Abstract

This paper examines the evolution of unemployment in a task-based model that allows for two types of technical change. One is automation, which turns labor tasks into mechanized ones. The second is addition of new labor tasks, which increases specialization, as in the expanding variety literature. The paper shows that in equilibrium the unemployment caused by automation converges to zero over time.

Similar content being viewed by others

Notes

See the empirical survey in Sect. 5.4.

The demand for labor increases in their paper because the new tasks are more productive than the old.

This simplifying assumption implies that a period is quite long, around 30 years.

This assumption is also plausible empirically, see Bloom et al. (2020).

We also show below in Sect. 5.4 that the main result of the paper does not depend on the specific assumptions on saving, namely on the OLG structure and on the utility in (2).

This assumption is made both for its realism and it also makes the equilibrium less messy, as it reduces the cases of structural unemployment, which is defined below and is not the main focus of the paper.

The model identifies labor tasks and jobs. In the real world, a job might consist of a number of tasks, so that automation might not always lead to a job loss. Actually, this would further strengthen our main result.

See Mortensen and Pissarides (1999) for a survey of this literature.

Note, that in an infinite horizon model, we would have to introduce a third type of unemployment, of people who need to enter a new task, and must leave their previous task for a whole period to learn the new one. This would complicate the model, so it further supports our choice of an OLG model.

See Basso and Jimeno (2021) for empirical support for this result.

See Parisi et al. (2006).

See Bogliacino et al. (2012), Vivarelli (2012), Hall et al. (2008) and Harrison et al. (2014) for a strong effect of product innovation on employment, while a negative effect for process innovation. Lachenmaier and Rottmann (2011) find a strong positive employment effect of process innovation as well, as found by Fukao et al. (2017).

See Dauth et al. (2021).

Graetz and Michaels (2017, 2018), find that the effect of industrial robots on employment differs by country. Bessen (2019) rules out the possibility that automation is a major cause of unemployment. Using Italian data, Dottori (2021) finds that the effect of robots on employment is insignificant. Mann and Püttermann (2023) find a positive correlation between automation and employment.

A recent paper on automation by Ray and Mookherjee (2022) finds that the share of labor can converge to zero. However, it differs from ours in its technology assumptions, as it does not have growth of tasks.

Merriam-Webster defines automation as a “system by mechanical or electronic devices that take the place of human labor.”

Except for the 15 years of the Great Depression and WWII. See Jones (2016).

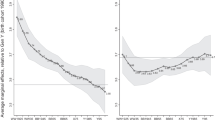

Period 1 is 1685–1715, period 5 is 1805–1835 and period 12 is 2015–2045.

See Hrdy (2019) for an analysis of such a proposal.

References

Acemoglu, D. (2010). When does labor scarcity encourage innovation? Journal of Political Economy, 118(6), 1037–1078. https://doi.org/10.1086/658160

Acemoglu, D., & Restrepo, P. (2018). The race between man and machine: Implications of technology for growth, factor shares and employment. American Economic Review, 108(6), 1488–1542. https://doi.org/10.1257/aer.20160696

Acemoglu, D., & Restrepo, P. (2019). Artificial intelligence, automation and work. In A. Agrawal, J. Gans, & A. Goldfarb (Eds.), The economics of artificial intelligence: An agenda (Chapter 8) (pp. 197–236). Chicago: University of Chicago Press. https://doi.org/10.7208/chicago/9780226613475.001.0001

Acemoglu, D., & Restrepo, P. (2020). Robots and jobs: Evidence from US labor markets. Journal of Political Economy, 128(6), 2188–2244. https://doi.org/10.1086/705716

Acemoglu, D., & Restrepo, P. (2022). Demographics and automation. Review of Economic Studies, 89(1), 1–44. https://doi.org/10.1093/restud/rdab031

Aghion, P., & Howitt, P. (1992). A model of growth through creative destruction. Econometrica, 60(2), 323–351. https://doi.org/10.2307/2951599

Aghion, P., Jones, B. F., & Jones, C. I. (2019). Artificial intelligence and economic growth. In A. Agrawal, J. Gans, & A. Goldfarb (Eds.), The economics of artificial intelligence: An agenda (pp. 237–282). Chicago: University of Chicago Press. https://doi.org/10.7208/chicago/9780226613475.001.0001

