Abstract

Purpose Unmet rehabilitation needs are common. We therefore developed a risk score using administrative data to assess the risk of permanent work disability. Such a score may support the identification of individuals with a high likelihood of receiving a disability pension. Methods Our sample was a random and stratified 1% sample of individuals aged 18–65 years paying pension contributions. From administrative records, we extracted sociodemographic data and data about employment and welfare benefits covering 2010–2012. Our outcome was a pension due to work disability that was requested between January 2013 and December 2017. We developed a comprehensive logistic regression model and used the model estimates to determine the risk score. Results We included 352,140 individuals and counted 6,360 (1.8%) disability pensions during the 5-year follow-up. The area under the receiver operating curve was 0.839 (95% CI 0.834 to 0.844) for the continuous risk score. Using a threshold of ≥ 50 points (20.2% of all individuals), we correctly classified 80.6% of all individuals (sensitivity: 71.5%; specificity: 80.8%). Using ≥ 60 points (9.9% of all individuals), we correctly classified 90.3% (sensitivity: 54.9%; specificity: 91.0%). Individuals with 50 to < 60 points had a five times higher risk of a disability pension compared to individuals with low scores, individuals with ≥ 60 points a 17 times higher risk. Conclusions The risk score offers an opportunity to screen for people with a high risk of permanent work disability.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Population ageing and the transition from communicable to non-communicable diseases increase the number of people living with disabilities [1]. There are globally more than 1 billion people with disabilities; by 2050, the World Health Organization expects that the number will rise to over 2 billion [2]. Their equal participation is one of the major challenges that our health and social security systems are facing [3, 4].

Paid employment is one of the life domains in which there is a particular need for action. Employment secures income, guarantees material security, and supports an independent lifestyle. In addition, the accumulation of pension entitlements reduces the risk of poverty in old age. However, employment rates among people with disabilities are only half those of people without disabilities in many countries [5]. Enhancing the work participation of people with chronic and severe health impairments requires effective rehabilitation strategies that reduce the consequences of illness and find ways to enable people with health impairments to return to work. In many European countries, pension and health insurance agencies provide rehabilitation programs for this purpose [6]. These rehabilitation programs aim to prevent permanent work disability and the need for disability pensions by restoring and improving work ability. Although these services are available, and the possibility of utilization is—as in Germany—guaranteed by law, unmet needs are common. In Germany, there are about 170,000 new disability pensioners each year, and roughly half of them did not use rehabilitation before receiving a disability pension [7]. In order to ensure access to rehabilitation for all who need it, persons at increased risk of permanent work disability have to be identified in time.

The increasing accessibility of digital health and employment data has renewed interest in the use of these data for research and developing health care [8]. These data are easily available and can be processed in real time. If these data can be effectively used to identify people at high risk of permanent work disability, this would open up new avenues for targeted information on rehabilitation services. In Germany, the pension agencies routinely collect data on employment and welfare benefits, in particular to determine later pension entitlements, but they are also responsible for providing rehabilitation for working-aged people. Many of the data routinely collected are known to be associated with future disability pensions. Based on a previous case–control study, we therefore proposed to merge these data, assuming that this would offer more insight into the risk of permanent work disability than looking at the various distinct pieces of data separately [9]. In our present study, we sought to weight and combine various administrative sociodemographic data and data on employment and welfare benefits into a single score which accurately predicts future disability pensions. Moreover, we intended to determine a reasonable threshold that separates individuals with low and high risks of permanent work disability.

Methods

Study Design and Participants

Our study is a cohort study employing administrative data which are routinely collected by pension agencies. We used a random 1% sample of individuals aged 18 to 65 years who were paying pension contributions in 2012, stratified by pension insurance institutions. Excluded were persons who applied for an old age or disability pension before 1 January 2013. The study protocol was approved by the ethics committee of the University of Lübeck (18-246A).

Outcome

Our outcome was a disability pension claimed between 1 January 2013 and 31 December 2017. In Germany, there is a compulsory pension insurance scheme. In total, there are 16 agencies which currently administer the pension contributions of around 55 million working-aged people, of whom about 38 million had paid contributions in 2017. In the case of lasting work disability, the agencies have to pay a disability pension. Disability pensions can be approved as full or partial pensions: about 90% are full pensions [7]. Disability pensions are usually permitted temporarily (up to 3 years), and a continuation of the pension needs further verification. Once approved, a later refusal is rather rare. Temporary pensions turn into permanent pensions after 9 years. Data on disability pensions were extracted from administrative records. Since temporary pensions usually turn into permanent pensions we did not distinguish between temporary and permanent pensions.

