Abstract

Despite persistent housing affordability issues, energy policy and housing renovation are usually investigated separately from housing costs other than energy. Researchers have examined the financial viability of renovation attending to building conditions and the socio-economic characteristics of their occupants. However, the distributional impacts of renovation incentives and the potential of fiscal policy to redistribute housing costs remain understudied. Dutch fiscal policy, favouring homeownership, offers a relevant context to evaluate how property taxation can boost renovation rates. The novelty of this paper resides in investigating the impact of two policies, the current direct subsidy and a proposal for a green tax, on both the financial viability of renovation and the subsequent distribution of housing costs. The proposed green tax combines energy efficiency and taxation of property revenue. We employ a model considering marginal costs of housing renovation, obtained from a government dataset, and marginal benefits, drawn from a hedonic regression. We assess the distributional impacts of different policy scenarios by examining changes in user costs across income deciles. Our findings indicate that existing renovation subsidies exacerbate the regressive distributional impacts resulting from the current housing taxation system in the Netherlands. Introducing energy-efficiency-linked property taxation can make homeownership fiscality less regressive while incentivising housing renovation. Ultimately, this study highlights the importance of incorporating housing affordability as a fundamental element in renovation policies to balance environmental and distributional objectives.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Since its inception in 2002, the Energy Performance of Buildings Directive (EPBD)(2002/91/EC) has been the cornerstone of building standards across EU Member States (MSs). The EPBD has progressively broadened its scope through successive recasts, 2010/31 and 2018/844. At first, this directive established only optional reporting and certification guidelines in the form of Energy Performance Certificates (EPCs). In subsequent recasts, the EU has strengthened its demands requiring MSs to define specific plans to phase out the worst energy-performing building stock (Bertoldi et al., 2021) (Economidou et al., 2020). At the time of writing, in the midst of an energy crisis, debates at the European Parliament on a new EPBD recast underline the relevance of energy efficiency in achieving carbon neutrality by 2050 (Ernould, 2022).

Concurrently, the European Commission (EC) has also launched the Renovation Wave (COM 2020 662), an action plan assessing the budgeting solutions that the EU could draw on to support housing renovation. The Renovation Wave estimated that 275€ billion of public and private investment a year are needed to attain the 55% reduction in emissions by 2030 envisioned in the EU’s Climate Target Plan. The Renovation Wave builds on a series of initiatives by MSs which have fostered the viability of renovation through an array of subsidies including grants and low-interest loans with a clear focus on owner-occupied housing (Castellazzi et al., 2019).

The financial viability of housing renovation hinges on its costs and the resulting value increase of an energy-efficient home (Copiello & Donati, 2021). The value increase of energy-efficient improvements in real estate markets usually takes the form of a green premium identified through different econometric techniques, see for example Aydin et al. (2020) for a recent study of property premiums in the Netherlands. To increase the financial viability of renovation, the EU proposes two approaches that have been incorporated differently by MSs (Bertoldi et al., 2021). On the one hand, grants and loans rely on the reduction or complete elimination of up-front costs—a carrot approach—to encourage renovation (Eryzhenskiy et al., 2022). On the other hand—the stick side of housing renovation incentives—draws, first, on mandatory Minimum Performance Standards (MEPSs) which preclude the renting or selling of properties under a certain EPC level (Economidou et al., 2020). Second, the EC also plans to expand the Emissions Trading Systems (ETS) to encompass buildings before the end of the decade (2003/87/EC). This will likely impact energy costs and increase the viability of energy-efficient renovations (Backe et al., 2023).

In the Netherlands, when it comes to owner-occupied housing, MEPSs have not yet been defined. Instead, the government has put in place a series of subsidies and loans to incentivise renovation. Homeowners can access different forms of grants covering up to half of the renovation costs when they insulate or change the heating source in their homes (Ministry of Economic Affairs and Climate Policy, 2019). Since 2022, 0% interest loans are also available to low-income households from the National Heat Fund. On the stick side, the Netherlands implements a form of carbon taxation on individual households which has produced, according to the Joint Research Centre (JRC), regressive effects, that is taxing those on lower incomes comparatively more (Maier & Ricci, 2022). Despite the direct link between renovation subsidies and housing costs (Haffner, 2003) together with the regressiveness in current carbon taxation (Maier & Ricci, 2022), the distributional impact of renovation on affordability remains understudied. While this gap in knowledge is substantive to the Netherlands, it also speaks more broadly to the incorporation of renovation within the study of housing affordability.

Housing affordability is arguably one of the most pressing issues in the Netherlands. Despite a nuanced descent in 2023, house prices have been on the rise for more than a decade with 19.5% increases year on year in Q1 2022 (CBS, 2022). However, housing costs are not equally distributed across the population and present stark differences by tenure. Dutch homeowners, even those on low incomes, are among the least likely to be overburdened with housing costs, that is spend more than 40% of their income on housing (OECD, 2022). Conversely, the median burden of rent payments for tenants, 30%, is the second highest among OECD countries (OECD, 2022). Notwithstanding the Dutch housing market heading toward price correction in 2023, chronic inequalities in access to housing have created a cleavage between “insiders”, homeowners, and “outsiders”, renters (Arundel & Lennartz, 2019). Despite housing costs being a major driver of inequalities between tenures in the Dutch context, these considerations are absent in the design of housing renovation policies and the academic discussion on housing renovation. This has so far focused on post-renovation energy savings and subsidy uptake across households due to low-income levels or built fabric determinants, see for instance Brom et al. (2019) and Sunikka-Blank and Galvin (2012), and also McCoy and Kostch (2021) for the distributional impacts of built components in housing renovation in the UK.

Furthermore, in the Netherlands, renovation subsidies come to join a series of distortive tax deductions favouring homeowners (Fatica & Prammer, 2018). As a result, it is critical to understand the impact housing renovation subsidies have on affordability to account for their distributional impact on housing costs. The recent comparative study of housing taxation by Millar-Powell (2022) has explored how housing taxation is underutilised and shows that adapting effective tax rates across income lines can help reduce inequalities in the housing market. In the Netherlands, the withdrawal of mortgage deductions would produce the largest increase in the Marginal Effective Tax Rate of debt-owned housing among all OECD countries, 67.7 points (Millar-Powell, 2022). Proposals have been made to substitute these forms of inefficient housing taxation with a Land Value Tax (LVT) (Allers, 2020). The Netherlands shares a lot of these traits with the UK where an LVT has also been proposed as a substitute for council tax, a regressive form of housing taxation (Mirrlees & Adam, 2011). Particularly apposite in this context is a proposal made by Muellbauer (2018) linking housing taxation to energy efficiency through a Green Land Value Tax (GLVT) designed to be progressive while incentivising housing renovation. Moreover, in 2022, an EC discussion paper also highlighted the potential of immovable property taxes to support the green transition and reduce inequalities (Leodotler et al., 2022).

