Abstract

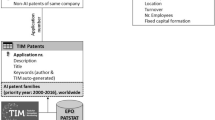

We study the determinants of patent quality for a panel of U.S. manufacturing firms, focusing mainly on the effects of firm-level technological diversity and appropriability conditions. Technological diversity increases the quality-adjusted patent count on most of the diversity distribution, but its relationship with average patent quality is an inverted-U. We find that appropriability conditions (proxied by the rate of self-citations at the firm level) have similar, non-linear effects on both the average quality of patents, and quality-adjusted patents per R&D, which is consistent with an inverted-U pattern. Firm size has no effect on the average quality of patented innovation at the firm level. Finally, as R&D intensity increases, the rate of corporate innovation falls, but its average quality increases, indicating a quality–quantity trade-off in R&D.

Similar content being viewed by others

Notes

Authors have used a number of diversity measures, which commonly are inverted concentration indexes, and less often simpler ones such as the number of technological fields a firm is active in. These measures will be discussed in Sect. 4.

There is a growing line of literature that is interested in how firm diversify, which emphasizes the role of technological relatedness in firms’ diversification strategies. For an introduction, see MacDonald (1985), Teece et al. (1994) and Breschi et al. (2003). We also avoid a detailed discussion on the extant literature on the diversity of product lines, which is indirectly related to the current topic in that product market and technological diversification occur in conjunction with one another. On this, also see Pavitt et al. (1987), Pavitt (1998) and Scott (1993).

Even though groups with zero medians are very few, medians representing one or two raw citations are common. Normalizing using such low numbers can be misleading, hence higher percentiles are prefererred. Nevertheless, we experiment with scores using medians and the 90th percentile, which do not produce different results.

Lanjuow and Schankerman (2004) obtain family size for a random sample of a little over 100,000 patents, which makes up a mere 20% of their entire sample of patents. Hence, including family size is impractical unless one wishes to omit a large fraction of the patent database from the sample.

A few important policy changes regarding patent law occur during the sample period. For a review, see Jaffe (2000).

We thank Pelin Demirel for reminding us of this possibility.

Note that if we were interested in the “impact” of innovations alone, it wouldn’t be desirable to net out visibility effects from coefficients, since increased visibility would be a natural part of a firm’s external impact. This is not true when one is interested in quality as such.

We thank Bronwyn Hall for pointing this out.

Hence, our time window is 11 years. On average, a patent receives 48.6% (Drugs and medical) to 68.3% (Computers and communications) of its lifetime citations during the first 11 years after application depending on its technological category.

Also note that for many patents of great significance (and with high lifetime citations as a result), one may expect fewer citations after the initial few years after grant, as these innovations could take longer time to be understood, adopted, and then cited.

For an argument for a quality-quantity trade-off in innovation, see Rassenfosse (2010), who shows that a firm’s (estimated) propensity to patent is negatively associated with average innovation value.

It is also unlikely that unobserved permanent effects are responsible for quality differences, since these are differenced away in the fixed effects specification.

Conversely, if the error term largely consisted of measurement error, averaging over time would increase this noise. Higher ability of this set of regressions (higher \(R^{2}\) values) to explain the variation in average quality suggests this is not the case.

Flow variables (patents and quality-weighted patents, R&D, sales, industry size) are summed, and stock variables (capital, employment, spillover pools) are averaged for each five year period. Firm age and visibility are taken as the age and visibility at the beginning of the period, while technological diversity is re-calculated using all patents of the firm in the five year interval.

References

Acs, Z. J., & Audretsch, D. B. (1991). R&D, firm size and innovative activity. In Z. J. Acs & D. B. Audretsch (Eds.), Innovation and technological change: An international comparison (pp. 39–59). Ann Arbor: University of Michigan Press.

Acs, Z. J., Audretsch, D. B., & Feldman, M. P. (1994). R&D spillovers and recipient firm size. The Review of Economics and Statistics, 76(2), 336–340.

Agarwal, R., & Audretsch, D. B. (1999). The two views of small firms in industry dynamics: A reconciliation. Economics Letters, 62, 245–251.

Aghion, P., Bloom, N., Blundell, R., Griffith, R., & Howitt, P. (2005). Competition and innovation: An inverted-U relationship. The Quarterly Journal of Economics, 120(2), 701–728.

Albert, M. B., Avery, D., Narin, F., & McAllister, P. (1991). Direct validation of citation counts as indicators of industrially important patents. Research Policy, 20(3), 251–259.

Arrow, K. J. (1962). Economic welfare and the allocation of resources for invention. In R. R. Nelson (Ed.), The Rate and Direction of Inventive Activity: Economic and Social Factors (pp. 609–626). Princeton: Princeton University Press.

Atallah, G., & Rodríguez, G. (2006). Indirect patent citations. Scientometrics, 67(3), 437–465.

Bartelsman, E. J., & Gray, W. (1996). The NBER manufacturing productivity database. NBER technical working paper 205.

