine learning algorithms. In: Intelligent Computing and Information and Communication: Proceedings of 2nd International Conference, ICICC 2017. Springer, Singapore, pp. 383–394

Valencia F, Gómez-Espinosa A, Valdés-Aguirre B (2019) Price movement prediction of cryptocurrencies using sentiment analysis and machine learning. Entropy 21(6):589

Nam K, Seong N (2019) Financial news-based stock movement prediction using causality analysis of influence in the Korean stock market. Decis Support Syst 117:100–112

Gurjar M, Naik P, Mujumdar G, Vaidya T (2018) Stock market prediction using ANN. Int Res J Eng Technol 5(3):2758–2761

Mehtab S, Sen J (2019) A robust predictive model for stock price prediction using deep learning and natural language processing. arXiv preprint arXiv:1912.07700

Liu J, Lin H, Yang L, Xu B, Wen D (2020) Multi-Element Hierarchical Attention Capsule Network for Stock Prediction. IEEE Access 8:143114–143123

Naik N, Mohan BR (2021) Novel Stock Crisis Prediction Technique—A Study on Indian Stock Market. IEEE Access 9:86230–86242

Lee J, Kim R, Koh Y, Kang J (2019) Global stock market prediction based on stock chart images using deep Q-network. IEEE Access 7:167260–167277

Alotaibi SS (2021) Ensemble technique with optimal feature selection for Saudi stock market prediction: a novel hybrid red deer-grey algorithm. IEEE Access 9:64929–64944

Yuan X, Yuan J, Jiang T, Ain QU (2020) Integrated long-term stock selection models based on feature selection and machine learning algorithms for China stock market. IEEE Access 8:22672–22685

Bouktif S, Fiaz A, Awad M (2020) Augmented textual features-based stock market prediction. IEEE Access 8:40269–40282

Wang Y, Liu H, Guo Q, Xie S, Zhang X (2019) Stock volatility prediction by hybrid neural network. IEEE Access 7:154524–154534

Chen Y, Lin W, Wang JZ (2019) A dual-attention-based stock price trend prediction model with dual features. IEEE Access 7:148047–148058

Hou X, Wang K, Zhong C, Wei Z (2021) St-trader: A spatial-temporal deep neural network for modeling stock market movement. IEEE/CAA Journal of Automatica Sinica 8(5):1015–1024

https://www.kaggle.com/datasets/rohanrao/nifty50-stock-market-data

Khan W, Ghazanfar MA, Azam MA, Karami A, Alyoubi KH, Alfakeeh AS (2020) Stock market prediction using machine learning classifiers and social media, news. Ambient Intell Humaniz Comput, pp.1–24

Zhong X, Enke D (2019) Predicting the daily return direction of the stock market using hybrid machine learning algorithms. Finan Innov 5(1):1–20

Jiang W (2021) Applications of deep learning in stock market prediction: recent progress. Expert Syst Appl 184:115537

Long J, Chen Z, He W, Wu T, Ren J (2020) An integrated framework of deep learning and knowledge graph for prediction of stock price trend: An application in Chinese stock exchange market. Appl Soft Comput 91:106205

Wen M, Li P, Zhang L, Chen Y (2019) Stock market trend prediction using high-order information of time series. Ieee Access 7:28299–28308

Chung H, Shin KS (2020) Genetic algorithm-optimized multi-channel convolutional neural network for stock market prediction. Neural Comput Appl 32:7897–7914

Liu Y (2019) Novel volatility forecasting using deep learning–long short term memory recurrent neural networks. Expert Syst Appl 132:99–109

Funding

The authors declare there is no funding in this project.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Declaration of interest

The authors declare that we have no Declaration of Interest.

Conflict of interest

The authors declare that we have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Sudhakar, K., Naganjaneyulu, S. Enhancing stock market forecasting using sequential training network empowered by tunicate swarm optimization. Multimed Tools Appl 83, 54449–54472 (2024). https://doi.org/10.1007/s11042-023-17686-8

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11042-023-17686-8