Abstract

The value-added tax (VAT) is meant to be an efficient and self-enforcing tax on consumption. Yet, being a rather sophisticated tax, the VAT can also be complex and costly to administer. By examining the case of Rwanda, this paper assesses the extent to which the VAT’s potential materialises in the context of a lower-income countries. Using a mixed-methods approach, which combines qualitative information from focus group discussions with the analysis of administrative and survey data, this paper makes two contributions. First, it documents reporting inconsistencies in VAT data, providing new evidence on how weak capacity prevents tax administrations in lower-income countries from reaping the full benefits of the VAT. Second, it shows that the VAT, as applied in practice, differs substantially from its theoretical functioning. This generates differences in tax burdens across firms, despite a proportional tax rate, with important distributional implications. We also document that the VAT chain often breaks down, with implications on the VAT’s efficiency.

Similar content being viewed by others

Explore related subjects

Find the latest articles, discoveries, and news in related topics.Avoid common mistakes on your manuscript.

1 Introduction

The introduction of the value-added tax (VAT) represents one of the most significant innovations in tax policy and administration in developing countries, if not the most significant one (Keen, 2013; Moore et al., 2018). At the beginning of the 1980s, only about 30 countries had adopted the VAT. As of 2020, it has become a huge success in terms of ubiquity of adoption (160 + countries) and revenue raised, with much of its expansion driven by low- and middle-income countries (IMF, 2011). The VAT now accounts for about 30 percent of total tax revenue, on average, in countries where it has been adopted (Slemrod & Velayudahn, 2020), and almost 40 percent in African countries (ATAF, 2019). The introduction of this tax has often been accompanied with technological innovation, such as electronic billing machines (EBMs) that record highly disaggregated data on firms’ transactions and report them directly to the revenue administration.

The combination of VAT introduction and technological advances promised to be transformative for tax administration, perhaps especially in lower-income countries. On the one hand, the VAT’s unique design provides contrasting incentives to trading partners, facilitating compliance through the so-called self-enforcement mechanism. It also leaves a paper trail in both trading partners’ records, which can be used for enforcement. On the other hand, technologies like EBMs, and more generally the availability of digitised administrative data, make it possible for tax administrators to systematically verify the accuracy of taxpayers’ records and perform cross-checks between trading partners (Okunogbe & Santoro, 2021).Footnote 1 Section 2 describes these features in more detail.

Against this background, the overarching question that motivates this paper is: to what extent does the transformative potential of the VAT materialise in practice, in the context of lower-income countries where administrative capacity is weaker and evasion more widespread than in their higher-income counterparts? We address this question by adopting a mixed-methods approach to study the case of Rwanda. This country provides a particularly good case because it has a relatively solid and efficient institutional setting, which is a necessary condition for the VAT to work, while also facing some of the common challenges found in other lower-income countries (see Sect. 3). While our results are only directly applicable to Rwanda, it is plausible that the challenges we highlight here would be present and even more severe in other lower-income countries with weaker institutions and less effective public administrations.

More specifically, our analysis focuses on two questions that are testable with our administrative data. First, we ask whether technological advances, like the use of electronic billing machines, help improve the quality of administrative data and the extent to which it can be used for VAT enforcement. Second, we investigate whether the VAT’s self-enforcement mechanism and paper trail work in practice, both to provide incentives for taxpayer compliance and to facilitate enforcement. We complement the analysis of administrative data with insights from focus group discussions (FGDs). This qualitative component allows us to capture taxpayer experiences with the VAT process, which provide some initial explanations for the discrepancies we observe in the administrative data and for the ways in which the VAT might break down in practice in a lower-income country. We also use a nationally representative survey of Rwandan taxpayers to corroborate and investigate further some of the findings from the FGDs, in a larger sample of taxpayers. Our mixed-methods approach and data sources are described in more detail in Sect. 4.

Our analysis provides three sets of results. Firstly, we show that technological advances have limited potential in contexts where administrative capacity is weak. Even once firms adopt EBMs, the records produced by the machines remain widely inconsistent with those reported in taxpayers’ declarations. To the best of our knowledge, this is the first evidence of inconsistencies between EBM and declarations data in the literature. One available study from Ethiopia has shown that similar machines can improve tax records’ accuracy and compliance, while also documenting large inconsistencies in records across tax types (Mascagni et al., 2021). We add nuance to this finding by documenting widespread difficulties among taxpayers with operating the machines, emerging from our FGDs.

Secondly, we investigate whether the self-enforcement mechanism and paper trail work in practice, as intended in theory. Again, we find widespread inconsistencies in tax records across trading partners. Interestingly, however, these results are at odds with the theoretical predictions, based on the VAT’s structure of incentives. The expected case of seller under-reporting occurs in a small minority of observations, while most inconsistencies are related to buyers’ under-claiming for inputs, either partly or fully. This is a particularly severe problem for smaller taxpayers. Their perspectives, as captured in the FGDs, suggest that the explanation lies in a combination of compliance costs, administrative complexity and uncertainty, and fear of audit. These findings are consistent with the only other study we are aware of on this issue, from Uganda (Almunia et al., 2021).

Thirdly, the results on missed input claims led us to investigate the distributional implications of the VAT across firms. We find that smaller firms are less likely to claim for their inputs, and many of them claim no input credit altogether. This results in a larger effective tax burden at the bottom of the distribution, compared to the top. Survey evidence suggests that a plausible explanation relates to small firms’ weaker knowledge, worse business practices, and fewer resources to dedicate to tax affairs, compared to larger ones.

Our study speaks to various strands of literature on taxation, and particularly to the available evidence on lower-income countries. Data inconsistencies are in line with the literature showing that, while the self-enforcement mechanism seems to work to some extent (Pomeranz, 2015), it is unlikely to be fully effective in low-capacity environments where it is not backed up by effective verification (Carrillo et al., 2017; Steenbergen, 2017). Our results on widespread data inconsistencies (Sects. 5.1.1 and 5.1.2) confirm that tax administrations in lower-income countries like Rwanda are unable to perform the systematic cross-checks that underpin effective VAT enforcement. Importantly, these inconsistencies are not specific to Rwanda, but are in line with recent evidence from other African countries, such as Uganda and Ethiopia (Almunia et al., 2021; Mascagni et al., 2021).

The explanations emerging from FGDs and survey data (Sects. 5.1.2, 5.2.2, and 5.3.2), while being largely descriptive, are highly consistent with the broader literature on tax compliance in lower-income contexts. One of the key explanations emerging in FGDs refers to the case of buyers’ under-reporting and practical difficulties with EBMs. These issues, which can broadly be labelled as compliance costs, have been increasingly documented in the literature and have been shown to be particularly severe for smaller taxpayers (Ebrill et al., 2001; Coolidge, 2012; Barbone et al., 2012; Bird & Gendron, 2007; World Bank, 2016; Harju et al., 2019; Gerard et al., 2018; Atnafu et al., 2019; Slemrod & Velayudhan, 2020). Similarly, taxpayers’ difficulties with VAT refunds, which emerged from the FGDs as another key explanation for buyer under-reporting, are fully in line with other studies, showing that the refund system is a particularly problematic feature of the VAT (Harrison & Krelove, 2005; Keen, 2007).

Our study also relates to a growing literature exploring the role of technology in tax administration, recently reviewed by Okunogbe and Santoro (2021). This literature has shown that there is great potential in digitised data and technology, to improve tax collection, reduce corruption, and decrease compliance costs (for example, see Okunogbe & Pouliquien, 2022; Mascagni et al., 2021; Okunogbe, 2021). However, these studies have also shown limitations in the transformative potential of technology, particularly in lower-income contexts, as taxpayers respond to technological change and tax administrators have limited capacity to cross check their records (Almunia et al., 2021; Mascagni et al., 2021).

