Abstract

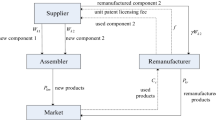

This study focuses on the optimal pricing and product refurbishing decisions of an original equipment manufacturer (OEM) and a retailer in a supply chain. The OEM sells the new product through a retailer, which serves as a reseller or selling agency, and then chooses whether to provide the refurbished product to consumers. By constructing four models, we obtain the following results. First, we show that the OEM and the retailer always prefer to sell a refurbished product as a monopoly. Second, competing refurbishments leads to a prisoner’s dilemma in which both parties suffer greater losses compared to the no refurbishment scenario. This implies that competing refurbishments, except for product cannibalization, hinder the refurbishing industry. Finally, with different refurbishers, the OEM has different preferences for a new product’s selling format. However, when the retailer serves as the sole refurbisher, the OEM always prefers agency mode.

Similar content being viewed by others

Data availability

The data that support the findings of this study are available from the corresponding author, Wen Zhang, upon reasonable request.

Notes

Apple website repair product homepage https://www.apple.com/shop/refurbished/about.

References

Abhishek, V., Jerath, K., & Zhang, Z. J. (2015). Agency selling or reselling? Channel structures in electronic retailing. Management Science, 62(8), 2259–2280.

Atasu, A., Guide, V. D. R., Jr., & Van Wassenhove, L. N. (2008a). Product reuse economics in closed-loop supply chain research. Production and Operations Management, 17(5), 483–496.

Atasu, A., Sarvary, M., & Van Wassenhove, L. N. (2008b). Remanufacturing as a marketing strategy. Management Science, 54(10), 1731–1746.

Branderburger, A., & Nalebuff, B. (1997). Co-opetition: A revolution mindset that combines competition and cooperation: The game theory strategy that’s changing the game of business. Currency Doubleday.

Chen, Y., & Chen, F. (2019). On the competition between two modes of product recovery: Remanufacturing and refurbishing. Production and Operations Management, 28(12), 2983–3001.

Ferrer, G., & Swaminathan, J. M. (2006). Managing new and remanufactured products. Management Science, 52(1), 15–26.

Geda, M. W., Zheng, P., Kwong, C. K., & Tang, Y. M. (2023). A bilevel optimisation model for the joint configuration of new and remanufactured products considering specification upgrading of used products. Journal of Intelligent Manufacturing. https://doi.org/10.1007/s10845-023-02140-1

Govindan, K., & Hasanagic, M. (2018). A systematic review on drivers, barriers, and practices towards circular economy: A supply chain perspective. International Journal of Production Research, 56(1–2), 278–311.

Guo, X., Zheng, S., Yu, Y., & Zhang, F. (2021). Optimal bundling strategy for a retail platform under agency selling. Production and Operations Management, 30(7), 2273–2284.

Hagiu, A., & Wright, J. (2014). Marketplace or reseller? Management Science, 61(1), 184–203.

Ha, A. Y., Luo, H., & Shang, W. (2022a). Supplier encroachment, information sharing, and channel structure in online retail platforms. Production and Operations Management, 31(3), 1235–1251.

Ha, A. Y., Tong, S., & Wang, Y. (2022b). Channel structures of online retail platforms. Manufacturing & Service Operations Management, 24(3), 1547–1561.

Huang, Y., & Wang, Z. (2019). Pricing and production decisions in a closed-loop supply chain considering strategic consumers and technology licensing. International Journal of Production Research, 57(9), 2847–2866.

Hu, H., Zheng, Q., & Pan, X. A. (2022). Agency or wholesale? The role of retail pass-through. Management Science, 68(10), 7538–7554.

Lai, G., Liu, H., Xiao, W., & Zhao, X. (2022). Fulfilled by Amazon: A strategic perspective of competition at the e-commerce platform. Manufacturing & Service Operations Management, 24(3), 1406–1420.

Liu, J., & Ke, H. (2021). Firms’ preferences for retailing formats considering one manufacturer’s emission reduction investment. International Journal of Production Research, 59(10), 3062–3083.

