Abstract

This article studies how agglomeration economies affect tax competition between local jurisdictions. We develop a theoretical model with two main testable predictions: in a setting where agglomeration forces lessen the responsiveness of capital to tax, high-regime agglomeration jurisdictions should adopt a rent-taxing behavior, and they should react less to their neighbors’ tax policies. The panel dataset spans the period from 1995 to 2007 and focuses on the local business taxes set at the French mid-subnational jurisdiction level of départements. First, instrumental variables estimates indicate that attractive jurisdictions capture a significant part of firms’ agglomeration rent by levying higher tax rates. An increase by 1% of the localization economies indicator (a specialization index) leads to increasing the business tax rate by 0.43%. Second, local tax setting behaviors are characterized by a mimetic behavior, with best response functions that slope upwards. We propose a two-agglomeration-regime spatial lag model to estimate through ML the relationship between tax competition and attractiveness. Our main result shows that both are linked and tax mimicry is less pronounced if a jurisdiction is agglomerated. Specifically, in response to a decrease in the tax rate of neighboring local governments by 1%, local governments with strong agglomeration economies reduce their tax rate by 0.4% against 0.6% for local government characterized by a low-agglomeration regime. We show that the classical one-size-fits-all-case of a single regime of agglomeration suffers from a 40% downward bias for low-agglomeration jurisdictions. We draw the link to policy praxis by discussing the optimal design of equalization schemes.

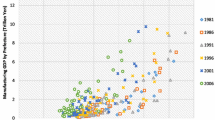

Source: Interior Ministry. Figure: authors. Discretization based on quartiles

Source: Interior Ministry. Graph: authors. Discretization based on quartiles

Source: Interior Ministry. Maps: authors

Source: Interior Ministry. Note: The distinction between strong/weak specialization is made using the Herfindahl–Hirschman sectoral specialization index with the third quartile as threshold

Similar content being viewed by others

Notes

See Tiebout (1956).

See Wilson (1999) for a survey.

Under-provision of the public good and suboptimal levels of taxation.

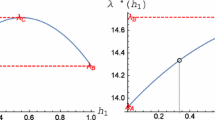

For intermediate trade costs where the effect of agglomeration (here the market access effect) is stronger. Tax competition forces follow a U-shaped pattern in the degree of economic integration related to a \(\cap \)-shaped agglomeration rent. Under some conditions, the tax differential is also hump-shaped and the agglomeration rent is said to be taxable, see Kind et al. (2000), Ludema and Wooton (2000), Baldwin and Krugman (2004).

Local tax revenues have been reformed in 2010 in France, with a business tax deeply reshaped. Following the reform, local governments cannot choose their tax rates anymore and the “new business tax” is mainly based on the firm’s value-added. This reform is outside our period of analysis.

Knowledge spillovers are generally thought to be more localized, without be it set in stone.

Agglomeration measures highlight a low variation in the time dimension (in line with previous studies showing the time persistence of agglomeration measures, see Duranton and Overman 2005) so that we chose not to introduce jurisdiction (département) fixed effects in our main specifications.

Jurisdiction or département fixed effects are equivalent to individual or still spatial fixed effects in our setting as reference may be made to in the spatial econometrics literature see Elhorst (2010).

This result is obtained by having rejected in a preliminary step the presence of vertical interactions (where the tax rate of a given level of local government depends on the one chosen by the other levels) that would lead to over-taxation and could interfere with horizontal effects.

Except for the proportion of elderly, probably due to its small variation in the time dimension. As we will see, specifications with département fixed effects are more appropriate to gauge the genuine effects of controls.

Bischoff and Krabel (2016), still for Germany, illustrate in a different context how tax setting is adapted according to the local power of dominant firms (in terms of their contribution to fiscal revenues of municipalities), also using spatial panel econometrics techniques.

These authors found that municipalities in larger urban areas set higher tax rates but that, within urban areas, municipal tax rates are disconnected to the size of economic activity within and surrounding municipalities. Tax rates are however positively related to the size of the political jurisdiction. Luthi and Schmidheiny (2014) interpret these results in the light of the asymmetric jurisdictions theory of tax competition.

Lyytikäinen (2012) for instance argued that changes in the statutory lower limit to property taxes could be used as a source of exogenous variation in tax rates to identify tax competition among local governments in Finland. Parchet (2014) made use of fiscal reforms at the canton level in Switzerland to instrument taxes for municipalities located on the other side of the administrative border and found that strategic substitutability is the common situation (strategic complementarity is the exception, only present in the case of large tax cuts.)

As a by-product, a Matlab \(^{\copyright }\) routine of the estimation procedure for best response tax functions has been designed, with a potential widespread application of the methodology.

