Abstract

The paper presents exact formulae related to the distribution of the first passage time τx of the jump-telegraph process. In particular, the Laplace transform of τx is analysed, when a jump component is in the opposite direction to the crossing level x > 0. The case of double exponential jumps is also studied in detail.

Similar content being viewed by others

References

Abundo M (2000) On first-passage times for one-dimensional jump-diffusion processes. Probab Math Stat 20(2):399–423

Bogachev L, Ratanov N (2011) Occupation time distributions for the telegraph process. Stoch Process Appl 121:1816–1844

Brémaud P (1999) Markov chains, Gibbs fields, Monte-Carlo simulation, and queues. Springer, Berlin

Di Crescenzo A, Iuliano A, Martinucci B, Zacks S (2013) Generalized telegraph process with random jumps. J Appl Probab 50(2):450–463

Di Crescenzo A, Martinucci B (2013) On the generalized telegraph process with deterministic jumps. Methodol Comput Appl Probab 15(1):215–235

Di Crescenzo A, Meoli A (2018) On a jump-telegraph process driven by an alternating fractional Poisson process. J Appl Probab 55(1):94–111

Di Crescenzo A, Pellerey F (2002) On prices’ evolutions based on geometric telegrapher’s process. Appl Stoch Models Bus Ind 18:171–184

Di Crescenzo A, Ratanov N (2015) On jump-diffusion processes with regime switching: martingale approach. ALEA Lat Am J Probab Math Stat 12(2):573–596

Fontbona J, Guérin H, Malrieu F (2016) Long time behavior of telegraph processes under convex potentials. Stoch Process Appl 126(10):3077–3101

Foong SK (1992) First-passage time, maximum displacement, and Kac’s solution of the telegrapher equation. Phys Rev A 46:707–710

Foong SK, Kanno S (1994) Properties of the telegrapher’s random process with or without a trap. Stoch Process Appl 53:147–173

Kolesnik AD, Ratanov N (2013) Telegraph processes and option pricing. Springer, Heidelberg

Kou SG (2002) A jump-diffusion model for option pricing. Manag Sci 48 (8):1086–1101

Kou SG, Wang H (2003) First passage times of a jump diffusion process. Adv Appl Probab 35:504–531

López O, Ratanov N (2012) Kac’s rescaling for jump-telegraph processes. Statist Probab Lett 82:1768–1776

López O, Ratanov N (2014) On the asymmetric telegraph processes. J Appl Probab 51:569–589

Orsingher E (1990) Probability law, flow function, maximum distribution of wave-governed random motions and their connections with Kirchhoff’s laws. Stoch Process Appl 34:49–66

Pogorui AA, Rodrguez-Dagnino RM, Kolomiets T (2015) The first passage time and estimation of the number of level-crossings for a telegraph process. Ukrain Math J 67(7):998–1007. (Ukrainian Original, 67(7):882–889)

Prudnikov AP, Brychkov YuA, Marichev OI (1992) Integrals and series, vol 5. Inverse Laplace Transforms. Gordon and Breach Science Publ

Ratanov N (2007) A jump telegraph model for option pricing. Quant Finan 7:575–583

Ratanov N (2010) Option pricing model based on a Markov-modulated diffusion with jumps. Braz J Probab Stat 24(2):413–431

Ratanov N (2013) Damped jump-telegraph processes. Stat Probab Lett 83:2282–2290

Ratanov N (2014) Double telegraph processes and complete market models. Stoch Anal App 32(4):555–574

Ratanov N (2017) Self-exciting piecewise linear processes. ALEA Lat Am J Probab Math Stat 14:445–471

Ratanov N (2018) Kac-Lévy processes. J Theor Probab. https://doi.org/10.1007/s10959-018-0873-6

Shiryaev AN (2007) On martingale methods in the boundary crossing problems of Brownian motion. Sovrem Probl Mat 8:80. (in Russian)

Zacks S (2004) Generalized integrated telegraph processes and the distribution of related stopping times. J Appl Probab 41(2):497–507

Zacks S (2017) Sample path analysis and distributions of boundary crossing times. Lecture notes in mathematics, vol 2203. Springer, Berlin

Acknowledgments

I am very grateful to anonymous referees and the editor for the careful reading of the paper and for the helpful comments that have greatly improved the text.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix: Conditions determining appearance of conjugate complex roots

Appendix: Conditions determining appearance of conjugate complex roots

Consider the compound Poisson process with constant drift, \(X(t)=ct+{\sum }_{n = 1}^{N(t)}Y_{n},\) where N(t) is a homogeneous Poisson process with parameter λ,λ > 0; {Yn}n≥ 1 are independent identically distributed random jumps. For simplicity, we assume that Yn has the symmetric Laplace distribution with the density function \(h(y)=\dfrac 12 b\exp (-b|y|), b>0\).

In this particular case, Eq. 3.9 is equivalent to the pair of equations:

Let c > 0 (the case c < 0 can be analysed similarly). Since for q > 0

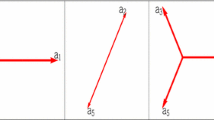

and c > 0, all three roots of the first equation of (A.1) are always real: one negative and two positive, see Fig. 10.

The second equation of (A.1) is equivalent to

This equation always has one negative root. The other two roots are real positive if and only if function f(α) has a negative local minimum, minα> 0f(α) < 0, which is taken at the stationary point

After the tedious algebra, one can see that the inequality minα> 0f(α) < 0 is equivalent to

where α∗ is defined by (A.3).

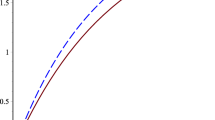

Note that condition (A.4) fails when b = (λ + q)/c, see Fig. 11.

If b≠(λ + q)/c, then (A.4) is valid only when the trend c is far from (λ + q)/b. More precisely, if c↓ 0, then α∗↑ +∞, in such a way that \(c\alpha _{*}\downarrow \dfrac 23(\lambda +q),\) which ensures (A.4) for a small c > 0. In contrast, if c → +∞, then \(\alpha _{*}\to b/\sqrt {3}\), which again gives (A.4) for a sufficiently large trend c.

See Fig. 11: in case (1) (0 < c ≪ (λ + q)/b) and in case (3) (c ≫ (λ + q)/b) we have two positive real roots; case (2) with moderate c corresponds to two conjugate complex roots with a positive real part.

Consider another example. Let c1 = −c2 = c > 0 and the jump part is the same. In this case, Eq. 3.29 becomes

Note that

Hence, Eq. A.5 always has at least one positive real root, see Fig. 12.

Equation A.5 has two additional positive real roots if and only if there exists α > b such that

see Fig. 12 (dashed parabola (λ + q)2 − c2α2 with small c which corresponds to three real positive roots). Otherwise, Eq. A.5 has one real positive root and a pair of conjugate complex roots with positive real part.

Since, the point of local maximum of f(α),α > b, corresponds to

Equation A.5 has three real positive roots if the following relation holds:

which is equivalent to sufficiently small c,c < (λ + q)/b, such that

Rights and permissions

About this article

Cite this article

Ratanov, N. First Crossing Times of Telegraph Processes with Jumps. Methodol Comput Appl Probab 22, 349–370 (2020). https://doi.org/10.1007/s11009-019-09709-5

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11009-019-09709-5