Abstract

The term ‘affordable housing’ has been rapidly gaining currency over the last decade across Europe, both in policy and research circles. While it is often used as a synonym or close relative of the term ‘social housing’, more recently it is finding its own definition and policy instruments in specific cities and countries. However, boundaries between both concepts remain unclear. To shed light on recent developments of each of these terms, this paper presents findings from a study commissioned by the European Investment Bank, which investigated current trends in definitions, programmes and policies both in social housing and affordable housing. This paper focuses on findings for England, Italy, Poland and The Netherlands. Methods used included desk research and interviews with key informants in each of the four countries. In addition, in-depth information about Italy and The Netherlands was gathered through stakeholder workshops carried out between September and November 2016. Findings show that affordable housing in all four countries is becoming a more distinct field, in parallel to developments in social housing. In addition, the paper describes some innovative policies undertaken to develop affordable housing solutions. The paper concludes with a reflection on scenarios for future policy developments and an agenda for further research.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The social housing sector has been undergoing comprehensive changes in many European countries for a number of years (Scanlon et al. 2014; Houard 2011). There is a steady reduction of public sector funding for social housing, with significantly decreasing levels of social housing capital grants in countries where these are used as support mechanisms. In addition, privatization policies have weakened the foundation of social renting with home ownership and private rental sectors policies being promoted as better options (Ronald 2013). At the same time, social housing has become more diversified to include social forms of home ownership and hybridized in terms of finance, construction and management (Czischke 2009; Mullins et al. 2012).

The availability of adequate affordable housing has become a key issue, impacting the lives of millions of European citizens. Housing costs is the single highest expenditure item for households, at about a quarter of total households’ budget in 2015 (EU SILCFootnote 1). In 2015, 11.3% of the EU-28 population lived in households that spent 40% or more of their equalised disposable income on housing. Low-income households face higher overburden rates: in 2015, 33% of the households that had an income below 60% of median faced housing cost overburden.Footnote 2

While social and affordable housing providers continue to offer rents significantly lower than the market, these providers are under increasing pressure to respond to growing demand. The number of households on waiting lists is increasing across Europe (Housing Europe 2017).

New models and institutions for the provision of ‘affordable housing’ have emerged over the past decades, partly as a result of the abovementioned changes in social rental provision and the widely acknowledged lack of adequate affordable housing. There is a growing interest amongst policy circles in affordable housing, visible not only in the number of media articles and policy documents issued at national level, but also in the recent inclusion of affordable housing by the European Union as a policy priority (EU Urban Agenda 2016). This is especially significant because the EU does not have an official mandate on housing, and the provision of affordable and social housing is primarily a concern of national and local policies (Czischke 2014). However, the ambition to use a supra-national definition of affordable housing is often at odds with the many national and local definitions used to describe rental housing market segments.

Research on affordable housing has mainly focussed on the description and causes of the increasing difficulties of different sections of the population to find suitable accommodation in the market. However, limited attention has been paid to what we are actually talking about when we talk about ‘affordable housing’. How can we understand and discuss this type of housing without a clear definition of what it is? How are different national and sub-national definitions of affordable housing related? This discussion is related to ‘affordability’ as an outcome indicator of housing policy. However, in this paper we will focus on affordable housing from an institutional perspective, exploring how this sector is represented in national housing policies and what actors are involved in the provision of this rental housing typology.

To help shed light on this knowledge gap, this paper presents findings from research on current trends in definitions, programmes and policies both in social housing and affordable housing. The study was commissioned by the European Investment Bank (EIB) and originally covered Italy, Poland, Portugal, Lithuania The Netherlands and the United Kingdom. The EIB study sought to provide an overview of social and affordable housing in the European Union, and to explore further potential for financing countries where the EIB is either already operating or where the Bank has not been active so far. This paper focuses on four out of these six countries, namely England, Italy, Poland and The Netherlands, where significant evidence of an emerging sector of ‘affordable housing’ (as distinct from ‘social’ housing) was found. The study adopted a working definition of ‘affordable housing’ as rental housing that is below-market rent and open to a broader range of household incomes than social housing. Taking this working definition as a starting point, this paper aims to shed light on the current definitions of affordable housing in the countries covered by this study, with a view to contribute to the elucidation of the meaning, measurement and policies of affordable housing in different contexts in Europe.

The study, as well as this paper, focuses on social and affordable rental housing, in line with the EIB’s remit to finance housing that is to remain available at affordable price in the long term (i.e. excluding any form of private capitalisation of public funds, e.g. through private home-ownership). It is worth noting, however, that in some countries (e.g. England and Poland) affordable housing also includes low cost homeownership, shared ownership or the option (sometimes the obligation) for the tenants to purchase the rental property.

The paper is structured in four sections: the first outlines the conceptual framework of our working definition on affordable housing; the second summarizes the main findings of the study for each of the four countries covered in this paper; the third section develops a discussion, focusing on similarities and differences between the countries. The fourth section concludes with a summary of main trends and questions for further research.

2 Conceptual framework

This section seeks to conceptually frame our working definition of housing affordability, drawing on a selection of definitions found in the literature. An extensive body of academic literature and policy reports covers the factors contributing to rapid increases in house prices and rents; the social and economic impact of a lack of affordable housing; the strategies and institutions needed to increase affordable housing supply, or support consumers, and the need to combine affordable housing with social and environmental sustainability (Ball 2015; Gilbert 2015; Habitat for Humanity 2015; Housing Europe 2015; Haffner et al. 2012; Salvi del Pero et al. 2016; Yates and Milligan 2012).

Oxley (2012) provides a general definition of affordable housing as accommodation allocated outside of market mechanisms according to need rather than ability to pay. Milligan and Gilmour (2012) define this ‘ability to pay’ as housing that is provided at a rent or purchase price that does not exceed a ‘designated standard’ of affordability. This standard of affordability is often defined as housing costs that should not exceed a fixed proportion of household income and/or should result in a household income that is sufficient to meet other basic living costs after allowing for these housing costs. There is a considerable body of research literature on the topic of housing affordability (see Haffner and Heylen 2011; Haffner and Boumeester 2014; Hancock 1993; Stone et al. 2011; Whitehead 1991).

The framework in Fig. 1 is generic and pragmatic in nature. In the case study countries discussed later in the paper we will clarify some tensions between this framework and local practices.

