Abstract

This paper investigates the impact of technical progress on the relationship between competition and investment. Using a model of oligopolistic competition with differentiated products in which firms invest to reduce their marginal cost of production (or to improve quality), I find that technical progress, by increasing the size of innovation, defined as the drop in marginal costs (or the increase in quality) obtained for a given investment amount, increases total investment and decreases the level of competition that maximizes investment in the industry. This feature also holds for consumer surplus and welfare. This means that innovative industries maximize consumer surplus and welfare at a lower level of competitive pressure than do less innovative industries. In the model, competition is measured either by the number of competitors or by the degree of horizontal substitutability between offers. The results hold for both measures, subject to a relatively steady industry specific rate of technological change.

Similar content being viewed by others

Notes

Figures are computed by the author from data provided by Telecoms market Matrix Western Europe (Analysys Mason 11 January 2019)

The least efficient firm may merge with a more efficient one. The merged firms decide not to maintain both offerings. This is particularly likely to happen if substitutability is high enough (Haucap et al. 2019)

References

Aghion P, Bloom N, Blundell R, Griffith R, Howitt P (2005) Competition and innovation: an inverted-U relationship. Q J Econ 120(2):701–728

Aghion P, Akcigit U, Howitt P (2014) What do we learn from Schumpeterian growth theory? In: Pages 515–563 of: Handbook of economic growth, vol 2. Elsevier

Aghion, Philippe, Bergeaud, Antonin, Boppart, Timo, Klenow, Peter J, & Li, Huiyu. 2019. A theory of falling growth and rising rents. Federal Reserve Bank of San Francisco

Arrow KJ (1972) Economic welfare and the allocation of resources for invention. In: Pages 219–236 of: Readings in Industrial Economics. Springer

Berghӓll E (2016) Innovation, competition and technical efficiency. Cogent Business & Manage- ment 3(1):1199522

Boone (2008) A new way to measure competition. Econ J 118(531):1245–1261

Bourreau M, Jullien B, Lefouili Y (2018) Mergers and demand-enhancing innovation. In: Toulouse School of Economics Working Papers No 18-907

Ciriani S, Jeanjean F (2019) Competition, technological change and productivity gains: a sectoral analysis. Available at SSRN 3342537

Fudenberg D, Tirole J (1985) Preemption and rent equalization in the adoption of new technology. Rev Econ Stud 52(3):383–401

Gilbert RJ, Newbery DMG (1982) Preemptive patenting and the persistence of monopoly. Am Econ Rev:514–526

Haucap J, Rasch A, Stiebale J (2019) How mergers affect innovation: theory and evidence. Int J Ind Organ 63:283–325

Jeanjean F (2017) Technical progress in the relationship between competition and investment

Jeanjean F¸o, Houngbonon GV (2017) Market structure and investment in the mobile industry. Inf Econ Policy 38:12–22

Kamien MI, Schwartz NL (1982) Market structure and innovation. Cambridge University Press

Koh H, Magee CL (2006) A functional approach for studying technological progress: application to information technology. Technol Forecast Soc Chang 73(9):1061–1083

Koh H, Magee CL (2008) A functional approach for studying technological progress: extension to energy technology. Technol Forecast Soc Chang 75(6):735–758

Motta M, Tarantino E (2017) The effect of horizontal mergers, when firms compete in prices and investments. In: Working paper series, p 17

Reinganum JF (1981) On the diffusion of new technology: a game theoretic approach. Rev Econ Stud 48(3):395–405

Schmutzler A (2013) Competition and investment—a unified approach. Int J Ind Organ 31(5):477–487

Schumpeter JA (1942) Socialism, capitalism and democracy. Harper and Brothers. Shubik, Martin, & Levitan, Richard. 1980. In: Market structure and behavior. Harvard Univ Pr

Shubik M, Levitan R (1980) Market structure and behavior. Harvard Univ Pr

Singh N, Vives X (1984) Price and quantity competition in a differentiated duopoly. RAND J Econ:546–554

Tandon P (1984) Innovation, market structure, and welfare. Am Econ Rev 74(3):394–403

Vives X (2008) Innovation and competitive pressure. J Ind Econ 56(3):419–414

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Proof of Lemma 1

The relationship between the number of firms and industry-level investment is decreasing or inverted U-shaped.

