Abstract

This paper studies the impact of special interest lobbying on competition for foreign direct investment (FDI) in a common agency framework. We argue that special interest lobbying may provide an extra political incentive for governments to attract FDI. We show that compared with the benchmark case where governments maximize national welfare, now (1) an economically disadvantageous country has a chance to win FDI competition; (2) the equilibrium subsidy for attracting FDI is higher than in the benchmark case; (3) allocative efficiency cannot be always achieved.

Similar content being viewed by others

Notes

In our model, we treat the trade union and the domestic firm in each country as special interest groups. Lahiri and Ono (2004) point out that the trade union who wants the government to stipulate that multinationals purchase most of their inputs from the local markets, has an incentive to lobby the government, and the purpose is to maximize the income of workers. Using US data, Coughlin et al. (1991) show that keeping other things constant, higher unionization rates were not associated with reduced FDI, but rather with increased FDI. Kayalica and Lahiri (2007) notice that almost all countries have well-organized local producers, e.g., automobile industry, who lobby the government for higher levels of protection against the goods of foreign-owned plants producing in the country. We suppose that consumers do not organize into a special interest group in this paper.

See Chapter 10, section 10.3.1.

See Putnam (1988), p. 434. It may be argued that in his original work, Putnam did not suggest whether the idea of a two-level game should be modelled as a sequential game or as a simultaneous game. However, in economic analysis, this idea is related to the idea of strategic delegation, and is modelled as a sequential game. See Grossman and Helpman (1995b), and Persson and Tabellini (1995).

Persson and Tabellini (2000) present a slightly different version of this model. See Chapter 12, section 12.4.4.

Notice that trade unions and firms are not allowed to contribute to foreign governments since the scope for interest groups to influence foreign government’s decisions generally is quite limited. See Grossman and Helpman (1995a), p. 670. For the same reason, the multinational is not allowed to make political contributions to both governments.

If \(b_{i}\) is negative, it is a lump-sum tax. We have chosen lump-sum subsidies (taxes) rather than (more realistic) proportional subsidies (taxes) since the latter complicates the algebra without affecting any of the qualitative results of the paper.

Notice that first we assume that the fixed establishment costs are the same across two countries and are normalized to zero. Second, when the multinational locates in country i, it uses \(\gamma _{i}\) units of labor to produce one unit of output. Third, we do not consider direct export as one of the multinational’s options in the basic model. Also see discussion in the Conclusion.

In Appendix 2 in ESM, we examine different models with wage bargaining. It turns out that our results will carry over to most cases we consider. Also see discussion in the Conclusion.

This assumption makes the analysis as neat as possible and helps to deliver results in a clear-cut way. In Appendix 3 in ESM, we show that our results carry over to different models with trade. Also see discussion in the Conclusion.

Here, we consider the situation where a trade union is interested only in the nominal wage rate and neglects the effects of its wage setting behavior on the output price. This happens when workers do not consume the good they produce, or their share in the consumption is negligible as we assume. We also suppose that a domestic firm is not owned by consumers. Also see discussion in the Conclusion.

When it collects a lump-sum tax from the multinational, the tax revenue is distributed among consumers by a lump-sum subsidy.

One may argue that there is a problem about credibility and commitment on the payments of political contributions. When FDI competition is over, lobbying groups may have a strict incentive not to give governments the promised political contributions. However, Aidt and Magris (2006) notice that governments will punish lobbying groups that do not keep their promises; this in turn provides a proper incentive for them to keep their promises.

Notice that in the model, as we see in expressions (1) and (2), an interest group’s (a principal’s) political contribution schedule (contract) is contingent on the multinational’s location choices rather than its government’s (agent’s) actions. The latter case was considered by Bernheim and Whinston (1986), and Grossman and Helpman (1994), and a Truthful Equilibrium is used as the solution concept; while we try to find CPNEs in the first stage of the game. In short, these two equilibrium concepts are closely related, and CPNE can be used as a solution concept of a common agency game as well. See Bernheim and Whinston (1986) for further discussion. See Appendix 4 in ESM for the definition of a Coalition-Proof Nash Equilibrium.

Notice that \(w_{ii}=w_{ij}\), since the equilibrium employment levels when the multinational locates in country i are proportionate to those when it locates in country j.

We prescribe that the multinational locates in country i if \(\pi _{i}^{M}+b_{i}=\pi _{j}^{M}+b_{j}\).

