Abstract

This paper examines the effects of labor income taxation on parental time allocation in an OLG model in which child care arrangements, that is the combination of parental and non-parental time, matter for human capital accumulation. We show that the sign of the impact of labor income taxation on parental time with children and on growth critically depends on the assumption on the altruistic motives behind the choice of devoting time to children.

Similar content being viewed by others

Notes

For example, Del Boca et al. (2014) stress that parental time is more important for the cognitive development of children than money expenditure. Bernal and Keane (2010, 2011) find that, on average, the substitution of maternal time with other sources of care produces negative and rather sizable effects on children’s skills; however, they also stress that this effect is driven by the substitution of maternal time of highly educated mothers with low-quality child care. This is also documented by Heckman and Masterov (2007), who review the evidence supporting the idea that high-quality preschool centers available to disadvantaged children are highly effective in promoting achievement. The review of the literature in Almond and Currie (2011) points in the same direction. We also remark that the Europe 2020 strategy has forcefully highlighted the importance of the availability of quality day care services not just as a tool that complements parental labor, but as a means to develop future cohorts’ human capital and to promote equality of opportunities.

Note that what we label here “paternalism” (i.e., the fact that parental preferences are defined over the human capital of the child and not over her utility) is sometimes called “warm glow” or “joy of giving”. We deem it more appropriate to use the term “paternalism” because “warm glow” or “joy of giving” are used by many scholars to refer to a situation in which parental preferences are defined over a specific action of the parent (e.g., time devoted to children), rather than over the outcome of such an action (e.g., the level of human capital).

One should bear in mind that the effects working via the child care channel we look at should be combined with those operating via, e.g., formal schooling, to obtain the overall impact of taxation on growth.

Casarico and Sommacal (2012) focus on the growth impact of taxation in a model in which the human capital production function features both early childhood environments and formal schooling as inputs. Here, we abstract from the role of formal schooling, because we focus on the study of the impact of labor taxation on growth, using the allocation of parental time as the main transmission mechanism.

Kornstad and Thoresen (2007) assume, for instance, a fixed link between market work and day care time, i.e., the parent buys day care only for each hour of market work. Of course, the parent can per se buy day care services also to cover the leisure time. The price of day care is crucial to determine whether she will do so or not.

We have also explored the consequences of introducing a bequest motive into the model. We found that, qualitatively, the results of the policy experiments we focus on are unaffected. Further details are available from the authors upon request.

Note also that, differently from the model we solve analytically, here an increase in day care services does not necessarily imply a one to one reduction in productive parental time, and therefore a decline in the growth rate.

One may think that the upper bound of the values of \(\epsilon \) we use in the calibration is high compared to the available microeconometric estimates (e.g., Evers et al. 2008; Meghir and Phillips 2008). However, in this paper we are not distinguishing across gender, and it is well known that the wage elasticity for women is higher than that of men. In addition, macroelasticities and microelasticities need not be the same, and the former can be much higher than the latter (e.g., Keane and Rogerson 2015).

From Table 2, it is not possible to directly appreciate the magnitude of the marginal change in productive parental time \(n^{1}\) relative to that in day care services d: indeed, the table reports information on the elasticities of d and \(n^{1}\) with respect to taxation and not on their marginal changes, i.e., on derivatives of d and \(n^{1}\). However, to recover such a relative change it is enough to multiply by \(n^{1}/d\) the ratio between the tax elasticity of \(n^{1}\) and the tax elasticity of d (where \(n^{1}=0.04\) and \(d=0.17\), as specified in Table 1); in other terms: \(\left( \frac{\partial n^{1}}{\partial \tau }\right) /\left( \frac{\partial d}{\partial \tau }\right) =\frac{n^{1}}{d}\left( \frac{ \partial n^{1}}{\partial \tau }\frac{\tau }{n^{1}}\right) /\left( \frac{ \partial d}{\partial \tau }\frac{\tau }{d}\right) \).