Building on the discussion about taxation and housing renovation, this paper proposes to take a broader view of energy efficiency measures as a fundamental component of housing affordability. We propose expanding the scope of analysis to incorporate renovation policies in the distributional assessment of housing costs. In this vein, we pose the question: How do the financial incentives and distributional impacts of housing renovation policies vary across different tax scenarios? Our approach relies on a hedonic regression to identify green premiums combined with a distributional analysis of housing costs under two simulated scenarios: (1) the current subsidy and (2) a green tax model. By addressing the financial viability of renovation and its distributional impacts, this paper aims to elucidate the capacity of large-scale housing renovation to produce winners and losers affecting housing affordability unequally across income groups.

The next section introduces the relevant literature on econometric approaches to hedonic pricing valuation together with the analysis of housing costs. Then, the policy background section presents different concepts regarding housing taxation benchmarks as well as the most common financial incentives for housing renovation. The third section focuses on the data and the methodology composed of the econometric approach and the user costs of housing. The fourth and fifth sections respectively showcase the results and discuss their policy implications. Finally, the last section concludes and offers directions for further research.

2 Literature and background

2.1 Hedonic pricing and green premiums

Housing prices at the micro level have traditionally been investigated using hedonic valuation models, following Rosen (1974). In these models, housing is viewed as a heterogeneous good—a vector of characteristics—that can be individually priced through the regression of the different elements on price. This approach estimates P(z) from market data first and secondly, uses first-order conditions and marginal prices to deduce preferences. While Rosen’s model traces prices, it does not differentiate between producers’ offer and households’ demand for housing services. To address this identification problem, shortly after Rosen’s work, Witte et al. (1979) developed a model with simultaneous equations where they assumed that neighbourhood quality and accessibility are shifters of bid and offer curves.

In the last decade, Rosen’s hedonic pricing model has been widely applied to EPCs. EPCs are the main measure of energy efficiency in Europe ranking properties from most energy efficient, A, to least, E. In the United Kingdom, Fuerst et al. (2015) used repeated sales data to identify the influence of EPCs on price appreciation. This paper found a positive effect of energy efficiency on house prices, about 5% for dwellings rated A/B compared to those rated D. The differences between stock types were particularly striking, with premiums of 4.5% for townhouses versus only 1.6% for apartments. In this case, the authors note that the markups are consistent with retrofit costs. In the Netherlands, Brounen and Kok (2011) used a Heckman two-step method in a hedonic pricing regression with an Instrumental Variable (IV) for identification. They identified a 3.7% premium for dwellings with A, B or C ratings. This premium goes up to 10.2% for A-rated units. This paper finds that energy premiums are higher than the capitalisation of energy savings pointing to unobserved characteristics related to the materials used in construction. The need for identification and the use of instrumental variables has been disputed by Cheshire and Sheppard (1998) who find that identification is of minor significance for the estimation of elasticities. Similar work has been conducted using only cross-sectional housing survey data. Ayala et al. (2016) established a premium between 5.4 and 9.8% for energy-efficient dwellings in Spain. Cerin et al. (2014) offer similar results for Sweden using an OLS regression; however, these were contingent on the property-price class with higher-value dwellings acquiring higher premiums and least expensive ones showing negative price-energy efficiency correlations. Also, in Sweden, Wilhelmsson (2019) used a propensity score to compare treated houses with a control group and found a 3.36% premium, with higher impacts depending on regional climate.

More recently, also in the Dutch context, Aydin et al. (2020) used an (IV) approach to assess the capitalisation of energy efficiency in house prices. They found that a 10% increase in energy efficiency leads to a 2.2% increase in market value. Their approach is quasi-experimental and relies on a time discontinuity in the quality of housing construction in the Netherlands resulting from the introduction of the first construction code in 1965 and the oil crisis in 1974, which lead to significantly more energy-efficient dwellings. In the case of the rental market, retrofit expenses create split incentives where the landlord makes the investment but the energy savings are reaped by the tenant. Research by Fuerst et al. (2015) has shown however that these dwellings also command a small, 6%, but significant premium in the rental market. In an expansion of the traditional hedonic pricing model, this paper also uses time-on-market as the dependent variable also points to a weak negative relationship between time on the market and energy efficiency ratings. Groh et al. (2022) also find a substantial premium for energy-efficient dwellings in the German rental market, however, according to them, this premium is not enough to increase the financial viability of renovation in all cases. This research stream’s main conclusion is that property premiums are complex and driven by local specificities; however, there is a price retribution to renovation that varies in size depending on household characteristics and subjacent property value.

2.2 Housing affordability and taxation

Ultimately, green premiums are a form of asset value uplift connected to housing costs through a household’s balance sheet (Haffner, 2003). Traditionally the viability of renovation is assessed through a Discounted Cash-Flow (DCF) analysis of saved energy, which is highly contingent on the discount rate (Copiello & Donati, 2021). The same authors propose instead to use the capitalisation of energy savings into housing value which circumvents discounted predicted energy savings as these are already priced in the property value. Following this line of work, these two authors employ an asset approach to analyse renovation viability by assessing costs and benefits in the form of value increases. Poterba (1984) first developed the asset approach to housing which understands the dwelling as an investment producing a series of services, an income, which ought to be subject to taxation. This type of asset approach to housing affordability has been usually undertaken through the concept of capital user costs. These have been used to assess both the costs of owner-occupation (Haffner & Heylen, 2011) and the distributional impacts of housing taxation (Fatica & Prammer, 2018). The concept of user costs also provides a segue into housing taxation as these are employed in the definition of housing subsidies (Poterba, 1984; Haffner, 2003).

Government action through subsidisation or taxation affects housing costs, historically favouring homeownership over renting (Howard, 1997; Kemeny, 1981). Following this research stream, housing subsidisation does not only take the form of direct housing allowances but can also be engrained in fiscal policy through the under-taxation of homeownership vis-à-vis other investments (Haffner & Oxley, 1999). This under-taxation can be considered a subsidy, defined as a reduction in the price of housing services, which can ultimately make a consumer biased towards a particular tenure. Haffner (2003) proposes to draw from user costs to analyse subsidization. Arguably, user costs are a more comprehensive measure of housing costs than cash flows since the former includes changes in value through accrual accounting measures while the latter is limited to pecuniary exchanges. Equations (1) and (2) show these differences between user costs and cashflows for homeowners with a mortgage, where r stands for interest, D for debt, PP for principal payment, OC for Operating Costs, V for value, δ for depreciation, and ρ for premium, expected value change.

The equalisation of user costs across tenures can take different forms such as capital gains or imputed rent taxation in income tax, as Table 1 shows (Haffner, 2003). The objective of these taxes is to treat the proceeds of homeownership as those from other types of investment—tax neutrality (Mirrlees & Adam, 2011). According to the Mirrlees review (2011), tax neutrality is the elimination of arbitrariness in fiscal burden across households and activities. When it comes to the taxation of housing as an asset, the Mirrlees Review proposes to allocate a Rate-of-Return Allowance (Mirrlees & Adam, 2011), a form of capital gains taxation. Mirrlees’ fiscal proposal would allow the (partial) deductibility of mortgage interest. In turn, it would tax excess returns over the rate of allowance leaving households indifferent between investing in owner-occupied housing or renting and investing in other assets. Imputed rent taxation, that is the taxation of the services provided by a housing asset, is another form of achieving tax neutrality across tenures. However, the implementation of tax neutrality is particularly challenging since this benchmark is usually far from the actual fiscal policy which often favours homeownership (Mirrlees & Adam, 2011) (Haffner & Oxley, 1999). Comparative research across Europe has shown that mortgage interest deduction together with the lack or under-taxation of services from owner-occupied housing are the main fiscal instruments producing inequalities in costs across tenures (Fatica & Prammer, 2018). More broadly, Kholodilin et al. (2022) have linked the expansion of ownership subsidisation, through mortgage deductions and under taxation, to the abolition of rent controls and negative consequences for affordability.