We do not allow players to choose weakly dominated strategies. Also see Grossman and Helpman (1995a).

Notice that condition (13) is also necessary. Suppose not. Then given that trade union i and firm j do not make political contributions, clearly, firm i and trade union j can coordinate and help country j win FDI competition in a noncooperative way if pre-play communication is allowed.

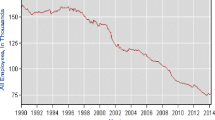

Notice that the benchmark case is represented by the origin point in the figure.

Notice that things become more complicated when non-trivial trade costs are allowed for in the segmented market model, and the results may change.

References

Aidt, T. S., & Hwang, U. (2008). On the internalization of cross-national externalities through political markets: The case of labour standards. Journal of Institutional and Theoretical Economics, 164, 509–533.

Aidt, T. S., & Magris, F. (2006). Capital taxation and electoral accountability. European Journal of Political Economy, 22, 277–291.

Barba Navaretti, G., & Venables, A. J. (2004). Multinational firms in the world economy. Princeton: Princeton University Press.

Bárcena-Ruiz, J. C. (2003). Politically preferred wage bargaining structures. European Journal of Political Economy, 19, 341–353.

Barros, P. P., & Cabral, L. (2000). Competing for FDI. Review of International Economics, 8, 360–371.

Bernheim, B. D., Peleg, B., & Whinston, M. D. (1987). Coalition-proof Nash equilibria I. Concepts. Journal of Economic Theory, 42, 1–12.

Bernheim, B. D., & Whinston, M. D. (1986). Menu auctions, resource allocation, and economic influence. Quarterly Journal of Economics, 101, 1–31.

Biglaiser, G., & Mezzetti, C. (1997). Politicians’ decision making with re-election concerns. Journal of Public Economics, 66, 425–447.

Coughlin, C. C., Terza, J. V., & Arromdee, V. (1991). State characteristics and the location of foreign direct investment within the United States. Review of Economics and Statistics, 73, 675–683.

Facchini, G., & Willmann, G. (2005). The political economy of international factor mobility. Journal of International Economics, 67, 201–219.

Fumagalli, C. (2003). On the welfare effects of competition for FDIs. European Economic Review, 47, 963–983.

Grossman, G. M., & Helpman, E. (1994). Protection for sale. American Economic Review, 84, 833–850.

Grossman, G. M., & Helpman, E. (1995a). The politics of free-trade agreements. American Economic Review, 85, 667–690.

Grossman, G. M., & Helpman, E. (1995b). Trade wars and trade talks. Journal of Political Economy, 103, 675–708.

Haaparanta, P. (1996). Competition for FDIs. Journal of Public Economics, 63, 141–153.

Haufler, A., & Mittermaier, F. (2011). Unionisation triggers tax incentives to attract foreign direct investment. The Economic Journal, 121, 793–818.

Haufler, A., & Wooton, I. (1999). Country size and tax competition for FDI. Journal of Public Economics, 71, 121–139.

Kayalica, M. Ö., & Lahiri, S. (2007). Domestic lobbying and FDI: The role of policy instruments. Journal of International Trade and Economic Development, 16, 299–323.

Lahiri, S., & Ono, Y. (2004). Trade and industrial policy under international oligopoly. Cambridge: Cambridge University Press.

Oman, C. (2000). Policy competition for FDI: A study of competition among governments to attract FDI. Paris: OECD Development Centre.

Persson, T., & Tabellini, G. (1992). The politics of 1992: Fiscal policy and European integration. Review of Economic Studies, 59, 689–701.

Persson, T., & Tabellini, G. (1995). Double-edged incentives: Institutions and policy coordination. In G. M. Grossman & K. Rogoff (Eds.), Handbook of International Economics (Vol. 3, pp. 1973–2030). Amsterdam: North-Holland.

Persson, T., & Tabellini, G. (2000). Political economics: Explaining economic policy. Cambridge, MA: The MIT Press.

Putnam, R. D. (1988). Diplomacy and domestic politics: The logic of two-level games. International Organization, 42, 427–460.

UNCTAD. (1996). Incentives and FDI. New York: United Nations.

Wilson, J. D. (1999). Theories of tax competition. National Tax Journal, 52, 269–304.

Wilson, J. D., & Wildasin, D. E. (2004). Capital tax competition: Bane or boon. Journal of Public Economics, 88, 1065–1091.

