Abstract

This study furthers recent research on Initial Coin Offerings (ICO) in understanding the set of characteristics that drive ICO performance and reduce information asymmetry. Using data on 166 ICOs and more than 300,000 contribution addresses that sent funds to ICOs in Bitcoins or in Ether between 2013 and 2017, we examined the effect of ICO characteristics on ICO performance. We found that three boundary conditions predict ICO fundraising amount, number of investors, hard cap achievement and token ranking. These are registering ICO and publishing project’s code on GitHub, obtaining VC or Business angel financing before the campaign or during presale, and finally, publishing the whitepaper before the campaign’s start. Other factors such as serial investors, presale of tokens, bonus sales and funders' ownership share explain ICO performance. We offer implications for ICO investors and policymakers.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In recent years, entrepreneurial finance has witnessed the emergence of new agents and channels of fundraising for startups. The new era based on digitization of entrepreneurial finance has started (Butticè & Vismara, 2021), which is different from the traditional entrepreneurial finance primarily referred to early-stage financing mechanisms, often supplied by the entrepreneur’s personal network as a consequence of her inability to fully access the public market (Audretsch et al., 2016). New regulations on alternative funding in the USA and Europe potentially have significant implications for entrepreneurs and investors (Cumming et al., 2020; Estrin et al., 2018). Alternative finance enables entrepreneurs to bypass the conventional financial industry’s channels such as banks, public debt, and Venture Capital (VC) (Block et al., 2020, 2018a, b; Hornuf & Schwienbacher, 2018).

Crowdfunding, a new alternative funding method of funding startups through online portals by collecting contributions from many investors, has become a universal tool to finance projects worldwide, regulated and promoted by many countries (Block et al., 2020; Cumming et al., 2016; Vismara, 2016, 2018). The subsequent development of blockchains and smart contracts embedded in the limited regulatory environment of emerged cryptocurrencies have been conducive to attracting funds from small, dispersed investors. While blockchain technology and Initial Coin Offerings (ICOs) have substantially improved the capacity to track and disseminate information on entrepreneurs and investors in equity crowdfunding (Cumming et al., 2020; Fisch & Momtaz, 2020; Fisch et al., 2021), the research on decision support systems to understand how these technologies improve the decision-making of entrepreneur and investor has been scarce.

Initial Coin Offerings (ICOs) or token sales, a relatively new and complex phenomenon, involve organizations issuing transferable tokens to the general public in exchange for invested financial resources (Adhami et al., 2018; Fisch, 2019; Howell et al., 2020; Momtaz, 2020). While token sales have been rapidly growing over the last five years, there is a paucity of knowledge how to reduce information asymmetry in ICO investment as a major part of ICOs are scams (Hornuf et al., 2019; Cumming et al., 2019c; Block et al., 2021). This would increase the popularity and the size of investment in ICOs, allowing more startups to fundraise for their ideas (Belitski, 2019; Schückes & Gutmann, 2021) and commercialize new knowledge (Audretsch & Belitski, 2013, 2021a).

Prior research on ICOs (Block et al., 2020; Momtaz, 2020) has focused on the opportunities and challenges of ICOs and the differences and similarities between ICO investments and other sources of funding (Butticè & Vismara, 2021). The first strand of literature relates to the economics and rationale of using ICOs as a financing method (Cumming et al., 2021; Howell et al., 2020; Vismara, 2019) and the geography of ICOs (Huang et al., 2020, 2021). The second strand has focused on the regulation of ICO activity (Block et al., 2021). The third strand of literature studies the potential determinants of ICO performance and investment-readiness (Amsden & Schweizer, 2018; Boreiko & Sahdev, 2018; Fisch & Momtaz, 2020). Howell et al. (2020) as well as Momtaz (2020) look at post-ICO performance as a measure of success, such as trading volume, liquidity, first-day underpricing and long-run returns, with the recent study of Huang et al. (2021) considers the visual traits and psychological aspects of ICO investors and Colombo et al. (2020) research the role of top executives’ physical attributes in ICO valuation by investors. Despite these three trends, there is a lack of research that focuses on the factors contributing to the success of the ICO such as an increase in ranking, achieving a hard cap in the financing, amount of fundraising, and attracting more ICO investors.

Therefore, the objective of this paper is to examine the set of ICO-related characteristics that enhance ICO performance. Using data on 374 token sales across 83 ICO campaigns that accepted funding in bitcoins (BTC) and 166 campaigns that were funded with ether (ETH) from 2013 to December 2017, this study helps to understand three boundary conditions– registering ICO and publishing project’s code on GitHub, obtaining VC or Business angel financing before the campaign or during presale and finally, publishing the whitepaper before campaign’s start as drivers of ICO performance.

This study makes two important contributions to ICO emerging literature. First, our methodological contribution is in developing the related methods to obtain information from blockchain that would allow replication for future research on ICO performance in greater detail.

Second, we identify ICO characteristics that serve as positive signals for ICO investors and enable to increase the size of fundraising, the number of investors, funds contributed to the maximum target set by founders, ICO listing on Coinmarketcap, and token ranking. We identify the role of other factors such as bonus sales and presales, the role of repeated and the largest (Top1%) ICO investors, in addition to other ICO-level characteristics contributing to prior research on ICOs (Cumming et al., 2021; Fisher et al., 2017; Vismara, 2019). This study offers policy implications to ICO investors, startups, and policymakers on reducing extreme information asymmetry related to ICO investment, making ICO investment more accessible, less risky, and more protected from fraud.