2 The value-added tax in theory

The VAT is an indirect tax on final consumption, typically levied at a rate between 15 and 20 per cent (Ebrill et al., 2001). Despite being a tax on consumption, it is collected at all stages of the production chain, as well as on sales to final consumers. The refund mechanism allows firms to claim back the VAT they paid on their inputs (input VAT), which is offset against the amount of VAT they collect on their sales (output VAT). They remit the difference to the revenue administration. If firms pay more VAT on the inputs that they purchase than the VAT they collect on sales, they can claim a refund from the revenue administration. This does not happen often, but it is common for exporters (who do not charge VAT on their sales but pay it on their inputs) and for new companies (which might face large initial input costs, and pay VAT on these, while still having limited sales).Footnote 2 These refund claims can usually be offset against future or other tax liabilities, or can be paid out by the revenue administration.

The VAT has several advantages compared to alternative sales taxes, such as retail sales taxes (RST) or turnover tax (TOT). Perhaps the most important ones are the so-called self-enforcing mechanism and the paper trail it creates across trading partners (Pomeranz, 2015).Footnote 3 The self-enforcing mechanism works by setting opposite incentives for sellers and buyers. While the former is expected to prefer under-reporting a transaction’s value, and thus pay less tax, the latter would rather over-report (or report correctly), because that allows for more input claims and thus a reduced net VAT liability. The paper trail is the record of transactions generated by trading partners along the value chain, with both buyers and sellers producing records for the same transaction. It represents an important source of data for revenue authorities to cross-check a firm’s declaration against those of its trading partners. These data are much easier to use for enforcement when they are collected digitally through e-filing of tax declarations, and when they can also be verified against EBM records. Importantly, to successfully improve compliance, the self-enforcement mechanism and the cross-checks on the paper trail need to work in tandem.

The VAT is a rather sophisticated tax. Precisely for this reason, it is complex to administer (Slemrod & Velayudhan, 2020). For example, while the large amount of information generated by the VAT is one of its key advantages, it also implies a burden on the tax administration to store and analyse it—if the benefits in terms of enforcement are indeed to materialise. Relatedly, the self-enforcing mechanism only works if taxpayers believe the tax administration uses the paper trail for tax enforcement—and when that is backed up by some degree of traditional verification and audits (Carrillo et al., 2017). Similarly, the refund mechanism is open to the possibility of fraud (Waseem, 2019; Alexeev & Chibuye, 2016). It requires some capacity to verify firms’ claims, especially in countries with low tax-to-GDP ratios that cannot afford to lose the revenue they have already collected. Some authors suggest that the VAT’s complexity may spur innovation and modernisation in tax administration more broadly (Ebrill et al., 2001; Keen, 2012). This has, to a certain extent, happened through the introduction of technological innovations like EBMs, among others.

The VAT also imposes compliance costs on the taxpayers who are registered for it. They need to keep a record of each transaction; aggregate such records periodically (monthly or quarterly) and send them to the tax administration; and make claims for inputs and back them up with appropriate records. All this represents an administrative burden for firms—or a compliance cost. These requirements may put taxpayers off registering for the VAT altogether (Barbone et al., 2012; Harju et al., 2019; Slemrod & Velayudhan, 2020). For this reason, VAT systems usually include a turnover threshold under which firms are not required to register for the VAT (Keen & Mintz, 2004). While the VAT threshold has a clear rationale, it creates its own inefficiencies: a recent study shows that firms select their trading partners based on VAT registration, thus creating segmentation in the value chain (Gadenne et al., 2019).

3 The VAT in Rwanda

Rwanda is a good setting for exploring how the VAT functions in practice in lower-income countries. It faces many of the challenges common to low- and middle-income countries, such as severe constraints in tax administration capacity and widespread evasion—compared to higher-income countries. However, within the group of low-income countries, Rwanda is seen as a good performer and the Rwanda Revenue Authority (RRA) is in a modern and efficient tax administration. For example, tax declarations can be filed online since 2014, through the e-tax system, or even via mobile phones, for micro-taxpayers. More generally, the country benefits from a stable institutional setting and an efficient public administration.Footnote 4 This is a necessary condition for the VAT to work, so we can expect the challenges we find in Rwanda to be even greater in countries with weaker settings.

The VAT was adopted in Rwanda in 2012 and is in line with international standard practice. It is levied at a rate of 18 percent, although the law also provides for zero-rating and exemptions for specific goods and services.Footnote 5 Smaller taxpayers need to submit quarterly declarations, while larger ones are required to declare every month.Footnote 6 To avoid placing an excessive compliance burden on small taxpayers, only firms with annual turnover above FRw20 million (over US$20,000) are required to register for VAT.Footnote 7 This threshold is relatively low compared to similar countries, standing at about half the average threshold applied elsewhere in Africa (ATAF, 2019). There is no alternative indirect tax on goods and services for firms below the VAT threshold.

As usual with the VAT, firms can claim back the VAT paid on their inputs by offsetting it against the VAT levied on their sales. Firms are required to claim the VAT they pay on their inputs in the relevant filing period. If necessary, they can delay this claim to the next filing period, as long as they do so within two years of the date of the original transaction. If the VAT paid on inputs exceeds the VAT charged on sales, firms are granted VAT credits. Credits under a certain threshold are rolled over to the next filing period to be offset against future VAT liabilities, while larger credits are refunded directly to the firm.Footnote 8 Strict timelines apply for these refunds, at least in principle (see Sect. 5.2.2). The RRA should refund the excess credit within 30 days of the end of the last tax period and after receipt of the required documentation. The law reserves the right for the RRA to conduct checks on the validity of refund claims. In those cases, the period to process the refund is extended to a maximum of 3 months. If a taxpayer has any outstanding tax payments, their VAT credits can be used to offset those arrears.

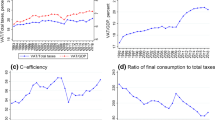

As in many other countries, the VAT is the main source of revenue in Rwanda and by far the most important of domestic taxes. According to RRA (2021), in the 2017/2018 financial year, the VAT contributed 33 per cent of total domestic revenue, followed by employment income tax (23%), profit tax (19%), excise tax (12%), and import duty (8%). Nonetheless, Rwanda’s VAT underperforms. The country’s C-efficiency ratio, a widely used indicator to evaluate the performance of VATs, is less than 30 per cent, compared to about 37 per cent for other countries in the region (USAID, 2018). Similarly, its refunds-to-VAT-revenue ratio is low: only 9 per cent, compared to an average of 15 per cent in comparable countries (ATAF, 2019). This suggests that the refund mechanism is not functioning properly, which we indeed document below.

Partly aiming to close this performance gap, a 2015 law introduced EBMs as a way to support enforcement and compliance. The use of an EBM, either a separate piece of hardware (EBM1) or the software equivalent (EBM2), became mandatory for most VAT-registered firms. Penalties were set for those who failed to adopt EBMs.Footnote 9 EBMs record all sales electronically and release an official VAT invoice that can be used as proof for claims against input VAT payments. They transfer these data directly to the revenue authority through the mobile network. EBMs thus produce a huge amount of data at transaction level that could be transformative if fully exploited by the RRA for enforcement.

The legal and administrative framework described above puts Rwanda very much in line with international best practice. However, we will show that the reality is more complex and puzzling than what this framework suggests.

4 Research design, data, and methods

Our study addresses two research questions. First, do technological advances, like the use of electronic billing machines, help improve the quality of administrative data and the extent to which it can be used for VAT enforcement? Second, does the VAT’s self-enforcement mechanism and paper trail work in practice, both to provide incentives to taxpayer compliance and to facilitate enforcement? In answering the second question, we found the unexpected result that many firms, especially smaller ones, seem to under-report input VAT claims or forego these claims altogether. This is a puzzling behaviour, as firms effectively forego a reduction in their tax payment. This led us to investigate a third question, in Sect. 5.3, on the distributional implications of the VAT’s practical functioning and the equity of its tax burden along the firm size distribution.