Acknowledgments

I am especially grateful to Robin A. Mason and Jian Tong for their guidance and advice. I thank the Editor-in-Chief, Andreas Haufler, two anonymous referees, Hongbin Cai, James Markusen, Emanuel Ornelas, Larry D. Qiu, Pascalis Raimondos, José V. Rodríguez Mora, Alistair M. Ulph, Juuso V älimäki, Anthony Venables, Thierry Verdier, Cheng Yuan, Lei Zhang, Weiying Zhang and Haiwen Zhou for their helpful comments and suggestions. I also would like to thank Lauren Johnston for help in revising the language of the paper. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix 1: Proofs

Appendix 1: Proofs

1.1 Proof of Lemma 1

First, let us establish trade union i’s best response. Given trade union j ’s political contributions, and firm j’s political contributions, government j’s political incentive (or disincentive) to attract the multinational is determined. Given that and given firm i’s political contributions, can trade union i make country i win FDI competition? If:

this is true. Clearly trade union i will choose the lowest possible political contributions. Hence, trade union i will choose a number, which makes the above inequality hold with equality. Define \(z_{i}^{T}\) such that:

If \(z_{i}^{T}\ge 0\), trade union i chooses \(C_{ii}^{T}=z_{i}^{T}\). However, if \(z_{i}^{T}<0\), it chooses \(C_{ii}^{T}=0\), since it is not allowed to make negative political contributions.

On the other hand, if:

then trade union i cannot make country i win FDI competition. It can choose arbitrarily its political contributions. Using the same type of arguments, we can establish the best responses for firm i, trade union j, and firm j, respectively. \(\square \)

1.2 Proof of Lemma 2

Step 1 We show that any strategy profile is self-enforcing. There are 14 nonempty proper subcoalitions. Four subcoalitions are formed by one player. Six subcoalitions are formed by two players. Four subcoalitions are formed by three players.

-

1.

Let us consider the subcoalitions formed by one player. Given that condition (13) holds, according to Lemma 1, the proposed strategy profiles are Nash equilibria. So, given any other three players’ strategies, the strategy prescribed for the left player is a CPNE of the one-player game played by itself.

-

2.

Let us consider the subcoalitions formed by two players.

-

(a)

The subcoalition formed by trade union i and firm i. Consider the game played by these two players given that \(C_{jj}^{T}\) is arbitrarily chosen and \(C_{ji}^{F}=0\). There are two nonempty proper subcoalitions: one formed by trade union i and the other formed by firm i. Given an arbitrarily chosen \(C_{ij}^{F}\), since condition (13) holds, we always have \(\lambda ^{i}\left( 0-C_{ij}^{F}\right) +\left( \frac{1}{16}+ \frac{1}{18}\right) \left( \Delta _{i}-\Delta _{j}\right) \ge \lambda ^{j}\left( C_{jj}^{T}-0\right) \), so, \(C_{ii}^{T}=0\) is a CPNE of the one-player game played by trade union i. Given \(C_{ii}^{T}=0\), since condition (13) holds, we always have \(\lambda ^{i}\left( 0-\frac{5}{72}\Delta _{i}\right) +\left( \frac{1}{16}+\frac{1}{18}\right) \left( \Delta _{i}-\Delta _{j}\right) \ge \lambda ^{j}\left( C_{jj}^{T}-0\right) \) , so, an arbitrarily chosen \(C_{ij}^{F}\) is a CPNE of the one-player game played by firm i. So, the strategy profile consisting of \(C_{ii}^{T}=0\) and \(C_{ij}^{F}\) is self-enforcing. Notice that any strategy profile consisting of \(C_{ii}^{T}=0\) and \(C_{ij}^{F\prime }\), where \(C_{ij}^{F}\ne C_{ij}^{F\prime }\), is also self-enforcing. But trade union i receives \( \frac{1}{3}\Delta _{i}\), and firm i receives \(\frac{1}{18}\Delta _{i}\), irrespective of self-enforcing strategy profiles. So, \(C_{ii}^{T}=0\) and \( C_{ij}^{F}\) constitute a CPNE of the game played by trade union i and firm i.

-

(b)

The subcoalition formed by trade union i and trade union j. Using the similar arguments to those in 1.2.a, it proves that \(C_{ii}^{T}=0\) and an arbitrarily chosen \(C_{jj}^{T}\) constitute a CPNE of the game played by trade union i and trade union j.