The paper remainder is as follows. In Sect. 2, describes the main differences between crowdfunding and ICO investments, formulating research hypotheses. In Sect. 3, we present data and methods. Section 5 discusses the results of our estimation and robustness check., Finally, Sect. 6 concludes with contributions to literature, policy implications and future research.

2 Theoretical framework

2.1 Understanding ICOs

We draw on Fisch et al. (2021) in defining an ICO is an event where a startup sells tokens to a crowd using blockchain technology. Tokens are value units and can provide utility (utility tokens) or resemble securities (security tokens). The former offers the right to use the products or services of the venture, whereas the latter makes the buyer a debt or equity holder (Block et al., 2021). Firms or individuals can initiate utility token ICOs and this is what makes them similar to reward-based crowdfunding, while security tokens are limited to firms because they relate to the issuance of debt or equity, as equity-based crowdfunding. In a utility token issue, a venture sells tokens with the promise that these tokens will have utility and value in the future. In security, tokens are deemed as securities (Block et al., 2021).

There could also be comparisons between an ICO and IPO (initial public offering), which is to offer shares of a private corporation to the public in a new stock issuance. Unlike IPO, ICO is the cryptocurrency industry. The significant difference between the two is that IPO is usually for well-settled companies, whereas ICO is generally for the young and risky.

While there are several important papers on the heterogeneity of crowdfunding platforms by Rossi and Vismara (2018). Bassani et al. (2019) and Cumming et al. (2019a), there is limited evidence for ICO platforms and information exchange and the role of managers in enhancing ICO performance (Boreiko & Risteski, 2021; Momtaz, 2021). While crowdfunding platforms govern the fundraising process by setting their particular platform rules, ICO is not listed on platforms and usually create a website that provides aggregate information and guidance, including expert ratings (Block et al., 2021). As such, screening and due diligence are entirely left to ICO investors and may be less transparent, requiring more information, with a high likelihood of information asymmetries (Momtaz, 2021).

ICO websites bringing together supply and demand for tokens and aim to reduce transaction costs of operations, while the extent of information about ICO is usually limited. There are websites to inform potential investors about ongoing ICO campaigns; however, these websites do not provide direct matching or clearing services and are currently of little importance in ICOs. Although some of the ICOs have yielded substantial returns for investors, ICOs are more prone to fraudulent activity (Sharma, 2021). Other reports highlight that only 10% of the overall ICO fundraising volume was allocated to later identified scams (Hornuf et al., 2019), with Cumming et al. (2019c) suggest that in contrast to the findings for crowdfunding, the extent of information available in ICOs makes it hard to identify possible fraud. Unlike utility token issues, security tokens are governed by security law and protected by collateral (Block et al., 2021), providing additional security.

The probability of a scam when investing in ICOs may deter the success of diligent ICOs, raising the questions of what are the factors and signals that may raise questions about ICO credibility and what ICO characteristics are most important for ICO investors to investigate, in order to screen it for due diligence.

Compared to the ICOs (Huang et al., 2020), conventional equity crowdfunding is smaller and much less internationalized (Cumming et al., 2019a, b, c). Equity crowdfunding platforms often publicly disclose information about investors and funding dynamics (Estrin et al., 2018). Such a unique setting allowed for investigating the role of information cascades in equity crowdfunding (Vismara, 2017, 2018) or funding dynamics (Hornuf & Schwienbacher, 2018). On the contrary, public blockchains’ records are publicly available for anyone to see and verify. As a result, theoretically, all the information about contributions in a specific token sale is recorded in the blockchain and may be used to study the ICO investors’ behavior.

2.2 Hypothesis formulation

Unlike crowdfunding platforms, ICOs do not allow anyone to view projects posted online. However, the ICO website may contain information about the product and whether the ICO has received venture capital (VC). Financial scholars have recognized that in the entrepreneurial setting, information asymmetry is particularly pronounced due to the difficulty entrepreneurs face in conveying the quality of their new ventures to firm outsiders, which could lead to agency issues (Audretsch et al., 2016). The problems related to adverse selection, moral hazard, and agency (Colombo et al., 2016) could create governmental venture capital to support innovative young firms’ to correct the supply-side failures in domestic VC markets. VCs are a promising path for entrepreneurial funding (Cumming et al., 2021), including ICOs. Specifically, we argue that due diligence in ICOs should be investigated by analysing VCs’ role in ICOs. The VC literature has frequently noted that the likelihood of investing in a venture decreases with an increase with geographic, cognitive, and other proximities because of, e.g., due diligence costs and ongoing monitoring efforts (Sorenson & Stuart, 2001). That is why ICO investors interested in investing in ICO will sear4ch for information on other professional investors, such as VC invested in ICO or not. ICO Investors have close cognitive and market proximity to VCs; this close cognitive proximity could be significant in deciding to invest and the number of tokens they wish to purchase. Investment by VC may guide ICO investors to specific ICO by industry, geography, or stock exchange.

