Abstract

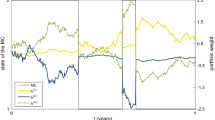

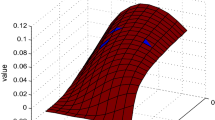

This work is intended to systematically characterize the problem of block trading. The author characterizes it as a constrained optimal purchasing (or control) problem, on behalf of the vendee. The purpose of this work is to investigate the optimal purchasing strategies and give quantitative reference information on the pricing of block trade. Noting that large block of stock trading may result in the price fluctuation and different market environment may lead to distinct investing strategies, the controlled diffusion model with regime switching is adopted, which can be used to represent distinct environment of financial market, and the model is modified to allow the price impact, by allowing the drift depend on the purchase rate. Where the switching regimes can be completely observable or unobservable (hidden). Which is a significant difference in contrast to most market models in the existing literature. The objective is to maximize the total discounted shares of the underlying stock, subject to the expected fund for building up corresponding position with an upper bound. This work mainly focuses on the completely observable case, as to the case with hidden regimes, this work just briefly talk about how to reduce the unobservable model to a completely observable one. In the completely observable case, to solve this constrained control problem, the Lagrange multiplier methods and the dynamic programming approaches are used. Though optimality is obtained, what is still lacking is an explicit solution to the optimality equation. To overcome this difficulty, the two loop approximation scheme is given. For fixed Lagrange multiplier, the inner loop is to obtain optimal strategies, which is based mainly on the finite difference approximation. While, the outer loop is a stochastic recursive approximation algorithm to get the optimal Lagrange multiplier. Convergence results are obtained for both the inner and the outer approximations. The quantitative pricing information is related to the threshold levels of the optimal purchasing strategy. Numerical examples are also provided to illustrate our results. Finally, as to the unobservable case, by using the well known Wonham filter approach, one can reduce the unobservable case to a completely observable one.

Similar content being viewed by others

References

Barles G, Souganidis PE (1991) Convergence of approximation schemes for fully nonlinear second order equations. Asymptotic Anal 4(3):271–283

Dai M, Zhang Q, Zhu QJ (2010) Trend following trading under a regime switching model. SIAM J Finanical Math 1(1):780–810

Robert J (1982) Elliott Stochastic Calculus and Applications. Springer, Berlin

Elliott RJ, Siu TK, Badescu A (2010) On the mean-variance portfolio selection under a hidden Markovian regime-switching model. Econ Model 27:678–686

Ethier SN, Kurtz TG (2005) Markov Processes: Characterizaion and Convergece. A John Wiley & Sons, Inc Publication, Hoboken

Fleming WH, Nisio M (1984) On stochastic relaxed control for partially observed diffusions. Nagoya Math J 93:71–108

Ghosh MK, Arapostathis A, Marcus SI (1993) Optimal control of switching diffusions with application to flexible manufacturing systems. SIAM J Control Optim 31(5):1183–1204

Guo X, Yin G (2006) The Wonham filter with random parameters: rate of convergence and erro bounds. IEEE Trans Automat Control 51(3):460–464

Guo X, Zhang Q (2005) Optimal selling rules in a regime switching model. IEEE Trans Autom Control 50(9):1450–1455

Helmes K (2004) Computing Optimal Selling Rules for Stocks Using Linear Programming. Mathematics of Finance, 187–198, Contemp math., 351, Amer. Math. Soc., Providence

Hull JC (2012) Options, Futures, and Other Derivatives. Pearson Education 8th edition

Ice futures u.s. block trade - faqs. https://www.theice.com/publicdocs

Jakobsen ER, Karlsen KH (2006) A “maximum principle for semicontinuous functions” applicable to integro-partial differential equations. NoDEA Nonlinear Differential Equations Appl 13(2):137–165

Jasso-Fuentes H, Escobedo-Trujillob BA, Mendoza-Prezc AF (2016) The lagrange and the vanishing discount techniques to controlled diffusions with cost constraints. J. Math. Anal. Appl. 437(2):999–1035

Karatzas I, Shreve SE (1998) Methods of Mathematical Finance. Springer, Berlin

Kushner HJ (1990) Weak Convergence Methods and Singularly Perturbed Stochastic Control and Filtering Problems. Birkhäuser , Boston

Kushner HJ, Yin G (1987) Asymptotic properties of distributed and communicating stochastic approximation algorithms. SIAM J Control Optim 25(5):1266–1290

Kushner HJ, Yin G (2003) Stochastic Approximation and Recursive Algorithms and Applications. Springer, Berlin

Lu X, Yin G, Zhang Q, Zhang C, Guo X (2016) Building up an illiquid stock position subject to expected fund availability: Optimal controls and numerical methods. Appl. Math Optim.