-

(c)

The subcoalition formed by trade union i and firm j. Consider the game played by these two players given that \(C_{ij}^{F}\) and \(C_{jj}^{T}\) are arbitrarily chosen. There are two nonempty proper subcoalitions: one formed by trade union i and the other formed by firm j. Given \( C_{ji}^{F}=0\), since condition (13) holds, we always have \( \lambda ^{i}\left( 0-C_{ij}^{F}\right) +\left( \frac{1}{16}+\frac{1}{18} \right) \left( \Delta _{i}-\Delta _{j}\right) \ge \lambda ^{j}\left( C_{jj}^{T}-0\right) \), so, \(C_{ii}^{T}=0\) is a CPNE of the one-player game played by trade union i. By the same token, given \(C_{ii}^{T}=0\), \( C_{ji}^{F}=0\) is a CPNE of the one-player game played by firm j. So, the strategy profile consisting of \(C_{ii}^{T}=0\) and \(C_{ji}^{F}=0\) is self-enforcing. This is the only self-enforcing strategy profile since no player has an incentive to make strictly positive political contributions. So, it is a CPNE of the game played by trade union i and firm j.

-

(d)

The subcoalition formed by firm i and trade union j. Consider the game played by these two players given \(C_{ii}^{T}=0\) and \(C_{ji}^{F}=0\). There are two nonempty proper subcoalitions: one formed by firm i and the other formed by trade union j. Given an arbitrarily chosen \(C_{ij}^{F}\) , since condition (13) holds, we always have \(\lambda ^{i}\left( 0-C_{ij}^{F}\right) +\left( \frac{1}{16}+\frac{1}{18}\right) \left( \Delta _{i}-\Delta _{j}\right) \ge \lambda ^{j}\left( \frac{1}{12}\Delta _{j}-0\right) \), so, an arbitrarily chosen \(C_{jj}^{T}\) is a CPNE of the one-player game played by trade union j. Given an arbitrarily chosen \( C_{jj}^{T}\), since condition (13) holds, we always have \(\lambda ^{i}\left( 0-\frac{5}{72}\Delta _{i}\right) +\left( \frac{1}{16}+\frac{1}{18} \right) \left( \Delta _{i}-\Delta _{j}\right) \ge \lambda ^{j}\left( C_{jj}^{T}-0\right) \), so, an arbitrarily chosen \(C_{ij}^{F}\) is a CPNE of the one-player game played by firm i. So, the strategy profile consisting of \(C_{ij}^{F}\) and \(C_{jj}^{T}\) is self-enforcing. Notice that any strategy profile consisting of \(C_{ij}^{F\prime }\), where \(C_{ij}^{F}\ne C_{ij}^{F\prime }\), or \(C_{jj}^{T\prime }\), where \(C_{jj}^{T}\ne C_{jj}^{T\prime }\), or both is also self-enforcing. But firm i receives \( \frac{1}{18}\Delta _{i}\), and trade union j receives \(\frac{1}{4}\Delta _{j}\), irrespective of self-enforcing strategy profiles. So, \(C_{ij}^{F}\) and \(C_{jj}^{T}\) constitute a CPNE of the game played by firm i and trade union j.

-

(e)

The subcoalition formed by firm i and firm j. Using the similar arguments to those in 1.2.a, it proves that an arbitrarily chosen \( C_{ij}^{F}\) and \(C_{ji}^{F}=0\) constitute a CPNE of the game played by firm i and firm j.

-

(f)

The subcoalition formed by trade union j and firm j. Using the similar arguments to those in 1.2.a, it proves that an arbitrarily chosen \( C_{jj}^{T}\) and \(C_{ji}^{F}=0\) constitute a CPNE of the game played by trade union j and firm j.

-

(a)

-

3.

Let us consider the subcoalitions formed by three players.

-

(a)

The subcoalition formed by trade union i, firm i and trade union j. Consider the game played by these three players given \(C_{ji}^{F}=0\). There are six nonempty proper subcoalitions: three formed by one player and three formed by two players.

-

(i)

Let us consider the three subcoalitions formed by one player. According to step 1.1, it is easy to show that fixing \(C_{ji}^{F}=0\), given any other two players’ strategies, the strategy prescribed for the left player is a CPNE of the one-player game played by itself.

-

(ii)

Let us consider the three subcoalitions formed by two players. According to step 1.2.a, 1.2.b and 1.2.d, it is easy to show that fixing \( C_{ji}^{F}=0\), given any player’s strategy, the strategies prescribed for the left two players constitute a CPNE of the two-player game played by themselves.

