Abstract

This study examines the effect of voluntary disclosure in annual reports on tax avoidance activities. The agency theory of tax avoidance suggests that tax sheltering is associated with important agency costs, underlining the importance of corporate governance mechanisms such as voluntary disclosure in shaping tax planning. Using a sample of 3448 firm-year observations of French listed firms over 2007–2013, the results show that voluntary disclosure is associated with lower tax avoidance activities, providing evidence that this disclosure can be seen as an effective monitoring tool that reduces the insiders’ likelihood to engage in rent extraction through tax avoidance activities. The results also indicate that the negative effect of voluntary disclosure on tax avoidance is significant only when family control is below 40%, suggesting that the disciplinary role of voluntary disclosure is limited to firms with relatively low family control levels. Overall, our findings are consistent with the agency theory of tax avoidance and highlight the important role of corporate disclosure in improving corporate governance.

Similar content being viewed by others

Notes

The agency view of corporate tax avoidance provides a primary channel through which voluntary disclosure can affect tax avoidance. Despite the existence of an alternative value creation view for tax avoidance, the literature underscores that its potential benefits are typically offset by the increased opportunities for managers to pursue self-serving actions through tax planning, particularly in poorly-governed firms. In this respect, Desai and Dharmapala (2009, pp. 537 and 538) argue that: “the simple view of corporate tax avoidance as a transfer of resources from the state to shareholders is incomplete given the agency problems characterizing shareholder-manager relations” and that “corporate tax avoidance not only entails distinct costs, but these costs may outweigh the benefits to shareholders, given the opportunities for a diversion that these vehicles provide”.

The complexity of tax avoidance stems from the fact that such activity involves the subdivision of the firm into many different business activities (e.g., income qualifying for treaty-based withholding taxes and activity qualifying for the domestic manufacturers’ deduction), a variety of tax-documents (e.g., transfer pricing documentation, signed intercompany agreements; and exemption certificates), and, sometimes, the simultaneous use of local and foreign tax jurisdictions (i.e., tax-motivated transfer pricing and cost-sharing agreements). Balakrishnan et al. (2019) provide other examples of tax planning strategies that increase corporate opacity such as the creation of entities for multi-state tax planning (e.g., captive real estate investment trusts [REITs] and intangible holding companies), net operating loss monetization, and capital loss utilization.

Kovermann and Velte (2019) provide a succinct overview of this literature that largely underscores the importance of agency costs associated with tax avoidance activities.

In France, the 2014 Finance Bill introduced a new anti-hybrid financing measure limiting the deductibility of interests accrued to related party lenders, which represents France’s first concrete step to give effect to the BEPS project (Deloitte & tax@hand 2014).

Art. 223 B quinquies of the French Tax Code.

In many other studies, tax avoidance is measured using the current effective tax rate (current tax expense to pretax income ratio). In our main analysis, we opt for cash effective tax rates rather than current effective tax rates to encounter some limitations. Indeed, tax expense includes current tax expense and deferred tax expense which means that if a firm accelerates deductions and deferring income for tax purposes, this diminishes current taxes but increases deferred taxes. This will not be captured in the current effective tax rate as it includes both current tax expense and deferred tax expense. Moreover, tax expenses can be overstated compared to taxes paid when firms have stock option deductions because when employees exercise their stock option rights, which is not considered in tax expenses (Dyreng et al., 2010).

Our results remain qualitatively the same when we use fixed effects estimations (Table 6, Columns 1–3).

A finding of greater tax aggressiveness in family firms is consistent with family owners valuing the tax savings and rent extraction more than the associated costs: price discount, IRS penalty, and reputation damage.

References

Allaya, M., Derouiche, I., & Muessig, A. (2020). Voluntary disclosure, ownership structure, and corporate debt maturity: A study of French listed firms. Forthcoming, International Review of Financial Analysis.