The evidence that both professional venture capitalists (VCs) and angel investors are active ICO members will signal other ICO investors to step in and invest. It is efficient if there is a social network connection between investors and entrepreneurs, such as equity crowdfunding (Vismara, 2016) and in particular industries e.g. healthcare (Bassani et al., 2019).

Despite the importance of VC participation as a positive signal for the highest ICO quality, links between VC, angel investment, and ICO literature remain largely unsettled and new. We know little about why business angels and VCs start selecting ICOs through websites and investing in them rather than their usual deal flow channels (Adhami et al., 2018; Howell et al., 2020). However, we are interested in whether ICO project is more likely to gain financing if ICO investors anticipate finding a high-quality project supported by VC. While different types of VCs may apply various investment schemes and mechanisms, VC screening deals on ICO websites may be helpful as additional information which ICO can relate to, as well as what portfolio of ICOs each VC is getting, and how business angels and VCs interact post-investment in ICO with ICO and other community. These all will be important for fundraising in ICO.

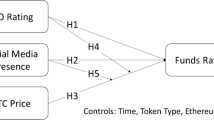

H1

ICOs supported by VC have greater performance outcomes.

Another factor related to signalling is publishing a Whitepaper, as reading a whitepaper carefully correlates with both ideological and technological motives of ICO investment (Fisch et al., 2021). The authors surveyed 517 ICO investors and conducted an exploratory factor analysis to identify the underlying investment motives building on self-determination theory (Deci & Ryan, 1985). Fisch et al. (2021) confirm that ICO and crowdfunding investors are driven by ideological, technological, and financial motives.

A Whitepaper is a document in which a venture provides information to the public and constitutes an important component of a venture's ICO campaign (Fisch, 2019). The effect of white paper on the success of ICO emanates from the following sources. Firstly, enabling anonymous transactions such as Bitcoin's white paper that first proposed a method. This desire for anonymity characterizes most ICOs based on blockchain technology (Kastelein, 2017). Secondly, decentralization. Decentralization refers to enabling transactions without intermediaries, thus reducing transaction costs and transaction complexity. Cumming et al. (2019b) relate this to a democratization process in alternative finance where the demand for democratization and disintermediation is high (Fisch et al., 2020, 2021). The high importance of technology is reflected in the information provided by ICO ventures. Thirdly, white paper reveals source code with a high degree of technological information, which may be crucial (Fisch, 2019). The highly technical environment implies that investors will benefit from technological knowledge (Fisch et al., 2021). This provides a degree of certainty and credibility to a project as ICO investors can appreciate the technical codes and applications proposed by each ICO. This mechanism is supported by Fisch (2019), who demonstrated that the indicators of technological capabilities are important signals in the ICO context and help ventures attract funding. We hypothesize:

H2

ICOs that publish a Whitepaper have greater performance outcomes.

ICOs are based on blockchain technology and a venture's source code as the result of the programming activities as a core component of the venture (Cohney et al., 2019). This source code could provide another signal to ICO investors as a project with high technological capabilities. Ventures reveal their code online, which ICO potential investors observe, usually on the platform GitHub (www.github.com), an open-source community platform for programmers (Fisch, 2019). Most ICO-tracking sites include references to a venture's source code and ventures' communication channels also reference the source code (e.g., website, white paper, social media). Investors guides available at ICOs highlight the importance of assessing GitHub before investing in an ICO (Mulders, 2018). Cohney et al. (2019) specify that publishing a code on the platform GitHub may or may not increase the probability of ICO fundraising. The code's quality should be the decisive factor and producing high-quality source code is expensive and time-consuming. As such, ventures with low technological capabilities will find developing high-quality code significantly more costly (Fisch, 2019).

On the contrary, more efficient ventures will reduce the costs and risk of producing a code with high technological capabilities and lower costs. This leads to an assumption that only ventures with high technological and financial capabilities will develop high-quality code and will publish it on the platform GitHub. At the same time, ICO investors need to have capabilities and technological expertise to evaluate the quality of a venture's source code and the level of programming.

Cohney et al. (2019) explain the system of repositories at GitHub and why they are important. Every repository at GitHub includes metrics that may indicate code's quality without a need for ICO investors to read and analyse the code (Fisch & Momtaz, 2020; Kalliamvakou et al., 2014; Vasilescu et al., 2015). Instead of using the number of commits, research uses the number of commits that refer to defect or bug fixes directly measure code quality (Syer et al., 2015). The number of defect-fixing changes inversely approximates the number of defects in a source code which is used as a proxy for the quality of the source code (Syer et al., 2015).

The number of defect-fixing commits is observable, and it signals the quality of the project. Low-quality and high-risk ICOs are more likely to avoid using GitHub and publish the source code as ICO investors may observe the repositories and the number of bugs and fixes. Observing defect-fixing commits on Github will not require programming expertise, and it affects the decision to invest. ICOs with lower technical capabilities will avoid GitHub as it may require an investment of time and finance into fixing defects in their code, or they will not be able to do so at all. ICO investors observe it and can therefore indirectly identify high-quality ventures which are more likely to grow and fundraise. We hypothesize:

H3

ICOs that engage with the GitHub platform have greater performance outcomes.

3 Data and methods

3.1 Descriptive analysis of the ICO sample

To identify all ICOs campaigns, we adopt an operational definition that treats an ICO as a crowdfunded fundraising campaign that sells the new proprietary tokens to investors in exchange for existing cryptocurrencies and fiat money. We exclude the cases where only fiat money is accepted as most of these are usually variations of elaborate frauds or Ponzi schemes not leading to the creation of the new cryptocurrency that is traded afterward.