This brief overview of our analysis already highlights how the VAT’s practical functioning deviates from the theory in unexpected and complex ways. To answer our research questions in a comprehensive way, we adopt a mixed-methods approach that combines quantitative evidence from administrative data with qualitative insights from focus group discussions (FGDs) and survey data. While the quantitative analysis of administrative records allows us to provide initial answers to our two questions, it cannot provide much insight on the motivations behind our results—especially the ones that deviate from theoretical expectations. It therefore seems appropriate to complement these results with taxpayers’ own perspective and everyday experiences of the VAT system. We do this through our FGDs, which allow us to gain qualitative insights into the practical complexities from first-hand conversations with taxpayers. Our survey data complement this analysis by testing and supporting some of the explanations emerging from FGDs on a bigger sample, which is representative of the Rwandan taxpayer population. These data are particularly useful to investigate further the distributional implications of our results.

In the remainder of this section, we describe our data sources and methods in more detail, while we also include additional methodological notes in Sect. 5, in relation to specific components of our analysis.

4.1 Administrative data

The immediate response to our questions can be found in the administrative data, by making two comparisons.Footnote 10 In relation to our first research question, we can check whether the data generated by EBMs is consistent with the data that firms self-report in their VAT declarations—we call this an internal inconsistency, as it would occur within a single taxpayer’s records. We might expect technology, in this case EBMs, to provide incentives for taxpayers to report accurately so that EBM amounts are consistent with their tax declarations. This might, in turn, reduce opportunities for evasion, to the extent that firms feel obliged by buyers to issue formal receipts (Naritomi, 2019; Fjeldstad et al., 2020).

In relation to our second research question, we can check whether records for sellers and buyers, for the same transactions and over the same time period, correspond or not—we call this an external inconsistency. The theory of VAT incentives would suggest two possible scenarios on the comparison between sellers’ and buyers’ records, to which we add a third one for completeness (for a detailed discussion on this, also see Almunia et al., 2021).

-

1.

seller amount = buyer amount: this is compatible with a scenario in which the self-enforcement mechanism, combined with the paper trail, leads taxpayers to fully comply and record all transactions. It is also compatible with collusive evasion, whereby sellers and buyers collude to avoid reporting transactions in either trading partners’ record.

-

2.

seller amount < buyer amount: this scenario would suggest evasion on the sellers’ side, as they are not reporting transactions that buyers are instead revealing to the tax administration by recording the relevant amount as an input claim. It would also be compatible with evasion on the buyers’ side, if they are inflating their input costs to claim more VAT inputs and thus decrease their net payment.

-

3.

seller amount > buyer amount: this scenario is not compatible with the VAT’s incentives, as whichever trading partner is misreporting, they are doing it to their own disadvantage since both sellers’ over-reporting and buyers’ under-reporting result in higher net VAT.

We check those comparisons using two sources of administrative transaction-level data made available by the RRA. The first is VAT declarations, which are the monthly or quarterly VAT filings of individual firms. Along with the main declaration, taxpayers are required to submit two annexes, which include the details of each transaction they make—their local purchases and sales.Footnote 11 The annexes include the Taxpayer Identification Number (TIN) of trading partners for each transaction. The second data source is EBM data, which records details of firms’ sales as registered by EBMs at the point of sale. Firms are required to enter all transactions into the EBM, including the value of the sale and VAT amount.Footnote 12 If the buyer has a TIN, they should enter it in the EBM so it can be included in the records and used as valid proof for an input claim.

The declarations dataset includes 18,336 firms for the fiscal year running from July 2016 to June 2017.Footnote 13 However, EBM data were only available for 11,425 of those firms—providing a first indication of limited EBM usage. We aggregated all data to the quarterly level. As such, the unit of analysis is a firm-quarter or pair-quarter observation, where pairs are seller-buyer trading partners.Footnote 14 Two notes are due on this dataset, both of which are discussed in more detail in Mascagni et al. (2019a). First, there is a relatively large share of nil-filers in the dataset, defined as firms who declare zero in all relevant fields (sales, inputs, and net VAT).Footnote 15 As discussed in more detail in Sect. 5, we retain them for our analysis. Second, we check for data consistency by comparing the total sales and inputs values as reported in VAT declarations and in the annexes, for the same firm in each quarter. These amounts are fully consistent in over 98 percent of cases, which gives us confidence in the quality of our declarations data. It should be noted that this consistency is not surprising, since the main declaration and its annexes are part of the same package of documents that taxpayers report to the tax authority.

4.2 Focus group discussions

To complement the analysis of administrative data, we ran six FGDs with VAT-registered firms in Rwanda between March and July 2019. We followed key methodological guides available in the literature to organise FGDs and to analyse the resulting data (Hennink & Leavy, 2014).Footnote 16 Firms were sampled from the RRA’s VAT database—the same source of administrative data described in the previous section. We restricted the sample to those firms that recently (in the last quarter under study, Q2 of 2017—see Sect. 4.1) displayed both an internal and an external inconsistency—to make sure we would capture participants with direct experience of the behaviour we are looking to investigate. To facilitate logistics, we only included firms with valid contact details and located in Kigali. The resulting sampling frame consisted of 500 firms. From this group, we then randomly selected 28 small and 28 large firms, defined based on annual turnover. In total 26 firms sent representatives, mostly business owners, but also, in a few instances (3), tax accountants or secretaries. The first three FGDs were conducted with representatives from large firms (13 in total), while the last three FGDs included representatives from smaller firms (13 in total).

The discussions were guided by a pre-designed protocol that included three sections. Part One focused on the VAT system as a whole, with the aim of capturing participants’ general impressions about what works and what does not. Parts Two and Three focused specifically on the inconsistencies we wanted to investigate in more depth, stemming from the key results of our analysis of administrative data. We presented participants with a hypothetical case of a data inconsistency and asked them to explain it based on their experience. More specifically, Part Two used a scenario in which a firm’s sales as reported by its EBM were larger than what had been declared in the VAT return. Part Three focused on the case of a hypothetical taxpayer who did not make a claim for any of the VAT credits they had built up.

We took particular care to allow for a truthful and open discussion, especially given the potential sensitivity of issues like evasion or discontent with RRA operations. To do so, we avoided asking direct questions and focused on hypothetical cases, so that taxpayers did not have to explicitly discuss their own behaviour or beliefs. We made sure that no official from the RRA participated in the discussions, as their presence would have inhibited participants and likely resulted in bias. Participants were told that the FGDs were meant to improve the RRA’s services, but were also reassured that their participation would be kept confidential and no individual details would be shared with the RRA. Although they are not intended to establish causality, FGDs provide useful insights on the practical functioning of the VAT from the taxpayer perspective, which in turn helps us to explain some of the inconsistencies in the data.

4.3 The Rwanda National Taxpayer Survey

Finally, we use a recent survey to corroborate and further investigate some of the insights emerging from the FGDs. The Rwanda National Taxpayer Survey was conducted in early 2020 by the International Centre for Tax and Development (ICTD), in partnership with the RRA. The survey collected data on 1,059 small and medium firms that are listed in the RRA’s taxpayer registry and had recently reported some business income to the RRA through their tax declaration.Footnote 17 Crucially, this implies that we can connect the survey and administrative data through unique identifiers. Firms were randomly sampled from the RRA’s taxpayer registry to make sure the survey is nationally representative. The questionnaire includes the following modules: (1) demographics, (2) business characteristics, (3) risk aversion, (4) knowledge about the tax system, (5) satisfaction with public services, (6) interactions with the RRA, (7) overall tax burden and compliance costs, and (8) attitudes and perceptions about tax compliance. Although it was not a requirement for selection into the survey, 329 firms in the sample are registered for the VAT. Our main results are based on this sub-sample, but they are also confirmed when we look at the full survey sample.