Investment at industry level is \( {F}_{ind}=\frac{n\tau {q}^2}{2} \).

Let us denote \( F{\hbox{'}}_{ind}=\frac{\partial {F}_{ind}}{\partial n},q"=\frac{\partial q\hbox{'}}{\partial n},\mathrm{and}\ F{"}_{ind}=\frac{\partial F{\hbox{'}}_{ind}}{\partial n} \).

We can write \( F{\hbox{'}}_{ind}=\tau q\left(\frac{q}{2}+ nq\hbox{'}\right)\ and\ F{"}_{ind}=\tau {q}^{\hbox{'}}\left(\frac{q}{2}+ nq\hbox{'}\right)+\tau q\left(\frac{3q\hbox{'}}{2}+ nq"\right) \).

First-order condition (Find = 0) provides the number of firms for which investment of the industry reaches an optimum. This optimum is a maximum if the second order condition (F"ind < 0) is verified.

I will first show that if there is an optimum, then it is a maximum and it is unique. That is to say if Find = 0 and F"ind < 0.

From Eq. (6),

Functions Find, F'ind, and F"ind are continuous for n ∈ ℝ and n ≥ 1 because the denominator of Eqs. (5), (6), and (11) are different from zero since τ < 2.

If there is an optimum, then F' = 0; therefore, \( \frac{q}{2}+n{q}^{\hbox{'}}=0 \) or τq = 0. Yet by definition, τ > 0 and q > 0 since a > c0. As a result, if there is an optimum for n = n*, then \( {n}^{\ast }=-\frac{q}{2q\hbox{'}} \).

At the optimum, the sign of F"ind is the sign of \( \frac{3q\hbox{'}}{2}+ nq" \) because τq is strictly positive.

We can write \( \frac{3q\hbox{'}}{2}+{n}^{\ast }q"=\frac{3{q}^{\hbox{'}}- qq"}{2q\hbox{'}} \) using \( {n}^{\ast }=-\frac{q}{2q\hbox{'}} \).

From Eq. (6), we can check that for n ≥ 2, q’ < 0; thus, the sign of F"ind is the sign of qq " − 3q'.

Using Eqs. (5), (6), and (11), we can write the following:

The denominator of this expression, as those of Eqs. (5), (6), and (11), is strictly positive since τ ∈ ]0, 2[.

If n ≥ 2, then 1 + γ(n − 2) ≥ 1, and thus, 2γ3(1 − γ)(1 + γ(n − 2))(1 − τ) ≥ 2γ3(1 − γ)(1 − τ).

Furthermore, (1 − τ) > − 1, and as a result, \( 2{\gamma}^3\left(1-\gamma \right)\left(1-\tau \right)>-\frac{\gamma^2}{2} \), the numerator is positive.

This means that qq " − 3q' is negative and thus F"ind ≤ 0. The optimum is a maximum.

In summary, if ∃n* ≥ 2 such that F ′ (n*) = 0 then F"ind(n*) ≤ 0 then n* is a maximum.

This maximum is unique because there is no minimum. Indeed, it is not possible to have a second relative maximum without a relative minimum as functions Find and F'ind are continuous.

If there is no optimum, the relationship cannot be monotonically increasing because Find(n) = τq2/2, and from equation (5)

If investment of the industry is maximized for n = 1, then function Find(n) is monotonically decreasing because there is no relative minimum.

As a result, the relationship between the number of firms and industry-level investment is inverted U-shaped or monotonically decreasing.

Proof of Proposition 1: From Lemma 1, the relationship between the number of firms and industry-level investment is inverted U-shaped or monotonically decreasing.If the relationship is inverted U-shaped, the number of firms n* that maximizes industry-level investment is such that F ′ (n*) = 0, which means n* = − q/2q'.

How does n* move when technical progress, τ, increases?

Output q tends to increase with technical progress, deriving q from Eq. (5) with respect to τ yields:

Moreover, deriving q’ from Eq. (6) yields:

As a result,

If n* ≥ 2 then q' < 0; therefore, \( \frac{\partial {n}^{\ast }}{\partial \tau}\le 0 \). This means that if the relationship between competition and investment of the industry is inverted U-shaped, the number of firms that maximizes investment of the industry decreases with technical progress.