Liu, Z., Chen, J., & Diallo, C. (2018a). Optimal production and pricing strategies for a remanufacturing firm. International Journal of Production Economics, 204, 290–315.

Liu, H., Lei, M., Huang, T., & Leong, G. K. (2018b). Refurbishing authorization strategy in the secondary market for electrical and electronic products. International Journal of Production Economics, 195, 198–209.

Li, S., Zhang, H., Yan, W., & Jiang, Z. (2021). A hybrid method of blockchain and case-based reasoning for remanufacturing process planning. Journal of Intelligent Manufacturing, 32, 1389–1399.

Li, Y., Wang, K., Xu, F., & Fan, C. (2022). Management of trade-in modes by recycling platforms based on consumer heterogeneity. Transportation Research Part E: Logistics and Transportation Review, 162, 102721.

Luo, H., Zhong, L., & Nie, J. (2022). Quality and distribution channel selection on a hybrid platform. Transportation Research Part E: Logistics and Transportation Review, 163, 102750.

Shen, Y., Willems, S. P., & Dai, Y. (2019). Channel selection and contracting in the presence of a retail platform. Production and Operations Management, 28(5), 1173–1185.

Tian, L., Vakharia, A. J., Tan, Y., & Xu, Y. (2018). Marketplace, reseller, or hybrid: Strategic analysis of an emerging e-commerce model. Production and Operations Management, 27(8), 1595–1610.

Timoumi, A., Singh, N., & Kumar, S. (2021). Is your retailer a friend or foe: When should the manufacturer allow its retailer to refurbish? Production and Operations Management, 30(9), 2814–2839.

Vorasayan, J., & Ryan, S. M. (2006). Optimal price and quantity of refurbished products. Production and Operations Management, 15(3), 369–383.

Wang, W., Mo, D. Y., Wang, Y., & Tseng, M. M. (2019). Assessing the cost structure of component reuse in a product family for remanufacturing. Journal of Intelligent Manufacturing, 30, 575–587.

Wang, L., Chen, J., & Song, H. (2021). Marketplace or reseller? Platform strategy in the presence of customer returns. Transportation Research Part E: Logistics and Transportation Review, 153, 102452.

Xiong, Y., Zhou, Y., Li, G., Chan, H. K., & Xiong, Z. (2013). Don’t forget your supplier when remanufacturing. European Journal of Operational Research, 230(1), 15–25.

Xiong, Y., Zhao, Q., & Zhou, Y. (2016). Manufacturer-remanufacturing vs supplier-remanufacturing in a closed-loop supply chain. International Journal of Production Economics, 176, 21–28.

Zhang, Y., & Zhang, W. (2023). Optimal pricing and greening decisions in a supply chain when considering market segmentation. Annals of Operations Research, 324(1–2), 93–130.

Zhang, F., Guan, Z., Zhang, L., Cui, Y., Yi, P., & Ullah, S. (2019a). Inventory management for a remanufacture-to-order production with multi-components (parts). Journal of Intelligent Manufacturing,30, 59–78.

Zhang, Y., He, Y., Yue, J., & Gou, Q. (2019b). Pricing decisions for a supply chain with refurbished products. International Journal of Production Research,57(9), 2867–2900.

Zhang, Z., Wu, J., & Wei, F. (2019c). Refurbishment or quality recovery: Joint quality and pricing decisions for new product development. International Journal of Production Research,57(8), 2327–2343.

Zhen, X., Xu, S., Li, Y., & Shi, D. (2022). When and how should a retailer use third-party platform channels? The impact of spillover effects. European Journal of Operational Research, 301(2), 624–637.

Zhou, Q., Meng, C., & Yuen, K. F. (2021a). Remanufacturing authorization strategy for competition among OEM, authorized remanufacturer, and unauthorized remanufacturer. International Journal of Production Economics, 242, 108295.

Zhou, Q., Meng, C., Yuen, K. F., & Sheu, J. B. (2021b). Remanufacturing authorization strategy for an original equipment manufacturer-contract manufacturer supply chain: Cooperation or competition? International Journal of Production Economics, 240, 108238.