As explained in Sect. 5.3, we use the survey particularly to investigate some of the distributional implications emerging from the analysis of administrative data. Since some of the patterns we see in the latter particularly concern the first decile, we map the survey data onto the deciles obtained from the administrative dataset to allow for a more meaningful comparison. More specifically, we take the decile cut-offs from administrative data (based on the sales distribution) and apply them to total sales, as reported in tax declarations, for survey participants. By doing this, we obtain ten categories in the survey sample, which are broadly comparable with the income ranges of the deciles from the administrative data. We call these categories administrative deciles. Naturally, our survey data is more representative of the bottom administrative deciles than the top ones, as it focused particularly on small and medium taxpayers. However, we have some observations across the whole distribution.Footnote 18 To support our results on the distributional implications of the VAT, we compare a set of key variables between the first administrative decile and all other deciles. For robustness, we also compare the first decile with the next four ones, finding highly consistent results.

5 Results

Using the data and methods outlined in the previous section, we now show results on our two main research questions. Sect 5.1 addresses the question of whether technology has helped VAT enforcement through better data accuracy. Sect 5.2 looks at the self-enforcement mechanism and paper trail in practice by comparing buyers’ and sellers’ records. In both sections, results from administrative data are complemented with insights from FGDs. Finally, Sect. 5.3 discusses the distributional implications of our results, using administrative and survey data.

5.1 The effectiveness of technology to support VAT enforcement: discrepancies in records produced by the same taxpayer

Rwanda’s VAT system generates two flows of information: from EBMs that report transactions in real time to the RRA, and from the VAT declarations that firms regularly submit to the RRA. In principle, the RRA can use EBM data to cross-check sales or purchases firms report in their VAT declarations. We would therefore expect the data on firms’ declarations to be at least consistent, even if not truthful, to avoid raising suspicion and triggering inspection. The reality is different.

5.1.1 Inconsistencies between declaration and EBM data

We analyse internal inconsistencies (those within taxpayers’ own records) by comparing the value of the VAT on sales reported by a firm in its VAT declaration, to the VAT value transmitted by its EBM, over the same period. To avoid picking up mistakes in dates or minor timing differences, we aggregate all transactions for each taxpayer at the quarter level. We also exclude extremely large inconsistencies, by trimming them at the 99th percentile, as they might be due to simple mistakes. We consider transaction values to be consistent when the inconsistency is either zero or below FRw 5,000 (about USD 5).

Declarations and EBM data include the same information for the same transactions. If firms believe that the RRA systematically cross-checks their information and acts on it, we would expect them to at least make sure that the information they report to the RRA is consistent. Figure 1 shows that, in practice, this is the case for just over half of all observations. For over 43 per cent of firm-quarter observations, these numbers do not match.Footnote 19

In the majority of cases where an inconsistency exists, taxpayers declare lower sales in their declarations than what is recorded by their EBM. In these cases, EBM-recorded sales are on average 40 per cent higher than what is reported in the relevant VAT declarations. By doing this, firms reduce their net VAT payments, as their tax liability is determined on the basis of declarations—not EBM data. This behaviour is consistent with evasion, where firms try to minimise their tax payments by under-reporting sales. Fully closing the gap between the two data sources would generate RWF 38.2 billion in additional revenue, or about 43.5 million USD. However, it is surprising that firms still record those un-declared sales through the EBM system, thus exposing themselves to the risk of inspections and sanctions.

In a sizeable minority of cases where an inconsistency occurs, firms report more in their tax declaration than the value recorded on their EBM. This is surprising for the opposite reason: why would firms effectively pay more tax than what appears to be due based on EBM records? We explore possible explanations in Sect. 5.1.2.

Interestingly, the incidence of each case of inconsistency is correlated with firm size: smaller firms are more likely to declare less than their EBM record (VAT declaration < EBM data), while larger firms are more likely to do the opposite (VAT declaration > EBM data). Appendix Figure 9 reports the extent of inconsistencies by total sales deciles. We come back to this result in Sect. 5.3.

We explore these findings further by checking whether more exposure to EBM usage decreases the incidence of inconsistencies. This might happen, for example, if firms have difficulties operating the machines when they adopt them, but then learn how to use them over time, and make fewer mistakes. To test this hypothesis, we check if inconsistencies are more likely to happen for taxpayers that adopted the machine more recently, compared to those with more experience. Figure 2 shows internal inconsistencies separately by taxpayers’ date of EBM adoption. The results are largely consistent regardless of their exposure or experience with it. If anything, we observe a higher degree of records’ consistency for those who adopted later.

5.1.2 Insights from FGDs on inconsistencies in taxpayers’ own records

Internal inconsistencies are particularly relevant for policy purposes, as they could suggest evasion and a potential revenue gain from closing that gap. The next few paragraphs summarise three key insights with respect to internal consistencies that emerged from the FGDs.

5.1.2.1 Beliefs on enforcement and fear of audit

The presence of widespread inconsistencies in taxpayers’ own records can only occur if the RRA does not raise any objections to them and firms do not believe that the RRA can cross-check administrative data. We know that the RRA did not cross-check data systematically in the data period considered here, but rather performed targeted checks based on risk profiles. But do taxpayers still believe that the RRA can check that data and use it for enforcement? If they do not, then inconsistent records are much less surprising: they simply do not believe that their inconsistent records would give rise to an investigation.

The FGDs provided little support for the hypothesis that firms do not believe that the RRA has the necessary enforcement capacity. On the contrary, firms generally see RRA enforcement as rather effective and aggressive, as we also discuss in Sects. 5.2.2 and 5.3. Therefore, our FGDs seem to suggest that weak administrative capacity does not translate into beliefs about enforcement—at least not to the extent that firms might intentionally report inconsistent information.

5.1.2.2 Compliance costs and taxpayer confusion

Issues related to compliance costs and taxpayer confusion were by far the most common element emerging from FGDs. Generally, Rwandan taxpayers see value in the use of EBMs and agree that they help them to meet their compliance obligations.Footnote 20 However, representatives from small firms reported experiencing frequent problems in operating EBMs—more so than larger firms. These include practical issues like topping up the machine’s SIM card,Footnote 21 or difficulties with the necessary equipment required to keep up with the new EBM2 version (computers, connection, etc.).Footnote 22 They also expressed a desire to receive more training and assistance from RRA on the correct operation of EBMs.Footnote 23

More specifically, they reported considerable difficulties related to correcting mistakes in EBM records, citing this as a common explanation for discrepancies between declarations and EBM records.Footnote 24 For example, we learned that to correct mistakes in the EBM records, firms need to contact the RRA and report the mistake, which can then only be corrected at the RRA’s headquarters in Kigali. Given that these mistakes are usually discovered close to a filing deadline, and given the high penalties for late filing, many firms prefer not to correct the EBM records. Importantly, the widespread incidence of mistakes is known by RRA officials, who usually only correct very large ones—while most others remain in the system. These mistakes were cited more often by smaller firms, which might explain why we see a greater incidence of cases where EBM data are larger than the declaration among these firms.

These are very practical issues that might appear to have little meaning for the bigger picture of how the VAT functions in practice, compared to the theory. However, in the broader context of practical difficulties with operating EBMs, the example of mistakes illustrates particularly well the complexity that taxpayers face with tasks that should be relatively simple in principle. On the tax administration’s side, capacity is simply too limited to allow for systematic correction of mistakes—even the ones that taxpayers themselves highlight. This makes the use of EBM data for enforcement less straightforward than it might be otherwise, since officials cannot be sufficiently confident that the data accurately reflects firms’ activity.