If the relationship is monotonically decreasing, this means that n* = 1.

Investment of the industry is \( {F}_{ind}(1)=\frac{\tau {\left(a-{c}_0\right)}^2}{2{\left(2-\tau \right)}^2} \); furthermore, \( {F}_{ind}(2)=\frac{\tau {\left(a-{c}_0\right)}^2}{{\left(2-\tau +\gamma \left(1-\gamma \right)\right)}^2} \);

Find decreasing means Find(1) > Find(2), and \( \tau >2-\frac{\gamma \left(1-\gamma \right)}{\sqrt{2}-1} \). What happens if τ increases?

\( \frac{\partial {F}_{ind}(1)}{\partial \tau }=\frac{\left(4-{\tau}^2\right){\left(a-{c}_0\right)}^2}{2{\left(2-\tau \right)}^4} \) and \( \frac{\partial {F}_{ind}(2)}{\partial \tau }=\frac{\left(4-{\tau}^2+\gamma \left(1-\gamma \right)\left(4+\gamma \left(1-\gamma \right)\right)\right){\left(a-{c}_0\right)}^2}{{\left(2-\tau +\gamma \left(1-\gamma \right)\right)}^4} \)

We can check that if \( \tau >2-\frac{\gamma \left(1-\gamma \right)}{\sqrt{2}-1} \), then \( \frac{\partial {F}_{ind}(1)}{\partial \tau }>\frac{\partial {F}_{ind}(2)}{\partial \tau } \).

This means that if the relationship is monotonically decreasing, an increase in technical progress widens the gap and keeps the decreasing shape of the curve. In any case, an increase in technical progress tends to decrease (never increase) the number of firms that maximizes investment of the industry.

1.2 Proof of Lemma 2

Let us denote \( C{S}^{\hbox{'}}=\frac{\partial CS}{\partial n} \) and \( W\hbox{'}=\frac{\partial W}{\partial n} \)

From Eq. (7), it can be written as follows:

And from Eq. (8):

If \( \tau \le \frac{3\left(1-\gamma \right)}{2} \), then CS' > 0 which means that CS is monotonically increasing.

If \( \tau >\frac{3\left(1-\gamma \right)}{2} \), then CS' may be positive for low values of n, but CS' is negative for high values of n which means that CS is inverted U-shaped or monotonically decreasing.

If τ ≤ (1 − γ), then W ′ > 0 which means that W is monotonically increasing.

If τ > (1 − γ), then W' may be positive for low values of n, but W' is negative for high values of n which means that W is inverted U-shaped or monotonically decreasing.

1.3 Proof of proposition 2:

From Eq. (4), it can be written as follows:

In symmetric market, this equation becomes p = a − (1 + γ(n − 1))q. The derivative of the price according to n can be written p' = − (γq + (1 + γ(n − 1))q') which yields using Eqs. (5) and (6):

The denominator is positive, thus the sign of p' is the sign of the numerator. p ′ ≥ 0 if \( \tau \ge \left(1-\gamma \right){\left(\frac{1+\gamma \left(n-1\right)}{1+\gamma \left(n-2\right)}\right)}^2 \). Price is increasing if τ is high enough. \( \left(1-\gamma \right){\left(\frac{1+\gamma \left(n-1\right)}{1+\gamma \left(n-2\right)}\right)}^2 \) is decreasing with n, as a result, the probability that p' > 0 increases with n.

For n = 1, price is increasing if \( \tau \ge \frac{1}{1-\gamma } \) and

As a result, if \( \tau \ge \frac{1}{1-\gamma } \), then p' ≥ 0 for all values of n; this means that the number of firms always increases price.

If τ ≤ 1 − γ, then p' ≤ 0 for all values of n; this means that the number of firms always decreases price.

If \( \left(1-\gamma \right)<\tau <\frac{1}{1-\gamma } \), then price is decreasing for low values of n and increasing for high values. The relationship between price and the number of firms is U-shaped.

