Abstract

In the U.S., means-tested cash, in-kind assistance, and social insurance are part of a patchwork safety net, often run with substantial involvement of state and local governments. Take-up–participation among eligible persons in this system is incomplete. A large literature points to both neo-classical and behavioral science explanations for low take-up. In this paper, we explore the response of the safety net to COVID-19 using newly-collected survey data from one U.S. state–Utah. The rich Utah data ask about income and demographics as well as use of three social safety net programs which collectively provided a large share of relief spending: the Unemployment Insurance program, a social insurance program providing workers who lose their jobs with payments; the Supplemental Nutrition Assistance Program, which provides benefit cards for purchasing unprepared food at retailers; and Economic Impact Payments, which provided relatively universal relief payments to individuals. The data do not suffice to determine eligibility for all of the programs, so we focus on participation per capita. These data also collect information on several measures of hardship and why individuals did not receive any of the 3 programs. We test for explanations that differentiate need, lack of information, transaction costs/administrative burden, stigma, and lack of eligibility. We use measures of hardship to assess targeting. We find that lack of knowledge as well as difficulty applying, and stigma in the UI program each play a role as reasons for not participating in the programs.

Similar content being viewed by others

1 Introduction

The United States (U.S.) safety net is a patchwork system, run by different agencies at different levels of government with the participation of various non-governmental actors. Most social-insurance programs and safety net programs in the US require individuals (or families) to apply in addition to satisfying eligibility requirements which often have different rules about whose income is relevant or who counts as a family member. This leads to take-up rates (defined as participation among eligible persons) that are well below 100%. Recently, attention in the field of public economics has turned to understanding the determinants of incomplete safety-net program take-up and assessing the targeting of programs—whether they reach the most needy participants—and what the welfare implications of incomplete take-up are. This new area of literature seeks to differentiate between the implications of two neoclassical models. The first model hypothesizing that would-be participants make informed, forward-looking choices and incomplete take-up might be efficiently deterring less needy individuals. This is compared with the behavioral science models—which point to frictions and deviations from the neoclassical model which may lead the neediest participants to make sub-optimal choices. Drawing on insights from the public-administration literature, new research points to the role of governments, and other actors, in creating what has been called administrative burden, where application processes are confusing at best.

We contribute to this literature with new survey data from the Utah Consumer and Business Economic Surveys during the first thirteen months of the COVID-19 crisis. In addition to mortality and morbidity, COVID-19 led to a very speedy and deep recession, where the unemployment rate reached levels not seen since the 1930s. This economic shock tested the U.S. safety net and led to expanded government assistance through many sources. We explore participation in three large programs: The Supplemental Nutritional Assistance Program (SNAP), the Unemployment Insurance Program (UI), and the Economic Impact Payment program (EIPs, or stimulus).Footnote 1

We take advantage of an ongoing state-representative survey of Utah households, from October 2020 through April 2021 to understand the characteristics of participants and non-participants in these programs in Utah including SNAP, UI, and the stimulus payments. We asked non-participants questions to elicit information on various reasons suggested in the literature for incomplete take-up of programs: lack of information, administrative burden or difficulty in applying to programs, being ineligible for them, and a question about whether the program was not for “people like me” to capture possible stigma.Footnote 2

We also assess how well-targeted the programs are by looking at how they are associated with hardship while also looking at hardship experienced by non-participants citing each reason for not participating. Measures of need included sometimes/often not having enough to eat,Footnote 3 having trouble paying a mortgage or rent and having difficulty paying bills.

We find multiple characteristics are associated with non-participation in the programs. Education was tied to lack of knowledge about UI. The transaction costs with SNAP were tied to being low income. People who needed programs but were ineligible were disproportionately divorced or separated. People who thought the program was “not for people like me” (stigma) were more educated (UI), had lower education (SNAP) and had low education, or were divorced or separated (EIPs).

Concerning targeting of the programs and levels of hardship among those who did or did not participate, we concluded that the programs were well targeted to those with need, but that many of the non-participants had even higher need. We also quantified a role for both new-classical reasons such as lack of knowledge and more behavioral-science reasons such as difficulty applying. Stigma seemed to play little role outside of UI.

We provide a road map for the rest of this paper. Section 2 discusses the literature on COVID-19 and the government response, focusing on the most relevant papers. In Sect. 3, we discuss the survey data, and compare Utah to the rest of the U.S., both along demographic dimensions, and in terms of the crisis and crisis response. We then turn to a discussion of the three programs with large components of COVID-19 relief we will examine; SNAP, UI and the EIPs in Sect. 4. Section 5 describes our findings about who participated in the programs, and the reasons why non-participants did not obtain the benefits. Section 6 will assess targeting. Section 7 will explore explanations for why Utah’s safety net response was robust, both from our own findings and from considering the way the two-state-run programs (UI and SNAP) are administered. Finally, we conclude in Sect. 8 by placing our findings in context with the relevant literature.

2 COVID-19, The response from the government to COVID-19, and take-up more broadly: literature

In this section, we briefly remind the reader about the COVID-19 pandemic and then touch on the key papers about the safety net and COVID-19 which inform our discussion, focused on evidence about the three programs we look at. Then we remind the reader of some of the existing literature about program take-up.