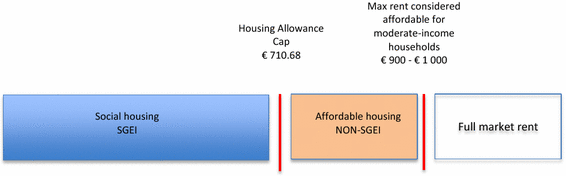

What does it take to make rental housing ‘social’ or ‘affordable’? To help operationalize this question, in Fig. 1 we illustrate the position of each of these tenures alongside a continuum ranging from ‘social rents’ on one extreme, and ‘free market rents’ on the other. The first segment represents social housing rent, which is based on costs or household income (depending on the specific country or city). This tenure type in most cases is delivered by government agencies and/or not-for-profit organisations (supply support), and made affordable by housing allowance systems (demand support), or both. Eligibility for social housing is often based on strict criteria concerning household needs/deprivation, income and other criteria such as age and household.

The second segment illustrates ‘affordable rent’, which is often derived from, but lower than, full-market rents. The target group for affordable housing includes a wide array of households; key workers such as nurses, teachers, emergency workers, but also early-career professionals (Urwin et al. 2016) and other groups that are not eligible for ‘social housing’ but are unable to acquire a home or pay full market rents. In comparison to social housing, eligibility for affordable housing is often less strictly regulated.

Affordable rent levels can be attained through several routes: for example, when investors accept a return on investment that is lower than would be possible based on local market conditions, but is still sufficient to cover the costs of capital. Market-actors seeking at profit maximisation could deliver below-market affordable housing, if compensated for the lower return on investment. This compensation can take several forms, such as financial grants, lower land prices or loan guarantees. It is worth noting that this illustrative framework aims to supplement, and not replace, the rich and varied landscape of national and local affordable housing definitions.

The tentative demarcation between rental sectors used in Fig. 1 does not exclude private sector rental housing with rent-levels similar to social or affordable housing. Compared to private sector rental housing, social housing (and often also affordable housing) is allocated based on income and/or housing needs (Oxley 2012), often offers higher value for money, uses higher quality standards and provides stronger tenant security (Lennartz 2014).

3 Methodology

The data was collected through a review of secondary sources covering journal articles, books, policy reports and statistical sources and interviews with key informants, including national experts and policy-makers. The interviews mainly focused on completing and validating information collected through the review of secondary data.

A second phase of the study included additional data collection through two half-day workshops with local and national stakeholders in The Netherlands and Italy, respectively. The workshops brought together the following types of participants:

-

Representatives from a range of national, regional and local stakeholders concerned with the potential use of EFSI in the provision of affordable housing in each country.

-

EIB financial and/or technical experts (e.g. EIB staff located in the regional offices Amsterdam, Warsaw and Rome).

-

Local researchers and/or experts.

Desktop research and interviews were conducted in advance to each workshop as part of preparatory work. In addition, follow-up phone and Skype interviews were held with some of these and other stakeholders in order to clarify issues, validate and/or deepen information from the workshops.

4 Findings

This section presents the main findings for each of the four countries covered in this paper. Findings are structured in four headings per country: first, a brief introduction on the general housing market at national level; second, a description of the social housing sector, and third, a description of the definition and main characteristics of the ‘affordable housing’ sector in each of the countries. In this section, we apply the illustrative scheme devised previously in our “conceptual framework” (Fig. 1). We conclude with a short section on recent developments.

4.1 England

4.1.1 General housing market

England’s housing market is characterised by a high proportion of owner-occupiers, a weakly regulated private rental sector and a dwindling stock of social rental housing. There is recognition of a chronic undersupply of affordable housing (Wilcox and Perry 2014), which is to be aggravated in the coming years due to demographic trends and changes in household composition.

Renting has become more common alongside the decreasing affordability of home-ownership in the UK. Households starting on the housing market are increasingly unable to buy a home, thus a new ‘generation rent’ has emerged (see for example PWC 2015; Pattison 2016). First time buyers have been hit by the combined effect of rising house prices and lenders withdrawing from higher Loan-to-Value mortgages. As a result, average deposits for first time buyers have increased almost five-fold since the late 1990s, from £10,000 to almost £50,000. The rise in average deposits far exceeds the growth in average earnings over this period (which have gone up by only around 50%). This creates a much greater hurdle for first time buyers to overcome and threatens to lock many low and middle-income households out of the housing market. The proportion of people living in private rented accommodation had doubled from around 10–20% overall since 2000, but for those in the 20–39 age bracket it has jumped from 20 to 50% (PWC 2015).

4.1.2 Social housing

Social housing in England is low cost housing allocated on the basis of need. It includes the provision of rental dwellings, affordable home ownership as well as shared ownership schemes. Social rental housing accounts for around 18% of the total homes in England (CECODHAS Housing Europe 2012). Social housing is owned and managed by local authorities (and sometimes managed by Arms Length Management companies) and by “registered social landlords” (RSLs). RSLs—most commonly known as housing associations—are not-for-profit housing providers approved and regulated by Government through the Homes and Communities Agency. Many also run shared ownership schemes to help people who cannot afford to buy their own homes outright.

Housing associations are the main delivery vehicle for social housing, currently managing 54% of social housing (Housing Europe 2012). This follows a long-term trend towards decline in council house building combined with a ‘right to buy’ policy targeting council tenants since the 1980s and the transfer of over one million council dwellings to housing associations between 1988 and 2009. Since the implementation of the 1977 Housing Act, all local authorities in England are obliged to provide housing to those in housing need, assuming they meet a certain number of objective criteria and match the target groups to be cared for with priority. Social housing is targeted to vulnerable groups within the population and priority is generally given by law to certain categories, including people who are homeless. Under the Localism Bill, which came into effect in 2012, local authorities in England have more discretion to formulate their own criteria to determine who may qualify for social housing in their areas. The measure builds on 2009 guidance encouraging councils to make use of local freedoms to prioritise applicants, with, for example, a local connection. Central government, however, retains the power to prescribe what types of people may or may not qualify for social housing where it deems such intervention necessary.

