Abstract

While the literature has well-documented economic consequences of corruption on economic development, whether and how corruption affects corporate tax evasion is unclear. This study uses anti-corruption investigations in China as an exogenous shock to local corruption to identify the link between corruption and firms’ tax evasion behavior in a difference-in-differences framework. We present strong evidence that the anti-corruption campaign has a negative effect on corporate tax evasion. One plausible explanation is that the anti-corruption campaign conducted by the central inspection team undermined the political umbrella of companies and increased the chances of local government-enterprise collusion being detected, thereby inhibiting tax avoidance. This effect is more significant among firms in provinces with high inspection intensity, firms in economically-developed regions, large firms and firms in politically-sensitive industries. Our findings enrich the existing studies on the economic and fiscal effects of anti-corruption campaigns.

Similar content being viewed by others

Notes

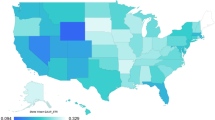

Data Source: Central Commission for Discipline Inspection State Supervision Website.

CSMAR database is a comprehensive research-oriented database focusing on China finance and economy. CSMAR was developed by Shenzhen CSMAR Data Technology Co., Ltd based on academic research needs, meeting with the international professional standards (such as CRSP, COMPUSTAT) while adapting to China’s features. This database has been widely used in research on Chinese corporate issues (Fang et al., 2022).

Wind database has built a complete and accurate large-scale financial engineering and financial data center on financial and securities data in China, which covers stocks, bonds, funds, foreign exchange, financial derivatives, commodities, macroeconomics, and financial news. Wind’s data is also frequently cited by authoritative Chinese and English media, research reports, and academic papers (Kong et al., 2021).

There are some limitations using ETR as a measure for tax evasion. Most researchers in the field of tax evasion acknowledge this fact but cannot come up with proper measurements. For example, Hanlon and Heitzman (2010) made an outstanding review of tax research, and pointed out that an important issue highlighted by the growing research on tax avoidance is how to measure avoidance, and empirical measures of tax avoidance that rely on financial statements have known limitations in part because they capture variation in tax avoidance as well as the choice between conforming and non-conforming tax avoidance. However, as there is no better measure for tax evasion, the recent literature began to use the effective tax rate measures (ETR) as a tax evasion indicator (such as, Armstrong et al., 2015; Li et al., 2017). This measure is not perfect but widely accepted. Given the facts above, our findings should be interpreted with caution. We thank the editor for pointing out this issue.

We also expand the pre-treatment period in the dynamic difference-in-differences design to get a more comprehensive perspective on trends in treatment and control group prior to treatment in Appendix Table 13. We find that the coefficients of Prek (k = 1, 2, 3, 4, 5) are negative and insignificant, which does not show any pre-trends, suggesting that firm tax evasion has no significant change prior to China’s anti-corruption campaign. The coefficient estimates of Postk (k = 1, 2) are positive and significant at 5%. This finding is consistent with the parallel pre-event trend hypothesis.

However, we find that the results in table 6 are not as significant using these other indicators from the statistical perspective, which are significant at 5% or 10% level. A plausible explanation is that, the observation here is reduced a lot due to the missing data. In addition, we follow the literature (such as, Armstrong et al., 2015; Li et al., 2017), and use the effective tax rate measures (ETR) in our main regression, a measure which has been widely accepted. So, the results in Table 6 are just the supplements to our main findings, which help to strengthen our empirical results.

We repeat the study for SOEs, controlling for the same fixed effects as the base results. The results are presented in Appendix Table 14. We find that SOEs are more significantly influenced by anti-corruption actions.

The positions of civil servants are divided into leadership and non-leadership positions. The pyramid of leadership positions is divided into 10 levels: national-level positions, national-level deputy positions, provincial-ministerial-level positions, provincial-ministerial-level deputy positions, department-bureau-level positions, department-bureau-level deputy positions, county-level positions, county-level deputy positions, township-level positions, and township-level deputy positions. Non-leadership positions are set below the department and bureau level.

The number of officials punished can be used to measure not only the inspection intensity, but also the corruption levels in the province.

References

Adhikari, A., Derashid, C., & Zhang, H. (2006). Public policy, political connections, and effective tax rates: Longitudinal evidence from Malaysia. Journal of Accounting and Public Policy, 25(5), 574–595.