See also Fernandez (2005), Burbidge and Cuff (2005) and Krogstrup (2008) for extensions of NEG results to the standard tax competition model. Fernandez (2005) proved the fiercer tax competition result with moderated and uniform agglomeration (see Jofre-Monseny and Sollé-Ollé 2012 for an empirical investigation of this question in a NEG-modeling). Krogstrup (2008) replicated the case of catastrophic agglomeration.

Note that the same qualitative results of the model will still hold if \(a_i\) would be a function of the total stock of capital (per head) in the jurisdiction, as in Fernandez (2005) for instance.

A direct extension of the model dealing with the case of catastrophic agglomeration and mimicking the most famous NEG result would be to pose \(f''>0\) or, alternatively, to make \(a_{i}\) depend on \(k_{i}\) with the assumption \(\frac{\partial }{\partial k_{i}}[f'(k_{i}).a_{i}(k_{i})]>0\) under \(f''<0\) with \(a_{i}'>0\). This assumption would create a new order in which agglomeration forces are stronger than the dispersion ones, preventing any equalizing adjustment scheme for the return of capital to hold. Nash equilibrium in tax rates would be hence characterized by a situation in which tax competition pressures are undone leading trivially to a degenerated reaction function with a zero slope for the jurisdiction with strong agglomeration. This situation in which all the production is located in only one jurisdiction (the most attractive) is however not well adapted to analyze competition between multiple jurisdictions (see Ottaviano and van Ypersele (2005)) and is not considered here. See Krogstrup (2008) for the analysis of this case.

We rule out head taxes because of their artificial character and the fact that they would completely break the link between fiscal competition and under-provision (and thus the rat race leading to lesser resources).

This assumption is necessary to make the model non-trivial under the budget constraint and the ruling out of head taxes. We choose to introduce heterogeneity as in Brueckner and Saavedra (2001).

We can indeed expect positive correlates between agglomeration and the needs for public goods (infrastructures, roads and so on) so that \(\eta _{1}>\eta _{2}\) whenever \(a_{1}>a_{2}\).

DePater and Myers (1994) introduce a lump-sum tax (a head tax) as a second instrument.

Each jurisdiction has a compact and convex strategy space. Therefore a Nash equilibrium exists (Fudenberg and Tirole 1991, p. 34). Utility is quasi-concave and continuous. As a result, first-order conditions characterize best response functions.

As it is well known, the slope of best response functions cannot be signed in general (even without agglomerating forces).

The classical result of a lower slope (in absolute value) for the reaction function and a higher tax rate for the larger jurisdiction (Bucovetsky 1991; Wilson 1991) is also recovered in the standard asymmetric version of the model (when \(a_{i}=1\) for \(i=1,2\) and say \(N_{1}>N_{2}\)). As shown by the expressions in the body of the text, in the NEG version of the model with partial agglomeration (\(f''<0\) and \(a_{1}>a_{2}> 1\)), these results crucially depend on parameters a and on their relative magnitude compared to those of \(\eta \)s and Ns (an extension of the result of Brueckner and Saavedra 2001, p. 210).

Data that come from INSEE (the French National institute of statistics) are only available at the départements level for sectors of activities.

French Local tax revenues have been deeply reformed in 2010. The reform has created a new tax revenue on capital (“contribution économique territoriale”, CET) made up of two parts: a main part based on firms’ value-added (“cotisation sur la valeur ajoutée”, CVAE) and a residual part based on firms’ property (“cotisation foncière des entreprises”, CFE). The CVAE gives now no leeway to local jurisdictions to choose their tax rates and thus precludes any possibility of tax competition to attract capital. Note that the year 2009 was a transition year where the “old business” tax was cut and local governments got a transitional grant covering previous tax revenues. The date of entry into force of the reform have governed our choice of the final year for the period of analysis.

In addition to 2010 tax reform (by neutralizing the transitional year 2009), the summary economic classification of the French institute of statistics (INSEE) in 36 sectors has been profoundly modified in 2008 occasioning a break in series that year and explaining the choice of the year 2007 as end point.

It could be argued that business tax is not entirely determined through the demand for local public goods and that supply-driven arguments exist (lobbies, trade-off between different local taxes, etc.). However, there is a safe bet that such factors remain marginal in our setting (welfare expenditures), as it is shown by the absence of vertical interactions.

Vertical effects characterize a situation where the tax rate of a locale (here départements) would depend on those chosen by the other local levels.

The absence of vertical effects is supported by the French empirical literature on fiscal competition, see Leprince et al. (2005).

The relatively low specialization index for Haute–Garonne in map 3 comes from the quirks of the INSEE’s sectoral breakdown with many aeronautic jobs split in different items. The high value for Lozère comes from the high share of jobs in the health and social sector.