1.4 Proof of Proposition 4:

From Lemma 2, consumer surplus and welfare are monotonically increasing if τ is under a certain level. An increase in technical progress may cross the threshold and thus decrease the number of firms maximizing consumer surplus or welfare.

The number of firms that maximizes consumer surplus or welfare is denoted n** and n* * *, respectively. If consumer surplus or welfare is monotonically decreasing, then the number of firms that maximizes consumer surplus or welfare is n** = 1 and n* * * = 1, respectively. In such cases, CS'(1) < 0 or W'(1) < 0

and \( \frac{\partial {CS}^{\hbox{'}}(1)}{\partial \tau }<0 \) or \( \frac{\partial {W}^{\hbox{'}}(1)}{\partial \tau }<0 \).

If the relationship between the number of firms and consumer surplus or welfare is inverted U-shaped, the number of firms that maximizes consumer surplus is such that CS'(n**) = 0 or W'(n* * *) = 0. In that case, \( \frac{\partial {CS}^{\hbox{'}}\left({n}^{\ast \ast}\right)}{\partial \tau }<0 \) or \( \frac{\partial {W}^{\hbox{'}}\left({n}^{\ast \ast \ast}\right)}{\partial \tau }<0 \). This means that the number of firms that maximizes consumer surplus or welfare decreases with technical progress.

1.4.1 Reallocation of Output Tends to Increase Industry-Level Investment

Investment of firm i is Fi = τqi/2. Investment of the industry is

Let firm i be the least efficient firm: ∀j ≠ i, qi < qj. The reallocation of output decreases the output of firm i which becomes qi − εi and increases the output of the other firms that are more efficient: qj − εj. The reallocation induces \( {\varepsilon}_i=\sum \limits_{j\ne i}{\varepsilon}_j \).

Investment of the industry after reallocation is written as follows:

If qi < qj, then \( {\sum}_{j\ne i}{\varepsilon}_j{q}_i<{\sum}_{j\ne i}{\varepsilon}_j{q}_j \), and thus, \( {\varepsilon}_i{q}_i<{\sum}_{j\ne i}{\varepsilon}_j{q}_j \) which leads to \( {\sum}_{j\ne i}{\varepsilon}_j{q}_j-{\varepsilon}_i{q}_i>0 \). As a result,

1.5 Proof of Lemma 3

The general expression of output of firm i can be written as follows:

With A = 1 + γ(n − 1) and B = 1 + γ(n − 2).

γ*is the value above which the least efficient firm has no output. Let j be the least efficient firm, by definition, qj(γ*) = 0.

For γ = 0, \( \forall i,\kern0.5em {q}_i(0)=\frac{\left({a}_i-{c}_{0i}\right)}{\left(2-\tau \right)} \) and

From Eq. (13), we can check that \( \frac{\partial {F}_{ind}(0)}{\partial \tau }>\frac{F_{ind}\left(\gamma \right)}{\partial \tau } \), provided γ ≤ γ*. As a result, if for a given τ, Find(0) > Find(γ*), then, for a higher τ, Find(0) > Find(γ*) still holds.

For example, for n = 2,then \( {q}_i\left(\gamma \right)=\frac{\left(2-{\gamma}^2-\tau \right)\left({a}_i-{c}_{0i}\right)-\gamma \left({a}_j-{c}_{0j}\right)}{{\left(2-{\gamma}^2-\tau \right)}^2-{\gamma}^2} \). If j is the least efficient firm:

Let τ* be the value of technical progress for which Find(0) = Find(γ*).

If τ ≤ τ*, then Find(0) ≤ Find(γ*), and if τ > τ*, then Find(0) > Find(γ*).

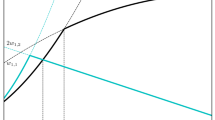

1.5.1 Investment in a Symmetric Market

For this figure, the parameters are the following: (ai − c0i) = 0.3 and τ = 0.8

Rights and permissions

About this article

Cite this article

Jeanjean, F. Impact of Technical Progress on the Relationship Between Competition and Investment. J Ind Compet Trade 21, 81–101 (2021). https://doi.org/10.1007/s10842-020-00341-5

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-020-00341-5