Al-Hadi, A., Taylor, G., & Richardson, G. (2022). Are corruption and corporate tax avoidance in the United States related? Review of Accounting Studies, 27(1), 344–389.

Alm, J., Martinez-Vazquez, J., & McClellan, C. (2016). Corruption and firm tax evasion. Journal of Economic Behavior & Organization, 124, 146–163.

Armstrong, C. S., Blouin, J. L., Jagolinzer, A. D., & Larcker, D. F. (2015). Corporate governance, incentives, and tax avoidance. Journal of Accounting and Economics, 60(1), 1–17.

Armstrong, C. S., Blouin, J. L., & Larcker, D. F. (2012). The incentives for tax planning. Journal of Accounting and Economics, 53(1–2), 391–411.

Bilicka, K., & Seidel, A. (2020). Profit shifting and corruption. International Tax and Public Finance, 27(5), 1051–1080.

Blaufus, K., Möhlmann, A., & Schwäbe, A. N. (2019). Stock price reactions to news about corporate tax avoidance and evasion. Journal of Economic Psychology, 72, 278–292.

Bologna, J., & Ross, A. (2015). Corruption and entrepreneurship: Evidence from Brazilian municipalities. Public Choice, 165(1), 59–77.

Cai, H., Fang, H., & Xu, L. C. (2011). Eat, drink, firms, government: An investigation of corruption from the entertainment and travel costs of Chinese firms. The Journal of Law and Economics, 54(1), 55–78.

Cai, H., & Liu, Q. (2009). Competition and corporate tax avoidance: Evidence from Chinese industrial firms. The Economic Journal, 119(537), 764–795.

Callaway, B., & Sant’Anna, P. H. C. (2021). Difference-in-differences with multiple time periods. Journal of Econometrics, 225(2), 200–230.

Cao, X., Wang, Y., & Zhou, S. (2018). Anti-corruption campaigns and corporate information release in China. Journal of Corporate Finance, 49, 186–203.

Célimène, F., Dufrénot, G., Mophou, G., & N’Guérékata, G. (2016). Tax evasion, tax corruption and stochastic growth. Economic Modelling, 52, 251–258.

De Chaisemartin, C., & D’Haultfoeuille, X. (2022). Difference-in-differences estimators of intertemporal treatment effects (No. w29873). National Bureau of Economic Research.

Chen, C. J., Li, Z., Su, X., & Sun, Z. (2011). Rent-seeking incentives, corporate political connections, and the control structure of private firms: Chinese evidence. Journal of Corporate Finance, 17(2), 229–243.

Chen, H., Liu, S., Wang, J., & Wu, Z. (2022). The effect of geographic proximity on corporate tax avoidance: Evidence from China. Journal of Corporate Finance, 72, 102131.

Chen, S., Chen, X., Cheng, Q., & Shevlin, T. (2010). Are family firms more tax aggressive than non-family firms? Journal of Financial Economics, 95(1), 41–61.

Chen, Y. J., Li, P., & Lu, Y. (2018). Career concerns and multitasking local bureaucrats: Evidence of a target-based performance evaluation system in China. Journal of Development Economics, 133, 84–101.

Cheng, C. A., Huang, H. H., Li, Y., & Stanfield, J. (2012). The effect of hedge fund activism on corporate tax avoidance. The Accounting Review, 87(5), 1493–1526.

Chyz, J. A., Leung, W. S. C., Li, O. Z., & Rui, O. M. (2013). Labor unions and tax aggressiveness. Journal of Financial Economics, 108(3), 675–698.

Clarke, D., & Mühlrad, H. (2021). Abortion laws and women’s health. Journal of Health Economics, 76, 102413.

DeBacker, J., Heim, B. T., & Tran, A. (2015). Importing corruption culture from overseas: Evidence from corporate tax evasion in the United States. Journal of Financial Economics, 117(1), 122–138.

Desai, M. A., & Dharmapala, D. (2006). Corporate tax avoidance and high-powered incentives. Journal of Financial Economics, 79(1), 145–179.

Desai, M. A., Dyck, A., & Zingales, L. (2007). Theft and taxes. Journal of Financial Economics, 84(3), 591–623.