4.1.3 Affordable housing

In, 2011 the Department of Communities and Local Government (DCLG) and the Homes and Communities Agency (HCA)—the social housing funder and regulator—formulated the most recent definition of affordable housing in England. In the 2012 National Planning Policy Framework, DCLG’s states that affordable rented housing is

(…) let by local authorities or private registered providers of social housing to households who are eligible for social rented housing. Affordable Rent is subject to rent controls that require a rent of no more than 80 per cent of the local market rent (including service charges, where applicable).Footnote 3

In addition, the planning framework also identifies a much smaller ‘intermediate’ housing tenure, defined as

(…) homes for sale and rent provided at a cost above social rent, but below market levels subject to the criteria in the Affordable Housing definition above. These can include shared equity (shared ownership and equity loans), other low cost homes for sale and intermediate rent, but not affordable rented housing.Footnote 4

While affordable rents are based on local market rents, social housing rents are based on a formula set by Government. The formula calculates a rent for each property, which is based on the relative value of the property, relative local income levels, and the size of the property. An aim of this formula-based approach is to ensure that similar rents are paid for similar social rent properties (see Fig. 2). Over the 2013/2014 reporting period 19,740 affordable rental properties were added, and 10,920, social rental properties were delivered in the same period. In that same period only 790 intermediate rental properties were produced.Footnote 5

Affordable housing allocation is based on the same allocation rules as social housing. Eligibility rules for social housing also apply to affordable housing. Affordable housing is not restricted by the social housing Rent Regime, but should be no more than 80% of the local market rent. Rent caps used by local authorities and individual housing providers can apply.

Affordable housing is mainly delivered by housing associations; to a lesser extend by local authorities and private developers. It is funded by capital investment grants from HCA, based on competitive bidding procedures. On average the Housing and Communities (HCA) grant only covers 20% of the investment needed to produce an affordable rented property. Grants are supplemented by internal resources generated by housing sales, the conversion of social housing into affordable housing and by loans or bonds. The HCA provides capital investment grants through its Affordable Homes Programme 2015–2018. Private developers have reduced their involvement in the production of affordable housing after recovery of the housing market in recent years made developments in the private rented and ownership sectors more attractive.

4.1.4 Recent developments

We found that the supply of affordable rented housing is increasingly delivered by housing associations, not the commercial private sector. Furthermore, some commercial house builders have returned HCA grant funding for affordable homes following a boom in the private sales market. House builders have rejected almost half of the £60 m cash they were allocated for the 2011–2015 affordable homes programme. Often the development of the affordable housing was transferred to a housing association (Apps 2014). The supply of affordable housing is further threatened by the extension of the Right to buy to properties owned by housing associations. Restrictions on rent increases introduced in the Conservative Government’s 2015 Budget may damage the business case underpinning current affordable housing programmes, according to the National Housing Federation (NHF 2015).

Over the last years an alternative way of provision of affordable housing in the UK is the gradual development of a community-led housing sector. The term ‘community led housing’ is commonly used in the UK to describe homes that are developed and/or managed by local people or residents, in not for profit organisational structures. The HCA establishes that communities can collectively own, develop and/or manage their own land and developments through models such as co- operatives, mutuals, co-housing, self-build, Community Land Trusts, (CLTs) and the emerging Community-Right-to-Build, as well as self-build and custom-build approaches. Community-led groups have been able to access funding under the 2011–2015 Affordable Homes Programme (AHP) and the continuous engagement element of the Affordable Homes Guarantee Programme. Groups can also now apply for the new 2015–2018 Affordable Homes Programme. In order to be eligible, the Guidance (Homes and Communities Agency 2014) states that community-led bids may be best delivered by working within a Registered Provider led development partnership, which can also offer economies and more efficient procurement. In addition, funding for community-led affordable housing is available through the DCLG’s Community Empty Homes programme.

4.2 Italy

4.2.1 General housing market

An important characteristic of the Italian housing system is a high level of devolution of responsibilities for housing policies to the 23 Italian regions and involvement of provinces and municipalities in the provision of affordable housing. From the stakeholder workshop conducted by our study in Rome, it emerged that the main groups in need of affordable housing include starters (i.e. young people without a stable income), internal work migrants (e.g. freelancers and temporary workers), low-income families, and the elderly. The type of demand for elderly housing is also changing, and supply is being slow to respond. These groups are to be found in cities, both medium and large. There is internal geographical mobility from rural to urban areas, particularly from South to North of the country. Cities under pressure are not only large cities, but also smaller cities close-by to the larger cities, where people look for housing.

4.2.2 Social housing

Social rental housing currently represents about 4% of the national housing stock. There are three main types of publicly supported housing: subsidised housing (edilizia sovvenzionata), assisted housing (edilizia agevolata) and agreed housing (edilizia convenzionata).Footnote 6 Subsidised housing can be divided into public and social housing. The term ‘social housing’ in Italy is frequently used to refer to affordable housing, so as to distinguish it from public housing for low-income households. We will therefore discuss social housing in the affordable housing section.

Financing for public housing is provided by the Regions. Municipalities together with the Regions co-finance personal rental housing assistance, and allocate land to providers. The central government is responsible for macro programming and co-financing of projects through housing allowances, co-funding of urban renewal programmes and programmes to support social rental housing.

4.2.3 Affordable housing

Affordable housing (in Italy usually referred to as ‘social housing’) is allocated through different selection procedures regulated locally. This tenure is intended for households that can neither afford market prices nor are eligible to apply for a public dwelling. Rents are generally halfway between market rents and public dwellings rent. There are no exact figures available on the number of households living in social housing at national level (Bianchi 2015) (Fig. 3).

The maximum income level for affordable housing is determined by the local authority on a project-by-project basis.

Providers of affordable housing in Italy include foundations (for example Fondazione Housing Sociale, Milan); local, provincial and regional governments agencies; cooperatives; and private developers.

Funding for affordable housing takes the shape of shares in national and local housing investment funds. Funding institutions include the Cassa Depositi e Prestiti (CDPI); local project partnerships (public, private and not-for-profit actors. For example regional and local governments, banks, local cooperatives and non-for-profit organisations) and asset management companies.

4.2.4 Recent developments

In 2009 a National Housing Plan set the basis for new forms of public/private partnerships, through the creation of an integrated real estate fund consisting of a national fund and a network of local revolving funds dedicated primarily to financing social housing.Footnote 7 Based on the National Housing Plan the Italian state-related bank Cassa Depositi e Prestiti (CDPI) established a real estate investment fund, the FIA (Fondo Investimenti per l’Abitare). This fund is reserved for qualified investors only, and is intended to increase the supply of social housing with specific maximum rent and sale prices. The Bank of Italy approved the Management Rules of the FIA in 2010. The aim is to produce housing units at affordable prices, intended for families unable to meet their housing needs on the marketplace, but with incomes higher than those that would entitle them to public housing.