Given the absence of a coherent and reliable database, the task of constructing a complete list of genuine ICOs has not been easy. We proceeded with our sample collection as follows.

First, the lists from seven of the largest ICO tracking websites as of January 2018 were identified. Second, we merged information on ICOs using the websites of Smith & Crown, Tokenmarket, Icobazaar, Coinschedule, Hubcoin, Icodata, and Icoprojectrank and eliminating the double entries, canceled or unfinished campaigns with ICO actual end dates until December 24, 2017. Third, we checked the list for errors and double entries and enlarged it by additional ICOs found with a textual search for words “ICO”, “crowdfunding,” “token sales” in Bitcointalk.org forums. Fourth, due to the missing data, we had to reduce the initial sample of the firms. In addition, we added data from the websites of the ICO companies or their archived versions, such as archive.org. Fifth, we added information from the private blogs (e.g. Medium.com, Steemit or Dusil) and blockchain forums (e.g. Bitcointalk, Bitcoingarden, Reddit, Thewiring and Forebits), social media communication channels (e.g. Twitter, Facebook, Linkedin, Tumblr; Github), and chat channels (e.g. Telegram, Slack, Discord).

Finally, we constructed a database of 338 deals is a unique source of ICO activity from 2013 that is the most comprehensive and rich in detail as at the moment of writing. We further limit our sample by excluding all clear suspicious ICOs before or during the fundraising campaign and ICOs run as jokes. Our final sample consists of 166 ICO campaigns. For these genuine ICOs we identified all valid non-empty bitcoin and ether contribution addresses used by the founders to collect investments.

Table 1 shows summary statistics for the full ICO sample and the BTC- and ETH-run campaigns separately. The data shows that an average ICO in our sample raises $US9 million, with one-fifth of all raising less than $US100,000. One-sixth of all ICOs have obtained some form of seed financing before the fundraiser, and, in general, founders manage to sell only two-thirds of the offered tokens while leaving for themselves 16% of total tokens. Less than a third of the campaigns run private pre-sale rounds, closed or restricted for public investors, with 12% accepting fiat currencies contributions and almost two-thirds of all ICOs offered token price discounts for large or earlier investors. Around 40 percent used the “all-or-nothing” model of fundraising used in crowdfunding by defining a minimum sum needed to proceed with the project (min cap). One in five selected a proportional-sale model where the price and number of allocated tokens are defined only at the end of the campaign by dividing the total funds raised by the number of offered tokens. Around 5 percent of all used an uncapped sale model, where they were ready to accept any amount of money contributed during the campaign period. Around 45 percent of all issued token are built on Ethereum blockchain, with 12 percent of all founding teams choosing to run the sale or incorporate the legal entity in jurisdictions that passed ICO-benevolent laws (Singapore, Switzerland, and Estonia). The average fundraising campaign is planned to last 34 days, usually ending earlier by a week, and only two-thirds of all issued tokens end up being listed on a crypto exchange.

The data on BTC- and ETH-run token sales and subsamples of ICOs with identified contribution statistics do not show any particular selection bias. BTC-run campaigns are clustered more at the start of the sample period before the year 2017, when ICOs raised fewer funds and ran more often proportional sales models. They were willing to proceed with any amount collected without defined min cap, more aggressively awarded bonus tokens to earlier/larger investors and developed their blockchains for tokens. ETH-run campaigns, on the contrary, are clustered at the end of the sample, larger by size and more often marketing the campaign with the published whitepaper, offering bonus tokens less often and choosing Ethereum blockchain.

3.2 Variables

3.2.1 Dependent variables

In crowdfunding success of a campaign is usually proxied by the dummy indicating if the projects reach their goals or a total number of contributors (Vismara, 2016, 2018). Many more measures can be taken to represent ICO’s success (Boreiko & Risteski, 2021; Boreiko & Vidusso, 2019). We selected the log of total funds raised as the main measure of ICO success. This is an intuitive measure that directly shows the investor’s interest and beliefs in the project. Having been used in crowdfunding (Ahlers et al., 2015) and VC-funding research (Cumming et al., 2019b; Fisch, 2019).

To test the robustness of the results, we also use several other measures of ICO success. Amsden and Schweizer (2018) argue that the success of ICO can be measured as the ability of founders to provide for post-ICO trading of the issued tokens. Adhami et al. (2018) consider an ICO successful when the min cap has been reached. However, if insufficient funds are collected, this definition may become misleading (Boreiko & Sahdev, 2018): some enterprises start projects despite not having reached their minimum-funds target and even ICOs with no stated minimum cap. Instead, we use the hard cap as an arbitrary maximum financial goal defined by the ICO’s launchers which can be used as a qualitative dummy variable to define the success of an ICO. Hard cap indicates fundraising has been achieved, as funds ready to be committed to the project may well exceed the maximum estimate by the founders.

