Abstract

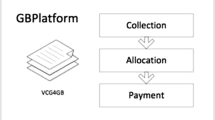

Online group-buying is a popular business mode based on Internet. Group-buying websites can get discount for goods or services through promotion and other means which used to gather enough number of people, and sellers can also sell more quantities of goods. However, the existing group-buying mode is that all buyers unify the fixed pricing, the mechanism cannot distinguish the contribution of different buyers and motivate buyers report truthfully. In this paper, an online group-buying pricing method based on buyer’s fixed bidding is proposed in view of the influence of buyer’s bidding price and demand quantity on the participants’ group in the group-buying mechanism. We introduce the concept of relative importance to the allocation and pricing of mechanisms and propose a new mechanism named Fixed bids Truthful Mechanism for Group Buying (FTM4GB) based on correlation importance. At the end of the paper, we prove the economic attributes of individual rationality, incentive compatibility and budget balance.

Similar content being viewed by others

References

Anand KS, Aron R (2003) Group Buying on the Web: A comparison of Price-Discovery Mechanisms[J]. Manag Sci 49(11):1546–1562

Babaioff M, Nisan N (2001) Concurrent auctions across the supply chain[C]// arXiv, pp 1–10

Chen RR, Roma P (2015) Group buying of competing Retailers[J]. Prod Oper Manag 20(2):181–197

Dolan RJ (1987) Quantity discounts: Managerial issues and research Opportunities[J]. Mark Sci 6(1):1–22

Gibbard A (1973) Manipulation of voting schemes: a general Result[J]. Econometrica 41(4):587–601

Guttman RH, Maes P (1998) Agent-Mediated Integrative Negotiation for Retail Electronic Commerce[C]// Selected Papers from the First International Workshop on Agent Mediated Electronic Trading on Agent Mediated Electronic Commerce. Springer, Berlin, pp 70–90

Hendrick TE (1997) Purchasing Consortiums: Horizontal Alliances among Firms Buying Goods and Services: What? Who? Why? How?[J]. Managing Channel Profits Marketing Science

Hurwicz L (1973) The design of mechanisms for resource Allocation[J]. Am Econ Rev 63(2):1–30

Jr JD (2003) Buyer groups as strategic commitments[J]. Games Econ Behav 74 (2):470–485

Kauffman RJ, Wang B (2002) Bid together, buy together: On the efficacy of group-buying business models in Internet-based selling[J]. Handbook of Electronic Commerce in Business and Society Boca, pp 27–28

Lesca J, Perny P (2012) Almost-truthful mechanisms for fair social choice functions[J]. Front Artif Intell Appl 242:522–527

Li C, Sycara K (2002) Algorithm for combinatorial coalition formation and payoff division in an electronic marketplace[C]// In: International Joint Conference on Autonomous Agents and Multiagent Systems. ACM, pp 120–127

Li C (2006) Game analysis of group buying mode[J]. J Guangdong Coll Financ Econ 5(2):61–63

Lu H, Li Y, Chen M et al (2018) Brain intelligence: go beyond artificial intelligence[J]. Mob Netw Appl 23(2):368–375

Muller E, Satterthwaite MA (1985) Strategy-proofness: the existence of dominant-strategy mechanisms[J]. Social goals and social organization: Essays in memory of Elisha Pazner, pp 131–172

Myerson RB, Satterthwaite MA (1983) Efficient mechanism for bilateral Trading[J]. J Econ Theory 29(2):265–281

Sandholm T, Conitzer V, Boutilier C (2007) Automated design of multistage mechanisms[C]// International Joint Conference on Artifical Intelligence. Morgan Kaufmann Publishers Inc., Burlington, pp 1500–1506

Thomson W, Moulin H (1988) Axioms of cooperative decision Making[J]. Camb Books 57(228):543

Vickrey W (2012) Counterspeculation, auctions, and competitive sealed Tenders[J]. J Financ 16(1):8–37

Yamamoto J, Sycara K (2001) A stable and efficient buyer coalition formation scheme for e-marketplaces[C]. In: Proceedings of the fifth international conference on Autonomous agents. ACM, pp 576–583

Yokoo M, Sakurai Y, Matsubara S (2000) The effect of false-name declarations in mechanism design: towards collective decision making on the Internet[C]// In: International Conference on Distributed Computing Systems, 2000. Proceedings. IEEE, pp 146–153

Zhang Y, Gravina R, Lu H et al (2018) PEA: Parallel Electrocardiogram-based authentication for smart healthcare systems[J]. J Netw Comput Appl 117:10–16

Zaman S, Grosu D (2010) Combinatorial auction-based allocation of virtual machine instances in clouds[C]. IEEE Second International Conference on Cloud Computing Technology and Science. IEEE Computer Society, pp 127–134

Acknowledgements

This work was supported by the National Nature Science Foundation of China under Grant 61872313, Grant 61170201, Grant 61070133, and Grant 61472344, the key research projects in education informatization in Jiangsu province Grant 20180012, in part by the Postgraduate Research and Practice Innovation Program of Jiangsu Province under Grant KYCX18_2366, in part by the Natural Science Foundation of the Jiangsu Higher Education Institutions under Grant 14KJB520041, in part by the Advanced Joint Research Project of Technology Department of Jiangsu Province under Grant BY2015061-06 and Grant BY2015061-08, and in part by the Yangzhou Science and Technology under Grant YZ2017288 and YZ2018076, and Yangzhou University Jiangdu High-end Equipment Engineering Technology Research Institute Open Project under Grant YDJD201707.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interests

We declare that we have no financial and personal relationships with other people or organizations that can inappropriately influence our work, there is no professional or other personal interest of any nature or kind in any product, service and/or company that could be construed as influencing the position presented in, or the review of, the manuscript entitled, ’Allocation and Pricing of Group-Buying Based on the Fixed Bidding of Buyer’.

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhang, X., Zhu, Z., Li, B. et al. Allocation and pricing of group-buying based on the fixed bidding. Multimed Tools Appl 79, 14689–14710 (2020). https://doi.org/10.1007/s11042-019-7302-4

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11042-019-7302-4