The Hausman specification test refutes orthogonality between random individual effects and explanatory variables (with a \(\chi ^{2}\) equal to 66.53 for 6 df and p<0.01) and, hence, validates a specification with fixed effects. According to Fisher test, we should introduce both jurisdiction and time-period fixed effects (F(105,1109) = 163.26, \(p<0.01\)). However, in line with the aim of this paper and data, it did not seem relevant to introducing département fixed effects in the main specifications.

More precisely, \(t_{it}= L_{it}\beta _{L}+ U_{it}\beta _{U}+\alpha + \mathbf{X}'_{it}\beta _{X}+\mu _{i}+\epsilon _{it}\) with jurisdiction fixed effects \(\mu _{i}\) accounting for unobservable heterogeneity across locations. Year dummies for 2003, 2005 and 2006 are here introduced in the vector \(\mathbf {X}_{ it}\) following the Chow test for structural stability. To avoid dummy variables traps, \(\sum _{i} \mu _{i}=0\). Note that due to data available from INSEE, we cannot properly instrument agglomeration’s variables when jurisdiction fixed effects are present. First, the breakdown by sector and département simply does not exist at INSEE before the year 1989 to construct the localization index, with consequently little hindsight to construct a credible “rolling panel” instrumentation (which avoids overlaps); note that the same problems would arise when using Bartik-type instruments as in Luthi and Schmidheiny (2014). Second, as already mentioned, indicators feature little variation over time.

The proportion of young people (less than 19) is not significant and not integrated as a control. The explanations of this non-significance are that the database is ill-suited to recover the legal age threshold from which benefits are allowed and that age is probably not the best criterion to approximate potential young beneficiaries of welfare in France.

These findings are in line with Buettner (2001) where it is shown that large population jurisdictions in Germany set higher capital tax rates in inter-jurisdictional competition, or with Exbrayat (2007) in an international context, where the market size of OECD countries positively and significantly impacts the levels of corporate tax rates set nationally.

Whose negative sign can be explained by its weak variation in the time dimension so that its effect is captured by jurisdiction fixed effects.

A robustness check, available upon request from the authors, has been performed with a spatial matrix based on euclidean distance.

In order to minimize omitted variable bias, these tests have been run with two-way fixed effects.

Denoting \(\hbox {LM}_{\rho }\) and \(\hbox {RLM}_{\rho }\) respectively Lagrange multiplier tests and their robust version of a model without a spatial dimension against the spatial lag model and \(\hbox {LM}_{\lambda }\) and \(\hbox {RLM}_{\lambda }\) Lagrange multiplier tests of a model without a spatial dimension against the spatial error model, decision rules are the following: If \(\hbox {LM}_{\rho }\) is more significant than \(\hbox {LM}_{\lambda }\) and \(\hbox {RLM}_{\rho }\) is significant whereas \(\hbox {RLM}_{\lambda }\) is not, then the appropriate specification is the spatial lag model.

These authors test political yardstick competition with a two-regime spatial Durbin model with fixed effects where regimes reflect the level of confidence of local governments in their reelection prospects. The Durbin specification, where spatially lagged independent variables are introduced in addition to spatially lagged endogeneous variables (and exogenous characteristics), has been tested and does not impact estimates. In our setting (tax competition), the SAR model is more adapted, in particular, for the treatment of endogeneity. Note that in the SAR model, neighbors’ covariates are also included in the reduced form through the spatial multiplier.

Introducing lagged strategic interaction and agglomeration variables with a 1-year time lag to treat endogeneity does not change the results. The same remark applies to Eq. (8).

The two-regime modeling is suited for capturing (or not) the main lessons from theory of the low homogeneous agglomeration case versus the high-agglomeration case.

The \(\varPhi \)s functions having the “good properties”, there exists q such that \(q=\varPhi ^{L-1}(\tau )\) (the same is true for U-indicator).

The proportion of young people (less than 19) being not significant, it is excluded from controls.

A related problem is the one of false evidence of strategic interactions when, for instance, unobservable determinants of tax rates are correlated across jurisdictions due to correlated shocks. As shown by testing for spatial residual auto-correlation (and spatial lag exogenous), this problem is absent in our data set.

An alternative way to fix the potential persistence problem would have been to adopt a Quasi-Maximum Likelihood (QML) approach. However, with serially correlated error terms within jurisdictions, QMLE would not be consistent in general (see White 1982) and would necessitate to specify the unknown form of auto-correlation(s) (which has never been done in the literature in the spatial case (see Lee 2004)).

A frequent critique against spatial ML-estimates is that the Jacobian may become computationally unstable if N is greater than 1000, Anselin (2005). With \(N=94\) spatial units, we are immune to this criticism.