3.2.2 Independent variables

We use three independent variables. First, a whitepaper publication is a binary variable equal to one if ICO publishes a white paper, zero otherwise (Fisch et al., 2021). Our second variable is a binary variable equal to one if a firm listed in the Github code repository indicates the project’s quality (Fisch, 2019). Our third variable is the backing of a VC fund before the ICO, which is extremely important in raising funds, as it certifies the quality of a VC-backed ICO (Cumming et al., 2021). To identify VC-backed ICOs, we have looked at the announcements issued by fundraisers and run a Google search to determine if a particular ICO obtained VC financing before the token sale (Adhami et al., 2018; Howell et al., 2020).

3.2.3 Control variables

Based on prior research (Cumming et al., 2019c; Fisher et al., 2017) we expect that some crypto-friendly institutional environments can nourish successful ICO projects. We, therefore, included a binary variable if founders incorporated their ICO in a country where institutional context is conducive to digital startups (Audretsch & Belitski, 2021b). ICOs with one for Estonia, Singapore and Switzerland, where regulation exists to facilitate ICOs. How the token sale is organized might send a signal to investors inducing higher participation. We, therefore, introduced two binary variables if the sale was made without any defined funding limit (uncapped) or if it was run as a proportional sale model where the token price is determined only after the campaign ends. Offering large discounts on token prices to induce higher participation might indicate that the founders cannot signal the good quality of the project (Boreiko & Risteski, 2021).

By retaining a larger portion of token capital, the founder might indicate a belief in the project’s future as we add the variable of a share of tokens held by a founder. This may send a positive signal to ICO investors about the co-commitment of the project. We measure the proportion of total tokens planned to be retained by founders. Finally, we include the variable presale, a binary variable equals one if a firm had presale of tokens, zero otherwise. As founder’s share, the presale of tokens may send a convincing seems to be another strong signal to ICO investors. We control whether or not ICOs that raised less funds were willing to proceed with any amount collected without a defined min cap and awarded bonus tokens to earlier/larger investors = 1, zero otherwise.

Finally, we control for repeated investors' contributions. Repeated investors have long experience in investing in several token sales (Fisch et al., 2020). We add a control variable of funds contributed in ICO by repeated investors. It is believed that this is likely to signal to other ICO investors on the quality of the project. The list of variables used in this study and their descriptive statistics are illustrated in Table 2.

3.3 Method

To test our research hypotheses, we use Generalized least squared (GLS) estimation with robust heteroskedasticity standard errors. We employ five specifications for each of five dependent variables (Table 2) and the various characteristics of the ICO as explanatory variables. To test the timing of investment, we use GLS model regression with the time of investment of each contribution as a dependent variable and the various types of investors as explanatory variables. In vector form, our data estimation is written as:

where yit is one of our dependent variables one at a time (Total funds raised, Number of investors, Hardcap-reached, Token listed, Token rank) (specifications 1–5, Table 3) in a given ICO. β and θ are parameters to be estimated, xi is a vector of independent explanatory variables (GitHub repository, publishing a Whitepaper and VC-backed ICO), and zit is a vector of exogenous control variables; at presents time controlfor a year of ICO (2013–2017). As mentioned above, the error term ui is identically and independently distributed.

To address the multicollinearity concern, we used the variance inflation factor (VIF) in each of fivce models, which were between 2 and 5. All models with F statiatics > 8 seem to suggest that the predictors in question are reliably associated with the ICO outcome (McElreath, 2020).

We note that the significance and size of the beta coefficients might not always reflect the size or nature of the relationship if there is possible nonlinearity between ICO characteristics and performance outcomes. We therefore discuss what do the coefficents mean in economic terms and their significance.

4 Results

Table 3 reports the regression analysis results across five models with five types of ICO performance as dependent variables. Our H1 is supported as we found that ICOs that obtained VC or Business angel financing before the campaign or during presale has raised more funding (β = 1.32, p < 0.05), have been 1.22 times more likely to reach the hard cap funding (β = 1.22, p < 0.05), have been more likely to be listed in the Coinmarketcap.com list of cryptocurrencies (β = 1.22, p < 0.05). VC backed up ICO received a higher ranking (β = −0.38, p < 0.05). Interestingly that Token ranking and several investors were not associated with VC funding.

Our H2 is partly supported. In contrast to what we know about the importance of Whitepapers to stimulate investors, the publication of a white paper increases the number of investors (β = 1.36, p < 0.05), while it does not affect the amount raised and other ICO performance indicators.

Our H3 is supported. ICOs founders who published their project in the GitHub repository were raising more funds (β = 1.44, p < 0.05), had more investors (β = 0.84, p < 0.05), were more likely to reach the hard cap (β = 1.29, p < 0.05), were listed in the Coinmarketcap.com (β = 1.29, p < 0.05), and had higher ranking, with the negative coefficients means its climbing in the ranking up (β = −0.41, p < 0.05). Other factors that enhance the success rate of ICOs are Repeated investors funds was not associated with an increase in ICO performance, on the contrary, it was negatively associated with reaching the hard-cap. We, therefore, argue that repeated and serial investors with records of contributions to multiple ICOs, may not have superior information or increase the credibility to the project, adding to understanding the behavior of serial investors in ICOs. On the contrary, the experienced investors seem to invest less than non-serial ones in all higher-quality token sales. ICOs located in countries with a regulation conducive to ICO were more likely to achieve higher performance, including hard cap, increase ranking, as well as raise more funding with more investors. The pre-token sale was positively associated with ICO success rate and performance, while the founders stake negatively affected the total amount of funding.