The fund’s size is around € 2 billion, of which € 1 billion subscribed by CDPI, € 140 million by the Ministry of Infrastructure and Transport and € 888 million by bank and insurance groups and private pension funds.Footnote 8 The duration of the fund is 35 years, plus possible extension for a maximum period of 3 years.

FIA invests its assets mainly in real estate investment fund shares operating at a local level and managed by other asset management companies through shareholding for a maximum limit of 80%. This limit is intended to stimulate the investment of resources by third parties external to the Fund, while allowing FIA to maintain a relevant presence in all initiatives. The envisaged return is approximately 3% excluding inflation, deriving from the lease of the properties and from value revaluation during the investment. On behalf of FIA, CDPI has committed € 1.5 billion in 27 local funds managed by 9 asset management companies. Support is provided to 220 projects across Italy for a total of 14.000 social housing units and 6.800 beds in temporary residential facilities and student halls.

4.3 Poland

4.3.1 General housing market

Poland is a country of homeowners (75%). However, in contrast to other Central and Eastern European Countries (CEE), Poland has a large cooperative housing sector (16%). The social housing sector is small (around 7%); most of this is public—municipal—housing. TBS (Towaryszystwa Budownictwa Spolecznego) are building associations that own less than 1% of the housing stock. The private rental sector is almost non-existent (0.8%) in Poland (Housing Europe 2015). Developers generally build housing units for sale, and are predominantly not inclined to develop housing for rent– partly because of the safeguards contained in the Tenants Protection Act (Panek 2015).

4.3.2 Social housing

There is no official definition of social rental housing Poland (UNECE 2014; p. 8). There are two segments in the Polish housing market that provide rental housing for below average incomes. The first segment can be regarded as social housingFootnote 9 and provides housing for households in the 1st and 2nd income deciles. Housing in this segment is provided by municipalities and government-supported homeless shelters. Funding is provided by the national government through the Funding Decree. The second segment, catering for households between the 3rd and 7th income deciles, can be considered ‘affordable housing’, as explained in the next paragraphs.

4.3.3 Affordable housing

Affordable housing in Poland can be defined as targeting a broad group of moderate-income households between the 3rd and 7th income deciles. These households are served by housing cooperatives and Social Building Associations (TBS). Figure 4 positions these tenure types in the context of the Polish rental housing market.

Cooperative housing units are frequently used as an investment in buy to let properties. These properties are often let on the ‘grey’—unofficial—rental market. Cooperatives, although well developed in pre-war Poland, are now considered by many as relics of the communist era, whose significance is likely to gradually decrease (Panek 2015). Less than 25% of the cooperative housing stock is considered to be rented housing;Footnote 10 18.000 units can be regarded as affordable rental housing, which is comparable to the housing provided by TBS. In deviation of the affordable rent sectors in the other case studies, TBS-rents are cost-based and regulated by law. In most housing cooperatives the tenant—who is a member of the cooperative—pays 3% of the cost upfront and then a rent that covers maintenance costs. Until 2015 the stock in cooperative ownership was gradually reduced by transfer to private individual ownership (Housing Europe 2015).

In 1995, a new form of tenancy for households with moderate incomes was introduced by the ‘Act on Certain Forms of Support for the Building Industry’ (ACFSBI). This system of Social Building Associations (TBS) has been in use since 1996. Ever since around 81.000 dwellings have been completed.Footnote 11 There are about 400 registered TBS companies, which can take several legal forms, such as Limited Liability Company, joint-stock company or cooperative of legal persons (Lux 2009). However, municipalities are the dominant shareholders in 80% of TBS Building associations. Proceeds from TBS activities are not to be distributed among the shareholders or members, but invested for statutory purposes. TBS rents are calculated in such a way as to cover maintenance and renovation costs. The terms and conditions of TBS leases are different from general rental housing as elaborated in the Tenants Protection Act 2001 (TPA). The TPA—along with the Polish Civil Code—sets out the general legal rental housing (Panek 2015).

TBS housing is offered only to households able to document that their income is below eligible thresholds. If the income of a particular household should grow and surmount the statutory quota, the tenancy agreement either terminates or the rent is adjusted. Prospective tenants may have to cover a part of the construction costs (up to 30%), which means that the offer is not addressed at the least affluent groups of the population (Panek 2015). This contribution is refunded when leaving the properties, but gives no right to purchase.Footnote 12 In 2011, the ACFSB law was revised, allowing TBS, under certain conditions, to privatize some dwellings based on market prices (Panek 2015).

4.3.4 Recent developments

Recent trends suggest that the Polish government is now taking a more active role in addressing housing needs by establishing a new housing finance system especially aimed at affordable rental housing. In 2014, the Polish Ministry of Infrastructure and Development presented a National Urban Policy (Krajowa Polityka Miejska). This document highlighted the acute need for a funding mechanism for affordable housing as part of urban regeneration policies (Jadach-Sepioło and Jarczewski 2015).

Funding modalities include preferential loans provided by the government (until abolishment of National Housing Fund in 2009); free land provided by municipalities; and upfront payment by tenants (usually 25 or 30% of construction costs). There is also the possibility to acquire commercial loans provided by BGK (introduced 2012). Commercial bonds issued by individual TBS, guaranteed by BKG were introduced in 2014. The new preferential loan programme (introduced in 2015, first tender in 2016, subsequent annual tenders until 2025/2016). The main institution involved is the National Housing Fund (established in 1995, abolished in 2009). Since 2009 funding to build affordable housing is provided by the state-owned Bank Gospodarstwa Krajowego (BGK) national development bank.

In 2015, the ACFSB law was amended twice in order to support a new line of preferential credits to cooperatives, TBS and municipal companies. This programme will allocate 4.5 million Polish Zlotys annually to finance affordable housing. The plan is to have 10 annual tender rounds until 2025–2026; 50% of houses funded through the Preferential Loans Programme are intended for families raising children. This preferential loans programme is managed by BGK. Loans cover up to 75% of the project value. TBS organizations cover the remaining 25% through their own resources and often require tenants to fill a part of the gap between the cost of construction and the amount of the public loan. It is expected that the first projects will be funded through this new line of credit in the course of 2016.