Microsimulation techniques are one of the main tools used in the study of fiscal policy and its distributional consequences. Microsimulations allow to design counterfactuals against which reforms can be assessed (Bourguignon & Spadaro, 2006). This is particularly relevant when assessing tax and benefits as they shed light over the winners and losers under different scenarios. For example, in the UK, Clark and Leicester (2005) show how income tax cuts increased inequalities while increases in means-tested benefits reduced them. When it comes to housing, Figari et al. (2019) use EUROMOD, the multi-country tax benefit calculator of the EU, to analyse the distributional consequences of including net imputed rent in the taxable income while removing the special tax treatment of homeownership. Through this counterfactual exercise, they identify a homeownership bias which could be remedied by raising taxes without regressive effects.

Following these fiscal imbalances between owner-occupied housing and other assets, the OECD has called for the reform of these fiscal policies and the introduction of more progressive forms of taxation of housing assets over the lifecycle, for example with the taxation of housing income through imputed rent during occupation and capital gains at disposal (Millar-Powell, 2022). Country-specific studies have explored how changes in policymaking can tilt housing taxation towards the optimal levels defined in the Mirrlees Review (2011). Haffner and Winters (2016) have analysed fiscal changes in the Belgian Region of Flanders and benchmarked five European countries against tax neutrality. They find that tax neutrality is challenging to implement but the Flemish changes in fiscal policy, reducing the mortgage deduction, did move housing taxation towards the optimum. Heylen (2013) has shown how the Flemish housing tax advantages for owner occupation are received by tax payers with the highest incomes and the average owner-occupier receives fourfold the subsidy amount of the average tenant. When it comes to house improvements, Heylen (2013), also shows how the reduced VAT in the case of home improvement is positively related to income, a particularly relevant finding in the context of the energy-efficient renovations.

2.3 Housing renovation subsidies in The Netherlands

Subsidisation, through grants and loans, as well as tax rebates are commonly used across Europe to incentivise the energy-efficient renovation of the housing stock (Castellazzi et al., 2019). Following this trend, the Dutch government has put in place a series of grants and subsidised loans to incentivise renovation. First, the “Subsidie Energiebesparing Eigen Huis” is a grant programme covering up to 50% of renovation costs when at least two energy-saving measures improving EPC levels have been implemented. Dutch homeowners can also apply for the Investment Grant for Sustainable Energy Savings (ISDE) in the case of single measures such as solar boilers or heat pumps (Ministry of Economic Affairs and Climate Policy, 2019). Since 2022, 0% interest loans are also available to low-income households from the National Heat Fund. On the stick side, as mentioned above, the Netherlands implements a regressive form of carbon taxation on individual households (Maier & Ricci, 2022). On a similar note, research by the Dutch National Bank has also alluded to the strong impact of energy taxation on lower incomes and the inelasticity of energy consumption. Havlinova et al. (2022) have found that the introduction of stronger forms of energy taxation in heated energy markets can impinge on lower incomes resulting in regressive distributional impacts. See Table 1 for a classification of housing taxes and subsidies. At the EU level, the Renovation Wave is actively promoting this approach to housing renovation through its proposal to include buildings in the Emissions Trading Scheme (ETS) together with the implementation of renovation subsidies (2003/87/EC). As a result, while owner-occupied housing is undertaxed, the tax burden on energy consumption at the household level is poised to increase.

As the research presented above has shown, renovation subsidies usually come to join fiscal systems favouring owner occupation. These forms of direct subsidisation of housing renovation coalesce with increases in the fiscal burden on energy consumption. According to Haffner and Heylen (2011), the housing taxation structure favours owner-occupation with a mortgage through large deductions in income tax. In the Netherlands, imputed rent, the main form of housing taxation is calculated on the basis of a notional rent value and then added onto Box 1 which comprises labour income. All other income from investments is taxed under box 3 at a different rate. Haffner and Heylen (2011) have analysed the lack of tax neutrality in this system and propose to include the taxation of housing assets under box 3 as a tax-neutral benchmark. In the context of housing renovation, the favourable fiscal treatment of homeownership comes to join generous subsidies for owner-occupied housing renovation with no maximum income threshold offered by the Dutch government.

As a response to the regressiveness of housing taxation and the subsidisation model of housing renovation, Muellbauer (2018) has proposed a form of GLVT. This tax would take into account land occupation and energy efficiency to excise more on those occupying more land with less energy-efficient buildings. Although there is no land value taxation in the Netherlands, the Dutch case remains particularly apposite to test green taxation proposals through imputed rent. The work of Davis et al. (2017) is also particularly relevant in this context as it combines EPC modelling with property values and taxation arguing for the redistributive potential of this approach. Drawing from the literature presented above, the Netherlands lacks tax neutrality across tenures and imposes regressive taxes on energy consumption. These renovation incentivising policies result from a consumption interpretation of housing renovation as a one-off expense, not as an investment resulting in the appreciation of a financial asset (Copiello & Donati, 2021). Albeit under-taxing it according to the literature presented before, Dutch fiscal policy treats owner-occupied housing as an asset (Haffner, 2003). Aligning incentives for renovation with the asset interpretation of housing present in fiscal policy opens up paths for a set of green tax tools. This paper builds on Haffner and Heylen’s (2011) interpretation of tax neutrality to analyse the distributional impacts of housing renovation. The proposed green taxation framework follows Muellbauer (2018); however, it does not rely on land value but is embedded in the current Dutch imputed rent taxation system (see Table 2 for detail).

3 Methodology and data

The objective of this analysis is twofold. On the one hand, we discuss the redistributive potential of green-imputed rent taxation. On the other hand, we also assess the impact of green taxation on the financial viability of renovation in comparison to the current subsidy model. These issues come together in three research sub-questions: (1) What are the distributional impacts of current and green imputed rent taxation compared to a tax-neutral benchmark? (2) How do the current subsidy and green taxation affect the financial viability of housing renovation? (3)What are the distributional impacts of subsidy and green taxation scenarios on housing costs? By bringing together the literature on housing affordability and housing renovation, we want to assess the potential role fiscal policy can play in the alignment of social and environmental goals.