2.1 COVID-19: the shock

Toward the end of 2019, it was clear that a new virus was spreading based on news from China; the first case of COVID-19 in the U.S. was diagnosed at the end of January 2020, and a national emergency was declared on March 3, 2020. States quickly followed with lock-downs and school closures and the economy ground to a halt. Unemployment quickly reached very high levels, rising from 3.5 percent in February 2020 to a peak of 14.7 percent in April 2020 (the nadir of the recession). Congress responded quickly with several bills, two passing in March of 2020, one in October 2020, one in December 2020, and one in March of 2021. This included funding directed at responding to the pandemic itself, ranging from funds to develop vaccines and create stockpiles of protective equipment to mask mandates on public transportation to making testing and vaccines free. It also included historically-unprecedented fiscal stimulus.

Utah’s experience of the economic effects of COVID-19 seemed less severe than the rest of the country.Footnote 4

2.2 Government responses to COVID-19 in the U.S.

A large literature has explored the correlates of the COVID-19 shock and government responses and well-being. We focus here on the most relevant work, spanning our programs and time period and data granularity. So, we do not discuss work on the Child Tax Credit, which came after our data end; nor do we discuss at length Pandemic-EBT which both depended on schools being closed (which was infrequent in Utah after Spring 2020) and also applied to many non SNAP recipient families.Footnote 5 Farrell et al. (2020) show that spending from Chase accounts in 10 states increased with UI benefit deposits among formerly employed account holders, leveraging data from regular state UI and the top-up FPUC from 2020. Casado et al. (2020) find UI benefits affect economic activity. Coibion et al. (2020) find that EIP benefits led to spending, savings, and paying off debt.

Bitler et al. (2020) focuses on what we would expect from previous recessions on spending on safety net programs and social insurance programs, showing that UI is the most responsive program given local labor market shocks, but also finding that SNAP is the most counter-cyclical of the means-tested programs. Hembre (2021) finds that SNAP was less responsive to the unemployment shock than during the Great Recession and TANF was more responsive while UI seemed to enhance the effects of both programs. Bitler et al. (2020) focuses on spending by summer 2020, and documents holes in the safety net for unauthorized and sometimes authorized immigrants as well as delays in payments.

2.3 General work on take-up

We conclude this section by reviewing some work on take-up and targeting more broadly. A paper by Currie and Gahvari (2008) discusses transfers in cash and in-kind that reviews the neoclassical theory and more behavioral science approaches and discusses the literature. A more recent (soon to be reviewed) article by Ko and Moffitt (2022) presents survey estimates from around the world of safety-net program take-up and reasons for participation. (We note that they also discuss some of the issues with calculating take-up relative to participation.) Ko and Moffitt describe big differences across programs, time, and place. Some reasons discussed are non-financial barriers (for AFDC/TANF), and the role of for-profit companies in helping people sign up (for the EITC). The authors also show take-up rates across other high-income countries, with wide differences across locations. It is notable that there is even wide variation in take-up rates across Europe, which they note is seen as having more universal programs than the U.S. does. One important thing they do note is that programs run via the tax agencies seem to have high take-up and this is consistent with high rates of take-up in the US for the EITC and the EIP, in part because of information about who is eligible in some counties through population registries. They also note that voluntary application and administrative burden play a role in explaining low rates. Lastly, the authors describe program take-up for selected Low-or-Middle Income Countries. Dubois and Ludwinek (2015) consider program participation across the Netherlands, United Kingdom (U.K.) and Slovakia. They report that knowledge and lack of need are important predictors of not participating in social safety net programs but also note that the cost of applying and social stigma can be barriers to take up. Stuber and Kronebusch (2004) document the importance of stigma in TANF and Medicaid take-up in the U.S. Work by Kopczuk and Pop-Eleches (2007) and Herd and Moynihan (2018) both document the role of application and participation costs as barriers to program take-up. Kleven and Kopczuk (2011) discuss the roles of program operators in affecting take-up and touch on the costs of administrative burden or complexity. Finn and Goodship (2014) comprehensively look at take-up and theories for low take-up in the UK, as well as the role of efforts to increase take-up.

3 Context: Utah, the UCBES survey, and Utah’s response to COVID

For this analysis, we start by pointing out how Utah is different from the rest of the U.S. along various demographic dimensions. Then we present information about our Survey data and how we have adjusted it to match the nationally representative CPS. Finally, we discuss how Utah’s COVID-19 response may have differed from some other parts of the U.S.

3.1 Utah and the rest of the U.S.

We start by presenting demographics from the Current Population Survey’s Annual Social and Economic Supplement (ASEC) for Utah compared to the rest of the U.S. Our survey data (discussed immediately below) collect demographics primarily from household heads, so we first compare all adults in Utah to the rest of the U.S., and then switch to comparisons of household heads from ASEC and the Utah Consumer and Business Economic Surveys.