Independent Variables

Administrative sociodemographic data and data on employment and welfare benefits were used to predict disability pensions. The sociodemographic characteristics taken into account were age, gender, nationality, and the pension agency. Nationality was categorized as German, Turkish, former Yugoslavia, Russian and Commonwealth of Independent States, Polish, Italian, Greek, and other. Persons with German citizenship formed the reference category in our model calculations. The reference category for the pension agency was the Federal German Pension Insurance, which is the largest agency mainly covering white-collar workers. Employment was represented by cumulative income (in 1000 euros) for the years 2010 to 2012. The duration of welfare benefits (short-term unemployment benefit, long-term unemployment benefit, and sickness absence benefit) was also cumulated for 2010 to 2012 and then categorized. For this purpose, the median was determined for persons who were entitled to welfare benefits for at least 1 day, and the duration of benefits was then categorized as no benefits vs. short benefits vs. long benefits.

Statistical Analysis

Sample characteristics were determined using descriptive methods. Subsequently, disability pensions were regressed on all independent variables using simple logistic regression models. For each characteristic, both the crude association and interactions with gender were tested. If we identified a significant interaction effect, sex-specific estimators were considered in the final model. In the final model, we included sex, age, nationality, the pension agency, income, the duration of short-term and long-term unemployment benefits, and the duration of sickness absence benefits. In the case of income, the duration of long-term unemployment benefits, and the duration of sickness absence benefits, sex-specific variables were included to account for the significant interaction in the crude models. In order to consider the non-linear effect of age in predicting a disability pension, the squared age was also included. Unstandardized estimates and odds ratios with corresponding 95% confidence intervals were determined as estimators. To calculate our risk score, the unstandardized estimators and the characteristics of the included individuals were combined linearly and then transformed into probabilities before being converted into T-scores with a mean of 50 and a standard deviation of 10.

The prognostic accuracy of the continuous risk score was assessed using a receiver operating characteristic curve and the corresponding area under the curve. A value of > 0.5 implies that the predictive power is better than random; values of ≥ 0.8 are considered good [10]. As the apparent performance of a prognostic model on a development sample is usually better than the performance on other samples, even if the latter sample consist of individuals from the same population we internally validated our model [11]. We used the bootstrapping technique described by Harrell et al. [12] with 200 repetitions. To assess the prognostic accuracy of a categorized risk score, we calculated sensitivity and specificity, the correct classification rate, and the positive and negative likelihood ratios for each potential threshold. The index J (J = sensitivity + specificity − 1) proposed by Youden was used to determine the optimal threshold for categorization of our risk score [13]. The optimized threshold was determined as the score for which the Youden index reached its maximum. Finally, Kaplan–Meier curves were generated to describe the prognostic relevance of our categorized risk score. Time-to-event was computed from 1 January 2013 until the date of application for an approved disability pension. The serial time of people who received an old-age pension was censored at the date of start of the old-age pension. Individuals’ serial time without an event ended on 31 December 2017. In addition, a proportional hazard model using the categorized risk score as the independent variable was calculated, and hazard ratios and their 95% confidence intervals were determined.

Statistical tests were considered significant if the two-tailed level of significance was less than 5%. All analyses were calculated using STATA version 15.

Results

Sample Characteristics

We included 352,140 individuals and counted 6360 (1.8%) disability pensions during the 5-year follow-up. Table 1 shows the sample characteristics for individuals with and without a disability pension separately. Persons who received a disability pension during the 5-year follow-up were older, were less often customers of the Federal German Pension Insurance, were more often Turkish nationals, achieved less income, and received welfare benefits for longer.

Determinants of a Disability Pension

The final model is available as Supplementary File 1. Men had slightly higher odds of a disability pension compared to women in this model. Higher age and lower income were associated with an elevated risk of a disability pension. The odds of a disability pension were slightly higher for Turkish people compared to those of German nationality. Persons of Russian nationality and those from the Commonwealth of Independent States, Poland, and people of other nationalities had lower odds of a disability pension compared to Germans. Compared to the Federal German Pension Insurance, the odds of a disability pension were slightly higher for almost all other pension insurance institutions. The length of time in receipt of short-term or long-term unemployment benefits, as well as sickness absence benefits, clearly increased the risk of a disability pension. In particular, prolonged receipt of long-term unemployment benefits and sickness absence benefits raised the likelihood of a disability pension.