Recently, the European Investment Bank (EIB) and BGK, have signed an agreement to set up an investment platform supporting social and affordable housing projects in different municipalities across Poland (EIB 2017a). A first investment in the City of Poznań served as a pilot. The EIB lent around EUR 34 million to the TBS company of Poznan, for the construction of approximately 1300 affordable housing. This EIB financing operation is guaranteed under the European Fund for Strategic Investments (EFSI). The loan explicitly contributes to providing housing for people whose incomes are too high for them to benefit from social housing, but whose means are deemed insufficient to secure housing on the open market (EIB 2017b).

4.4 The Netherlands

4.4.1 General housing market

The Dutch housing market is characterised by strong, direct and indirect, government intervention through spatial planning and land policy, regulation and supervision of housing associations, rent regulation, generous mortgage interest deductibility, and other explicit or implicit subsidies. In view of the relatively rigid supply, fiscal incentives and demand factors have largely determined price developments. Compared to other Euro area members, The Netherlands has relatively high levels of leveraged housing wealth (Vandevyvere and Zenthöfer 2012). With a share of 33% in the total housing stock, The Netherlands has the largest share of social housing of the EU Member States (followed by Austria) with a very high quality stock (Housing Europe 2015).

4.4.2 Social housing

Social housing is defined by rents below € 710,68 per month, which used to be adapted annually up till 2016. Social housing is considered a Service of General Economic Interest (SGEI) in compliance with EU rules on state aid and competition. Eligibility for social housing is bound to a household income ceiling of € 35.739 per year, which is adjusted annually (Rijksoverheid 2017). Allocation is mostly done through waiting lists or Choice Based letting systems, with exception for vulnerable groups (people with a medical indication, social indication, age, homelessness and refugees).

The main providers of social housing are housing associations (woningcorporaties), which are private entities assigned with the public task, embedded in the 2015 Housing Act, of providing housing. The total housing stock owned by housing associations amounts to 2.4 million (Aedes 2015).

4.4.3 Affordable housing

While there is a clear definition of social housing since 2010, there is no such clear description of ‘affordable’ housing in The Netherlands. Many ad-hoc and local definitions of affordable housing circulate. Local rental housing market segments can be regarded as ‘affordable’. These are roughly demarcated by the gap between the social housing sector threshold/housing allowance cap (€ 710,68) and the rent level that is still affordable for moderate-income households that do not want, or are not able to buy a home (Fig. 5). The provision of housing in this segment is largely dominated by not-for profit housing associations, but the involvement of for-profit providers is growing. The social housing sector threshold also demarcates the boundary of the rent regulation regime, entailing an elaborate system of permissible rents levels derived from quality points that are based on floor space, housing amenities and energy efficiency.Footnote 13 Above the regulatory boundary, rent control is less strict. While the lower-boundary of the affordable housing sector can be clearly defined. The upper-boundary depends on local market circumstances. In Amsterdam for example, the affordable housing segment (‘middenhuur’) is defined by monthly rents between € 710,68 and € 971,00 (Municipality of Amsterdam 2016).

In contrast to social housing, there are no national allocation or eligibility rules for affordable housing. Whether the affordable housing segment exists at all depends on local market circumstances and policies. In many local housing markets, moderate-income households can easily acquire a home. But, especially in high demand areas, affordability of rental housing is an issue. Several large cities have demarcated an affordable rental-housing segment that needs policy interventions to prevent market forces from pushing rents to levels that are unaffordable for moderate-income households. Local governments of the four largest cities (Amsterdam, Rotterdam, Utrecht and The Hague) have developed modest programmes and subsidy schemes to support housing for moderate-income housing (‘middensegment’). Eligibility rules can apply for these local programmes.

4.4.4 Recent developments

The GFEC proved that not all housing associations were resilient companies; many had great deficiencies in terms of governance and especially financial risk management (Boelhouwer et al. 2014). This, in combination with the concerns about State Aid and the legitimacy of the housing associations, has led to recent regulation changes concerning the role of the housing associations and their playing field. The enactment of the 2015 Housing Act has introduced more governmental influence and supervision on housing associations. The Act limits activities of housing associations in affordable housing above the SGEI threshold (€ 710.68 in 2017). Non-SGEI activities are only allowed under very strict preconditions. Social landlords cannot use state guaranteed loans to fund activities in this market segment. Activities in this segment are only allowed after approval by local government and after proof has been delivered that market actors are not willing to invest.

Furthermore, the national government has introduced less strict rent regulation for investments by private sector actors in the transformation of empty offices and redundant care homes into housing. However, private landlords are still reluctant to invest in affordable housing because of the Landlord Levy that amounts to around 2 months’ rent annually per dwelling. Housing above the SGEI threshold is officially not subject to the Landlord Levy, but private landlords fear this threshold is not stable and could in future be altered to include their rental properties. Consequently, most new affordable housing is priced far above the SGEI threshold, at € 800 per month or higher.

Some commentators, such as the Dutch Association of Institutional Property Investors (IVBN), argue that the dominance of housing associations in the rental sector has made it hard for private landlords to compete due to the housing associations’ below market rent setting practices (IVBN 2015). The government has introduced measures designed to open up the rental market to private investors, such as loosening restrictions on rent increases, making it easier for landlords to increase rents for higher earners in SGEI housing. This would encourage those who can afford it to move out of social housing and into the private sector, in turn freeing up regulated housing for low-income households. Although construction of affordable (Non-SGEI) housing has increased recently in several large cities, notably in Amsterdam, there is still a large demand for moderately priced housing for households that are not eligible for social housing, but are also unable to pay full market rents.

The new 2015 Housing Act also opened-up the possibility for housing cooperatives (wooncoöperaties) to enter the social housing sector. These entities could potentially help bridging the gap between the social rented sector and the owner-occupied sector. A pilot project concerning the establishment of these cooperatives was launched in 2016, with the objective to provide affordable housing for middle-incomes (Platform31 2016). Some obstacles slowing down the take-off of housing cooperatives include risk-adverse attitudes amongst traditional financial institutions, for example national banks, due to the unknown risks that are involved with this new type of provider. However, recent evidence shows the gradual start of some pioneering initiatives (de Vries 2017).

5 Discussion

Our review of recent developments in social housing across the EU confirms long-standing trends such as the steady reduction of direct provision by state-owned providers as well as the cutback of public sector funding for social housing. As seen through our case studies, both the social housing and affordable housing sectors are undergoing wide-ranging transformations in many EU Member States. As a result, in countries like England and The Netherlands a new market segment for the provision of ‘affordable housing’ is opening up to housing providers, both not-for-profit and for-profit.