We can solve the government budget constraint in (22) with respect to the subsidy rate \(\xi \). We then take the derivative of \(\xi \) with respect to \(\tau \), keeping the lump-sum transfer T, the labor supply l and time in day care centers d constant. We find: \(\left. \frac{ \partial \xi }{\partial \tau }\right| _{T=\overline{T}}=\frac{l}{d}\chi >1\). Thus, the change in the subsidy rate (and therefore in the price of day care services) is higher than the change in the tax rate (and therefore in the price of parental time).

We point out that the impact on the labor supply that we measure is the average impact during the parenthood period, which lasts for 25 years in our calibration. If we split parenthood into sub-periods, the labor supply would likely decrease in the first sub-period, when the child demands care, and increase in the following periods.

The literature shows mixed results on public financing of day care services. Rosen (1997) shows that a subsidy to day care is likely to reduce GDP, whereas Blomquist et al. (2010) and Domeij and Klein (2013) argue in favor of subsidizing day care. These papers, as mentioned in the Introduction, abstract from the impact of child care on human capital accumulation.

We also explored the case in which the utility function of the parent depends (through a logarithmic function) on the net income of the child or directly on the time devoted to him. In both cases, the marginal utility of parental time is not affected by taxation and we obtain the same results as under paternalism, in which preferences depend on the human capital of the child. In general, we argue that every choice on the modeling of altruism such that the marginal utility of parental time is (not) directly affected by taxation will deliver results which mimic those under full altruism (paternalism).

A sensitivity analysis on \(\chi \) is available upon request. Qualitatively, the results of policy experiments 1 and 2 are not affected by the choice of a higher value of \(\chi \). Quantitatively, for higher values of \(\chi \), namely for \(\chi =10\), in policy experiment 1 fully altruistic parents increase productive parental time for all the values of the wage elasticity of labor supply we consider. Indeed, we point out that, in the basic model of Sect. 2, \( \chi \) is one of the parameters affecting the threshold elasticity of labor supply \(\bar{\epsilon _{l\tau }}\) (see Proposition 2): the higher \(\chi \), the lower \(\bar{\epsilon }_{l\tau }\). Thus, the choice of \(\chi =5\) is somehow conservative.

Note that leisure is therefore defined as the time not spent either working or providing productive and unproductive time to the child: thus, it is not a measure of leisure only, because it also includes, for example, housework.

The countries we consider are: Belgium, Finland, France, Germany, Italy, Norway, Spain, Sweden and the United Kingdom. Data refer to people in the 25–50 age group, which corresponds in our three-period OLG model to the second period of life. The period we consider is 1999–2004. This is the reference period for all the average data we use in the calibration.

In Time Use surveys activities taking place at the same time are divided into primary/main activities and secondary/parallel activities.

To the best of our knowledge, direct estimates of the elasticity of substitution between non-parental time and parental time in the production of the quality of the early childhood environment are not available. Therefore, we also perform a sensitivity analysis on \(\nu \), which is available upon request. From a qualitative point of view, results are unaffected by changes in \(\nu \). From a quantitative point of view, the higher is \(\nu \) the higher the wage elasticity of labor supply should be, in order to have fully altruistic parents increasing productive parental time when taxes are reduced under policy experiment 1 (e.g., for \(\nu =0.8\) this happens for a wage elasticity of labor supply greater than 0.2). As to policy experiment 2, it is more likely to deliver positive tax elasticity of the growth rate under paternalism the lower \(\nu \) is (e.g., for \(\nu =0.2\), this happens not only when the wage elasticity is equal to 0.5 but also when it is equal to 0.4).

The implicit tax rate is an average effective tax burden indicator that also includes social security contributions. We choose such a comprehensive indicator because the distortionary effects of taxation on time allocation depend on the overall tax burden. The choice of an indicator capturing the average tax burden is consistent with a homogeneous agent model and with the proportional tax schedule we assume herein.

As stressed by de la Croix and Michel (2002), even a rather low annual depreciation rate (e.g., 5%), can produce a large depreciation of the capital stock in a two-period OLG model: in particular, in our setup in which a model period is equal to 25 years, an annual depreciation rate of 5%, generates a per period depreciation of the capital stock of 72%.

References

Aguiar, M., Hurst, E., & Karabarbounis, L. (2012). Recent developments in the economics of time use. Annual Review of Economics, 4, 373–397.