Mendoza-Pérez AF, Jasso-Fuentes H, Hernández-Lerma O (2015) The lagrange approach to ergodic control of diffusions with cost constraints. Optimization 64(2):179–196

Øksendal B (2003) Stochastic Differential Equations. Springer, Berlin

Pemy M, Zhang Q, Yin G (2008) Liquidation of a large block of stock with regime switching. Math Finance 18(4):629–648

Yin G, Zhu C (2010) Hybrid Switching Diffusions. Springer, Berlin

Yin G, Liu RH, Zhang Q (2002) Recursive algorithms for stock liquidation A stochastic optimization approach. SIAM J Optim 13(1):240–263

Yong J, Zhou X (1999) Stochastic Controls: Hamiltonian Systems and HJB Equations. Springer, Berlin

Zhang Q (2001) Stock trading: an optimal selling rule. SIAM J Control Optim 40(1):64–87

Acknowledgements

I would like to express my gratitude to the editor and the anonymous reviewers. Many thanks for their useful suggestions and comments, which help me to improve my work.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This work was supported in part by the Natural Science Foundation of China (Grants #11801590).

Appendix

Appendix

Definition A.1

For each \(i\in \mathcal {M}\) and fixed λ, V (x,i,λ) ∈ C([0,∞)) (the space of all continuous functions on [0,∞)) is a viscosity solution of (3.4), if,

-

(a)

V (x,i,λ) is a viscosity supersolution of (3.4) on [0,∞); i.e.,

$$\rho \varphi(x_{0})\geq\sup_{u\in\mathbb{U}}\left\{\mathcal{L}^{u}\varphi(x_{0})+a(x_{0},u,\lambda)\right\}, $$holds for all φ(⋅) ∈ C2([0,∞)) with C2([0,∞)) as the family of all functions on [0,∞) which are twice conotinuously differentiable with respect to x, and all x0 ∈ S such that V (x,i,λ) − φ(x) has a local minimum at x0.

-

(b)

and V (x,i,λ) is also a viscosity subsolution of (3.4) on [0,∞); i.e.,

$$\rho \varphi(x_{0})\leq\sup_{u\in\mathbb{U}}\left\{\mathcal{L}^{u}\varphi(x_{0})+a(x_{0},u,\lambda)\right\}, $$for all φ(⋅) ∈ C2([0,∞)), and x0 ∈ S such that V (x,i,λ) − φ(x) has a local maximum at x0.

The viscosity solution method will see its application in characterizing the convergence property of the approximation structure later in Section 4.

Definition A.2

A sequence {πm}⊆π is said to be weakly convergent to π ∈π, if for any square integrable function f(x,i) defined on S, and bounded continuous function g(x,i,u) defined on \(S\times \mathbb {U}\),

for each \(i\in \mathcal {M}\).

Proof of Theorem 3.4

The idea of the proof is similar to the corresponding part in Pemy et al. (2008). For any stopping time τ, the dynamic programming principle implies that for each \(i\in \mathcal {M}\),

Let \(\alpha (0)=i_{0}\in \mathcal {M}\), X(0) = x0 ∈ [0,∞). Let φ(x) ∈ C2([0,∞)) such that V (x,i0,λ) − φ(x) has a local minimum at x0 in N(x0), a neighborhood of x0. Without loss of generality we can assume that V (x0,i0,λ) − φ(x0) = 0. Let τ be the first jump time of α ⋅. Moreover, let τ0 ∈ (0,τ] be a stopping time such that for 0 ≤ t ≤ τ0, X(t) ∈ N(x0). Consider the control \(u(t)=u\in \mathbb {U}\), for t ∈ [0,τ0], and u a constant such that \(u\cdot \in \mathcal {A}\). Moreover, for t ∈ [0,τ0], V (X(t),i,λ) − φ(X(t)) ≥ 0.