In countries with a small and residualised social housing sector (i.e. Poland and Italy) new rental tenures are emerging. We have classified these as ‘affordable housing’ mainly on the basis of their target groups: key workers, early-career professionals and other groups that are not eligible for ‘social housing’ (In Poland and Italy often referred to as ‘public housing’) but are unable to acquire a home. When comparing countries, it is important to note that in countries with a large social housing sector (such as The Netherlands) the target group partly overlaps with the households served by affordable housing in countries such as Italy and Poland. The main distinguishing factor of ‘affordable housing’ is its function as intermediary sector between social housing, and the homeownership and full market rent sectors.

In The Netherlands, the new 2015 Housing Act restricts the activities of social housing corporations in the moderately priced private rental sector (‘affordable’ housing segment—see Fig. 1), with the aim to create a more level playing field and attract private sector investments. A key question is whether for-profit housing providers are willing to enter this market, especially outside high-demand market areas like Amsterdam. So far, there is inconclusive evidence that this is the case. Recent private sector investments in this segment have been largely driven by a lack of attractive investment opportunities in the owner-occupied housing sector. Now that the housing market is recovering, there are indications of for-profit sector retrenchment from the rental sector. This development is reinforced by the Dutch taxation system that favours owner-occupied over rental housing. In combination with the inclination of municipal land departments to maximise the land revenues, this makes owner-occupied housing the only sector able to generate returns on investments that are attractive for private sector actors (Hendriks 2016; PBL 2017).

In England, the ‘affordable rental housing’ product launched in 2011 by the coalition government allows housing associations, and other ‘registered providers’, to charge up to 80% of market rents. However, despite being labelled ‘affordable’, sharp variations between regional housing markets mean that this is not necessarily the case everywhere. In a city like London, for instance, 80% of the market price is still not affordable for the majority of the capital’s inhabitants. Although not in the same explicit or formalised way as in England and The Netherlands, also in Italy and Poland affordable housing has begun to find its way into policies, programmes and investment strategies of different types of third sector providers.

Table 1 summarizes key findings on both social and affordable housing. This table should be read in conjunction with Fig. 1, which illustrates the distinction we draw between these two segments. The following points provide a more detailed analysis of each segment.

5.1 Definitions and target groups

Be it formal or informal, the definition of social rental housing across the four countries consistently refers to rental housing targeting people on low incomes and/or with special (social) needs. Both the level of income considered ‘low’ as well as the specific ‘social’ conditions vary per country.

We found some form of definition of affordable housing (either explicit or implicit) in all four countries. These segments tend to target middle income groups, either as a result of former social housing tenants who are now ineligible for social rental housing as a result of recent regulatory changes (England, The Netherlands) or as a separate target group in its own right (e.g. following specific national, regional or local priorities in Italy and Poland).

5.2 Providers

Municipalities (i.e. local authorities) provide social rental housing in all but one of the four countries. The exception is The Netherlands, where housing associations are the main type of provider of social rental housing, and only a handful of municipal housing companies remain. In England, housing associations are also the dominant type of provider, albeit councils still retain their role as such despite the steady reduction of their stock via transfers to housing associations and the Right to Buy. A more fragmented landscape characterises Poland and Italy, where different types of providers co-exist to provide social housing to different target groups.

In England and The Netherlands, providers tend to be not-for-profit housing associations, which are ‘recycling’ their involvement with former actual or potential tenants, now above the revised income ceilings in each country. In both cases, this represents a new ‘business’ or ‘market’ for these providers, which requires operating under a different set of rules and regulations. At the same time, there is not enough evidence to assert whether, and to what extent, other types of providers are becoming significantly active in this market at present. Conversely, in both Poland and Italy there is a wider variety of providers (mostly non-State owned, not-for-profits and other third sector bodies), which have begun to be active in this field. It remains to be seen to what extent their involvement may become larger in the near future.

5.3 Trend

Social housing across all four countries is either facing stagnation or becoming more targeted. In none of the countries did we find any evidence of growth in this sector. However, it is worth noting that while in The Netherlands the allocation criteria have become stricter, the number of potential beneficiaries is potentially higher. This poses challenges to supply including, for example, physical adaptation of existing stock to match new and diverse housing needs, new construction and/or acquisition. Housing associations are re-assessing their policies towards selling their current stock in line with prospective increases in the number of eligible tenants.

Overall, the affordable housing landscape in all four countries seems to be plagued by both policy uncertainty and market volatility, thereby hindering any coherent longer-term investment by potential providers despite increasing need/demand, particularly in large cities.

The last row in Table 1 aims to compare whether the social and affordable housing sectors, respectively, seem to be converging or diverging in each country. Our analysis shows a trend towards divergence between the two sectors across most of these countries. This divergence seems to be particularly acute in Poland and The Netherlands. This trend means that social housing continues to become a residual tenure (i.e. targeting the low income and/or the most vulnerable in society) while affordable housing tends to be focusing on a range of middle-income groups in each country.

6 Conclusions

This paper aimed to contribute to understanding what ‘affordable housing’ means from a comparative international perspective. We did so by presenting results of a study covering England, Italy, Poland and The Netherlands. We started from an operational definition of affordable housing, broad enough to encompass international variations. In order to place the development of affordable housing in each country, we provided a baseline account on the latest developments in ‘social housing’ in each country, and explored if and how both concepts are related. Our findings showed that in all four countries there is indeed an emerging affordable housing sector, which is generally characterised by policies (at different scales) aimed at helping middle-income households rent housing at below-market price. The definition of ‘middle-income’ and ‘below-market’ price varies across countries, regions and cities. The types of target groups also vary, but in general three key groups were identified: households with temporary and/or precarious income (including families and single people) and mobile workers. While the main type of area affected tends to be cities, we also found evidence of worsening affordability in smaller towns, such as in Italy.

Regarding the relationship between social housing and affordable housing, our study confirmed that social housing (or public rental housing, as defined in Poland and Italy), is increasingly becoming a residual tenure. In other words, social (public) housing is mostly accommodating people on very low-incomes and those with special needs. This confirms the general trend, across Europe, towards the progressive residualisation of this sector (Borg 2015).

We found convergence between England and The Netherlands; there is a trend towards stricter targeting in the social housing sector and a ‘creaming off’ former social housing tenants, who are now the new target group for affordable rental housing in each country.

