Abstract

Studies involving the analysis of objective data from online operators attempt to address common concerns about biases in self-report research. This paper surveys the progress in this area of research over the last 15 years. The findings highlight many areas of achievement, including: the development of a set of behavioural markers that reliably differentiate variations in gambler risk. Online gamblers can be grouped into clusters based on the intensity and frequency of gambling; behavioural variability; or, signs of over-commitment (e.g., deposit frequency or expenditure patterns). Behavioural indicators have also been successfully used to predict proxies of harm such as self-exclusion or account closures. However, relatively few studies have combined objective data with self-report data to achieve independent validation of the risk-status of gamblers. Evidence also supports the potential value of short-term responsible gambling interventions involving the use of voluntary and mandatory limits, messages and behavioural feedback. Less work has, on the other hand, addressed the comparative risk of different online gambling products. The findings suggest the need for further validation of findings against independent measures of gambling risk; consistent definitions of indicators; a greater focus on the differentiation of product risk; and, on the long-term impact of RG interventions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

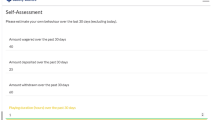

A central feature of gambling research is to understand the phenomenon itself. This includes insights into how much time and money people are spending and if they might be experiencing any harm associated with the activity. For the most part, such insights have traditionally been gained from self-report and principally survey-based methodologies. People will be asked a series of questions about the type and frequency of their gambling and be administered a standardised instrument (e.g., the Problem Gambling Severity Index) to determine whether they are displaying any negative consequences or behaviours indicative of gambling-related harm. Such behaviours might include spending more than they can afford to lose, chasing losses, or borrowing money. Methodologies of this nature have been central to epidemiological and public health approaches to gambling research as well as many psychological studies (Heirene, Wang, & Gainsbury, 2022).

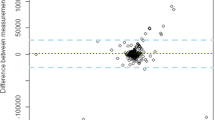

Although methodologies of this type have proved useful in providing insights into the general prevalence of gambling, the relationships between variables, and how people are negatively affected (Browne et al., 2016), many limitations are acknowledged. The first principal concern is that such studies are unlikely to provide accurate estimates of gambling behaviour. For example, inaccuracies may arise when people are asked to recall their behaviours across multiple activities and then partition them to certain time periods (e.g., last 12 months). Even more problematically, people appear to find questions about gambling expenditure very difficult to answer (Blaszczynski et al., 2006). A question such as ‘how much did you spend’ could very easily be interpreted in multiple ways (turnover, net expenditure, or the amount taken along to gamble). In addition, people may not be able to engage in the level of mental accounting that enables them to provide accurate estimates of expenditure, particularly if money on gambling comes from multiple sources or is spread across a variety of activities (Schottler Consulting, 2020). Indeed, estimates in studies of both land-based gambling (Productivity Commission, 1999) and online gambling (e.g., Auer and Griffiths, 2017; Braverman et al., 2014; Heirene et al., 2022) show that actual or net gambling expenditure (or the amount lost) can be under-estimated by more than 50%. A second concern relates to sampling. Standard methods used to capture self-report data (e.g., population prevalence studies) are facing increasingly low response rates, difficulties in sampling across land and cellular numbers, and challenges in capturing certain demographic groups who may be reluctant to participate (e.g., minorities, young people, those with poor cellular coverage) (Jackson et al., 2014). Meanwhile, questions have been raised about whether panel samples offered by research companies (e.g., Qualtrics, Prolific, Amazon Turk) may be biased towards certain demographic groups and be difficult to generalise to broader populations (Pickering & Blaszczynski, 2021).

For these reasons, there has been increasing interest in whether it might be possible to obtain more accurate objective gambling data from other sources. Accordingly, in the last 15 years, several research teams have sought to investigate the potential value of objective data obtained from gambling operators; most notably online operatorsFootnote 1. Such anonymised data-sets involve accurate objective data of the recorded behaviour of online gamblers using a particular platform for a specified time. Data-sets can include brief sign-up information (e.g., some demographics), the number and frequencies of deposits as well as detailed records of how much is spent, won or lost on different gambling activities per stake, session, or across days. The potential of this information was recognised over a decade ago (see Shaffer et al., 2010; Griffiths and Whitty, 2010) as a way to gain accurate insights into actual gambling behaviour and to be able to profile large samples of gamblers while avoiding the methodological issues described above.

Insights from this type of analysis have been seen to have several important benefits. First, such work has the potential to help operators, regulators and policy-makers identify what people are most at risk of gambling harm and how reliable this can be predicted using operator data. For example, it may be possible to generate more definitive data about what percentage of online gamblers are exceeding safe-gambling limits (e.g., Currie et al., 2008; Dowling et al., 2021) in a way that captures populations of gamblers rather than those who agree to respond to online or telephone surveys. A second potential benefit of this research is that it may help to identify products or structural features of activities which appear to have a stronger association with higher risk gambling or harm. A third important area relates to responsible gambling or secondary public health strategies for people who are actively (and often regularly) involved in online gambling (Korn & Shaffer, 1999). If operators are able to identify people who are showing potentially risky patterns of gambling, there may be opportunities for them to use this as the basis for interventions. As a result, a number of researcher and operator research collaborations have developed around the world which have involved investigations into the characteristics of online gambling, the potential relationship between behaviour and harm (e.g., Xuan & Shaffer, 2009; McAuliffe et al., 2022), and the behavioural impact of responsible gambling interventions (e.g., limits, messaging and behavioural feedback) (e.g., Auer et al., 2014, 2022a, b).

Aims of this Review

In this paper, we examine the extent to which many of these ambitions have been achieved. Our purpose is to review what is currently known from 15 years of studies involving the analysis of objective behavioural data sourced from gambling operators. In this review, we provide insights into the extent to which the existing literature has covered these different areas. For example, we examine what proxy measures have been used to measure harm; the range and coverage of behavioural indicators; and, what areas appear to be most promising for future assessments of product and player risk as based on current evidence. Given the diversity of approaches, predictors and outcomes in this literature, the current value of meta-analytic approaches is likely to be limited. Instead, what we provide here is an overview of the general trends in the research findings as a way to identify what appear to be the most promising lines of enquiry at this point in time.