Almond, D., & Currie, J. (2011). Human capital development before age five. In O. Ashenfelter & D. Card (Eds.), Handbook of labor economics, chap 15 (Vol. 4, pp. 1315–1486). Amsterdam: Elsevier.

Benhabib, J., Rogerson, R., & Wright, R. (1991). Homework in macroeconomics: Household production and aggregate fluctuations. Journal of Political Economy, 99(6), 87–1166.

Berger, T., & Heylen, F. (2011). Differences in hours worked in the OECD: Institutions or fiscal policies? Journal of Money, Credit and Banking, 43, 1333–1369.

Bernal, R., & Keane, M. (2010). Quasi-structural estimation of a model of child-care choices and child cognitive ability production. Journal of Econometrics, 156, 164–189.

Bernal, R., & Keane, M. (2011). Child care choices and children’s cognitive achievement: The case of single mothers. Journal of Labor Economics, 29, 459–512.

Blomquist, S., Christiansen, V., & Micheletto, L. (2010). Public provision of private goods and nondistortionary marginal tax rates. American Economic Journal: Economic Policy, 2, 1–27.

Cardia, E., & Ng, S. (2003). Intergenerational time transfers and childcare. Review of Economic Dynamics, 6, 431–454.

Casarico, A., Micheletto, L., & Sommacal, A. (2015). Intergenerational transmission of skills during childhood and optimal fiscal policies. Journal of Population Economics, 28, 353–372.

Casarico, A., & Sommacal, A. (2012). Labor income taxation, human capital, and growth: The role of childcare. Scandinavian Journal of Economics, 114, 1182–1207.

de la Croix, D., & Michel, P. (2002). A theory of economic growth: Dynamics and policy in overlapping generations. Cambridge: Cambridge University Press.

Del Boca, D., Flinn, C., & Wiswall, M. (2014). Household choices and child development. Review of Economic Studies, 81, 137–185.

Domeij, D., & Klein, P. (2013). Should day care be subsidized? Review of Economic Studies, 80, 568–595.

Evers, M., De Mooij, R., & Van Vuren, D. (2008). The wage elasticity of labour supply: A synthesis of empirical estimates. De Economist, 156, 25–43.

Gelber, A. M., & Mitchell, J. W. (2012). Taxes and time allocation: Evidence from single women and men. The Review of Economic Studies, 79, 863–897.

Greenwood, J., Seshadri, A., & Yorukoglu, M. (2005). Engines of liberation. Review of Economic Studies, 72(1), 109–133.

Gronau, R. (1977). Leisure, home production, and work-the theory of the allocation of time revisited. Journal of Political Economy, 85(6), 1099–1123.

Heckman, J. J., & Masterov, D. V. (2007). The productivity argument for investing in young children. Review of Agricultural Economics, 29(3), 446–493.

Heckman, J. J., & Mosso, S. (2014). The economics of human development and social mobility. Annual Review of Economics, 6(1), 689–733.

Ihori, T. (2001). Wealth taxation and economic growth. Journal of Public Economics, 79, 129–148.

Juster, F. (1985). A note on recent changes in time use. In F. Juster & F. Stafford (Eds.), Time, goods, and well-being. Ann Arbor: Institute for Social Research, University of Michigan.

Keane, M., & Rogerson, R. (2015). Reconciling micro and macro labor supply elasticities: A structural perspective. Annual Review of Economics, 7(1), 89–117.

King, R., & Rebelo, S. (1990). Public policy and economic growth: Developing neoclassical implications. Journal of Political Economy, 98, 519–550.

Kornstad, T., & Thoresen, T. O. (2007). A discrete choice model for labor supply and childcare. Journal of Population Economics, 20(4), 781–803.

Lundholm, M., & Ohlsson, H. (1998). Wages, taxes and publicly provided day care. Journal of Population Economics, 11, 185–204.

Meghir, C., & Phillips, D. (2008). Labour supply and taxes. Working paper No. 3405, IZA

Ohanian, L., Raffo, A., & Rogerson, R. (2008). Long-term changes in labor supply and taxes: Evidence from OECD countries, 1956–2004. Journal of Monetary Economics, 55, 1353–1362.