Zou, Z. B., Wang, J. J., Deng, G. S., & Chen, H. (2016). Third-party remanufacturing mode selection: Outsourcing or authorization? Transportation Research Part E: Logistics and Transportation Review, 87, 1–19.

Zu-Jun, M., Zhang, N., Dai, Y., & Hu, S. (2016). Managing channel profits of different cooperative models in closed-loop supply chains. Omega, 59, 251–262.

Acknowledgements

The research of the first author is supported in part by the Natural Science Foundation of Shandong Province (Grant No. ZR2021QG067), that of the second author is supported in part by National Science Foundation of China (Grant No. 72201110), and that of the third author is supported in part by Natural Science Foundation of Shandong Province (Grant No. ZR2021MG046).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

No potential conflict of interest was reported by the author(s).

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

A Proof of Proposition 3

Using the backward method, we will first calculate the new and the refurbished product’s optimal prices(\(p_N\) and \(p_{RO}\)). As the OEM make decision on the price of the refurbished product, the retailer decides the new products price, and their profit functions of the OEM and the retailer are displayed in Eqs. (5) and (6) respectively, we have \(\frac{\partial ^2\pi _O}{\partial p_{RO}^2}=-\frac{2}{1-\delta }-\frac{2}{\delta }<0\) and \(\frac{\partial ^2\pi _T}{\partial p_{N}^2}=-\frac{2}{1-\delta }<0\). Hence, they are concave in \(p_{RO}\) and \(p_N\) respectively. Thus by jointly solving \(\frac{\partial \pi _O}{\partial p_{RO}}\) and \(\frac{\partial \pi _T}{\partial p_{N}}=0\), we have the optimal prices are \(p_N=\frac{(2+\delta )w-\delta c_N+c_{RO}+2(1-\delta )}{4-\delta }\) and \(p_{RO}=\frac{3\delta w-2(\delta c_N-c_{RO})+\delta (1-\delta )}{4-\delta }\). Substituting them into Eq. (5), we have \(\frac{\partial ^2\pi _O}{\partial w^2}=-\frac{2(8+\delta )}{(4-\delta )^2}<0\). Hence, w is concave in profit function shown by Eq. (5). Finally, we will get the optimal wholesale price of the new product \({\hat{w}}=\frac{2(4+\delta )c_N+\delta (\delta -c_{RO})+8}{2(8+\delta )}\) by solving \(\frac{\partial \pi _O}{\partial w}=0\). Then we have the sales of the new and refurbished products are \({\hat{D}}_N=\frac{(2+\delta )(1+c_{RO}-c_{N}-\delta )}{(1-\delta )(8+\delta )}\) and \({\hat{D}}_{RO}=\frac{2\delta (1+3c_N)-(8-\delta ^2-\delta )c_{RO}-\delta ^2(1+\delta )}{2\delta (1-\delta )(8+\delta )}.\) To make sure the sales are non-negative, the equilibrium results are under the condition \(\frac{(8-\delta ^2-\delta )c_{RO}+\delta ^2(1+\delta )-2\delta }{6\delta }\le c_N\le 1+c_{RO}-\delta \) in this case. Then substituting the \({\hat{w}}\) into relevant functions, we can get the Proposition 3.