In Table 1, columns 1 and 2, we present weighted mean demographic characteristics from the ASEC to the Current Population Survey for adults 18 and older from the rest of the U.S. (column 1) and Utah (column 2) for survey years 2018–2019. Utah’s demographics are different from the rest of the U.S. on a variety of dimensions. Utah has a considerably larger share of white non-Hispanic persons (80% vs. 62% of adults in the rest of the U.S.) and a much lower share of Black non-Hispanic adults (1% vs. 12% in the rest of the U.S.) Utah adults are also more likely to be married and less likely to be divorced, separated, or widowed than other U.S. adults, and they are also considerably younger. Utah adults are about as likely to be Hispanic persons (of any race) as are adults in the rest of the U.S., and Utah adults are more likely to have a high school degree and less likely to have more than a B.A. relative to adults in the rest of the U.S.. Gender of adults is distributed similarly across the two groups.

3.2 The Utah consumer and business economic surveys

Next, we discuss the methodology for the Utah Consumer and Business Economic Surveys (UCBES).Footnote 6 The UCBES data set we take advantage of was sponsored by the state of Utah to study the state of the economy during COVID. It was carried out by the Eccles School of Business at the University of Utah. It is a set of repeated cross sections based on a survey frame about characteristics of households by mailing address. It was designed to match the state distribution of adults by race/ethnicity, and also designed to over-sample groups with low response rates, so it would be self-weighting.

We compared the UCBES data for household heads to data for Utah household heads from the Annual Social and Economic Supplement to the Current Population Survey (CPS). We created weights using propensity score methods so that the resulting weights for the COVID-19 survey match demographic characteristics in the CPS. We did this as follows. We pooled our household survey respondents with adult household heads from the ASEC. Then we use a probit regression to predict being in the ASEC as a function of demographics (race, ethnicity, education, marital status, and age; also using missing data flags and using existing survey weights for the ASEC.Footnote 7 Then, we weight the COVID-19 respondents by \(\frac{\widehat{p}}{(1-\widehat{p})}\), where \(\widehat{p}\) is the predicted probability from this regression of being in the ASEC. This makes our survey data match the observable distribution of characteristics across categories. Table 1, column 4 has means from UCBES with the adjusted weights to match the ASEC, which can be compared to column 4, weighted ASEC means for household heads from Utah. The mean differences between the adjusted weighted UCBES data and the ASEC data are small.

3.3 Utah and COVID-19

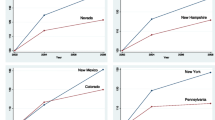

We also touch on Utah’s experiences including medical and economic response to the COVID-19 crisis. Before COVID-19 struck, the economy in Utah was booming, more so than in the rest of the country. The magnitude of the shock was less severe in Utah than the rest of the U.S. Overall, the unemployment rate was lower in Utah in the rest of the U.S. before COVID-19, with the February 2020 unemployment rate being 2.5 percent in Utah, while it was 3.5 percent for the rest of the U.S. In April at the peak, the Utah unemployment rate was 10.1 percent as opposed to 14.9 percent in the rest of the U.S.. Of course, this might be simply due to the difference in demographics. To net this out, we used micro-CPS-monthly data from March 2019 through April 2021, and run regressions of unemployment status on month dummies, as well as race/ethnicity, gender, education, and marital status dummies meant to match the demographics in the Utah data, for everyone in the labor force; we then allow the effect of the crisis to vary by month. This yields the effect of COVID-19 on the unemployment rate by month from March 2020 on. This regression shows that net of these other factors and month dummies (a proxy for seasonality), COVID-19 in Utah led the unemployment rate in April to jump up by 8.3 percentage points, but by July was down to 1.4 percentage points above usual for July, with a slight uptick in September to 2.5 percentage points above usual for September. The effect of the initial shock was still larger in magnitude in the rest of the U.S., jumping up by 11.3 percentage points above the usual in April, and staying at least 3 percentage points above the monthly average through December of 2020. Thus, even net of demographics and adjusted for seasonality, the Utah economy recovered more quickly than the rest of the U.S. during our study period.

The relatively younger population in Utah meant that Utah experienced lower mortality rates despite having higher infection rates and lower vaccination rates than the rest of the U.S. Utah also had limited school closures and mask mandates. As of 7/2/2021, Utah reported 38% of those eligible were fully vaccinated, and 49% had had one dose, below the U.S. average. Deaths as of July 7, 2021 were well below the U.S. average, but aggregate infections were higher. Seegert et al. (2020) discusses the response of Utah to COVID-19 and finds evidence that the public health measures taken to prevent the spread of COVID-19 were less restrictive than other states.

We also explore information about the generosity and/or competence of the programs pre-COVID-19 in Utah. We found that in 2018 and 2019, Utah had a smaller share of insured unemployed (those filing for regular UI) as a percentage of total unemployment. Utah has a lower tax rate for UI as a share of total wages than the U.S. However, there is evidence that Utah is competent in administering UI for a smaller rate, given acknowledgement from the Department of Labor for Utah’s performance excellence in 2020. Utah also has a high taxable wage base for UI, up to nearly $37,000. Finally, while UI in Utah has a fairly high minimum earnings requirement. Regarding SNAP, UI had low relatively low underpayments and over-payments. Considering Utah in Economic Research Services’ policy index about generosity of SNAP, Utah is in the middle.