5.1.2.3 Tax evasion

One explanation for higher EBM amounts than VAT declarations is the existence of a market for VAT receipts. One FDG participant described a typical case of VAT fraud as follows.Footnote 25 Firm A might look for a fake VAT receipt to increase its input VAT and thus reduce the VAT it has to remit to the RRA. These fake receipts are typically supplied by a clerk in a larger firm B, like a hotel or grocery store, where it is difficult for management to impose strict control over the issuance of EBM receipts. For a fee, the clerk of firm B issues an EBM receipt to firm A, which in turn pockets the difference between the amount on the receipt and what it pays the clerk—in terms of increased input claims. For firm B, the value of the EBM transactions will therefore be higher than the real activities of the company, which they declare in the firm’s VAT return. For the reasons described earlier, the firm may not want to correct the EBM records.

5.2 The self-enforcement mechanism in practice: discrepancies in records across trading partners

We now turn to our second research question. Much of the appeal of the VAT lies in the self-enforcement mechanism and paper trail it creates, which revenue administrations can exploit for enforcement. This section assesses the consistency of records generated in the VAT system using administrative transaction-level data. If the self-enforcement mechanism works, sellers’ and buyers’ records should be consistent. At a minimum, the paper trail should make sellers reluctant to unilaterally underreport their sales, since their trading partners’ records can be used to cross-check the accuracy of their declaration.

5.2.1 Inconsistencies between trading partners’ administrative records

External inconsistencies (between reports of buyers and sellers) are obtained by comparing the VAT value that buyers and sellers report for the same transactions in the same time period. Based on transaction-level data from VAT declarations, we compare the total value of reported VAT in each quarter for a given pair of firms, where one is the seller and the other the buyer. If a trading partner does not report a transaction at all or reports zero, the inconsistency is assumed to be equal to the full amount as reported by the other trading partner.

In the case of external inconsistencies, however, we need to apply two further restrictions to make sure our analysis is meaningful. First, we exclude sales to final consumers. To do this, we only consider observations in which the buyer recorded a TIN number during the transaction—indicating that they are a firm and that they could claim the relevant input in their VAT declaration. Second, we need to include only taxpayers who are registered for the VAT. This would naturally happen for firms that appear as sellers, as we observe their sales from a VAT declaration—implying they are registered. However, buyers could have a TIN even if they are not VAT registered. This would be the case, for example, for firms that are under the VAT threshold, or organisations that are not required to register for the VAT. Inconsistencies between those firms and sellers would be 100 percent, because these buyers do not submit any input claim for the VAT. We therefore restrict our dataset to those taxpayers who submit a VAT declaration in at least one quarter during our data period.

Figure 3 shows that external inconsistencies are widespread in Rwanda’s VAT declarations data. Contrary to theoretical expectations, sellers and buyers report the same amounts in only 25 per cent of all pair-quarter observations. Inconsistencies are therefore the norm. Not only are these inconsistencies widespread, but they also go in an unexpected direction. By far the most common case is the one of buyers under-reporting and sellers over-reporting (67% of our pair-quarter observations).Footnote 26 In most of these cases, the buyer claims no input credit at all for the sales reported by the seller—while in the remainder they simply claim less than the full amount reported by the seller.

This behaviour does not seem to be due to exemptions—inconsistencies are still extensive in sectors that have a low incidence of VAT exemptions.Footnote 27 Importantly, 79 per cent of buyers who are failing to claim do have a VAT liability that could be offset by these missed input claims. The remaining 21 per cent report zero liability and would therefore need to claim a net refund rather than be able to offset their VAT liability. Interestingly, failure to claim VAT inputs is much more common among smaller taxpayers than larger ones, as we show in Figure A1.2.

This result is at odds with theoretical expectations based on the VAT’s incentive structure. Why would firms fail to report purchases that would allow them to reduce their VAT payments? And why does this seem to happen particularly for small firms? We explore some possible explanations emerging from FGDs in the next section, while Sect. 5.3 discusses the distributional implications in more detail.

Finally, it is worth noting that in Fig. 3 we also observe the expected kind of inconsistency, showing firms underreporting their sales (and thus paying less VAT) and over-reporting their purchases (and thus increasing their input claims). This happens in a small minority of observations, 8 per cent, and is consistent with tax evasion or fraud. This low figure, however, does not necessarily mean that VAT evasion does not exist in Rwanda. It may simply mean that taxpayers have ways to evade that would not necessarily show up in the data, like collusive evasion.

5.2.2 Insights from FGDs on inconsistencies in data across trading partners

In the FGDs, we explored the kind of discrepancy in which buyers under-report, which goes against their own interest. There are four key insights that emerged from the FGDs that can help understand the surprising results from the administrative data.

5.2.2.1 Compliance costs and taxpayer confusion

As highlighted earlier, compliance costs and taxpayer confusion are a major theme emerging from the FGDs. The technical problems with EBMs that we described above, for example, might also explain external inconsistencies: when a seller has a technical problem with an EBM, the buyer might not feel confident about making a claim for that purchase as they might not have the proper receipt to back it up. Similarly, when EBM receipts contain mistakes, the process to correct them is even harder and more uncertain for buyers than described above, as they also need to contact the seller, who then needs to go through the process with RRA. Buyers might therefore choose not to report the purchase and forgo the VAT input credit, since the erroneous EBM record might not be considered as a valid proof to back up those claims—or might be too large and put them in a refund position, which they typically try to avoid (see below). These mistakes emerged in multiple FGDs as a possible explanation for buyer under-reporting.Footnote 28

5.2.2.2 Complexity and uncertainty in administrative practices

Although the law might be clear on the functioning of the VAT, in reality contradictory messages and confusing practices often emerge in interactions between taxpayers and tax officials, which in turn reinforces the problems linked to high compliance costs. Our FGDs provide two examples of administrative complexity and uncertainty, both related to input claims and buyer under-reporting.

The first example regards the time window that taxpayers have in which to claim for an input, after the original purchase took place. Although the Rwandan law allows for delayed input claims, FGD participants, especially from smaller firms, expressed confusion over whether this is permitted in practice. According to some taxpayers, the interpretation of these provisions by the RRA varies depending on which department they interact with. While delayed claims are generally accepted through the declarations system, they might be questioned and rejected during audits or checks.Footnote 29 To avoid this, some firms do not report older purchases if they failed or forgot to report them during the previous filing period.

The second example concerns net refunds, that is, cases where input claims are larger than the VAT on sales and thus require a refund. Net refunds are allowed according to Rwandan law, and should be processed within 30 days, or a maximum of 3 months when additional checks are required (see Sect. (3). However, in practice many taxpayers reported experiencing delays or even failing to obtain legitimate refunds.Footnote 30 Rather than waiting for an uncertain refund, with the associated transaction costs related to interactions with RRA, many taxpayers prefer to forego input credits that would put them in a refund position. These delays are confirmed by World Bank data: the average time to obtain a VAT refund in Rwanda is 39 weeks—about 10 months (World Bank, 2019). Consistently, Rwanda scores very weakly on the ‘adequacy of refund processing’ in a recent TADAT assessment (TADAT, 2019). All this fuels taxpayer confusion, uncertainty, and distrust in the proper functioning of the VAT refund system.

5.2.2.3 Fear of audit and strategic withholding of input claims

Discussions with taxpayers about net refunds also revealed widespread fear of audit. FGD participants attempt to avoid being in a net credit position, as they believe this would trigger an audit.Footnote 31 This belief is not entirely misplaced. The RRA does indeed audit every VAT net-refund claim above certain thresholds, which vary according to firm size. These thresholds are publicly available from the RRA website, and we report them in Appendix Table 8. In practice, this means that the vast majority of VAT refund claims triggers an audit. World Bank data confirms that 50–74 per cent of VAT refund claims are exposed to an audit in Rwanda (World Bank, 2019). While this caution is partly justified by the possibility of VAT refund fraud, our FGDs suggest that RRA officials are sometimes overzealous. As one participant put it: ‘[claiming a VAT refund] is like inviting the RRA to come for an audit’.Footnote 32 As a result, firms prefer to avoid reporting purchases that would put them in a net refund position.