This paper draws from the model of marginal benefits and costs used by Copiello and Donati (2021) which itself builds on Marshall’s marginal utility theory and was previously used in the analysis of energy efficiency by Jakob (2006). Recently, Groh et al. (2022) have also employed this model to analyse renovation viability in the German rental market. Marginal Benefit (MB) is the benefit increase resulting from one additional unit of activity, conversely, Marginal Cost (MC) is the rise in cost derived from one unit of activity. These are calculated as per Eqs. (3) and (4) where TB is the total benefit, that is the increase in value resulting from energy efficiency improvements, TC is total costs, the costs of energy efficiency improvements and ∆EPI is the change in the Energy Performance Index (EPI) a measure of kWh/m2/year which in our case is derived from an EPC average.

As opposed to the use of NPV calculations highly dependent on discount rates (Copiello & Donati, 2021), the use of marginal costs and benefits allows to analyse the financial viability of renovation drawing from parameters already present in the data. As introduced above, hedonic pricing regressions have been the traditional tool for the estimation of property premiums, that is the marginal benefit side of the model. Drawing from the economic literature presented in the review section, this paper implements an IV approach to identify property premiums. An instrumental variable serves to determine accurate estimates through the elimination of endogeneity biases (Angrist & Pischke, 2009). In this case, endogeneity in the EPC coefficient is likely the result of reverse causality and simultaneity bias between EPC and the target variable, price per square meter. Aydin et al. (2020) argue that unobserved determinants of home prices influence the EPI coefficient. Also, multicollinearity between the year of construction and EPI may increase the bias when controlling for the construction year. Finally, Aydin et al. (2020) contend that measurement error is another source of bias, which in this case could be reinforced through the use of EPC certificates and EPI averages.

According to Angrist and Pischke (2009), the use of IV in two-stage least squares equations (2SLS) relies on finding a variable that is correlated with the endogenous regressor of interest and is independent of the measurement error. This paper draws from Aydin’s et al. (2020) approach in the use of age of construction as an IV to ascertain renovation premiums. While Aydin exploits the discontinuity between dwellings built before and after 1974, as presented in the economic literature section, we use age of construction in a continuous form through year of construction groupings. EPCs are strongly correlated with age of construction as older stock tends to be less energy efficient, fulfilling the relevance condition (see Fig. 1). As the proportion of dwellings with higher energy efficiency increases with age of construction, this allows identifying the impact of a higher EPC on house value. The identification premise is that holding prices, resident incomes, neighbourhoods, and regions constant, a higher EPC value than expected by age of construction shows the impact of higher energy efficiency on house value. In this vein, the first and second stages regressions can be formulated as Eqs. (7) and (8).

The WoON dataset is used for the estimation of property premiums (BZK et al., 2022). WoON is a large household-level dataset obtained through the periodical survey of Dutch households complemented with registry data. Its 2021 iteration included 40.000 respondents. About half of the responses included Energy Performance Certificates (EPC) and were used for the estimation of property premiums (see Table 3 for descriptive statistics). Checks conducted on the representativeness of the sample on income, property value and EPC distribution can be found in Appendix 1. Data on costs were obtained from the End User Costs Dashboard, a dataset developed by Nederlandse Organisatie voor Toegepast-Natuurwetenschappelijk Onderzoek (TNO) and Planbureau voor de Leefomgeving (PBL). The two cost scenarios used, renovation to EPC B and D rating respectively are described in Appendix 2. These costs are proposed as benchmarks for transitional plans at the municipal level and therefore offer a limited level of granularity at the level of the building typology and EPC certificate. Both of these scenarios are built around heat transition, this is a particularly pressing issue in the Netherlands since an overwhelming majority of dwellings are heated with natural gas. Heat transition poses a financial challenge since it nay entail higher costs than natural gas (Rooijers & Kruit, 2018).

Finally, the changes in user costs result from renovation costs and increases in value determined in the model above. The user costs of capital calculations as per Eqs. (9) and (10) reflect the variations in user costs under two policy scenarios. We define these scenarios following the literature presented in the policy background section. The first includes the current taxation benchmark and the ISDE subsidy, the second one incorporates a green dimension in the imputed rent taxation. The parameters are the same as those included in Eq. (2) except for ρ Vt which here reflects the green property premium resulting from the renovation and Tax, which includes the fiscal impact.

As the literature section on housing affordability has shown, the microsimulation of user costs is commonly used to disentangle the effects of taxation on households (Fatica & Prammer, 2018). In this case, user costs of capital are a relevant tool since they elucidate the double reward of subsidising renovation for homeowners resulting from a direct cash transfer and asset appreciation through green premiums. These two scenarios diverge over the accounting for the financial incentive of renovation. On the one hand, the grant is a direct transfer and it is included in the user costs. In the green tax scenario, the renovation incentive takes the form of the Net Present Value (NPV) of tax saved over 15 years with a conventional discount rate of 0.06, similar to the one used by Bonifaci and Copiello (2018). Arguably, the NPV of a tax cash flow is less volatile than that of energy savings and more amenable to discounting. This incentive is included in the simulations of renovation financial viability in the next section. However, it is excluded from the user costs formula since this draws from accrual accounting implementing an asset approach to owner-occupied housing and does not incorporate directly investment decisions.

4 Results

4.1 Green premiums: analysis and limitations

Table 4 shows the regression outcomes for the IV, OLS and the first stage IV. The use of building age as an instrument holds since the f statistic of the first stage is larger than 10. Also, the Wu-Hausman and Wald test for weak variables are significant rejecting the weak variable hypothesis, see Appendix 3 for details. The EPC change estimate doubles its magnitude in the IV regression pointing to the underestimation of this coefficient by OLS. Note that the results are log-level and should be interpreted as logY t = + X βt + µt: Here a unit change inXt; ∆X t = 1; causes a 100 β% change inY t. Following Angrist and Kolesar (2021), this paper uses a just-identified approach and interprets the result of the estimators as unbiased. The resulting 3.7% of property value uplift per EPC improvement is in line with those present in the literature which show premiums between 2.2 and 6% per EPC depending on the country and dataset. One of the main limitations of this approach is that it assumes linearity which may result in the underestimation of the EPC effects in tail cases.

A second limitation of these estimates results from certain features of the WoON dataset. WoOn consists of a cross-sectional dataset which is not amenable to some hedonic pricing analysis drawing from repeated sales data. A final limitation derives from the static estimation of a single parameter relating to property valuation and EPCs. The rise in property value is a mixture of substitution and income effects, from energy savings capitalized in the value of the dwelling. The shift toward a more energy-efficient built environment is also likely to lead to supply and demand shifts that affect equilibrium prices not captured by an IV analysis of this type. While Copiello and Donatti’s (2021) model is static, changes in property valuation resulting from subsidisation are likely to affect value through second and third-order effects which are treated more in-depth in the discussion section (Fig. 2).

Pecuniary difference between tax neutral benchmark and current imputed tax, as per Table 2, across income deciles

4.2 Distributional impact and financial viability of housing renovation

4.2.1 What are the distributional impacts of current and green imputed rent taxation compared to a tax-neutral benchmark?

This section tackles first the distributional impact in the fiscal burden under the three different taxation benchmarks presented in Table 2: Current Tax, Box 3: Tax Neutrality and Green Tax. Second, we focus on the viability of renovation in two scenarios: subsidy and green tax. Finally, we present the distributional impact of user costs and other indicators in those cases where the renovation is financially viable.