Literature Search Strategy

A search was undertaken using Scopus in December 2022 to identify peer reviewed articles relevant to this review. Key words included: “online/ Internet” AND “gambling/ wagering/ sports-betting”. The term “gaming” was excluded to avoid including the video-game literature. A total of 1795 sources were identified using “gambling” AND “online” and this was found to significantly overlap with the results for “gambling” and “Internet”. Further publications were identified through some earlier published reviews; through inspection of secondary sources cited in the most recent (2022) papers; audits of individual Scopus profiles (e.g., Harvard Medical School team); major funding bodies (e.g., GambleAware in the UK); and, using Google searches using the same key terms. Only publications published in English were included (nearly all were). To be included, the studies had to involve objective online behavioural data in at least some part of the research rather than self-reported attitudes or knowledge relating to online gambling. Studies that were only self-report surveys, descriptions of methodology without data, theoretical or scoping reviews, or focused on land-based gambling only were excluded. The search resulted in a total of 56 peer reviewed articles and 2 major reports.

Definition of Online Gambling

Online gambling was defined as any gambling that was undertaken using a gambling operator using Internet services (whether from a PC or mobile device). Nearly all of this was account based and so does not include gambling occurring using decentralised or blockchain technology (likely to be a very small percentage). Activities included online casino games (slots, blackjack, roulette), online poker, online bingo lottery games, and online wagering (sports or race betting).

Structural Approach to Review

The key information from studies was compiled in a way to enable readers to gain a rapid overview of the principal areas of focus in these studies; the outcomes investigated (e.g., how do they measure harm or higher risk gambling); the behavioural markers that have been used to detect or predict those outcomes; the methodological approaches; and, the principal trends which are emerging across different studies. It is important to note that not all studies necessarily contain a clear differential between independent measures / predictors and outcomes. Many studies (and particularly the earlier ones) are more descriptive and provide profiles, descriptions or cluster analyses of different groups of online gamblers. Another important caveat relates to the breath of the evidence. As will become clear, much of this research is highly concentrated. A number of papers arise from the same operator; often involve the same group of researchers; and, data has tended to be principally sourced from one part of the world (Europe). Finally, as noted by Gainsbury (2011) and Griffiths and Whitty (2010), it is important to be mindful of how much objective analysis of inferred harm has been verified against other sources of data (e.g., the individual risk status of gamblers as based on their self-report).

Content Overview

The principal details of the studies are set out in Tables 1 and 2. Table 1 summarises the authors, year, data-sources and aims, whereas Table 2 provides an overview of the methodology and findings. There is a brief summary of the analytical approach taken; the principal behavioural variables included in the investigation; and, the main findings.

Broad Area Of Focus: Individual vs. Product Risk

It is clear from Table 1 that individual risk (or the description of individual behaviour) rather than product risk has been the principal focus of most studies. Of the 58 publications, 45 (78%) are principally about individual player risk, 21% discuss individual risk as well as some reference to product variations. Only one paper (Auer & Griffiths, 2022d) appeared to be principally focused on product risk. Thus, the current literature provides greater insights into how to identify riskier players rather than riskier online products.

Proxy Measures of Harm

Table 1 also indicates that some studies used what could be considered as proxy measures of harm, i.e., whether certain predictor variables seemed to be related to a higher risk outcome. Four main outcomes appear to have been favoured in this context. These include the closure of online accounts (e.g., Adami et al., 2013; Braverman and Shaffer, 2012; LaBrie & Shaffer, 2011; McAuliffe et al., 2022; Xuan and Shaffer, 2009); responsible gambling (RG) incidents of various types (Gray et al., 2012); setting higher gambling limits (e.g., Braverman et al., 2013; Chen et al., 2022); and, whether people exceeded low risk gambling limits set previously for land-based activities (e.g., Braverman et al., 2014; Louderback et al., 2021). Other studies offered profiles of gamblers (e.g., based on cluster or latent class analysis) which attempted to infer that a certain top percentage of customers (e.g., based on a combination of variables) were higher risk and different from the rest of the customer population (e.g., Braverman and Shaffer, 2012; Perrot et al., 2018). A final method has been to use commercial algorithms (e.g., Catania and Griffiths, 2022 report a set of indicators mapped to DSM-5 diagnostic criteria for gambling disorder, whereas Auer and Griffiths, 2022f refer to the Mentor system which is a methodology developed by the first author). Wood and Wohl (2015) presented findings relating to Playscan developed by Svenska Spel.

Independent Measures of Harm/ Problem Gambling

There were 6 studies which included an independent self-report measure of problem gambling. Some of these used the Problem Gambling Severity Index (PGSI) (e.g., Auer & Griffiths, 2022e; Luquiens et al., 2019; Perrot et al., 2022; Price-Waterhouse Coopers, 2017); others used brief screening measures such as the Brief Psychosocial Gambling Screen (e.g., Braverman et al., 2014; LaPlante et al., 2014). These studies were able to compare the classifications of risk based on behavioural measures with PGSI classifications; one of the best examples of this is the PWC report in the UK which compared the top 20% of “riskiest” players with PGSI scores of 8+ (problem gambling range).

Responsible Gambling Measures

A number of studies have examined the effectiveness of responsible gambling measures. These include the effects of voluntary limits (e.g., Auer and Griffiths, 2013, 2020, 2021; Ivanova et al., 2019; Nelson et al., 2008); mandatory limits (Auer & Griffiths, 2022d); breaks in play (Auer & Griffiths, 2022d; Hopfgartner et al., 2022a) or the effects of pop-up or personalised messages (Auer et al., 2014; Auer & Griffiths, 2015b, 2016, 2022a). These studies generally employ a pre-post design (sometimes with a comparison group) to determine whether expenditure, time spent, or the number or size of account deposits differ after exposure to the intervention.

Categories of Behavioural Indicator

Table 2 shows that a range of different behavioural indicators have been studied. For ease of reference, these are summarised into categories into Table 3. The list displayed in Table 3 is not exhaustive because of the capacity to create all manner of calculated variables using machine learning and other algorithmic methods but should provide a comprehensive guide to what information has been used. As Table 3 indicates, one of the most measured aspects of gambling is the intensity or how much people gamble. This can be broken down into 4 main categories: frequency; expenditure level; duration; and, speed. Studies appear to vary in whether some of this information is provided in the form of primary data or calculated from macro-level data such as: total wagered, total sessions, total minutes and days gambled. A particular area of contention worth noting is whether it is better to use theoretical loss as opposed to actual net expenditure when calculating the intensity of gambling. Auer and Griffiths (2014) have used a method which essentially multiplies the house edge by the amount staked to estimate losses, but this has attracted criticism from some authors (e.g., Tom and Shaffer, 2016a, b) on the grounds that it may not generalise to all forms of gambling. For example, people may play a suboptimal strategy on card games such as blackjack, so that their returns are lower than the assumed house edge. The house edge may also be difficult to calculate for some activities such as sports and racing, which are odds-based activities which may not have a mathematically prescribed expected return to players. These points appear valid, although, as Auer and Griffiths (2014) note, the correlation between theoretical loss and actual expenditure may be high enough (e.g., 0.85) to allay concerns about the generalisability of the theoretical loss measure.