Ahituv, A., & Zeira, J. (2011). Technical progress and early retirement. Economic Journal, 121(551), 171–193. https://doi.org/10.1111/j.1468-0297.2010.02392.x

Alesina, A., Battisti, M., & Zeira, J. (2018). Technology and labor regulations: Theory and evidence. Journal of Economic Growth, 23(1), 41–78. https://doi.org/10.1007/s10887-017-9146-y

Autor, D. H., & Salomons, A. (2018). Is automation labor-displacing? Productivity growth, employment and the labor share. NBER working papers no. 24871. https://doi.org/10.3386/w24871

Autor, D. H. (2015). Why are there still so many jobs? The history and future of workplace automation. Journal of Economic Perspectives, 29(3), 3–30. https://doi.org/10.1257/jep.29.3.3

Autor, D. H., Dorn, D., Katz, L. F., Patterson, C., & Van Reenen, J. (2020). The fall of the labor share and the rise of superstar firms. Quarterly Journal of Economics, 135(2), 645–709. https://doi.org/10.1093/qje/qjaa004

Barkai, S. (2020). Declining labor and capital shares. Journal of Finance, 75(5), 2421–2463. https://doi.org/10.1111/jofi.12909

Bartel, A. P., & Sicherman, N. (1993). Technological change and retirement. Journal of Labor Economics, 11(1), 162–183. https://doi.org/10.1086/298321

Basso, H. S., & Jimeno, J. F. (2021). From secular stagnation to robocalypse? Journal of Monetary Economics, 117(C), 833–847. https://doi.org/10.1016/j.jmoneco.2020.06.004

Benmelech, E., Bergman, N., & Kim, H. (2022). Strong employers and weak employees: How does employer concentration affect wages? Journal of Human Resources, 57(1), S200–S250. https://doi.org/10.3368/jhr.monopsony.0119-10007R1

Berg, A., Buffie, E. F., & Zanna, L. F. (2018). Should we fear the robot revolution? (The correct answer is yes). Journal of Monetary Economics, 97(C), 117–148. https://doi.org/10.1016/j.jmoneco.2018.05.014

Bessen, J., Goos, M., Salomons, A., & Van den Berge, W. (2020). Automation: A guide for policymakers. In Economic studies at brookings. https://www.brookings.edu/wp-content/uploads/2020/01/Bessen-et-al_Full-report.pdf

Bessen, J. (2019). Automation and jobs: When technology boosts employment. Economic Policy, 34(100), 589–626. https://doi.org/10.1093/epolic/eiaa001

Blanas, S., Gancia, G., & Lee, S. Y. (2018). Who is afraid of machines? Economic Policy, 34(100), 627–690. https://doi.org/10.1093/epolic/eiaa005

Bloom, N., Jones, C. I., Van Reenan, J., & Webb, M. (2020). Are ideas getting harder to find? American Economic Review, 110(4), 1104–1144. https://doi.org/10.1257/aer.20180338

Bogliacino, F., Piva, M., & Vivarelli, M. (2012). R&D and employment: An application of the LSDVC estimator using European microdata. Economic Letters, 116(1), 56–59. https://doi.org/10.1016/j.econlet.2012.01.010

Casey, G. (2019). Growth, unemployment, and labor-saving technical change. From Technology-Driven Unemployment (repec.org).

Champernowne, D. (1961). A dynamic growth model involving a production function. In F. A. Lutz & D. C. Hague (Eds.), The theory of capital (pp. 223–244). London: MacMillan Press.

Charalampidis, N. (2020). The U.S. labor income share and automation shocks. Economic Inquiry, 58(1), 294–318. https://doi.org/10.1111/ecin.12829

Chuah, L. L., Loayza, N. V., & Schmillen, A. D. (2018). The future of work: Race with—not against—the machine. SSRN No.3400509. https://doi.org/10.2139/ssrn.3400509

Cords, D., & Prettner, K. (2022). Technological unemployment revisited: Automation in a search and matching framework. Oxford Economic Papers, 74(1), 115–135. https://doi.org/10.1093/oep/gpab022