4 Context: relief programs

In this section, we discuss the three programs our work explores: Supplemental Nutrition Program (SNAP), Unemployment Insurance (UI) and Economic Impact Payments (EIPs). All three programs were either established or greatly expanded during COVID.

4.1 The supplemental nutrition assistance program (SNAP)

SNAP is an important program in our food-assistance safety net. SNAP is the largest food assistance program, spending $56 billion on benefits for 35 million persons in 2019. It is means tested, based on income and asset limitations. It is universal, with the exception of certain groups of immigrants and able-bodied adults without dependents whose benefits are limited except in economic downturns. Generally, eligibility is conditioned on total income being below 130% of the Federal-Poverty guideline, and then on income net of disregards (net income) being under 100% of the Federal-Poverty guideline.Footnote 8

One additional distinction is that in good-economic conditions, able-bodied adults without dependents (ABAWDS) are only able to obtain benefits for three of every 36 months. Bitler et al. (2020) document that SNAP is the most responsive of the means tested programs on a population level in the recent era but before COVID, although less so than UI.

During COVID, SNAP expanded eligibility and maximum benefits in several ways. First, USDA granted states waivers which ended requirements to apply/re-certify in person, and otherwise simplified some administrative hurdles for states, including extending the period for which benefits are accessible without recipients being re-certified if states wanted to. Benefits were also expanded so everyone obtained the maximum benefit (regardless of other income which would usually reduce benefits). Then, in January 2021, the maximum benefit was increased. Finally, SNAP was used as a vehicle for administering Pandemic EBT payments—meant to replace school meals while schools were closed, and was added to the SNAP payment for SNAP recipients as of March 16, 2020 as a one time payment of $308 per child.Footnote 9

USDA also explored expanding online SNAP redemption for more states. Summarizing these changes, SNAP expanded both because of administrative flexibility making it easier to apply, qualify for and remain on the program but also because more families got the maximum amount of benefits (called the maximum allotment).

4.2 Unemployment insurance (UI)

Unemployment Insurance (UI) is a jointly federal-state run social insurance program. It is mandated for all states to participate, and in normal times, states collect premiums from employers and use those funds to pay out benefits for workers who have sufficient work history and earnings for a period of up to 26 weeks (some states only pay for a shorter period). There is a shared state-federal extended benefit program when insured unemployment reaches specified thresholds, and in particularly strong downturns, the Federal Government often funds fully federally funded extensions. During COVID-19 this meant an extra 6 months of federally-funded extensions (Pandemic Emergency Unemployment Compensation (PEUC)), top-ups for all recipients (Federal Pandemic Unemployment Compensation (FPUC)), and eligibility for UI for the self-employed and those not satisfying previous earnings/work history requirements (Pandemic Unemployment Assistance (PUA), which also qualified individuals for FPUC). The FPUC payments led some workers to have a replacement rate over 100% because it was set at discrete amounts to make it easy to implement ($600, then $400 or $300, then $300). Importantly, the FPUC was quite generous especially for the lowest earners. Also, the PUA program included a host of self-employed and low earnings/work history workers into the program who normally would be ineligible. As a result of these changes, states had to implement new programs while facing high increases in caseloads. States also made different choices about how to make sure no one was getting regular UI and PUA at the same time—some states assessed eligibility for both in one step while others forced applicants to apply and be turned away from for regular UI before they could apply for PUA. States differed widely in their capacity to implement the new components of UI efficiently. Utah’s weekly benefit is set as the wages in the highest paid quarter of the base period over 26 minus $5, with a maximum weekly benefit of $596 and a duration of 10–26 weeks for the state program.

4.3 Economic impact payments (EIPs)

Over the course of the Pandemic, three EIPs were paid out. The first was provided to families with eligible citizen adults (up to $1200 per person) as well as an additional $500 per qualifying child under 17. It was taxed away for higher income families (individuals with annual gross income (AGI) \(\ge \$75,000\), or if married, AGI \(\ge \$150,000\)). A second round with similar rules was enacted in late 2020. Finally, the American Rescue plan, put in place March 21,2020, provided larger payment amounts. The American Rescue Plan also included expanded Child Tax Credit payments, but they occur after the end of our survey period. Individuals where the government could assign eligibility and send benefits received payments early. Other eligible groups may have had to apply to obtain benefits (e.g., those on Social Security Payments with dependents, or those who had not filed taxes lately). Over $271 billion was paid out in the first EIP (U.S. Treasury Press Release (June 29, 2021)).

4.4 Considerations for take-up

Bitler et al. (2020) show that these three programs sent large amounts of money to needy individuals. However, the design may also have affected different groups differently. The use of the maximum allotment meant more money for those who were relatively higher income on SNAP. At the same time, lifting SNAP-ABAWD rules and loosening re-certification/application rules should enhance participation in SNAP during COVID. UI has expanded broadly, but there were some delays in getting the new programs FPUC (the UI top-up), PEUC (extended emergency benefits), and PUA (the program for the self-employed and those lacking earnings history). Additionally, some of the new programs ended and restarted several times. The first EIP left out any family with unauthorized immigrants unless they were in the military, even if there were citizens in the family unit. Those who had filed taxes recently with bank account information with the government got the EIPs right away. Conversely, others, disproportionately low income/those not likely to file taxes, had to apply. And for all these forms of relief payments, unauthorized immigrants are not included.