B Proof of Proposition 4

In this case, The OEM sets the prices of the new and the refurbished products. As OEM’s profit function is Eq. (14), we optimize \(p_N\) and \(p_{RO}\) and find the Hessian of \(\pi _O\) is \(\left( \begin{array}{ccc} -\frac{2(1-\beta )}{1-\delta } &{} \frac{2-\beta }{1-\delta } \\ \frac{2-\beta }{1-\delta } &{} -\frac{2}{1-\delta }-\frac{2}{\delta } \\ \end{array} \right) \). In addition, as \(\delta <\frac{4(1-\beta )}{(2-\beta )^2}\), we can get \(|H|=\frac{4(1-\beta )-\delta (2-\beta )^2}{\delta (1-\delta )^2}>0\). Thus, \(\pi _O\) jointly concave in \(p_N\) and \(p_{RO}\). By solving the \(\frac{\partial \pi _O}{\partial p_N}=0\) and \(\frac{\partial \pi _O}{\partial p_{RO}}=0\), we can get the optimal prices are \(p_N^*=\frac{(2-2\delta +\beta \delta )c_N-\beta c_{RO}+2(1-\delta )(1-\beta )}{4(1-\beta )-(2-\beta )^2\delta }\) and \(p_{RO}^*=\frac{\beta \delta c_N+(\beta \delta -2\beta -2\delta +2)c_{RO}+\delta (1-\delta )(1-\beta )(2-\beta )}{4(1-\beta )-(2-\beta )^2\delta }\). Then substituting the them into demand functions, we have the sales of the two products are \(D_{N}^*=\frac{(2-\beta )c_{RO}-2 c_N+2(1-\beta )-\delta (2-\beta )}{4(1-\beta )-(2-\beta )^2\delta } \) and \(D_{RO}^*=\frac{\delta (2-\beta ) c_N-(1-\beta )(2c_{RO}-\beta \delta )}{4(1-\beta )-(2-\beta )^2\delta }.\) To avoid the negative sales, It is need to notice that the cases are under the condition \(\frac{(1-\beta )(2c_{RO}-\beta \delta )}{\delta (2-\beta )}\le c_N\le \frac{(2-\beta )c_{RO}+2(1-\beta )-\delta (2-\beta )}{2}\). Substituting them into other relevant functions, the proposition is proved.

C Proof of Proposition 5

Using the backward method, we will first calculate the optimal prices of the new and refurbished product which is shown by Eq. (23). Optimizing for \(p_N\) and \(p_{RT}\), the Hessian Matrix of \(\pi _T\) is \(\left( \begin{array}{ccc} -\frac{2}{1-\theta \delta } &{} \frac{2}{1-\theta \delta } \\ \frac{2}{1-\theta \delta } &{} -\frac{2}{(1-\theta \delta )\theta \delta }\\ \end{array} \right) \). and \(|H|=\frac{2}{(1-\theta \delta )\theta \delta }>0\). Hence we can conclude \(p_N\) and \(p_{RT}\) are jointly concave in \(\pi _T\). From the first order conditions, jointly solving \(\frac{\partial \pi _T}{\partial p_{N}}=0\) and \(\frac{\partial \pi _T}{\partial p_{RO}}=0\), we can get \(p_N=\frac{1+w}{2}\) and \(p_{RT}=\frac{\theta \delta +c_{RT}}{2}\). Then substituting them into the Eq. (22), we have \(\frac{\partial ^2 \pi _O}{\partial w^2}=-\frac{1}{1-\theta \delta }<0\). By solving \(\frac{\partial \pi _O}{\partial w}=0\), we get the optimal \(w=\frac{1+c_{N}+c_{RT}-\theta \delta }{2}\), then substituting this into the sales functions, we can the sales of the two products are \({\hat{D}}_N=\frac{1+c_{RT}-c_N-\theta \delta }{4(1-\theta \delta )}\) and \({\hat{D}}_{RT}=\frac{\theta \delta (1+c_N-\theta \delta )-(2-\theta \delta )c_{RT}}{4\theta \delta (1-\theta \delta )}.\) Furthermore, to ensure the sales of both product non-negative, the equilibrium results are under the condition \(\frac{(2-\theta \delta )c_{RT}}{\theta \delta }+\theta \delta -1\le c_N \le 1+c_{RT}-\theta \delta \) in this case. Then substituting the function into other functions, we can have Proposition 5.