4.1 Post-hoc analysis

In the post hoc analysis, we look at the ICOs funded by the leading investor group that is different in size from the other groups. Table 4 reports the results for Top1% ICO investor group. On average such investors account only for 1.9% of all contributions, but these contributions make up around 31% of total ICO funding. Our results in Table 4 are consistent with the finding in Table 3, while publishing a white paper is now positively associated with both a number of ICO funders (β = 1.33, p < 0.05) and the amount of funding raised (β = 1.56, p < 0.05). Results for publication of the project on the Github and receiving VC backed up is consistent with the prior results. An increase in funding by the Top1% ICO investors also increases the likelihood of reaching a hard cap (β = 1.43, p < 0.05), but in particular significantly increases the amount of fundraising (β = 2.53, p < 0.05). The effect is more than double compared to the overall investments. Our H1 and H3 are supported, while H2 is partly supported.

To further test the robustness of our findings, we reclassified Repeated investors as those who participated at least in three token sales. The results stay quantitatively the same – recurrent investors do not seem to possess superior information about projects, although the time the market and invest earlier in the campaign.

5 Discussion and conclusion

Although a growing number of studies investigate new ways to finance entrepreneurial ventures, which emerge on the crossroads between private and public equity (Audretsch et al., 2016; Butticè & Vismara, 2021), several emerging forms of finance have started making their way into entrepreneurial finance. Research on entrepreneurial finance will need to cope with collective-action problems, explaining the nuances of crowdfunding campaigns (Vismara, 2018, 2019), and further investigating the emerging role of “quasi” crowdfunding such as ICOs (Huang et al., 2020, 2021; Kher et al., 2020; Schückes & Gutmann, 2021). The general expectation is that both ICOs and equity crowdfunding “democratizes” entrepreneurial finance (Cumming et al., 2021), thereby increasing the possibility of various founders from different backgrounds raising finance (Fisch et al., 2020).

As a new form of crowdfunding, blockchain financing with ICOs and token sales is now a well-established practice worldwide with start-ups. Our understanding of how ICO characteristics change the propensity of ICO fundraising, ICO listing, ranking, number of ICO investors contributing, and the total amount raised is limited.

Building on the equity crowdfunding literature (Vismara, 2016, 2018), we outline the peculiarities of the ICO context, which provide initial insights into the potential motives and drivers for ICO investments and what characteristics of the ICO could serve as positive signals for potential ICO investors. Similar to the context of equity crowdfunding, ICO investors are driven by both intrinsic and extrinsic motives. Investors are attracted to ICOs as the volatility of token prices may be attractive for investment opportunities and speculation in the short term (Adkisson, 2018), whereby confident investors are looking for the prospect of finding the “next Bitcoin” (Fisch, 2019).

While ICO gains its popularity (Fisch, 2019; Fisher et al., 2017; Momtaz, 2020), there is a growing demand to know a set of characteristics that can make ICO more credible and transparent, reducing uncertainty for ICO investors. This is due to several scam ICOs (Cumming et al., 2016) and a paucity of knowledge related to characteristics that are associated with a successful ICO campaign (Momtaz, 2021), including fundraising, investors number, publishing whitepapers, attracting business angels, and VCs, presale of tokens and many others. This study demonstrates three boundary conditions—registering ICO and publishing project’s code on GitHub, obtaining VC or Business angel financing before the campaign or during the presale, and finally, publishing the whitepaper before the campaign’s start.

This study has direct implications to ICO investors, advising them what characteristics of ICO they should be first looking at and how to differentiate ICOs by a success and due diligence characteristics (Cumming et al., 2016; Hornuf et al., 2019). It also has implications for authorities regulating ICOs and other cryptocurrencies as adoption of ICO regulation. The regulation, for example, requesting an ICO to publish a whitepaper, publishing project’s code on GitHub, or receive back up from the investors during the presale may reduce the number of scams and high asymmetry of information between ICOs and potential investors. We believe that this study can complement our understanding of some aspects of technology transfer for entrepreneurs (Audretsch et al., 2014), which we hope will continue to grow in the pursuit of more granulated research in finance.

This study contributes to the growing stream of research on what comprises as well as what drives ICOs performance (Adhami et al., 2018; Fisch et al., 2021; Howell et al., 2020), seeking to unveil the drivers of ICO performance across all ICO investors and the leading group of Top1% of ICO investors. Our novel results add to what we know in the crowdfunding and IPO literature.

Subsequent research will need to focus on the dynamics of investing activity, how it is differentiated across various types of token sale auctions, and the effects of the bonus campaigns on timing, size of investments, and the number of investors. Self-compliance and the effects of legal tools chosen to ensure smooth token sales also represent exciting topics to look at. Future scholars may research the post-ICO performance (Momtaz, 2020) of the projects and use the difference in difference analysis between different types of ICOs and investors to understand what type of changes in the ICO setting, auctions, and investor types may change ICO performance. The comparative studies of token sales versus more traditional means such as VC and equity crowdfunding may further the work of Fisch et al. (2021) and Cumming et al., (2020, 2021). Although most ICOs are not genuine projects, it attracts attention from investors and regulators; we evidence that tokenization of economies is increasing with more research on future projects of token sales is an important avenue of research in financing knowledge creation and knowledge transfer.