Baltagi, B. H., & Wu, P. X. (1999). Unequally spaced panel data regressions with AR(1) disturbances. Econometric Theory, 15(6), 814–823.

Bessen, J. (2009). NBER PDP project user documentation: Matching patent data to compustat firms. Unpublished manuscript.

Bhargava, A., Franzini, L., & Narendranathan, W. (1982). Serial correlation and fixed effects model. Review of Economic Studies, 49(4), 533–549.

Blair, J. M. (1972). Economic concentration: Structure, behavior, and public policy. New York: Harcourt, Brace, Jovanovich, Inc.

Bound, J., Cummins, C., Grilliches, Z., Hall, B. H., & Jaffe, A. (1984). Who does R&D and who patents. In Z. Griliches (Ed.), R&D, Patents and Productivity (pp. 21–54). Chicago: University of Chicago Press.

Breschi, S., Lissoni, F., & Malerba, F. (2003). Knowledge-relatedness in firm technological diversification. Research Policy, 32, 69–87.

Breschi, S., Malerba, F., & Orsenigo, L. (2000). Technological regimes and Schumpeterian patterns of innovation. The Economic Journal, 110, 388–410.

Cockburn, I. M., & Henderson, R. M. (2001). Scale and scope in drug development: Unpacking the advantages of size in pharmaceutical research. Journal of Health Economics, 20, 1033–1057.

Cohen, W. M., & Klepper, S. (1996). A reprise of size and R&D. The Economic Journal, 106, 925–951.

Cohen, W. M., Nelson, R. R., & Walsh, J. P. (2000). Protecting their intellectual assets: Appropriability conditions and why U.S. manufacturing firms patent (or not). NBER working paper 7552.

Comanor, W. S. (1967). Market structure, product differentiation, and industrial research. The Quarterly Journal of Economics, 81(4), 639–657.

Cooper, A. C. (1964). R&D is more efficient in small companies. Harvard Business Review, 42(3), 75–83.

Crépon, B., Duguet, E., & Mairesse, J. (1998). Research, innovation and productivity: An econometric analysis at the firm level. Economics of Innovation and Technological Change, 7, 115–158.

de Rassenfosse, G. (2010). Do firms face a trade-off between the quantity and quality of their inventions? Research Policy, 42, 1072–1079.

Doraszelski, U., & Jaumandreu, J. (2013). R&D and productivity: Estimating endogenous productivity. Review of Economic Studies, 80, 1338–1383.

Galbraith, J. K. (1956). American capitalism: The concept of countervailing power. Boston: Houghton Mills.

Gallini, N. T. (1992). Patent policy and costly imitation. RAND Journal of Economics, 23(1), 52–63.

Gallini, N. T. (2002). The economics of patents: Lessons from recent U.S. reform. Journal of Economic Perspectives, 16(2), 131–154.

Gambardella, A., & Torrisi, S. (1998). Does technological convergence imply convergence in markets? Evidence from the electronics industry. Research Policy, 27, 445–463.

Garcia-Vega, M. (2006). Does technological diversification promote innovation? An empirical analysis for European firms. Research Policy, 35, 230–246.

Gonzáles-Álvarez, N., & Nieto-Antolín, M. (2007). Appropriability of innovation results: An empirical study in Spanish manufacturing firms. Technovation, 27, 280–295.

Goodall, A. H. (2009). Highly cited leaders and the performance of research universities. Research Policy, 38, 1079–1092.

Granstrand, O., & Oskarsson, C. (1994). Technology Diversification in MUL-TECH Corporations. IEEE Transactions on Engineering Management, 41(4), 355–364.

Griliches, Z. (1998). R&D and productivity: The econometric evidence. Chicago: University of Chicago Press.

Hall, B. H. (2002). The financing of research and development. Oxford Review of Economic Policy, 18, 35–51.

Hall, B. H., Jaffe, A. B., & Trajtenberg, M. (2001). The NBER patent citations data file: Lessons, insights and methodological tools. NBER working paper 8498.

Hall, B. H., & Ziedonis, R. M. (2001). The patent paradox revisited: An empirical study of patenting in the U.S. semiconductor industry, 1979–1995. The RAND Journal of Economics, 32(1), 101–128.

Harabi, N. (1995). Appropriability of technical innovations: An empirical analysis. Research Policy, 24, 981–992.

Harhoff, D., Narin, F., Frederic, N., Scherer, M., & Vopel, K. (1999). Citation frequency and the value of patented inventions. Review of Economics and Statistics, 81(3), 511–515.

Henderson, R. M., & Cockburn, I. M. (1996). Scale, scope and spillovers: The determinants of research productivity in drug discovery. The RAND Journal of Economics, 27(1), 32–59.

Huang, Y., & Chen, J. (2010). The impact of technological diversity and organizational slack on innovation. Technovation, 30, 420–428.

Idson, T. L., & Oi, W. Y. (1999). Workers are more productive in large firms. The American Economic Review (Papers and proceedings of the one hundred eleventh annual meeting of the American Economic Association), 89(2), 104–108.