This coefficient equals to 0.33 when jurisdiction fixed effects are introduced as well as time dummies (see Table 5 in the Appendix). The large empirical literature on tax competition, be it whether on panel data or on cross-sectional data, using either maximum likelihood (ML), generalized method of moments (GMM) or instrumental variables (IV) methods, generally find a strategic complementarity between neighbors’ tax rates. Related to our setting, see for instance Besley and Case (1995) or Hernández-Murillo (2003) on US states; Revelli (2001) and Revelli (2002) on English districts; Feld and Reulier (2009) on Swiss Cantons; Heydenls and Vuchelen (1998) for Belgium municipalities; Leprince et al. (2005) and Jayet et al. (2002) for the three levels of French jurisdictions.

Of the 117 observations in the strong urbanization agglomeration group (with \(Q_{0.9}^{U}\) as threshold), only 39 do not adhere to the cutoff and can really be differentiated.

With the following specification: \(t_{it}=\rho _{1}d_{it} \sum _{j=1}^{N}w_{ij} t_{jt} + \rho _{2}(1-d_{it}) \sum _{j=1}^{N}w_{ij} t_{jt}+\alpha +{\mathbf{X}}'_{it}\beta + \mu _{i} + \epsilon _{it}\), with \(\mu _{i}\) the jurisdiction fixed effects, year dummies defined earlier, and political dummies are integrated in \(\mathbf{X}_{ it}\).

In this case, neighbors’ tax rates are instrumented along the lines aforementioned. Agglomeration indicators cannot be properly instrumented with 2SLS when jurisdiction fixed effects are introduced since variables used to instrument agglomeration indicators do not vary over time.

Lyytikäinen (2012) finds the quite surprising result of zero-slope tax reaction functions under exogenous source of variation opposed to positive slopes with spatial econometric techniques.

Results of estimations are not reported here and are available upon request from the authors.

We adopt here a more natural norm than the one chosen in Duranton and Puga (2000) by selecting the sum instead of the max operator.

See Anselin and Hudak (1992) for the case of a spatial lag model with one coefficient of interaction (“single regime”) with cross-sectional data.

The (log-)Jacobian determinant of \(\mathbf \epsilon \) with respect to \(\mathbf t\) under the spatial filter (of dimension \(NT\times NT\)) simplifies to a product of T N-dimensional determinants (Ord 1975). With such a decomposition, eigenvalues are only computed once for all and iterating over \(\rho _{i}\)-values becomes straightforward. Several methods exist to evaluate these N-dimensional determinants. We use the one proposed by Pace and Barry (1997) who compute the determinant over a grid of values for the parameter \(\rho _{i}\) ranging from \(1/\omega _{min}\) to 1 prior to estimations (\(\omega _{min}\) being the smallest eigenvalue of \(\mathbf {W}_{N}\) matrix). We adopt a grid based on 0.001 increments for \(\rho _{i}\) over the feasible range. Given these predetermined values, one can quickly evaluate the concentrated log-likelihood function for all values of \(\rho _{i}\) in the grid and determine the optimal value of \(\rho _{i}\) that maximizes the concentrated log-likelihood function over the grid.

This matrix being symmetric, the lower diagonal elements are omitted.

References

Andersson, F., & Forslid, R. (2003). Tax competition and economic geography. Journal of Public Economic Theory, 5(2), 279–303.

Anselin, L. (1988). Spatial econometrics: Method and models. Studies in operational regional science. Dordrecht: kluwer.

Anselin, L. (2005). Spatial econometrics. Journal of Geographical Systems, 4, 405–2421.

Anselin, L., & Bera, A. (1998). Spatial dependence in linear regression models with an introduction to spatial econometrics. New York: Marcel Dekker.

Anselin, L., & Florax, R. (Eds.). (1995). Small sample properties of tests for spatial dependence in regression models. In New directions in spatial econometrics (pp. 21–74). Berlin: Springer.

Anselin, L., & Hudak, S. (1992). Spatial econometrics in practice:a review of software options. Regional Science and Urban Economics, 22, 509–536.

Baldwin, R., Forslid, R., Martin, P., Ottaviano, G., & Robert-Nicoud, F. (2003). Economic geography and public policy. Princeton: Princeton University Press.

Baldwin, R., & Krugman, P. (2004). Agglomeration, integration and tax harmonisation. European Economic Review, 48, 1–23.

Baltagi, B. H. (2005). Econometric analysis of panel data. New York: Wiley.

Besley, T., & Case, A. (1995). Incumbent behaviour: Vote seeking, tax setting and yardstick competition. American Economic Review, 85, 25–45.

Bierens, H. J. (2005). Introduction to the mathematical and statistical foundations of econometrics. State College: Pennsylvania State University.

Bischoff, I., & Krabel, S. (2016). Local taxes and political influence: Evidence from locally dominant firms in German municipalities. International Tax and Public Finance. doi:10.1007/s10797-016-9419-y.

Blochliger, H., & Charbit, C. (2008). Fiscal equalization. OECD Economic Studies, 44, 1–22.