References

Adhami, S., Giudici, G., & Martinazzi, S. (2018). Why do businesses go crypto? An empirical analysis of initial coin offerings. Journal of Economics and Business, 100, 64–75.

Adkisson, J. (2018). Why is bitcoin so volatile. Available at: https://www.forbes.com/sites/jayadkisson/2018/02/09/why-bitcoin-is-so-volatile. Accessed 1 July 2021.

Ahlers, G. K., Cumming, D., Günther, C., & Schweizer, D. (2015). Signaling in equity crowdfunding. Entrepreneurship Theory and Practice, 39(4), 955–980.

Amsden, R., & Schweizer, D. (2018). Are blockchain crowdsales the New‘Gold Rush‘? Success determinants of initial coin offerings. Success determinants of initial coin offerings (April 16, 2018).

Audretsch, D. B., & Belitski, M. (2013). The missing pillar: The creativity theory of knowledge spillover entrepreneurship. Small Business Economics, 41(4), 819–836.

Audretsch, D. B., & Belitski, M. (2021a). Knowledge complexity and firm performance: Evidence from the European SMEs. Journal of Knowledge Management, 25(4), 693–713.

Audretsch, D. B., & Belitski, M. (2021b). Towards an entrepreneurial ecosystem typology for regional economic development: The role of creative class and entrepreneurship. Regional Studies, 55(4), 735–756.

Audretsch, D. B., Lehmann, E. E., & Wright, M. (2014). Technology transfer in a global economy. Journal of Technology Transfer, 39(3), 301–312.

Audretsch, D. B., Lehmann, E. E., Paleari, S., & Vismara, S. (2016). Entrepreneurial finance and technology transfer. Journal of Technology Transfer, 41, 1–9.

Bassani, G., Marinelli, N., & Vismara, S. (2019). Crowdfunding in healthcare. Journal of Technology Transfer, 44(4), 1290–1310.

Belitski, M. (2019). Innovation in Schumpeterian-type firms: Knowledge collaboration or knowledge spillover? Foundations and Trends in Entrepreneurship, 15(3–4), 368–390.

Block, J. H., Colombo, M. G., Cumming, D. J., & Vismara, S. (2018a). New players in entrepreneurial finance and why they are there. Small Business Economics, 50(2), 239–250.

Block, J., Hornuf, L., & Moritz, A. (2018b). Which updates during an equity crowdfunding campaign increase crowd participation? Small Business Economics, 50(1), 3–27.

Block, J. H., Groh, A., Hornuf, L., Vanacker, T., & Vismara, S. (2020). The entrepreneurial finance markets of the future: A comparison of crowdfunding and initial coin offerings. Small Business Economics, 1–18.

Block, J.H., Fisch, C. & Hirschmann, M. (2021). The determinants of bootstrap financing in crises: Evidence from entrepreneurial ventures in the COVID-19 pandemic. Small Business Economics. https://doi.org/10.1007/s11187-020-00445-6.

Boreiko, D., & Sahdev, N. K. (2018). To ICO or not to ICO–Empirical analysis of initial coin offerings and token sales. Available at SSRN 3209180.

Boreiko, D., & Vidusso, G. (2019). New blockchain intermediaries: Do ICO rating websites do their job well? The Journal of Alternative Investments, 21(4), 67–79.

Boreiko, D. & Risteski, D. (2021). Serial and large investors in initial coin offerings. Small Business Economics. https://doi.org/10.1007/s11187-020-00338-8.

Butticè, V., & Vismara, S. (2021). Inclusive digital finance: The industry of equity crowdfunding. The Journal of Technology Transfer, 1–18.

Cohney, S., Hoffman, D., Sklaroff, J., & Wishnick, D. (2019). Coin-operated capitalism. Columbia Law Review, 119(3), 591–676.

Colombo, M. G., Cumming, D. J., & Vismara, S. (2016). Governmental venture capital for innovative young firms. The Journal of Technology Transfer, 41(1), 10–24.

Colombo, M. G., Fisch, C., Momtaz, P. P., & Vismara, S. (2020). The CEO Beauty Premium. Available at SSRN 3654561.

Cumming, D. J., Hornuf, L., Karami, M., & Schweizer, D. (2016). Disentangling crowdfunding from fraudfunding (SSRN Scholarly Paper No. ID 2828919). Rochester, NY: Social Science Research Network.

Cumming, D. J., Meoli, M., & Vismara, S. (2019a). Investors’ choice between cash and voting rights: Evidence from dualclass equity crowdfunding. Research Policy, 48(8), 103740.

Cumming, D., Meoli, M., & Vismara, S. (2019b). Does equity crowdfunding democratize entrepreneurial finance? Small Business Economics, 1–20.

Cumming, D. J., Hornuf, L., Karami, M., & Schweizer, D. (2019c). Disentangling crowdfunding from fraudfunding. Max Planck Institute for Innovation & competition research paper, no. 16–09.

Cumming, M. E., Rawhouser, H., Vismara, S., & Hamilton, E. L. (2020). An equity crowdfunding research agenda: Evidence from stakeholder participation in the rulemaking process. Small Business Economics, 54(4), 907–932.

Cumming, D., Meoli, M., & Vismara, S. (2021). Does equity crowdfunding democratize entrepreneurial finance? Small Business Economics, 1–20. https://doi.org/10.1007/s11187-019-00188-z.