Olivetti, C. (2006). Changes in women’s hours of market work: The role of returns to experience. Review of Economic Dynamics, 9(4), 557–587.

Prescott, E. (2004). Why do Americans work so much more than Europeans? Federal Reserve Bank of Minneapolis Quarterly Review, 28(1), 2–13.

Ragan, K. (2013). Taxes, transfers and time use: Fiscal policy in a household production model. American Economic Journal: Macroeconomics, 5(1), 168–192.

Rogerson, R. (2007). Taxation and market work: Is Scandinavia an outlier? Economic Theory, 32(1), 59–85.

Rosen, S. (1997). Public employment, taxes, and the welfare state in Sweden. In R. B. Freeman, R. Topel, & B. Swedenborg (Eds.), The welfare state in transition: Reforming the Swedish model (pp. 79–108). University of Chicago Press.

Stokey, N., & Rebelo, S. (1995). Growth effects of flat-rate taxes. The Journal of Political Economy, 103, 519–550.

Acknowledgements

We thank for their insightful comments the editor and two anonymous referees, as well as seminar participants at the PET conference in Lisbon, at the IIPF conference in Taormina, at the SIEP meeting in Pavia, at the University of Oslo and at the OLG days conference at the Paris School of Economics. The usual disclaimers apply. Part of the paper was written while Alessandra Casarico was visiting Oslo Fiscal Studies, which she thanks for hospitality. Alessandra Casarico acknowledges financial support from MIUR within a PRIN project. Alessandro Sommacal acknowledges financial support from MIUR within the FIRB project RBFR0873ZM 001.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1: Proof of Propositions 1 and 2

We stationarize Eqs. (6), (8), (9) and (12)–(14) and focus on a balanced growth path. We denote a stationarized variable with a \(\widetilde{}\) . After few manipulations it is possible to show that the equilibrium can be expressed as a function of l and n only, and it is characterized by the following system of equations:

where \(\frac{\text {d}\widetilde{x}_{}}{\text {d}n_{}}\frac{1}{\widetilde{x}_{}}=\frac{-\sigma (a-n_{})^{\nu -1}+(1-\sigma )n_{}^{\nu -1}}{\sigma (a-n)^{\nu }+(1-\sigma )n^{\nu }}.\)

We apply the implicit function theorem to the system of Eqs. (23 )–(24), and we obtain:

and

In the case of paternalism (Proposition 1), we have:

where:

with \(\widetilde{x}=\left[ \sigma (a-n)^{\nu }+(1-\sigma )(n_{t})^{\nu } \right] ^{\frac{1}{\nu }}\). Note that \(\frac{\text {d}}{\text {d}n}\left( \frac{\text {d}\widetilde{x} }{\text {d}n}\frac{1}{\widetilde{x}}\right) <0\) (recall that \(\nu <1\)).

After a few manipulations, we can write \(\frac{\partial l}{\partial \tau }\) in (25) as follows:

Since both the numerator and the denominator of Eq. (34) are negative, we get \(\frac{\partial l}{\partial \tau }<0\).

As to \(\frac{\partial n}{\partial \tau }\), after a few calculations we can write it as

The denominator of (35) corresponds to the one in Eq. ( 34) and it is negative, whereas the numerator is positive; thus, \( \frac{\partial n}{\partial \tau }>0\).

We now focus on the case of full altruism (Proposition 2). Equations (27), (28) and (29) still hold, whereas Eqs. (30), (31) and (32) read as

Starting from \(\frac{\partial l}{\partial \tau }\), it is straightforward to see that both the numerator and the denominator of (25) are negative and thus \(\frac{\partial l}{\partial \tau }<0\). The sign of \(\frac{\partial n }{\partial \tau }\) is instead ambiguous. To identify a condition such that \( \frac{\partial n}{\partial \tau }\) is positive or negative, we first note that \(\frac{\partial n}{\partial \tau }\) can be written as followsFootnote 14:

The denominator of (39) is positive. As to the numerator, we substitute from (36) and from (38); rearranging terms we obtain \(\frac{\partial n}{\partial \tau }>0\) if and only if:

which is condition (16) in the main text.

Appendix 2: Calibration

The calibration follows Casarico and Sommacal (2012).