D Proof of Proposition 6

Using the backward method, we will optimize for \(p_{RT}\) in Eq. (30). \(\frac{\partial ^2 \pi _T}{\partial p_{RT}^2}=-\frac{2}{1-\theta \delta }-\frac{2}{\theta \delta }<0\), hence, it is a concave function of \(p_{RT}\). Solving \(\frac{\partial \pi _O}{\partial p_{RT}}=0\), the optimum is \(p_{RT}=\frac{\theta \delta (1+\beta )p_N+c_{RT}}{2}\). Then substituting \(p_{RT}\) into Eq. (29) to calculate the optimal \(p_N\). With \(\frac{\partial ^2 \pi _O}{\partial p_{N}^2}=-\frac{(1-\beta )(2-\theta \delta -\theta \delta \beta )}{1-\theta \delta }<0\), we can get the optimal \(p_N^*=\frac{c_N}{2(1-\beta )}+\frac{c_{RT}+2(1-\theta \delta )}{2(2-\theta \delta -\theta \delta \beta )}\) by solving \(\frac{\partial \pi _O}{\partial p_{N}}=0\). Substituting optimal \(p_N\) into the demand functions, we have the sales of the two products are \(D_N^*=\frac{c_{RT}+2(1-\theta \delta )}{4(1-\theta \delta )} -\frac{(2-\theta \delta -\theta \delta \beta )c_N}{4(1-\theta \delta )(1-\beta )}\) and \(D_{RT}^*=\frac{c_N}{4(1-\theta \delta )}-\frac{(4-3\theta \delta -\theta \delta \beta ) c_{RT}}{4\theta \delta (1-\theta \delta )(2-\theta \delta -\theta \delta \beta )}+\frac{1-\beta }{2(2-\theta \delta -\theta \delta \beta )}.\) To ensure the sales are non-negative, we have

\(\frac{(4-3\theta \delta -\theta \delta \beta )c_{RT}-2\theta \delta (1-\beta )(1-\theta \delta )}{\theta \delta (2-\theta \delta -\theta \delta \beta )}\le c_N\le \frac{(1-\beta )[c_{RT}+2(1-\theta \delta )]}{2-\theta \delta (1+\beta )}\) under the case, and it also implies \(c_{RT}\le \theta \delta (1-\beta )\). Substituting the optimal results into the relevant function, Proposition 6 is proved.

E Proof of Proposition 7

With the same method as other proposition, we will first calculate the retail prices of two products which is showed by Eqs. (35) and (36). As Hessian matrix of the \(p_N\) and \(p_{RT}\) in \(\pi _T\) is \(\left( \begin{array}{ccc} -\frac{2}{1-\delta } &{} 0 \\ 0 &{} -\frac{2}{(1-\theta )\delta }-\frac{2}{\theta \delta }\\ \end{array} \right) \). and \(|H|=\frac{4}{(1-\theta )(1-\delta )\theta \delta }>0\), Thus, we can conclude they jointly concave in \(\pi _T\). In addition, the \(\frac{\partial ^2 \pi _O}{\partial p_{RO}^2}=-\frac{2}{1-\delta }-\frac{2}{\delta (1-\theta )}<0\), \(p_{RO}\) is concave in \(\pi _O\). Then solving the \(\frac{\partial \pi _T}{\partial p_{N}}=0\), \(\frac{\partial \pi _T}{\partial p_{RT}}=0\) and \(\frac{\partial \pi _O}{\partial p_{RO}}=0\) jointly, we can get the optimum \(p_N\), \(p_{RT}\) and \(p_{RO}\). Substituting them into \(\pi _O\) to optimize for w, with \(\frac{\partial ^2 \pi _O}{\partial w^2}=-\frac{2(8+\delta )-(19\delta +8)\theta +(1+8\delta )\theta ^2}{(4-\theta -\delta -2\theta \delta )^2}\) and \(\theta \ge \delta \), we can conclude \(\frac{\partial ^2 \pi _O}{\partial w^2}<0\) and w is concave in \(\pi _O\). At last, we get optimal \({\hat{w}}=\frac{[(10\theta ^2-23\theta +4)\delta +(4-\theta )^2]c_N-2(1-\theta ) (\theta +\delta -2\theta \delta )c_{RO}}{2[\delta (8\theta ^2-19\theta +2)+(4-\theta )^2]} +\frac{(8+\theta +\delta -10\theta \delta )c_{RT}+(14\theta ^2-7\theta +2)\delta ^2-3 \theta \delta (7-\theta )+(4-\theta )^2}{2[\delta (8\theta ^2-19\theta +2)+(4-\theta )^2]}\) by solving \(\frac{\partial \pi _O}{\partial w}=0\). Then substituting \({\hat{w}}\) into other function, we have we will have \({\hat{D}}_{N} =\frac{{\begin{matrix}2[\delta (7\theta ^2-17\theta +4)-\theta ^2-\theta +8]c_ {RO}+(1-\delta )[\delta (17\theta ^2-34\theta +8)\\ +(4-\theta )^2-3\theta c_{RT}]\end{matrix}}}{4(1-\delta )[\delta (8\theta ^2-19\theta +2)+(4-\theta )^2]} -\frac{[\delta (11\theta ^2-28\theta +8)+(4-\theta )^2]c_N}{4(1-\delta ) [\delta (8\theta ^2-19\theta +2)+(4-\theta )^2]}, \)