5 Participation in the programs and reasons for not participating

5.1 Determinants of participation

Figure 1a–e show average participation in the three programs in the UCBES by demographic groups, showing averages across age, gender, race/ethnicity, education level, and marital status of the household heads.

Across all demographics, participation in the EIP was the most broad (as it was the most widely available/least targeted form of relief). Hispanic persons were slightly less likely to get the EIP as were Black non-Hispanic persons compared to whites. Women were a little more likely to get it. As would be expected given it is clawed back for higher income persons, there is a downward gradient in receipt by education of the household head. And the youngest are the least likely to participate.

Use of UI is pretty similar across groups except it is lower among elderly household heads (who are less likely to be working). Use of SNAP is higher among heads who are Black non-Hispanics or Hispanics, who are women, who have lower levels of education, and who are not married.

Of course, many of these characteristics are correlated, so we turn to regressions predicting use of the three programs while controlling for all of these characteristics at the same time.

Each of the vectors of variables \(X^j\), \(j=1\) to \(j=5\) is a set of dummies for the categories of each demographic and where relevant, including a missing indicator. The regressions also control for income being more than $75,000 and it being missing (\(j=6)\), and there are county (\(C_c\)) and month-of-survey (\(M_t\)) fixed effects. The regressions are weighted with the propensity score weights discussed above.

The results of these regressions are in Table 2. First note that for UI and SNAP, as one would expect, the highest income participants are much less likely to get them. For UI, this might be because they were less likely to lose their jobs, but for SNAP they would be more likely to be income eligible. Again as expected, households with younger heads are more likely to get UI than those 65 and older, who are less likely to be working. Those unmarried are more likely to participate in SNAP, and the younger families were surprisingly less likely to get the EIP. Finally, there was an education gradient, with the less-educated more likely to obtain SNAP and the EIP. Somewhat puzzlingly, Hispanic headed households are more likely to be on SNAP but less likely to obtain the EIP.

5.2 Why people report not participating in the programs

Next, we explore the reasons why people report not having obtained the programs.Footnote 10 We asked non-participants a series of questions aimed at understanding if people thought they did not need the program, they needed the programs but were simply ineligible for them, if they were uninformed about the programs, had difficulty applying for them, or if they thought they weren’t for people like them. These questions are meant to capture some of the usual explanations offered up for low take-up of programs. Not needing the program corresponds to individuals who are typically not targeted and so policymakers are less concerned about their exclusion. Those who don’t know might have imperfect information. Those who need it but are ineligible are more concerning, although sometimes it is by program design as when it is about immigration status. Difficulty managing the application process might be a marker of administrative burden or high-transaction costs. Finally, reporting that the program is not for “people like me” is meant to get at perceived stigma of program participation.

Reasons did not participate in programs for those with specific characteristics, UCBES. Coefficients on selected characteristics in regressions of determinants of not participating in the programs with CI on bars. Regressions also control for other demographic/income characteristics and county and time FE. UCBES data

We note that these reasons are not highly co-linear and likely represent separate concepts. We also note that when we estimate regressions similar to Eq. (1) in terms of controls, but only for non-participants in the programs, we found that they seemed to capture relevant features. Figure 2 reports selected coefficients from these regressions. For example, for all three programs, Fig. 2a shows that those heads with income above $75,000 were much more likely to report not needing the programs (and less likely to report not knowing about SNAP and EIP). Those with higher income were also less likely to report needing UI despite being ineligible. Figure 2b shows analogous coefficients for those heads who are divorced or separated. These persons were much less likely to report not needing the programs and more likely to say they needed them but were ineligible. Figure 2c reports the coefficients for the head having at most a HS degree. Here we conclude individuals are far less likely to report not needing the programs. Lastly, Fig. 2d and 2e report the coefficients by race. Hispanic (Fig. 2d) and white non-Hispanic (Fig. 2e) are reported as compared to the reference category of Black non-Hispanic, a relatively small group. There is more variation across programs when considering the reasons for non-participation by race. Hispanic individuals less likely to report that they did not need SNAP, but they were more likely to report not needing or being ineligible for the EIP. White individuals were less likely to report that any of the three programs was “not for people like me,” but they were more likely to need but be ineligible for SNAP and EIP though at a lower rate than Hispanic people.