Bénassy-Quéré, A., Gobalraja, N., & Trannoy, A. (2007). Tax and public input competition. Economic Policy, 22, 385–430.

Boadway, R., & Shah, A. (2005). Intergovernmental fiscal transfers: Principles and practice. In R. Boadway & A. Shah (Eds.), Public sector governance and accountability series. Washington, DC: The World Bank.

Borcherding, T., & Deacon, R. (1972). The demand for the services of non-federal governments. American Economic Review, 62, 891–901.

Borck, R., & Pflüger, M. (2006). Agglomeration and tax competition. European Economic Review, 50, 647–668.

Brülhart, M., Bucovetsky, S., & Schmidheiny, K. (2015). Taxes in cities. Chapter 17. In G. Duranton, J. V. Henderson, & W. Strange (Eds.), Handbook of regional and urban economics (Vol. 5B). North Holland: Elsevier.

Brülhart, M., Jametti, M., & Schmidheiny, K. (2012). Do agglomeration economies reduce the sensitivity of firm location to tax differentials? The Economic Journal, 122(september), 1069–1093.

Brueckner, J. K. (1998). Testing for strategic interaction among local governments: The case of growth controls. Journal of Urban Economics, 44, 438–467.

Brueckner, J. K. (2003). Strategic interaction among governments: An overview of empirical studies. International Regional Science Review, 26(2), 175–188.

Brueckner, J. K., & Saavedra, L. A. (2001). Do local governments engage in strategic property-tax competition? National Tax Journal, 54, 203–229.

Bucovetsky, S. (1991). Asymmetric tax competition. Journal of Urban Economics, 30, 67–181.

Buettner, T. (2001). Local business taxation and competition for capital: The choice of the tax rate. Regional Science and Urban Economics, 33, 215–245.

Burbidge, J., & Cuff, K. (2005). Capital tax competition and returns to scale. Regional Science and Urban Economics, 35, 353–373.

Cameron, A. C., Gelbach, J., & Miller, D. L. (2008). Bootstrap-based improvements for inference with clustered errors. The Review of Economics and Statistics, 90, 414–427.

Case, A., Hines, J., & Rosen, H. (1993). Budget spillovers and fiscal policy interdependence. Journal of Public Economics, 52, 285–307.

Charlot, S., & Paty, S. (2005). The french local tax setting: Do interactions and agglomeration forces matter? Working Paper 2005-11, CESAER.

Charlot, S., & Paty, S. (2007). Home market effect and local tax setting: Evidence from a french panel data. Journal of Economic Geography, 7(3), 1–17.

Charlot, S., & Paty, S. (2010). Do agglomeration forces strengthen tax interactions? Urban Studies, 47, 1099–1116.

Combes, P. P., & Gobillon, L. (2015). The empirics of agglomeration. CEPR Discussion Paper 10174 .

Combes, P. P., Thisse, J. F., & Toutain, J. C. (2011). The rise and fall of spatial inequalities in France: A long-run perspective. Explorations in Economic History, 48, 243–271.

Corrado, L., & Fingleton, B. (2012). Where is the economics in spatial econometrics? Journal of Regional Science, 52(2), 210–239.

DePater, J., & Myers, G. (1994). Strategic capital tax competition: A pecuniary externality and a corrective device. Journal of Urban Economics, 36, 66–78.

Devereux, M. P., Lockwood, B., & Redoano, M. (2008). Do countries compete over corporate tax rates? Journal of Public Economics, 92, 1210–1235.

Duranton, G., & Overman, H. (2005). Testing for localization using micro-geographic data. Review of Economic Studies, 72, 1077–1106.

Duranton, G., & Puga, D. (2000). Diversity and specialisation in cities: Why, where and when does it matters? Urban Studies, 37, 533–555.

Duranton, G., & Puga, D. (2004). Microfoundations of urban agglomeration economies. In Handbook of regional and urban economics (Vol. 48, pp. 2063–2117). Elsevier.

Elhorst, J. P. (2010). Spatial panel data models. In M. M. F. A. Getis (Ed.), Handbook of applied spatial analysis (pp. 338–355). Berlin: Springer.

Elhorst, J. P., & Fréret, S. (2009). Evidence of political yardstick competition in france using a two-regime spatial durbin model with fixed effects. Journal of Regional Science, 49, 931–951.

Elhorst, J. P., & Vega, S. H. (2013). On spatial econometric models, spillover effects, and w. Working paper, University of Groningen.

Exbrayat, N. (2007). The impact of trade integration and agglomeration economies on tax interactions: Evidence from OECD countries.

Feld, L., & Reulier, E. (2009). Strategic tax competition in switzerland: Evidence from a panel of the swiss cantons. German Economic Review, 10, 91–114.