A second category relates to the input or output of money from gambling platforms. A number of studies have examined the size and frequency of player deposits into their gambling accounts (Auer & Griffiths, 2022a, d; Haeusler, 2016; Luquiens et al., 2016). Deposits which are greater in size, frequency and variability have been considered potential indicators of greater gambling risk; and this has been considered even more indicative if there is evidence of deposits being rejected (e.g., due to inadequate funds or a suspicion of illegal activity by the operator). Higher risk players may make repeated deposits (i.e., top-up their balances within the same session of play) (Auer & Griffiths, 2022f) which is hypothesised to be a sign of chasing. Withdrawals of money are also considered potential useful indicators of risk if players reverse the action; such behaviour may indicate chasing or an inability to allow winnings (a potential source of funding for further gambling opportunities) to be removed (McAuliffe et al., 2022).

A third category of indicators which can be grouped into different subcategories relates to dynamic changes in behaviour (e.g., Haeusler, 2016). Several studies have examined chasing based on whether people increase their bets following losing outcomes, sessions or days (e.g., Auer and Griffiths, 2022f; Challet-Bouju et al., 2020) or placed bets with longer odds (e.g., Xuan & Shaffer, 2009). Studies have also examined the variability of behaviour (e.g., the amount wagered from day to day) with some (e.g., Adami et al., 2013) referring to a “saw-tooth” pattern in which higher risk was seen to be characterised by a cycle of higher and lower expenditure (either due to chasing losses or a cyclical reduction in expenditure due to inadequate funds). A third category of dynamic variable (e.g., Adami et al., 2013; Braverman and Shaffer, 2012) has involved the calculation of behavioural gradients or slope values based on the change in a given outcome variable (e.g., amount wagered per day) calculated against variations in time. Higher slope values are taken to indicate higher risk gambling.

A fourth category of indicators relates to statistical anomalies in the timing of gambling activity: how often the person gambles late at night (Forrest & McHale, 2022; McAuliffe et al., 2022) or gambling on weekdays rather than weekends (Braverman et al., 2013). The logic here is that people who may have less control over their gambling are engaging in activity during the night either to disguise their gambling from others or because this reflects an inability to stop gambling.

A fifth category (as mentioned above) relates to any activity that might indicate a self-recognised risk. Voluntary exclusions; account closures; or, contacts to customer service about gambling-related problems are all indicators of risk. Other more subtle indicators which have been examined include contacting customer services for other reasons (e.g., to seek bonuses) (e.g., Gray et al., 2012).

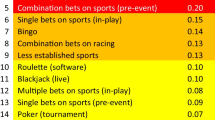

A final category which (as indicated above) has been less commonly studied relates to product selection and engagement. Indicators of risk that have been studied include gambling on a wider range of products (often termed “breadth” to distinguish it from the depth of level of engagement, see LaPlante et al., 2014) or on specific products that are considered to be riskier by design. For example, rapid, more continuous products such as in-play sports betting (e.g., Brosowski et al., 2012; Gray et al., 2012) or slots (e.g., Dragicevic et al., 2011; Hopfgartner et al., 2022b) have been reported to be higher risk than products that have more natural breaks in play or which afford fewer opportunities to bet. It has been hypothesised that rapid and continuous games lead to increased losses, poor decision making and may encourage chasing behaviour.

Principal Findings: Behavioural Risk Indicators

In this section, we summarise what is generally been found in relation to each of the content areas. We commence with a discussion of the behavioural indicator findings and then provide an overview of findings from responsible gambling studies (Table 3). Inspection of the general pattern of results from studies that included measures of intensity and engagement generally allow several conclusions to be drawn: (a) gambling expenditure on online platforms is highly skewed, with the vast majority of people having low levels of expenditure, but with clearly identifiable higher risk clusters (often comprising 1 to 5%) of the customer population (Catania & Griffiths, 2022) across different product types including, for example, sports betting (LaBrie et al., 2007), casino (LaBrie et al., 2007), and poker (LaPlante et al., 2009). Analysis (e.g., Forrest & McHale, 2022) shows that the top 10% of gamblers on online platform appear to account for 50%+ of total turnover and/ or net revenue; (b) most people lose money, but that returns to player appear to be higher (i.e., a lower percentage of money wagered is lost) in the highest value players; (c) studies using proxy measures of gambling risk show that people who close accounts, who evoke RG interventions or who exclude themselves tend to have a higher engagement with gambling (total amount wagered, frequency of gambling, total sessions and duration of gambling); (d) a significant proportion of people exceed low risk gambling limits (Louderback et al., 2021); (e) Studies using proxy measures have been validated in studies which have also been able to administer the PGSI (Auer & Griffiths, 2022e; Luquiens et al., 2019; PWC, 2017) using associated self-report surveys. These studies generally show higher levels of objective gambling intensity and involvement (frequency, expenditure) in higher risk gamblers as classified by the PGSI.

Support for the second category (Money in/ Money out) has also generally been obtained with more frequent and larger deposits amongst those classified as problem gamblers on the PGSI (Auer & Griffiths, 2022e; Luquiens et al., 2019), and more reversed withdrawals (although some of these behaviours are often so rarely observed as to be less useful in models, see McAuliffe et al., 2022).

Studies of the dynamics of gambling behaviour (Category 3) have generally been more mixed. Some studies have found a positive wagering gradient for those in higher risk clusters (e.g., Braverman et al., 2011) or who subsequently closed an account (Xuan & Shaffer, 2009), while other studies have found little evidence for stake increases following losses within or across sessions (e.g., Auer and Griffiths, 2022f; Chen et al., 2022). However, Ma et al. (2014) found that the scale and immediacy of losses are an important consideration such that, while gambling behaviour may decrease following an immediate loss, it will increase following a longer period of accumulated net loss. Support for chasing behaviour as a risk marker may also depend on how it is operationally defined. When defined as ‘frequent within-session depositing’ this construct receives more consistent support (Auer & Griffiths, 2022f; Challet-Bouju et al., 2020), whereas chasing in the form of making longer odds (i.e., riskier, less probable) bets to recoup losses was not observed by Xuan and Shaffer (2009). In a more nuanced consideration of how chasing might provide a behavioural indication of high-risk gambling, Adami et al. (2013), reported that a “saw-tooth” pattern of behaviour (i.e., a cyclical pattern involving the gradual ‘ramping up’ of staking behaviour followed by a ‘crash’) was more common in higher risk gamblers. Although some players may increase their bets to chase larger wins, this pattern appears more consistent with a pattern of chasing losses given the sudden decrease in staking sizes after the peak is reached, thereby suggesting a decrease in the availability of funds. This observation is consistent with the other studies which found greater variability in behaviour to be indicative of higher risk (e.g., Braverman et al., 2011, 2013).