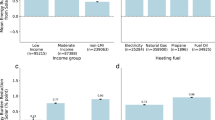

The comparison between current imputed rent taxation and a tax-neutral benchmark shows how the current fiscal policy favours the three highest deciles, see Fig. 3. This is a result of the unequal distribution of owner-occupied housing which is concentrated in the highest income deciles making the under-taxation of owner-occupied housing regressive. The tax-neutral benchmark, taxation of income from housing as that of any other financial asset, would increase the average contribution of those on the highest income decile by €1250 a year. In the highest quartile it could result in increases above €2500. On the contrary, the first deciles have an average change of 0 since renting is more common among these groups. As shown in Figs. 3 and 4, the impact of introducing a green dimension in housing taxation would fall also on the highest five income deciles. However, green taxation would only produce small redistributive effects over the current fiscal policy. A minority in these middle to high-income groups would see its tax fall marginally, while a majority would see small increases up to €500 per year. While green taxation does not have the redistributive reach of tax neutrality, its average impact over the first income deciles remains €0 due to the unequal distribution of owner-occupied housing. As a result, the limited increases in housing costs would only take place in the highest-earning half of the population.

Pecuniary difference between tax neutral benchmark and green tax, as per Table 2, across income deciles

Pecuniary difference between current tax and green tax, as per Table 2, across income deciles

4.2.2 How do subsidies and green taxation affect the financial viability of housing renovation?

Figure 5 schematically represents Copiello and Donati’s (2021) model of marginal benefits and marginal costs. This graph uses the data presented above on costs and premiums drawing from the simulated renovation of units included in the WoON dataset. The introduction of subsidies reduces the marginal costs and increases renovation viability; however, these also carry a certain deadweight loss. A green tax incentivises the financial viability of renovation by increasing the marginal benefits through the reduction of future tax obligations. In this scenario, the equilibrium point for renovation is where the MB line intersects with the “MC with subsidy” line. Conversely, it is the intersection of “MB with the green tax” and the Marginal Cost that points to the equilibrium in the green tax scenario. The green tax scenario is marginally higher which points to the renovation taking place also at higher property values in the Green Tax scenario.

As previous studies have showed (Copiello & Donati, 2021), the higher improvements in energy performance have the lower marginal costs. The density plots in Fig. 6 (subsidy) and 7 (green tax) indicate that upgrading from EPC C to B, which would reduce the EPI by 40 on average, is often not feasible because the costs outweigh the benefits. However, for more extensive renovations with larger EPI reductions, marginal benefits are likely to exceed marginal costs. For instance, when renovating from E to B, the EPI is reduced by 240 and the benefits of renovation surpass the costs.

A comparison between the green tax and subsidy scenarios based on the reduction in EPI is shown in Figs. 6 and 7. They reveal the similar effects of these policies on the viability of renovation from two angles: costs for subsidies and benefits for taxes. The overall changes in renovation viability are displayed in Figs. 8 and 9, which also indicate minor differences between the two scenarios. However, Fig. 9, which shows the renovation to D, suggests that green taxation has a smaller impact on renovation viability than subsidisation. This is because green taxation depends on energy performance rather than renovation costs. As explained in Table 2, green taxation aims to promote deep renovation to a high energy efficiency standard. Therefore, the post-renovation tax rebates are proportional to the EPC improvements, which lowers the feasibility of small-scale renovations.

4.2.3 What are the distributional impacts of subsidy and green taxation scenarios on housing costs?

The effect of financially viable renovations on user costs is shown in Table 5 and 6 for the two scenarios. Table 5 shows the user cost reduction for renovations to EPC-B with a subsidy. The reduction is higher for the lowest and highest income groups, and lower for the middle-income groups. This creates a U-shaped pattern. However, the total amount of subsidy is not distributed equally. It increases with income, which means that most of the subsidy goes to the well-off homeowners, while only a few low-income homeowners benefit from lower user costs. In the green tax scenario, the reduction in user costs exhibits a more pronounced U pattern, with higher reductions among lower-income deciles than those in deciles 8 and 9. However, the cumulative Net Present Value (NPV) of renovation in the green tax scenario progressively increases the viability of investment among higher-income segments through tax savings. Consequently, the higher NPV rates together with the lower user cost reductions point to the untapped potential of green taxes to increase renovation rates without reinforcing the under-taxation of owner-occupied housing, shown in Figs. 2 and 3.

Figure 9 shows that the viability of renovations to EPC-D is lower in the green tax scenario compared to the subsidy scenario. Despite this overall difference in viability, Table 6, like Table 5, presents a similar U-shaped pattern in user cost reductions for both subsidy and green tax scenarios, with cumulative subsidies and NPV amounts growing with income. While green taxation seems to be more effective in increasing the viability of larger renovations, both simulations underscore the redistributive capacity of green taxation. Green taxation incentivises renovation by enhancing its benefits instead of subsidizing its costs, thereby mitigating the regressive distributional effects of current fiscal policy.

5 Discussion and policy implications

This paper contends that housing renovation policies ought to be conceptualised within housing subsidisation and taxation frameworks to grasp more comprehensively their distributional consequences on affordability and housing costs. Our analysis hinges on two points, first the estimation of energy efficiency premiums and, second, the calculation of user costs to assess the distributional impacts of housing renovation. This paper has followed Copiello and Donati (2021) in its departure from the usual DCF model used to assess renovation viability. Research based on the DCF model usually focuses on energy consumption patterns and assesses the viability of renovation based on energy savings. Using an asset approach allows to circumvent the discounting of energy savings therefore reducing arbitrariness in the election of a discount rate.

Our results show that renovation policies based on subsidisation reinforce the homeownership bias present in the current Dutch fiscal policy. The key policy takeaway is that green taxation offers possibilities to increase the financial viability of renovation and mitigate regressiveness in housing taxation. This is accomplished by mobilising untaxed housing income towards renovation. Conversely, the regressiveness of housing renovation subsidies is a result of home ownership being concentrated among taxpayers with higher incomes. As shown in the prior section, incentivising renovation through a green tax is overall more redistributive than through subsidies. This is in line with the proposals of Muellbauer (2018) and Davis et al. (2017). However, compared with a fully tax-neutral benchmark a green tax has a more moderate distributive effect (Haffner & Heylen). Ultimately, imposing the same treatment to imputed rental income and other forms of income from wealth, thus eliminating homeownership bias, would require a much deeper rearrangement of the fiscal burden than the introduction of an energy efficiency element in imputed rent taxation.

The findings of this study also resonate with a recent OECD report which has highlighted the need to account for heterogenous taxpayers according to tenure (Millar-Powell, 2022). Renovation subsidies are targeted more strongly towards homeowners than renters. This could lead to regressive outcomes in countries where property ownership is concentrated among higher-income households. However, renovation viability has impact on both households’ balance sheets and cash flows. While tax increases incentivise renovation, they do not reduce up-front costs. However, the existing subsidized loans already enable the elimination of upfront housing costs. Thus, green-imputed rent appears as a complement to subsidized renovation loans incentivising reticent households. For instance, in France, zero-interest renovation loans boosted renovation rates in the first two years of their introduction, especially for low-income homeowners. However, the demand for these loans declined over time (Eryzhenskiy et al., 2022) highlighting the need for further stimuli. On a similar note, tax increases could pose affordability challenges for lower-income homeowners, the asset-rich income-poor. Although, as stated in the introduction, low-income homeowners in the Netherlands are unlikely to live in unaffordable housing, deferring the payment of imputed rent tax until the property is sold or inherited would ease this burden.