\({\hat{D}}_{RO}=\frac{(1-\delta )\{[(3\theta ^2-10\theta +1)\delta +2(4-\theta )]c_{RT} +\delta (1-\theta )[\delta (\theta ^2-9\theta +2)+(1-\theta )(4-\theta )]\}}{2\delta (1-\theta )(1-\delta ) [\delta (8\theta ^2-19\theta +2)+(4-\theta )^2]} +\frac{[(\theta ^3-5\theta +1)\delta ^2+(2\theta ^3-11\theta ^2+14\theta +1)\delta -(2-\theta )(4-\theta )] c_{RO}}{\delta (1-\theta )(1-\delta )[\delta (8\theta ^2-19\theta +2)+(4-\theta )^2]} +\frac{[(4-\theta )(3-\theta )-\theta \delta (11-5\theta )]c_{N}}{2(1-\delta )[\delta (8\theta ^2-19\theta +2) +(4-\theta )^2]}\)

and \({\hat{D}}_{RT}=\frac{{\begin{matrix}\theta \{\delta (1-\theta )[20-13\theta \delta -2\delta -5\theta -(4-\theta )c_N]\\ +2[\delta (5\theta ^2-14\theta +3)+2(4-\theta )]c_{RO}\}\end{matrix}}}{4\theta \delta (1-\theta )[\delta (8\theta ^2 -19\theta +2)+(4-\theta )^2]} -\frac{[\delta (23\theta ^2-39\theta +4)+4(\theta ^2-6\theta +8)]c_{RT}}{4\theta \delta (1-\theta ) [\delta (8\theta ^2-19\theta +2)+(4-\theta )^2]}\). To make sure the sales are non-negative, the equilibrium results should be under the condition

\(\frac{{\begin{matrix}2[(2 - \theta )(4 - \theta ) - (\theta ^3 - 5\theta + 1)\delta ^2 - (2\theta ^3 - 11\theta ^2 + 14\theta + 1)\delta ]c_{RO} - (1 - \delta )\\ \{[(3\theta ^2 - 10\theta + 1)\delta + 2(4 - \theta )]c_{RT} + \delta (1 - \theta )[(\theta ^2 - 9\theta + 2) \delta + (\theta + 1)(4 - \theta )\}\end{matrix}}}{\delta (1 - \theta )[(4 - \theta )(3 - \theta ) - \theta \delta (11 - 5\theta )]}\)

\(<c_N<\min \Big \{\frac{{\begin{matrix}2(\delta (7\theta ^2 - 17\theta + 4) - \theta ^2 - \theta + 8)c_{RO} + (1 - \delta )[\delta (17\theta ^2 \\ - 34\theta + 8) + (4 - \theta )^2 - 3\theta c_{RT}]\end{matrix}}}{\delta (11\theta ^2 - 28\theta + 8) + (4 - \theta )^2}\),

\(~\frac{{\begin{matrix}\theta \delta (1 - \theta )(-13\delta \theta - 2\delta - 5\theta + 20) + 2\theta [(5\theta ^2 - 14\theta + 3)\delta + 8 - 2\theta ]c_{R O} \\ - [(23\theta ^2 - 39\theta + 4)\delta + 4\theta ^2 - 24\theta + 32] c_{RT}\end{matrix}}}{\theta \delta (1 - \theta )(4 - \theta )}\Big \}\). Then the proposition is improved.