Fernandez, G. (2005). A note on tax competition in the presence of agglomeration economies. Regional Science and Urban Economics, 35, 837–847.

Fudenberg, D., & Tirole, J. (1991). Game theory. Cambridge: The MIT Press.

Garrett, G., & Mitchell, D. (2001). Globalization, government spending and taxation in the oecd. European Journal of Political Research, 39(2), 145–177.

Gibbons, S., & Overman, H. G. (2012). Mostly pointless spatial econometrics. Journal of Regional Science, 52, 172–191.

Hernández-Murillo, R. (2003). Strategic interaction in tax policies among states. St. Louis: The Federal Reserve Bank of St. Louis.

Heydenls, B., & Vuchelen, J. (1998). Tax mimicking among Belgian municipalities. National Tax Joumal LI, 51, 89–101.

Hill, B. (2008). Agglomerations and strategic tax competition. Public Finance Review, 36(6), 651–677.

Hoover, E. (1948). The location of economic activity. New York: McGraw Hill.

Inman, R. (2009). The flypaper effect. The New Palgrave of Economics.

Jacobs, J. (1959). The economy of cities. New York: Vintage.

Jayet, H., Paty, S., & Pentel, A. (2002). Existe-t-il des interactions ficales stratégiques entre les collectivités locales. Economie et prévision, 3, 95–105.

Jofre-Monseny, J. (2013). Is agglomeration taxable. Journal of Economics Geography, 13(1), 177–201.

Jofre-Monseny, J., & Sollé-Ollé, A. (2012). Which communities should be afraid of mobility? The effects of agglomeration economies on the sensitivity of employment location to local taxes. Regional Science and Urban Economics, 42, 257–268.

Kelejian, H., & Prucha, I. R. (1998). A generalized spatial two stage least squares procedure for estimating a spatial autoregressive model with autoregressive disturbances. Journal of Real Estate Finance and Economics, 17, 99–121.

Kind, H., Knarvik, K., & Schjelderup, G. (2000). Competing for capital in a lumpy world. Journal of Public Economics, 78, 253–274.

Koh, H. J., Riedel, N., & Böhm, T. (2013). Do governments tax agglomeration rents? Journal of Urban Economics, 75, 92–106.

Krogstrup, S. (2003). Are capital taxes racing to the bottom in the European Union. HEI Working Paper.

Krogstrup, S. (2008). Standard tax competition and increasing returns. Journal of Public Economic Theory, 10, 547–561.

Krugman, P. (1980). Scale economies, product differentiation, and the pattern of trade. American Economic Review, 70, 950–959.

Lee, L. F. (2004). Asymptotic distribution of quasi-maximum likelihood estimators for spatial autoregressive models. Econometrica, 72, 1899–1925.

Leprince, M., Paty, S., & Reulier, E. (2005). Choix d’imposition et interactions spatiales entre collectivités locales: un test sur les départements français. Recherches Economiques de Louvain, 71, 67–94.

Ludema, R., & Wooton, I. (2000). Economic geography and the fiscal effects of jurisdictional integration. Journal of International Economics, 55(2), 331–357.

Luthi, E., & Schmidheiny, K. (2014). The effect of agglomeration size on local taxes. Journal of Economic Geography, 14(2), 265–287.

Lyytikäinen, T. (2012). Tax competition among local governments: Evidence from a property tax reform in Finland. Journal of Public Economics, 96(7–8), 584–595.

Maguain, D., & Fréret, S. (2013). The determinants of welfare spending in france: A spatial panel econometric approach. The Annals of Economics and Statistics, 109–110, 93–131.

Manski, C. F. (1993). Identification of endogenous social effects: The reflection problem. Review of Economic Studies, 60, 531–542.

Marshall, A. (1920). Principles of economics (8th ed.). London: Macmillan and Co., Ltd.

Ord, K. (1975). Estimation methods for models of spatial interactions. Journal of the American Statistical Association, 70, 120–126.

Ottaviano, G., & van Ypersele, T. (2005). Market size and tax competition. Journal of International Economics, 67, 25–46.

Pace, R., & Barry, R. (1997). Sparse spatial autoregressions. Statistics and Probability Letters, 33, 291–297.

Parchet, R. (2014). Are local tax rates strategic complements or strategic substitutes? IDEP Economic Papers 2014/07 .

Pinkse, J., & Slade, M. (2010). The future of spatial econometrics. Journal of Regional Science, 50(1), 103–117.

Revelli, F. (2001). Spatial patterns in local taxation: Tax mimicking or error mimicking? Applied Economics, 33, 1101–1107.

Revelli, F. (2002). Testing the tax mimicking versus expenditure spill-overs hypotheses using English data. Applied Economics, 14, 1723–1731.

Revelli, F. (2005). On spatial public finance empirics. International Tax and Public Finance, 12, 475–492.