Cortes, G. M., Jaimovich, N., & Siu, H. (2017). Disappearing routine jobs: Who, how, and why? Journal of Monetary Economics, 91(C), 69–87. https://doi.org/10.1016/j.jmoneco.2017.09.006

Dauth, W., Findeisen, S., Suedekum, J., & Woessner, N. (2021). The adjustment of labor markets to robots. Journal of the European Economic Association, 19(6), 3104–3153. https://doi.org/10.1093/jeea/jvab012

Dechezleprêtre, A., Hémous, D., Olsen, M., & Zanella, C. (2020). Automating labor: Evidence from firm-level patent data. SSRN No.350783. From https://doi.org/10.2139/ssrn.3508783

Dixit, A. K., & Stiglitz, J. E. (1977). Monopolistic competition and optimum product diversity. The American Economic Review, 67(3), 297–308. https://doi.org/10.7916/D8S75S91

Dottori, D. (2021). Robots and employment: Evidence from Italy. Economia Politica, 38(2), 739–795. https://doi.org/10.1007/s40888-021-00223-x

Eden, M., & Gaggl, P. (2018). On the welfare implications of automation. Review of Economic Dynamics, 29, 15–43. https://doi.org/10.1016/j.red.2017.12.003

Edin, P. A., Evans, T., Graetz, G., Hernnäs, S., & Michaels, G. (2019). Individual consequences of occupational decline. Economic Journal, 133(654), 2178–2209. https://doi.org/10.1093/ej/uead027

Ford, M. (2015). Rise of the robots: Technology and the threat of a jobless future. New York: Basic Books.

Fukao, K., Ikeuchi, K., Kim, Y. G., & Kwon, H. U. (2017). Innovation and employment growth in Japan: Analysis based on microdata from the basic survey of Japanese business structure and activities. Japanese Economic Review, 68(2), 200–216. https://doi.org/10.1111/jere.12146

Gomes, O. (2019). Growth in the age of automation: Foundations of a theoretical framework. Metroeconomica, 70(1), 77–97. https://doi.org/10.1111/meca.12229

Goos, M., Manning, A., & Salomons, A. (2014). Explaining job polarization: Routine-biased technological change and offshoring. American Economic Review, 104(8), 2509–2526. https://doi.org/10.1257/aer.104.8.2509

Graetz, G., & Michaels, G. (2017). Is modern technology responsible for jobless recoveries? American Economic Review, 107(5), 168–173. https://doi.org/10.1257/aer.p20171100

Graetz, G., & Michaels, G. (2018). Robots at work. Review of Economics and Statistics, 100(5), 753–768. https://doi.org/10.1162/rest_a_00754

Gregory, T., Salomons, A., & Zierhan, U. (2022). Racing with or against the machine? Evidence on the role of trade in Europe. Journal of European Economic Association, 20(2), 869–906. https://doi.org/10.1093/jeea/jvab040

Grossman, G. M., & Helpman, E. (1991). Innovation and growth in the global economy. Cambridge: MIT Press.

Hall, B. H., Lotti, F., & Mairesse, J. (2008). Employment, innovation, and productivity: Evidence from Italian microdata. Industrial and Corporate Change, 17(4), 813–839. https://doi.org/10.1093/icc/dtn022

Harrison, R., Jaumandreu, J., Mairesse, J., & Peters, B. (2014). Does innovation stimulate employment? A firm-level analysis using comparable micro-data from four European countries. International Journal of Industrial Organization, 35(1), 29–43. https://doi.org/10.1016/j.ijindorg.2014.06.001

Hémous, D., & Olsen, M. (2022). The rise of the machines: Automation, horizontal innovation and income inequality. American Economic Journal: Macroeconomics, 14(1), 179–223. https://doi.org/10.1257/mac.20160164

Hrdy, C. A. (2019). Intellectual property and the end of work. Florida Law Review, 71(2), 303–363.

Jones, B. F., & Liu, X. (2022). A framework for economic growth with capital-embodied technical change. In NBER working papers No 30459. https://doi.org/10.3386/w30459

Jones, C. I. (2016). The facts of economic growth. In J. B. Taylor & H. Uhlig (Eds.), Handbook of macroeconomics (Chapter 1) (Vol. 2, pp. 3–69). New York: Elsevier. https://doi.org/10.1016/bs.hesmac.2016.03.002

Kaldor, N. (1961). Capital accumulation and economic growth. In F. A. Lutz & D. C. Hague (Eds.), The theory of capital (pp. 177–222). London: MacMillan Press.