F Proof of Proposition 8

Using the same method with the last proposition, we will first calculate the optimal \(p_{RT}\) in the retailer’s profit function which is showed by Eq. (47). As the \(\frac{\partial ^2 \pi _T}{\partial p_{RT}^2}=-\frac{2}{\theta \delta (1-\theta )}<0\), \(p_{RT}\) is concave in retailer’s profit function. Thus, we can get the optimum \(p_{RT}=\frac{\theta p_{RO}+c_{RT}}{2}\) by solving \(\frac{\partial \pi _T}{\partial p_{RT}}=0\). Then substituting the \(p_{RT}\) in to the OEM’s profit function to find the optimal \(p_N\) and \(p_{RO}\), we have the Hessian matrix is\(\left( \begin{array}{ccc} -\frac{2(1-\beta )}{1-\delta } &{} \frac{2-\beta }{1-\delta } \\ \frac{2-\beta }{1-\delta } &{} -\frac{2-\theta -\theta \delta }{\delta (1-\delta )(1-\theta )}\\ \end{array} \right) \) and \(|H|=\frac{2[(2-\theta )(1-\delta )(1-\beta )-\delta \beta ^2(1-\theta )]}{\delta (1-\delta )^2(1-\theta )}\). With the assumption \(\delta <\frac{4(1-\beta )}{(2-\beta )^2}\), we have \(|H|>0\) and can conclude the \(p_N\) and \(p_{RO}\) are jointly concave in \(\pi _O\). Hence, we can obtain \(p_N^*=\frac{{\begin{matrix}c_N+(2-\theta -\theta \delta )[2(1-\beta )(1-\delta )-\beta c_{RO}]\\ +(1-\delta )(2-\beta )c_{RT}\end{matrix}}}{2[(2-\theta )(1-\delta )(1-\beta )-\delta \beta ^2(1-\theta )]}\) and

\(p_{RO}^*=\frac{{\begin{matrix}\delta \beta (1-\theta )c_N+[(2-\theta )(1-\delta -\beta )+\beta \delta ] c_{RO}+(1-\delta )(1-\beta )\\ [(1-\theta )(2-\beta )\delta +c_{RT}]\end{matrix}}}{2(2-\theta )(1-\delta ) (1-\beta )-\delta \beta ^2(1-\theta )}\) by solving \(\frac{\partial \pi _O}{\partial p_{N}}=0\) and \(\frac{\partial \pi _O}{\partial p_{RO}}=0\) jointly. Substituting them into the demands function and ensure the non-negative sales, it needs to notice that the case should under the condition

\(\max \{\frac{(1-\beta )\{[(2-\theta )c_{RO}-\beta \delta (1-\theta )](2-\theta -\theta \delta ) -[\beta \delta (1-\theta )+(2-\theta )(1-\delta )]c_{RT}\}}{\delta (1-\theta )(2-\theta )(2-\beta )},\)

\(\frac{{\begin{matrix}c_{RT}-\theta \delta (1-\beta )(2-\beta )(1-\theta )\\ (1-\delta )-\theta [(2-\theta )(1-\delta )-(2-\theta -\delta )\beta ]c_{RO}\end{matrix}}}{\theta \beta \delta (1-\theta )}\}\le c_N\le 1-\beta -\delta +\frac{\beta (2\delta -c_{RT})}{2(2-\theta )}+\frac{(2-\beta )c_{RO}}{2}\). Substituting the optimal results into other functions, we can have Proposition 8.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Zhang, Y., Zhang, W., Shi, X. et al. Competing refurbishment in a supply chain with different selling modes. J Intell Manuf (2023). https://doi.org/10.1007/s10845-023-02180-7

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10845-023-02180-7