In relation the second to last category, studies further show that gambling late into the night appears to be generally supported as an indicator of higher risk gambling (e.g., Forrest & McHale, 2022; McAuliffe et al., 2022).

The final category product risk generally shows two main findings: (a) People who gamble on a wider range of products (i.e., greater “breadth”) generally appear to be higher risk gamblers (e.g., Braverman et al., 2013; LaPlante et al., 2014); and, (b) have greater involvement in faster, more continuous activities such as slot games (Dragicevic et al., 2011; Hopfgartner et al., 2022b) or in-play sports betting. In general, however, relatively little research has been undertaken to examine how indicators of behavioural risk can be used to identify higher risk products or structural characteristics that might encourage riskier styles of play (e.g., greater variability in betting or chasing). In one of the few exceptionsAuer and Griffiths (2022c) found that many different behavioural variables were significantly associated with increases in bets per session and theoretical loss, but this study did not include any proxy (e.g., exclusion or account closure data) or direct measures of problem gambling or harm (e.g., PGSI).

Principal Findings: Responsible Gambling Features

Most of the studies of RG involve the Auer and Griffiths collaboration. As shown in Table 2, the principal RG categories include: voluntary limits; mandatory limits; pop-ups; messaging; breaks-in-play and voluntary exclusion. All of the studies involving voluntary self-exclusion showed that those who excluded tended to decrease their gambling intensity on at least one measure (whether expenditure, time spent or other measure) (Auer & Griffiths, 2013; Auer et al., 2020, 2021; Broda et al., 2008). Mandatory breaks also appear to lead to decreases in gambling on the same day (Auer & Griffiths, 2022d) (60-minute break) or where the limit was set at 15 min rather than shorter intervals (Hopfgartner et al., 2022a). Pop-up messages were found to lead to increases in the number of sessions terminated early (Auer et al., 2014), personalised communications or feedback (e.g., spend relative to limit) have been associated with subsequent decreases in gambling (Auer & Griffiths, 2022a; Auer et al., 2015a, 2016). Voluntary exclusion has also been associated with reductions in gambling (Catania & Griffiths, 2021; Dragicevic et al., 2015); however, as Catania and Griffiths (2021) caution, such behaviour can sometimes be observed very soon after registration by people who do not gamble at all.

General Discussion

Taken as a whole, this body of work provides many important insights into the nature of online gambling. Expenditure is generally highly concentrated in a very small percentage of participants; most people lose money, but also generally do not spend large amounts. Using various statistical techniques (e.g., cluster, latent class, or machine learning / decision-tree approaches), it is possible to identify a small percentage of higher risk gamblers whose gambling (at least) suggests that they consistently exceed safe gambling limits (e.g., Currie et al., 2008; Dowling et al., 2021) and who are statistically much more likely to show evidence of harm. In a number of studies, this has been inferred through a higher prevalence of proxy measures of harm (e.g., self-exclusions and account closures). A small number of studies have also shown that groups identified as higher risk based on their objective data score in the problematic range on the PGSI (e.g., PWC, 2017). Studies show that these high-risk clusters can be identified based on a range of risk indicators. These extend beyond indicators of gambling intensity (frequency, time and expenditure level) to encompass: differences in depositing behaviour; whether people reverse withdrawals; when people gamble; the range of activities they choose; and, also if they interact with the operator in a way that indicates signs of harm or escalating involvement (e.g., requests to reduce RG limits or obtain additional bonus opportunities). Importantly, the research shows that there may be important dynamic changes which are observable over time which are indicative of higher risk gambling. These include variability in several measures of gambling involvement, the most notable of which may be upward slope trajectories in staking, expenditure and deposit patterns. Such variability in the form of upward slope trajectories may be followed by a steep downward slope or ‘crash’ indicating that further gambling may no longer be economically sustainable (e.g., Adami et al., 2013). Exactly to what extent this variability reflects loss-chasing may depend on how loss-chasing behaviour is defined and over what time scale it is measured.

All of these findings provide an important evidence base that can help support and inform attempts to develop regulatory and industry standards relating to risk detection for online operators. However, it is evident that some decisions would need to be made about how this information can be used to meet the needs of operators and regulators. Findings that are based upon academic research are often retrospective and based on variable coding, offline statistical analysis, and several layers of decision-making often driven by earlier stages of the data-analysis. As a result, it may not always be available in real-time. Accordingly, for researchers who work directly with operators, the answer has been to adopt a more algorithmic or machine-learning approach that tries to capture real-time variables. Examples of this approach are summarised in Percy et al. (2016), Wood and Wohl (2015) and Catania and Griffiths (2022).

Machine-learning and algorithmic approaches differ from more theoretically driven academic approaches in that they are more specifically focused on prediction. All manner of variables (e.g., complex interactions) may be included in models to achieve the best possible predictions and the meaning of these may not always be immediately evident in a theoretical sense (e.g., late night play on a weekday x 5 + wager per hour x increasing bet slope). Such predictive methods may be effective in classifying high risk gamblers, but may not be easy to scrutinise and evaluate. Many of these algorithms may not necessarily use the set of standard risk variables (usually an accumulation of single and definable variables) that academic research has suggested. Thus, an important issue for discussion in this area is whether these are complementary or divergent approaches to the same research problem. If commercial operators are classifying risky gamblers using their own custom algorithms, will these be accepted by the broader academic community or be treated with suspicion if they are difficult to understand?

Limitations of the Existing Evidence Base

Our review also underscores many the gaps and areas where caution needs to be expressed about objective behavioural analyses. Independent validations of objective risk against self-reported risk (e.g., PGSI scores) are rare (e.g., PWC, 2017). Although the studies that have included these validations show promising results, models tend to be unsatisfactory unless they are comparing people classified as problem gamblers vs. non-problem gamblers. Detecting lower or moderate risk gambling and differentiating it from non-problem gambling is harder and this potentially limits the public health benefits of models if the interest is on minimising harm and preventing it. Nevertheless, as Wood and Wohl (2015) show, this does not prevent the use of more graded RG systems that provide interventions and information (e.g., yellow light, red light) to capture the varying levels of risk that might apply to different customers.

A second and related limitation is that few studies have examined how variations in objective behaviour are related to independently assessed measures of harm. Although a number of studies have examined proxy measures of harm (e.g., account closures, declined deposits) or requests for assistance, it would be good to strengthen this work by examining whether people who display certain patterns of behaviour report greater harm associated with gambling, e.g., financial, psychological or in their social relationships.