Dyreng, S. D., Hanlon, M., & Maydew, E. L. (2010). The effects of executives on corporate tax avoidance. The Accounting Review, 85(4), 1163–1189.

Faccio, M., Masulis, R. W., & McConnell, J. J. (2006). Political connections and corporate bailouts. The Journal of Finance, 61(6), 2597–2635.

Fan, J. P., Wong, T. J., & Zhang, T. (2007). Politically connected CEOs, corporate governance, and Post-IPO performance of China’s newly partially privatized firms. Journal of Financial Economics, 84(2), 330–357.

Fang, H., Li, Z., Xu, N., & Yan, H. (2022). Firms and local governments: Relationship building during political turnovers. Review of Finance, 1, 24.

Ferris, S. P., Hanousek, J., & Tresl, J. (2021). Corporate profitability and the global persistence of corruption. Journal of Corporate Finance, 66, 101855.

Fisman, R., & Wang, Y. (2015). The mortality cost of political connections. The Review of Economic Studies, 82(4), 1346–1382.

Giannetti, M., Liao, G., You, J., & Yu, X. (2021). The externalities of corruption: Evidence from entrepreneurial firms in China. Review of Finance, 25(3), 629–667.

Gupta, S., & Newberry, K. (1997). Determinants of the variability in corporate effective tax rates: Evidence from longitudinal data. Journal of Accounting and Public Policy, 16(1), 1–34.

Hanlon, M., & Heitzman, S. (2010). A review of tax research. Journal of Accounting and Economics, 50(2–3), 127–178.

Hering, L., & Poncet, S. (2014). Environmental policy and exports: Evidence from Chinese cities. Journal of Environmental Economics and Management, 68(2), 296–318.

Julio, B., & Yook, Y. (2012). Political uncertainty and corporate investment cycles. The Journal of Finance, 67(1), 45–83.

Khan, M., Srinivasan, S., & Tan, L. (2017). Institutional ownership and corporate tax avoidance: New evidence. The Accounting Review, 92(2), 101–122.

Kim, C., & Zhang, L. (2016). Corporate political connections and tax aggressiveness. Contemporary Accounting Research, 33(1), 78–114.

Kim, D. S., Li, Y., & Tarzia, D. (2018). Value of corruption in China: Evidence from anti-corruption investigation. Economics Letters, 164, 112–116.

Kim, E. H., Lu, Y., Shi, X., & Zheng, D. (2022). How does stock liquidity affect corporate tax noncompliance? Evidence from China. Journal of Comparative Economics, 50(3), 688–712.

Kong, D., & Qin, N. (2021). China’s anticorruption campaign and entrepreneurship. The Journal of Law and Economics, 64(1), 153–180.

Kong, D., Zhao, Y., & Liu, S. (2021). Trust and innovation: Evidence from CEOs’ early-life experience. Journal of Corporate Finance, 69, 101984.

Leff, N. H. (1964). Economic development through bureaucratic corruption. American Behavioral Scientist, 8(3), 8–14.

Levy, G. (2007). Decision–making procedures for committees of careerist experts. American Economic Review, 97(2), 306–310.

Li, B., Wang, Z., & Zhou, H. (2021). China’s anti-corruption campaign and credit reallocation from SOEs to non-SOEs. PBCSF-NIFR Research Paper No. 17–01.

Li, H., Meng, L., Wang, Q., & Zhou, L. A. (2008). Political connections, financing and firm performance: Evidence from Chinese private firms. Journal of Development Economics, 87(2), 283–299.

Li, H., & Zhou, L. A. (2005). Political turnover and economic performance: The incentive role of personnel control in China. Journal of Public Economics, 89(9–10), 1743–1762.

Li, O. Z., Liu, H., & Ni, C. (2017). Controlling shareholders’ incentive and corporate tax avoidance: A natural experiment in China. Journal of Business Finance & Accounting, 44(5–6), 697–727.

Lin, C., Morck, R., Yeung, B. Y., & Zhao, X. (2016). Anti-corruption reforms and shareholder valuations: Event study evidence from China. Available at SSRN 2729087.

López, J. J. (2017). A quantitative theory of tax evasion. Journal of Macroeconomics, 53, 107–126.