Risk Score

The distribution of the risk score was right-skewed, with the mass of the distribution on the left and a long tail on the right. About one quarter had scores below 45 points. The median was 47 points. About one in five people had a score of at least 50 points, and about every tenth person had a score of at least 60 points (Fig. 1).

The risk score clearly discriminated individuals with and without disability a pension. The area under the receiver operating curve was 0.839 (95% CI 0.834 to 0.844). Internal validation showed that optimism tended to be zero (< 0.001), meaning that our apparent area under the curve was not overoptimistic. The optimal threshold determined by maximizing the Youden index was 50 points (Table 2). Using the threshold of ≥ 50 points, we correctly classified 80.6% of all individuals (sensitivity: 71.5%; specificity: 80.8%). Using ≥ 60 points, we correctly classified 90.3% (sensitivity: 54.9%; specificity: 91.0%).

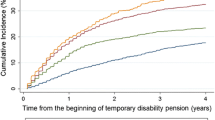

The probability of a disability pension for persons with values < 50 points was 0.7%; for persons with values 50 to < 60 points, it was 2.9%; and for persons with values ≥ 60 points, it was 10.1% (Table 3). Figure 2 shows the cumulative risk of the three risk groups over the 5-year follow-up period. Individuals with moderate (50 to < 60 points) or high risk scores (≥ 60 points) had a 5 times (HR = 4.71; 95% CI 4.24 to 4.94) or 17 times higher risk (HR = 17.32; 95% CI 16.37 to 18.34) of a disability pension compared to individuals with low scores.

Discussion

The aim of the study was to predict the risk of a disability pension using administrative data from the German Pension Insurance and to develop a risk score, which can be used to identify unmet rehabilitation needs. The prognostic accuracy of the risk score was acceptable and similar to that of well-established risk scores in health care settings like the management of cardiovascular risk [14]. Internal validation of the model performance using bootstrapping revealed that the model was not overoptimistic. The hazards of receiving a disability pension were 5 and 17 times higher in people with moderate and high risk scores than in people with low risk scores. The number of false positive results was, however, high. Due to the low incidence of disability pensions, most people with high risk scores were still employed at the end of our 5-year follow-up.

The most important predictor of a disability pension was the duration of sickness absence benefits. These results are consistent with the findings of other large cohort studies which also examined the effect of long-term sickness absence benefits on disability pensions [15,16,17,18,19,20,21], and findings from an earlier case–control study in which we initially tested our idea of a risk score based on administrative data [9]. Though many studies have identified relevant risk factors for disability pensions, they did not combine these data into a single risk score. However, we believe that the overall burden of risk factors should be taken into account when assessing the individual risk of a permanent work exit. Many people who later receive a disability pension are affected by several risk factors. These factors interact with each other and thus generate the overall individual risk.

The use of administrative data to identify persons who are likely to leave the labor force due to health reasons and receive a disability pension is an appealing idea. A screening of administrative data harnesses complete data, avoids recall bias and can be applied rapidly, with little effort and low costs even for large groups. This could help to reduce the high number of disability pensions if early detection and intervention are effective. However, the requirements for an effective screening program go beyond acceptable sensitivity and specificity. Wilson and Jungner [22], in their seminal paper on the principles and practice of screening, formulated essential requirements for the implementation of screening half a century ago. Some of these requirements are certainly met. Permanent work incapacity is an important individual and social problem, and the number of disability pensions is sufficiently high to warrant preventive strategies. There is also evidence that effective strategies are feasible to support the work participation of people with chronic health problems [23,24,25,26,27]. Other challenges could be solved in principle, but solutions are not yet well established. Firstly, acceptance of the collection and processing of personal data by state institutions is low, and health-related data are particularly worthy of protection [28]. If they become freely available, assumptions about future restrictions could have significant negative consequences for the individuals in question and, for instance, reduce promotion opportunities or the likelihood that temporary jobs become permanent jobs. However, resistance to institutional data collection and data analysis is significantly lower when people expect a health benefit from it [28]. This benefit must be communicated in a comprehensible way. Secondly, facilities must be available to meet the increased care needs that arise for definitive diagnostic clarification and any necessary rehabilitative interventions. Thirdly, full diagnosis and treatment of people with high risk scores would cause considerable costs, although the initial costs for screening administrative data are negligible. A work disability screening using administrative data may not be cost-effective, even if a randomized controlled trial may prove that work retention is improved in comparison to a non-screened population.