A third limitation that needs to be addressed is product risk. The vast majority of papers are designed to assist in the identification of higher risk individuals, but operators and regulators may also need guidance in which products and game features need greater attention. Are there populations of product users who should receive greater RG attention, and should regulators be more wary about the expansion or introduction of certain online products and features rather than others? The assessment of product risk is a different research question and may require a focus on different range of risk indicators or, a different emphasise. For example, while individual risk assessments often focus on how people gamble (time, money, variations), this may not necessarily indicate greater product risk. Some activities may be relatively cheap to play at a population level (e.g., slot games), but have a higher risk of harmful play. Thus, the average expenditure per session or player may not always indicate higher product risk per se. For these reasons, studies of product risk suggest that other factors need to be considered. These include: the speed of the game; (Delfabbro et al., 2020); the timing of bets (e.g., in-play vs. pre-match) (Hing et al., 2019); accessibility; the accessibility of activities; the role of promotions and inducements; and, the range of activities utilised (Gainsbury, Angus, & Blaszczynski, 2019).

Third, the review also shows how there can be further score for the expansion of the range of indicators used to identify higher risk individual gambling. So far, much of the focus on assessing the risk of products has been based on whether engagement in certain products is associated with greater gambling intensity (e.g., number of bets or theoretical loss) (Auer & Griffiths, 2022b) or exceeding low-risk gambling limits (Brosowski et al., 2012), but such work could be expanded to include a wider range of indictors, even when markers are harder to define and measure (e.g., chasing), or are less frequently observed in the population of players (e.g., declined deposits) as these atypical indicators may prove useful for grading risk at the more extreme end of the spectrum.

Fourth, in conducing this review, we acknowledge the broader limitations of objective data studies: sample representativeness, account usage, and, competing activities. Those who gamble online are usually more likely to be male, younger, highly educated or have higher incomes than other gamblers (see Gainsbury, 2012; Hing et al., 2022), so that findings cannot be generalised to other land-based forms of gambling. Studies can also not control for shared use of account, the use of accounts by different operators. Moreover, without self-report survey data, one does not know if people’s problems may be, at least in part, caused by concomitant land-based gambling activities.

Finally, it should be acknowledged that research in this area is likely to be improved through greater collaboration and transparency in the sharing of objective data, analytical techniques and replication of results across different gambling markets, countries and methodological approaches. For example, greater convergence of findings and advancement of insights may result from the development of consistent definitions of key variables (e.g., chasing), sharing of methodological approaches and data, and collaboration between researchers, industry groups and regulators (Delfabbro et al., 2021).

Conclusion

In conclusion, our review shows that considerable progress has been in online gambling research. Objective data-analysis has an important place in the field of gambling studies and shows considerable potential as a way to capture the behaviour of online gamblers, different levels of risk, and the potential of online responsible gambling initiatives. Important future developments include the further consolidation and standardisation of behavioural indicators, including their definition and measurement, as well as the independent validation of risk models against other sources of data that captures the use of other online operators as well as engagement in land-based gambling. It is also hoped that additional work will be undertaken to understand how indicators can be used to profile the risk of different gambling products to provide regulatory guidance on what products may be “safer” or riskier for players.

Notes

The authors acknowledge that there are many studies which have gained access to data from land-based operators (e.g., in the UK and Australia). However, the principal focus of this paper is on online data analysis.

References

Adami, N., Benini, S., Boschetti, A., Canini, L., Maione, F., & Temporin, M. (2013). Markers of unsustainable gambling for early detection of at-risk online gamblers. International Gambling Studies, 13(2), 188–204. https://doi.org/10.1080/14459795.2012.754919

Auer, M., & Griffiths, M. D. (2013). Voluntary Limit setting and Player Choice in most intense online gamblers: An empirical study of Gambling Behaviour. Journal of Gambling Studies, 29(4), 647–660. https://doi.org/10.1007/s10899-012-9332-y

Auer, M., & Griffiths, M. D. (2014). An empirical investigation of theoretical loss and gambling intensity. Journal of Gambling Studies, 30(4), 879–887. https://doi.org/10.1007/s10899-013-9376-7

Auer, M., & Griffiths, M. D. (2015a). Theoretical loss and gambling intensity (revisited): A response to Braverman et al. (2013). Journal of Gambling Studies, 31(3), 921–931. https://doi.org/10.1007/s10899-014-9463-4

Auer, M. M., & Griffiths, M. D. (2015b). The use of personalized behavioral feedback for online gamblers: an empirical study. Frontiers in Psychology, 6, art. no. 1406, https://doi.org/10.3389/fpsyg.2015.01406

Auer, M. M., & Griffiths, M. D. (2016). Personalized behavioral feedback for online gamblers: A real world empirical study. Frontiers in Psychology, 7(NOV), artno1875. https://doi.org/10.3389/fpsyg.2016.01875

Auer, M., & Griffiths, M. D. (2017). Self-reported losses Versus actual losses in Online Gambling: An empirical study. Journal of Gambling Studies, 33(3), 795–806. https://doi.org/10.1007/s10899-016-9648-0

Auer, M., & Griffiths, M. D. (2022a). The impact of Personalized Feedback Interventions by a Gambling Operator on subsequent Gambling expenditure in a sample of dutch online gamblers. Journal of Gambling Studies. https://doi.org/10.1007/s10899-022-10162-2

Auer, M., & Griffiths, M. D. (2022b). Attitude towards Deposit limits and relationship with their account-based data among a sample of german online slots players. Journal of Gambling Studies. https://doi.org/10.1007/s10899-022-10155-1

Auer, M., & Griffiths, M. D. (2022c). The relationship between structural characteristics and gambling behaviour: An online gambling player tracking study. Journal of Gambling Studies. https://doi.org/10.1007/s10899-022-10115-9

Auer, M., & Griffiths, M. D. (2022d). The Effect of a mandatory play break on subsequent gambling behavior among british online casino players: A large-scale real-world study. Journal of Gambling Studies. https://doi.org/10.1007/s10899-022-10113-x

Auer, M., & Griffiths, M. D. (2022e). Using artificial intelligence algorithms to predict self-reported problem gambling with account-based player data in an online casino setting. Journal of Gambling Studies. https://doi.org/10.1007/s10899-022-10139-1

Auer, M., & Griffiths, M. D. (2022f). An empirical attempt to operationalize chasing losses in Gambling utilizing account-based player Tracking Data. Journal of Gambling Studies. https://doi.org/10.1007/s10899-022-10144-4