Deci, E. L., & Ryan, R. M. (1985). Intrinsic motivation and self-determination in human behavior. Plenum.

Estrin, S., Gozman, D., & Khavul, S. (2018). The evolution and adoption of equity crowdfunding: Entrepreneur and investor entry into a new market. Small Business Economics. https://doi.org/10.1007/s11187-018-0009-5

Fisch, C. (2019). Initial coin offerings (ICOs) to finance new ventures. Journal of Business Venturing, 34(1), 1–22.

Fisch, C., & Momtaz, P. P. (2020). Institutional investors and post-ICO performance: An empirical analysis of investor returns in initial coin offerings (ICOs). Journal of Corporate Finance, 64, 101679.

Fisch, C., Meoli, M., & Vismara, S. (2020). Does blockchain technology democratize entrepreneurial finance? An empirical comparison of ICOs, venture capital, and REITs. Economics of Innovation and New Technology, 1–20.

Fisch, C., Masiak, C., Vismara, S., & Block, J. (2021). Motives and profiles of ICO investors. Journal of Business Research, 125, 564–576.

Fisher, G., Kuratko, D. F., Bloodgood, J. M., & Hornsby, J. S. (2017). Legitimate to whom? The challenge of audience diversity and new venture legitimacy. Journal of Business Venturing, 32(1), 52–71.

Howell, S. T., Niessner, M., & Yermack, D. (2020). Initial coin offerings: Financing growth with cryptocurrency token sales. The Review of Financial Studies, 33(9), 3925–3974.

Hornuf, L., & Schwienbacher, A. (2018). Market mechanisms and funding dynamics in equity crowdfunding. Journal of Corporate Finance, 50, 556–574.

Hornuf, L., Schilling, T., & Schwienbacher, A. (2019). Initial coin offerings, information disclosure, and fraud, CESifo working paper no. 7962.

Huang, W., Meoli, M., & Vismara, S. (2020). The geography of initial coin offerings. Small Business Economics, 55(1), 77–102.

Huang, W., Vismara, S., & Wei, X. (2021). Confidence and capital raising. Journal of Corporate Finance. https://doi.org/10.1016/j.jcorpfin.2021.101900

Kastelein, R. (2017). What initial coin offerings are, and why VC firms care. Available at: https://hbr.org/2017/03/what-initial-coin-offerings-are-and-why-vc-firmscare.

Kalliamvakou, E., Gousios, G., Blincoe, K., Singer, L., German, D. M., & Damian, D. (2014). The promises and perils of mining GitHub. In Proceedings of the 11th working conference on mining software repositories, pp. 92–101

Kher, R., Terjesen, S., & Liu, C. (2020). Blockchain, Bitcoin, and ICOs: A review and research agenda. Small Business Economics. https://doi.org/10.1007/s11187-019-00286-y

McElreath, R. (2020). Statistical rethinking: A Bayesian course with examples in R and Stan. CRC Press.

Momtaz, P. (2020). Initial coin offerings, asymmetric information, and loyal CEOs. Small Business Economics. https://doi.org/10.1007/s11187-020-00335-x

Momtaz, P. P. (2021). CEO emotions and firm valuation in initial coin offerings: An artificial emotional intelligence approach. Strategic Management Journal, 42(3), 558–578.

Mulders, M. (2018). 10 Keys for evaluating Initial Coin Offering (ICO) investments. Available at: https://cryptopotato.com/10-keys-evaluating-initial-coin-offeringico-investments.

Rossi, A., & Vismara, S. (2018). What do crowdfunding platforms do? A comparison between investment-based platforms in Europe. Eurasian Business Review, 8(1), 93–118.

Schückes, M., & Gutmann, T. (2021). Why do startups pursue initial coin offerings (ICO)? The role of economic drivers and social identity on funding choice. Small Business Economics. https://doi.org/10.1007/s11187-020-00337-9.

Sharma, T. K. (2021). A comprehensive guide on ICO scams and how to identify them. Blockchain council. Available at: https://www.blockchain-council.org/blockchain/

Sorenson, O., & Stuart, T. (2001). Syndication networks and the spatial distribution of venture capital investments. American Journal of Sociology, 106, 1546–1588.

Syer, M. D., Nagappan, M., Adams, B., & Hassan, A. E. (2015). Studying the relationship between source code quality and mobile platform dependence. Software Quality Journal, 23(3), 485–508.

Vasilescu, B., Yu, Y., Wang, H., Devanbu, P., & Filkov, V. (2015). Quality and productivity outcomes relating to continuous integration in GitHub. In Proceedings of the 2015 10th joint meeting on foundations of software engineering, pp. 805–816.

Vismara, S. (2016). Equity retention and social network theory in equity crowdfunding. Small Business Economics, 46(4), 579–590.

Vismara, S. (2018). Information cascades among investors in equity crowdfunding. Entrepreneurship Theory and Practice, 42(3), 467–497.

Vismara, S. (2019). Sustainability in equity crowdfunding. Technological Forecasting and Social Change, 141, 98–106.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Belitski, M., Boreiko, D. Success factors of initial coin offerings. J Technol Transf 47, 1690–1706 (2022). https://doi.org/10.1007/s10961-021-09894-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-021-09894-x