Karabarbounis, L., & Neiman, B. (2014). The global decline of the labor share. Quarterly Journal of Economics, 129(1), 61–103. https://doi.org/10.1093/qje/qjt032

Keynes, J. M. (2010). Economic possibilities for our grandchildren. In J. M. Keynes (Ed.), Essays in persuasion (pp. 321–332). London: Palgrave Macmillan. https://doi.org/10.1007/978-1-349-59072-8_25

Lachenmaier, S., & Rottmann, H. (2011). Effects of innovation on employment: A dynamic panel analysis. International Journal of Industrial Organization, 29(1), 210–220. https://doi.org/10.1016/j.ijindorg.2010.05.004

Lerch, B. (2022). Robots and non-participation in the US: Where have all the workers gone? SSRN No. 3650905. https://doi.org/10.2139/ssrn.3650905

Lin, J. (2011). Technological adaptation, cities, and new work. Review of Economics and Statistics, 93(2), 554–574. https://doi.org/10.1162/REST_a_00079

Mann, K., & Püttermann, L. (2023). Benign effect of automation: New evidence from patent texts. Review of Economics and Statistics, 105(3), 562–579. https://doi.org/10.1162/rest_a_01083

Martinez, J. (2018). Automation, growth and factor shares. Meeting Papers 736, Society for Economic Dynamics. Available from Automation, Growth and Factor Shares (repec.org).

Mokyr, J., Vickers, C., & Ziebarth, N. L. (2015). The History of technological anxiety and the future of economic growth: Is this time different? Journal of Economic Perspectives, 29(3), 31–50. https://doi.org/10.1257/jep.29.3.31

Mortensen, D. T., & Pissarides, C. A. (1999). New developments in models of search in the labor market. In O. C. Ashenfelter & D. Card (Eds.), Handbook of labor economics (Part B, Chapter 39) (Vol. 3, pp. 2567–2627). Amsterdam: North-Holland. https://doi.org/10.1016/S1573-4463(99)30025-0

Nakamura, H. (2009). Micro-foundation for a constant elasticity of substitution production function through mechanization. Journal of Macroeconomics, 31(3), 464–472. https://doi.org/10.1016/j.jmacro.2008.09.006

Nakamura, H. (2010). Factor substitution, mechanization and economic growth. The Japanese Economic Review, 61(2), 266–281. https://doi.org/10.1111/j.1468-5876.2009.00486.x

Nakamura, H. (2022). Difficulties in finding middle-skilled jobs under increased automation. Macroeconomic Dynamics, 23(5), 1179–1203. https://doi.org/10.1017/S1365100522000177

Nakamura, H., & Nakamura, M. (2008). Constant-elasticity-of-substitution production function. Macroeconomic Dynamics, 12(5), 694–701. https://doi.org/10.1017/S1365100508070302

Parisi, M. L., Schiantarelli, F., & Sembenelli, A. (2006). Productivity, innovation and R&D: Micro evidence for Italy. European Economic Review, 50(8), 2037–2061. https://doi.org/10.1016/j.euroecorev.2005.08.002

Prettner, K., & Strulik, H. (2020). Innovation, automation, and inequality: Policy changes in the race against the machine. Journal of Monetary Economics, 116(C), 249–265. https://doi.org/10.1016/j.jmoneco.2019.10.012

Ray, D., & Mookherjee, D. (2022). Growth, automation and the long-run share of labor. Review of Economic Dynamics, 46, 1–26. https://doi.org/10.1016/j.red.2021.09.003

Romer, P. M. (1990). Endogenous technological change. Journal of Political Economy, 98(5), S71–S102. https://doi.org/10.1086/261725

Sachs, J. D., Benzell, S. G., & LaGarda, G. (2015). Robots: Curse or blessing? A basic framework. NBER Working Papers No. 21091. https://doi.org/10.3386/w21091

Sachs, J. D. (2017). Man and machine: The macroeconomics of the digital revolution. In From a conference organized by the centre for economic performance and the international growth centre. Available from https://www.jeffsachs.org/recorded-lectures/94cfpae6f22cdrkzrllbzs2leaxkrx

Say, J. B. (2001). A treatise on political economy or the production, distribution and consumption of wealth. Batoche Books. First French edition 1803. A Reprint of the English translation of 1880.