-

(iii)

So, fixing \(C_{ji}^{F}=0\), the strategies prescribed for the left three players are self-enforcing. Notice that any strategy profile consisting of \(C_{ij}^{F\prime }\), where \(C_{ij}^{F}\ne C_{ij}^{F\prime }\), or \(C_{jj}^{T\prime }\), where \(C_{jj}^{T}\ne C_{jj}^{T\prime }\), or both is also self-enforcing. But trade union i receives \(\frac{1}{3}\Delta _{i}\), firm i receives \(\frac{1}{18}\Delta _{i}\), and trade union j receives \( \frac{1}{4}\Delta _{j}\), irrespective of self-enforcing strategy profiles. So, \(C_{ii}^{T}=0\), \(C_{ij}^{F}\) and \(C_{jj}^{T}\) constitute a CPNE in this case.

-

(i)

-

(b)

The subcoalition formed by trade union i, firm i and firm j. Consider the game played by these three players when \(C_{jj}^{T}\) is arbitrarily chosen. There are six nonempty proper subcoalitions: three formed by one player and three formed by two players.

-

(i)

Let us consider the three subcoalitions formed by one player. According to step 1.1, it is easy to show that fixing an arbitrarily chosen \( C_{jj}^{T}\), given any other two players’ strategies, the strategy prescribed for the left player is a CPNE of the one-player game played by itself.

-

(ii)

Let us consider the three subcoalitions formed by two players. According to step 1.2.a, 1.2.c and 1.2.e, it is easy to show that fixing an arbitrarily chosen \(C_{jj}^{T}\), given any player’s strategy, the strategies prescribed for the left two players constitute a CPNE of the two-player game played by themselves.

-

(iii)

So, fixing an arbitrarily chosen \(C_{jj}^{T}\), the strategies prescribed for the left three players are self-enforcing. Notice that any strategy profile consisting of \(C_{ij}^{F\prime }\), where \(C_{ij}^{F}\ne C_{ij}^{F\prime }\), is also self-enforcing. But trade union i receives \( \frac{1}{3}\Delta _{i}\), firm i receives \(\frac{1}{18}\Delta _{i}\), and firm j receives \(\frac{1}{8}\Delta _{j}\), irrespective of self-enforcing strategy profiles. So, the proposed strategy profile is a CPNE in this case.

-

(i)

-

(c)

The subcoalition formed by trade union i, trade union j and firm j. Using the similar arguments to those in step 1.3.b, it proves that the proposed strategies constitute a CPNE of the game played by themselves.

-

(d)

The subcoalition formed by firm i, trade union j and firm j. Using the similar arguments to those in step 1.3.a, it proves that the proposed strategies constitute a CPNE of the game played by themselves.

-

(a)

So far, we have established that any strategy profiles prescribed in Lemma 2 are self-enforcing.

Step 2 Are there any other self-enforcing strategy profiles? No. This is because given that condition (13) holds, both trade union i and firm j do not have an incentive to make strictly positive political contributions.

Step 3 Finally, it is easy to show that given any proposed strategy profile, trade union i receives \(\frac{1}{3}\Delta _{i}\), firm i receives \(\frac{1}{18}\Delta _{i}\), trade union j receives \(\frac{1}{4} \Delta _{j}\), and firm j receives \(\frac{1}{8}\Delta _{j}\).

We conclude that any proposed strategy profile is a CPNE in the first stage of the game. \(\square \)

1.3 Proof of Lemma 3

Step 1 We show that any strategy profile is self-enforcing. There are 14 nonempty proper subcoalitions. Four subcoalitions are formed by one player. Six subcoalitions are formed by two players. Four subcoalitions are formed by three players.

-

1.

Let us consider the subcoalitions formed by one player. Given that condition (17) holds, according to Lemma 1, the proposed strategy profiles are Nash equilibria. So, given any other three players’ strategies, the strategy prescribed for the left player is a CPNE of the one-player game played by itself.

-

2.

Let us consider the subcoalitions formed by two players.