The fear of inspections by the RRA featured especially in discussions with smaller taxpayers, who perceive these inspections to be overly aggressive and costly.Footnote 33 One participant noted that ‘if you claim back your money, the RRA starts to control your movements, makes audits, and sometimes instead of getting your money back you lose some’.Footnote 34 There is a perception that the RRA is reluctant to issue refunds and will look for evidence of evasion or mistakes, which are often easy to find.

Interestingly, the experience of larger firms is quite different in this respect. FDG participants from larger firms also prefer not to be in a net-refund position to avoid audits, and they too report overzealous and sometimes aggressive behaviour by tax officials.Footnote 35 However, rather than foregoing input claims like small taxpayers do, they strategically delay them to filing periods when they have a positive net VAT liability to offset.Footnote 36 Importantly, strategically delaying input claims requires some ability in record-keeping and managing books of accounts that many small taxpayers simply may not have.

5.2.2.4 Tax evasion and looking small

Finally, it is important to note that all the issues highlighted here are still compatible with widespread VAT evasion—though this does not seem to be the main explanation for inconsistent VAT records across trading partners. While we observe buyers’ under-claiming, our administrative data do not allow us to observe whether taxpayers declare all the relevant sales accurately. It is quite likely that some firms under-report their VAT sales, which might also not appear on the buyers’ side if they are colluding to evade.

There is also evidence, both in our data and in the broader literature, that firms make limited use of EBMs (for example, see Fjeldstad et al., 2020). Substantial under-reporting of sales could be consistent with widespread under-claiming of inputs. Firms might prefer to ‘look small’ by both under-reporting sales and foregoing input claims, as systematic reports of large input credits, against much lower sales, would look suspicious. In the context of evasion on the sales side, the issue of missed refunds might perhaps seem less worrying. However, our results remain concerning for two reasons. First, with foregone input claims, particularly by small firms, the VAT burden might end up being uneven across the firm size distribution, which raises new questions on equity. Second, under-reporting on the sales and input sides means that the VAT chain is broken and might inevitably bear on intermediate stages—instead of being the tax on consumption it is intended to be.

5.3 Distributional implications of the VAT’s practical functioning

The results on inconsistencies across trading partners raise some important concerns about equity, since smaller firms are particularly likely to under-report input claims or forego them altogether. These concerns are confirmed in the FDGs, where smaller taxpayers raised concerns about taxpayer confusion and administrative complexity, which larger firms were better able to navigate. Smaller taxpayers also expressed difficulties with the VAT, particularly regarding input claims, net-refunds, and the operation of EBMs. We therefore turn our attention to the distributional implications of our results, both with some additional analysis of administrative data and with supporting evidence from survey data.

5.3.1 Effective tax rates and VAT equity across the firm-size distribution

The debate around the VAT’s equity has typically focused on its incidence among consumers (Alavuotunki et al., 2019; Bachas et al., 2020; Bird & Gendron, 2007; Cnossen, 2019). Our results on external inconsistencies, however, highlight another dimension along which to evaluate the VAT’s equity: firm size. Foregone input claims seem to affect small firms disproportionately, which could in turn increase their effective tax burden.

In this section, we test this hypothesis by calculating two statistics: effective tax rates (ETRs) and input-to-sales ratio. We calculate ETRs as the ratio of a firm’s net VAT liability (VAT collected on sales—VAT paid on purchases) to its VAT sales. Because firms offset the VAT they collect on their sales with the VAT they pay on their inputs, this ratio should be well below the statutory VAT rate of 18 per cent. ETRs can be taken as an indication of the effective tax burden on firms. The input ratio is calculated as the total claims for purchased inputs made by a firm, divided by total VAT sales. It is an indication of how much firms are able to make use of input claims to offset their VAT liability. We compute these two statistics for all firms in the administrative dataset. We then analyse them across the sales distribution, to check for any differences between smaller and larger firms.

The results are striking. Figure 4 shows that firms in the first decile of the sales distribution have a lower input ratio than relatively larger firms—45 per cent, compared with an average of 50 per cent in the rest of the distribution. This is particularly due to a large portion of firms in the first decile (42 per cent) which make no input claim at all—compared to 21 per cent in the rest of the distribution. Once we exclude firms with zero input claims, the differences in the input ratio across the distribution are much less striking, as displayed in Appendix Figure. 4 This suggests that under-reporting is particularly due to small firms foregoing all input claims, rather than claiming selectively. This is in line with the results in Sect. 5.2.1, showing that making no input claim is more common than under-reporting input claims compared to the seller’s reported amount. After the sharp increase between the first and second decile, the input ratio then decreases with sales, which is consistent with economies of scale and efficiency gains.

Correspondingly, Fig. 5 shows that ETRs display the opposite pattern. Firms in the first decile face much higher ETRs than firms in higher deciles. The smallest firms face an ETR of 8.3 per cent, compared with an average of 5.4 per cent in the rest of the distribution.Footnote 37 This graph illustrates an important implication of buyers’ under-reporting: by foregoing input claims, the smallest firms end up facing a higher effective VAT burden than larger ones. Appendix Figure. 5 reports ETRs after we remove firms with zero input claims. In this case, the ETR varies less by size and shows a slightly progressive pattern. This result suggests that the adverse implications on equity are largely due to small firms entirely foregoing input claims, rather than selectively under-reporting them. Because small firms fail to claim all their input, they inevitably end up paying more VAT instead of offsetting it. The results are robust to alternative measures of firm size, such as business income.Footnote 38

We further test these differences in ETR across the sales distribution in a multivariate framework, where we can control for other firm characteristics. The relation of interest is the one between the ETR (transformed to take values from 0 to 100 to improve the readability of coefficients) and (the log of) sales, as a measure of size. Exploiting the panel dimension of our data, Appendix Table. 2 reports fixed effects estimates (FE) and the between estimates (BE) of the relation between size and ETR. We control for firm characteristics such as sector, location, and other firm fixed effects. We find that the ETR decreases with firm size, both when considering variations within firms over time (FE) and across firms (BE). This association is statistically significant and economically large: a 1 per cent increase in size is associated with a 0.66 (FE) to 0.68 (BE) percentage point decrease in the ETR. These results confirm the descriptive result of Fig. 4 and suggest that it is not due to other firm characteristics. Still the ETR-size relationship is unlikely to be linear. Table A2.3 confirms that, showing a decreasing coefficient on size as firms grow larger and a more sizeable negative association between size and ETR for smaller firms.

5.3.2 Supporting survey evidence on distributional implications

The results reported so far have shown widespread inconsistencies in administrative practices, with important implications on equity across firms, and provided some explanations based on taxpayer experiences. Importantly, FDGs also highlight very different experiences of small taxpayers as opposed to larger ones, largely due to their higher vulnerability to complexity and confusion. In this section, we use a nationally representative survey from 2020, described in Sect. 4.3, to complement our main results and support some of the explanations emerging from FGDs, particularly in relation to the comparison between large and small taxpayers.

To this aim, we compare a large set of survey variables across two groups of taxpayers, which we label small and large for the purpose of this discussion. We focus particularly on the comparison between firms in the first decile and in the rest of the distribution, as defined in the administrative data, to be consistent with the previous section. To allow for a meaningful comparison between the survey and administrative data, we map the administrative deciles onto the survey data. By doing this, we can observe differences in key survey variables for the same categories of firms that are behind the results of the administrative data analysis.

Table 1 reports basic summary statistics of variables related to the key explanations emerging from FGDs, with a particular focus on compliance costs. More specifically, it reports the mean for the full sample, for the first decile, and for the rest of the distribution, as well as a t test for the statistical significance of the difference between the latter two statistics. We only include firms that are registered for VAT, as they are the most relevant sample for our purpose. All variables used in this section are described in Appendix Table A2.4, including the relevant survey questions from which they derive.