Lu, Y., & Yu, L. (2015). Trade liberalization and markup dispersion: Evidence from China’s WTO accession. American Economic Journal: Applied Economics, 7(4), 221–253.

Méon, P. G., & Weill, L. (2010). Is corruption an efficient grease? World Development, 38(3), 244–259.

Piotroski, J. D., & Zhang, T. (2014). Politicians and the IPO decision: The impact of impending political promotions on IPO activity in China. Journal of Financial Economics, 111(1), 111–136.

Rambachan, A., & Roth, J. (2019). An Honest Approach to Parallel Trends. Working Paper.

Stickney, C. P., & McGee, V. E. (1982). Effective corporate tax rates the effect of size, capital intensity, leverage, and other factors. Journal of Accounting and Public Policy, 1(2), 125–152.

Sun, L., & Abraham, S. (2021). Estimating dynamic treatment effects in event studies with heterogeneous treatment effects. Journal of Econometrics, 225(2), 175–199.

Suzuki, M. (2014). Corporate effective tax rates in Asian countries. Japan and the World Economy, 29, 1–17.

Wilkie, P. (1988). Corporate average effective tax rates and inferences about relative tax preferences. The Journal of the American Taxation Association, 10(1), 75–88.

Wu, J., Chen, Z., & Guo, C. (2022). How does anti-corruption affect green innovation? Evidence from China. Economic Analysis and Policy, 73, 405–424.

Wu, L., Wang, Y., Lin, B. X., Li, C., & Chen, S. (2007). Local tax rebates, corporate tax burdens, and firm migration: Evidence from China. Journal of Accounting and Public Policy, 26(5), 555–583.

Xu, G., & Yano, G. (2017). How does anti-corruption affect corporate innovation? Evidence from recent anti-corruption efforts in China. Journal of Comparative Economics, 45(3), 498–519.

Yang, C., Zhang, W., Sheng, Y., & Yang, Z. (2021). Corruption and firm efforts on environmental protection: Evidence from a policy shock. Pacific-Basin Finance Journal, 65, 101465.

Yu, J., & Qi, Y. (2022). BT-to-VAT reform and firm productivity: Evidence from a quasi-experiment in China. China Economic Review, 71, 101740.

Zimmerman, J. L. (1983). Taxes and firm size. Journal of Accounting and Economics, 5, 119–149.

Acknowledgement

We thank the editor, Nadine Riedel, two referees, Chen Lin, Rui Shen, Shasha Liu, Jian Zhang, and seminar participants at Jinan University, Shanghai University of Finance and Economics, and Zhongnan University of Economics and Law for helpful comments. We acknowledge the financial support of the Major Project of the National Social Science Foundation of China (Grant No. 21ZDA010), the National Natural Science Foundation of China (Grant No. 72202078), the Humanities and Social Science Fund of Ministry of Education of China (Grant No. 22YJC790097), and Huazhong University of Science and Technology Double First-Class Funds for Humanities and Social Sciences, and the Fundamental Research Funds for the Central Universities HUST:2021WKFZZX007. All authors contributed equally to this paper.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank the editor, Nadine Riedel, two referees, Chen Lin, Rui Shen, Shasha Liu, Jian Zhang, and seminar participants at Jinan University, Shanghai University of Finance and Economics, and Zhongnan University of Economics and Law for helpful comments. We acknowledge the financial support of the Major Project of the National Social Science Foundation of China (Grant No. 21ZDA010), the National Natural Science Foundation of China (Grant No. 72202078), the Humanities and Social Science Fund of Ministry of Education of China (Grant No. 22YJC790097), Huazhong University of Science and Technology Double First-Class Funds for Humanities and Social Sciences, and the Fundamental Research Funds for the Central Universities HUST:2021WKFZZX007. All authors contributed equally to this paper.

Appendixes

Appendixes

See Tables 10, 11,12, 13, 14 and 15.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Kong, D., Zhang, Y. & Qin, N. Anti-corruption campaign and corporate tax evasion: evidence from China. Int Tax Public Finance (2023). https://doi.org/10.1007/s10797-023-09777-x

Accepted:

Published:

DOI: https://doi.org/10.1007/s10797-023-09777-x