-

(a)

The subcoalition formed by trade union i and firm i. Consider the game played by these two players given \(C_{jj}^{T}=\frac{1}{12}\Delta _{j}\) and \(C_{ji}^{F}\). There are two nonempty proper subcoalitions: one formed by trade union i and the other formed by firm i. Given \( C_{ij}^{F}=\frac{5}{72}\Delta _{i}\), it is optimal for trade union i to choose \(C_{ii}^{T}\), such that condition (16) holds. Given \( C_{ii}^{T}\), \(C_{ij}^{F}=\frac{5}{72}\Delta _{i}\) is a CPNE of the one-player game played by firm i. So, the strategy profile consisting of \( C_{ii}^{T}\) and \(C_{ij}^{F}=\frac{5}{72}\Delta _{i}\) is self-enforcing. Notice that any other strategy profiles are not self-enforcing since \( C_{ii}^{T}\) and \(C_{ij}^{F}=\frac{5}{72}\Delta _{i}\) constitute a unique Nash equilibrium of this two-player game. (The nature of this game is a standard Bertrand game with cost asymmetries.) So, it is a CPNE of the game played by trade union i and firm i.

-

(b)

The subcoalition formed by trade union i and trade union j. Using the similar arguments to those in 1.2.a, it proves that \(C_{ii}^{T}\) and \(C_{jj}^{T}=\frac{1}{12}\Delta _{j}\) constitute a CPNE of the game played by trade union i and trade union j.

-

(c)

The subcoalition formed by trade union i and firm j. Consider the game played by these two players given \(C_{ij}^{F}=\frac{5}{72}\Delta _{i}\) and \(C_{jj}^{T}=\frac{1}{12}\Delta _{j}\). There are two nonempty proper subcoalitions: one formed by trade union i and the other formed by firm j. Given \(C_{ji}^{F}\), it is optimal for trade union i to choose \( C_{ii}^{T}\), such that condition (16) holds. Given \(C_{ii}^{T} \), it is optimal for firm j to choose \(C_{ji}^{F}\), such that condition (16) holds. So, the strategy profile consisting of \( C_{ii}^{T}\) and \(C_{ji}^{F}\) is self-enforcing. Notice that there are other self-enforcing strategy profiles. First of all, any strategy profile consisting of \(C_{ii}^{T\prime }\) and \(C_{ji}^{F\prime }\), such that \( C_{ii}^{T\prime }\) and \(C_{ji}^{F\prime }\) satisfy condition (16), is self-enforcing. But \(C_{ii}^{T\prime }\) and \( C_{ji}^{F\prime }\) cannot be strictly smaller than \(C_{ii}^{T}\) and \( C_{ji}^{F}\) at the same time. Otherwise, condition (16) does not hold. So, the proposed strategy profile cannot be strictly Pareto dominated by those self-enforcing strategy profiles. We also have a Nash equilibrium, in which trade union i and firm j free-ride on each other. But the payoffs received in this case are strictly smaller than the payoffs received in the case when \(C_{ii}^{T\prime }\) and \(C_{ji}^{F\prime }\) satisfy condition (16), where \(0<C_{ii}^{T\prime }<\frac{1}{12 }\Delta _{i}\), and \(0<C_{ji}^{F\prime }<\frac{5}{72}\Delta _{j}\). In summary, the proposed strategy profile is a CPNE of the game played by trade union i and firm j.

-

(d)

The subcoalition formed by firm i and trade union j. Consider the game played by these two players given that \(C_{ii}^{T}\) and \(C_{ji}^{F}\) satisfy condition (16). It is easy to show that any strategy profiles are Nash equilibria, and hence self-enforcing, since firm i receives \(\frac{1}{18}\Delta _{i}\), and trade union j receives \(\frac{1}{4} \Delta _{j}\), irrespective of strategy profiles. So, the strategy profile consisting of \(C_{ij}^{F}=\frac{5}{72}\Delta _{i}\) and \(C_{jj}^{T}=\frac{1}{ 12}\Delta _{j}\) is self-enforcing and is not strongly Pareto dominated by any other self-enforcing strategy profiles. It constitutes a CPNE of the game played by firm i and trade union j.

-

(e)

The subcoalition formed by firm i and firm j. Using the similar arguments to those in 1.2.a, it proves that \(C_{ij}^{F}=\frac{5}{72} \Delta _{i}\) and \(C_{ji}^{F}\) constitute a CPNE of the game played by firm i and firm j.

-

(f)

The subcoalition formed by trade union j and firm j. Using the similar arguments to those in 1.2.a, it proves that \(C_{jj}^{T}=\frac{1}{12} \Delta _{j}\) and \(C_{ji}^{F}\) constitute a CPNE of the game played by trade union j and firm j.

-

(a)

-

3.

Let us consider the subcoalitions formed by three players.