Taxing income from housing through imputed rent according to its underlying energy efficiency is also complementary to a transition based on increasing energy costs through carbon taxation. There are multiple forms of carbon taxation (Rosenow et al., 2023) and the multiple effects these produce are beyond the scope of this paper. However, when it comes to the Netherlands, the carbon tax embedded in energy prices has been identified as one of the leading causes of regressiveness in the Dutch fiscal system (Maier & Ricci, 2022). The introduction of green imputed rent taxation focusing on energy-consuming assets instead of on energy consumption has the potential to revert these regressive distributional impacts. Groh et al. (2022) argue that, in the German case, splitting a C02 tax between landlord and tenant may prove too low to overcome split incentives preventing landlords from renovating their properties. Ultimately, the introduction of taxation on landlords and imputed rent on homeowners shares a similar objective: by taxing revenue from a polluting asset, it incentivises its renovation.

One of the key limitations of this research stems from a simulation constrained to first-order effects. Although this type of simulation offers insights into the distributional capacity of taxation and subsidisation policies, these simulations do not account for long-term effects which are affected by portfolio adjustment decisions. For example, in the US, Poterba and Sinai (2011) have shown how the revenue raised through the phasing out of mortgage interest deductions is highly contingent on portfolio decisions resulting from behavioural adjustments. A green tax is likely to have ripple effects diverting capital from real estate into other sectors. While this could accentuate green premiums, disinvestment into real estate could affect overall valuations ultimately having an impact on renovation viability. A structural equation model would serve to disentangle these effects. A more complex model of housing, following the likes of Skinner (1996) and Berkovec and Fullerton (1992), can help elucidate second-order dynamics related to affordability and consumption. A similar issue is highlighted by Figari et al. (2019), while the taxation of imputed rents increases homeownership costs, this inequality-reducing effect may be lower after portfolio and market adjustments. While in silico simulations allow for the comparison of ideal models, it is key to contextualise these findings within the literature on ex-post policy evaluation. In this regard, Neveu and Sherlock (2016) point out that tax credits for residential energy efficiency are inequitable in the US context since lower incomes or those already benefitting from deductions receive a lower benefit than those with a higher tax liability. This paper points again to the regressive effects of tax cuts and subsidies resulting from the uneven distribution of homeownership.

Another limitation in our approach is the absence of explicit decision-making processes in renovation choices. While we show that the theoretical financial viability of renovation changes little under the green tax scenario with respect to the subsidy one, decision-making processes are much more complex. It is beyond the scope of this paper to assess the behavioural reactions to these policies. However, reactions to taxation and subsidisation have been studied from an array of perspectives (Chetty et al., 2009). When it comes to housing renovation, the discounting approach coupled with behavioural theory has been most widely used to shed light on individual households’ decision-making processes (Ebrahimigharehbaghi et al., 2022). The findings presented in this paper aim to complement the analysis of individual decision-making by interrogating the overall distribution of housing user costs.

Together with the limitations in its behavioural dimension, this paper is also constrained by the limited granularity in cost data and fabric interventions. Consequently, user behaviour and actual energy consumption after renovation are beside the issues of housing appreciation and distribution explored in this paper. McCoy and Kotsch (2021) have shown that building conditions are likely to impact the redistributive effects of housing renovation. As shown by Brom et al. (2019), user characteristics after renovation are also an issue when it comes to energy savings. Moreover, energy efficiency improvements are not necessarily correlated with energy savings following the rebound and prebound effects identified for example by Sunikka-Blank and Galvin (2012). These effects could result in asset appreciation also being joined by increases in costs for future occupants. The decoupling of energy savings from property appreciation could impinge further on affordability, particularly in the case of renters.

Ultimately, this paper has aimed to problematise a model of housing renovation based on state-led asset appreciation through subsidisation and under-taxation. Under this model, it is asset owners, those with the higher incomes in the Dutch case, who stand to reap the main benefits of renovation while only covering a proportion of the costs. Green imputed rent, a similar model to that of Muellbauer (2018), offers a redistributive counterpoint further elucidated by assessing housing affordability through the reductions in user costs. However, this paper has estimated one key parameter and its results rely on simulations limited to first-order effects on viability and affordability. A more comprehensive analysis should interrogate renovation focusing further on welfare distributional analysis to assess the different policy options more comprehensively.

6 Conclusion and recommendations

In conclusion, this study underscores the pressing need for adjustments in housing taxation and renovation policies to address the unequal distribution of housing costs in the Netherlands. Arguably, by focusing on energy efficiency gains, policymakers have remained oblivious to economic inequalities. As presented in the introduction, among OECD countries, Dutch renters spend on average the second highest proportion of their income on housing. Conversely, Dutch homeowners are the least likely to face affordability issues. Furthermore, the regressive outcomes of a carbon tax on energy and the under-taxation of home ownership impinge on the unequal distribution of housing costs. In this context, renovation policies carry the risk of further increasing the divide between homeowners and renters.

This paper’s main takeaway is that green imputed rent taxation can make homeownership fiscality less regressive while concurrently incentivising renovation. Green imputed rent operates at the intersection of energy taxation and the progressive treatment of housing as a financial asset generating revenue. EPC-weighted imputed rent produces incentives for energy-efficient renovations by increasing their marginal benefits. Conversely, renovation subsidies increase renovation viability through cost reductions. These grants ultimately capitalise on property prices which further subsidise reductions in the user costs of owner-occupation, arguably one of the main drivers of housing affordability.

The introduction of green imputed rent taxation would marginally reduce the distortion of housing taxation from the tax-neutral benchmark, while enhancing the financial feasibility of renovations for homeowners. Rather than relying on additional state subsidization, homeowners would be incentivised to finance the improvement of their dwellings themselves. Although this might be desirable from a renovation finance and equity perspective, it would impose a burden on the budgets of a large segment of homeowners. Hence, a key obstacle to the implementation of green asset taxation would be the social acceptability of homeowners’ contributions. From an academic perspective, the analysis of renovation subsidies within the broader framework of housing fiscal policies reveals the potential for aligning social redistribution and environmental objectives. The taxation of energy-consuming assets instead of energy consumption itself offers a greater redistributive potential for housing costs. Such a redistributive shift might be crucial to address the disparities between homeowners and renters who are excluded from the value appreciation resulting from a renovation.