Susskind, D. (2020). A world without work: Technology, automation and how we should respond. London: Penguin.

Thomson, D. (2015). A world without work. The Atlantic, July/August Issue. https://users.manchester.edu/Facstaff/SSNaragon/Online/100-FYS-F16/Readings/Thompson,%20A%20World%20Without%20Work.pdf

Vermeulen, B., Kesselhut, J., Pyka, A., & Saviotti, P. P. (2018). The impact of automation on employment: Just the usual structural change? Sustainability, 10(5), 1–27. https://doi.org/10.3390/su10051661

Vivarelli, M. (2012). Innovation, employment and skills in advanced and developing countries: A survey of the literature. IZA DP No. 6291. https://doi.org/10.2139/ssrn.1999319

Zeira, J. (1998). Workers, machines, and economic growth. Quarterly Journal of Economics, 113(4), 1091–1117. https://doi.org/10.1162/003355398555847

Zuleta, H. (2008). Factor saving innovations and factor income shares. Review of Economic Dynamics, 11(4), 836–851. https://doi.org/10.1016/j.red.2008.02.002

Zuleta, H. (2015). Factor shares, inequality, and capital flows. Southern Economic Journal, 82(2), 647–667. https://doi.org/10.1002/soej.12035

Acknowledgements

We are grateful to Daron Acemoglu, Philippe Aghion, Gadi Barlevy, Francesco Caselli, Matthias Doepke, Marty Eichenbaum, Sergiu Hart, Eugene Kandel, Marti Mestieri, Masakatsu Nakamura and Hernando Zuleta for very helpful comments. We especially thank the Editor and two anonymous reviewers for comments that helped us improve the paper significantly. Remaining errors are all ours.

Funding

No funding was received for conducting this study.

Author information

Authors and Affiliations

Contributions

Hideki Nakamura and Joseph Zeira are equal co-authors in writing this manuscript.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 A. Proofs

Proof of Proposition 1

We prove it by negation, assuming that \(\varphi (M_{t} ) > R_{t}^{{\frac{\theta }{1 - \theta }}}\). The definition of φ implies:

Hence, there is a set of positive measure of automated tasks for which \(p_{t} (j) > R_{t} k(j)\). This violates perfect competition and free entry in the markets for automated goods.□

Proof of Proposition 2

Note first that since \(\theta^{\theta /(1 - \theta )} < 1\) we get:

Applying Eq. (10) we get:

Applying this inequality to the number of unemployed due to automation in Eq. (21), we get the result of the proposition.□

Proof of Proposition 3

We prove the proposition by negation. Assume that automation is bounded. We first show that the number of tasks T is bounded as well. If not, Eq. (10) shows that if T is unbounded, while M is bounded, the gross interest rate Rt goes to infinity. We next show that this is impossible. If that is the case, the equilibrium in the capital market implies that from some time on \(K_{t + 1} = w_{t}\). Multiplying with employment \(E_{t}\) on both sides of this equality and using Eqs. (15) and (16) on shares of labor and capital, implies:

If the gross interest rate R goes to infinity, while M is bounded, the RHS of this equation goes to infinity. This means that output growth rises to infinity. Clearly this is impossible, since according to Eq. (13) the numerator of output grows at a rate which is a multiple of the rate of growth of T, which is bounded, while the denominator of (13) converges to 1 and does not grow in the long run. Hence, R cannot grow to infinity and therefore T is bounded, just as M is.If T and M are bounded, they converge, as increasing sequences, to finite numbers, \(M_{\infty }\) and \(T_{\infty }\) correspondingly. As a result, the rate of growth of tasks converges to zero. Note that it is impossible that \(M_{\infty } = T_{\infty }\), since then Eq. (12) implies that employment E converges to zero, while it should always be larger than 1. If \(M_{\infty } < T_{\infty }\), Proposition 5 implies that the rate of automation unemployment converges to zero, as the changes in M converge to zero. Equation (20) implies that structural unemployment also converges to zero in this case. Hence, the LHS of (12) converges to \(1 + e\). However, the RHS of (12) converges to a number smaller than \(1 + e\), due to Assumption 1. Hence, bounded automation leads to a contradiction.□