-

(a)

The subcoalition formed by trade union i, firm i and trade union j. Consider the game played by these three players given \(C_{ji}^{F}\) . There are six nonempty proper subcoalitions: three formed by one player and three formed by two players.

-

(i)

Let us consider the three subcoalitions formed by one player. According to step 1.1, it is easy to show that fixing \(C_{ji}^{F}\), given any other two players’ strategies, the strategy prescribed for the left player is a CPNE of the one-player game played by itself.

-

(ii)

Let us consider the three subcoalitions formed by two players. According to step 1.2.a, 1.2.b and 1.2.d, it is easy to show that fixing \( C_{ji}^{F}\), given any player’s strategy, the strategies prescribed for the left two players constitute a CPNE of the two-player game played by themselves.

-

(iii)

So, fixing \(C_{ji}^{F}\), the strategies prescribed for the left three players are self-enforcing. Are there any other self-enforcing strategy profiles? Notice that if a strategy profile is self-enforcing, it must be the case that \(C_{ij}^{F}=\frac{5}{72}\Delta _{i}\) and \(C_{jj}^{T}=\frac{1}{ 12}\Delta _{j}\). Otherwise, this strategy profile will not induce a CPNE either in the game played by trade union i and firm i, (see step 1.2.a), or in the game played by trade union i and trade union j, (see step 1.2.b), or both. Since \(C_{ji}^{F}\) is fixed, given \(C_{ij}^{F}=\frac{5}{72} \Delta _{i}\) and \(C_{jj}^{T}=\frac{1}{12}\Delta _{j}\), it must be the case that trade union i chooses \(C_{ii}^{T}\), such that \(C_{ii}^{T}\) satisfies condition (16). So, the self-enforcing strategy profile in this case is unique, and hence a CPNE.

-

(i)

-

(b)

The subcoalition formed by trade union i, firm i and firm j. Consider the game played by these three players given \(C_{jj}^{T}=\frac{1}{12 }\Delta _{j}\). There are six nonempty proper subcoalitions: three formed by one player and three formed by two players.

-

(i)

Let us consider the three subcoalitions formed by one player. According to step 1.1, it is easy to show that fixing \(C_{jj}^{T}=\frac{1}{12 }\Delta _{j}\), given any other two players’ strategies, the strategy prescribed for the left player is a CPNE of the one-player game played by itself.

-

(ii)

Let us consider the three subcoalitions formed by two players. According to step 1.2.a, 1.2.c and 1.2.e, it is easy to show that fixing \( C_{jj}^{T}=\frac{1}{12}\Delta _{j}\), given any player’s strategy, the strategies prescribed for the left two players constitute a CPNE of the two-player game played by themselves.

-

(iii)

So, fixing \(C_{jj}^{T}=\frac{1}{12}\Delta _{j}\), the strategies prescribed for the left three players are self-enforcing. Are there any other self-enforcing strategy profiles? Notice that if a strategy profile is self-enforcing, it must be the case that \(C_{ij}^{F}=\frac{5}{72}\Delta _{i}\) . Otherwise, this strategy profile will not induce a CPNE either in the game played by trade union i and firm i, (see step 1.2.a), or in the game played by firm i and firm j, (see step 1.2.e), or both. Since \( C_{jj}^{T}=\frac{1}{12}\Delta _{j}\) is fixed, it must be the case that any strategy profile consisting of \(C_{ii}^{T\prime }\) and \(C_{ji}^{F\prime }\), such that \(C_{ii}^{T\prime }\) and \(C_{ji}^{F\prime }\) satisfy condition (16), is self-enforcing. But the proposed strategy profile is not strongly Pareto dominated by any other self-enforcing strategy profiles. Hence, the proposed strategy profile is a CPNE in this case.

-

(i)

-

(c)

The subcoalition formed by trade union i, trade union j and firm j. Using the similar arguments to those in step 1.3.b, it proves that the proposed strategies constitute a CPNE of the game played by themselves.

-

(d)

The subcoalition formed by firm i, trade union j and firm j. Using the similar arguments to those in step 1.3.a, it proves that the proposed strategies constitute a CPNE of the game played by themselves.

-

(a)

So far, we have established that any strategy profiles prescribed in Lemma 3 are self-enforcing.

Step 2 Are there any other self-enforcing strategy profiles? No. This is because given a self-enforcing strategy profile, it must be the case that \( C_{ij}^{F}=\frac{5}{72}\Delta _{i}\), \(C_{jj}^{T}=\frac{1}{12}\Delta _{j}\), and \(C_{ii}^{T}\) and \(C_{ji}^{F}\) satisfy condition (16).