A critical appraisal of our findings has to consider the following limitations. Firstly, the data we used are collected primarily for the calculation of future pensions. Thus, the purpose of the data is not to assess rehabilitation needs. Important information, such as the type of illness, is not available, as this information is not relevant for the calculation of the pension amount. This limits the sensitivity and specificity of our risk score. Secondly, a critical editorial pointed out that performance of recently developed prediction models is not good enough for implementing risk-based intervention strategies [29]. While these models demonstrated the importance of certain risk factors they were mostly not sufficient to accurately identify individuals at risk of disability benefits and to target these individuals for interventions that permanently reduce this risk. In line with these findings, our low positive predictive value indicates that our risk score is—at best—suitable for screening but not appropriate to directly assign rehabilitation services. Thirdly, though we internally validated our model using bootstrapping we have not externally validated our model. While internal validation did not reveal optimism the model performance in independently established cohorts may be worse [30,31,32]. Fourthly, the employment and income data used are not reported in real time by employers, but only after the end of the year. The risk score may refer to an event that has already been overcome. Interventions may have been initiated, or the favorable course of an illness may have already resolved the limitations of the persons concerned.

These limitations are countered by the following strengths. Firstly, we were able to use a large random sample for the development of our risk score. The external validity of our results is therefore high. Secondly, the administrative data we used as independent variables and outcome were complete, reliable, and valid. Thirdly, we used 3-year cumulated data to predict disability pensions rather than single measurements only.

In conclusion, our risk score can be calculated for every person aged 18 to 65 years paying pension contributions in Germany. If the necessary data are available in time, this yields two key applications. Firstly, the risk score can be used as an additional evaluation criterion when assessing rehabilitation and pension requests. Secondly, there is the possibility of identifying people with high risk scores and informing them about rehabilitation services. Subsequently, it is possible to discuss whether rehabilitative services can enable them to remain in working life.

References

Stucki G, Bickenbach J, Gutenbrunner C, Melvin J. Rehabilitation: the health strategy of the 21st century. J Rehabil Med. 2018;50(4):309–316.

World Health Organization. World report on disability. Geneva: World Health Organization; 2011.

Negrini S, Kiekens C, Heinemann AW, Ozcakar L, Frontera WR. Prioritising people with disabilities implies furthering rehabilitation. Lancet. 2020;395(10218):111.

Lancet T. Prioritising disability in universal health coverage. Lancet. 2019;394(10194):187.

United Nations. Disability and development report. New York: United Nations; 2018.

Mittag O, Kotkas T, Reese C, Kampling H, Groskreutz H, de Boer W, et al. Intervention policies and social security in case of reduced working capacity in the Netherlands, Finland and Germany: a comparative analysis. Int J Public Health. 2018;63(9):1081–1088.

German Pension Insurance Federation. Pensions 2017. Berlin: German Pension Insurance Federation; 2018.

Corrigan-Curay J, Sacks L, Woodcock J. Real-world evidence and real-world data for evaluating drug safety and effectiveness. JAMA. 2018;320(9):867–868.

Bethge M, Egner U, Streibelt M, Radoschewski FM, Spyra K. Risk Index Disability Pension (RI-DP). A register-based case-control study with 8,500 men and 8,405 women. Bundesgesundheitsbl. 2011;54(11):1221–1228.

Rice ME, Harris GT. Comparing effect sizes in follow-up studies: ROC Area, Cohen's d, and r. Law Hum Behav. 2005;29(5):615–620.

Steyerberg EW, Harrell FE Jr, Borsboom GJ, Eijkemans MJ, Vergouwe Y, Habbema JD. Internal validation of predictive models: efficiency of some procedures for logistic regression analysis. J Clin Epidemiol. 2001;54(8):774–781.

Harrell FE Jr, Lee KL, Califf RM, Pryor DB, Rosati RA. Regression modelling strategies for improved prognostic prediction. Stat Med. 1984;3(2):143–152.

Youden WJ. Index for rating diagnostic tests. Cancer. 1950;3(1):32–35.

Conroy RM, Pyorala K, Fitzgerald AP, Sans S, Menotti A, De Backer G, et al. Estimation of ten-year risk of fatal cardiovascular disease in Europe: the SCORE project. Eur Heart J. 2003;24(11):987–1003.

Salonen L, Blomgren J, Laaksonen M, Niemela M. Sickness absence as a predictor of disability retirement in different occupational classes: a register-based study of a working-age cohort in Finland in 2007–2014. BMJ Open. 2018;8(5):e020491.