Allegrini, M., & Greco, G. (2013). Corporate boards, audit committees and voluntary disclosure: evidence from Italian Listed Companies. Journal of Management & Governance, 17(1), 187–216.

Anderson, R. C., & Reeb, D. M. (2003). Founding-family ownership and firm performance: Evidence from the S&P 500. The Journal of Finance, 58(3), 1301–1328.

Armstrong, C. S., Blouin, J. L., Jagolinzer, A. D., & Larcker, D. F. (2015). Corporate governance, incentives, and tax avoidance. Journal of Accounting and Economics, 60(1), 1–17.

Austin, C. R., & Wilson, R. J. (2017). An examination of reputational costs and tax avoidance: Evidence from firms with valuable consumer brands. The Journal of the American Taxation Association, 39(1), 67–93.

Balakrishnan, K., Blouin, J. L., & Guay, W. R. (2019). Tax aggressiveness and corporate transparency. The Accounting Review, 94(1), 45–69.

Beatty, A., Liao, S., & Weber, J. (2010). Financial reporting quality, private information, monitoring, and the lease-versus-buy decision. The Accounting Review, 85(4), 1215–1238.

Blaylock, B. S. (2016). Is tax avoidance associated with economically significant rent extraction among US firms? Contemporary Accounting Research, 33(3), 1013–1043.

Blaylock, B., Shevlin, T., & Wilson, R. J. (2012). Tax avoidance, large positive temporary book-tax differences, and earnings persistence. The Accounting Review, 87(1), 91–120.

Blouin, J. L., Fich, E. M., Rice, E. M., & Tran, A. L. (2020). Corporate tax cuts, merger activity, and shareholder wealth. Journal of Accounting and Economics, 101315.

Boubaker, S. (2007). Ownership-control discrepancy and firm value: Evidence from france. Multinational Finance Journal, 11(3/4), 211.

Boubaker, S., Derouiche, I., & Hassen, M. (2015). Family control and the value of cash holdings. Journal of Applied Business Research (JABR), 31(2), 647–660.

Brown, S., & Tucker, J. (2011). Large-sample evidence of firms’ year-over-year MD&A modifications. Journal of Accounting Research, 49, 309–346.

Brune, A., Thomsen, M., & Watrin, C. (2019). Family firm heterogeneity and tax avoidance: The role of the founder. Family Business Review, 32(3), 296–317.

Chan, K. H., Mo, P. L. L., & Tang, T. (2016). Tax avoidance and tunneling: Empirical analysis from an agency perspective. Journal of International Accounting Research, 15(3), 49–66.

Chang, H., Dai, X., He, Y., & Wang, M. (2020). How internal control protects shareholders' welfare: evidence from tax avoidance in China. Forthcoming, Journal of International Accounting Research.

Chen, S., Chen, X. I. A., & Cheng, Q. (2008). Do family firms provide more or less voluntary disclosure? Journal of Accounting Research, 46(3), 499–536.

Chen, S., Chen, X., Cheng, Q., & Shevlin, T. (2010). Are family firms more tax aggressive than non-family firms? Journal of Financial Economics, 95(1), 41–61.

Chrisman, J. J., & Patel, P. C. (2012). Variations in R&D investments of family and nonfamily firms: Behavioral agency and myopic loss aversion perspectives. Academy of Management Journal, 55(4), 976–997.

Chung, H., Judge, W. Q., & Li, Y. H. (2015). Voluntary disclosure, excess executive compensation, and firm value. Journal of Corporate Finance, 32, 64–90.

Chung, S. G., Goh, B. W., Lee, J., & Shevlin, T. (2019). Corporate tax aggressiveness and insider trading. Contemporary Accounting Research, 36(1), 230–258.

Claessens, S., Djankov, S., & Lang, L. H. (2000). The separation of ownership and control in East Asian corporations. Journal of Financial Economics, 58(1–2), 81–112.

Davis, A. K., Guenther, D. A., Krull, L. K., & Williams, B. M. (2016). Do socially responsible firms pay more taxes? The Accounting Review, 91(1), 47–68.