Auer, M., Malischnig, D., & Griffiths, M. (2014). Is “pop-up” messaging in online slot machine gambling effective as a responsible gambling strategy? Journal of Gambling Issues, 29(10), 1–10. https://doi.org/10.4309/jgi.2014.29.3

Auer, M., Hopfgartner, N., & Griffiths, M. D. (2020). The Effects of Voluntary Deposit Limit-Setting on long-term online gambling expenditure. Cyberpsychology Behavior and Social Networking, 23(2), 113–118. https://doi.org/10.1089/cyber.2019.0202

Auer, M., Hopfgartner, N., & Griffiths, M. D. (2021). An empirical study of the Effect of Voluntary Limit-Setting on gamblers’ loyalty using behavioural Tracking Data. International Journal of Mental Health and Addiction, 19(6), 1939–1950. https://doi.org/10.1007/s11469-019-00084-3

Blaszczynski, A., Ladouceur, R., Goulet, A., & Savard, C. (2006). How much do you spend gambling?” Ambiguities in questionnaire items assessing expenditure. International Gambling Studies, 6(2), 123–128. https://doi.org/10.1080/14459790600927738

Braverman, J., LaBrie, R. A., & Shaffer, H. J. (2011). A taxometric analysis of actual internet sports gambling behavior. Psychological Assessment, 23, 234–244. https://doi.org/10.1037/a0021404

Braverman, J., & Shaffer, H. J. (2012). How do gamblers start gambling: Identifying behavioural markers for high-risk internet gambling. The European Journal of Public Health, 22(2), 273–278.

Braverman, J., Laplante, D. A., Nelson, S. E., & Shaffer, H. J. (2013). Using cross-game behavioral markers for early identification of high-risk internet gamblers. Psychology of Addictive Behaviors, 27(3), 868–877. https://doi.org/10.1037/a0032818

Braverman, J., Tom, M. A., & Shaffer, H. J. (2014). Accuracy of self-reported versus actual online gambling wins and losses. Psychological assessment, 26(3), 865–877. https://doi.org/10.1037/a0036428

Broda, A., LaPlante, D. A., Nelson, S. E., LaBrie, R. A., Bosworth, L. B., & Shaffer, H. J. (2008). Virtual harm reduction efforts for internet gambling: Effects of deposit limits on actual internet sports gambling behavior. Harm Reduction Journal, 5, artno27. https://doi.org/10.1186/1477-7517-5-27

Brosowski, T., Meyer, G., & Hayer, T. (2012). Analyses of multiple types of online gambling within one provider: An extended evaluation framework of actual online gambling behaviour. International Gambling Studies, 12(3), 405–419. https://doi.org/10.1080/14459795.2012.698295

Browne, M., Langham, E., Rawat, V., Greer, N., Li, E., Rose, J., Rockloff, M., Donaldson, P., Thorne, H., Goodwin, B., Bryden, G., & Best, T. (2016). Assessing gambling-related harm in Victoria: A public health perspective. Melbourne: Victorian Responsible Gambling Foundation.

Catania, M., & Griffiths, M. D. (2021). Understanding online voluntary self-exclusion in gambling: An empirical study using account-based behavioral tracking data. International Journal of Environmental Research and Public Health, 18 (4), art. no. 2000, 1–11. https://doi.org/10.3390/ijerph18042000

Catania, M., & Griffiths, M. D. (2022). Applying the DSM-5 criteria for Gambling Disorder to Online Gambling Account-Based Tracking Data: An empirical study utilizing cluster analysis. Journal of Gambling Studies, 38(4), 1289–1306. https://doi.org/10.1007/s10899-021-10080-9

Challet-Bouju, G., Hardouin, J. B., Thiabaud, E., Saillard, A., Donnio, Y., Grall-Bronnec, M., & Perrot, B. (2020). Modeling early gambling behavior using indicators from online lottery gambling tracking data: Longitudinal analysis. Journal of Medical Internet Research, 22(8), art. no. e17675. https://doi.org/10.2196/17675

Chen, Z., Doekemeijer, R. A., Noel, X., & Verbruggen, F. (2022). Winning and losing in online gambling: Effects on within-session chasing. PLoS ONE, 17 (8 August), art. no. e0273359. https://doi.org/10.1371/journal.pone.0273359

Currie, S., Hodgins, D., Wang, J., el-Guebaly, N., & Wynne, H. (2008). Pursuit of empirically based responsible gambling limits. International Gambling Studies, 8, 207–227. https://doi.org/10.1080/14459790802172265

Delfabbro, P., King, D. L., Browne, M., & Dowling, N. A. (2020). Do EGMs have a stronger association with Problem Gambling than Racing and Casino Table Games? Evidence from a decade of australian prevalence studies. Journal of Gambling Studies, 36(2), 499–511. https://doi.org/10.1007/s10899-020-09950-5

Delfabbro, P., Parke, J., Dragecvic, S., Percy, C., & Bayliss, R. (2021). Safer by design: Building a collaborative, integrated and evidence-based framework to inform the regulation and mitigation of gambling product risk. Journal of Gambling Issues, 48(48), 158–201.

Dowling, N. A., Greenwood, C. J., Merkouris, S. S., Youssef, G. J., Browne, M., Rockloff, M., & Myers, P. (2021). The identification of australian low-risk gambling limits: A comparison of gambling-related harm measures. Journal of Behavioral Addictions, 10(1), 21–34. https://doi.org/10.1556/2006.2021.00012

Dragicevic, S., Tsogas, G., & Kudic, A. (2011). Analysis of casino online gambling data in relation to behavioural risk markers for high-risk gambling and player protection. International Gambling Studies, 11(3), 377–391. https://doi.org/10.1080/14459795.2011.629204

Dragicevic, S., Percy, C., Kudic, A., & Parke, J. (2015). A descriptive analysis of demographic and behavioral data from internet gamblers and those who self-exclude from online gambling platforms. Journal of Gambling Studies, 31(1), 105–132.

Finkenwirth, S., MacDonald, K., Deng, X., Lesch, T., & Clark, L. (2021). Using machine learning to predict self-exclusion status in online gamblers on the PlayNow.com platform in British Columbia. International Gambling Studies, 21(2), 220–237. https://doi.org/10.1080/14459795.2020.1832132

Forrest, D. (2022). In I. McHale (Ed.), Patterns of play (Technical report., 2 vol.). GambleAware. Account data stage.

Gainsbury, S. (2011). Player account-based gambling: Potential for behaviour based research methodologies. International Gambling Studies, 11(2), 153–171. https://doi.org/10.1080/14459795.2011.571217

Gainsbury, S. (2012). ). Internet gambling: Current research findings and implications. Springer.