We interpret each period as having a length of 25 years. We set the time span over which child care is provided to 6 years; thus, \(a=6/25=0.24\). This means that \(24\%\) of the first period of life is spent receiving child care. Because population is constant, we normalize its size N at 1.

To choose the productivity parameter of the day care sector \(\chi \) we look at the child to staff ratio. According to the OECD family database,Footnote 15 this ratio changes depending on the country considered and on the age range of the children, being lower for children between 0 and 3 and higher for children between 3 and 5. We set \( \chi \) equal to 5, which is at the lower bound of the child to staff ratio in the data mentioned above.Footnote 16

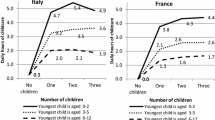

We choose the parameters \(\beta \) and \(\delta \) in the utility function (20) and the parameter \(\sigma \) in the production function of the quality of child care (18) to generate a realistic allocation of time between labor l, productive parental time with the child \(n^1\) and unproductive parental time with the child \(n^2\). Leisure z is residually determined using the time constraint (7).Footnote 17 In line with previous research (e.g., Juster 1985; Cardia and Ng 2003; Ragan 2013), we assume that non-personal time available for discretionary use amounts to 100 hours per week. We use the Harmonized European Time Use Survey (HETUS).Footnote 18 As a proxy of productive time with the child we use child care performed by parents as a primary activity and as a proxy of unproductive time we use child care performed as a secondary activity, plus the time spent transporting children.Footnote 19 The data show that on average \(32\%\) of the time endowment is devoted to work, \(4\%\) to productive time with the child and \(3\%\) to unproductive time with the child.

As to the parameter \(\nu \) which governs the elasticity of substitution between \(d_{t}h_{t}\) and \(n^1_{t}h_{t}\), \(\zeta _{\nu }=1/(1-\nu ) \), see Eq. (18), the existing estimates refer to the elasticity of substitution between inputs in the production of the general category of home-produced goods. We use a value of \(\nu =0.5\), giving an elasticity \(\zeta _{\nu }=2\) which belongs to the range of available estimates (see Aguiar et al. 2012).Footnote 20

With regard to the choice of \(\tau \), we use Eurostat data to compute the average of the implicit tax ratesFootnote 21 on labor income for the set of countries we mention in footnote 18 and set the policy parameter \(\tau \) to \(39\%\).

The day care subsidy is set in order to match a ratio of public expenditure on child care and preschool to GDP equal to \(0.9\%\), which is the average value for the countries mentioned in footnote 18, according to OECD data.

The intertemporal discount factor \(\theta \) is chosen in order to have a ratio of gross savings to GDP equal to 0.23. We choose \(\alpha \), that is the share of capital income in national product, equal to 0.33. The depreciation rate is set equal to 1, which is a quite common assumption in two-period OLG models.Footnote 22 We choose the parameter q of the human capital production function to obtain an annual growth rate of GDP per capita (\((1+g)^{\frac{1}{25}}-1\)) equal to \(2\% \) which is the average value for the set of countries we consider.

The parameter characterizing the degree of paternalism \(\gamma ^{p}\) is set equal to the intertemporal discount factor \(\theta \) when the case of paternalism is considered (i.e., we assume that the parent gives the same weight to her own consumption and to the human capital of the child), whereas it is set to 0 when we consider the case in which parental child care is motivated by fully altruistic preferences. By the same token we set the parameter characterizing the degree of full altruism \(\gamma ^{fa}\) equal to \(\theta \) when the case of full altruism is analyzed, whereas it is 0 when we consider the case of paternalistic parental preferences.

We finally choose the parameter \(\kappa \) in the utility function (20) to obtain different values for the wage elasticity of labor supply, namely 0.1, 0.2, 0.3, 0.4, 0.5.

The values of all the parameters calibrated according to the procedure specified above are reported in Table 4.

Rights and permissions

About this article

Cite this article

Casarico, A., Sommacal, A. Taxation and parental time allocation under different assumptions on altruism. Int Tax Public Finance 25, 140–165 (2018). https://doi.org/10.1007/s10797-017-9447-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-017-9447-2