The first panel of Table 1 relates to compliance costs, knowledge, and complexity. While our survey does not allow for a detailed quantification of compliance costs, it does provide information on the importance of these issues. The results confirm that there are large and statistically significant differences between small and large firms. Smaller taxpayers are less knowledgeable, have worse business practices, and fewer resources to spend on their tax affairs than larger firms. They are also generally less educated and less likely to use the internet for their business. We also observe differences in perceptions on how easy it is to comply with the tax system, and the VAT in particular, but these are not statistically significant.Footnote 39

These results suggest that compliance costs, knowledge, and complexity are plausible explanations for some of our results, such as missed refunds and the related higher tax burdens on smaller firms. Importantly, the survey data confirm that smaller firms are much less likely to claim refunds than larger ones: only 13 per cent of small firms do so, compared to 29 per cent of larger ones.

Related to compliance costs and taxpayer confusion, we also investigate some of the practical difficulties for smaller firms when using EBMs, as discussed in Sect. 5.1. Table 1 shows that there are large and statistically significant differences in EBM usage between smaller and larger firms: only 29 per cent of the former use them, against 54 per cent of the latter.

Difficulties in operating EBMs also emerge in a question on whether firms experience issues with EBM usage, showing they are more common among smaller firms than larger ones. Consistently with FGDs, the issues most commonly reported are: (1) the system is slow, mentioned 35% of the times; (2) it is difficult to amend mistakes done on the machine (26%); (3) the machine is difficult to operate (18%). Still, mirroring the positive feedback from FGDs, survey data confirm that many taxpayers find EBMs to be a useful tool to manage their tax affairs.

Importantly, these results hold in a multivariate framework. We run descriptive regressions explaining the key survey variables with a dummy for small taxpayers and include a number of controls. The results are included in Appendix Table. 4 In line with the descriptive findings from Table 1, the dummy for small firms is significant in the regressions with taxpayer knowledge (col. 1–2), business practices except bookkeeping (col. 3–4–5), EBM usage (col. 6) and claiming a refund (col. 7). Our results are also robust to expanding the sample to taxpayers who are not registered for VAT (see Appendix Table. 1) and to comparing the first decile to the following 4 ones only, thus excluding the top half of the distribution (see Appendix Table.7)

6 Conclusions and policy recommendations

This study reports three sets of results. First, we investigate whether technological innovations like the EBM might improve the accuracy of taxpayer data and, ultimately, improve compliance. While existing evidence shows that they do (Mascagni et al., 2021), we show that large inconsistencies in taxpayer data persist even after EBM adoption. Consistent with other studies, we therefore argue that, while technological innovation can indeed be transformative for tax administration, this potential is not yet fully realised in the case of low-income countries like Rwanda. Complementing these results, we also offer new insights into taxpayer experiences with the VAT and EBM system that were previously available only anecdotally.

Second, we investigate whether the VAT’s self-enforcement mechanism and paper trail work in practice to encourage compliance and support enforcement. We document widespread inconsistencies in data between trading partners. These inconsistencies are not in line with theoretical expectations based on the VAT’s structure of incentives. Buyers’ under-reporting of inputs is far more common than sellers’ under-reporting, with many buyers foregoing input claims altogether. Our FGDs suggest that the reason behind missed input claims is a combination of high compliance costs, complex and uncertain procedures, and fear of aggressive audits.

Third, we investigate the distributional implications of our results. We confirm that smaller firms are much less likely to claim their inputs than larger ones, thus effectively foregoing the possibility to benefit from tax rebates. As a result, they also face a higher effective tax burden than larger firms. Our survey data lend some support to the idea that the explanation for these results is at least partly related to compliance costs, knowledge, and complexity. Smaller taxpayers are less knowledgeable, less sophisticated, and have fewer resources to dedicate to their tax affairs than larger ones.

These results, taken together, substantially improve our understanding of the VAT. The analysis of administrative records shows that the role of highly disaggregated data to improve enforcement is limited in contexts like Rwanda, where the tax administration does not have the capacity to fully exploit its potential. We are also able to add more nuance to our results than previous studies, by documenting taxpayers’ perspectives on the taxpaying process. We show that their interaction with the tax administration is often characterised by uncertainty and complexity, which explains why VAT practice deviates sometimes widely from the theory.

These results have at least two broad policy implications. The first relates to VAT efficiency. When the VAT chain breaks down, for example, because firms fail to reclaim the VAT paid on inputs, the VAT essentially becomes a tax on production, rather than the tax on consumption it is intended to be. The consequences can be far-reaching. Absorbing part of the VAT would push up production costs for firms. This in turn could lower profits, increase prices, or distort input choices—precisely what the introduction of the VAT was meant to address. The second implication is related to the VAT’s equity, which has largely been debated in relation to its incidence on consumers. Our analysis shows that the VAT might be inequitable in a very different way: across firms rather than across consumers. Because small firms fail to claim all their input, they end up over-paying VAT rather than offsetting it.

Notes

These checks are also possible without digitised data, but they are much more burdensome and time consuming, making it impossible for capacity-constrained tax administrations to perform them systematically.

Exports are typically zero-rated for the VAT to follow the destination-based rule of taxing consumption goods. Other goods are typically exempted or zero-rated on equity grounds (e.g. basic food items, school uniforms or books). VAT exemptions differ from zero-rating because they do not allow beneficiaries to claim input VAT. As such, exemptions represent a potential threat to the correct functioning of the VAT (Ebrill et al., 2001).

Other advantages of the VAT over RST or TOT include its greater efficiency (compared to the TOT), as it taxes final consumption and not production, and its lower vulnerability to evasion (compared to the RST), as it is levied at multiple stages in the production chain rather than only at the retail stage (Ebrill et al., 2001; Keen & Lockwood, 2010). The VAT may also be able to reach informal firms, to the extent that they may trade with formal ones (Keen, 2008; de Paula & Scheinkman, 2010).

For example, Rwanda scores 55 on the Transparency International’s Corruption Perception Index for 2017, compared with the East African average of 33. A similar picture emerges from the World Bank Governance indicators for 2016. Specifically, Rwanda has much higher control of corruption than the rest of the region (a score of 0.69 and -0.59, respectively). Similarly, the rule of law index, which measures the degree of confidence in and compliance with the rules of society, is much larger in Rwanda (0.07 compared to -0.50 in the region).

The legislation that established the VAT is Law No 37/2012. This has been complemented by Law No 02/2015, which updated the list of zero rates and exempted goods and introduced EBMs. Exemptions are granted for basic goods and services related to healthcare, education, telecommunications, agricultural products, and goods used as inputs to agriculture, among others. Investors also receive special exemptions and benefits.

According to the Code of Value Added Tax (Law 37/2012), taxpayers with turnover below FRw 200 million (roughly US$200,000) can file quarterly, while others file monthly. The main purpose of this provision is to decrease compliance costs for small firms.

While registration is not compulsory below this threshold, firms can still voluntarily opt into the VAT system.

These thresholds are FRw 200,000, FRw 100,000 and FRw 50,000 for large, medium and small firms respectively.

Some firms are, however, exempted from using EBMs – e.g. petrol stations, telecommunication companies and financial institutions. Companies issuing less than three invoices a year are also exempted from using EBMs, which is meant to ease their compliance burden.

The local purchases annex excludes imported purchases. The VAT on these can be claimed through a separate field in the VAT declaration.

There are some exemptions, as mentioned in Sect. 3. If the machine experiences a temporary loss of connectivity, it can save the data and send it later. If it is not functioning, taxpayers are allowed to use paper receipts while the machine is not working.