Gainsbury, & Russell, S. M., A (2015). Betting patterns for sports and races: A longitudinal analysis of Online Wagering in Australia. Journal of Gambling Studies, 31(1), 17–32. https://doi.org/10.1007/s10899-013-9415-4

Gainsbury, S. M., Angus, D. J., & Blaszczynski (2019). Isolating the impact of specific gambling activities and modes on problem gambling and psychological distress in internet gamblers. Bmc Public Health, 19, 1372. https://doi.org/10.1186/s12889-019-7738-5

Gray, H. M., Laplante, D. A., & Shaffer, H. J. (2012). Behavioral characteristics of internet gamblers who trigger corporate responsible gambling interventions. Psychology of Addictive Behaviors, 26(3), 527–535. https://doi.org/10.1037/a0028545

Gray, H. M., Jónsson, G. K., LaPlante, D. A., & Shaffer, H. J. (2015). Expanding the study of internet gambling behavior: Trends within the Icelandic lottery and sportsbetting platform. Journal of Gambling Studies, 31 (2), art. no. A006, pp. 483–499. https://doi.org/10.1007/s10899-013-9427-0

Griffiths, M. D., & Whitty, M. W. (2010). Online behavioural tracking in internet gambling research: Ethical and methodological issues. International Journal of Internet Research Ethics, 3, 104–117.

Haefeli, J., Lischer, S., & Schwarz, J. (2011). Early detection items and responsible gambling features for online gambling. International Gambling Studies, 11(3), 273–288. https://doi.org/10.1080/14459795.2011.604643

Haeusler, J. (2016). Follow the money: Using payment behaviour as predictor for future self-exclusion. International Gambling Studies, 16(2), 246–262.

Heirene, R. M., Wang, A., & Gainsbury, S. M. (2022). Accuracy of self-reported gambling frequency and outcomes: Comparisons with account data. Psychology of Addictive Behaviors, 36(4), 333–346. https://doi.org/10.1037/adb0000792

Hing, N., Russell, A. M. T., Thomas, A., & Jenkinson, R. (2019). Wagering advertisements and inducements: Exposure and perceived influence on betting behaviour. Journal of Gambling Studies, 35(3), 793–811. https://doi.org/10.1007/s10899-018-09823-y

Hing, N., Russell, A. M. T., Black, A., Rockloff, M., Browne, M., Rawat, V., Greer, N., Stevens, M., Dowling, N. A., Merkouris, S., King, D. L., Salonen, A. H., Breen, H., & Woo, L. (2022). Gambling prevalence and gambling problems amongst land-based-only, online-only and mixed-mode gamblers in Australia: A national study. Computers in Human Behavior, 132, 107269. https://doi.org/10.1016/j.chb.2022.107269

Hopfgartner, N., Auer, M., Santos, T., Helic, D., & Griffiths, M. D. (2022a). The Effect of Mandatory Play breaks on subsequent Gambling Behavior among Norwegian Online Sports Betting, Slots and Bingo Players: A large-scale Real World Study. Journal of Gambling Studies, 38(3), 737–752. https://doi.org/10.1007/s10899-021-10078-3

Hopfgartner, N., Auer, M., Griffiths, M. D., & Helic, D. (2022b). Predicting self-exclusion among online gamblers: An empirical real-world study. Journal of Gambling Studies. https://doi.org/10.1007/s10899-022-10149-z

Ivanova, E., Magnusson, K., & Carlbring, P. (2019). Deposit limit prompt in online gambling for reducing gambling intensity: A randomized controlled trial. Frontiers in Psychology, 10(MAR), artno639. https://doi.org/10.3389/fpsyg.2019.00639

Jackson, A.C., Pennay, D., Dowling, N.A., Coles-Janess, H., & Christensen, D.R. (2014). Improving Gambling Survey Research Using Dual-Frame Sampling of Landline and Mobile Phone Numbers. Journal of Gambling Studies, 30, 291–307. https://doi.org/10.1007/s10899-012-9353-6

Kainulainen, T. (2021). Does losing on a previous Betting Day Predict how long it takes to return to the Next Session of Online Horse Race Betting? Journal of Gambling Studies, 37(2), 609–622. https://doi.org/10.1007/s10899-020-09974-x

Korn, D., & Shaffer, H. (1999). Gambling and the health of the public: Adopting a public health perspective. Journal of Gambling Studies, 15, 289–365.

Labrie, R., & Shaffer, H. J. (2011). Identifying behavioral markers of disordered internet sports gambling. Addiction Research and Theory, 19(1), 56–65. https://doi.org/10.3109/16066359.2010.512106

LaBrie, R., LaPlante, D., Nelso, S. E., Schumann, A., & Shaffer, H. J. (2007). Assessing the playing field: A prospective longitudinal study of internet sports. Journal of Gambling Studies, 23, 347–362.

LaBrie, R. A., Kaplan, S., LaPlante, D., Nelson, S. E., & Shaffer, H. J. (2008). Inside the virtual casino: A prospective longitudinal study of actual internet casino gambling. European Journal of Public Health, 18(4), 410–416. https://doi.org/10.1093/eurpub/ckn021

LaPlante, D., Kleschinsky, J., LaBrie, R., Nelson, S. E., & Shaffer, H. J. (2009). Sitting at the virtual poker table: A prospective epidemiological study of actual internet poker gambling behavior. Computers in Human Behavior, 25(3), 711–717.

LaPlante, D. A., Nelson, S. E., & Gray, H. M. (2014). Breadth and depth involvement: Understanding internet gambling involvement and its relationship to gambling problems. Psychology of Addictive Behaviors, 28(2), 396–403. https://doi.org/10.1037/a0033810

Louderback, E. R., LaPlante, D. A., Currie, S. R., & Nelson, S. E. (2021). Developing and validating lower risk online gambling thresholds with actual bettor data from a major internet gambling operator. Psychology of Addictive Behaviors, 35(8), 921–938. https://doi.org/10.1037/adb0000628

Luquiens, A., Tanguy, M. L., Benyamina, A., Lagadec, M., Aubin, H. J., & Reynaud, M. (2016). Tracking online poker problem gamblers with player account-based gambling data only. International Journal of Methods in Psychiatric Research, 25(4), 333–342.