Step 3 Finally, it is easy to show that given any strategy profile, trade union i receives \(\frac{1}{3}\Delta _{i}-C_{ii}^{T}\), firm i receives \( \frac{1}{18}\Delta _{i}\), trade union j receives \(\frac{1}{4}\Delta _{j}\), and firm j receives \(\frac{1}{8}\Delta _{j}-C_{ji}^{F}\). Notice that \( C_{ii}^{T}\) and \(C_{ji}^{F}\) cannot be lowered simultaneously. Otherwise, condition (16) does not hold. This means that any self-enforcing strategy profile is not strongly Pareto dominated by any other self-enforcing strategy profiles.

We conclude that any proposed strategy profile is a CPNE in the first stage of the game. \(\square \)

1.4 Proof of Proposition 2

Notice that the sufficiency part of the Proposition is implied by Lemmas 2, 3 and 4.

Next, we establish that in the first stage of the game, if there exists a CPNE, in which country i wins FDI competition, the following condition:

must hold.

Suppose that there is such a CPNE \(\left( C_{ii}^{T},C_{ij}^{F},C_{jj}^{T},C_{ji}^{F}\right) \), but \(\frac{1}{72} \lambda ^{i}\Delta _{i}+\left( \frac{1}{16}+\frac{1}{18}\right) \left( \Delta _{i}-\Delta _{j}\right) <\frac{1}{72}\lambda ^{j}\Delta _{j}\). We want to show that \(\left( C_{ii}^{T},C_{ij}^{F},C_{jj}^{T},C_{ji}^{F}\right) \) is not self-enforcing, and hence is not a CPNE since given \(C_{ii}^{T}\) and \(C_{ji}^{F}\), \(\left( C_{ij}^{F},C_{jj}^{T}\right) \) is not a CPNE of the game played by firm i and trade union j.

There are two nonempty proper subcoalitions: one formed by firm i and the other formed by trade union j. It is easy to show that \(\left( C_{ij}^{F},C_{jj}^{T}\right) \) is self-enforcing. Since by supposition that \( \left( C_{ii}^{T},C_{ij}^{F},C_{jj}^{T},C_{ji}^{F}\right) \) is a CPNE, given \(C_{ii}^{T}\), \(C_{ji}^{F}\), and given \(C_{jj}^{T}\), \(C_{ij}^{F}\) is an optimal strategy for firm i; given \(C_{ii}^{T}\), \(C_{ji}^{F}\), and given \( C_{ij}^{F}\), \(C_{jj}^{T}\) is an optimal strategy for trade union j. Firm i receives \(\frac{1}{18}\Delta _{i}\), and trade union j receives \(\frac{1 }{4}\Delta _{j}\).

But there are other self-enforcing strategy profiles, in which \(C_{ij}^{F}\) and \(C_{jj}^{T}\) satisfy:

where \(0<C_{ij}^{F}<\frac{5}{72}\Delta _{i}\), and \(0<C_{jj}^{T}<\frac{1}{12} \Delta _{j}\). I.e., given \(C_{ii}^{T}\) and \(C_{ji}^{F}\), firm i and trade union j can coordinate and help country j win FDI competition noncooperatively. Firm i receives \(\frac{1}{8}\Delta _{i}-C_{ij}^{F}>\frac{ 1}{18}\Delta _{i}\), and trade union j receives \(\frac{1}{3}\Delta _{j}-C_{jj}^{T}>\frac{1}{4}\Delta _{j}\).

So, \(\left( C_{ij}^{F},C_{jj}^{T}\right) \) is strongly Pareto dominated by other self-enforcing strategy profiles described in the above, and hence is not a CPNE of the game played by firm i and trade union j, given \( C_{ii}^{T}\) and \(C_{ji}^{F}\). Therefore, \(\left( C_{ii}^{T},C_{ij}^{F},C_{jj}^{T},C_{ji}^{F}\right) \) is not self-enforcing, and hence is not a CPNE. A contradiction.

Notice that similar arguments prove that in the first stage of the game, if there exists a CPNE, in which country j wins FDI competition, the following condition:

must hold. \(\square \)

Rights and permissions

About this article

Cite this article

Ma, J. Double-edged incentive competition for foreign direct investment. Int Tax Public Finance 24, 282–312 (2017). https://doi.org/10.1007/s10797-016-9409-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-016-9409-0