Given 0 < 𝜖 ≤ τ0, using (A.1), we have

Define

Using Dynkin’s formula, we have

Recall that x0 is a local minimum of V (x,i0,λ) − φ(x). Then for 0 ≤ t ≤ 𝜖, we have

It follows that

Moreover, (A.4) implies that

Then from (A.5) we have

Combining (A.2) and (A.6), we obtain

By letting 𝜖 → 0 enables us to conclude that

Thus, V (x,i,λ) is a viscosity supersolution.

Next, we show that V (x,i,λ) is viscosity subsolution on S for fixed λ and \(i\in \mathcal {M}\). Assume otherwise, for \(i_{0}\in \mathcal {M}\) there exists x0 ∈ [0,∞) and δ > 0 such that for \(u\in \mathbb {U}\),

in the neighborhood of N(x0), where φ(x) ∈ C2([0,∞)) such that V (x,i0,λ) − φ(x) attains its maximum at x0 in N(x0). Without loss of generality, we can assume that V (x0,i0,λ) − φ(x0) = 0. let u(⋅) be an admissible control. Let τ be the first jump time of the process α(⋅). Let τ0 ≤ τ be a stopping time such that for 0 ≤ s ≤ τ0 ≤ τ, X(s) ∈ N(x0) and V (X(s),i0,λ) − φ(X(s)) ≤ 0. Then for 0 ≤ 𝜖 ≤ τ0, we have

Recall that x0 is the local maximum of V (x,i0,λ) − φ(x). Then using (A.3), for 0 ≤ t ≤ 𝜖, we have

Similarly, we have

Thus we have

Taking the supremum over all admissible control u(⋅) we have

This contradicts the fact that δ > 0. Therefore V (x,i0,λ) is a viscosity subsolution.

Finally the uniqueness of viscosity solution can be obtained as in Jakobsen and Karlsen (2006). □

Let νn be a sequence of positive numbers so that

as n →∞. Here l is a positive integer.

Lemma A.3

For eachl ≥ 1 and fixedλ,we have

in probability,

in probability. Where (X(⋅),π(λ,⋅)) is the weak limit of (Xn(⋅),πn(λ,⋅). And En is the conditional expectation with respect to \(\mathcal {G}_{n}\), the σ-algebra generated by {ξj : j ≤ n}.

Proof

First we derive the tightness of the pair (Xn(⋅),πn(λ,⋅)). since {πn(λ,⋅)} is in π, the sequence is tight. Now we show that the associated controlled diffusion Xn(⋅) is tight in \(D([0,\infty ):\mathbb {R})\), the space of functions that are right continuous with left limits endowed with the Skorohod topology. As in (Yin and Zhu 2010, p31, Proposition 2.3), by using Itô isometry and the Gronwall inequality, detailed computations lead to

for any T > 0 and s ≤ T, with sup0≤s≤TECn(s,T) < ∞. Within this proof \({E_{s}^{n}}\) denotes the expectation with respect to \(\mathcal {F}_{s}^{n}=\sigma \{W_{n}(t): t\leq s\}\). Thus, for any η > 0,t ≥ 0 and 0 ≤ s ≤ η, we have

with \(\tilde {C}_{n}(\eta ,s,T)\) satisfies that

Then by the tightness criterion (Ethier and Kurtz 2005, Chapter 3, Corollary 8.6), see also (Kushner and Yin 2003, p230, Theorem 3.3), we conclude that Xn(⋅) is tight in \(D([0,\infty ):\mathbb {R})\). Thus (Xn,πn(λ,⋅)) is tight in \(D([0,\infty ):\mathbb {R})\times {\Pi }\).

Since (Xn,πn(λ,⋅)) is tight, it is sequentially compact. So we can extract weakly convergent subsequences. Select such a sequence still denoted by (Xn,πn(λ,⋅)). Denote its limit by (X(⋅),π(λ,⋅)). By Skorohod representation, we assume that (Xn,πn(λ,⋅)) converges to (X(⋅),π(λ,⋅)) with probability 1. Consider the sequence {ξn}, we can deduce the following estimation

Next, {ξn} is an independent sequence because the sequence is generated by integrating w.r.t. independent Brownian motions. By the weak convergence, the Skorohod representation, and the dominated convergence theorem,

Similarly, we can derive the other assertion of this lemma. The desired result follows. □

Rights and permissions

About this article

Cite this article

Lu, X. Block Trading: Building up a Stock Position Under a Regime Switching Model. Methodol Comput Appl Probab 21, 805–828 (2019). https://doi.org/10.1007/s11009-019-09698-5

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11009-019-09698-5