6 Targeting

6.1 Measures of hardship

In this section, we explore the levels of hardship experienced by families during COVID. We focus on three measures of hardship: Sometimes or often not having enough to eat, being behind on mortgage payments or rent, and having difficulty paying household expenses. Figure 3 shows the average level of these hardship measures across the same demographic characteristics as we explore for program participation in Fig. 1. First, note that “sometimes or often not having enough to eat” is far more common than the other two measures (as often happens in the heat or eat literature and may also have happened here because of eviction moratoria). For example, they range from 5 percent (for households headed by those 65-and-older) up to 16 percent (for households headed by 18–24 year olds), and from 7 percent (for other-non-Hispanic household heads) to 24 percent (for Black non-Hispanic household heads). Rates of being behind on mortgage payments or rent are lower (1–3 percent) for households with household heads of various ages, and the group with the highest level is Black non-Hispanic household heads, where 14 percent reported this hardship. Difficulty paying expenses is even less variable. Second, note that there are clear differences in need across these characteristics in not having had enough to eat. Households headed by younger persons; females; non-Hispanic Blacks or non-Hispanics of other races, and Hispanics; those with less education, and the unmarried had higher levels of inadequate food than did others.

6.2 Hardship, receipt of programs, and reasons for not participating

In this subsection, we present results of regressions predicting hardship as a function of receipt of the programs; reasons for not participating in the programs (excepting did not need it); and the demographics; income controls; and county and month fixed effects. As before, we included the propensity score weights. Table 3 shows the coefficients on receipt of the programs and the reasons for not participating, in regressions about the determinants of sometimes or often not having enough food. First, we note that the programs were targeted to individuals and households in need. Household heads who got UI were 7 percentage points more likely to not have enough food, those who got SNAP were 23.5 percentage points more likely to do so, and those getting the EIP were 4.8 percentage points more likely to do so. However, those who did not obtain the program also at high need.

Considering those facing food insecurity but who neither got UI nor did not need it; those without knowledge about the program, those who faced problems applying, those who needed the program but were ineligible, and those who thought UI who was not for people like them all had high levels of need (larger than those who got the program). Turning to SNAP, those getting SNAP faced considerable food insecurity. Individuals in food hardship did not however face stigma (reported SNAP is not for people like me) in obtaining SNAP. Finally, as one might expect, EIP receipt was associated with need, but need was associated with non-receipt for lack of knowledge, difficulty applying, and being ineligible.

Given the broad income levels eligible for the EIP and wide program targeting, it is interesting to know that fewer people reported that they did not get it because they faced difficulty applying or lack of knowledge than for the other two programs. SNAP and the EIP programs were also associated with less reported stigma. These findings show that broad targeting and ease of application/lack of administrative burden may play a large role in affecting households access to benefits.

7 Conclusion

In this paper, we have explored determinants of one state’s response to COVID-19 with three large social safety net programs—SNAP, UI, and the EIPS, along with new data on hardship. We explored participation in the programs as well as the determinants of non-use of programs for various reasons.

Were it possible, we would have ideally considered take-up but there were constraints in our ability to measure eligibility in our data. The difference between take-up and participation is larger when programs are less universal and smaller when they are more comprehensive. Thus, this difference is smallest for the EIP which was the most broadly targeted program. It is also important to note that both UI and SNAP were widely expanded in COVID-19, making them broader and more generous. Eligibility in both UI and SNAP is broader in COVID-19 as well as in other downturns simply due to the link between eligibility and shocks, with more people being eligible when times are worse (SNAP) because incomes are lower and because people have lost their jobs (UI).

Lastly, we explored the extent to which benefits were targeted and those not using the benefits, for various reasons, were also at risk. We found that outside of survey respondents not needing the benefits, it was clear that those not participating for reasons outside of stigma were needier than participants. Specific reasons suggested those ineligible were at high need, and that the EIPs—the most broadly targeted program–had the smallest share of those who did not have enough food sometimes or often who did not know about the program, or had trouble applying. This suggests that transactions costs and/or administrative burden did matter less for this broadly targeted program. More work is needed to understand how the safety net responded to COVID-19 and how this was affected by state capacity, state policy choices, and the shock.

Notes

Note, most of our analysis is of participation among persons irrespective of eligibility due to the fact that our data do not contain all of the characteristics needed to determine eligibility for any of the programs we study. We discuss below some regressions which attempt to come closer to representing take-up than participation per capita. We discuss this further below, but participation is informative about take-up under some assumptions, and we are not alone in focusing on participation rather than take-up due to these complications.

We followed some previous work to decide what questions to ask to elicit these reasons (e.g., Stuber and Kronebusch (2004), for difficulty applying; or Wang et al. (2022) for work about race stereotypes in subjects (for stigma/not for people like me) as well as questions about lack of knowledge about programs and ineligibility.

We follow the Census Pulse in measuring hardship this way. This is a short and low-burden way of assessing food-related hardship and is related to food insecurity.

We explored whether Utah was better at getting safety net and social insurance programs out to residents of Utah. We used descriptive synthetic control regressions of the effect of being “Utah” during various periods to assess the deployment of social safety net programs in Utah. However, our findings were not particularly compelling and varied considerably with different recipient rates or spending per capita on the right-hand side.

The UCBES sampled 400 Utah residents per month and follows the Michigan Survey of Consumers, which includes 500 completed interviews per month. Recruitment occurs through a hard copy letter sent to physical addresses. Participants are paid a $10 gift card. Addresses are selected from the universe of addresses in Utah based on prior non-response rates in a way that has been shown to produce a representative sample (Samore et al., 2021; Yang et al., forthcoming; Gaulin et al., 2020). More details are available in the appendix.