Deloitte & Tax@hand (2014). Draft comments on anti-hybrid rule. https://www.taxathand.com/article/1238/France/2014/Draft-comments-on-anti-hybrid-rule. Accessed 17 April 2014.

Derouiche, I., Jaafar, K., & Zemzem, A. (2016). Firm geographic location and voluntary disclosure. Journal of Multinational Financial Management, 37, 29–47.

Desai, M. A., & Dharmapala, D. (2006). Corporate tax avoidance and high-powered incentives. Journal of Financial Economics, 79(1), 145–179.

Desai, M. A., & Dharmapala, D. (2009). Corporate tax avoidance and firm value. The Review of Economics and Statistics, 91(3), 537–546.

Dhaliwal, D. S., Lee, H. S., Pincus, M., & Steele, L. B. (2017). Taxable income and firm risk. The Journal of the American Taxation Association, 39(1), 1–24.

Dhaliwal, D. S., Li, O. Z., Tsang, A., & Yang, Y. G. (2011). Voluntary nonfinancial disclosure and the cost of equity capital: The initiation of corporate social responsibility reporting. The Accounting Review, 86, 59–100.

Dicko, S., Khemakhem, H., & Zogning, F. (2020). Political connections and voluntary disclosure: the case of Canadian listed companies. Journal of Management and Governance, 24(2), 481–506.

Directive 2006/46/EC of the European Parliament and of the Council of 14 June 2006 amending Council Directives 78/660/EEC on the annual accounts of certain types of compa-nies, 83/349/EEC on consolidated accounts, 86/635/EEC on the annual accounts and consolidated account of banks and other financial institutions and 91/674/EEC on the annual accounts and consolidated accounts of insurance undertakings, Official Journal of the European Union, L 224/1, 16.8.2006.

Dyer, T., Lang, M., & Stice-Lawrence, L. (2017). The evolution of 10-K textual disclosure: Evidence from Latent Dirichlet Allocation. Journal of Accounting and Economics, 64(2–3), 221–245.

Dyreng, S. D., Hanlon, M., & Maydew, E. L. (2010). The effects of executives on corporate tax avoidance. The Accounting Review, 85(4), 1163–1189.

Eng, L. L., & Mak, Y. T. (2003). Corporate governance and voluntary disclosure. Journal of Accounting and Public Policy, 22(4), 325–345.

Fuest, C., Parenti, M., & Toubal, F. (2019). International corporate taxation: What reforms? What impact? Notes Du Conseil D’analyse Économique, 6, 1–12.

Graham, J. R., & Tucker, A. L. (2006). Tax shelters and corporate debt policy. Journal of Financial Economics, 81(3), 563–594.

Guenther, D. A., Matsunaga, S. R., & Williams, B. M. (2017). Is tax avoidance related to firm risk? The Accounting Review, 92(1), 115–136.

Gujarati, D. (2004). Basic econometrics (4th ed.). McGraw-Hill Publishers.

Hanlon, M., & Heitzman, S. (2010). A review of tax research. Journal of Accounting and Economics, 50(2–3), 127–178.

Healy, P. M., & Palepu, K. G. (2001). Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. Journal of Accounting and Economics, 31, 405–440.

Hoi, C. K., Wu, Q., & Zhang, H. (2013). Is corporate social responsibility (CSR) associated with tax avoidance? Evidence from irresponsible CSR activities. The Accounting Review, 88(6), 2025–2059.

Hope, O. K., Ma, M. S., & Thomas, W. B. (2013). Tax avoidance and geographic earnings disclosure. Journal of Accounting and Economics, 56(2–3), 170–189.

Hsu, P. H., Moore, J. A., & Neubaum, D. O. (2018). Tax avoidance, financial experts on the audit committee, and business strategy. Journal of Business Finance & Accounting, 45(9–10), 1293–1321.