Slemrod, J. (2004). Are corporate tax rates, or countries, converging? Journal of Public Economics, 88, 1169–1186.

Tiebout, C. (1956). A pure theory of local expenditures. The Journal of Political Economy, 64, 416–424.

White, H. (1982). Maximum likelihood estimation of misspecified models. Econometrica, 50, 1–25.

Wildasin, D. (1988). Nash equilibria in models of fiscal competition. Journal of Public Economics, 35, 229–240.

Wilson, J. D. (1986). A theory of interregional tax competition. Journal of Urban Economics, 19(3), 296–315.

Wilson, J. D. (1991). Tax competition with interregional differences in factor endowments. Regional Science and Urban Economics, 21(3), 423–451.

Wilson, J. D. (1999). Theories of tax competition. National Tax Journal, 53, 269–304.

Wrede, M. (2008). Agglomeration, tax competition, and fiscal equalization. MAGKS Discussion Paper .

Zodrow, G., & Mieszkowski, P. (1986). Pigou, Tiebout, property taxation, and the underprovision of local public goods. Journal of Urban Economics, 19(3), 356–370.

Acknowledgements

We would like to thank two anonymous referees for valuable comments. We are very grateful to Giovanni Millo, Paul Elhorst, Benoît Coeuré, Malik Koubi, Lung-fei Lee, Tanguy van Ypersele and Raj Chetty for their exchange or useful remarks on previous drafts. We also thank Klaus B. Beckmann, Gonzalo E. Fernàndez, Brian Hill, Jordi Jofre-Monseny, Federico Revelli, and Matthias Wrede. We thank the audiences where this research has been presented, in Paris, Geneva, Brussels, Berlin, New York and Vienna. The usual caveat applies.

Author information

Authors and Affiliations

Corresponding author

Appendix: The variance–covariance matrix of the two-regime spatial panel tax model

Appendix: The variance–covariance matrix of the two-regime spatial panel tax model

In the following, we derive the variance–covariance matrix of the tax model with two agglomeration regimes. We consider the case with both jurisdiction (or individual) and time fixed effects—the case where only one type of fixed effects is present can be straightforwardly recovered from it, and only deal with NIID disturbances of zero mean and variance \(\sigma ^{2}\). We refer in the following to the notations of the body of the text but moving on to matrix notations when necessary. Thanks to the Gaussian error terms, the log-likelihood function of model (9) is given by:

where the vector of residuals \(\mathbf {\epsilon }\) contains two-way fixed effects, that is both time \(\lambda _{t}\) and jurisdiction (département) \(\mu _{i}\) fixed effects with \(t=1,\ldots ,T\), \(i=1,\ldots ,N\). \(\mathbf {I}_{N}\) is the identity matrix of dimension N, \(\mathbf {W}_{N}\) is the row-normalized contiguity spatial weight matrix (\(N\times N\)) and \(\mathbf {D}_{t}\) is a matrix of dimension \(N\times N\) whose diagonal entries are given by a binary variable \(d_{it}\) that takes the unit value if the local jurisdiction i is characterized by a high-agglomeration regime and the value of 0 if not. \(\mathbf {D}_{t}\) are diagonal elements of a block-diagonal matrix \(\mathbf {D}\) of dimension \(NT\times NT\). The second term of the right-hand side of (10) accounts for spatial endogeneity and is the (log-)Jacobian determinant in modulus of \(\mathbf {\epsilon }\) with respect to \(\mathbf t\) (the \(NT\times 1\)-vector of the business tax rates) under the spatial filter obtained using standard rules for transformations of random vectors (Bierens 2005), where the block-diagonal structure of the Jacobian has been exploited. This term might vary over time through its \(\mathbf{D}_{t}\) component, and hence cannot be post-multiplied by T as it is usually the case in the spatial lag model with panel data and a single coefficient of interaction. To tackle this problem, the first step consists in solving first-order conditions with respect to \(\lambda _{t}\), \(\mu _{i}\) and \(\alpha \) to obtain usual expressions of fixed effects (see Baltagi 2005 for details), without be it necessary to correct for the cross-sectional dependence between observations at each point in time except naturally for the spatial-lag-dependent variables. Using the restriction \(\sum \lambda _{t}=0\), \(\sum \mu _{i}=0\), the concentrated log-likelihood function with respect to \(\rho _{1}\), \(\rho _{2}\), \(\beta \) and \(\sigma ^{2}\) is:

with \(\mathbf {X}\) the \(NT\times K\)-matrix of K controls with the associated vector of coefficients \(\beta \) and \(\mathbf {W}_{NT}=\mathbf {I}_{T}\otimes \mathbf {W}_{N}\) the \(NT\times NT\) spatial weight matrix where \(\otimes \) is the tensor product. \(\mathbf {I}_{NT}\) is the identity matrix of dimension NT. Demeaning transformation of variables in (11) is denoted by an asterisk. To estimate the parameters \(\rho _{1}\), \(\rho _{2}\), \(\beta \) and \(\sigma ^{2}\) in this spatial-panel-extended setting with two binary regimesFootnote 56, we stack the observations as successive cross sections for \(t=1, \ldots , T\) to get a \(NT\times 1\)-vector for the demeaned endogeneous variables \(\mathbf {t}^{*}\), \(NT\times NT\)-block-diagonal matrices \(\text {diag}(.,\mathbf{D}_ {t}{} \mathbf{W}_{N} ,.) = \text {diag}(\mathbf{D}_ {1}{} \mathbf{W}_{N}, \ldots , \mathbf{D}_ {T}{} \mathbf{W}_{N})\) and \(\text {diag}(.,(\mathbf{I}_{N}-\mathbf{D}_ {t})\mathbf{W}_{N} ,.) = \text {diag}((\mathbf{I}_{N}-\mathbf{D}_ {1})\mathbf{W}_{N}, \ldots , (\mathbf{I}_{N}-\mathbf{D}_ {T})\mathbf{W}_{N})\), and a \(NT\times K\)-matrice for the demeaned exogeneous variables \(\mathbf{X}^{*}\). Within the spirit of the Frisch–Waugh–Lovell theorem, we then successively regress \(\mathbf {t}^{*}\), \(\text {diag}(.,\mathbf{D}_ {t}{} \mathbf{W}_{N} ,.)\mathbf {t}^{*}\) and \(\text {diag}(.,(\mathbf{I}_{N}-\mathbf{D}_ {t})\mathbf{W}_{N} ,.)\mathbf {t}^{*}\) on \(\mathbf{X}^{*}\) to get \(\mathbf{b_{0}}\), \(\mathbf{b_{1}}\), \(\mathbf{b_{2}}\) and \(\mathbf{e}_{0}\), \(\mathbf{e}_{1}\), \(\mathbf{e}_{2}\) respectively the associated ordinary least squares estimators and residuals. The ML-estimator for \(\rho _{1}\) and \(\rho _{2}\) is then obtained by maximizing the following concentrated log-likelihood function:

where \(\varLambda \) is a constant.

Closed-form solutions for interaction coefficients \(\rho _{1}\) and \(\rho _{2}\) cannot be achieved with (12). Numerical simulations are needed for the latterFootnote 57 to get ML-estimates of \(\beta \) and \(\sigma ^{2}\) respectively given by :

Last, tedious algebra yields the asymptotic variance–covariance matrix, derived from the (inverse of the) Fisher information matrix, for \(\beta \), \(\sigma ^{2}\), \(\rho _{1}\), \(\rho _{2}\) and used for inference (standard errors, t values/p values)Footnote 58:

where

with \(\mathbf {tr}(.)\) the trace operator, \(\mathbf{W}_{t}^{1}\) and \(\mathbf{W}_{t}^{2}\) (\(N\times N\))-matrices with superscript denoting the spatial regime, while the subscript t indicates that these matrices are time-dependent since they depend on \(\mathbf{D}_{t}\), and where we remind that \(\mathbf{{diag}}(.)\) is the (block)-diagonal operator.

Last, for the inference part and when only time fixed effects are included, standard errors are cluster-bootstrapped along the lines of Cameron et al. (2008) to account for any potential within-group serial correlation.

Three major differences are noteworthy compared to the cross-sectional counterpart with a “single regime” spatial lag model (a unique coefficient of interactions) as reported in Anselin and Bera (1998) or Lee (2004). First of all, the extension leads to a last row and a last column that take account of the second spatial regime (when both are removed and \(\mathbf{D}=\mathbf{I}_{N}\), \(\mathbf \sum ^{Asy}\) reduces to the (inverse) Fisher information matrix of a “single-regime” spatial lag model with panel data). Second, the matrix \(\mathbf{X}^{*}\) expands in dimension from N to (\(N\times T\)). Third, the summation is now over T cross sections with the manipulations of the (\(N\times N\)) spatial lag operator \(\mathbf{W}_{N}\).

To wrap up the estimation procedure, estimates are produced with a \({Matlab}^{\tiny {\copyright }}\) routine designed by the authors (see Tables 5, 6) .

Rights and permissions

About this article

Cite this article

Fréret, S., Maguain, D. The effects of agglomeration on tax competition: evidence from a two-regime spatial panel model on French data. Int Tax Public Finance 24, 1100–1140 (2017). https://doi.org/10.1007/s10797-016-9429-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-016-9429-9

Keywords

- Tax competition

- New Economic Geography

- Agglomeration regimes

- Spatial panel econometrics

- Instrumental variables