Proof of Proposition 4

Assume by negation that interest rates are not bounded from above. Then:

As the rate of interest rises and is above \(1 + \rho\), the capital market equilibrium condition (18) implies that \(K_{t + 1} = w_{t}\) from some period on. Multiplying this equality by employment \(E_{t}\) on both sides and using the shares of capital and labor in Eqs. (15) and (16), leads to the equality (32) as in the proof of Proposition 3. Applying (33) to (32) implies that the rate of growth of output converges to infinity. However, the numerator in Eq. (13) grows at a rate proportional to the rate of growth of T, which is bounded, while its denominator converges to 1. Hence, the rate of growth cannot rise to infinity.

Proof of Proposition 5

Divide the proof to three cases, \(A < (1 + \rho )^{\theta /(1 - \theta )}\), \(A > (1 + \rho )^{\theta /(1 - \theta )}\) and \(A = (1 + \rho )^{\theta /(1 - \theta )}\). In the first case the proof is straightforward, since \(R_{t} \ge 1 + \rho\) for all t.

In the second case, we prove the proposition by negation. If the proposition does not hold, we have:

In the second case Proposition 1 and Assumption 2 imply that from some period on, \(R_{t} > 1 + \rho\) and hence \(K_{t + 1} = w_{t}\). We next multiply this equality by employment \(E_{t}\) and derive an equality similar to (32) in the proof of Proposition 3:

Note that condition (34) implies that the numerator in the RHS of (35) converges to zero. The denominator is bounded below by a positive number according to Proposition 4. Hence, the rate of growth of output converges to zero. However, Eq. (13) implies that output grows both because T rises continuously and increases the numerator, and because the denominator converges to zero due to (34). Hence, the rate of growth of output must be positive and \(Y_{t + 1} /Y_{t}\) should be greater or equal to 1. This contradiction proves the proposition in this case.

In the third case we prove the proposition by negation as well. Assume that (34) holds. If the interest rates are above \(1 + \rho\), then the analysis of the second case holds and we reach the same contradiction. If not, from some period on \(R_{t} = 1 + \rho\). Hence, capital satisfies: \(K_{t + 1} \le w_{t}\). We can derive, similar to the derivation of (32), the following inequality:

Since this ratio converges to zero, it contradicts Eq. (13).□

Proof of Proposition 6

Note first that Eq. (10) implies that:

The denominator of the RHS of (37) converges to \(R_{\infty }^{\theta /(1 - \theta )} - A\), which is positive, due to Proposition 5. As for the numerator of the RHS of (37) we get from Fig.

3, where the function ψ is determined by the intersection between the tangent to φ and the vertical axis, that:

However, both \(\psi (M)\) and \(\varphi (M)\) converge to \(A\). Hence, the numerator of the RHS of (37) converges to zero.□

1.2 B. Adding capital to production by labor

This appendix extends the benchmark model, by assuming that production by labor of each intermediate good \(j \in (M_{t} ,T_{t} ]\) requires not only a worker, but also a structure of size s, which is capital in labor production. Assume further that \(k(j) \ge s,\,\,{\text{for}}\;{\text{all}}\,\,j \ge 0\), as automation requires a structure as well and we include it in the function k. Assume further that structures fully depreciate within one period, so that all capital depreciates at a rate of 1. In this extension the price of an old labor task unit is:

The price of a new labor task unit is:

Substituting these prices in the demand condition (4) in the paper we get that the wage in this extension is described by:

Equating income in the R&D sector and in labor in production leads to equilibrium condition similar to (11):

We can use this equilibrium condition and the FOC to calculate the amount of labor for each task and in the R&D sector and get a labor market equilibrium condition similar to (12):

From (39) and (40) we get that output per worker in the economy is:

Note that the share of labor is equal to:

Using Eqs. (38) and (41) we get that:

Clearly, this ratio converges in the long-run to \(1 - R_{\infty }^{ - \theta /(1 - \theta )} A\). As the ratio \(R_{t} s/y_{t}\) converges to 0 as well, we get from (42) that in the long-run the share of labor in output converges to \(1 - R_{\infty }^{ - \theta /(1 - \theta )} A\), just as in the benchmark model.