We also control for income being at least $75,000, but cannot include an indicator in each data set for missingness of the income variables because the data are collected differently across the Utah Survey and the ASEC. We have explored controlling for missing income in the Utah data below, and find it makes little-to-no difference.

Certain states have chosen a policy called Broad Based Categorical Eligibility which enables them to set a higher income threshold than 130% of the Federal Poverty guideline.

Families obtaining free or reduced meals whose schools were closed could apply for P-EBT from 3/16/2020-8/31/2020.

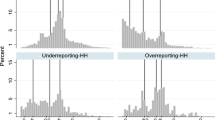

We note there is a large literature documenting under-reporting of benefits in normal times (e.g., Meyer et al. (2015)). One might wonder if they under-report because of stigma. We think government benefits were expanded and likely had less stigma during COVID-19.

References

Bauer, L., Pitts, A., Ruffini, K., & Whitmore Schanzenbach, D. (2020). The effect of Pandemic EBT on measures of food hardship. https://www.brookings.edu/research/the-effect-of-pandemic-ebt-on-measures-of-food-hardship/

Bitler, M., Hoynes, H., & Schanzenbach, D. W. (2020). The social safety net in the wake of COVID-19. Brookings Papers on Economic Activity, Summer 2020 Special Edition, COVID 19 and the Economy, part 1. 119–145.

Bitler, M. P., Hoynes, H. W., & Iselin, J. (2020). Cyclicality of the U.S. safety net: Evidence from the 2000s and implications for the COVID-19 crisis. National Tax Journal, 73(3), 759–780.

Casado, M. G., Glennon, B., Lane, J., McQuown, D., Rich, D., & Weinberg, B. (2020). The effect of fiscal stimulus: evidence from COVID-19. Technical Report w27576, National Bureau of Economic Research, Cambridge, MA.

Coibion, O., Gorodnichenko, Y., & Weber, M. (2020). How did U.S. consumers use their stimulus payments? Technical Report w27693, National Bureau of Economic Research, Cambridge, MA.

Currie, J., & Gahvari, F. (2008). Transfers in cash and in-kind: Theory meets the data. Journal of Economic Literature, 46(2), 333–383.

Dubois, H. & Ludwinek, A. (2015). Access to social benefits: Reducing non-take-up. Publications Office of the EU. https://www.eurofound.europa.eu/publications/report/2015/social-policies/access-to-social-benefits-reducing-non-takeup.

Farrell, D., Ganong, P., Greig, F., Liebeskind, M., Noel, P., & Vavra, J. (2020). Consumption effects of unemployment insurance during the Covid-19 Pandemic. SSRN Electronic Journal. https://www.jpmorganchase.com/institute/research/labor-markets/unemployment-insurancecovid19-pandemic

Finn, D. & Goodship, J. (2014). Take-Up of Benefits and Poverty: An Evidence and Policy Review. Centre for Economic and Social Inclusion, London (Centre for Economic and Social Inclusion). https://researchportal.port.ac.uk/en/publications/take-up-of-benefits-and-poverty-anevidence-and-policy-review

Gaulin, M., Seegert, N., & Yang, M.-J. (2020). Doing good rather than doing well: What stimulates personal data sharing and why? Working Paper, University of Utah. http://www.nathanseegert.com/research

Hembre, E. (2021). Examining SNAP and TANF Caseload Trends, Responsiveness, and Policies during the COVID-19 Pandemic. SSRN Scholarly Paper 3693339, Social Science Research Network, Rochester, NY. https://www.erikhembre.com/research.html

Herd, P., & Moynihan, D. (2018). Administrative burden: Policymaking by other means. Russell Sage: Publisher.

Kleven, H., & Kopczuk, W. (2011). Transfer program complexity and the take-up of social benefits. American Economic Journal: Economic Policy, 3, 54–90.

Ko, W. & Moffitt, R. (2022). Take-up of Social Benefits. Working Paper, NBER Cambridge, MA (30148). https://www.nber.org/papers/w30148

Kopczuk, W., & Pop-Eleches, C. (2007). Electronic filing, tax preparers, and participation in the earned income tax credit. Journal of Public Economics, 91(7–8), 1351–1367.

Meyer, B., Mok, W., & Sullivan, J. (2015). Household surveys in crisis. Journal of Economic Perspectives, 29(4), 199–226.

Parolin, Z., Curran, M., Matsudaira, J., Waldfogel, J., Wimer, C. (2022). Estimating Monthly Poverty Rates in the United States. Poverty and Social Policy Working Paper, New York, NY: Center on Poverty and Social Policy, Columbia University. https://www.povertycenter.columbia.edu/news-internal/2020/covid-projecting-monthly-poverty

Samore, M. H., Looney, A., Orleans, B., Greene, T., Seegert, N., Delgado, J. C., Presson, A., Zhang, C., Ying, J., Zhang, Y., Shen, J., Slev, P., Gaulin, M., Yang, M.-J., Pavia, A., & Alder, S. (2021). Probability-based estimates of severe acute respiratory syndrome coronavirus 2 seroprevalence and detection fraction, Utah, USA. Emerging Infectious Diseases, 27(11), 2786. Publisher: Centers for Disease Control and Prevention.