The number of VAT firms refers to firms that make at least one declaration in the period. When comparing the number of VAT and EBM taxpayers, it is useful to keep in mind that: 1) taxpayers can voluntarily choose to use the EBM even if they are not obliged to do so—RRA has encouraged EBM adoption widely; 2) some taxpayers are exempt from using EBMs even if they are registered for the VAT (see Sect. 3).

As explained in more detail in Mascagni et al. (2019a), we exclude observations where there is no valid buyer TIN. It is likely that such cases mostly reflect transactions at the retail level or exported products.

43% of taxpayer-quarter observations are nil-filers in at least one quarter and 35% are nil-filers across all quarters in which they file. These figures are largely in line with other evidence on nil-filers in low-income countries, including Almunia et al. (2021) in Uganda, Mascagni et al. (2018) in Ethiopia, Santoro and Mduli (2019) in Eswatini and Mascagni et al. (2022) in Rwanda.

The FGDs took place on the premises of a private research company in Kigali. Each FGD was led by one ICTD researcher, with assistance from the Rwandan research company. Each session lasted for about two hours and was conducted in a combination of English, French and Kinyarwanda. The audio recordings of the FGDs and accompanying notes were analysed ex-post using a coding framework organised around a list of key thematic areas. Bits of text were categorised systematically into each area to identify common patterns and themes across the six focus groups.

We used the taxpayer registry and declarations data—the latter to figure out taxpayers’ filing status (non-filer, nil-filer, and active taxpayer). In this paper we only use data on active taxpayers, those who declare some income to the revenue authority, and exclude non-filers and nil-filers. The full sample, including the latter, would be about 2,000 taxpayers. More details on nil-filers in Rwanda can be found in Mascagni et al. (2022). In order to survey 1,059 taxpayers, 1,631 attempts have been run. Comparing taxpayers who refused to participate with those who gave consent, it emerges that companies are more likely to refuse than individuals, as well as taxpayers in Kigali. This means that our sample is more skewed towards individual taxpayers in rural areas—also explaining the relatively low rate of VAT registration (31%) among participants.

The first administrative decile includes 558 surveyed taxpayers (i.e. 53% of the survey sample), the second 181 (17%), the third 66 (6%); the next 7 administrative deciles each contain about 3.5% of the sample.

Inconsistencies are even more widespread if we exclude nil-filers from the analysis, in which case records match in just over a quarter of all observations.

Several participants reported that EBMs improve the quality of their record-keeping as they, for instance, by providing transaction lists. For example, in the FGD with small taxpayers held on 4 July 2019, P3 from FGD5 said: ‘EBM also helps you to know how your stock is and the profit you have encountered in that period’.

P1 from FGD6 said: ‘EBM1 was a little bit tricky because of the airtime—for example, sometimes you buy airtime but after a while you may forget the exact time when you bought so you keep using the machine and the airtime just finishes while maybe doing a receipt for a client, which is bad’.

P2 from FGD6 said: ‘EBM2 is expensive to use, you have to buy a computer, a printer, internet and also pay someone who knows how to use the computer and the software system’. P3 from FGD5 said: ‘EBM2 is also good but it requires a lot of things like a computer, internet, printer and also it requires to have the knowledge of how to use a computer which is not likely for everyone to know how to’. P6 from FGD6 reported: ‘The EBM2 is also very good and clear but the problem is that not all companies can afford to buy a computer and a printer’.

FGD with small taxpayers held on 2 July 2019 (P4 from FGD4). It should be noted, however, that the RRA already organises several training sessions – showing a need for more of it or better outreach, consistent with available evidence Mascagni et al. (2019b).

Example from FGD with small taxpayers held on 2 July 2019: P2 from FG4 said: I think the problem is about the typing mistakes. You print a receipt of FRw 20,000 instead of FRw 2,000 so that 0 that you added by mistake can cause you problems’. Another example is about inexperienced operators who may repeat a transaction when the EBM loses connectivity or fails to print a proper receipt. Yet, these transactions are still registered and sent to the RRA as soon as connectivity is restored, thus creating duplicates.

FGD with large taxpayers held on 6 March 2019 (P5 from FGD3: ‘At the end of the month you go to the RRA back office and you count, for example, that EBM shows you that you have to pay 3 million and so you think about that you go to sound out shops ‘Can you give me a receipt and I give you something’. So the owner of that shop when they come and see that they have sold goods for 2 million. But those receipts that have been bought do not count’).

The numbers are highly consistent (65% and 67%) whether we compare purchase annex with sales annex data or with EBM data. This result is also consistent with recent evidence from Uganda (Almunia et al., 2021).

For more details see Mascagni et al. (2019a).

Multiple FGDs (FGD 2,3,4,5,6) supported this argument: (1) FGD with large taxpayers held on 6 March 2019 (P1 from FGD1: ‘when you are making your declarations before the deadline, and you find one with a mistake you can cancel the other one and make a new invoice. But for this one you have to go back to your customer’); (2) FGD with large taxpayers held on 5 March 2019 (P2 from FGD2: ‘I think one of the issues could be that the receipts fade off so if you can't see the number you will definitely keep the purchase because it has happened to me, I tried to figure out numbers tried putting in many numbers, but it didn't work so I just left it’.); (3) FGD with small taxpayers held on 2 July 2019 (P3 from FGD2: ‘there must be some error and he typed the wrong numbers and he hasn’t recognised so that he goes back and cancels so even when the time to declare and pay he doesn’t remember that there is somewhere he made a mistake’); (4) FGD with small taxpayers held on 4 July 2019 (P2 from FGD5: ‘I think it is the bad usage of the machines, maybe due to the lack of knowledge of how to use it or that he may make mistakes and fail to correct them’; (5) FGD with small taxpayers held on 5 July 2019 (P5 from FGD6: ‘it happens for example they are times when you are going to make a receipt of 2 million and you type 20 million instead and you come to know it when you are going to declare seeing it in the back office of the machine and you can’t even remember the client nor can you find him’).

FGD with large taxpayers held on 6 March 2019 (P2 from FGD3): ‘a receipt from January, even if it is February, is allowed by the system, but when the auditor comes he will reject this receipt and take it out’.

FGD with large/small taxpayers held on 5 July 2019 (P2 from FGD6: ‘if a taxpayer asks for a refund, it should at least be 1 or 2 days but it takes a lot of time, almost a year. It is not convenient for businesses’).

FGD with small taxpayers held on 4 July 2019 (P3 from FG5: ‘But it is a difficult process because first of all if you claim back your money the RRA starts to control your movements, makes audits and sometimes instead of getting your money back you lose some’). Also, FGD with small taxpayers held on 2 July 2019 (P1 from FGD4: ‘what many people fear about claiming their money, is because it is like inviting RRA to come for an audit’), and FGD with small taxpayers held on 5 July 2019 (P2 from FGD6: ‘so when you go to RRA to ask for the money, they make things very complicated’).

FGD with small taxpayers held on 2 July 2019 (P1 from FGD4: ‘what many people fear about claiming their money, is because it is like inviting RRA to come for an audit so even if some have refunds to make they prefer to keep it quiet’.).

FGD with small taxpayers held on 2 July 2019 (P5 from FGD4: ‘We don't reclaim a refund. You can claim 100,000 for example, Auditors can say that you have to pay 10 million so there's no need of claiming a 100,000 If you're going to end up playing 10 million’. P1 from FGD4: ‘if it is a small amount and you are not ready for an audit then you won’t be claiming anything at all’).

FGD with small taxpayers held on 4 July 2019 (P3 from FGD5).

FGD with large taxpayers held on 5 March 2019 (P5 from FGD3): ‘If you file the receipts correctly the RRA should see that you need a refund, so why do they come to audit you?’ They then went on to mention that their business records are not always properly organised. The participant then complained that ‘one day they come and ask you to use the EBM, if they come to audit, they won’t tolerate [that] your files weren’t in order. That’s why we prefer avoiding the audit and keep the receipts for the following month’.