Lallukka T, Kronholm E, Pekkala J, Jappinen S, Blomgren J, Pietilainen O, et al. Work participation trajectories among 1,098,748 Finns: reasons for premature labour market exit and the incidence of sickness absence due to mental disorders and musculoskeletal diseases. BMC Public Health. 2019;19:1418.

Alexanderson K, Kivimaki M, Ferrie JE, Westerlund H, Vahtera J, Singh-Manoux A, et al. Diagnosis-specific sick leave as a long-term predictor of disability pension: a 13-year follow-up of the GAZEL cohort study. J Epidemiol Community Health. 2012;66(2):155–159.

Lund T, Kivimaki M, Labriola M, Villadsen E, Christensen KB. Using administrative sickness absence data as a marker of future disability pension: the prospective DREAM study of Danish private sector employees. Occup Environ Med. 2008;65(1):28–31.

Wallman T, Wedel H, Palmer E, Rosengren A, Johansson S, Eriksson H, et al. Sick-leave track record and other potential predictors of a disability pension. A population based study of 8,218 men and women followed for 16 years. BMC Public Health. 2009;9:104.

Gjesdal S, Bratberg E, Maeland JG. Gender differences in disability after sickness absence with musculoskeletal disorders: five-year prospective study of 37,942 women and 26,307 men. BMC Musculoskelet Disord. 2011;12:37.

Kivimaki M, Ferrie JE, Hagberg J, Head J, Westerlund H, Vahtera J, et al. Diagnosis-specific sick leave as a risk marker for disability pension in a Swedish population. J Epidemiol Commun Health. 2007;61(10):915–920.

Wilson JMG, Jungner G. Principles and practice of screening for disease. Geneva: World Health Organization; 1968.

de Boer AG, Taskila TK, Tamminga SJ, Feuerstein M, Frings-Dresen MH, Verbeek JH. Interventions to enhance return-to-work for cancer patients. Cochrane Database Syst Rev. 2015;9:CD007569.

Marin TJ, Van Eerd D, Irvin E, Couban R, Koes BW, Malmivaara A, et al. Multidisciplinary biopsychosocial rehabilitation for subacute low back pain. Cochrane Database Syst Rev. 2017;6:CD002193.

Nieuwenhuijsen K, Faber B, Verbeek JH, Neumeyer-Gromen A, Hees HL, Verhoeven AC, et al. Interventions to improve return to work in depressed people. Cochrane Database Syst Rev. 2014;12:CD006237.

Schaafsma FG, Whelan K, van der Beek AJ, van der Es-Lambeek LC, Ojajarvi A, Verbeek JH. Physical conditioning as part of a return to work strategy to reduce sickness absence for workers with back pain. Cochrane Database Syst Rev. 2013;8:CD001822.

van Vilsteren M, van Oostrom SH, de Vet HC, Franche RL, Boot CR, Anema JR. Workplace interventions to prevent work disability in workers on sick leave. Cochrane Database Syst Rev. 2015;10:CD006955.

Knorre S, Müller-Peters H, Wagner F. Die Big-Data-Debatte. Chancen und Risiken der digital vernetzten Gesellschaft. Wiesbaden: Springer Gabler; 2020.

Burdorf A. Prevention strategies for sickness absence: sick individuals or sick populations? Scand J Work Environ Health. 2019;45(2):101–102.

Ohnuma T, Uchino S. Prediction models and their external validation studies for mortality of patients with acute kidney injury: a systematic review. PLoS ONE. 2017;12(1):e0169341.

Steyerberg EW, Vickers AJ, Cook NR, Gerds T, Gonen M, Obuchowski N, et al. Assessing the performance of prediction models: a framework for traditional and novel measures. Epidemiology. 2010;21(1):128–138.

Airaksinen J, Jokela M, Virtanen M, Oksanen T, Koskenvuo M, Pentti J, et al. Prediction of long-term absence due to sickness in employees: development and validation of a multifactorial risk score in two cohort studies. Scand J Work Environ Health. 2018;44(3):274–282.

Funding

This research was funded by the Federal German Pension Insurance. Funding was provided by Deutsche Rentenversicherung Bund (DE) (Grant No. FV-1253-18-0156-01). Open Access funding provided by Projekt DEAL.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Bethge, M., Spanier, K. & Streibelt, M. Using Administrative Data to Assess the Risk of Permanent Work Disability: A Cohort Study. J Occup Rehabil 31, 376–382 (2021). https://doi.org/10.1007/s10926-020-09926-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10926-020-09926-7