On the other hand, we found some diverging trends between both countries, with English housing associations diversifying their offer while their Dutch counterparts are retreating into the regulated social housing market. The latter responds to the stark changes in the role and scope of Dutch social housing associations established in the 2015 Housing Act, following intense public debate and a long dispute with the European Commission regarding state aid rules (Czischke 2014; Lind and Elsinga 2015). In Italy, there is a growing sector of affordable housing, provided by not-for-profits, including cooperatives and private foundations. In Poland, social housing is stagnating while affordable housing provided by TBS organisations is growing.

What can other countries learn from these findings? We suggest a couple of policy implications: first, in countries like England and The Netherlands, where affordable housing relies increasingly on private sector finance, stabilisation mechanisms ought to be put in place to ensure the continuity of an adequate level of investment at times when market investors prioritise other segments due to relatively higher margins. These mechanisms may include, for example, government incentives and guarantees, solidarity guarantee funds amongst providers, and other mutualisation systems.

Second, countries like Poland, where there hasn’t been historically a strong social housing sector, are beginning to set up regulatory frameworks and support new types of providers, all of which has been able to attract EIB financing. In Italy, on the other hand, a more bottom-up institutional setting has taken shape, characterised by partnerships involving market (banks), not-for-profit actors (e.g. foundations) and government agencies to deliver affordable rental housing.

Overall, our findings show that affordable housing appears to be profitable for actors seeking a ‘fair’ financial profit, but defer from maximising financial profit in order to also generate a social return on their investments. There are, however, a couple of flip sides: first, the volume of investment funding for affordable housing is still limited. Second, investors find it difficult to find affordable land on adequate locations. Thus, a recommendation is for government agencies on all levels (EU, national, regional, local) to play a more active role in improving the preconditions for affordable housing to develop, notably in terms of access to affordable land and finance.

Against this backdrop, the emergence of alternative forms of affordable housing provision stands out. These include a wide variety of self-organised collective housing provision initiatives, also called resident-led or ‘collaborative housing’ (Czischke 2017). While not (yet) in large numbers, the strategies applied in these initiatives represent examples of (social) innovation, notably in the field of non profit-maximising models for affordable housing. These bring up opportunities for socially responsible lending by private actors, as well as crowd funding. Policy makers at different levels ought to support these initiatives and link them up with their own policies and programmes to support the development of affordable housing. From a research point of view, this also represents a new field worth further developing.

Notes

EU-SILC (European Union Statistics on Income and Living Conditions) is an instrument aiming at collecting comparable cross-sectional and longitudinal multidimensional microdata on income, poverty, social exclusion and living conditions. This instrument is part of the European Statistical System (ESS).

Source: EU SILC, [ilc_lvho08a] 2015.

https://www.gov.uk/guidance/national-planning-policy-framework/annex-2-glossary. Rretrieved 07 June 2017.

Housing Europe website. http://www.housingeurope.eu/. Retrieved 14 Sept 2015.

Housing Europe website. http://www.housingeurope.eu/. Retrieved 14 Sept 2015.

Personal communication (2016) Stachera.

www.housingeurope.eu website. Retrieved 14 Sept. 2015.

Personal communication, 2016, Stachera.

See: www.housingeurope.eu website. Retrieved 14 Sept. 2015.

For for information on the Dutch Rent Regulation system see: www.government.nl/topics/housing/rented-housing. Retrieved 22 Dec 2017.

References

Aedes. (2015). Dossier: Woningwet in de Praktijk. Retrieved from http://www.aedes.nl/content/dossiers/woningwet-in-de-praktijk.xml.

Apps, P. (2014). Private developers return cash for 2,600 affordable homes. Inside Housing. London. 29 August 2014. Retrieved 17-09-2015 from http://www.insidehousing.co.uk/private-developers-return-cash-for-2600-affordable-homes/7005380.article?adfesuccess=1&adfesuccess=1.

Ball, M. (2015). Housing provision in 21st century Europe. Habitat International, 54(2016), 182–188.

Bianchi, R. (2015). National Report for Italy. TENLAW tenancy law and housing policy in multi-level Europe. Bremen: Zerp.

Blackman, D. (2016). Analysis: Is affordable housing a natural home for LA pension funds? Social Housing http://www.socialhousing.co.uk/analysis-is-affordable-housing-a-natural-home-for-la-pension-funds/7014244.article#. Retrieved 1 June 2017.

Borg, I. (2015). Housing deprivation in Europe: On the role of rental tenure types. Housing, Theory and Society, 32(1), 73–93. https://doi.org/10.1080/14036096.2014.969443.

CECODHAS Housing Europe. (2012). Housing Europe review. Brussels: The nuts and bolts of European social housing systems.

Czischke, D. (2009). Managing social rental housing in the EU: A comparative study. European Journal of Housing Policy, 9(2), 121–151.

Czischke, D. (2014). Social housing and European community competition law. In Social housing in Europe (pp. 333–346). Oxford: Wiley Blackwell.

Czischke, D. (2017). Collaborative housing and housing providers: towards an analytical framework of multi-stakeholder collaboration in housing co-production. International Journal of Housing Policy. https://doi.org/10.1080/19491247.2017.1331593.

de Vries, B. (2017). Huurders in Den Haag kopen eigen straat. NOS online newspaper. Hilversum. Retrieved 01/06/2017 from: http://nos.nl/artikel/2176065-huurders-in-den-haag-kopen-eigen-straat.html.

EIB. (2017a). EIB and BGK establish investment platform for social and affordable housing in Poland under Juncker Plan. http://www.eib.org/infocentre/press/releases/all/2017/2017-126-eib-and-bgk-establish-investment-platform-for-social-and-affordable-housing-in-poland-under-juncker-plan.htm. Retrieved: 20 Dec 2017.

EIB. (2017b). Contributing to social inclusion in Poland: EIB finances 1 300 affordable housing units in Poznań under Investment Plan for Europe. http://www.eib.org/infocentre/press/releases/all/2017/2017-027-contributing-to-social-inclusion-in-poland-eib-finances-1300-affordable-housing-units-in-poznan-under-ipe.htm. Retrieved 20 Dec 2017.

Gilbert, A. (2015). Rental housing: The international experience. Habitat International, 54(2016), 171–181.

Housing Europe. (2015). The state of housing in the EU. Brussels: Housing Europe.

Housing Europe. (2017). The state of housing in the EU 2017. Brussels: Housing Europe.

Habitat for Humanity. (2015). Housing review 2015 affordability, liveability sustainability. Bratislava: Habitat for Humanity.