At the European level, tenure composition varies widely across countries, a factor that is likely to influence the effectiveness of carbon taxation and renovation subsidies. For example, the distributional impact of different renovation subsidies is likely to be very different in Southern and Eastern European countries where low-income homeownership is more common than in the Netherlands. Comparative approaches are instrumental in interrogating the potential of renovation policies and formulating tailored approaches to each national context. While cross-country datasets like EU-SILC and tools such as EUROMOD allow for the microsimulation of housing taxation, the lack of comparable data for renovation costs and housing quality hinders the comparative analysis of “green” forms of housing taxation. As the EU and member states discuss the introduction of Minimum Energy Performance Standards (MEPSs) in owner-occupied housing, more research is needed to interrogate the distributional outcomes of large-scale housing renovation. This requires a better understanding of second-order effects on property prices and portfolio decisions, as well as on consumption and welfare.

Finally, this paper has offered an initial investigation of the effects renovation policies can have on housing affordability. A contextualised approach is employed to account for the heterogeneity of households and tenures and to assess the costs and benefits of renovation for different groups. It is shown that renovation policies have differential impacts on housing affordability and may produce winners and losers in the decarbonisation process. Further research is needed to explore the distributional consequences of renovation policies and their interplay with other housing policies.

References

Allers, M. (2020). Belasting op grond is efficiënt, rechtvaardig én uitvoerbaar. ESB 105(4783). https://esb.nu/wp-content/uploads/2022/11/U1ZVsgdjZ8ird2W1IgAHqipoSg8.pdf

Angrist, J., & Kolesar, M. (2021). One instrument to rule them all. NBER Working Paper 29417, 26.

Angrist, J. D., & Pischke, J.-S. (2009). Mostly harmless econometrics: An empiricist’s companion. Princeton University Press.

Arundel, R., & Lennartz, C. (2019). Housing market dualization: Linking insider-outsider divides in employment and housing outcomes. Housing Studies, 35(8), 1390–1414. https://doi.org/10.1080/02673037.2019.1667960

Ayala, A. D., Galarraga, I., & Spadaro, J. V. (2016). The price of energy efficiency in the Spanish housing market. Energy Policy, 94, 16–24. https://doi.org/10.1016/j.enpol.2016.03.032

Aydin, E., Brounen, D., & Kok, N. (2020). The capitalization of energy efficiency: Evidence from the housing market. Journal of Urban Economics, 117, 103243. https://doi.org/10.1016/j.jue.2020.103243

Backe, S., Pinel, D., Askeland, M., Lindberg, K. B., Korpås, M., & Tomasgard, A. (2023). Exploring the link between the EU emissions trading system and net-zero emission neighbourhoods. Energy and Buildings, 281, 112731. https://doi.org/10.1016/j.enbuild.2022.112731

Berkovec, J., & Fullerton, D. (1992). A general equilibrium model of housing, taxes, and portfolio choice. Journal of Political Economy, 100(2), 390–429.

Bertoldi, P., Economidou, M., Palermo, V., Boza-Kiss, B., & Todeschi, V. (2021). How to finance energy renovation of residential buildings: Review of current and emerging financing instruments in the EU. Wires Energy and Environment, 10(1), e384. https://doi.org/10.1002/wene.384

Bonifaci, P., & Copiello, S. (2018). Incentive policies for residential buildings energy retrofit: An analysis of tax rebate programs in Italy. In A. Bisello, D. Vettorato, P. Laconte, & S. Costa (Eds.), Smart and sustainable planning for cities and regions (pp. 267–279). Springer International Publishing.

Bourguignon, F., & Spadaro, A. (2006). Microsimulation as a tool for evaluating redistribution policies. The Journal of Economic Inequality, 4(1), 77–106. https://doi.org/10.1007/s10888-005-9012-6

Brounen, D., & Kok, N. (2011). On the economics of energy labels in the housing market. Journal of Environmental Economics and Management, 62(2), 166–179. https://doi.org/10.1016/j.jeem.2010.11.006

Castellazzi, L., Zangheri, P., Paci, D., Economidou, M., Labanca, N., Ribeiro, S., Panev, V., Zancanella, P., & Broc, J. S. (2019). Assessment of second long-term renovation strategies under the Energy Efficiency Directive. Joint Research Centre. https://doi.org/10.2760/973672

Central Bureau voor Statistiek (2022). Dutch house price increase among EU top four. Retrieved Nov 2023 https://www.cbs.nl/en-gb/news/2022/28/dutch-house-price-increase-among-eu-top-four

Cerin, P., Hassel, L. G., & Semenova, N. (2014). Energy performance and housing prices. Sustainable Development, 22(6), 404–419. https://doi.org/10.1002/sd.1566

Cheshire, P., & Sheppard, S. (1998). Estimating the demand for housing, land and neighbourhood characteristics. Oxford Bulleting of Economics and Statistics, 60(3), 357–382.

Chetty, R., Looney, A., & Kroft, K. (2009). Salience and taxation: Theory and evidence. American Economic Review, 99(4), 1145–1177. https://doi.org/10.1257/aer.99.4.1145

Clark, T., & Leicester, A. (2005). Inequality and two decades of British tax and benefit reforms. Fiscal Studies, 25(2), 129–158. https://doi.org/10.1111/j.1475-5890.2004.tb00100.x

Copiello, S., & Donati, E. (2021). Is investing in energy efficiency worth it? Evidence for substantial price premiums but limited profitability in the housing sector. Energy and Buildings, 251, 111371. https://doi.org/10.1016/j.enbuild.2021.111371

Davis, P., McCord, M. J., McCluskey, W., Montgomery, E., Haran, M., & McCord, J. (2017). Is energy performance too taxing?: A CAMA approach to modeling residential energy in housing in Northern Ireland. Journal of European Real Estate Research, 10(2), 124–148. https://doi.org/10.1108/JERER-06-2016-0023

Ebrahimigharehbaghi, S., Qian, Q. K., de Vries, G., & Visscher, H. J. (2022). Application of cumulative prospect theory in understanding energy retrofit decision: A study of homeowners in the Netherlands. Energy and Buildings, 261, 111958. https://doi.org/10.1016/j.enbuild.2022.111958

Economidou, M., Todeschi, V., Bertoldi, P., D’Agostino, D., Zangheri, P., & Castellazzi, L. (2020). Review of 50 years of EU energy efficiency policies for buildings. Energy and Buildings, 225, 110322. https://doi.org/10.1016/j.enbuild.2020.110322

Ernould, E. (2022). Revision of the energy performance of buildings directive (EU Legislation in Progress). European Parliament.

Eryzhenskiy, I., Giraudet, L.-G., Segú, M., Dastgerdi, M. (2022). Zero-interest green loans and home energy retrofits: Evidence from France. https://cnrs.hal.science/hal-03585110/

Fatica, S., & Prammer, D. (2018). Housing and the tax system: How large are the distortions in the euro area? Fiscal Studies, 39(2), 299–342. https://doi.org/10.1111/1475-5890.12159

Figari, F., Hollan, K., Matsaganis, M., Zolyomi, E. (2019). Recent changes in housing policies and their distributional impact across Europe (No. EM12/19). EUROMOD Working Paper.