Jaffe, A. B. (1986). Technological opportunity and spillovers of R&D: Evidence from firms’ patents, profits, and market value. The American Economic Review, 76(5), 984–1001.

Jaffe, A. B. (2000). The U.S. patent system in transition: Policy innovation and the innovation process. Research Policy, 29, 531–557.

Kim, J., Lee, S. J., & Marschke, G. (2009). Inventor productivity and firm size: Evidence from panel data on inventors. Pacific Economic Review, 14(4), 513–531.

Lanjuow, J. O., & Schankerman, M. (2004). Patent quality and research productivity: Measuring innovation with multiple indicators. The Economic Journal, 114, 441–465.

Lerner, J. (2002). Patent protection and innovation over 150 years. NBER working paper 8977.

Leten, B., Belderbos, R., & Van Looy, B. (2007). Technological diversification, coherence, and performance of firms. Journal of Product Innovation Management, 24(6), 567–579.

Lettl, C., Rost, K., & von Wartburg, I. (2009). Why are some independent inventors ‘heroes’ and others ‘hobbyists’? The moderating role of technological diversity and specialization. Research Policy, 38, 243–254.

Levin, R. C., Klevorick, A. K., Nelson, R. R., & Winter, S. G. (1987). Appropriating the returns from industrial research and development. Brookings Papers on Economic Activity, 3, 783–831.

Lichtenberg, F., & Siegel, D. (1991). The impact of R&D investment on productivity-new evidence using linked R&D-LRD data. Economic Inquiry, 29(2), 203–229.

Link, A. N. (1980). Firm size and efficient entrepreneurial activity: A reformulation of the Schumpeter hypothesis. Journal of Political Economy, 88(4), 771–782.

Link, A. N., & Rees, J. (1991). Firm size, university-based research and the returns to R&D. In Z. J. Acs & D. B. Audretsch (Eds.), Innovation and technological change: An international comparison (pp. 60–70). Ann Arbor: University of Michigan Press.

Lööf, H., & Heshmati, A. (2002). Knowledge capital and performance heterogeneity: A firm-level innovation study. International Journal of Production Economics, 76, 61–85.

MacDonald, J. M. (1985). R&D and the directions of diversification. The Review of Economics and Statistics, 67, 583–590.

Miller, D. J. (2006). Technological diversity, related diversification, and firm performance. Strategic Management Journal, 27, 601–619.

Nelson, R. R. (1959). The simple economics of basic scientific research. Journal of Political Economy, 67(3), 297–306.

Nelson, R. R., & Wolff, E. N. (1997). Factors behind cross-industry differences in technical progress. Structural Change and Economic Dynamics, 8, 205–220.

Nesta, L., & Saviotti, P. P. (2005). Coherence of the knowledge base and the firm’s innovative performance: Evidence from the U.S. pharmaceutical industry. The Journal of Industrial Economics, 53(1), 123–142.

Patel, P., & Pavitt, K. (1997). The technological competencies of the world’s largest firms: Complex and path-dependent, but not much variety. Research Policy, 26, 141–156.

Pavitt, K. (1998). Technologies, products and organization in the innovating firm: What Adam Smith tells us and Joseph Schumpeter does not. Industrial and Corporate Change, 7(3), 433–452.

Pavitt, K., Robson, M., & Townsend, J. (1987). The size distribution of innovative firms in the U.K.: 1945–1983. The Journal of Industrial Economics, 35(3), 297–316.

Quintana-García, C., & Benavides-Velasco, C. A. (2008). Innovative competence, exploration and exploitation: The influence of technological diversification. Research Policy, 37, 492–507.

Reinganum, J. F. (1983). Uncertain innovation and the persistence of monopoly. The American Economic Review, 73, 61–66.

Rothwell, R. (1989). Small firms, innovation and industrial change. Small Business Economics, 1, 51–64.

Scherer, F. M. (1980). Industrial market structure and economic performance. Chicago: Rand McNall.

Schumpeter, J. A. (1942). Capitalism, socialism and democracy. New York: Harper.

Scott, J. T. (1993). Purposive diversification and economic performance. Cambridge: Cambridge University Press.

Teece, D. J., Rumelt, R., Dosi, G., & Winter, S. G. (1994). Understanding corporate coherence: Theory and evidence. Journal of Economic Behaviour and Organization, 23, 1–3.

Trajtenberg, M. (1990). A penny for your quotes: Patent citations and the value of innovations. RAND Journal of Economics, 21(1), 172–189.

Trajtenberg, M., Henderson, R., & Jaffe, A. B. (1997). University versus corporate patents: A window on the basicness of invention. Economics of Innovation and New Technology, 5(1), 19–50.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Dindaroğlu, B. Determinants of patent quality in U.S. manufacturing: technological diversity, appropriability, and firm size. J Technol Transf 43, 1083–1106 (2018). https://doi.org/10.1007/s10961-017-9587-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10961-017-9587-7