Huseynov, F., Sardarli, S., & Zhang, W. (2017). Does index addition affect corporate tax avoidance? Journal of Corporate Finance, 43(C), 241–259.

Jensen, M., & Meckling, W. (1976). Theory of the firm: Management behavior, agency costs and capital structure. Journal of Financial Economics, 3(4), 305–360.

Kerr, J. N. (2019). Transparency, information shocks, and tax avoidance. Contemporary Accounting Research, 36(2), 1146–1183.

Khan, M., Srinivasan, S., & Tan, L. (2017). Institutional ownership and corporate tax avoidance: New evidence. The Accounting Review, 92(2), 101–122.

Khurana, I. K., Moser, W. J., & Raman, K. K. (2018). Tax avoidance, managerial ability, and investment efficiency. Abacus, 54(4), 547–575.

Kim, J. B., Li, Y., & Zhang, L. (2011). Corporate tax avoidance and stock price crash risk: Firm-level analysis. Journal of Financial Economics, 100(3), 639–662.

Kovermann, J., & Velte, P. (2019). The impact of corporate governance on corporate tax avoidance—A literature review. Journal of International Accounting, Auditing and Taxation, 36, 100270.

Kubick, T. R., G. B. Lockhart, and J. R. Robinson. 2014. Does inside debt moderate corporate tax avoidance? Working paper, The University of Kansas, Clemson University, and Texas A&M University.

Lanis, R., & Richardson, G. (2018). Outside directors, corporate social responsibility performance, and corporate tax aggressiveness: An empirical analysis. Journal of Accounting, Auditing & Finance, 33(2), 228–251.

Lee, K. W. (2007). Corporate voluntary disclosure and the separation of cash flow rights from control rights. Review of Quantitative Finance and Accounting, 28(4), 393–416.

Lim, Y. (2011). Tax avoidance, cost of debt and shareholder activism: Evidence from Korea. Journal of Banking & Finance, 35(2), 456–470.

McGuire, S. T., Wang, D., & Wilson, R. J. (2014). Dual class ownership and tax avoidance. The Accounting Review, 89(4), 1487–1516.

Moore, J. A., Suh, S., & Werner, E. M. (2017). Dual entrenchment and tax management: Classified boards and family firms. Journal of Business Research, 79, 161–172.

Nelson, K. K., & Pritchard, A. C. (2016). Carrot or stick? The shift from voluntary to mandatory disclosure of risk factors. Journal of Empirical Legal Studies, 13(2), 266–297.

OECD. (2013). Action plan on base erosion and profit shifting. OECD Publishing.

Phillips, J. D. (2003). Corporate tax-planning effectiveness: The role of compensation-based incentives. The Accounting Review, 78(3), 847–874.

Rego, S. O., & Wilson, R. (2012). Equity risk incentives and corporate tax aggressiveness. Journal of Accounting Research, 50(3), 775–810.

Steijvers, T., & Niskanen, M. (2014). Tax aggressiveness in private family firms: An agency perspective. Journal of Family Business Strategy, 5(4), 347–357.

Stock, J. H., & Yogo, M. (2005). Testing for weak instruments in linear IV regression. In D. W. K. Andrews, & J. H. Stock (Eds.). Chapter 5 in identification and inference in econometric models: Essays in honor of Thomas J. Rothenberg.

Tinaikar, S. (2014). Voluntary disclosure and ownership structure: an analysis of dual class firms. Journal of Management & Governance, 18(2), 373–417.

Verrecchia, R. E. (1983). Discretionary disclosure. Journal of Accounting and Economics, 5, 179–194.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

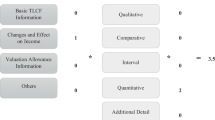

Appendix

Rights and permissions

About this article

Cite this article

Boubaker, S., Derouiche, I. & Nguyen, H. Voluntary disclosure, tax avoidance and family firms. J Manag Gov 26, 129–158 (2022). https://doi.org/10.1007/s10997-021-09601-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10997-021-09601-w