Abstract

Despite its relevance for fiscal policy, non-tax revenue is only defined by exclusion and it is an area that has been scarcely studied for developed economies. This study is an attempt to provide an analysis of this relevant component of government revenue, using comparable national accounts data. It assesses the size, composition and volatility of non-tax revenue in the European Union, and it explores, by means of panel data analysis, whether macroeconomic and fiscal conditions can explain the observed heterogeneity in non-tax revenue across the Member States. We also find that the relative variability of non-tax revenue is around three times higher than that of tax revenue, being a significant source of fiscal risk that is often overlooked.

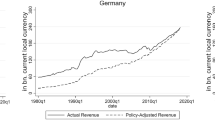

Source: Eurostat, own calculations

Source: Eurostat, own calculations

Source: Eurostat, own calculations

Source: Eurostat, own calculations

Source: Eurostat, own calculations

Source: Eurostat, own calculations

Source: Eurostat, own calculations

Similar content being viewed by others

Notes

See Nontax Revenue, Dec 1968, Tax Foundation Inc., Research Publication No. 18: http://taxfoundation.org/article/nontax-revenues.

For a detailed discussion, see Bird (2001).

See OECD (1998).

See Eurostat (2013).

See Eurostat (2014). A government fee is a tax if it is not proportionate to the cost incurred by the government to provide that good or service to the public. The Manual of Government Deficit and Debt—Implementation of ESA 2010 (MGDD-ESA 2010) states that the following should be treated as a tax: annual permission to use a motor vehicle irrespective of where and when it is used, a charge on the use of land or buildings when the government does not own them, and charges for the permission to own particular type of assets. The MGDD-ESA 2010 further clarifies that if the issuing of licenses involves little or no work for the government, the payment for licenses should be considered a tax, whereas the payment should be treated as a sale of service if the government uses the issue of the licences to organise a regulatory function, such as checking the competence of applicants.

See European Commission (2016).

Var(Total Revenue) = Var(Tax) + Var(Non-tax) + 2Cov(Tax, Non-tax). If tax revenue and non-tax income are independent variables, Cov(Tax, Non-tax) = 0 and Var(Total Revenue) = Var(Tax) + Var(Non-tax). The covariance between tax and non-tax revenue can reflect the effect of macroeconomic developments on both revenue streams, such as the effect of growing private consumption expenditure on indirect taxes and on government sales of goods and services.

Measure of amplification/mitigation of revenue volatility by non-tax revenue = [Contribution of Var(Non-tax) to Var(Total Revenue) %]/[Share of Non-tax in Total Revenue %].

We exclude Croatia and Greece because of some limitations in the available data sets.

As a result, the variable ‘central government expenditure’ actually consists of the spending of central and state governments and the social security funds controlled by these units.

An example of empirical research concluding that own-revenue decentralisation leads to a reduction in the tax burden is presented in European Commission (2012), Fiscal decentralisation and fiscal discipline, Quarterly Report on the Euro Area No. 4/2012.

References

Bird, R. M. (2001). User charges in local government finance. In M. E. Freire & R. Stren (Eds.), The challenge of urban government. Washington, DC: The World Bank Institute.

European Commission. (2012). Fiscal decentralisation and fiscal discipline. Quarterly Report on the Euro Area No. 4/2012, from http://ec.europa.eu/economy_finance/publications/qr_euro_area/2012/pdf/qrea4_en.pdf.

European Commission. (2016). Assessment of the 2016 stability programme for Finland. Section 3.1 (Deficit Developments in 2015), p. 5, from https://ec.europa.eu/info/sites/info/files/file_import/26_fi_scp_en_4.pdf.

Eurostat. (2013). European System of Accounts—ESA 2010. Luxembourg: Publications Office of the European Union.

Eurostat. (2014). Manual of government deficit and debt—Implementation of ESA 2010 (MGDD-ESA 2010). Luxembourg: Publications Office of the European Union.

Hickey, R., & Smyth, D. (2015). Government revenues in Ireland since the financial crisis. Central Bank of Ireland Economic Letter Series (Vol. 2015, No. 7).

Morrison, K. M. (2009). Oil, nontax revenue and the redistributional foundations of regime stability. International Organisation, 63(1), 107–138.

Mourre G., Astarita, C., & Maftei, A. (2016). Measuring the uncertainty in predicting public revenue. European Economy Discussion Paper, No. 039.

Organisation for Economic Co-operation and Development. (1998). User charging for government services: Best practice guidelines and case studies. Public Management Occasional Papers No. 22.

Tax Foundation Inc. (1968). Nontax Revenue. Research Publication No. 18.

Acknowledgements

We would like to thank the Editor-in-Chief, Ron Davies, and two anonymous referees, for helpful comments that improved the paper. We also thank Lucio Pench and Ingrid Toming for their valuable comments on an earlier draft of the paper. The views expressed herein are the views of the authors only and may not, under any circumstances, be interpreted as stating an official position of the European Commission or the Université libre de Bruxelles.

Author information

Authors and Affiliations

Corresponding author

Appendix: Examples of non-tax revenue and results

Appendix: Examples of non-tax revenue and results

Rights and permissions

About this article

Cite this article

Mourre, G., Reut, A. Non-tax revenue in the European Union: A source of fiscal risk?. Int Tax Public Finance 26, 198–223 (2019). https://doi.org/10.1007/s10797-018-9498-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-018-9498-z