Haffner, M., & Boumeester, H. (2014). Is renting unaffordable in The Netherlands? International Journal of Housing Policy, 14(2), 117–140.

Haffner, H., Elsinga, M., & Hoekstra, H. (2012). Access and affordability: Rent regulation. International encyclopedia of housing and home (pp. 40–45). Amsterdam: Elsevier.

Haffner, M., & Heylen, K. (2011). User costs and housing expenses. Towards a more Comprehensive Approach to Affordability Housing Studies, 26(04), 593–614. https://doi.org/10.1080/02673037.2011.559754.

Hancock, K. E. (1993). Can’t pay? Won’t pay?’ or Economic Principles of ‘Affordability. Urban Studies, 30(1), 127–145.

Hegedüs, J. & Horváth, V. (2015). Housing review of 15 countries in Europe and Central Asia. Housing Review 2015. Affordability, Livability, Sustainability. Habitat for Humanity.

Hendriks, P. (2016). Hoelang blijft huren in het middensegment van Amsterdam betaalbaar? (English). Retrieved 2 June 2017. https://www.ftm.nl/artikelen/huur-middensegment-amsterdam?share=1.

Homes and Communities Agency. (2014). Affordable Homes Programme 2015–2018. Prospectus. January 2014.

Houard, N. (Ed.). (2011). Social housing across Europe. Paris: La documentation française.

IVBN. (2015). IVBN reageert over ophef over ABF-rapport over scheefwonen [IVBN responds to discussion on skewed rents/income ratios] http://www.ivbn.nl/actueel-artikel-detail/ivbn-reageert-over-ophef-over-abf-rapport-over-scheefwonen/. Retrieved: 5 June 2017.

Jadach-Sepioło, A. & Jarczewski, W. (2015). Housing policy as a part of Urban regeneration policy—the case of Poland. Journal of Business and Economics, 6(2), 381–392.

Lennartz, C. (2014). Competition between social and private rental housing (Ph.D. thesis). Delft: Delft University Press.

Lind, H., & Elsinga, M. (2015). The Effect of EU-legislation on rental systems in Sweden and The Netherlands. Housing Studies, 28(7), 960–970. https://doi.org/10.1080/02673037.2013.803044.

Lux, M., Sunega, P., & Boelhouwer, P. (2009). The effectiveness of selected housing subsidies in the Czech Republic. Journal of Housing and the Built Environment, 24(3), 249–269.

Milligan, V. & Gilmour, T. (2012). Affordable Housing Strategies. International Encyclopedia of Housing and Home (pp. 58–64). Elsevier Ltd.

Mullins, D., Czischke, D., & G. van Bortel (2012). Exploring the meaning of hybridity and social enterprise in housing organizations. Housing Studies, 27(4), 405–417.

Municipality of Amsterdam. (2016). Wonen in Amsterdam 2015. Eerste resultaten woningmarkt (Living in Amsterdam 2015. First housing market results) https://www.amsterdam.nl/publish/pages/410516/wia_2015_factsheet_eerste_resultaten_woningmarkt_maart_2016.pdf. Retrieved 22 Dec 2017.

NHF. (2015). National housing federation submission to comprehensive spending review 2015. London: NHF.

Oxley (2012). Supply-Side Subsidies for Affordable Rental Housing. Elsevier Encyclopaedia of Housing and Home.

PAM. (2017). Platform Amsterdam Middenhuur (Platform Amsterdam Mediumrent). http://www.pamwonen.nl/. Retrieved 1 June 2017.

Panek, G. (2015). National Report on Poland, TENLAW Project. http://www.tenlaw.uni-bremen.de/Ministry of the Interior and Kingdom Relations. (2015). In Vogelvlucht: De Woningwet 2015, nieuwe spelregels voor de sociale huursector.

Pattison, B. (2016). Understanding the drivers for, and policy responses to, the rapid growth of private renting in England: has ‘generation rent’ been ‘priced out’? Doctoral dissertation, University of Birmingham.

Planbureau voor de Leefomgeving [PBL]. (2017). Perspectieven voor het middensegment van de woningmarkt [English title]. The Hague: PBL.

PWC. (2015). UK housing market outlook July 2015: the continuing rise of Generation Rent. London: PWC.

Rijksoverheid. (2017). https://www.rijksoverheid.nl/onderwerpen/huurwoning/vraag-en-antwoord/sociale-huurwoning-voorwaarden. Retrieved 1 June 2017.

Ronald, R. (2013). Housing and welfare in Western Europe: Transformations and challenges for the social rented sector. LHI Journal of Land, Housing, and Urban Affairs, 4(1), 1–13.

Salvi del Pero, A., Adema, W., Ferraro, V., & Frey, V. (2016). Policies to promote access to good-quality affordable housing in OECD countries. OECD Social, Employment and Migration Working Papers, No. 176, OECD Publishing, Paris. http://dx.doi.org/10.1787/5jm3p5gl4djd-en.

Scanlon, K., Whitehead, C., & Arrigoitia, M. F. (Eds.). (2014). Social housing in Europe. London: Wiley.

Stone, M., Burke, T., & Ralston, L. (2011). The residual income approach to housing affordability: The theory and the practice. Melbourne: Swinburne-Monash Australian Housing and Urban Research Institute (AHURI) Research Centre.

Urban Agenda for the EU: Pact of Amsterdam. (2016). http://ec.europa.eu/regional_policy/sources/policy/themes/urban-development/agenda/pact-of-amsterdam.pdf. Accessed 30 May 2016.

Urwin, P., Gould, M., & Faggio, G. (2016). Estimating the value of discounted rental accommodation for London’s ‘squeezed’ key workers. London: Dolphin Living.

Whitehead, C. M. E. (1991). From need to affordability: An analysis of U.K. housing objectives. Urban Studies, 28(6), 871–887.

Wilcox, S., & Perry, J. (2014). UK housing review. Coventry: Chartered Institute of Housing.

Yates, J. & Milligan, V. (2012). Policies to Support Access and Affordability of Housing. Encyclopedia of Housing and Home (pp. 293–305). Elsevier Ltd.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Czischke, D., van Bortel, G. An exploration of concepts and polices on ‘affordable housing’ in England, Italy, Poland and The Netherlands. J Hous and the Built Environ 38, 283–303 (2023). https://doi.org/10.1007/s10901-018-9598-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10901-018-9598-1