Fuerst, F., McAllister, P., Nanda, A., & Wyatt, P. (2015). Does energy efficiency matter to home-buyers? An investigation of EPC ratings and transaction prices in England. Energy Economics, 48, 145–156. https://doi.org/10.1016/j.eneco.2014.12.012

Groh, A., Kuhlwein, H., & Bienert, S. (2022). Does retrofitting pay off? An analysis of german multifamily building data. Journal of Sustainable Real Estate, 14(1), 95–112. https://doi.org/10.1080/19498276.2022.2135188

Haffner, M. (2003). Tenure neutrality, a financial-economic interpretation. Housing Theory and Society, 20, 72–85. https://doi.org/10.1080/14036090310001903

Haffner, M., & Heylen, K. (2011). User costs and housing expenses. Towards a more comprehensive approach to affordability. Housing Studies, 26(4), 593–614. https://doi.org/10.1080/02673037.2011.559754

Haffner, M. E. A., & Oxley, M. J. (1999). Housing subsidies: Definitions and comparisons. Housing Studies, 14(2), 145–162. https://doi.org/10.1080/02673039982894

Haffner, M., & Winters, S. (2016). Homeownership taxation in Flanders: Moving towards ‘optimal taxation’? International Journal of Housing Policy, 16(4), 473–490. https://doi.org/10.1080/14616718.2015.1085214

Havlinova, J., van Voss, B. H., Zhang, L., van der Molen, R., & Caloia, F. (2022). Financiering voor de verduurzaming van de woningvo. De Nederslandsche Bank.

Heylen, K. (2013). The distributional impact of housing subsidies in Flanders. International Journal of Housing Policy, 13(1), 45–65. https://doi.org/10.1080/14616718.2013.764660

Howard, C. (1997). The hidden welfare state: Tax expenditures and social policy in the United States. Princeton University Press.

Jakob, M. (2006). Marginal costs and co-benefits of energy efficiency investments. The case of the Swiss residential sector. Fuel and Energy Abstracts, 47(3), 193–194. https://doi.org/10.1016/S0140-6701(06)81299-3

Kholodilin, K. A., Kohl, S., Korzhenevych, A., & Pfeiffer, L. (2022). The hidden homeownership welfare state: An international long-term perspective on the tax treatment of homeowners. Journal of Public Policy, 1–29. https://doi.org/10.1017/S0143814X2200023X

Kemeny, J. (1981). The myth of home ownership: Private versus public choices in housing tenure. Routledge.

Leodolter, A., Princen, S., & Rutkowski, A. (2022). Immovable property taxation for sustainable & inclusive growth. European Commission Directorate-General for Economic and Financial Affairs. https://doi.org/10.2765/431531

Maier, S., & Ricci, M. (2022). The Redistributive Impact of Consumption Taxation in the EU: Lessons from the post-financial crisis decade (No. 10; JRC Working Papers on Taxation and Structural Reforms).

McCoy, D., & Kotsch, R. A. (2021). Quantifying the distributional impact of energy efficiency measures. The Energy Journal, 42(01). https://doi.org/10.5547/01956574.42.6.dmcc

Millar-Powell. (2022). Measuring Effective Taxation of Housing: Building the foundations for policy reform (OECD Taxation Working Papers No. 56; OECD Taxation Working Papers, Vol. 56). https://doi.org/10.1787/0a7e36f2-en

Ministerie van Binnenlandse Zaken en Koninkrijksrelaties—BZK, (Ministry of Interior), & Centraal Bureau voor de Statistiek—CBS. (2022). Thematische collectie: Onderzoeken naar de woningmarkt (WoON en WBO). https://doi.org/10.17026/dans-27e-r9y3

Ministry of Economic Affairs, Policy and Climate (2019). Integrated National Energy and Climate Plan.

Mirrlees, J. A., & Adam, S. (2011). Tax by design: The Mirrlees review. Oxford University Press.

Muellbauer, J. (2018). Housing, debt and the economy: A tale of two countries. National Institute Economic Review, 245, R20–R33. https://doi.org/10.1177/002795011824500112

Neveu, A. R., & Sherlock, M. F. (2016). An evaluation of tax credits for residential energy efficiency. Eastern Economic Journal, 42(1), 63–79. https://doi.org/10.1057/eej.2014.35

OECD Directorate of Employment, Labour and Social Affairs - Social Policy Division. (2022). Affordable Housing Database. HC1–2-Housing-costs-over-income.pdf. https://www.oecd.org/els/family/HC1-2-Housing-costs-over-income.pdf

Poterba, J. M. (1984). Tax subsidies to owner-occupied housing: An asset-market approach. The Quarterly Journal of Economics, 99(4), 729–752.

Poterba, J. M., & Sinai, T. (2011). Revenue costs and incentive effects of the mortgage intrest deduction for owner-occupied housing. National Tax Journal, 64(2), 531–564.

Rooijers, F., & Kruit, K. (2018). Incentives voor de warmtetransitie Hoe wordt klimaatneutraal verwarmen voor de energiegebruiker een reële optie? CE Delft.

Rosen, S. (1974). Hedonic prices and implicit markets: Product differentiation in pure competition. Journal of Political Economy, 82(1), 34–55.

Rosenow, J., Thomas, S., Gibb, D., Baetens, R., De Brouwer, A., & Cornillie, J. (2023). Clean heating: Reforming taxes and levies on heating fuels in Europe. Energy Policy, 173, 113367. https://doi.org/10.1016/j.enpol.2022.113367

Skinner, J. (1996). The dynamic efficiency cost of not taxing housing. Journal of Public Economics, 59, 397–417.

Sunikka-Blank, M., & Galvin, R. (2012). Introducing the prebound effect: The gap between performance and actual energy consumption. Building Research and Information, 40(3), 260–273. https://doi.org/10.1080/09613218.2012.690952

van den Brom, P., Meijer, A., & Visscher, H. (2019). Actual energy saving effects of thermal renovations in dwellings—Longitudinal data analysis including building and occupant characteristics. Energy and Buildings, 182, 251–263. https://doi.org/10.1016/j.enbuild.2018.10.025

Wilhelmsson, M. (2019). Energy performance certificates and its capitalization in housing values in Sweden. Sustainability (Switzerland). https://doi.org/10.3390/su11216101

Witte, A. D., Sumka, H. J., & Erekson, H. (1979). An estimate of a structural hedonic price model of the housing market: An application of rosen’s theory of implicit markets. Econometrica, 47(5), 1151. https://doi.org/10.2307/1911956

Acknowledgements

This project has received funding from the European Union's Horizon 2020 research and innovation programme under the Marie Skfodowska-Curie grant agreement No 956082

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

1.1 WoON dataset

See Fig.

10.

Appendix 2

2.1 Costs dataset

Source: TNOPBL, (2021) Dashboard Eindgebruikerskosten, https://www.expertisecentrumwarmte.nl/eindgebruikerskosten/default.aspx [Accessed November 2023] (Table

7).

Appendix 3

3.1 Regression tests and graphs

See Figs.

11,

12,

13 and Table

8.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Fernández, A., Haffner, M. & Elsinga, M. Subsidies or green taxes? Evaluating the distributional effects of housing renovation policies among Dutch households. J Hous and the Built Environ (2024). https://doi.org/10.1007/s10901-024-10118-5

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10901-024-10118-5