Seegert, N., Gaulin, M., Yang, M.-J., & Navarro-Sanchez, F. (2020). Information revelation of decentralized crisis management: Evidence from natural experiments on mask mandates. http://www.nathanseegert.com/research

Stuber, J., & Kronebusch, K. (2004). Stigma and other determinants of participation in TANF and Medicaid. Journal of Policy Analysis and Management, 23(3), 509–530.

Wang, M.-T., Henry, D., Wu, W., Del Toro, J., & Huguley, J. (2022). Racial stereotype endorsement, academic engagement, mindset, and performance among black and white american adolescents. Journal of Youth and Adolescence, 51, 984–1001.

Yang, M.-J., Seegert, N., Gaulin, M., Looney, A., Orleans, B., Pavia, A., Stratford, K., Samore, M., & Alder, S. forthcoming. What is the active prevalence of COVID-19? Working Paper, University of Utah.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank participants at IIPF, David Agarwal, and Aline Bütikofer for helpful suggestions.

Appendices

Appendix

A survey description

To study the impact of the COVID-19 pandemic on the residents of Utah, primary survey data was collected on a racially-representative group of individuals across 22 counties in the state. Six-waves of monthly data were collected beginning in October 2020. Respondents replied to a letter invitation and completed the survey online. The specific dates of collection are below:

-

Wave 1: October 2020 (N = 175)

-

Wave 2: November 2020 (N = 411)

-

Wave 3: December 2020 (N = 472)

-

Wave 4: January 2021 (N = 421)

-

Wave 5: February 2021 (N = 391)

-

Wave 6: April 2021 (N= 523)

The survey was initially created to assess consumer sentiment and report on the Michigan and Eccles Consumer Sentiment Indices for Utah residents. In addition to questions about earnings and spending expectations, basic demographic and socioeconomic information is asked including age, gender, race, marital status, education, number of adults and children in the household and annual income. The survey also asked about participation in public assistance programs including:

-

Unemployment Insurance (UI)

-

Economics Impact Payments (EIP)

-

Supplemental Nutrition Assistance Program (SNAP)

Beginning in February, the survey was expanded to include questions about food security, receiving free groceries, ability to pay household expenses and getting behind on mortgage or rent payments. In addition, questions were added to assess the reasons behind not participating in public assistance programs. Specifically, for each program, if a respondent did not answer affirmatively to participation, they were asked to select one of 6 reasons for non-participation. Note that some of the wording was adjusted between wave 5 and 6 while the meaning remained consistent. Wording adjustments are indicated by the partition:

-

Did not know that the program existed / have not heard of the program

-

Didn’t need the benefit / did not apply for the benefit

-

Difficulty enrolling / managing the enrollment process

-

I applied for the benefit but was denied / needed but ineligible

-

I did not apply for the benefit

-

Program is not for people like me (added for wave 6)

1.1 A.1 Survey weighting

The survey was well matched to be racially representative of Utah; however, on the dimensions of education, age and marital status there were prominent differences from the Current Population Survey Annual Social and Economic Supplement (ASEC) for Utah. To adjust for this discrepancy, survey weights were calculated using probit regressions to predict the probability of being in the ASEC. The final weight for the Utah survey is the predicted probability of ASEC divided by one minus the predicted probability of being in the ASEC.

B Resource eligibility

Unemployment Insurance

-

Separated from employment or hours reduction.

-

Weekly benefit is calculated to be wages in highest paid quarter of base period divided by 26, minus $5.

-

Maximum weekly benefit is $496.

-

benefit range is 10 to 26 weeks.

-

13 additional weeks of extended unemployment through the CARES Act is available until 12/31/2020.

-

First payment date of FPUC ($600/week additional) was 4/8/2020.

-

First payment of extended unemployment was 5/21/2020.

-

First PUA payment was 4/15/2020.

-

First LWA payment was 9/9/2020.

Supplemental Nutrition Assistance Program (SNAP)

-

Gross Income must be below 130% of the federal poverty guideline based on household size.

-

Net income must be below 100% of the federal poverty guideline based on household size.

-

Exempted from the income requirements are families where each member is receiving Family Employment Program (FEP), SSI or General Assistance.

Economic Impact Payments

-

$1200 payment per person for January

-

Payment will be reduced by 5% of the amount by which income exceeds the payment thresholds below:

-

Income under $150,000 if filing a joint return

-

Income under $112,500 if filing as head of household

-

Income under $75,000 for any other filing status

-

-

Ineligible

-

Claimed as a dependent on another tax return

-

No valid Social Security number

-

Nonresident alien

-

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Bitler, M., Cook, J., Horn, D. et al. Incomplete program take-up during a crisis: evidence from the COVID-19 shock in one U.S. state. Int Tax Public Finance 29, 1373–1394 (2022). https://doi.org/10.1007/s10797-022-09760-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-022-09760-y