Luquiens, A., Dugravot, A., Panjo, H., Benyamina, A., Gaïffas, S., & Bacry, E. (2019). Self-exclusion among online poker gamblers: Effects on expenditure in time and money as compared to matched controls. International Journal of Environmental Research and Public Health, 16 (22), art. no. 4399, https://doi.org/10.3390/ijerph16224399

Ma, X., Kim, S. H., & Kim, S. S. (2014). Online gambling behavior: The impacts of cumulative outcomes, recent outcomes, and prior use. Information Systems Research, 25(3), 511–527. https://doi.org/10.1287/isre.2014.0517

McAuliffe, W. H. B., Louderback, E. R., Edson, T. C., LaPlante, & Nelson, D. A., S.E (2022). Using “Markers of Harm” to Track Risky Gambling in two cohorts of Online Sports Bettors. Journal of Gambling Studies, 38(4), 1337–1369. https://doi.org/10.1007/s10899-021-10097-0

Nelson, S. E., LaPlante, D. A., Peller, A. J., Schumann, A., LaBrie, R. A., & Shaffer, H. J. (2008). Real limits in the virtual world: Self-limiting behavior of internet gamblers. Journal of Gambling Studies, 24(4), 463–477. https://doi.org/10.1007/s10899-008-9106-8

Nelson, S. E., Edson, T. C., Louderback, E. R., Tom, M. A., Grossman, A., & Laplante, D. A. (2022). Changes to the playing field: A contemporary study of actual european online sports betting. Journal of Behavioral Addictions. https://doi.org/10.1556/2006.2021.00029

Percy, C., França, M., Dragičević, S., & d’Avila Garcez, A. (2016). Predicting online gambling self-exclusion: An analysis of the performance of supervised machine learning models. International Gambling Studies, 16(2), 193–210. https://doi.org/10.1080/14459795.2016.1151913

Peres, F., Fallacara, E., Manzoni, L., Castelli, M., Popovič, A., Rodrigues, M., & Estevens, P. (2021). Time series clustering of online gambling activities for addicted users’ detection. Applied Sciences (Switzerland), 11 (5), art. no. 2397. https://doi.org/10.3390/app11052397

Perrot, B., Hardouin, J. B., Grall-Bronnec, M., & Challet-Bouju, G. (2018). Typology of online lotteries and scratch games gamblers’ behaviours: A multilevel latent class cluster analysis applied to player account-based gambling data. International Journal of Methods in Psychiatric Research, 27 (4), art. no. e1746, https://doi.org/10.1002/mpr.1746

Perrot, B., Hardouin, J. B., Thiabaud, E., Saillard, A., Grall-Bronnec, M., & Challet-Bouju, G. (2022). Development and validation of a prediction model for online gambling problems based on players’ account data. Journal of Behavioral Addictions, 11(3), 874–889. https://doi.org/10.1556/2006.2022.00063

Pickering, D., & Blaszczynski, A. (2021). Paid online convenience samples in gambling studies: Questionable data quality. International Gambling Studies, 21(3) Advance online publication. https://doi.org/10.1080/14459795.2021.1884735

Price-Waterhouse Coopers. (2017). Remote gambling research. Interim report on phase II. GambleAware.

Productivity Commission. (1999). Australia’s gambling industries. Productivity Commission.

Remote Betting Association (RBA) (2018). Behavioural analytics: RGA good practice guidelines. www.rga.edu.com.Accessed5/1/23

Schottler Consulting. (2020). What is the impact of cashless gaming on gambling behaviour and harm? Victorian Responsible Gambling Foundation.

Shaffer, H. J., Peller, A. J., LaPlante, D. A., Nelson, S. E., & LaBrie, R. A. (2010). Toward a paradigm shift in internet gambling research: From opinion and self-report to actual behavior. Addiction Research and Theory, 18, 270–283.

Tom, M. A., & Shaffer, H. J. (2016a). Devil in the details: A critical review of “theoretical loss. Journal of Gambling Studies, 32(3), 865–875.

Tom, M. A., & Shaffer, H. J. (2016b). Devil in the details: A critical review of “theoretical loss. Journal of Gambling Studies, 32(3), 865–875.

Ukhov, I., Bjurgert, J., Auer, M., & Griffiths, M. D. (2021). Online Problem Gambling: A comparison of Casino Players and Sports Bettors via Predictive modeling using behavioral Tracking Data. Journal of Gambling Studies, 37(3), 877–897. https://doi.org/10.1007/s10899-020-09964-z

Whiteford, S., Hoon, A. E., James, R., Tunney, R., & Dymond, S. (2022). Quantile regression analysis of in-play betting in a large online gambling dataset. Computers in Human Behavior Reports, 6, art. no. 100194, https://doi.org/10.1016/j.chbr.2022.100194

Wood, R. T. A., & Wohl, M. J. A. (2015). Assessing the effectiveness of a responsible gambling behavioural feedback tool for reducing the gambling expenditure of at-risk players. International Gambling Studies, 15(2), 1–16. https://doi.org/10.1080/14459795.2015.1049191

Xuan, Z., & Shaffer, H. (2009). How do gamblers end gambling: Longitudinal analysis of internet gambling behaviors prior to account closure due to gambling related problems. Journal of Gambling Studies, 25(2), 239–252. https://doi.org/10.1007/s10899-009-9118-z

Funding

Open Access funding enabled and organized by CAUL and its Member Institutions. This paper was prepared as part of a broader product risk project involving Kindred Group which has sponsored the private consulting business Sophro Ltd (JP) and associated sub-contacted work (PD). The work has been undertaken independently without inference or prejudice as would be the case with any other review prepared for an academic journal.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

MC has worked within the gambling industry.

Paul Delfabbro

I have received funding for research, support for conference travel and speaking engagements from government and non-government research bodies such as AGRI, VRGF, IAGR and the Department of Consumer Affairs, GambleAware/ RGT, Gambling Research Australia, Independent Gambling Authority, the ARC, NHMRC, Channel 7 Children’s Foundation and Australian Institute of Criminology. I have conducted paid consultancy work on responsible gambling for regulatory bodies, government, peak bodies and industry groups (e.g., reviews of indicators, standard of player protection, product risk assessment). I acknowledge that many peak research bodies are indirectly funded by industry through levies or contributions.

Jonathan Parke

Jonathan has received support for research, travel and speaking engagements from a variety of government and non-government sources including AGRI and GambleAware. He has conducted a number of commissioned reports for industry groups. The principal focus of this work has been on harm minimisation, responsible gambling and risk associated with different gambling products and features.

Maris Catania

Maris has been employed by the Kindred Group in roles involving research, player protection, risk assessment and responsible gambling.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Delfabbro, P., Parke, J. & Catania, M. Behavioural Tracking and Profiling Studies Involving Objective Data Derived from Online Operators: A Review of the Evidence. J Gambl Stud (2023). https://doi.org/10.1007/s10899-023-10247-6

Accepted:

Published:

DOI: https://doi.org/10.1007/s10899-023-10247-6