The long-run gross rate of interest \(R_{\infty }\) should also be the same as in the benchmark model. The reason is that the demand for capital is determined by the share of capital in output and that is equal in the long-run to the share of capital in the benchmark model. Hence, the share of labor in this paper should not be affected by the narrow definition of capital, which includes only equipment without structures.

1.3 C. Skill, wages and technical change

This appendix introduces differences in skill between workers. We add it mainly to examine the effect of skill-biased technical change on the share of labor in output, as explained in Sect. 5 in the paper. For simplicity assume that each generation lives only one period. Assume that there are two skill levels, high and low. To become high skilled a person needs to acquire education at the beginning of the period. We denote the amount of high skilled in the population by H and of low skilled L, with \(H + L = 1\). Utility of each person is equal to \(c/z\), where z is the effort of acquiring education. This effort is distributed randomly across the population in the following way. If H people acquire skill, denote the effort of the marginal person by \(z(H)\), where z is an increasing function. Clearly the others who acquire education have a lower effort. Assume also that \(z(0) > 0\). If the high skill wage in period t is \(w_{H,t}\) and the low skill wage is \(w_{L,t}\), maximization of utility implies:

Hence, the wage ratio, or the skill premium, depends positively on the amount of high skilled in the economy.

We abstract in this section from unemployment, to focus mainly on the share of labor. We also assume that the economy is open and small, so that there is no sector in this economy that invents new tasks, and these are created abroad. This assumption also implies that the interest rate is exogenous, and determined in the global capital market, so we assume that it is constant at R.

Next, we assume that labor tasks can be either high or low skilled. There is an indicator function on tasks h, that is equal to 1 if a task requires high skill labor and to 0, if it requires low skill labor. Denote:

Hence, d is the density of skilled tasks in the interval [x, y]. Actually, this density measures the skill bias of technical change, as it measures the demand for skill across new tasks. To simplify the analysis, assume that the distribution of demand for skill is uniform across tasks, namely that d is constant over all intervals of tasks.

The rest of the economy is similar to the benchmark model, but we allow for the cost of machines to differ between high skill and low skill tasks. Hence, there are two cost of machines functions, \(k_{H} \,\,{\text{and}}\,\,k_{L}\). Each cost function defines its own φ function:

Each φ function converge to its own limit: \(A_{H} = \mathop {\lim }\limits_{M \to \infty } \varphi_{H} (M)\,\,{\text{and}}\,\,A_{L} = \mathop {\lim }\limits_{M \to \infty } \varphi_{L} (M)\).

Since the production function of the final good is the same as in the benchmark model, the equilibrium condition (4) holds as well. The supply prices of the intermediate goods, or tasks, are equal to:

As this equation shows, there are two frontiers of automation in this extension of the model, \(M_{H,t} \,\,{\text{and}}\,\,M_{L,t}\). These are determined by the following condition of automation adoption, similar to the benchmark model:

Substituting the supply prices (44) in condition (4) leads to the following equilibrium condition:

This equation describes a negative relation between the wages of high and of low skilled. To determine the two wage levels, we examine what determines the wage ratio, or the skill premium. First note that due to the FOC (3) in the paper for the labor tasks we get:

From equating the two equations in (47) and using (43) we get:

Note that in the long-run \((T_{t} - M_{H,t} )/(T_{t} - M_{L,t} )\) converges to 1, since tasks grow faster than automation. Hence in the long-run H depends only on d and it depends positively. Thus, the long-run wage gap depends positively on the degree of skill bias, as expected.

We next turn to calculate the share of labor in output. Using (47) we get:

Applying (46) we get:

As a result, the share of labor converges to:

Hence, the skill bias reduces the share of labor only if \(A_{H} > A_{L}\). This happens only if the machine cost functions satisfy: \(k_{H} < k_{L}\). This is rather unlikely, as it means that machines that replace high skill labor are less costly than machines that replace low skill labor.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Nakamura, H., Zeira, J. Automation and unemployment: help is on the way. J Econ Growth (2023). https://doi.org/10.1007/s10887-023-09233-9

Accepted:

Published:

DOI: https://doi.org/10.1007/s10887-023-09233-9